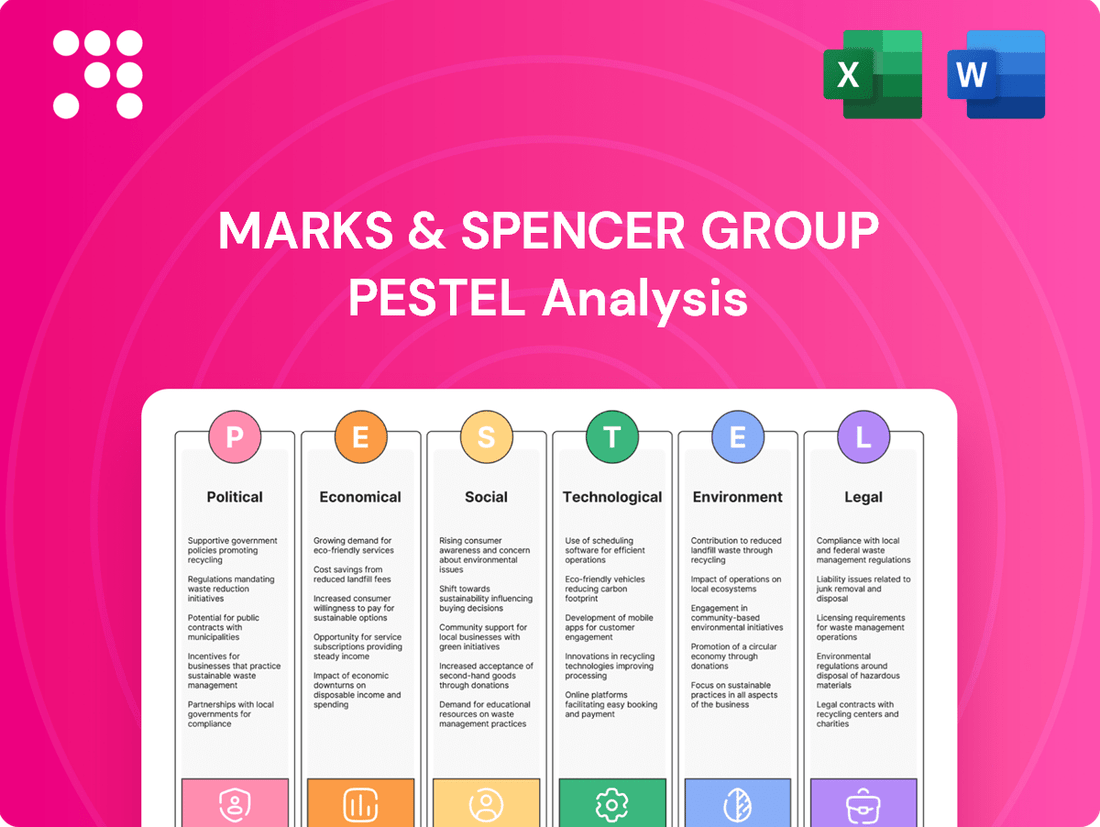

Marks & Spencer Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marks & Spencer Group Bundle

Marks & Spencer Group operates within a dynamic external environment, influenced by evolving political landscapes, economic fluctuations, and shifting social trends. Understanding these forces is crucial for strategic planning and identifying potential opportunities and threats. Our comprehensive PESTLE analysis delves deep into these factors, providing you with the actionable intelligence needed to navigate the complexities of the retail sector.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for Marks & Spencer Group. Uncover how technological advancements, environmental regulations, and legal frameworks are shaping the company's strategic direction. Download the full version now and equip yourself with the insights to make informed decisions and strengthen your market position.

Political factors

Marks & Spencer navigates a complex web of government policies and regulations across its operating markets, particularly in the UK. These include stringent consumer protection laws and evolving retail standards that directly influence how M&S conducts business. For instance, compliance with new packaging regulations, such as those aimed at reducing plastic waste, can lead to increased operational costs and necessitate ongoing adaptation of supply chains and product design. The UK's Competition and Markets Authority (CMA) plays a crucial role in ensuring fair market practices, requiring M&S to remain vigilant and proactive in understanding and adhering to its directives.

International trade agreements are a big deal for Marks & Spencer, directly impacting how much they pay for their products and how much it costs to ship things in and out. For example, changes in tariffs or new trade deals can quickly alter their cost of goods sold.

