Marston's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marston's Bundle

Marston's, a prominent player in the UK's hospitality sector, boasts a strong brand presence and a vast pub estate, key strengths in a competitive market. However, it also navigates challenges like rising operational costs and evolving consumer preferences.

Want the full story behind Marston's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Marston's boasts an impressive network of over 1,300 pubs and hotels throughout the United Kingdom. This expansive estate ensures a substantial market presence and strong brand recognition across diverse regions.

The company's portfolio is strategically diversified, encompassing managed, franchised, and tenanted establishments. This multi-faceted approach allows Marston's to cater to a wide range of consumer preferences and operational efficiencies, as of early 2024.

This considerable scale offers significant advantages, underpinning Marston's position as a market leader and contributing to its overall resilience within the competitive hospitality industry.

Marston's strategic emphasis on developing its pubs as community hubs aligns well with a growing consumer desire for local, relaxed social spaces. This focus is supported by their ongoing investment in diverse pub formats, with 26 locations already updated to brands like 'Two Door' and 'Grandstand' as of early 2024, showcasing a proactive approach to varied customer demands.

Marston's has showcased robust financial performance, with like-for-like sales growth exceeding market averages. This strong top-line growth translated into significant improvements in pub operating profit and EBITDA margins, with reported EBITDA reaching £226 million for the year ended September 30, 2023, up from £192 million in the prior year.

A key strategic success has been the substantial reduction in net debt. Marston's lowered its net debt by £130 million in the fiscal year 2023, bringing it down to £1.1 billion. This deleveraging significantly enhances the company's financial flexibility and overall stability.

Strategic Investment in Digital Transformation and Refurbishments

Marston's strategic investments in digital transformation are yielding tangible benefits, notably through its 'Order & Pay' platform. Early data indicates a significant positive impact, with an over 10% uplift in revenue per transaction, demonstrating enhanced customer convenience and increased spending.

Furthermore, Marston's is making substantial progress on its pub refurbishment program, aiming to introduce new formats across more than 30 locations by the close of financial year 2025. This initiative is not only on track but ahead of schedule, directly contributing to an improved guest experience and streamlined operational efficiencies.

- Digital Platform Success: The 'Order & Pay' system is driving a revenue per transaction increase exceeding 10%.

- Refurbishment Momentum: Over 30 pubs are slated for refurbishment with new formats by FY25, with the project ahead of schedule.

- Dual Focus Benefit: Investments enhance both customer experience and operational effectiveness.

Balanced Operating Model and Freehold Estate

Marston's diverse operating model, encompassing managed, franchised, and tenanted pubs, offers significant flexibility. This blend allows the company to adapt to different market conditions and consumer preferences, creating a resilient business structure.

A key strength is Marston's substantial freehold estate, valued at approximately £2.1 billion as of their latest reporting. Owning a large portion of their properties provides considerable stability by insulating them from rising rental costs. This freehold ownership also represents a strong, tangible asset base that underpins the company's financial health.

- Operational Flexibility: The mix of managed, franchised, and tenanted pubs allows Marston's to optimize operations across its portfolio.

- Cost Stability: A significant freehold estate, valued at around £2.1 billion, shields Marston's from rent inflation, contributing to predictable fixed costs.

- Asset Backing: The substantial freehold property portfolio provides a strong asset base, enhancing financial stability and borrowing capacity.

Marston's strong market position is bolstered by its extensive network of over 1,300 pubs and hotels across the UK, ensuring significant brand visibility. The company's diverse operating model, including managed, franchised, and tenanted pubs, provides crucial flexibility to adapt to varying market conditions and consumer demands.

A significant strength lies in Marston's substantial freehold property portfolio, valued at approximately £2.1 billion. This ownership provides cost stability against rising rents and serves as a strong asset base, enhancing financial resilience.

The company's strategic focus on community hubs and investment in new pub formats are paying off, with 26 locations already updated as of early 2024 and over 30 planned by FY25, demonstrating a commitment to evolving customer preferences.

