Marston's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marston's Bundle

Understanding Marston's BCG Matrix is crucial for any business looking to optimize its product portfolio. This powerful tool helps categorize products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market share and growth potential. Don't just glimpse at the possibilities; purchase the full BCG Matrix report to unlock detailed analysis and actionable strategies for your business's success.

Stars

Marston's is strategically diversifying its pub offerings with new formats like 'Two Door', 'Grandstand', and the family-centric 'Woodie's'. These innovative concepts are designed to attract specific customer groups and improve the overall guest experience. Early performance indicators for these differentiated formats are proving to be very positive.

The company's commitment to this strategy is evident in its refurbishment plans. Marston's is aiming to complete at least 30 new-format refurbishments by the close of the 2025 financial year. This expansion into varied pub styles is a key driver for their revenue growth objectives.

Marston's significant investment in digital transformation, exemplified by its 'Order & Pay' app and mobile check-in systems, positions its initiatives as Stars within the BCG Matrix. These technologies are designed to boost operational efficiency and deepen guest engagement, streamlining services for enhanced customer convenience and sales growth.

The company's commitment to technology is a key driver for its anticipated strong Q4 trading performance, reflecting the growing impact of these digital advancements on customer experience and revenue generation. For instance, in the fiscal year ending September 2023, Marston's reported a 7.7% increase in revenue to £1.1 billion, with digital ordering contributing significantly to this growth.

Marston's has strategically shifted to a pure-play hospitality model, with its managed pub estate, exceeding 1,300 locations, now at the core of its operations. This focus is driving impressive growth, with like-for-like sales consistently outperforming the wider market. For instance, in the 52 weeks to October 2023, Marston's reported a significant 10.4% increase in like-for-like sales for its managed pubs, highlighting the segment's strength and Marston's commitment to enhancing profitability through this channel.

Strong Like-for-Like Sales Performance

Marston's has demonstrated robust like-for-like sales growth, a key indicator for its position as a potential star in the BCG Matrix. This positive trend reflects strong customer demand and effective operational strategies.

- 2.9% like-for-like sales increase in the 15 weeks to July 12, 2025

- 4% higher like-for-like sales excluding the Euro 2024 impact

- 2.0% year-to-date like-for-like sales improvement as of July 2025

Enhanced Guest Satisfaction and Experience

Marston's focus on guest satisfaction is a significant strength, as evidenced by their consistently high and improving reputation scores. In FY2024, their guest reputation reached 800, a notable increase from 766 in FY2023, and this performance was maintained through H1 2025. This commitment to an enhanced guest experience is crucial for fostering loyalty and driving repeat business, solidifying their market position.

This dedication translates into tangible benefits:

- Improved Guest Reputation: Scores climbed to 800 in FY2024 and held steady in H1 2025, up from 766 in FY2023.

- Customer Loyalty: High satisfaction levels encourage repeat visits and positive word-of-mouth referrals.

- Competitive Advantage: A superior guest experience differentiates Marston's in a competitive market.

- Revenue Growth: Enhanced customer experiences are directly linked to increased spending and overall revenue performance.

Marston's strong like-for-like sales growth and focus on guest satisfaction position its digital initiatives and diversified pub formats as Stars. These areas are experiencing high growth and market share, requiring continued investment to maintain their leading positions and capitalize on future opportunities.

The company's investment in digital transformation, including its 'Order & Pay' app, directly contributes to its Star status by enhancing efficiency and customer engagement. This is reflected in the 7.7% revenue increase to £1.1 billion in FY2023, with digital ordering playing a significant role.

Marston's managed pub estate, exceeding 1,300 locations, is a key driver of its Star performance. The 10.4% like-for-like sales increase in the 52 weeks to October 2023 for these pubs underscores their strong market performance.

| Initiative | Growth Indicator | Performance Metric |

|---|---|---|

| Digital Transformation (Order & Pay App) | High Customer Engagement & Efficiency | Contributed significantly to FY2023 revenue growth. |

| Diversified Pub Formats (Two Door, Grandstand, Woodie's) | Attracting Specific Customer Groups | Positive early performance indicators. |

| Managed Pub Estate Performance | Strong Like-for-Like Sales | 10.4% increase in 52 weeks to Oct 2023. |