The lingering effects of Brexit continue to create ripples for M&S's supply chain. This means navigating new regulations, which could mean higher tariffs on imported goods and more complicated logistics, potentially increasing operational costs.

Looking at specific examples, the UK-Australia Free Trade Agreement, which began in 2023, might encourage M&S to explore new sourcing options or adjust existing ones to take advantage of potentially reduced trade barriers with Australia, impacting their product mix and costs.

Changes in employment and wage legislation, such as increases in the National Living Wage in the UK, directly impact M&S's operational costs. The UK's minimum wage increased to £11.44 per hour for those aged 21 and over from April 2024, adding to expenditure.

Compliance with these laws is crucial to avoid penalties and maintain brand reputation, influencing staffing models and pricing strategies for M&S.

Political Stability and Geopolitical Tensions

The political stability of the United Kingdom, M&S's primary market, directly impacts consumer confidence and spending. For instance, the general election scheduled for 2024 could introduce policy shifts affecting retail and consumer goods sectors. Geopolitical events also pose significant risks; the ongoing conflict in Ukraine continues to affect global energy prices and supply chain logistics, with the International Monetary Fund (IMF) projecting global growth to slow to 2.9% in 2024, a figure susceptible to further geopolitical shocks.

Marks & Spencer's international presence means it navigates a complex web of political landscapes. Political instability in key operating regions can lead to unpredictable economic downturns, directly impacting M&S's sales performance. The company must remain agile to adapt to varying regulatory environments and potential trade disruptions stemming from international relations.

- UK Political Landscape: Upcoming elections in 2024 could influence consumer spending patterns and regulatory frameworks relevant to M&S.

- Global Supply Chain Disruptions: Ongoing geopolitical tensions, such as those in Eastern Europe, continue to pose risks to M&S's international supply chains and operational costs.

- International Market Volatility: Political instability in any of M&S's operating countries can lead to economic uncertainty, affecting demand for its products.

Tax Policies

Tax policies in the UK and other countries where Marks & Spencer operates significantly influence its pricing and profitability. For instance, changes in Value Added Tax (VAT) directly impact the final price consumers pay for M&S products. A rise in corporate tax rates, like the UK's main rate increasing to 25% from April 2023 for companies with profits over £250,000, requires M&S to adjust its financial planning and potentially its investment strategies.

These tax shifts necessitate careful financial management and strategic adaptation. M&S must factor in potential increases in product prices to maintain margins, which could affect consumer demand. The company's ability to navigate these fiscal changes is crucial for sustained financial health and competitive positioning in the retail market.

Key considerations for M&S regarding tax policies include:

- Impact of VAT changes: Fluctuations in VAT rates directly affect the retail price of goods, influencing sales volume and consumer purchasing power.

- Corporate tax rate adjustments: Increases in corporate tax, such as the UK's 25% rate, necessitate adjustments in profit forecasting and cash flow management.

- International tax regulations: M&S must comply with diverse tax laws in its global operating markets, adding complexity to financial reporting and strategy.

- Tax incentives and reliefs: The company may leverage available tax incentives or reliefs to mitigate tax liabilities and support investment in areas like sustainability or innovation.

Political factors significantly shape Marks & Spencer's operational landscape, from consumer protection laws to international trade agreements. The UK's upcoming general election in 2024 could bring policy shifts impacting the retail sector. Geopolitical instability, like the conflict in Ukraine, continues to affect global supply chains and economic growth, with the IMF projecting a 2.9% global growth for 2024, susceptible to further shocks.

Changes in employment legislation, such as the UK's National Living Wage increase to £11.44 per hour for those 21 and over from April 2024, directly impact M&S's labor costs. Furthermore, the UK's corporate tax rate stands at 25% for profits over £250,000 since April 2023, influencing financial planning.

| Political Factor | Impact on M&S | Example/Data (2024/2025) |

| UK Regulatory Environment | Compliance costs, operational adjustments | New packaging regulations (plastic reduction) |

| International Trade Agreements | Cost of goods, supply chain efficiency | UK-Australia FTA (effective 2023) |

| Employment Legislation | Labor costs | UK National Living Wage: £11.44/hr (April 2024) |

| Tax Policies | Profitability, pricing strategies | UK Corporate Tax: 25% (April 2023 onwards) |

| Geopolitical Stability | Consumer confidence, supply chain disruption | IMF Global Growth Projection: 2.9% (2024) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the Marks & Spencer Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights and forward-looking perspectives to help identify strategic opportunities and mitigate potential threats for the business.