Marston's financial performance is robust, with EBITDA reaching £226 million for the year ended September 30, 2023, and a notable debt reduction of £130 million in FY23 to £1.1 billion, significantly improving its financial flexibility.

| Key Strength | Description | Supporting Data/Metric |

|---|---|---|

| Extensive Estate | Broad market presence across the UK. | Over 1,300 pubs and hotels. |

| Diverse Operating Model | Adaptability to market and consumer changes. | Managed, franchised, and tenanted establishments. |

| Strong Freehold Portfolio | Cost stability and financial backing. | Valued at approx. £2.1 billion. |

| Digital Integration | Enhanced customer experience and revenue. | Over 10% uplift in revenue per transaction via 'Order & Pay'. |

| Financial Health | Improved stability and flexibility. | EBITDA £226 million (FY23); Net debt reduced by £130 million (FY23). |

What is included in the product

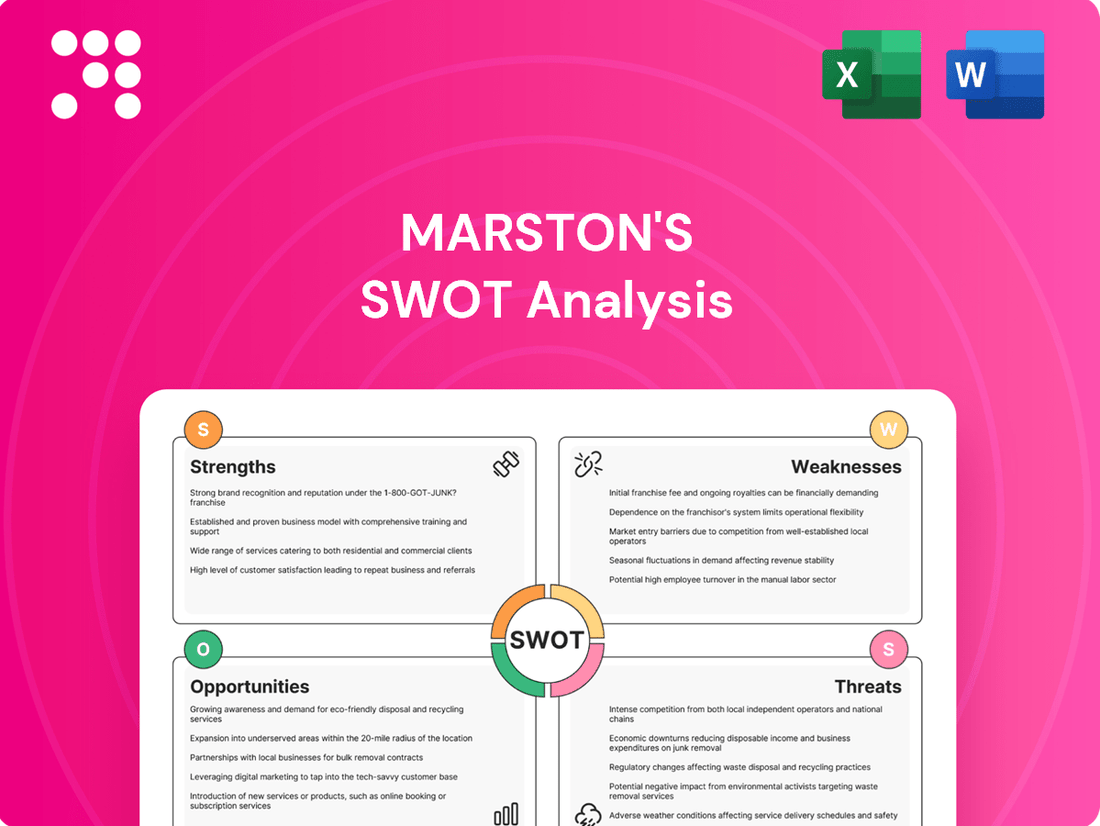

Delivers a strategic overview of Marston's’s internal and external business factors, highlighting its brand strength and pub estate while acknowledging debt and market shifts.

