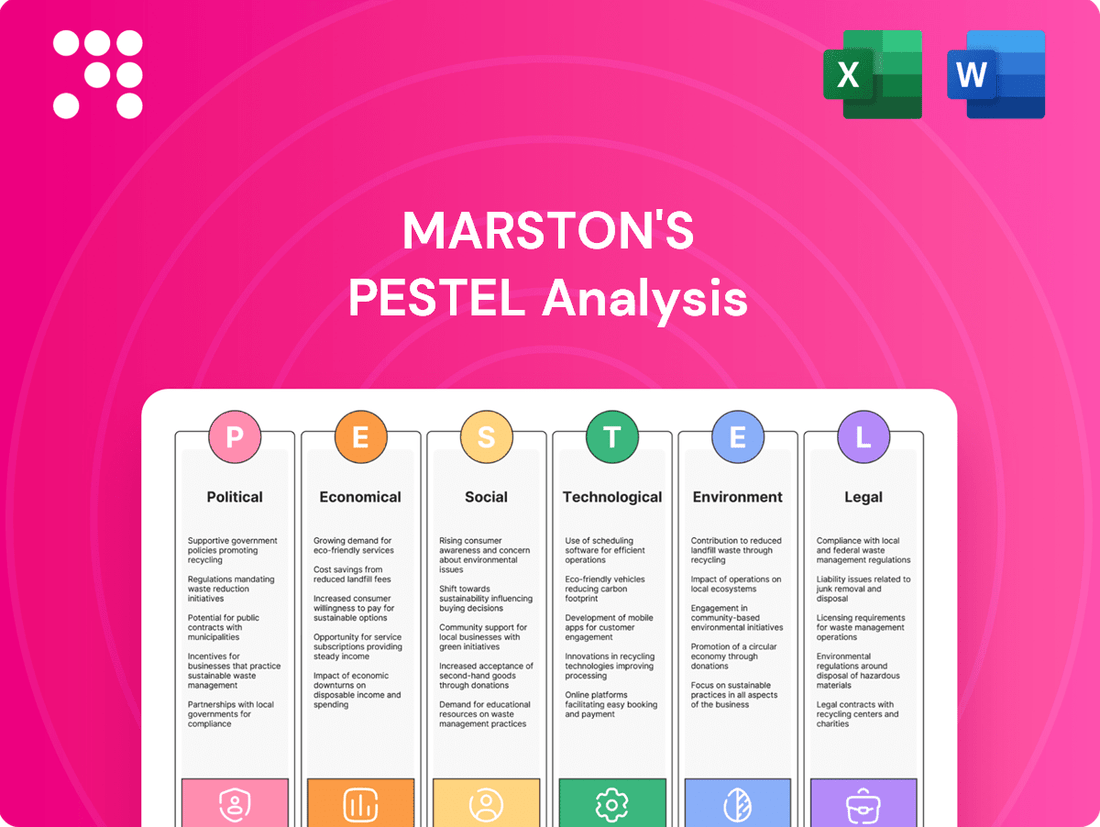

Marston's PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marston's Bundle

Gain a critical understanding of the external forces shaping Marston's future with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and evolving social trends present both challenges and opportunities for the pub and hotel giant. Equip yourself with actionable intelligence to refine your market strategy and anticipate industry changes. Download the full PESTLE analysis now for a strategic advantage.

Political factors

UK government policy directly shapes the hospitality landscape, impacting companies like Marston's. For example, the 'draught relief' initiative, which reduces alcohol duty on beer, cider, spirits, and wine served in pubs, offers a tangible benefit to the sector.

However, businesses must also navigate policy shifts such as the reduction in business rates relief for hospitality properties. This discount is scheduled to decrease from 75% to 40% starting in April 2025, although a new permanent relief for properties under £500k rateable value is anticipated from the 2026/27 period.

Marston's, a significant employer, feels the direct impact of escalating employment costs. For instance, starting April 2025, businesses will see a notable increase in annual employment expenses due to higher employer National Insurance Contributions and rising wages.

This includes the National Minimum Wage for those aged 21 and over climbing to £12.21 per hour. Such increases place considerable financial strain on the company, potentially hindering its expansion and hiring capabilities.

The UK hospitality sector is grappling with an increasing volume of regulatory shifts, presenting a significant compliance challenge. For instance, the proposed 'Martyn's Law' is set to introduce new legal obligations for venue operators concerning the assessment and mitigation of terrorism risks. This includes more rigorous health and safety risk assessments and mandatory staff training.