A concise, actionable PESTLE analysis for M&S Group, highlighting key external factors to proactively address strategic challenges and capitalize on opportunities.

Economic factors

Inflation remains a significant concern for Marks & Spencer, with the UK's Consumer Price Index (CPI) standing at 3.2% in March 2024. This directly affects M&S's operational costs, from sourcing raw materials for its food and clothing divisions to energy expenses.

The prevailing interest rate environment, exemplified by the Bank of England's base rate holding steady at 5.25% throughout 2024, has a dual impact. It increases M&S's borrowing costs for any outstanding loans or future investments. Simultaneously, higher interest rates tend to dampen consumer spending, particularly on discretionary purchases like apparel, as disposable incomes are squeezed.

Consumer confidence remains a vital barometer for Marks & Spencer's performance. In early 2024, UK consumer confidence showed signs of gradual improvement, with GfK's Consumer Confidence Index rising, though remaining in negative territory. This suggests consumers are still cautious, impacting discretionary spending on items like clothing and home goods, core to M&S's offerings.

When confidence is high, consumers are more inclined to spend, directly benefiting retailers like M&S. Conversely, a dip in confidence, as seen during periods of economic uncertainty, can lead to reduced sales. For instance, in late 2023, the cost of living crisis continued to weigh on household budgets, forcing consumers to prioritize essentials over non-essential purchases, a trend M&S has had to navigate.

M&S's strategy to offer perceived value, through initiatives like its Sparks loyalty program and curated product ranges, is critical for retaining customers during periods of low consumer confidence. The company's ability to adapt its product mix and pricing to meet evolving consumer priorities, such as a growing demand for sustainable and value-for-money options, directly influences its sales trajectory.

As a global retailer, Marks & Spencer (M&S) is significantly exposed to the ups and downs of exchange rates. When the British Pound weakens, the cost of goods M&S imports from overseas automatically increases, directly impacting their cost of sales. Conversely, a stronger Pound can make their imported products cheaper, potentially allowing for more competitive pricing or improved profit margins on those items.

For instance, in the fiscal year ending March 2024, M&S's international revenue represented a notable portion of their overall business. Fluctuations in the Euro or US Dollar against the Pound, therefore, have a tangible effect on the translation of these earnings back into Sterling. A 5% depreciation in the Pound against a basket of major currencies could, for example, add millions to M&S's import costs, necessitating careful management of sourcing and pricing strategies to mitigate these impacts and maintain profitability.

Economic Growth and Recession Risks

The overall economic growth trajectory in the UK and key international markets where Marks & Spencer (M&S) operates significantly impacts its revenue streams and overall profitability. A robust economy typically translates to higher consumer confidence and spending, benefiting M&S's diverse product offerings from food to apparel.

However, the risk of economic downturns or recessions presents a considerable challenge. During such periods, consumers tend to tighten their belts, leading to reduced discretionary spending and a heightened sensitivity to price. This can directly affect M&S's sales volumes, particularly in its clothing and home sectors.

For instance, the UK's GDP growth forecast for 2024 is projected to be around 0.5%, a modest increase from 2023, indicating a cautious economic environment. This necessitates M&S to develop agile strategies to sustain sales and protect its market share amidst economic volatility. The company's focus on value and quality becomes even more critical during these times.

- UK GDP Growth: Projected at approximately 0.5% for 2024, signaling a slow but positive economic expansion.

- Consumer Confidence: Fluctuations in consumer confidence directly influence M&S's sales, especially for non-essential items.

- Inflationary Pressures: Persistent inflation can erode consumer purchasing power, making M&S's pricing strategies crucial for maintaining competitiveness.

- International Market Performance: Economic conditions in markets like Ireland and France also play a vital role in M&S's global revenue.

Supply Chain Costs and Efficiency

Fluctuations in fuel prices, labor expenses, and global shipping rates significantly impact Marks & Spencer's (M&S) supply chain costs. For instance, the International Monetary Fund (IMF) projected Brent crude oil prices to average around $82.2 per barrel in 2024, a factor directly affecting transportation expenses. M&S's strategic focus on enhancing supply chain efficiency and optimizing sourcing played a key role in its financial results, contributing to a notable uplift in profitability during the 2024 fiscal year. The company's efforts to streamline operations are crucial for maintaining competitive pricing in a dynamic retail environment.