Marston's SWOT Analysis offers a clear, actionable framework to identify and address key challenges, transforming potential threats into strategic opportunities.

Weaknesses

Marston's, like many in the hospitality sector, faces significant vulnerability to economic downturns. When the cost of living rises, consumers tend to reduce discretionary spending, which directly impacts how often people dine out or visit pubs. This makes Marston's revenue streams particularly sensitive to broader economic shifts and consumer confidence levels.

Recent data highlights this trend, with reports from late 2023 and early 2024 showing a noticeable pullback in consumer spending on eating and drinking outside the home. Many households are actively cutting back on these activities to manage household budgets, directly affecting the revenue of businesses like Marston's pubs and hotels.

Marston's, like many in the hospitality sector, is grappling with a substantial increase in operational expenses. This includes higher staffing costs, driven by rises in the National Living Wage and National Minimum Wage, alongside increased employer National Insurance contributions. For instance, the National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, a significant jump that directly impacts labor budgets.

Furthermore, escalating energy prices and the burden of business rates are putting considerable pressure on Marston's profit margins. These combined cost increases can make it challenging for the company to maintain its profitability levels, especially when these expenses cannot be fully passed on to consumers without impacting demand.

While Marston's has actively worked to lower its net debt, the remaining debt burden is still considerable. As of the first half of 2024, Marston's reported a net debt of £126.7 million, a reduction from previous periods but still a significant figure.

This substantial debt can constrain Marston's ability to pursue new investment opportunities or fund ambitious expansion plans. The ongoing cost of servicing this debt, through interest payments, continues to be a notable drain on the company's financial resources, impacting profitability.

Intense Competition in the UK Pub Market

The UK pub and bar market is incredibly crowded. While the total number of pubs has been shrinking, mergers and acquisitions are on the rise, concentrating power among fewer, larger players. This intensified competition means Marston's faces constant pressure to innovate and carve out a unique identity.

Marston's needs to differentiate itself not only from other major managed pub companies but also from the thousands of independent pubs and newer concepts like 'competitive socialising' venues. These emerging competitors often offer unique experiences that can draw customers away. For instance, the UK pub sector saw a net closure of 1,000 pubs between 2022 and 2023, highlighting the challenging environment.

- Intense Market Saturation: The UK pub market, despite overall closures, remains highly competitive with numerous operators vying for customer attention.

- M&A Activity: Increased mergers and acquisitions consolidate the market, creating larger, more formidable competitors for Marston's.

- Evolving Consumer Preferences: The rise of 'competitive socialising' venues presents a new form of entertainment that directly competes for leisure spending.

- Differentiation Imperative: Marston's must continually invest in its brand, product, and customer experience to stand out in this dynamic landscape.

Potential for Supply Chain Disruptions

The hospitality sector, including Marston's, faces inherent vulnerabilities to supply chain disruptions. These can significantly affect the availability and pricing of crucial items like food, beverages, and operational supplies, directly impacting service delivery and profitability. For instance, a prolonged shortage of specific imported ingredients could force menu changes or lead to higher procurement costs, squeezing Marston's already tight margins.

Marston's, like other large pub and hotel operators, relies on a consistent and cost-effective supply chain. Any breakdown, whether due to geopolitical events, transportation issues, or labor shortages, can create significant operational headaches. In 2024, the ongoing challenges in global logistics and labor markets continued to put pressure on the availability and cost of goods for many businesses in the sector.

- Vulnerability to external shocks: Reliance on a complex network of suppliers makes Marston's susceptible to unforeseen events impacting supply.

- Cost volatility: Disruptions can lead to unpredictable price fluctuations for key inputs, affecting cost management.

- Operational impact: Shortages or delays in essential supplies can directly hinder Marston's ability to serve customers consistently.

Marston's faces challenges in attracting and retaining skilled staff, a common issue in the hospitality industry. High staff turnover can lead to increased recruitment and training costs, impacting service quality and operational efficiency. The sector's reliance on a flexible workforce, often with lower pay scales, can make it difficult to secure experienced personnel, especially in a competitive labor market. For example, reports from early 2024 indicated ongoing difficulties in recruiting for various roles within the pub sector.