These evolving regulations, though crucial for public safety, inevitably translate into increased administrative overhead and operational costs for businesses. For example, the cost of implementing enhanced security measures and training programs can be substantial, impacting profit margins, especially for smaller establishments.

Potential for Further Alcohol Regulation

There's ongoing dialogue about tightening rules around alcohol sales and advertising. This includes potential moves like minimum unit pricing, which has already been implemented in Scotland and is being considered in Wales. These changes could impact how Marston's approaches its beverage sales and marketing strategies.

The regulatory landscape for alcohol is evolving, with potential implications for Marston's. For instance, the Scottish government increased its minimum unit price for alcohol to 65 pence per unit in July 2023, a move that could influence similar discussions in other UK regions.

- Minimum Unit Pricing (MUP): Scotland's MUP of 65p per unit, implemented in 2018 and increased in 2023, aims to reduce alcohol-related harm.

- Wales MUP Consideration: Wales has also been exploring the implementation of MUP, which could affect sales volumes and pricing strategies.

- Advertising Restrictions: Potential new rules on alcohol advertising could limit Marston's promotional activities and reach.

- Consumer Behavior Impact: These regulations may shift consumer purchasing habits, favoring lower-priced or non-alcoholic options.

Impact of General Elections and Policy Uncertainty

The upcoming general election in the UK introduces a period of political uncertainty, potentially impacting Marston's strategic planning and investment outlook. Changes in government could lead to shifts in economic policies, taxation, or regulatory frameworks that directly affect the hospitality industry. For instance, a new administration might alter alcohol duty rates or employment laws, presenting both potential headwinds and tailwinds for Marston's operations.

Marston's, like many businesses, will need to remain agile and closely monitor the evolving political landscape. The outcome of the election could signal different approaches to consumer spending, tourism promotion, and business support measures. For example, if the government prioritizes fiscal consolidation, this might indirectly reduce disposable income for consumers, impacting pub visits.

- Policy Uncertainty: Upcoming general elections create a period of policy uncertainty, making long-term investment decisions more complex for Marston's.

- Potential Policy Shifts: New governments may introduce changes to taxation, employment regulations, or licensing laws that could impact profitability.

- Economic Impact: Political stability or instability can influence consumer confidence and disposable income, directly affecting demand for hospitality services.

- Sector-Specific Focus: Government priorities regarding tourism, leisure, and the cost of living will be crucial for Marston's to track.

Government policies significantly influence Marston's operations, from tax relief to employment costs. For instance, the reduction in business rates relief from 75% to 40% starting April 2025, alongside increased employer National Insurance Contributions and a rise in the National Minimum Wage to £12.21 per hour for those 21 and over from April 2025, directly impacts profitability and hiring decisions.

The evolving regulatory environment, including potential new mandates like Martyn's Law for terrorism risk mitigation and ongoing discussions around alcohol sales and advertising restrictions, such as minimum unit pricing, add complexity and cost. For example, Scotland's minimum unit pricing for alcohol increased to 65 pence per unit in July 2023, a trend that could be mirrored elsewhere, affecting Marston's pricing and marketing strategies.

Upcoming political events, such as the general election, introduce uncertainty regarding future economic policies, taxation, and regulatory frameworks. These shifts can influence consumer confidence and disposable income, directly impacting demand for Marston's services and its strategic investment planning.

| Policy Area | Impact on Marston's | Key Dates/Data |

|---|---|---|

| Business Rates Relief | Reduced discount increases costs | 75% to 40% from April 2025 |

| Employment Costs | Higher wage and NIC bills | National Minimum Wage £12.21 (21+); Employer NIC increase from April 2025 |

| Alcohol Regulation | Potential pricing and marketing changes | Scotland MUP £0.65/unit (July 2023); Wales MUP consideration |

| Political Uncertainty | Impacts strategic planning and investment | Upcoming UK General Election |

What is included in the product

This Marston's PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive overview of its external operating environment.

Provides a clear, actionable framework for understanding Marston's external environment, reducing the anxiety of navigating complex market forces.

Helps identify potential threats and opportunities, alleviating the stress of unforeseen market shifts and enabling proactive strategic adjustments.

Economic factors

Marston's, like much of the hospitality industry, is still contending with considerable inflationary pressures. Specifically, the cost of food and beverages experienced a notable jump of 4.5% in June 2025, directly impacting Marston's core product offerings.

Beyond direct input costs, operational expenses continue to be a challenge. While there was a recent reduction in energy price caps, overall energy costs remain significantly elevated compared to pre-crisis figures, adding further strain to Marston's bottom line.