M&S's commitment to cost management within its supply chain is a critical driver of its business strategy. This focus directly influences their ability to offer value to customers while protecting profit margins. The company's performance in 2024 demonstrated the effectiveness of these initiatives, with reported improvements in operational efficiency.

- Fuel Price Impact: Rising fuel costs directly increase M&S's transportation and logistics expenses.

- Labor Cost Management: Controlling and optimizing labor expenditure across the supply chain is essential for cost efficiency.

- Global Logistics Expenses: Navigating the complexities and costs of international shipping and freight is a constant challenge.

- Strategic Sourcing: M&S's ability to secure favorable terms with suppliers is vital for mitigating supply chain cost pressures.

Economic factors significantly shape Marks & Spencer's operational landscape. Persistent inflation, with UK CPI at 3.2% in March 2024, impacts M&S's costs and consumer spending power. The Bank of England's base rate, holding at 5.25% in 2024, affects borrowing costs and consumer demand for discretionary items.

Consumer confidence, while showing gradual improvement in early 2024, remains a key indicator for M&S's sales, particularly in clothing and home. Economic growth forecasts for the UK in 2024, around 0.5%, suggest a cautious environment requiring agile strategies from M&S.

Exchange rate volatility, as seen with the British Pound, directly influences M&S's import costs and international revenue translation. Supply chain costs, driven by fuel prices (Brent crude averaging $82.2/barrel in 2024) and labor expenses, are critical for M&S's pricing and profitability.

| Economic Factor | 2024 Data/Trend | Impact on M&S |

|---|---|---|

| UK Inflation (CPI) | 3.2% (March 2024) | Increased operational costs, reduced consumer purchasing power |

| Bank of England Base Rate | 5.25% (throughout 2024) | Higher borrowing costs, dampened discretionary spending |

| UK GDP Growth Forecast | ~0.5% (2024) | Cautious economic environment, need for agile sales strategies |

| Brent Crude Oil Price | ~$82.2/barrel (projected 2024) | Elevated transportation and logistics costs |

Preview the Actual Deliverable

Marks & Spencer Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Marks & Spencer Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the critical external forces shaping M&S's strategic landscape.

Sociological factors

Consumer preferences are shifting rapidly, with a pronounced demand for convenience, healthier food choices, and tailored shopping journeys. Marks & Spencer is actively responding to these evolving tastes.

For example, M&S has committed to doubling sales of its vegan and vegetarian products by the 2024/25 financial year, reflecting a significant market trend towards plant-based diets.

In its clothing and home divisions, the company is prioritizing trend-led styles, aiming to capture consumer interest in contemporary fashion and home décor.

Consumers increasingly favor products that align with ethical and sustainable values. A 2024 survey revealed that a significant 65% of consumers now prioritize brands demonstrating ethical practices, influencing purchasing decisions and driving demand for responsible goods.

This growing societal shift compels M&S to intensify its commitment to eco-friendly sourcing, implement responsible production methodologies, and ensure transparency throughout its supply chain. The company's proactive approach to sustainability is a direct response to evolving consumer expectations.

Marks & Spencer's dedicated 'Plan A' sustainable product line has experienced notable sales growth, a clear indicator of its success in attracting and retaining value-driven customers. This growth not only bolsters the brand's reputation but also demonstrates the commercial viability of ethical business practices.

Demographic shifts, particularly the aging population in the UK, significantly impact consumer demand and M&S's marketing approach. As of 2024, the UK's over-65 population is projected to continue growing, a trend M&S has historically leveraged with its established customer base.

While M&S has a strong connection with older, affluent shoppers, the company is actively pursuing younger consumers. Initiatives include enhanced social media engagement and curated fashion collections designed to appeal to a broader age range, reflecting a strategic response to evolving consumer demographics.

Health and Wellness Trends

Consumers are increasingly prioritizing health and wellness, significantly influencing their purchasing decisions, especially concerning food. This shift fuels a growing demand for products perceived as healthier.

Marks & Spencer is actively responding to this trend by expanding its offerings, particularly in plant-based protein options. The company has set an ambitious target: to achieve at least half of its total food sales from healthier products.

This strategic direction directly taps into overarching societal movements that champion healthier lifestyles. M&S's commitment is further underscored by its stated goal of increasing sales from its "Eat Well" range, aiming for a 10% year-on-year growth in this segment.

- Growing Health Consciousness: A significant portion of consumers, particularly millennials and Gen Z, actively seek out healthier food options.

