Marks & Spencer Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marks & Spencer Group Bundle

Marks & Spencer Group faces moderate buyer power due to its established brand, but intense competition from both online retailers and other high street brands. The threat of new entrants is somewhat mitigated by brand loyalty and capital requirements, yet the digital landscape offers lower barriers. Supplier power is a key consideration, with M&S needing to manage relationships effectively to secure favorable terms.

The complete report reveals the real forces shaping Marks & Spencer Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Marks & Spencer's reliance on a concentrated supplier base for its core offerings, particularly in food and clothing, grants these suppliers considerable bargaining power. For instance, if only a handful of producers supply a critical ingredient for M&S's popular ready meals, those suppliers can dictate terms more effectively. This is especially true as M&S develops its own-brand products, deepening its dependence on specific manufacturing partners.

The costs and complexities Marks & Spencer (M&S) faces when changing suppliers directly influence supplier bargaining power. If M&S needs to retool production lines, renegotiate intricate supply chain agreements, or locate new suppliers that match their rigorous quality and ethical benchmarks, these high switching costs empower their current suppliers.

M&S's commitment to premium quality and responsible sourcing, a cornerstone of their brand, likely translates into elevated switching costs. The extensive vetting process required for new partners, ensuring alignment with M&S's sustainability and ethical sourcing policies, adds significant time and expense, thereby strengthening the hand of established, trusted suppliers.

The uniqueness of what suppliers offer significantly impacts their leverage over Marks & Spencer Group. If M&S relies on suppliers for specialized fabrics, unique food ingredients, or proprietary manufacturing processes that are key to its own-brand products, these suppliers gain considerable bargaining power. For instance, in 2024, M&S continued to emphasize its premium food offerings, which often depend on exclusive sourcing agreements for specific produce or artisanal ingredients, giving those suppliers more sway.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail operations, thereby becoming direct competitors to Marks & Spencer (M&S), can diminish M&S's bargaining power. While this is a less prevalent concern for a retailer of M&S's magnitude, the possibility can still impact negotiations and the terms of supply contracts.

For instance, a key apparel supplier could theoretically launch its own direct-to-consumer brand, leveraging its manufacturing expertise. This would place it in direct competition with M&S's established retail presence. Although M&S's robust brand equity and well-developed direct-to-consumer channels serve as significant deterrents, this remains a strategic consideration in supplier relationship management.

- Supplier Integration Risk: Suppliers might launch their own retail brands, directly competing with M&S.

- Impact on Bargaining: This potential competition can weaken M&S's negotiating position with suppliers.

- M&S Mitigation: M&S's strong brand and direct-to-consumer capabilities generally reduce this threat.

- Theoretical Consideration: While less common due to M&S's scale, it's a factor in strategic supplier management.

Importance of M&S to Suppliers

Marks & Spencer's (M&S) substantial purchasing volume significantly curtails the bargaining power of its suppliers. When M&S constitutes a large percentage of a supplier's total sales, that supplier becomes more dependent on M&S, thus diminishing their leverage in negotiations. For instance, in the fiscal year ending March 30, 2024, M&S reported total revenue of £12.3 billion, indicating the scale of its operations and its importance as a customer.

This reliance means suppliers are often motivated to maintain favorable terms with M&S to secure continued business. The sheer scale of M&S's orders provides considerable purchasing power, allowing them to negotiate better prices and terms. This dynamic is crucial in understanding the supplier's position within the M&S value chain.

The impact on supplier bargaining power can be summarized:

- Reduced Dependence: Suppliers who rely heavily on M&S for a significant portion of their revenue have less bargaining power.

- Volume Discounts: M&S's large order volumes enable them to secure volume discounts, further strengthening their negotiating position.

- Supplier Concentration: If the supplier base for key product categories is concentrated, M&S might have more leverage, but if it's fragmented, individual suppliers have less power.

- Long-Term Relationships: While M&S's size reduces supplier power, established long-term relationships can foster collaboration and mutual benefit, albeit within the framework of M&S's significant market influence.