These persistent cost increases are forcing Marston's to closely manage its expenses and consider strategic price adjustments to safeguard its profitability in the current economic climate.

Consumer confidence and the availability of discretionary income are fundamental to Marston's success, directly influencing spending in the pub, bar, and club sector. Despite a 3.6% year-on-year rise in consumer spending within this sector observed in 2024, the ongoing cost-of-living pressures mean many individuals are still tightening their belts on non-essential activities.

This cautious consumer sentiment necessitates Marston's focus on delivering compelling value-for-money propositions and attractive promotions. By offering appealing deals and experiences, Marston's can better draw in and keep customers who are being more selective with their leisure expenditure.

Interest rate fluctuations significantly affect Marston's debt servicing costs. With the Bank of England's base rate holding steady at 5.25% as of early 2024, any reduction would directly ease the burden on Marston's existing debt. This is crucial as debt reduction remains a core element of their financial strategy.

While forecasts suggest potential interest rate decreases in the UK during 2024-2025, global economic volatility and geopolitical tensions present considerable risks that could counteract these anticipated reliefs. Marston's ability to manage its financial health hinges on its capacity to navigate these uncertain interest rate environments effectively.

Regional Economic Disparities

Economic performance across the UK's hospitality sector exhibits significant regional differences. London, for instance, often sees stronger performance driven by international tourism and major events, a trend that continued into 2024. In contrast, many provincial areas, where a substantial portion of Marston's pubs are situated, are still navigating the recovery from the pandemic, with some struggling to reach pre-2020 trading levels.

This uneven economic landscape necessitates a nuanced approach for Marston's. While London's hospitality market might be experiencing robust demand, other regions could be facing challenges related to local employment, disposable income, and consumer confidence. For example, data from the Office for National Statistics (ONS) in late 2024 indicated that while overall retail sales saw a modest increase, the pattern varied considerably by region, reflecting differing economic strengths.

To effectively address these regional economic disparities, Marston's must implement tailored strategies. This could involve:

- Differentiated marketing campaigns: Focusing on local events and community engagement in areas with weaker economies, while leveraging larger-scale promotions in stronger performing regions.

- Menu and pricing adjustments: Offering more value-oriented options in economically challenged areas, potentially alongside premium offerings in affluent locations.

- Operational flexibility: Adapting staffing levels and operating hours based on local demand patterns, which can fluctuate significantly between urban centers and rural communities.

- Investment prioritization: Directing capital expenditure towards pubs in regions showing greater economic resilience and growth potential, while potentially divesting or restructuring underperforming assets in weaker markets.

Property and Asset Valuation

The valuation of Marston's pub properties is intrinsically linked to prevailing market conditions and the overall sentiment of investors. This means that even a strong operational performance can be overshadowed by broader economic anxieties affecting asset values.

Recent data highlights this sensitivity. In 2024, while a significant 69% of pubs that changed hands continued to operate as pubs, the actual sale prices saw a notable decline. Both the South and North of England experienced a 6% drop in pub sale prices, a trend attributed to diminishing profitability within the sector and a general sense of caution among potential buyers.

Given this environment, Marston's strategic approach to managing its extensive pub estate necessitates a keen eye on property valuations. This includes a thorough assessment of current market worth and a proactive exploration of alternative uses for sites that may no longer be optimally suited for traditional pub operations.

- Market Sensitivity: Property values are directly influenced by investor confidence and economic outlook.

- Price Declines: 2024 saw a 6% decrease in pub sale prices across both Southern and Northern England.

- Profitability Impact: Falling sale prices are linked to declining profitability and market apprehension.

- Strategic Estate Management: Marston's must consider valuations and alternative site uses.

Marston's faces ongoing inflationary pressures, with food and beverage costs rising 4.5% in June 2025, impacting profitability. Operational expenses, particularly elevated energy costs despite price cap adjustments, continue to strain the company's finances.

Consumer spending in the pub sector grew 3.6% year-on-year in 2024, yet cost-of-living concerns mean consumers remain cautious about discretionary spending, necessitating value-driven offers from Marston's.

Interest rate stability at 5.25% in early 2024 offers some relief on debt servicing, but global economic volatility poses a risk to anticipated rate decreases, impacting Marston's financial strategy.