What is included in the product

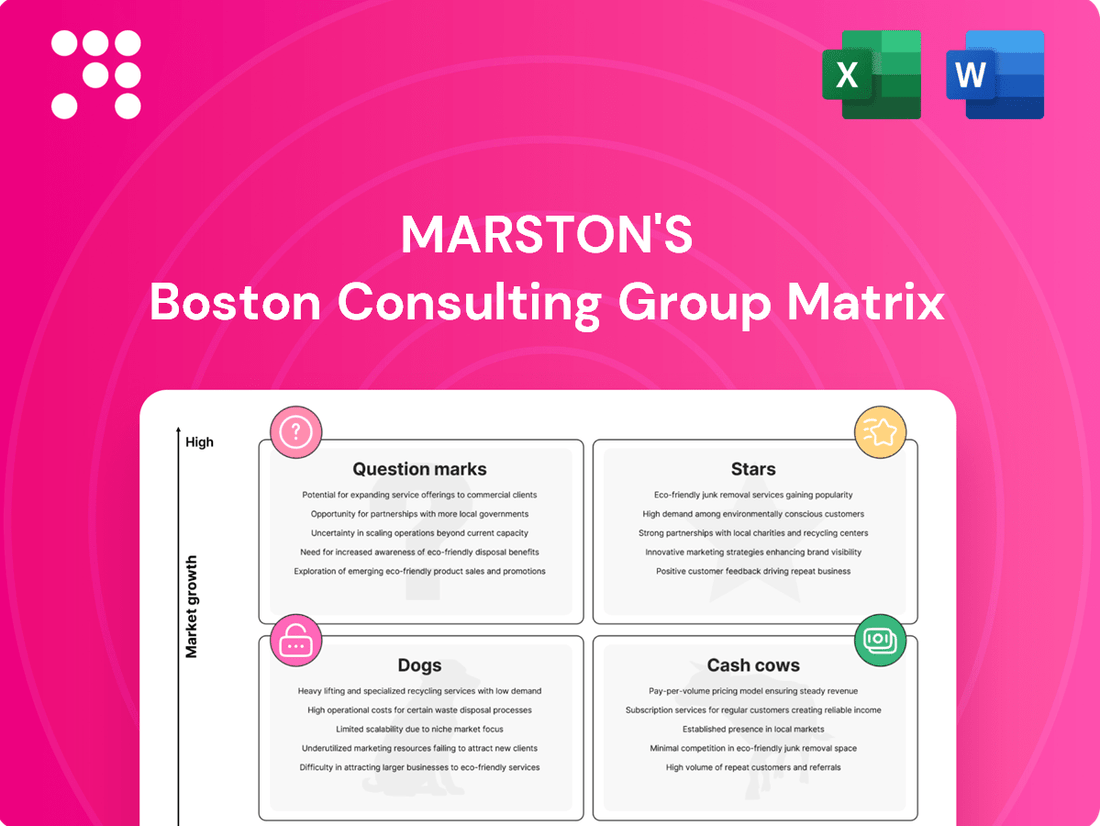

The Marston's BCG Matrix analyzes business units based on market share and growth, guiding strategic decisions on investment, divestment, or harvesting.

Marston's BCG Matrix offers a clear, visual roadmap for resource allocation, alleviating the pain of inefficient investment decisions.

Cash Cows

Marston's boasts an extensive and stable pub estate, comprising over 1,300 locations across the UK. This established network forms the backbone of its operations, consistently generating significant and reliable cash flow. The sheer scale and maturity of this pub portfolio are key to Marston's financial stability, underpinning its revenue streams even when assets are divested.

Marston's is demonstrating robust progress towards its target of generating over £50 million in recurring free cash flow annually in the near-to-medium term. This strong performance highlights the company's established pub operations as consistent cash generators, capable of funding future investments and reducing existing debt.

The company achieved a significant milestone in FY2024, reporting recurring free cash flow of £43.6 million. This marks a substantial turnaround from the cash outflow experienced in the previous financial year, underscoring the effectiveness of Marston's strategic initiatives.

Marston's "Cash Cows" showcase robust financial health, with underlying pub operating profit soaring by 17.9% to £147.2 million in FY2024. This strong performance, further evidenced by a 20.1% increase to £63.3 million in H1 2025, highlights the core business's exceptional cash-generating capabilities.