The bargaining power of suppliers for Marks & Spencer (M&S) is influenced by several factors, including the concentration of their supplier base and the uniqueness of their offerings. For instance, in 2024, M&S's continued focus on premium food sourcing meant that suppliers of exclusive produce or artisanal ingredients held considerable sway.

High switching costs for M&S, stemming from rigorous quality and ethical sourcing requirements, further bolster supplier leverage. The potential for suppliers to engage in forward integration, such as launching their own retail brands, also presents a strategic consideration, though M&S's strong brand equity mitigates this risk.

Conversely, M&S's substantial purchasing volume, evidenced by its £12.3 billion revenue in the fiscal year ending March 30, 2024, significantly curtails supplier power by making M&S a crucial customer for many.

| Factor | Impact on M&S | 2024 Relevance |

| Supplier Concentration | High concentration increases supplier power. | Key for specific food ingredients and unique fabrics. |

| Switching Costs | High costs empower existing suppliers. | Vetting for ethical sourcing and quality standards adds complexity. |

| Uniqueness of Offering | Unique products grant suppliers leverage. | Crucial for M&S's premium own-brand food and apparel lines. |

| Forward Integration Threat | Potential competition weakens M&S's position. | A theoretical risk, mitigated by M&S's brand strength. |

| Purchasing Volume | Large volume reduces supplier power. | M&S's £12.3 billion revenue (FY24) signifies significant buyer influence. |

What is included in the product

Tailored exclusively for Marks & Spencer Group, analyzing its position within its competitive landscape by examining supplier power, buyer bargaining, new entrant threats, substitute products, and existing rivalry.

Quickly identify and address the intensity of each Porter's Five Force for M&S, turning complex competitive analysis into actionable insights.

Customers Bargaining Power

Customer price sensitivity significantly influences M&S's bargaining power. In the highly competitive UK retail landscape, where alternatives abound, a noticeable price increase by M&S, particularly on staple or less differentiated items, could easily drive customers to competitors. For instance, in 2023, the average UK household spent approximately £580 per week on all goods and services, with a substantial portion allocated to retail purchases, highlighting the importance of perceived value.

M&S actively works to mitigate this by focusing on a balance between perceived quality and price. They understand that while brand loyalty exists, price remains a critical decision-making factor for a broad customer base. This strategy aims to retain customers by offering a compelling value proposition, even if it means absorbing some cost pressures rather than passing them entirely onto consumers.

The ease with which customers can find alternative products or retailers significantly impacts their bargaining power. For M&S, operating in highly competitive sectors like clothing, food, and home goods means customers have a wide array of choices, bolstering their leverage.

In 2024, the UK grocery market, a key area for M&S, saw intense competition with discounters like Aldi and Lidl continuing to gain market share, putting pressure on established retailers. Similarly, the apparel market is saturated with fast fashion brands and other mid-market retailers, offering readily available substitutes.

M&S strives to counter this by emphasizing its unique brand proposition, focusing on quality, sustainability, and a curated product selection. This differentiation aims to reduce the perceived substitutability of its offerings, thereby mitigating customer bargaining power.

Customers today have unprecedented access to information regarding pricing, product quality, and competitor offerings. This readily available data significantly amplifies their bargaining power. For instance, sites like Trustpilot and social media platforms allow consumers to research and compare M&S products and services against rivals, influencing their purchasing decisions and demanding better value.

Marks & Spencer's ongoing digital transformation is a key strategy in navigating this landscape. By enhancing its online presence and providing transparent product information, M&S aims to build trust and manage customer expectations effectively. In 2024, M&S reported a significant uplift in online sales, demonstrating the growing importance of its digital channels in engaging with this increasingly informed customer base.

Switching Costs for Customers

The bargaining power of customers is significantly influenced by the costs associated with switching from Marks & Spencer (M&S) to a competitor. For most retail customers, these switching costs are typically quite low, meaning they can easily shift their purchasing habits to other stores without incurring substantial financial or non-monetary penalties.