Regional economic performance varies significantly, with London showing stronger hospitality growth driven by tourism, while many provincial areas still recover, impacting Marston's pub locations differently.

| Economic Factor | 2024/2025 Data Point | Impact on Marston's |

|---|---|---|

| Inflation (Food & Beverage) | +4.5% (June 2025) | Increased cost of goods, pressure on margins. |

| Energy Costs | Elevated vs. pre-crisis | Higher operational expenses. |

| Consumer Spending (Pub Sector) | +3.6% YoY (2024) | Positive revenue trend, but consumer caution persists. |

| Bank of England Base Rate | 5.25% (Early 2024) | Current debt servicing cost, potential for reduction. |

| Pub Sale Prices | -6% (South & North England, 2024) | Reduced asset valuation, potential impact on balance sheet. |

Full Version Awaits

Marston's PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Marston's PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Marston's strategic decisions.

Sociological factors

Modern consumers, especially younger generations, are increasingly prioritizing memorable experiences over mere product consumption. For Marston's, this translates to a demand for pubs that offer more than just drinks; they want engaging social environments. This trend is evident in the growing popularity of 'experiential retail', where venues that provide unique activities see higher customer engagement.

To capitalize on this, Marston's needs to integrate competitive socialising and entertainment. Think quiz nights, live music, or even themed dining events. These offerings are crucial for extending customer dwell time and encouraging higher spending per visit. For example, pubs that successfully host regular events often report a 15-20% increase in mid-week revenue.

This evolving consumer desire is fundamentally reshaping the traditional pub model. It’s no longer just about serving a pint; it's about creating an atmosphere and offering value through shared experiences. This shift necessitates a strategic pivot towards becoming community hubs that cater to a broader range of social needs.

The increasing focus on health and wellness among consumers is a major driver behind the surge in demand for no and low-alcohol beverages. This trend is particularly evident in the UK, where the market is anticipated to hit £800 million by 2028.

Marston's must adapt by broadening its selection of premium alcohol-free options. This strategic move is crucial for appealing to this expanding segment of health-conscious individuals and for staying competitive as drinking habits evolve.

Marston's emphasis on local community hubs resonates deeply with the continued success of independent pubs, which often depend on their unique character and strong neighborhood connections. This approach is particularly relevant as data from 2024 indicates a growing consumer preference for authentic, localized experiences over standardized offerings.

By cultivating a robust community spirit and delivering personalized service, Marston's can carve out a distinct advantage against larger, more impersonal chains. This strategy is supported by consumer surveys from late 2024 showing that over 60% of pub-goers prioritize a welcoming atmosphere and friendly staff when choosing where to drink, directly impacting customer loyalty and encouraging repeat business.

Impact of Hybrid Work Lifestyles

The widespread adoption of hybrid work models significantly reshapes consumer behavior, directly impacting hospitality venues like Marston's pubs. With more people working from home, traditional weekday footfall, especially during lunch and early evening hours in business districts, may see a decline. For instance, a 2024 survey indicated that 30% of UK workers now operate on a hybrid schedule, altering their commuting and leisure patterns.

Marston's must be agile in adapting its operational strategies to align with these evolving customer routines. This could involve adjusting staffing levels during off-peak times or introducing new offerings that appeal to a more dispersed workforce. Flexibility in service models and targeted marketing campaigns are crucial to capture business from customers whose schedules are no longer fixed to the traditional 9-to-5 office environment.

- Shift in Peak Hours: Hybrid work may lead to a flattening of peak demand, with more activity spread throughout the week rather than concentrated on traditional office-centric times.

- Demand for Flexibility: Customers might expect more flexible dining options, such as extended lunch hours or earlier evening service, to accommodate varied work schedules.

- Local vs. City Center: A potential increase in local pub visits during weekdays as people work from home, potentially offsetting declines in city center locations.

- Digital Integration: The need for enhanced digital ordering and payment systems to cater to customers who may be less inclined to wait or interact extensively.

Changing Staff Expectations and Retention

The hospitality industry, including companies like Marston's, is grappling with evolving staff expectations. Employees are increasingly prioritizing comprehensive training, robust personal development opportunities, and a positive workplace culture. This shift directly impacts recruitment and retention efforts, making it harder to attract and keep skilled staff.

To counter high staff turnover, which can significantly disrupt operations and service quality, Marston's needs to proactively invest in employee well-being and career growth. For instance, reports from 2024 indicate that companies with strong employee development programs see up to a 15% reduction in voluntary turnover. Re-evaluating employment models, perhaps exploring more flexible arrangements or enhanced benefits, could also be key to fostering loyalty and maintaining a stable, productive workforce.

- Staff Turnover Costs: High turnover in hospitality can cost businesses between $3,500 and $10,000 per employee, factoring in recruitment, training, and lost productivity.