- Plant-Based Demand: The market for plant-based alternatives continues to surge, with projections indicating continued robust growth through 2025 and beyond.

- M&S "Eat Well" Initiative: M&S aims for 50% of its food sales to originate from healthier products, reflecting a direct response to consumer health trends.

- Market Alignment: This focus positions M&S to capitalize on the enduring societal emphasis on well-being and healthier living.

Influence of Social Media and Digital Engagement

Social media and digital engagement are reshaping how consumers, especially younger demographics, make purchasing choices. Marks & Spencer (M&S) is actively tapping into this trend by utilizing platforms like TikTok and Instagram, employing employee-generated content and influencer partnerships to boost its visibility and appeal. This strategy aims to connect with a broader audience and reinforce M&S's brand relevance in the digital space.

M&S's commitment to digital transformation is evident in its investment in artificial intelligence and enhanced digital experiences. These initiatives are designed to personalize customer interactions and attract the crucial Gen Z demographic. For instance, M&S reported that its digital sales grew by 7.2% in the first half of fiscal year 2024, highlighting the increasing importance of online channels. The company also noted a significant uplift in engagement metrics on social media platforms following its influencer campaigns.

- Digital Reach Expansion: M&S is using platforms like TikTok and Instagram, featuring employee-generated content and influencer collaborations, to broaden its audience and increase brand relevance, particularly among younger consumers.

- AI and Personalization Investment: The company is investing in AI and digital experiences to create more personalized shopping journeys, a key strategy for attracting and retaining Gen Z customers.

- Growing Digital Sales: M&S's digital sales saw a 7.2% increase in the first half of fiscal year 2024, underscoring the growing importance of online channels in their overall sales performance.

- Social Media Engagement Boost: Influencer marketing campaigns have demonstrably improved engagement rates on M&S's social media channels, indicating a successful approach to digital outreach.

Societal values increasingly emphasize ethical consumption and sustainability, influencing purchasing decisions. Marks & Spencer's "Plan A" initiative, focusing on eco-friendly sourcing and responsible production, resonates with consumers seeking brands that align with their values. This commitment is reflected in the notable sales growth of its sustainable product lines, demonstrating a clear commercial advantage.

Demographic shifts, particularly the growing UK elderly population, represent a core customer base for M&S. However, the company is actively targeting younger demographics through enhanced digital engagement and curated fashion, aiming to diversify its appeal. This strategic pivot acknowledges evolving consumer age profiles and the need to maintain relevance across generations.

The heightened consumer focus on health and wellness is driving demand for healthier food options. M&S is responding by expanding its "Eat Well" range, with a strategic goal to derive 50% of its food sales from healthier products. This aligns with broader societal trends promoting well-being and healthier lifestyles.

Digital engagement and social media are now pivotal in shaping consumer behavior, especially among younger demographics. M&S is leveraging platforms like TikTok and Instagram, using influencer collaborations and AI-driven personalization to enhance customer experience and reach. This digital-first approach is crucial for attracting and retaining a younger, digitally native customer base, as evidenced by a 7.2% rise in digital sales in H1 FY24.

Technological factors

Marks & Spencer is heavily invested in its digital transformation, aiming to boost customer loyalty and attract a broader audience. This includes a complete overhaul of its website and mobile app, alongside efforts to improve online stock availability and delivery efficiency. The company is also focused on seamlessly blending its physical and online operations.

The M&S app has become a crucial platform, now representing a substantial percentage of the company's total online orders. This signifies a successful shift towards mobile-first engagement, demonstrating the effectiveness of their digital strategy in reaching and serving customers.

Marks & Spencer is deeply embedding artificial intelligence and data analytics across its operations. This technology is key to personalizing customer interactions, streamlining how stores run, and ultimately boosting profits. For instance, AI helps M&S offer tailored style advice and even write product descriptions, making shopping more engaging.

Customer insights derived from AI are directly influencing product development, pricing strategies, and marketing campaigns. M&S is also exploring AI's potential beyond retail, piloting it for energy savings in its stores and even for precision pollination in agricultural supply chains, showcasing a broad application of the technology.

Marks & Spencer Group (M&S) is leveraging technology to bolster its supply chain, focusing on resilience and efficiency. Digital platforms are being implemented to monitor and track environmental progress among its vast network of suppliers, ensuring greater accountability.

M&S is actively investing in innovations aimed at reducing its carbon footprint across the entire supply chain. This includes specific initiatives targeting lower agricultural emissions, a key area for environmental impact in the food sector.