M&S actively works to mitigate this low switching cost environment. Initiatives like their Sparks loyalty program are designed to foster customer loyalty and increase stickiness. By offering personalized rewards and exclusive benefits, M&S aims to make the perceived cost of leaving their ecosystem higher for customers.

- Low Switching Costs: Generally, customers face minimal barriers when moving from M&S to another retailer, impacting their bargaining power.

- Loyalty Programs: M&S's Sparks program is a key strategy to increase customer retention and reduce the inclination to switch.

- Customer Stickiness: The success of loyalty programs directly correlates with how "sticky" customers are, meaning how likely they are to remain with the brand.

Customer Loyalty and Brand Strength

Marks & Spencer Group benefits significantly from strong customer loyalty and its established brand equity, which effectively diminishes the bargaining power of its customers. This loyalty is particularly evident in M&S's food division, where a long-standing reputation for quality and reliability keeps customers returning.

The brand strength allows M&S to maintain its customer base even when competitors offer lower prices or more aggressive promotions. For instance, in the fiscal year ending March 30, 2024, M&S reported a substantial increase in revenue, indicating continued customer patronage despite a competitive retail landscape.

- Strong Brand Equity: M&S's heritage and association with quality reduce price sensitivity among its core customer demographic.

- Food Segment Dominance: The food business, a key driver of loyalty, saw significant growth, with like-for-like sales increasing by 3.0% in the first half of FY24, demonstrating customer stickiness.

- Reduced Price Sensitivity: Customers are often willing to pay a premium for the perceived quality and trustworthiness of M&S products, limiting their ability to demand lower prices.

The bargaining power of customers for Marks & Spencer (M&S) is a significant factor, influenced by price sensitivity, availability of alternatives, and access to information. In 2024, the UK retail sector remained highly competitive, with consumers actively comparing prices and product offerings across numerous brands.

M&S counteracts this by focusing on its brand differentiation, emphasizing quality, and leveraging loyalty programs like Sparks to foster customer retention and reduce price sensitivity. Despite the general ease of switching for consumers, M&S's established reputation and curated product selection in key areas like food help to mitigate the direct impact of customer demands for lower prices.

The company's digital investments in 2024 also played a role, enhancing transparency and customer engagement, which can build trust and manage expectations, thereby influencing the perceived value proposition and ultimately customer leverage.

