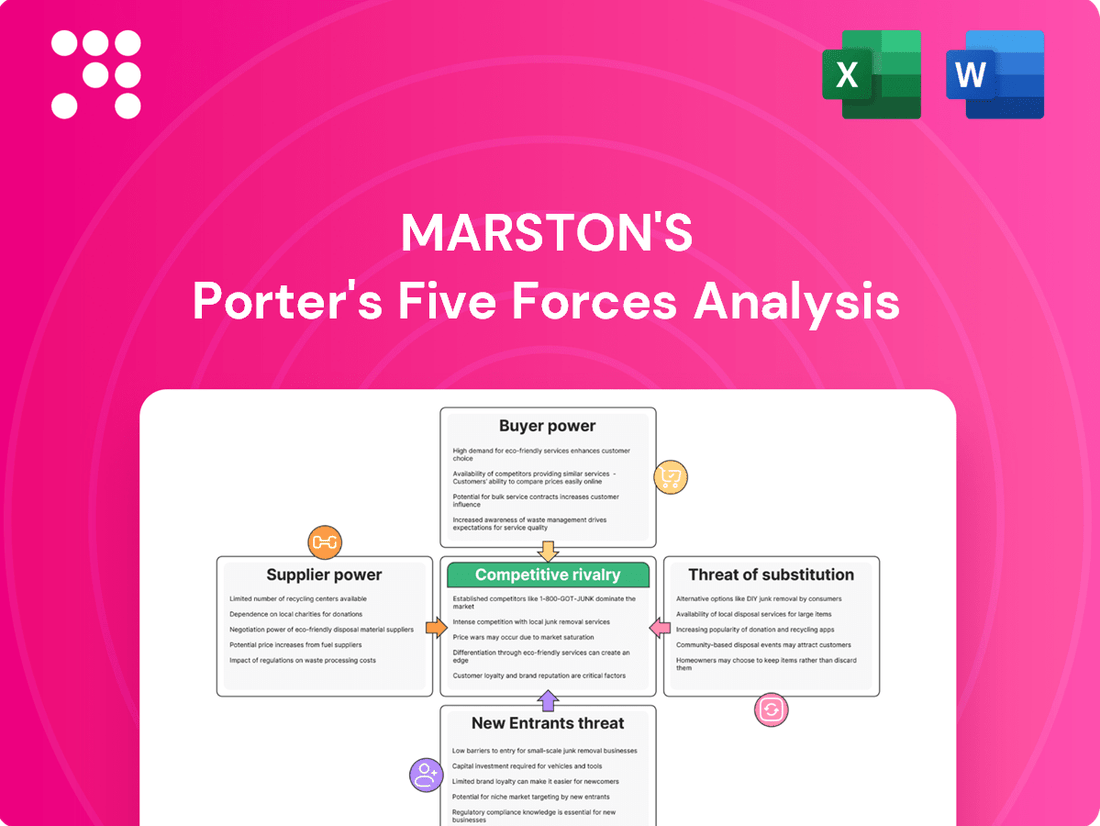

Marston's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marston's Bundle

Marston's operates in a dynamic pub and hotel sector, where understanding competitive forces is crucial for success. This analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

The complete report reveals the real forces shaping Marston's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of essential inputs such as food, beverages, and energy can wield considerable influence if the market for these inputs is concentrated, meaning there are few suppliers or the products are highly unique. Marston's, operating a substantial pub and hotel chain, likely benefits from economies of scale through its purchasing volume. However, specialized suppliers for certain beverages or unique food ingredients might still be able to dictate higher prices, impacting Marston's cost structure.

The quality and availability of Marston's essential supplies significantly influence its operational capacity and brand image. For instance, a consistent supply of high-quality cask ales and specific food ingredients is paramount to meeting customer expectations and maintaining the Marston's pub experience.

When a supplier's product is critical and lacks readily available substitutes, their bargaining power naturally escalates. This is evident if Marston's relies on a particular brewery for a signature ale or a specialized supplier for unique pub fare that defines its menu.

