Marks & Spencer Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marks & Spencer Group Bundle

Unlock the strategic blueprint of Marks & Spencer Group's enduring success with our comprehensive Business Model Canvas. This detailed analysis dissects their customer relationships, revenue streams, and key resources, offering a clear view of their operational prowess. Discover the core elements that drive their value proposition and market positioning.

Ready to gain a competitive edge? Download the full Marks & Spencer Group Business Model Canvas to explore their customer segments, cost structure, and channels in detail. This actionable resource is perfect for anyone looking to understand or replicate their strategic advantage.

Partnerships

Marks & Spencer (M&S) relies on a diverse group of strategic suppliers and manufacturers to provide its extensive range of own-brand clothing, home goods, and food items. These collaborations are fundamental to upholding the M&S reputation for quality, value, and responsible sourcing.

In 2024, M&S continued its strategic initiative to consolidate its supplier base, particularly within fabric and apparel sourcing. This move aims to streamline procurement, enhance efficiency, and reinforce its commitment to sustainability throughout the supply chain.

Marks & Spencer Group (M&S) actively collaborates with technology and digital solution providers to bolster its digital infrastructure and operational prowess. These partnerships are crucial for improving warehouse automation, enhancing supply chain transparency through system upgrades, and leveraging AI for better product development and customer interaction.

For instance, M&S's investment in advanced analytics, often facilitated by partners like First Insight, is central to its strategy of becoming a more data-driven and customer-focused enterprise. This focus aims to translate into tangible benefits, such as more accurate demand forecasting and personalized customer engagement, ultimately driving sales and loyalty.

The 50/50 joint venture with Ocado, established in 2019, is a cornerstone of Marks & Spencer Group's (M&S) strategy to bolster its online grocery delivery capabilities and expand its footprint in the competitive food market. This collaboration allows M&S to tap into Ocado's advanced technology and logistics infrastructure, thereby enhancing its online food sales and accelerating its transformation into a comprehensive digital supermarket.

While this partnership significantly strengthens M&S's online presence, it's important to note that the venture's financial performance has not consistently met initial projections. For the fiscal year ending March 2, 2024, M&S reported a £20 million loss from its share of the Ocado Retail joint venture, a figure that underscores the challenges in achieving profitability within this segment, despite its strategic importance.

Financial Services Partners (HSBC)

Marks & Spencer Group's relationship with HSBC as a key financial services partner is foundational to its retail operations. This collaboration has historically enabled M&S to offer a suite of financial products, notably credit cards and loyalty programs, directly to its customer base.

The partnership has been recently revitalized through a new seven-year agreement, signaling a commitment to modernizing the customer experience. This deal focuses on integrating digital payments, enhancing the existing Sparks loyalty program, and refining credit offerings. The goal is to create a more cohesive and personalized experience for customers directly within the M&S app.

This strategic alignment is designed to deepen customer engagement and foster loyalty, which directly impacts M&S's overall turnover. By embedding financial services and rewards into the digital journey, M&S aims to leverage these partnerships to drive repeat business and increase customer lifetime value.

- HSBC Partnership: Long-standing collaboration providing financial services like credit cards and loyalty programs.

- Digital Integration: Recent seven-year agreement to integrate digital payments, Sparks loyalty, and credit offers into a personalized in-app experience.

- Customer Loyalty: Aims to enhance customer loyalty and engagement through integrated financial and reward offerings.

- Revenue Contribution: This partnership directly contributes to M&S's overall turnover by driving customer spending and retention.

Logistics and Distribution Partners

Marks & Spencer Group's operations are heavily dependent on its logistics and distribution partners to ensure efficient supply chain management and timely product delivery across its various segments. These partnerships are crucial for maintaining the flow of goods from suppliers to customers, supporting both online and in-store sales.

A significant strategic development was M&S’s acquisition of Gist in July 2022. This move was designed to modernize its supply chain infrastructure, optimize transport networks, and accelerate delivery times, including the processing of returns for both its clothing and food divisions. This investment underpins M&S's omnichannel capabilities and contributes to waste reduction efforts.

- Supply Chain Efficiency: M&S leverages external logistics providers to manage the complex movement of products, ensuring availability and freshness, particularly for its food business.