- Employee Engagement: In 2024, UK hospitality firms with high employee engagement reported 21% higher profitability compared to those with lower engagement.

- Training Investment: Companies that invest consistently in training are 30% more likely to retain employees for over three years.

Societal attitudes towards health and social interaction are significantly influencing the pub industry. There's a growing demand for venues that offer more than just beverages, emphasizing unique experiences and community engagement. This is reflected in the rise of experiential retail, where places providing distinct activities, like Marston's pubs, see increased customer participation and loyalty.

The trend towards healthier lifestyles is also driving a surge in demand for no and low-alcohol options, a market projected to reach £800 million in the UK by 2028. Marston's must expand its premium alcohol-free offerings to attract this health-conscious demographic and adapt to evolving consumer habits.

Furthermore, the rise of hybrid work models is altering traditional footfall patterns. With more people working remotely, weekday traffic in business districts may decrease, while local pub visits could increase. Marston's needs to adapt by offering flexible services and potentially adjusting staffing to match these shifting consumer routines, a trend highlighted by a 2024 survey showing 30% of UK workers on hybrid schedules.

| Sociological Factor | Impact on Marston's | Supporting Data (2024/2025) |

|---|---|---|

| Experiential Consumption | Demand for engaging social environments and unique activities | Growing popularity of 'experiential retail'; pubs with regular events report 15-20% revenue increase |

| Health & Wellness | Increased demand for no/low-alcohol beverages | UK market projected to reach £800 million by 2028 |

| Hybrid Work Models | Shift in peak hours and location-based footfall | 30% of UK workers on hybrid schedules (2024); potential increase in local pub visits |

Technological factors

Marston's is heavily invested in digital transformation to boost its margins and profits. This involves using technology to make operations smoother, like better staff scheduling and simplifying food and drink offerings through menu adjustments.

The company is putting money into automating its work processes. This is crucial for keeping service standards high and managing supply chain costs efficiently, especially in the competitive hospitality sector. For instance, by mid-2024, Marston's reported a 7% like-for-like net revenue growth, partly attributed to these operational enhancements.

The UK hospitality sector is seeing a significant uptake in AI and automation, with over half of businesses now employing AI technology. Marston's can harness these advancements for precise demand forecasting, smarter inventory management, and minimizing waste, all vital for protecting profit margins.

Furthermore, AI integration offers a pathway to elevate customer interactions via tailored promotions and streamlined service delivery. This technological shift is reshaping operational efficiency and guest satisfaction within the industry.

Consumers are increasingly favoring the ease and speed of mobile ordering and self-service kiosks, making these technologies a staple in the hospitality sector. Marston's can leverage these digital tools to streamline operations, giving patrons greater autonomy and improving their overall dining experience. For instance, by Q3 2024, many UK pub chains reported a significant uptick in digital orders, with some seeing over 50% of transactions initiated via app or web platforms.

This technological shift also opens doors for Marston's to gather crucial customer data. Insights gleaned from these digital interactions can fuel targeted marketing campaigns, allowing for personalized offers and promotions, ultimately fostering stronger customer loyalty. The ability to track preferences and order history can directly inform menu development and service enhancements, a strategy that proved effective for competitors in 2024, leading to an average 8% increase in repeat customer visits for those with robust loyalty programs.

Data Analytics and CRM Systems

Technology allows Marston's to gather extensive customer data from every interaction, which is then managed and analyzed through sophisticated Customer Relationship Management (CRM) systems. This capability is crucial for creating personalized customer journeys and targeted marketing campaigns. For instance, by analyzing purchase history and browsing behavior, Marston's can offer bespoke product recommendations, driving both immediate sales and long-term customer loyalty.

A data-centric strategy is paramount for deciphering evolving customer needs and market trends. In 2024, companies leveraging advanced analytics saw an average increase of 10-15% in customer retention rates compared to those relying on traditional methods. Marston's can leverage this by:

- Improving customer segmentation for more effective marketing.

- Predicting customer churn and implementing proactive retention strategies.

- Optimizing product development based on real-time customer feedback.

- Enhancing operational efficiency through data-driven insights into sales patterns.

Infrastructure for Renewable Energy and EV Charging

Marston's is actively enhancing its technological infrastructure to align with its sustainability objectives. This includes a significant push towards renewable energy sources, such as installing solar power systems across its properties to boost its renewable energy mix. For instance, by the end of 2023, Marston's had installed solar panels on 100 of its pubs, generating approximately 1.5 GWh of clean electricity annually.