In 2024, the hospitality sector continued to grapple with supply chain volatility. Reports indicated that the cost of key ingredients, such as fresh produce and certain beverages, saw an average increase of 5-10% year-on-year, directly impacting Marston's procurement costs and highlighting the leverage of their suppliers in such an environment.

Switching suppliers for Marston's can be a costly endeavor. These costs often include the expense of renegotiating contracts, reconfiguring existing supply chains, and the necessity of training staff on new products or operational procedures. For instance, if Marston's needs to change its beverage supplier, it might involve significant lead times for new kegs and dispensing equipment, alongside staff training on new product ranges.

The impact of these switching costs directly bolsters the bargaining power of Marston's current suppliers. When the financial and operational disruption associated with changing providers is substantial, Marston's faces a higher barrier to seeking alternative sources, giving existing suppliers leverage in price negotiations or contract terms. In 2023, Marston's reported a significant portion of its cost of sales was tied to its supply chain, highlighting the importance of these relationships and the potential impact of switching costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Marston's operations, essentially running their own pubs or hospitality venues, directly amplifies their bargaining power. This would allow them to capture a larger portion of the value chain, potentially squeezing Marston's margins.

While this threat might not be significant for every supplier, major beverage companies could realistically consider this strategy. However, Marston's strategic decision to divest its brewing operations in the past, as seen in its 2003 sale of Marston's Beer Company to Carlsberg UK, indicates a focus on its core pub and hospitality business, somewhat mitigating this specific risk from its former brewing arm.

- Forward Integration Threat: Suppliers entering Marston's core business of pub operation increases their leverage.

- Beverage Company Potential: Large drink producers possess the resources to integrate forward.

- Marston's Strategic Shift: Divesting brewing operations reduces direct threat from former suppliers in that sector.

Supplier's Ability to Differentiate Products

When suppliers offer products that are unique, branded, or of exceptionally high quality, their bargaining power significantly increases. This is because customers may strongly desire these specific offerings, making them less willing to switch to alternatives. For instance, a craft brewery with a cult following for its unique IPAs or a specialty food supplier providing exclusive, hard-to-find ingredients can command better terms than a producer of generic, undifferentiated goods. This differentiation allows them to influence pricing and other contract conditions more effectively.

In 2024, the market for specialty ingredients saw continued growth, with some suppliers leveraging unique sourcing or proprietary processing techniques. For example, certain rare spices or ethically sourced cacao beans, commanding premium prices, demonstrated this supplier power. The demand for traceable and high-quality food components in the premium restaurant sector further amplified the leverage of these suppliers. This trend highlights how product uniqueness directly translates to supplier influence.

- Supplier Differentiation: Suppliers with unique, branded, or high-quality products possess greater power.

- Customer Desire: Strong customer demand for specific supplier offerings reduces their willingness to substitute.

- Example: Craft beer brands or exclusive food ingredients exemplify differentiated products that enhance supplier leverage.

- Market Trend: The 2024 specialty ingredient market showed growth, with unique sourcing and processing boosting supplier influence.

Suppliers hold significant bargaining power when they are few in number, their products are essential and undifferentiated, or when switching costs for Marston's are high. In 2024, the hospitality industry faced ongoing supply chain pressures, with reports indicating an average 5-10% year-on-year increase in costs for key ingredients like produce and beverages, directly impacting Marston's procurement expenses.

| Factor | Impact on Marston's | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | Few suppliers for critical inputs increase their leverage. | Concentration in specialty beverage markets remains a factor. |

| Switching Costs | High costs to change suppliers bolster existing supplier power. | Renegotiating contracts and reconfiguring supply chains are costly. |

| Product Uniqueness | Differentiated or branded products give suppliers pricing power. | Demand for unique craft ales and specialty food ingredients persists. |

| Cost Increases | Rising input costs directly affect Marston's profitability. | Average ingredient cost increases of 5-10% in 2024 impacted the sector. |

What is included in the product

Analyzes the competitive intensity within the pub and brewing industry for Marston's, examining threats from new entrants, substitutes, buyer and supplier power, and rivalry among existing firms.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customers in the UK pub market are showing heightened price sensitivity, particularly due to the ongoing cost-of-living crisis. This means they are more likely to scrutinize spending on non-essential items like eating out and drinking at pubs.