Preview the Actual Deliverable

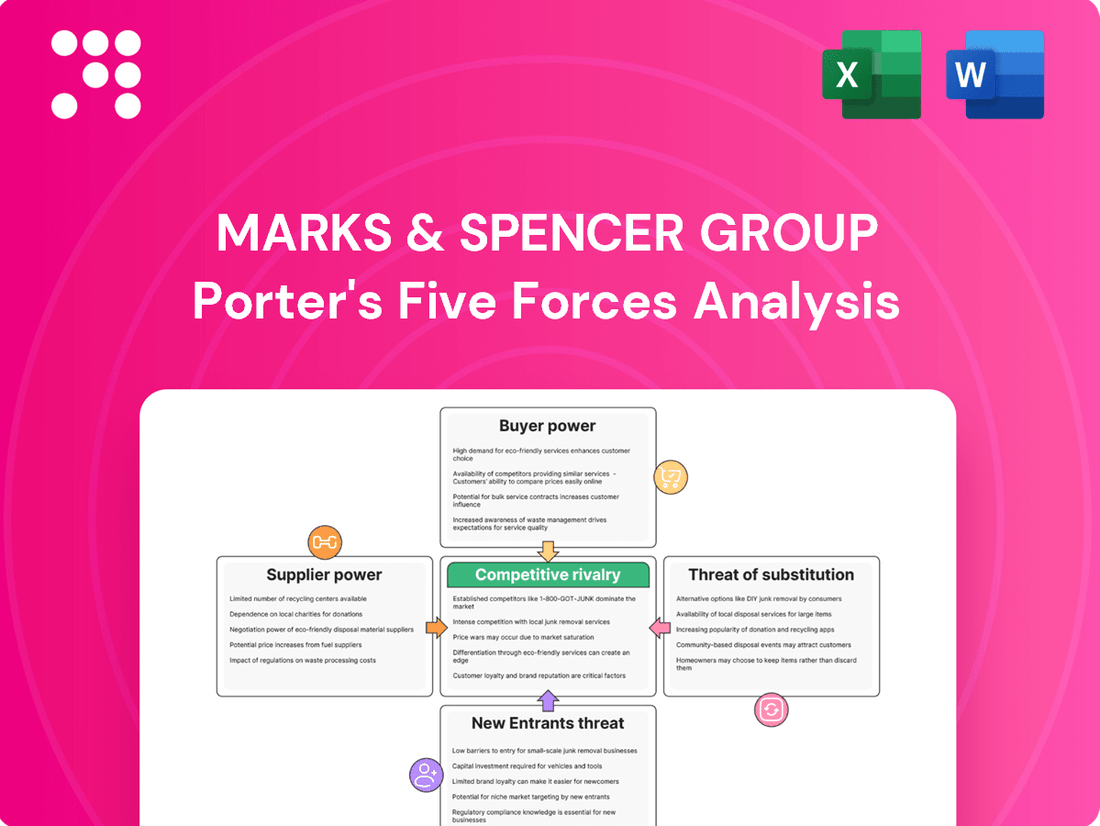

Marks & Spencer Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Marks & Spencer Group details the intensity of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This in-depth examination provides actionable insights into the strategic landscape of M&S.

Rivalry Among Competitors

Marks & Spencer Group operates in a UK retail landscape teeming with competitors. This saturation spans M&S's key areas: clothing, home goods, and food. The sheer volume and variety of rivals, from long-standing high street names to nimble online-only businesses and aggressive discounters, create a fiercely competitive environment.

In 2024, the UK grocery market alone saw significant activity. For instance, the market share of the top five supermarkets remained substantial, but discounters like Aldi and Lidl continued to gain ground, demonstrating the constant pressure from diverse players. This dynamic means M&S must contend with both legacy retailers and innovative newcomers, all vying for consumer attention and spending.

The United Kingdom's retail sector experienced a modest 1.1% growth in sales volume in 2023, a figure that underscores the challenging environment for companies like Marks & Spencer. When growth is slow, businesses tend to compete more fiercely for existing customers, intensifying rivalry as they vie for market share. This dynamic means that even as M&S pursues its own growth strategies, the broader market conditions can significantly amplify competitive pressures.

Marks & Spencer Group's competitive rivalry is significantly shaped by its product differentiation strategy. M&S focuses on its own-brand offerings, highlighting quality and perceived value to set itself apart from competitors.

However, in segments like basic apparel or staple food items, achieving strong differentiation is difficult, often intensifying direct price competition. For instance, in the competitive UK grocery market, M&S Food competes with discounters like Aldi and Lidl, where price is a primary driver for many consumers, thus limiting the impact of M&S's premium positioning.

Exit Barriers

High exit barriers in the UK retail sector mean that companies, even those struggling, might persist in operations, potentially at a loss. This prolonged presence can intensify competitive rivalry, as these businesses continue to vie for market share, thereby pressuring more profitable competitors.

The substantial investments required for physical store networks, intricate supply chains, and established brand equity create significant hurdles for retailers looking to exit the market. These sunk costs effectively lock businesses in, sustaining competitive pressures and influencing the overall market dynamic.

For instance, the UK retail property market saw significant challenges in 2024, with many high street locations struggling to attract and retain tenants. This can make divesting or closing stores a complex and costly process, reinforcing exit barriers.

- Significant Capital Investment: Retailers often have substantial capital tied up in physical stores, inventory, and distribution networks, making a complete withdrawal financially prohibitive.