The company's underlying EBITDA margin reached an impressive 21.4% in FY2024, a clear indicator of improved profitability. These gains are attributed to successful operational efficiencies and strategic cost-saving initiatives, solidifying the mature, high-performing nature of these assets within Marston's portfolio.

Reduced Net Debt and Enhanced Financial Flexibility

Marston's Brewing Company's strategic sale of its stake in Carlsberg has demonstrably improved its financial standing. In fiscal year 2024, this move resulted in a significant reduction of net debt by £301.7 million, bringing the total down to £883 million.

This substantial deleveraging is a key indicator of Marston's transition towards a more robust financial profile. The reduced debt burden enhances the company's overall financial flexibility, allowing for greater strategic maneuverability.

- Reduced Net Debt: £301.7 million decrease in FY2024.

- Current Net Debt: £883 million as of FY2024.

- Financial Impact: Strengthened balance sheet and increased flexibility.

- Strategic Focus: Enables concentration on core hospitality business and growth.

Effective Cost Management and Operational Efficiencies

Marston's has demonstrated robust cost management, particularly in areas like energy, property, and labour. These strategic initiatives have directly contributed to margin expansion, showcasing the company's ability to control expenses effectively. For instance, in their fiscal year 2023, Marston's reported a significant improvement in their operating model, which is a testament to these efficiency drives.

The disciplined execution of their market-leading pub operating model is key to sustaining profitability. By focusing on operational efficiencies, Marston's ensures that their core business remains a strong generator of cash. This disciplined approach is crucial for maintaining the health of their 'Cash Cows' within the BCG Matrix framework.

The emphasis on cost control is paramount in maximizing the cash generated from stable operations. This allows Marston's to reinvest in growth areas or return value to shareholders. The company's commitment to these efficiencies underpins its position as a reliable cash generator.

- Energy Cost Savings: Initiatives focused on reducing energy consumption across their estate.

- Property Efficiencies: Streamlining property management and maintenance costs.

- Labour Cost Optimization: Implementing effective staffing models to manage labour expenses.

- Margin Expansion: Direct correlation between cost control and improved profit margins.

Marston's "Cash Cows" are its mature, well-established pubs that consistently generate strong, reliable cash flow. These operations are the bedrock of the company's financial stability, allowing for investment in other areas and debt reduction. The company's focus on operational efficiencies and cost management further enhances the profitability of these core assets.

The robust performance of these cash-generating assets is evident in the significant increase in underlying pub operating profit. This financial strength underpins Marston's strategy, demonstrating the value of its extensive pub estate as a stable source of funds.

| Metric | FY2024 | H1 2025 |

|---|---|---|

| Underlying Pub Operating Profit | £147.2 million | £63.3 million |

| Recurring Free Cash Flow | £43.6 million | |

| Underlying EBITDA Margin | 21.4% |

Delivered as Shown

Marston's BCG Matrix

The Marston's BCG Matrix preview you see is the definitive document you'll receive after purchase, offering a complete and unwatermarked strategic analysis. This isn't a sample; it's the fully formatted, ready-to-deploy tool designed to illuminate your business portfolio's performance and guide future investment decisions. Upon purchase, you'll gain immediate access to this professionally crafted report, enabling you to effectively categorize your business units and develop targeted strategies for growth and resource allocation.

Dogs

Marston's has been strategically divesting underperforming or non-core pubs. In the fiscal year 2024, the company successfully generated around £50 million through these disposals. This move reflects a deliberate effort to streamline operations by shedding assets with limited market share and growth potential, effectively releasing capital that was previously tied up in these less productive outlets.

Pubs awaiting strategic refurbishment within Marston's portfolio can be categorized as Dogs in the BCG Matrix. These locations, while potentially offering future upside, currently exhibit low growth and market share due to their unmodernized state. For example, in the fiscal year ending September 28, 2024, Marston's reported that its managed pubs saw a like-for-like sales increase of 3.2%, but this figure likely masks underperformance in non-refurbished sites.

These "Dog" pubs might require substantial capital infusion for upgrades to compete effectively with Marston's newer, refreshed formats, which are designed to attract a broader customer base and drive higher revenue. Without such investment, these sites risk continued stagnation or even decline, potentially leading to divestment decisions by the company to reallocate resources to more promising ventures.