This increased price sensitivity directly impacts Marston's pricing power. If Marston's attempts to significantly increase prices, it risks alienating customers who may then choose cheaper alternatives or reduce their visits altogether, leading to lower sales volumes.

For instance, reports from early 2024 indicated that a significant portion of UK households were cutting back on discretionary spending, with food and drink away from home being a common area for reduction. This trend directly affects Marston's customer base.

Marston's customers hold significant bargaining power due to the sheer volume of alternative leisure and dining choices available. Think about it: people can easily opt for staying in with streaming services, cooking at home, or visiting a vast array of other pubs, bars, and restaurants. This abundance of substitutes means Marston's has to work harder to attract and retain customers, as switching costs are virtually non-existent.

Customers at Marston's pubs face virtually no costs when deciding to patronize a competitor or engage in a different leisure pursuit. This low barrier to switching directly empowers them, forcing Marston's to consistently deliver value. For instance, in 2024, the average consumer spent approximately £50 per month on leisure activities, a figure Marston's competes within.

Customer Information and Transparency

The bargaining power of customers for Marston's is significantly amplified by the widespread availability of information. Online reviews, social media platforms, and dedicated comparison websites provide consumers with easy access to pricing, quality assessments, and firsthand experiences across the hospitality sector. This transparency empowers customers to make well-informed decisions, directly influencing Marston's pricing strategies and service delivery.

This readily available data puts considerable pressure on Marston's to consistently deliver value and superior customer experiences. For instance, in 2024, the average customer review score for similar hospitality chains often dictates booking decisions, with venues scoring below 4.0 stars frequently experiencing lower occupancy rates. Marston's must therefore focus on maintaining high standards to meet customer expectations and retain their business in a competitive market.

- Increased Price Sensitivity: Customers can easily compare Marston's prices with competitors, leading to greater price sensitivity and a demand for competitive pricing.

- Demand for Quality and Service: Transparency in reviews highlights customer expectations regarding food quality, service efficiency, and overall ambiance, forcing Marston's to maintain high operational standards.

- Brand Loyalty Challenges: With abundant choices readily visible, customers may switch between brands more easily if they perceive better value or a more appealing experience elsewhere.

Customer Concentration (Low for Marston's)

Marston's benefits from a highly fragmented customer base, meaning no single customer or small group of customers holds substantial sway over the company's revenue. This diffusion of its customer base significantly diminishes the bargaining power of individual customers.

For instance, Marston's operates numerous pubs and hotels across the UK, serving millions of individuals annually. This broad reach ensures that the loss of any single customer, or even a small cluster, would have a negligible impact on overall sales. In 2024, Marston's reported serving millions of customers across its diverse portfolio, underscoring this low customer concentration.

- Low Customer Concentration: Marston's customer base is widely distributed, preventing any single entity from exerting significant influence.

- Minimized Individual Bargaining Power: The sheer volume of customers limits the ability of any one customer to negotiate favorable terms.

- Revenue Stability: This fragmentation contributes to revenue stability, as the company is not overly reliant on a few key clients.

- Reduced Price Sensitivity: With many customers, Marston's faces less pressure to lower prices due to individual customer demands.