- Brand and Reputation: A retailer's brand is a valuable asset, and a disorderly exit can damage its reputation, impacting any residual value or future ventures.

- Lease Obligations: Long-term lease agreements for retail spaces can create ongoing financial commitments, even if a business is no longer profitable.

- Employee and Stakeholder Relations: Managing redundancies and stakeholder expectations during an exit can be complex and costly, adding to the disincentive to leave.

Strategic Objectives of Competitors

Marks & Spencer's competitors, including major players like Next and John Lewis, are intensely focused on key strategic objectives. Many are vying for increased market share, particularly in the lucrative online retail space, while simultaneously striving to boost profitability through cost management and private label expansion. For instance, in the fiscal year ending March 2024, Next reported a pre-tax profit of £918 million, demonstrating a strong focus on operational efficiency.

These competitive aims directly shape the intensity of rivalry within the retail sector. M&S's own strategic initiatives, such as its ongoing store optimization program and significant investment in digital transformation, are both a response to this aggressive competitive environment and a proactive effort to gain an edge. The company's aim to become a more relevant and compelling brand for its core customer base necessitates a constant evaluation of competitor strategies and market trends.

- Market Share Focus: Competitors like Next and John Lewis are aggressively pursuing online market share.

- Profitability Drives: Cost control and private label strength are key to competitor profitability strategies.

- M&S Response: M&S's store optimization and digital investment are direct reactions to competitive pressures.

- Strategic Alignment: M&S's efforts to strengthen brand relevance are intertwined with competitor objectives.

The competitive rivalry for Marks & Spencer Group is intense, fueled by a crowded UK retail market across clothing, home, and food sectors. In 2024, discounters like Aldi and Lidl continued to gain market share in groceries, putting pressure on M&S’s premium positioning. Slow market growth, with UK retail sales volume up only 1.1% in 2023, forces businesses to fight harder for customers, intensifying competition.

M&S differentiates through its own-brand quality, but this is challenging in basic categories where price competition is fierce, especially against discounters. High exit barriers in retail, due to significant capital investment in stores and supply chains, mean struggling businesses often remain, prolonging competitive pressures. For example, UK retail property faced challenges in 2024, making store closures costly and difficult, thus reinforcing these barriers.

| Competitor Focus | M&S Strategy | Impact on Rivalry |

| Online Market Share Growth (Next, John Lewis) | Digital Transformation Investment | Intensified online competition |

| Profitability via Cost Control & Private Labels | Store Optimization Program | Pressure on margins and pricing |

| Brand Relevance for Core Customers | Brand Revitalization Efforts | Direct competition for customer loyalty |

SSubstitutes Threaten

The price-performance trade-off is a critical factor in assessing the threat of substitutes for Marks & Spencer Group. If alternative products or services provide comparable quality or utility at a lower cost, or even better performance for a similar price, the competitive pressure intensifies.

For M&S, this means that readily available, cheaper fast fashion brands pose a significant threat by offering trendy clothing at much lower price points. Similarly, discounters in the grocery sector, like Aldi and Lidl, present a strong substitute for M&S’s food offerings, often competing on price while maintaining acceptable quality levels.

In 2024, the UK grocery market continued to see strong growth from discounters, with reports indicating they captured a larger market share, putting pressure on mid-market retailers like M&S. This trend highlights how a favorable price-performance ratio from substitutes directly impacts M&S’s customer base and market position.

The willingness of Marks & Spencer's customers to switch to substitute products or services significantly impacts the company's competitive landscape. Factors like the convenience of purchasing elsewhere, evolving consumer tastes, and increased awareness of available alternatives all contribute to this propensity to substitute.

The proliferation of online retail channels and the diversification of shopping formats have undeniably amplified customers' ability to easily find and adopt substitute offerings. For instance, the growth of fast fashion retailers and specialized online grocers presents direct alternatives to M&S's clothing and food divisions.