Furthermore, the company is exploring and implementing advanced waste management technologies. For instance, M&S has been piloting food waste reduction technologies, aiming to divert more food from landfill and improve resource utilization. In 2024, M&S reported a 4.4% reduction in food waste across its operations compared to the previous year, a testament to these technological efforts.

Cybersecurity and Data Protection Technologies

Marks & Spencer Group's (M&S) operational reliance on digital platforms necessitates strong cybersecurity. A significant cyber incident in April 2025 underscored the critical need to safeguard sensitive customer information and fast-track digital enhancements for greater resilience.

In response, M&S is actively investing in upgrading its IT infrastructure and network capabilities. These improvements are designed to bolster defenses against evolving cyber threats and ensure the integrity of its digital operations.

- Enhanced Data Protection: M&S is implementing advanced encryption and access control measures to protect customer data.

- Infrastructure Upgrades: Significant investment is being made in modernizing network hardware and software to improve security posture.

- Resilience Acceleration: The company is prioritizing digital transformation initiatives aimed at increasing the robustness of its systems against potential disruptions.

Innovation in Product Development and Sustainability

Marks & Spencer Group is actively leveraging technology to pioneer advancements in both product creation and environmental responsibility. This commitment is evident in their efforts to develop novel production methods for meat and dairy products, aiming to significantly reduce their carbon emissions. For instance, M&S has been a leader in sustainable sourcing, with a significant portion of their food sourced from suppliers meeting rigorous environmental standards.

Further illustrating their technological drive, M&S is exploring innovative solutions like the use of invisible UV tags on milk bottles. This technology is designed to enhance the traceability of plastic recycling, contributing to a more circular economy. The company's focus on sustainability extends to clothing, where they are experimenting with new materials and circular waste management strategies, aiming to reduce landfill waste and promote resource efficiency.

- Product Innovation: M&S is investing in R&D for lower-carbon food production models.

- Sustainability Tech: Exploring UV tagging for improved plastic recycling tracking.

- Circular Economy: Piloting circular approaches for waste management and exploring new textile materials.

Marks & Spencer is significantly enhancing its digital capabilities, with its app now a primary channel for online orders, reflecting a successful mobile-first strategy. The company is integrating AI and data analytics for personalized customer experiences, operational efficiency, and informed product development, even exploring AI for energy savings and agricultural applications.

Technological advancements are crucial for M&S's supply chain resilience and environmental goals, including digital platforms for supplier monitoring and innovations for reducing agricultural emissions and food waste. In 2024, M&S achieved a 4.4% reduction in food waste, demonstrating the impact of these tech-driven initiatives.

M&S is prioritizing cybersecurity and infrastructure upgrades following a cyber incident in April 2025, investing in advanced data protection and network resilience to safeguard customer information and ensure operational integrity.

The group is also pioneering product innovation through technology, developing lower-carbon food production methods and utilizing solutions like UV tags for enhanced plastic recycling traceability, alongside exploring new materials and circular waste management for clothing.

| Technology Focus | Key Initiatives | 2024/2025 Data/Impact |

|---|---|---|

| Digital Transformation | App Development, Website Overhaul | App accounts for substantial online orders |

| AI & Data Analytics | Personalization, Operational Efficiency | Informs product development, pricing, marketing |

| Supply Chain Tech | Supplier Monitoring, Emission Reduction | Piloting UV tags for plastic recycling |

| Sustainability Tech | Waste Reduction, Circular Economy | 4.4% food waste reduction in 2024 |

| Cybersecurity | Infrastructure Upgrades, Data Protection | Response to April 2025 incident |

Legal factors

Marks & Spencer Group operates under a robust framework of consumer protection laws, both within the UK and in its international markets, mandating fair trading, precise product labeling, and stringent product safety standards. Failure to comply, as enforced by bodies like the UK's Competition and Markets Authority (CMA), can lead to significant penalties and damage to brand reputation.

In 2024, the CMA continued its focus on ensuring businesses provide clear and honest pricing information, with investigations into potential misleading pricing practices across various retail sectors. M&S, like its competitors, must demonstrate that its promotional offers and pricing are transparent to avoid scrutiny and maintain consumer confidence, especially as inflation impacts consumer spending habits.

Marks & Spencer Group is heavily regulated by data protection laws, notably the UK Data Protection Act 2018, which incorporates UK GDPR principles. This means M&S must meticulously manage customer data, ensuring privacy and security at every touchpoint.