The bargaining power of customers for Marston's is influenced by the availability of substitutes and low switching costs. In 2024, the UK pub market saw continued competition from various leisure activities, including home entertainment and other dining options. This abundance of choices means customers can easily shift their spending, putting pressure on Marston's to offer competitive value and experiences to retain their business.

| Factor | Impact on Marston's | 2024 Context/Data |

|---|---|---|

| Availability of Substitutes | High | Numerous pubs, restaurants, and home entertainment options available. |

| Switching Costs | Low | Customers can easily choose alternative venues or activities with minimal effort or expense. |

| Price Sensitivity | Elevated | Cost-of-living pressures in 2024 led consumers to scrutinize discretionary spending, impacting pub visits. |

| Information Availability | High | Online reviews and social media empower customers to compare Marston's offerings with competitors. |

| Customer Concentration | Low | Marston's serves millions of customers annually, meaning no single customer group dominates revenue, reducing individual leverage. |

Preview the Actual Deliverable

Marston's Porter's Five Forces Analysis

This preview shows the exact Marston's Porter's Five Forces analysis you'll receive immediately after purchase, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're looking at the actual document, which is fully formatted and ready for your strategic planning needs. Once you complete your purchase, you’ll get instant access to this comprehensive analysis, providing valuable insights into Marston's competitive landscape.

Rivalry Among Competitors

The UK pub market is incredibly fragmented, meaning there are a lot of different players. Marston's faces stiff competition from a vast number of independent pubs, each with its unique local appeal, alongside large, established pub chains and even gastropubs that offer a more food-centric experience.

This diversity extends to Marston's direct rivals. They go head-to-head not just with other pub companies, but also with a wide array of hospitality businesses. Think about casual dining restaurants, bars, and even some cafes that now offer alcoholic beverages, all vying for the same customer spending.

In 2024, the landscape remains highly competitive. For instance, while Marston's operates a significant number of pubs, the overall UK pub sector comprises thousands of individual establishments. This sheer volume ensures that Marston's must constantly innovate and differentiate itself to capture market share.

The UK pub and bar market is experiencing a period of modest growth, with projections indicating a steady upward trend. However, this growth is tempered by significant challenges, including a persistent decline in the overall number of pubs and rising operational expenses, such as energy and labor costs. For instance, industry reports in early 2024 highlighted that while consumer spending in the sector was recovering, profit margins remained under pressure due to these escalating costs.

This environment of relatively slow or challenged growth naturally fuels intense competitive rivalry. With the market not expanding rapidly, companies like Marston's must actively compete for existing customer bases and market share. This means that every customer gained is a significant win, leading to aggressive pricing strategies, innovative marketing campaigns, and a strong focus on customer experience to differentiate themselves in a mature and competitive landscape.

The pub industry, including companies like Marston's, faces intense competitive rivalry partly due to high fixed costs. These costs, stemming from property ownership, ongoing maintenance, and staffing, necessitate consistent revenue generation to cover expenses. For instance, in 2024, the average cost of maintaining a pub property can be substantial, impacting profitability if occupancy rates fall.

Furthermore, significant exit barriers contribute to this rivalry. The specialized nature of pub properties makes them difficult to repurpose or sell quickly, and long-term lease agreements can lock companies into operations. This means even in challenging economic periods, pubs may continue operating and competing fiercely to avoid substantial losses, intensifying the pressure on all players.

Product Differentiation and Brand Loyalty

Marston's strives to differentiate its pubs, aiming to foster strong community ties and offer unique experiences. However, the pub market is crowded with establishments providing comparable food, beverages, and entertainment. This makes building lasting brand loyalty through exceptional service and distinctive offerings a significant challenge.

In 2024, the UK pub sector continues to face intense competition, with many operators vying for consumer attention. For Marston's, success hinges on its capacity to stand out.

- Brand Loyalty Drivers: Marston's focuses on creating local hubs, but competitors often offer similar core products.

- Differentiation Strategy: Success relies on offering truly unique experiences and superior service quality to build customer allegiance.

- Market Saturation: The prevalence of similar offerings across many pubs intensifies the need for effective differentiation.