The relative pricing of substitute products directly impacts the threat level for Marks & Spencer Group. When alternatives are consistently cheaper for similar quality, M&S faces pressure to either lower its prices or enhance its unique selling points. For instance, M&S's 'Remarksable Value' food line is a strategic move to address this by offering competitive pricing on everyday essentials, aiming to retain price-sensitive customers.

Perceived Quality of Substitutes

The perceived quality of substitute products significantly influences the threat of substitution for Marks & Spencer (M&S). If consumers view alternatives, even from different retail channels like online marketplaces or discount chains, as offering comparable quality, they are more inclined to switch.

M&S's long-standing reputation for quality serves as a critical defense mechanism against this threat. For instance, in the food sector, M&S's premium positioning and focus on sourcing and product development aim to differentiate it from competitors offering lower-priced, but potentially lower-quality, alternatives.

- Consumer Perception: A belief that substitutes offer "good enough" quality erodes M&S's pricing power and customer loyalty.

- M&S's Defense: The company leverages its brand heritage and commitment to quality across its clothing, food, and home goods divisions to counter this.

- Competitive Landscape: The rise of fast fashion and specialized online retailers presents strong substitutes, particularly in apparel, where price and trend responsiveness are key.

- Data Point: While M&S's overall customer satisfaction remains relatively high, data from 2024 indicates a growing segment of consumers prioritizing value for money, potentially increasing the appeal of substitutes if M&S's price-quality ratio is not perceived as optimal.

Ease of Substitution

The ease with which customers can switch to alternative offerings significantly influences the competitive landscape for Marks & Spencer Group. The widespread availability of online shopping platforms and a multitude of physical retail outlets means consumers have readily accessible substitutes for many of M&S's product categories, particularly in food and clothing.

For instance, in the UK grocery sector, where M&S Food competes, the market is highly fragmented. In 2024, the top five UK supermarkets held approximately 70% of the market share, indicating a highly competitive environment where consumers can easily shift their spending to rivals like Tesco, Sainsbury's, or discounters such as Aldi and Lidl.

Similarly, in apparel, the fashion retail market is saturated with both fast-fashion brands and other mid-market retailers. This abundance of choice, coupled with the relatively low switching costs for consumers, means that M&S faces a constant threat from substitutes that may offer lower prices or more trend-driven selections.

- High Availability of Online and Physical Retailers: Consumers can easily compare prices and products across numerous competitors.

- Fragmented Grocery Market: The UK grocery sector, with its numerous players, intensifies substitution opportunities for M&S Food.

- Saturated Apparel Market: A wide array of fashion brands presents readily available alternatives to M&S clothing.

- Low Switching Costs: Customers can change their purchasing habits with minimal effort or expense.

The threat of substitutes for Marks & Spencer (M&S) is heightened by the ease with which consumers can find comparable products at different retailers, particularly online. This is evident in both M&S's food and clothing divisions, where numerous competitors offer similar value propositions.

In 2024, the UK grocery market continued to show the strength of discounters like Aldi and Lidl, which offer competitive pricing. Similarly, the apparel market is flooded with fast-fashion brands and other mid-market retailers, making it simple for consumers to switch their spending.

| Factor | M&S Offering | Key Substitutes | Impact on M&S |

| Price-Performance | Quality food and apparel | Fast fashion brands, discount grocers | Pressure on pricing and market share |

| Availability | Physical stores, online presence | Numerous online retailers, diverse physical stores | Increased customer choice and ease of switching |

| Consumer Perception | Brand heritage, quality focus | Perceived value from alternatives | Potential erosion of pricing power |

Entrants Threaten

The sheer financial capital needed to compete with a retailer like Marks & Spencer is immense. Building a comparable store network, robust supply chain, and sophisticated online presence requires billions in investment. For instance, M&S's capital expenditure was £588 million in the fiscal year ending March 30, 2024, highlighting the scale of ongoing investment necessary to maintain and grow operations.