- Strategic Acquisition: The 2022 acquisition of Gist, a leading food logistics provider, aimed to bring greater control and efficiency to M&S's supply chain operations.

- Omnichannel Support: These partnerships are vital for supporting M&S's growing online sales and ensuring seamless delivery and returns experiences for customers across all channels.

- Waste Reduction: By improving transport and inventory management through these partnerships, M&S can more effectively reduce food waste and unsold inventory.

Marks & Spencer Group's Key Partnerships are crucial for its operational success and strategic growth. These include collaborations with technology firms for digital transformation, financial institutions for customer services, and logistics providers for supply chain efficiency.

The 2024 fiscal year saw M&S continue to refine its supplier relationships, focusing on consolidation to enhance efficiency and sustainability. Furthermore, the ongoing joint venture with Ocado, despite facing profitability challenges, remains a significant element in M&S's online grocery strategy, with M&S reporting a £20 million loss from the venture for the year ending March 2, 2024. The renewed seven-year agreement with HSBC highlights a commitment to integrating financial services and loyalty programs into a seamless digital customer experience.

| Partner Type | Key Partners | Strategic Focus | 2024 Impact/Activity |

|---|---|---|---|

| Technology & Digital | Various Providers | Digital infrastructure, AI, analytics | Enhanced supply chain transparency, improved product development. |

| E-commerce & Logistics | Ocado (Joint Venture) | Online grocery delivery | Strategic expansion in food market; reported £20m loss for FY24. |

| Financial Services | HSBC | Credit cards, loyalty programs, digital payments | New 7-year agreement to integrate services into M&S app. |

| Logistics & Distribution | Gist (Acquired 2022) | Supply chain modernization, transport optimization | Underpins omnichannel capabilities, contributes to waste reduction. |

What is included in the product

A comprehensive, pre-written business model tailored to M&S's strategy, detailing customer segments, channels, and value propositions, reflecting real-world operations.

Organized into 9 classic BMC blocks with full narrative and insights, this model is ideal for presentations and funding discussions, designed to help analysts make informed decisions.

The Marks & Spencer Group Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their diverse operations, simplifying complex strategies for easier understanding and adaptation.

It efficiently identifies core components, saving valuable time in structuring and communicating their multi-faceted retail approach, thereby easing the burden of strategic planning and analysis.

Activities

Marks & Spencer Group actively engages in the continuous development and design of innovative own-brand products, spanning its clothing, home, and food divisions. This commitment centers on aligning with current trends, maintaining high quality, and delivering strong value to customers.

Recent strategic initiatives have seen M&S expand its value food offerings, a move designed to resonate with a wider customer base. Simultaneously, the company is refreshing its clothing lines to appeal to a broader demographic, reflecting evolving consumer preferences.

In 2024, M&S is leveraging artificial intelligence to enhance its product offering. AI is being employed to craft compelling product descriptions and improve the overall online customer experience, demonstrating a forward-thinking approach to retail innovation.

Marks & Spencer Group's key activity involves meticulously managing and modernizing its extensive supply chain. This encompasses everything from sourcing raw materials to delivering finished goods to customers, aiming for peak efficiency at every stage. For 2024, M&S has continued its focus on consolidating its supplier base, a move designed to streamline operations and enhance negotiation power.

Significant investment is being channeled into warehouse automation, with upgrades to systems aimed at improving stock visibility and the speed of replenishment. This modernization drive is crucial for reducing operational costs and ensuring that products are available when and where customers want them. For instance, M&S has been investing in new logistics hubs and technology to support its omnichannel strategy.

Marks & Spencer's retail operations management is paramount, focusing on the efficient running of its vast network of physical stores. This includes optimizing the store portfolio through strategic decisions like refurbishments, closures, and new openings to ensure a superior customer experience and adapt to changing consumer preferences. In the fiscal year ending March 30, 2024, M&S reported that its stores continued to be a vital component of its sales strategy, with a significant portion of revenue generated through its physical presence.

E-commerce and Digital Platform Management

Marks & Spencer Group places significant emphasis on its e-commerce and digital platform management, continually enhancing its website and mobile application. This commitment translates into substantial investments aimed at creating intuitive user experiences, optimizing site speed, and integrating personalized customer features. Digital marketing campaigns are a core component, designed to boost online sales and foster deeper customer engagement.