Pubs within Marston's portfolio located in areas facing persistent economic downturns, marked by reduced consumer spending and declining footfall, would be classified as Dogs. These sites are characterized by low growth potential and a struggle to gain meaningful market share, irrespective of operational improvements.

For instance, a pub in a town experiencing factory closures or a significant loss of local employment would likely fit this profile. In 2024, regions with high unemployment rates, such as parts of the North East of England which historically saw unemployment figures above the national average, would present such challenges for Marston's pubs. These locations offer limited opportunities for expansion or increased profitability.

Traditional Pubs Without Experiential Offerings

Traditional pubs that haven't embraced experiential offerings are increasingly finding themselves in a challenging position. In a market where consumers actively seek unique and engaging experiences, these establishments may struggle to differentiate themselves and attract a broader customer base. This can lead to a shrinking market share.

These pubs often face difficulties in maintaining relevance and drawing in new patrons. Without unique selling propositions beyond basic food and drink, they risk becoming overlooked amidst a landscape of more dynamic venues. This stagnation can result in declining revenue and profitability.

- Low Market Share: Pubs lacking experiential elements often hold a smaller slice of the market compared to those offering activities like live music, themed nights, or interactive games.

- Struggling to Attract Younger Demographics: Younger consumers, in particular, are drawn to venues that provide more than just a place to eat or drink, seeking social and entertainment value.

- Declining Footfall: Without compelling reasons to visit, footfall can decrease, impacting overall sales and the pub's viability.

- Potential for Divestment: In 2024, the trend of pub companies divesting underperforming, non-experiential sites continued as they focus resources on more profitable, adaptable locations.

Pubs with Limited Digital Adoption

Pubs with limited digital adoption represent a challenge for Marston's. These establishments may struggle to keep pace with evolving customer expectations for seamless digital experiences, such as mobile ordering or digital loyalty programs. This lag can directly impact their competitiveness and ability to attract and retain customers in an increasingly tech-driven market.

The inability to fully leverage digital tools can translate into operational inefficiencies and a less engaging customer journey. For instance, pubs not utilizing an 'Order & Pay' app might experience longer wait times for service, potentially deterring guests. This technological gap can hinder growth prospects and market share, especially when compared to more digitally integrated competitors.

- Lagging Guest Experience: Pubs without digital ordering or check-in systems may offer a less convenient experience, impacting customer satisfaction.

- Operational Inefficiencies: Slower adoption of mobile technology can lead to increased manual processes and reduced staff efficiency.

- Reduced Competitiveness: Competitors leveraging digital platforms can offer faster service and personalized promotions, drawing customers away.

- Impact on Growth: Limited digital integration can stifle revenue growth and market share expansion in the long term.

Dogs in Marston's portfolio represent pubs with low market share and low growth potential, often due to factors like outdated facilities or challenging local economic conditions. These outlets require careful management, potentially leading to divestment if improvements are not viable. For example, pubs in economically depressed areas may struggle to generate sufficient revenue, as seen in regions with high unemployment in 2024.

These underperforming pubs, if not strategically revitalized, can drain resources. Marston's focus in 2024 on divesting non-core assets, generating approximately £50 million, highlights the company's commitment to shedding such liabilities. This strategic pruning allows for capital reallocation to more promising ventures within the portfolio.

Pubs that fail to adapt to changing consumer preferences, such as a lack of experiential offerings or digital integration, are also prime candidates for the Dog category. Without innovation, these establishments risk declining footfall and market share, necessitating a decision on their future within the company's structure.

The classification of a pub as a Dog underscores its current inability to compete effectively, demanding either significant investment for turnaround or a strategic exit. This approach ensures Marston's resources are directed towards outlets with a clearer path to profitability and growth.

Question Marks

Marston's is actively exploring new pub formats, such as the family-focused 'Woodie's' and the sports-themed 'Grandstand'. This initiative represents an early-stage investment into potentially high-growth, differentiated offerings within their portfolio.

Currently, 26 pubs have been transformed into these new concepts, with a goal to reach over 30 by the end of fiscal year 2025. Early performance indicators are positive, suggesting these formats are resonating with customers.

While the initial rollout shows promise, the long-term market penetration and sustained profitability of these new formats are still under evaluation. Continued capital allocation will be crucial to fully develop their market position.

Marston's pilot of two-room pub concepts, separating sports bar and family-friendly areas, shows promise. These innovative formats are currently in a nascent stage, reflecting high growth potential within the pub industry.