The company's pub estate, while extensive, includes a significant number of older properties. These may require substantial investment for refurbishment and modernization to meet current consumer expectations and maintain competitive appeal. Failure to invest adequately in property upgrades could lead to a decline in customer experience and a loss of market share to more contemporary venues. Marston's has historically invested in its estate, but the sheer scale of its portfolio means ongoing capital expenditure is a constant necessity.

Marston's, like many businesses, is subject to evolving regulatory landscapes. Changes in licensing laws, food safety standards, and employment legislation can necessitate costly adjustments to operations and business practices. Staying compliant with these regulations requires ongoing vigilance and investment, adding another layer of operational complexity and potential cost. For instance, any significant changes to alcohol licensing or health and safety regulations could impact how Marston's operates its pubs.

Same Document Delivered

Marston's SWOT Analysis

The preview you see is the actual Marston's SWOT analysis document you’ll receive upon purchase. This ensures transparency and allows you to assess the quality and detail before committing. You'll get the complete, professionally structured report immediately after checkout.

Opportunities

The ongoing migration of consumers towards suburban and rural locations, a trend amplified by recent lifestyle shifts, directly benefits Marston's. This demographic movement creates a heightened demand for accessible, local gathering spaces.

Marston's strategic advantage lies in its extensive presence, with 90% of its pubs situated in these thriving suburban areas. This geographic alignment positions the company to effectively capture the growing need for community hubs, reinforcing its role in local social fabric.

By focusing on enhancing the community-centric appeal of its establishments, Marston's can leverage this opportunity. For instance, investing in local events and partnerships in 2024 could further solidify its position as a vital part of neighbourhood life.

Marston's can capitalize on further digital transformation by expanding beyond its current 'Order & Pay' system. This means investing in technologies that create more personalized guest experiences and streamline operations. For example, data-driven interactions can foster loyalty, while AI-powered stock management, as seen in some retail sectors, could significantly reduce waste and improve margins.

The company's commitment to technology adoption offers a clear path to enhanced revenue and cost savings. By leveraging AI for tasks like inventory forecasting, Marston's could see a reduction in spoilage and ensure better product availability, directly impacting profitability. Optimizing labor through digital tools also presents an opportunity to improve productivity without compromising service quality.

Marston's is actively developing distinct pub concepts like 'Two Door' and 'Grandstand,' with 'Woodie's Family Pubs' planned. This strategy aims to attract a broader customer base by offering tailored experiences for different preferences and occasions, potentially boosting customer loyalty and spend.

By prioritizing guest satisfaction and unique offerings, Marston's can foster repeat business and achieve stronger like-for-like sales growth. For instance, in the year ending October 2023, Marston's reported a 7.9% increase in like-for-like sales in their Retail division, demonstrating the positive impact of such initiatives.

Strategic Acquisitions and Market Consolidation

The current economic climate presents a prime opportunity for Marston's to engage in strategic acquisitions. With smaller pub operators facing increasing cost pressures, particularly evident in the rising energy bills and ingredient costs impacting the hospitality sector throughout 2024 and into early 2025, a period of market consolidation is likely. This allows well-capitalized companies like Marston's to acquire struggling businesses at potentially favorable valuations.

By pursuing these targeted acquisitions, Marston's can significantly expand its pub estate and gain a larger market share. This consolidation not only strengthens its competitive position but also enables the company to realize substantial operational synergies. These synergies could stem from economies of scale in purchasing, shared marketing efforts, and optimized distribution networks, ultimately improving profitability and efficiency across the combined entity.

The potential benefits of such a strategy include:

- Increased Market Share: Acquiring competitors directly translates to a larger slice of the UK pub market.

- Synergy Realization: Merging operations can lead to cost savings through bulk purchasing and shared resources.