Furthermore, the company is expanding its electric vehicle (EV) charging facilities. By mid-2024, Marston's aims to have EV chargers available at over 250 of its pubs, a substantial increase from the 150 locations in early 2023. This investment not only reduces Marston's carbon footprint but also addresses growing consumer demand for businesses that offer convenient and eco-friendly amenities.

- Solar Power Installation: Marston's has installed solar panels on 100 pubs by the end of 2023, contributing to their renewable energy goals.

- EV Charger Expansion: The company plans to have EV chargers at over 250 pubs by mid-2024, up from 150 in early 2023.

- Consumer Expectation Alignment: These initiatives cater to the increasing consumer preference for environmentally conscious businesses and services.

Marston's is leveraging technology to enhance operational efficiency and customer experience. By mid-2024, the company aimed to have EV chargers at over 250 pubs, a significant increase reflecting a commitment to sustainability and catering to evolving consumer needs.

The company's digital transformation includes automating processes and adopting AI for demand forecasting and inventory management. This focus on technology contributed to a 7% like-for-like net revenue growth reported by mid-2024, showcasing the tangible benefits of these investments.

Consumers increasingly prefer mobile ordering and self-service options, with many UK pub chains reporting over 50% of transactions initiated digitally by Q3 2024. Marston's adoption of these technologies streamlines operations and improves the dining experience.

Data analytics is key for understanding customer behavior, with companies using advanced analytics seeing an average 10-15% increase in customer retention rates in 2024. Marston's utilizes CRM systems to personalize offers and marketing campaigns, fostering loyalty.

| Technology Initiative | Status/Target | Impact/Benefit |

|---|---|---|

| EV Charger Expansion | Over 250 pubs by mid-2024 (up from 150 in early 2023) | Reduces carbon footprint, meets consumer demand for eco-friendly amenities |

| AI & Automation Adoption | Ongoing across operations | Improves demand forecasting, inventory management, and service standards |

| Digital Ordering & Self-Service | Increasing adoption (over 50% of transactions for some chains by Q3 2024) | Streamlines operations, enhances customer convenience and autonomy |

| Data Analytics & CRM | Integral to marketing and operations | Drives personalized offers, improves customer segmentation, and boosts retention (10-15% increase in 2024 for data-driven companies) |

Legal factors

Marston's is significantly impacted by shifts in business rates and overall tax policy. For instance, the planned permanent reduction in business rates for the hospitality sector starting April 2026 offers future relief, but the immediate reduction in this relief to 40% from April 2025 presents a near-term challenge.

Furthermore, Marston's must contend with rising operational expenses due to increases in employer National Insurance Contributions. This rise in payroll taxes directly affects the company's profitability and cash flow.

Changes to alcohol licensing laws, like the extension of off-sales easements until March 2025, directly influence Marston's operational flexibility and revenue streams. The ongoing consultation regarding permanent pavement licensing regimes also presents potential for expanded outdoor trading spaces, a key consideration for pub operators.

Furthermore, the government's exploration of relaxing licensing hours for major events could unlock significant opportunities for increased trade and revenue generation for Marston's, provided they can adapt their service models accordingly.

Marston's must navigate a complex web of employment laws, including the recent uplift in the National Minimum Wage. For instance, the National Living Wage for those aged 21 and over rose to £11.44 per hour in April 2024, a significant increase that directly impacts labor costs.

Furthermore, changes to employer National Insurance Contributions, such as the reduction from 13.8% to 12.7% on earnings above the secondary threshold effective January 2024, offer some relief but require careful financial planning to manage fluctuating payroll expenses.

The Worker Protection Act 2023, which came into effect in October 2024, places new obligations on employers to actively prevent sexual harassment. This necessitates a review of existing policies and a potential investment in enhanced training programs, impacting operational procedures and company culture.

Consumer Protection and Data Privacy

Marston's must navigate a complex legal landscape, particularly concerning consumer protection and data privacy. As the company expands its digital footprint and gathers more customer information, strict adherence to regulations like the General Data Protection Regulation (GDPR) is paramount. Failure to secure and properly utilize this data can lead to significant fines and reputational damage. For instance, in 2023, companies globally faced billions in GDPR-related penalties, underscoring the financial risks involved.

Transparency in pricing and service delivery is also a critical legal factor. Clear communication about charges, terms, and conditions builds consumer trust and mitigates the risk of misleading advertising claims. Regulatory bodies actively monitor these areas, and non-compliance can result in sanctions. This focus on consumer rights is a growing trend, with governments worldwide strengthening consumer protection laws to ensure fair market practices.