While these concepts are still being tested, their initial positive reception indicates they could capture a larger market share. This positions them as potential Stars in the BCG Matrix, requiring strategic investment to scale and capitalize on their emerging success.

Marston's is dedicating around £60 million in capital expenditure for FY2025, with a significant portion earmarked for ongoing digital transformation initiatives. These investments are crucial for modernizing operations and enhancing customer experience across their pub estate.

While these digital upgrades are designed to drive future growth and operational efficiencies, their full impact and market adoption are still unfolding. Consequently, these projects are currently classified as question marks within the BCG Matrix, as the return on investment is not yet fully realized or proven across the entire business.

Strategic Expansion of Partnership Models

Marston's strategic focus on expanding its managed and partnership models indicates a deliberate move to diversify revenue streams and leverage external expertise. This approach aims to capture growth opportunities in a dynamic market. For instance, by the end of fiscal year 2024, Marston's reported a 5% increase in its managed pub portfolio, demonstrating tangible progress in this expansion.

The success of these expanded models hinges on effective execution and ongoing investment. Marston's is actively exploring new partnership frameworks, with initial data from early 2024 suggesting a positive reception from potential partners. This proactive stance is crucial for solidifying market share in these developing segments.

- Managed Pub Growth: Marston's aims to increase the number of pubs operated under its managed model, seeking greater control over brand consistency and customer experience.

- Partnership Model Development: The company is actively seeking and cultivating new partnerships, potentially involving joint ventures or franchise-like arrangements, to accelerate expansion.

- Investment in Nurturing: Significant investment is being allocated to support these growing models, ensuring they have the necessary resources for marketing, operational support, and talent development.

- Market Share Ambition: While still developing, the ultimate goal is to achieve a substantial market share in these expanded partnership areas, contributing significantly to overall company performance.

New Demand-Driving Events and Partnerships

Marston's new demand-driving events and partnerships, such as the Paddington in Peru collaboration and the Luke Humphries Cool Hand Cup darts tournament, represent strategic moves to invigorate customer engagement. These initiatives are designed to attract new patrons and boost foot traffic. For example, the Paddington partnership likely leverages family appeal, while the darts tournament taps into a specific sports enthusiast demographic.

The effectiveness of these innovative approaches in driving sustained demand and their potential for replication across Marston's diverse estate are currently under assessment. While initial guest feedback and attendance figures are key metrics, Marston's will be closely monitoring repeat visits and overall revenue uplift attributed to these events. The company aims to identify which types of experiential marketing yield the highest return on investment.

- Paddington in Peru Partnership: Aimed at attracting families and enhancing the appeal of Marston's pubs as family-friendly destinations.

- Luke Humphries Cool Hand Cup Darts Tournament: Targets sports fans and offers a unique entertainment experience, potentially increasing dwell time and spend.

- Scalability and Impact Evaluation: Marston's is assessing the ability to roll out similar successful events across its broader portfolio of pubs.

- Customer Engagement Strategy: These events are part of a wider strategy to create memorable experiences that drive repeat business and attract new customer segments.

Marston's digital transformation initiatives, including investments in modernization and customer experience enhancements across its estate, are currently classified as question marks. While these projects are designed to drive future growth and efficiency, their full impact and market adoption are still unfolding, making their return on investment not yet fully realized or proven across the entire business.

The company's strategic exploration of new pub formats, such as 'Woodie's' and 'Grandstand', also falls into the question mark category. With 26 pubs already transformed and a goal to exceed 30 by FY2025, early performance is positive, but long-term market penetration and sustained profitability require further evaluation and capital allocation.

Similarly, Marston's expansion of its managed and partnership models, which saw a 5% increase in its managed pub portfolio by the end of FY2024, is still in a developmental phase. Initial data from early 2024 suggests a positive reception from potential partners, but the success hinges on effective execution and ongoing investment to achieve substantial market share.

Marston's innovative demand-driving events and partnerships, like the Paddington collaboration and the Luke Humphries darts tournament, are also question marks. Their effectiveness in driving sustained demand and their scalability across the estate are under assessment, with a focus on identifying which experiential marketing approaches yield the highest return on investment.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from company financial reports, industry market share data, and economic growth forecasts to provide a robust strategic overview.