Strategic Moves by Competitors

Competitors are actively shifting their strategies, with a notable emphasis on experiential dining, the growing market for no and low-alcohol beverages, and embracing digital transformation to enhance customer engagement. For instance, Greene King, a major competitor, has been investing in pub refurbishments and digital ordering systems to improve the customer journey.

Marston's needs to maintain vigilant observation of these evolving competitor tactics. This includes tracking initiatives like new menu developments, promotional campaigns, and any significant capital expenditures on property upgrades by rivals. For example, in the fiscal year ending March 2024, some pub groups reported increased investment in modernizing their estate to attract a broader customer base.

- Experiential Offerings: Competitors are enhancing the overall pub experience beyond just food and drink, focusing on atmosphere, entertainment, and unique events.

- No and Low-Alcohol Options: There's a clear trend towards expanding selections of non-alcoholic beers, ciders, and spirits to cater to changing consumer preferences.

- Digital Transformation: Investments in online booking, mobile ordering, and loyalty programs are becoming standard, aiming to streamline operations and boost customer convenience.

- Competitor Investments: Monitoring competitor refurbishments and new menu introductions provides insights into their strategic priorities and market positioning.

The competitive rivalry within the UK pub sector, a key consideration for Marston's, remains exceptionally high. This intense competition stems from a market characterized by a vast number of players, ranging from independent establishments to large chains, all vying for consumer spending. The market's fragmentation means Marston's must consistently differentiate itself to capture and retain market share.

In 2024, this rivalry is further amplified by relatively slow market growth and significant exit barriers. High fixed costs associated with pub operations, coupled with the difficulty of repurposing specialized properties, encourage existing players to compete fiercely. This dynamic often leads to aggressive pricing and marketing strategies as companies fight for every customer.

Competitors are actively adapting by focusing on experiential dining, expanding no and low-alcohol options, and embracing digital transformation. For instance, major rivals are investing in pub refurbishments and digital ordering systems to enhance customer experience and convenience.

| Competitor Focus Area | Marston's Challenge | 2024 Industry Trend Example |

|---|---|---|

| Experiential Dining | Matching competitor atmosphere and entertainment offerings | Increased investment in unique events and themed nights |

| No/Low Alcohol Options | Expanding diverse beverage selections | Growth in demand for non-alcoholic craft beers and spirits |

| Digital Transformation | Integrating seamless online and mobile customer journeys | Adoption of QR code ordering and loyalty apps |

SSubstitutes Threaten

The most significant substitute for visiting a pub like Marston's is enjoying food and drinks at home. This trend has been amplified by the ongoing cost-of-living crisis, making at-home consumption an increasingly attractive option due to its perceived lower cost and greater convenience.

In 2024, consumers are particularly sensitive to price. Reports indicate that household budgets are still strained, leading many to seek more economical ways to socialize and dine. This directly impacts the pub sector, as a night out can be significantly more expensive than preparing a meal and buying beverages at a supermarket.

The availability of a wide variety of ready-to-eat meals and a broad selection of alcoholic and non-alcoholic beverages in supermarkets further strengthens the substitute threat. Consumers can replicate a pub experience at home with ease, further diverting spending away from traditional hospitality venues.

Consumers today have an incredibly diverse range of choices for their leisure time and money. Beyond traditional pubs, they can opt for cinema trips, bowling, competitive socialising venues like escape rooms or axe throwing, or simply dining out at restaurants. This wide selection means Marston's pubs are constantly vying for attention and disposable income against many other entertainment providers.

The sheer volume of these alternatives directly impacts Marston's. For instance, in 2024, the UK cinema industry reported strong recovery, with admissions reaching significant figures, indicating a robust demand for out-of-home entertainment. This directly siphons off potential customers who might otherwise choose a pub visit, especially for social gatherings or evening entertainment.