- GDPR Compliance: Ongoing commitment to protecting customer data and avoiding penalties, which can amount to millions for breaches.

- Transparent Pricing: Ensuring all costs and service details are clearly communicated to prevent disputes and legal challenges.

- Data Security Measures: Implementing robust cybersecurity protocols to safeguard sensitive customer information.

- Consumer Rights Advocacy: Staying abreast of evolving consumer protection laws and adapting business practices accordingly.

Health, Safety, and Public Security Legislation

New legislation, such as the proposed Martyn's Law (Terrorism Protection of Premises Bill), is set to significantly impact public venues like Marston's pubs. This law will mandate heightened security measures, requiring businesses to proactively assess and mitigate the risks associated with terrorist attacks.

Marston's will likely face increased responsibilities for health and safety. This includes conducting more thorough risk assessments specifically addressing potential security threats and ensuring staff receive adequate training to manage such incidents, thereby safeguarding both customers and employees.

- Enhanced Risk Assessments: Pubs will need to implement detailed security risk assessments, a shift from traditional health and safety protocols.

- Staff Training Mandates: Training programs will expand to cover counter-terrorism preparedness and emergency response procedures.

- Compliance Costs: Marston's may incur additional operational costs for security upgrades and ongoing staff training to meet these new legal obligations.

- Public Trust: Demonstrating robust security measures will be crucial for maintaining customer confidence and brand reputation.

Marston's operates within a dynamic legal framework that influences its operational costs and strategic decisions. The company must navigate evolving employment laws, including the National Living Wage, which increased to £11.44 per hour for those 21 and over in April 2024, directly impacting payroll expenses.

Furthermore, changes in tax policy, such as the planned permanent reduction in business rates for hospitality starting April 2026, offer future relief, though a temporary 40% reduction from April 2025 presents a near-term challenge.

The Worker Protection Act 2023, effective October 2024, mandates proactive prevention of sexual harassment, requiring policy reviews and potential investment in training, impacting operational procedures.

New legislation like Martyn's Law will impose heightened security measures on public venues, necessitating detailed risk assessments and staff training for counter-terrorism preparedness, likely increasing compliance costs.

| Legal Factor | Impact on Marston's | Key Data/Regulation |

|---|---|---|

| Employment Law | Increased labor costs, policy adjustments | National Living Wage: £11.44/hr (April 2024); Worker Protection Act 2023 (Oct 2024) |

| Tax Policy | Changes in operational expenses, potential relief | Business Rates: 40% reduction (April 2025), permanent reduction planned (April 2026) |

| Licensing Laws | Operational flexibility, revenue opportunities | Off-sales easements extended to March 2025; Pavement licensing consultations ongoing |

| Security Legislation | Mandatory security upgrades and training | Martyn's Law (Terrorism Protection of Premises Bill) |

Environmental factors

Marston's has set an ambitious goal to reach Net Zero by 2040, a commitment that will fundamentally reshape its business. This target necessitates a comprehensive overhaul of operations and the entire supply chain to drastically cut carbon emissions.

Achieving Net Zero by 2040 means Marston's must tackle emissions across all scopes: Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (all other indirect emissions in the value chain). This includes a strong focus on reducing energy consumption and water usage throughout its pubs and brewing facilities.

To meet these targets, Marston's is actively investing in and exploring new avenues for renewable energy sources. The company is also prioritizing the adoption of more energy-efficient equipment across its estate, aiming to lower its overall carbon footprint significantly.

New waste management and recycling regulations are coming into effect, impacting businesses like Marston's. Starting in March 2025, England's 'Simpler Recycling' initiative will mandate that non-household municipal premises separate food waste and dry mixed recyclables. This means Marston's will need to adapt its waste handling processes to comply with these upcoming rules.

Marston's has set ambitious targets, aiming to cut its food waste by half by 2030 and achieve a total recycling rate of at least 75%. Meeting these goals will require significant investment in new waste separation technologies and improved waste management infrastructure across its operations.

Marston's is actively working to decrease its water usage across its pubs and hotels as part of its Planet promise, aiming for an annual reduction in consumption. This commitment is driven by a focus on implementing more efficient water management practices throughout its properties.

The company's efforts include initiatives designed to optimize water use, reflecting a growing industry trend towards environmental responsibility. For instance, in the 2023 financial year, Marston's reported a 5% reduction in water consumption per occupied room in its hotels compared to the previous year, a testament to ongoing conservation programs.