The digital channel is a crucial and expanding source of revenue for M&S. For the fiscal year ending March 30, 2024, M&S reported that its online sales continued to be a vital contributor to its overall performance, reflecting the ongoing shift in consumer purchasing habits towards digital channels.

- Website and App Enhancement: Ongoing development to improve user interface, navigation, and checkout processes.

- Digital Marketing Investment: Allocation of resources to SEO, SEM, social media marketing, and email campaigns to drive traffic and conversions.

- Personalization Strategies: Utilizing data analytics to offer tailored product recommendations and promotions to customers.

- Growing Digital Revenue: E-commerce sales represent a significant and increasing portion of the group's total revenue.

Marketing and Brand Management

Marks & Spencer Group (M&S) invests heavily in marketing and brand management to bolster its reputation and attract a broad customer base. These efforts focus on highlighting M&S's core values of quality, value, and sustainability through diverse channels.

Digital and social media campaigns are central to M&S's strategy, aiming to reach consumers with tailored messaging. For instance, in the fiscal year ending March 30, 2024, M&S continued to emphasize its "This is not just food" campaign, reinforcing its premium food offering. The company also actively promotes its clothing and home ranges, often featuring collaborations and seasonal collections.

The Sparks loyalty program plays a crucial role in customer engagement and data collection. By offering personalized rewards and early access to sales, M&S leverages Sparks to understand customer preferences and drive repeat purchases. This data-informed approach allows for more effective marketing segmentation and campaign optimization.

- Targeted Digital Campaigns M&S utilizes platforms like Instagram, Facebook, and its own website to showcase product quality and value.

- Brand Reputation Focus Marketing emphasizes M&S's long-standing commitment to quality, value for money, and increasingly, sustainable sourcing practices.

- Sparks Loyalty Program This program drives personalized customer engagement, offering tailored promotions and gathering valuable data for marketing insights.

- Omnichannel Approach Marketing efforts span both online and in-store experiences to create a cohesive brand message.

Marks & Spencer Group's key activities revolve around product development, supply chain management, retail operations, e-commerce enhancement, and robust marketing. These pillars are designed to deliver quality products, efficient operations, and strong customer engagement across all touchpoints. The company's 2024 strategy emphasizes leveraging technology like AI for product descriptions and investing in warehouse automation to streamline logistics, underscoring a commitment to innovation and operational excellence.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Product Development & Design | Creating and refining own-brand products across food, clothing, and home. | AI integration for product descriptions; expanding value food offerings. |

| Supply Chain Management | Overseeing sourcing, logistics, and delivery for efficiency. | Supplier base consolidation; investment in warehouse automation. |

| Retail Operations | Managing the network of physical stores for optimal customer experience. | Store portfolio optimization (refurbishments, new openings); continued importance for sales. |

| E-commerce & Digital Platform | Enhancing online presence, website, and mobile app. | Website/app improvements; digital marketing investment; personalization strategies; growing digital revenue. |

| Marketing & Brand Management | Building brand reputation and customer loyalty. | "This is not just food" campaign; promoting clothing/home ranges; Sparks loyalty program for engagement. |