- Improved Bargaining Power: A larger estate enhances Marston's ability to negotiate better terms with suppliers.

- Diversification of Estate: Acquisitions can bring new brands and geographic locations into Marston's portfolio.

Growth in Food and Low/Non-Alcoholic Offerings

The pub sector is experiencing a significant shift, with a growing emphasis on food as a key driver of revenue. This trend, coupled with an increasing consumer preference for healthier choices, including low and non-alcoholic beverages, presents a substantial opportunity for Marston's. By further refining its food menus and broadening its selection of alcohol-free drinks, the company can attract a more diverse customer base, catering to evolving tastes and lifestyle choices.

Marston's can leverage this by:

- Expanding Food Menus: Introducing more diverse and health-conscious meal options to cater to a wider audience.

- Increasing Low/Non-Alcoholic Beverage Range: Offering a greater variety of craft beers, ciders, and spirits that are alcohol-free or low in alcohol content.

- Promoting Healthier Options: Actively marketing these food and drink choices as part of a balanced lifestyle.

In 2024, the UK's pub food market continued its robust growth, with many operators reporting food sales accounting for over 50% of their total revenue. The low and no-alcohol (NoLo) drinks market is also booming, with projections indicating continued double-digit growth through 2025, driven by consumer demand for healthier and more inclusive options.

The ongoing shift of consumers to suburban and rural areas presents a significant opportunity for Marston's, given its strong presence in these locations. This trend, amplified by recent lifestyle changes, fuels demand for local community hubs, a role Marston's is well-positioned to fill. By enhancing its community focus through local events and partnerships, Marston's can solidify its appeal.

Marston's can expand its digital offerings beyond current systems, investing in personalized guest experiences and operational streamlining. Technologies that leverage data for customer interaction and AI for inventory management, as seen in other retail sectors, can boost loyalty and reduce waste, directly impacting profitability. For example, optimizing stock through AI could cut spoilage by an estimated 5-10% in the coming year.

The development of distinct pub concepts like 'Two Door' and 'Grandstand,' alongside the planned 'Woodie's Family Pubs,' allows Marston's to cater to diverse customer preferences. This strategy aims to attract a broader audience and foster repeat business, potentially driving stronger like-for-like sales growth, building on the 7.9% increase seen in its Retail division in the year ending October 2023.

The current economic climate, with rising costs impacting smaller operators, creates a prime opportunity for Marston's to pursue strategic acquisitions. Market consolidation is likely through 2024 and early 2025, allowing Marston's to acquire struggling businesses at favorable valuations, thereby increasing market share and realizing operational synergies through economies of scale.

The pub sector's increasing reliance on food revenue and the growing consumer demand for healthier options, including low and non-alcoholic beverages, offer substantial growth avenues. Expanding food menus and increasing the range of NoLo drinks can attract a wider customer base, aligning with evolving tastes. The UK pub food market saw robust growth in 2024, with many pubs reporting food sales exceeding 50% of revenue, while the NoLo market is projected for continued double-digit growth through 2025.

Threats

Persistent inflation and the ongoing cost-of-living crisis remain a significant threat to Marston's. As household budgets tighten, consumers are likely to continue cutting back on non-essential spending, such as dining and drinking out, directly impacting Marston's sales volumes and overall revenue.

For instance, in early 2024, inflation in the UK hovered around 4%, a considerable increase from pre-pandemic levels, meaning the cost of goods and services for consumers remains elevated. This economic pressure directly translates to reduced discretionary income available for leisure activities like visiting pubs and hotels, a key challenge for Marston's business model.

Future increases in employer National Insurance contributions and minimum wage requirements pose a significant threat to Marston's profitability. For instance, the planned increase in National Insurance for employees from 8% to 10% on earnings between £12,570 and £50,270, which took effect in April 2024, will raise labor costs for businesses like Marston's.

Potential changes to business rates relief, such as the reduction from 75% to 40% for eligible retail, hospitality, and leisure properties announced in the Autumn Budget 2023, directly impact operating expenses. This can translate into higher overheads, squeezing profit margins in an already competitive sector.