The growth of off-trade alcohol sales, particularly through supermarkets and off-licenses, represents a significant threat of substitutes for Marston's pub business. These channels provide consumers with a much wider variety of alcoholic beverages, often at considerably lower prices than what is available in a pub. This accessibility and price advantage mean that consumers can easily choose to purchase drinks for consumption at home, directly substituting the experience and sales that Marston's pubs would otherwise generate.

Rise of Delivery Services and Takeaways

The increasing prevalence of food and drink delivery services presents a significant threat of substitutes for Marston's. Consumers can now easily access restaurant-quality meals and a wide array of beverages delivered directly to their homes, offering a convenient alternative to visiting a pub.

This trend directly competes with the core offering of pubs, which is the experience of dining and socializing outside the home. For example, in 2024, the UK food delivery market continued its robust growth, with platforms reporting substantial increases in order volumes, indicating a growing consumer preference for at-home dining solutions.

- Convenience Factor: Delivery services eliminate the need for travel and offer immediate gratification.

- Variety of Options: Consumers have access to a broader culinary selection than any single pub might offer.

- Cost Comparison: While delivery fees exist, the perceived value for home dining can sometimes outweigh the cost of a pub visit, especially for families.

Health and Wellness Trends

The increasing consumer focus on health and wellness presents a significant threat of substitutes for Marston's core business. This trend is leading to a general reduction in alcohol consumption, impacting traditional high-margin products.

In response, Marston's has seen the rise of no and low-alcohol alternatives within its pubs. For instance, by early 2024, the UK market for low and no-alcohol drinks was experiencing robust growth, with some reports indicating double-digit percentage increases annually, although specific Marston's data on this shift's margin impact is not publicly detailed.

- Growing Health Consciousness: Consumers are actively seeking healthier lifestyles, which often involves moderating or eliminating alcohol intake.

- Rise of Non-Alcoholic Options: The availability and popularity of no and low-alcohol beers, ciders, and spirits are increasing, offering direct substitutes for traditional alcoholic beverages.

- Impact on Margins: While offering alternatives can attract customers, these lower-alcohol products may carry lower profit margins compared to full-strength alcoholic drinks, potentially affecting overall profitability.

The threat of substitutes for Marston's pubs is multifaceted, encompassing at-home consumption, alternative leisure activities, and evolving consumer health preferences. The increasing affordability and convenience of replicating a pub experience at home, coupled with a broader entertainment landscape, directly challenge Marston's market share. Furthermore, the growing demand for healthier lifestyle choices, including reduced alcohol consumption, necessitates adaptation within the pub sector.

| Substitute Category | Key Drivers | Impact on Marston's | 2024 Data Point Example |

|---|---|---|---|

| At-Home Consumption | Cost savings, convenience, wider beverage selection | Reduced footfall and sales | UK supermarket alcohol sales continue strong growth, offering price advantage over pubs. |

| Alternative Leisure Activities | Diverse entertainment options, social experiences | Competition for disposable income and leisure time | UK cinema admissions show robust recovery, indicating strong demand for out-of-home entertainment. |

| Health & Wellness Trends | Reduced alcohol intake, preference for healthier options | Potential decline in traditional beverage sales, need for product diversification | UK low and no-alcohol drinks market experiencing double-digit annual growth. |

Entrants Threaten

Opening and operating a pub, particularly one offering food and accommodation, demands significant upfront capital. This includes costs for property acquisition or leasing, extensive renovations and fit-out, securing necessary licenses and permits, and stocking initial inventory. For instance, in 2024, the average cost to purchase and fully equip a new pub could easily range from £300,000 to over £1,000,000, depending on location and scale.

These considerable capital requirements serve as a formidable barrier to entry for potential new competitors. Newcomers must secure substantial funding to even begin operations, making it difficult for smaller or less capitalized businesses to enter the market and compete with established players.

The UK pub industry faces significant barriers to entry due to stringent regulatory requirements. Obtaining licenses for alcohol sales, adhering to food hygiene standards, and securing necessary planning permissions are complex and can be a lengthy, expensive process for new operators. For example, in 2024, the average time to obtain a personal licence in the UK could extend several months, involving background checks and training courses.