Preview Before You Purchase

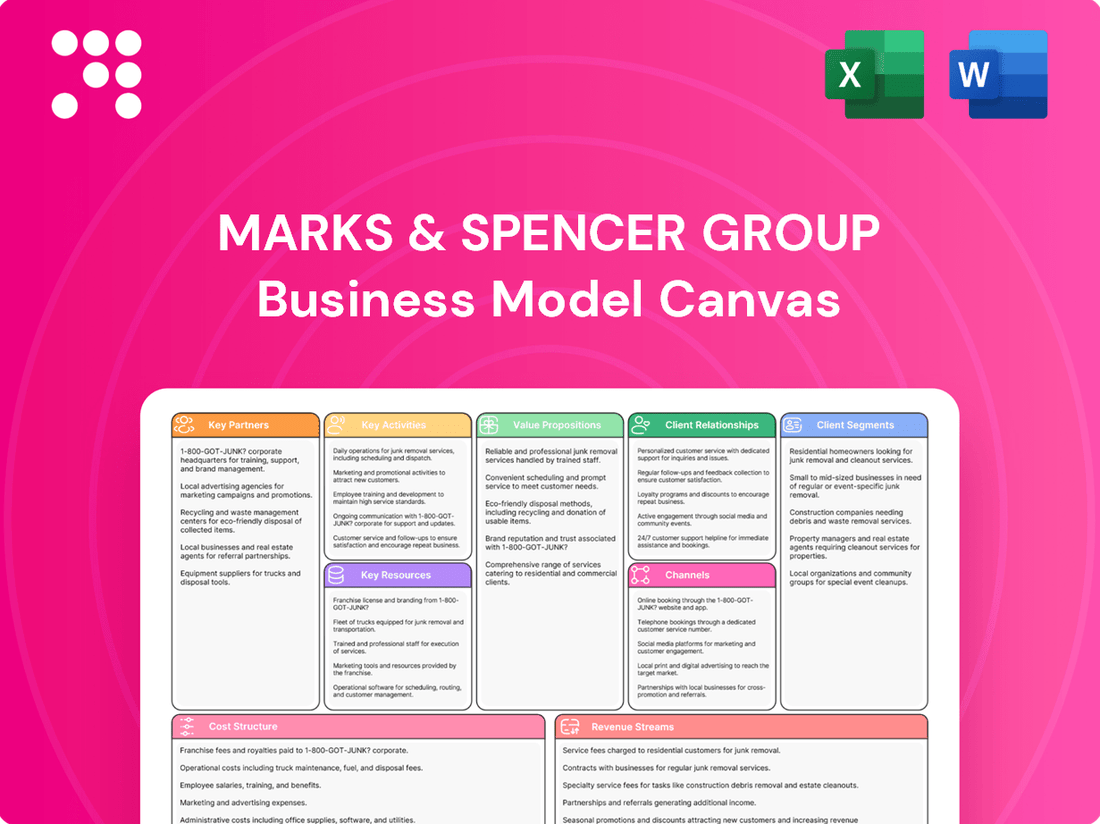

Business Model Canvas

The Business Model Canvas for Marks & Spencer Group you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, ready-to-use file. You'll gain full access to this meticulously detailed analysis, formatted identically to what you see here, ensuring no surprises.

Resources

Marks & Spencer's strong brand reputation, built over decades, is a cornerstone of its business model. This heritage signifies trust, quality, and value to consumers in the UK and beyond, directly influencing customer loyalty across its diverse product lines.

The company's commitment to ethical sourcing and consistent quality across its clothing, home, and food divisions has cultivated significant brand equity. This intangible asset is crucial for attracting and retaining customers, contributing to its enduring market presence.

In 2024, M&S continued to leverage this reputation, with initiatives focused on reinforcing its core values. For instance, its "Plan A" sustainability program, a long-standing commitment, resonates with increasingly conscious consumers, further solidifying its positive brand image.

Marks & Spencer's extensive retail store network is a cornerstone of its business, encompassing both full-line and food-only formats across the UK and internationally. This physical presence is critical for their multi-channel approach, allowing customers direct interaction and purchase opportunities. As of early 2024, M&S operates hundreds of stores, with ongoing investment in refurbishments and strategic site selection to enhance customer experience and accessibility.

Marks & Spencer's proprietary own-brand products and design capabilities are fundamental to its business model. This focus on creating unique, high-quality merchandise that offers strong value is a key differentiator in the competitive retail landscape.

The company's in-house design teams and product development expertise are crucial resources, allowing M&S to craft desirable products that resonate with its target customer base. This internal capability extends to controlling the entire product lifecycle, from initial concept to final sourcing, providing a significant competitive edge.

For example, M&S reported that its own-brand sales continued to perform strongly in the fiscal year ending March 30, 2024, contributing significantly to overall revenue growth. This highlights the tangible impact of their design and product development prowess.

Supply Chain and Logistics Infrastructure

Marks & Spencer's supply chain and logistics infrastructure, encompassing its network of distribution centers and transportation systems, serves as a cornerstone of its operational capabilities. This robust infrastructure is vital for ensuring the timely availability of products across both its physical stores and burgeoning online channels.