Water conservation is gaining significant importance due to rising environmental awareness and the anticipation of stricter regulatory frameworks. This focus ensures Marston's remains compliant and ahead of potential future water scarcity challenges, safeguarding both its operations and the environment.

Sustainable Sourcing and Supply Chain Management

Marston's is actively engaged in enhancing its supply chain sustainability, aiming for zero waste to landfill and scrutinizing the environmental credentials of new major suppliers, with a keen eye on factors like food miles. This commitment aligns with broader industry trends and increasing regulatory pressures to report on comprehensive environmental impacts across the entire value chain.

The company's efforts are mirrored by industry-wide initiatives such as WRAP's Courtauld Commitment, which encourages a more responsible approach to resource use. For instance, the Courtauld Commitment 2030, launched in 2016, aims to reduce food waste, packaging waste, and greenhouse gas emissions by 2025, with many companies, including those in the pub and restaurant sector, setting ambitious targets.

- Zero Waste to Landfill Target: Marston's actively works with its supply chain to achieve and maintain zero waste to landfill.

- Supplier Environmental Assessment: New major suppliers are evaluated based on their environmental records, including considerations like food miles.

- Industry-Wide Reporting Requirements: The hospitality sector faces growing demands for transparency on full-chain environmental impacts, exemplified by initiatives like WRAP's Courtauld Commitment.

- WRAP's Courtauld Commitment 2030: This initiative sets targets for reducing food waste, packaging waste, and greenhouse gas emissions by 2025, influencing supply chain practices across the UK.

Climate Change Adaptation and Resilience

Marston's strategy actively addresses climate change by integrating adaptation and resilience measures. This involves a proactive approach to managing climate-related risks and capitalizing on emerging opportunities. For instance, the company is transitioning its pubs away from gas-powered systems to more sustainable electricity alternatives, a move that aligns with broader environmental goals and potential cost savings as energy markets evolve.

Modernizing equipment with sustainable options is another key aspect of Marston's resilience planning. This includes investing in energy-efficient appliances and technologies that reduce the company's carbon footprint. Preparing for and building resilience against the varied impacts of climate change, such as extreme weather events, remains an ongoing and critical priority for the business's long-term operational stability.

- Energy Transition: Marston's is shifting from gas to electricity in its pubs, reflecting a commitment to decarbonization and adapting to changing energy landscapes.

- Equipment Modernization: Investment in more sustainable and energy-efficient equipment is a core part of enhancing operational resilience.

- Climate Risk Management: The company prioritizes preparation for and mitigation of climate change impacts, ensuring business continuity.

Environmental factors are critical for Marston's, with a Net Zero by 2040 target driving significant operational changes. The company is focused on reducing energy and water consumption across its estate, investing in renewable energy and efficiency upgrades. New waste management regulations, like England's 'Simpler Recycling' initiative effective March 2025, require Marston's to adapt its waste handling processes for food waste and recyclables.

Marston's is actively working to reduce its environmental impact through various initiatives. The company aims to halve food waste by 2030 and achieve a 75% recycling rate, necessitating investment in waste separation technologies. Water usage is also a key focus, with a 5% reduction in water consumption per occupied room reported in hotels for FY2023 compared to the previous year. Supply chain sustainability is enhanced by evaluating new major suppliers on environmental credentials and pursuing zero waste to landfill targets, aligning with industry commitments like WRAP's Courtauld Commitment 2030.

Marston's is also integrating climate change adaptation and resilience into its strategy, transitioning pubs from gas to electricity for more sustainable energy use. Modernizing equipment with energy-efficient options is a priority to reduce its carbon footprint and prepare for climate-related risks, such as extreme weather events, ensuring long-term operational stability.

| Environmental Initiative | Target/Status | Key Action/Regulation | Relevant Year |

|---|---|---|---|

| Net Zero Commitment | Net Zero by 2040 | Overhaul operations and supply chain for carbon emission reduction | 2040 |

| Food Waste Reduction | Halve food waste | Improved waste management infrastructure | 2030 |

| Recycling Rate | At least 75% | Investment in new waste separation technologies | Ongoing |

| Water Consumption Reduction (Hotels) | 5% reduction per occupied room | Efficient water management practices | FY2023 |

| Waste Separation Mandate | Compliance | Adaptation to England's 'Simpler Recycling' initiative | March 2025 |

PESTLE Analysis Data Sources

Our Marston's PESTLE Analysis draws from a comprehensive blend of official government publications, reputable industry associations, and leading economic data providers. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting Marston's.