Existing retailers like Marks & Spencer Group (M&S) leverage significant economies of scale, particularly in purchasing power and distribution efficiency. This allows them to negotiate better terms with suppliers and spread fixed costs over a larger volume of goods, creating a substantial cost advantage. For instance, M&S's extensive logistics network, optimized over years, reduces per-unit delivery costs, making it challenging for newcomers to match their pricing and operational efficiency.

Marks & Spencer Group benefits significantly from strong brand loyalty, particularly in its food division, which acts as a substantial barrier to new entrants. This loyalty means customers are often hesitant to try unfamiliar brands, viewing the established trust and familiarity with M&S as a valuable, albeit intangible, switching cost.

Access to Distribution Channels

New players entering the retail sector, particularly in the UK, face considerable hurdles in securing prime distribution channels. M&S, with its established network of over 1,000 stores and a robust online platform, possesses a significant advantage. This existing infrastructure makes it difficult for new entrants to compete on reach and convenience.

The threat of new entrants is somewhat mitigated by the difficulty in replicating M&S's established distribution capabilities. For instance, in 2024, M&S continued to invest in its omnichannel strategy, aiming to seamlessly integrate its physical and digital offerings. This focus on efficient logistics and customer accessibility presents a high barrier to entry for newcomers seeking to establish a comparable presence.

Consider these points regarding access to distribution channels:

- Limited prime retail locations: Securing high-traffic, desirable store spaces is challenging and expensive for new entrants.

- High cost of online fulfillment: Building an efficient and cost-effective online delivery and returns network requires substantial investment.

- M&S's established network: The Group's extensive physical store footprint and growing online operations offer a significant competitive edge.

- Brand loyalty and customer traffic: M&S benefits from decades of building customer relationships, driving consistent footfall and online engagement.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants for M&S. For instance, stringent food safety standards, like those enforced by the Food Standards Agency (FSA) in the UK, increase operational costs and complexity for any new food retailer. In 2024, compliance with evolving environmental regulations, such as waste reduction targets, also adds to the capital expenditure and operational planning required for market entry.

These regulatory hurdles can act as substantial barriers, particularly for smaller businesses. Consider the impact of planning permissions and zoning laws on opening new physical stores; these can be time-consuming and costly to navigate. Labor laws, including minimum wage requirements and employment regulations, also contribute to the cost base for new retail operations, making it more challenging to compete with established players like M&S.

- Increased Compliance Costs: New entrants must invest in meeting diverse regulatory requirements, from food hygiene to employment standards.

- Complexity of Operations: Navigating various legal frameworks adds a layer of complexity to setting up and running a retail business.

- Capital Investment: Adherence to regulations often necessitates upfront capital for compliant facilities and processes.

The threat of new entrants for Marks & Spencer Group is relatively low due to substantial capital requirements and established economies of scale. For example, M&S's capital expenditure of £588 million in FY24 underscores the significant investment needed to rival its infrastructure. New entrants also struggle to match M&S's brand loyalty, particularly in food, and its extensive distribution network, which includes over 1,000 stores and a robust online platform.

Regulatory compliance, such as stringent food safety standards and evolving environmental regulations, further elevates barriers to entry. These factors, combined with the difficulty in securing prime retail locations and building efficient online fulfillment capabilities, make it challenging for newcomers to compete effectively with M&S's established market position and operational efficiencies.

| Factor | Impact on New Entrants | M&S Advantage |

| Capital Requirements | High | Significant financial resources for infrastructure and operations |

| Economies of Scale | Challenging to achieve | Lower costs through purchasing power and optimized logistics |

| Brand Loyalty | Difficult to build | Established customer trust and repeat business, especially in food |

| Distribution Channels | Limited access | Extensive physical store network and efficient online platform |

| Regulatory Compliance | Costly and complex | Established systems and expertise in meeting standards |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Marks & Spencer Group is built upon a foundation of publicly available financial reports, including their annual statements and investor presentations. We also leverage industry-specific market research reports and data from reputable retail analytics firms to provide a comprehensive view of the competitive landscape.