A significant cyberattack in April 2025 highlighted the critical importance of these regulations. The incident emphasized the necessity for M&S to maintain advanced technical and organizational safeguards to protect sensitive customer information from breaches.

Failure to adhere to these stringent data protection mandates carries substantial risks. Non-compliance can result in severe financial penalties, potentially impacting profitability, and can also inflict considerable damage to M&S's brand reputation and customer trust.

Marks & Spencer (M&S) operates under a complex web of employment and labor laws across its global markets, impacting everything from minimum wage to working conditions and fundamental employee rights. For instance, in the UK, M&S must comply with the National Living Wage, which saw an increase to £11.44 per hour for those aged 21 and over from April 2024, directly affecting labor costs for its significant workforce.

Navigating these regulations is crucial for M&S, as shifts in labor laws can significantly alter operational expenses and necessitate ongoing adjustments to internal policies and employee training programs. Ensuring fair treatment for its approximately 65,000 colleagues worldwide hinges on strict adherence to these evolving legal frameworks.

Product Safety and Standards

Marks & Spencer (M&S) operates under stringent legal frameworks concerning product safety and quality, especially critical for its food and clothing divisions. The company is obligated to ensure all its own-brand products adhere to rigorous national and international safety standards, a commitment reinforced by ongoing staff training. For instance, in 2024, M&S continued its focus on food safety, with over 1,000 food safety and quality checks conducted across its supply chain weekly.

Navigating these regulations is paramount for maintaining consumer trust and avoiding penalties. M&S’s compliance efforts are extensive, covering everything from food ingredient sourcing to the flammability of textiles.

- Food Safety: M&S adheres to UK and EU food safety legislation, including HACCP principles.

- Product Standards: Compliance with standards like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) for clothing and home goods is essential.

- Staff Training: Regular updates on health and safety laws ensure all employees are equipped to handle product safety protocols.

- Recall Procedures: Robust legal frameworks dictate procedures for product recalls, which M&S must follow diligently.

Environmental Legislation and Reporting

Marks & Spencer (M&S) operates within a legal landscape increasingly focused on environmental responsibility. This includes stringent regulations concerning waste reduction, the composition and recyclability of packaging, and the management of carbon emissions. For instance, M&S has committed to making all its own-brand packaging widely recyclable by 2025/26, a target directly influenced by evolving legal requirements.

The company's ambitious sustainability goals, such as achieving net zero by 2040 and significant reductions in plastic use and food waste, necessitate adherence to a growing array of environmental reporting standards. These legal frameworks often mandate transparency and detailed disclosures on the company's environmental impact and progress towards its targets. Failure to comply can result in penalties and reputational damage.

- Waste Reduction Mandates: Legal pressures are driving M&S towards a circular economy model, pushing for all packaging to be recyclable by the 2025/26 fiscal year.

- Carbon Emission Regulations: M&S must comply with current and anticipated legislation related to greenhouse gas emissions, impacting its operational footprint and supply chain management.

- Reporting Standards: Evolving environmental reporting requirements, driven by legal obligations, demand robust data collection and transparent disclosure on sustainability metrics.

Marks & Spencer (M&S) must navigate a dynamic legal landscape, particularly concerning consumer protection and product safety. In 2024, regulatory bodies like the CMA intensified scrutiny on pricing transparency, impacting M&S's promotional strategies. Data protection laws, such as the UK Data Protection Act 2018, are paramount, as evidenced by a significant cyber incident in April 2025, underscoring the need for robust data security measures to avoid penalties and reputational harm.

Environmental factors

Marks & Spencer Group is actively addressing climate change, aiming for net zero across its operations by 2039/40. A key interim goal is to cut carbon emissions by 34% by 2025/26, with a significant focus on Scope 3 emissions, largely stemming from its food division.

To achieve these ambitious targets, M&S is allocating £1 million towards pioneering projects designed to reduce agricultural emissions. This includes initiatives like lowering methane output from cattle and experimenting with net zero wheat cultivation, demonstrating a commitment to tangible environmental action.

Marks & Spencer Group is placing a strong emphasis on sustainable sourcing, with ambitious targets set for the near future. By the 2025/26 period, the company aims to ensure 100% of its soy originates from regions verified as deforestation and conversion-free. This commitment extends to palm oil, with a goal of sourcing 100% segregated, responsibly sourced palm oil by the same timeframe.