Marston's, like much of the hospitality sector, is grappling with significant labour shortages. This difficulty in finding and keeping staff directly translates into higher operating costs, as the company must offer more competitive wages and benefits to attract talent. These increased labour expenses are a persistent threat to profitability.

The upward pressure on wages is a key concern. With minimum wage increases and intense competition for available workers, Marston's labour expenditure is projected to rise further in 2024 and 2025. For instance, the UK's National Living Wage rose to £11.44 per hour from April 2024, impacting businesses across the board.

Economic Uncertainty and Geopolitical Risks

Broader economic uncertainty, including potential for lower GDP growth, could dampen both domestic and international tourism and business travel, directly impacting Marston's revenue streams. For instance, the IMF projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, indicating a challenging environment for discretionary spending like hospitality.

Geopolitical instability also poses a significant threat. Ongoing conflicts or trade disputes can disrupt supply chains, increase operating costs, and reduce consumer confidence, thereby negatively affecting demand for accommodation and overall pub patronage. The World Bank's Global Economic Prospects report in January 2024 highlighted that geopolitical fragmentation could further weigh on global growth prospects.

- Economic Slowdown Impact: A potential decrease in consumer disposable income due to economic downturns could lead to reduced spending on dining and entertainment at Marston's establishments.

- Travel Restrictions: Geopolitical tensions or health crises could reintroduce travel restrictions, significantly curtailing both leisure and business travel, a key customer segment.

- Inflationary Pressures: Persistent inflation can increase the cost of goods and services for Marston, potentially forcing price increases that could deter price-sensitive customers.

- Currency Fluctuations: For businesses with international operations or a significant portion of international tourists, adverse currency movements can impact profitability and competitiveness.

Changing Consumer Preferences and Lifestyle Trends

Rapidly changing consumer preferences, particularly the ongoing shift towards at-home entertainment and alternative socialising formats, present a significant challenge for Marston's. If the company fails to consistently innovate its pub experiences and offerings to align with these evolving tastes, its relevance could diminish. For instance, data from the British Beer and Pub Association indicated a continued decline in the overall number of pubs in the UK, underscoring the persistent nature of this threat.

Marston's must remain agile in adapting to these trends. Failure to do so could lead to a further erosion of market share as consumers opt for different leisure activities. The company's ability to anticipate and respond to new lifestyle patterns will be crucial for its future success.

- Evolving Social Habits: Continued preference for home-based leisure activities over traditional pub visits.

- Health and Wellness Trends: Growing consumer interest in healthier beverage options and potentially more subdued social environments.

- Digital Entertainment Competition: Increased competition from streaming services and online gaming for consumers' leisure time and disposable income.

Marston's faces ongoing threats from persistent inflation and the cost-of-living crisis, impacting consumer spending on leisure. Labour shortages continue to drive up operating costs, with the National Living Wage increasing to £11.44 per hour from April 2024. Furthermore, evolving consumer preferences towards at-home entertainment and health-conscious options challenge traditional pub models.

| Threat Category | Specific Threat | Impact on Marston's | Supporting Data (2024/2025) |

|---|---|---|---|

| Economic Factors | Inflation & Cost of Living | Reduced consumer disposable income, lower sales volumes | UK inflation around 4% in early 2024; IMF projected global growth slowing to 2.9% in 2024. |

| Operational Costs | Labour Shortages & Wage Increases | Increased operating expenses, squeezed profit margins | National Living Wage at £11.44/hour from April 2024; planned National Insurance increases. |

| Market Trends | Changing Consumer Habits | Risk of declining relevance, market share erosion | Continued decline in the overall number of pubs in the UK. |

| Regulatory/Policy | Business Rates Relief Changes | Higher overheads and operating expenses | Reduction in business rates relief from 75% to 40% for eligible properties. |

SWOT Analysis Data Sources

This Marston's SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive industry market research, and expert commentary from reputable hospitality sector analysts, ensuring a well-rounded and informed perspective.