Established players like Marston's benefit from deeply entrenched relationships with key suppliers and distributors, securing favorable terms and reliable access. New entrants would face significant hurdles in replicating these networks, likely incurring higher procurement costs and potentially experiencing supply disruptions. For instance, in the UK pub and brewing industry, securing prime locations and reliable beer supply can be challenging for newcomers.

Brand Loyalty and Customer Acquisition

Marston's benefits from strong brand loyalty, a critical factor in deterring new entrants. Its community-focused pubs have cultivated a dedicated customer base, making it challenging for newcomers to gain traction. For instance, in 2024, Marston's reported continued strength in its leased pubs division, indicating sustained customer preference for its established brands and operational model.

New competitors face significant hurdles in acquiring customers. They would need substantial marketing budgets and unique value propositions to lure patrons away from Marston's. The cost of building brand recognition and fostering loyalty from scratch is a major barrier, requiring considerable investment in advertising and promotional activities.

- Established Brand Recognition: Marston's enjoys high awareness due to its long-standing presence in the pub sector.

- Customer Loyalty: A loyal customer base reduces the immediate threat from new entrants who lack established relationships.

- High Acquisition Costs: New entrants must overcome significant marketing and differentiation expenses to attract Marston's customers.

Economies of Scale and Experience Curve

Marston's, as a significant player in the pub industry, leverages substantial economies of scale. This allows them to negotiate better prices for supplies, from beverages to food, and to spread marketing costs across a wider base. For instance, in 2024, major pub chains often secure volume discounts that smaller, independent operators simply cannot access.

New entrants often face a steep uphill battle due to this cost disadvantage. They may be forced to pay higher prices for inventory and marketing, making it difficult to compete on price or achieve comparable profit margins. This is further compounded by the experience curve; established companies have refined their operations over years, leading to greater efficiency and lower per-unit costs.

- Economies of Scale: Marston's can achieve lower per-unit costs through bulk purchasing of goods and services, reducing their operational expenses compared to smaller competitors.

- Marketing Efficiency: Larger operators can spread advertising and promotional costs over a greater number of outlets, making their marketing spend more cost-effective.

- Operational Expertise: Years of experience have allowed Marston's to optimize supply chains, staffing, and service delivery, creating efficiencies that new entrants must replicate.

- Capital Investment: New entrants may require significant upfront capital to build brand recognition and achieve a scale that can rival established players, a barrier to entry.

The threat of new entrants for Marston's is generally moderate, primarily due to substantial capital requirements and regulatory hurdles. The high cost of acquiring property, renovations, licenses, and initial stock, estimated between £300,000 and over £1,000,000 for a new pub in 2024, deters many potential competitors. Furthermore, navigating complex licensing and food hygiene regulations, which can take months to secure in 2024, adds another layer of difficulty.

Established brands like Marston's benefit from strong customer loyalty and existing supplier relationships, making it challenging for newcomers to gain market share. New entrants must overcome significant marketing expenses to build brand awareness and attract customers away from established players. Economies of scale also provide Marston's with a cost advantage in purchasing and marketing, further increasing the barrier to entry.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront costs for property, fit-out, and licensing. | Significant financial barrier, requiring substantial investment. |

| Regulatory Hurdles | Complex licensing, food safety, and planning permissions. | Time-consuming and costly process, demanding expertise. |

| Brand Loyalty & Relationships | Established customer base and supplier networks. | Difficult for new entrants to replicate, leading to higher costs and supply chain challenges. |

| Economies of Scale | Lower per-unit costs through bulk purchasing and marketing efficiency. | New entrants face a cost disadvantage, impacting pricing and profitability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Marston's leverages data from their annual reports, investor presentations, and analyst reports to understand their financial health and strategic direction. We also incorporate industry-specific data from trade publications and market research firms to assess competitive intensity and buyer power within the pub and brewing sector.