Further demonstrating its dedication to environmental responsibility, M&S is working towards all key raw materials being sourced sustainably by 2025. This includes a specific target of 100% responsibly sourced cotton, a significant commodity in the apparel industry.

Marks & Spencer Group is actively pursuing ambitious environmental goals, particularly in waste reduction and circularity. By the 2025/26 financial year, M&S aims to redistribute 100% of its edible surplus food, a significant step towards minimizing food waste.

Further reinforcing this commitment, the company has set a target to halve food waste by 2030. M&S is also focused on packaging sustainability, with a goal to make all packaging recyclable by 2025/26 and eliminate 1 billion units of plastic packaging by 2027/28.

To support these initiatives, M&S is implementing innovative tracking solutions, such as UV tags on milk bottles, to monitor and improve recycling rates, demonstrating a data-driven approach to environmental stewardship.

Water Usage and Biodiversity

Marks & Spencer Group (M&S) recognizes the significant impact its operations can have on land use and biodiversity, actively working to mitigate negative effects through sustainable farming and operational practices. This commitment extends to water usage, where while specific 2024/2025 targets aren't publicly detailed, the company's overarching sustainability agenda necessitates careful management of this resource.

M&S's focus on working with its supply chain farmers is crucial for addressing environmental concerns. A key priority is improving soil health, which directly influences water retention and biodiversity. This collaborative approach aims to reduce the overall environmental footprint across its agricultural sourcing.

- Sustainable Sourcing: M&S prioritizes sourcing from suppliers who demonstrate strong environmental stewardship, including responsible water management and biodiversity protection.

- Farmer Collaboration: The company engages with farmers to implement practices that enhance soil health, which in turn supports better water usage and local ecosystems.

- Biodiversity Impact: M&S aims to minimize the negative impacts of its operations on land use and the natural habitats within its supply chain.

Energy Consumption and Operational Efficiency

Marks & Spencer Group is actively addressing energy consumption and operational efficiency as key environmental factors. The company is investing in its store network, distribution centers, and delivery vehicles to lower operational emissions and boost energy efficiency.

A notable initiative involves trialing AI-driven data to forecast the most effective heating, ventilation, and air conditioning settings in stores, a move anticipated to yield substantial annual savings in both carbon footprint and operational costs.

These efforts have already yielded significant results, with M&S achieving a 33% reduction in total Scope 1 and 2 greenhouse gas emissions compared to their 2016/17 baseline.

- Investment in Store and Logistics Infrastructure: M&S is upgrading its physical assets to enhance energy performance.

- AI for HVAC Optimization: Predictive AI is being used to manage store climate control for efficiency.

- Significant Emission Reduction: A 33% cut in Scope 1 and 2 emissions has been recorded against the 2016/17 baseline.

Marks & Spencer Group is committed to environmental stewardship, with ambitious targets for 2025/26 including 100% deforestation-free soy and 100% segregated, responsibly sourced palm oil. They aim for all key raw materials, including cotton, to be sourced sustainably by 2025.

The company is also tackling waste, planning to redistribute 100% of edible surplus food by 2025/26 and halve food waste by 2030. Packaging goals include making all packaging recyclable by 2025/26 and eliminating 1 billion units of plastic packaging by 2027/28.

M&S has already achieved a 33% reduction in Scope 1 and 2 greenhouse gas emissions against their 2016/17 baseline, demonstrating progress in operational efficiency through investments in stores and logistics, including AI for HVAC optimization.

Their net-zero ambition by 2039/40 includes a 34% cut in carbon emissions by 2025/26, with a focus on Scope 3 emissions, supported by a £1 million investment in agricultural emission reduction projects.

| Environmental Target | Current Status/Progress | Target Year |

|---|---|---|

| Net Zero Operations | Aiming for 2039/40 | 2039/40 |

| Scope 1 & 2 Emissions Reduction | Achieved 33% reduction from 2016/17 baseline | Ongoing |

| Deforestation-Free Soy Sourcing | Aiming for 100% | 2025/26 |

| Responsibly Sourced Palm Oil | Aiming for 100% segregated | 2025/26 |

| Edible Surplus Food Redistribution | Aiming for 100% | 2025/26 |

| Plastic Packaging Reduction | Aiming to eliminate 1 billion units | 2027/28 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Marks & Spencer Group is informed by a comprehensive review of official company reports, reputable financial news outlets, and market research firms. We incorporate data on consumer trends, economic forecasts, and regulatory changes to provide a holistic view.