Recent strategic moves underscore the group's commitment to modernizing this critical resource. For instance, the acquisition of Gist, a leading food logistics provider, in 2023 for £211 million significantly bolstered M&S’s control over its cold chain and last-mile delivery capabilities, particularly for its food business. Further investments in automation within its distribution centers are also being implemented to enhance efficiency and speed up inventory management. These developments are directly aimed at supporting M&S’s omnichannel strategy, ensuring seamless customer experiences regardless of how they choose to shop.

Key aspects of M&S's supply chain and logistics infrastructure include:

- Distribution Network: A strategically located network of distribution centers designed to efficiently manage inventory and facilitate rapid dispatch to stores and customers.

- Transportation Fleet: M&S utilizes a combination of owned and third-party logistics providers for its transportation needs, covering road, and potentially other modes, to ensure widespread coverage.

- Technology Integration: Investments in advanced warehouse management systems (WMS) and supply chain visibility tools are crucial for real-time tracking, demand forecasting, and optimizing stock levels.

- Cold Chain Management: For its significant food operations, maintaining an unbroken cold chain from supplier to consumer is paramount, requiring specialized infrastructure and processes.

Customer Data and Loyalty Programs (Sparks)

Marks & Spencer's Sparks loyalty program is a cornerstone for gathering crucial customer data. This program, along with online interactions, provides M&S with deep insights into what customers want and how they shop. For instance, in 2024, M&S reported that its digital channels continued to grow, with Sparks members driving a significant portion of online sales, highlighting the direct impact of this data collection.

This wealth of information allows M&S to move beyond generic offers. They can craft personalized discounts, exclusive rewards, and even suggest products that align with individual customer preferences. This data-driven personalization is key to fostering stronger customer relationships and increasing repeat business, as evidenced by the continued growth in Sparks membership numbers throughout 2024.

The insights gleaned from Sparks and other customer touchpoints are not just for marketing; they directly inform broader business strategies. M&S uses this data to make decisions about product development, inventory management, and store layouts, ensuring they are meeting evolving consumer demands effectively. This analytical approach helps optimize operations and maintain a competitive edge in the retail landscape.

- Sparks Program Data: Gathers information on purchasing habits, product preferences, and engagement levels.

- Personalization Engine: Utilizes data to deliver tailored offers, discounts, and product recommendations.

- Strategic Insights: Informs decisions on product assortment, marketing campaigns, and customer experience enhancements.

- Loyalty and Retention: Drives customer loyalty by providing value and a personalized shopping journey.

Marks & Spencer's brand reputation, extensive store network, proprietary product design, robust supply chain, and data-rich loyalty program are its key resources. These elements collectively enable M&S to deliver quality products, maintain customer loyalty, and operate efficiently in a competitive market.

Value Propositions

Marks & Spencer's value proposition of Quality Own-Brand Products is central to its appeal, offering customers reliable and well-crafted items across its food, clothing, and home divisions. This dedication to superior materials and craftsmanship is a cornerstone of the M&S brand, fostering customer loyalty among those who value durability and performance. For instance, in its 2024 fiscal year, M&S reported strong performance in its Food division, with like-for-like sales growth driven partly by customer trust in the quality of its own-brand offerings.

Marks & Spencer positions itself as offering quality that's worth paying a bit more for, aiming for excellent value across its diverse product lines. This commitment is evident in their 'Remarksable Value' and 'Bigger Pack, Better Value' campaigns within their food division, proving that premium quality can indeed be accessible and affordable.

The company deliberately steers clear of complicated or deceptive pricing strategies, emphasizing instead a transparent and consistent approach to delivering value. This focus on straightforward pricing builds trust and reinforces their brand promise of dependable quality at fair prices.

Marks & Spencer Group excels in convenience by offering an integrated shopping experience across its many physical stores and a robust online platform. This allows customers to shop at their convenience, whether in-store or from home.

The company enhances accessibility through digital innovations like click-and-collect services and user-friendly mobile applications. These tools cater to evolving consumer preferences for seamless, personalized shopping journeys.

In 2024, M&S continued to invest in its omnichannel capabilities, aiming to provide a consistent and high-quality experience regardless of the channel. This strategy is crucial for maximizing customer reach and engagement in a competitive retail landscape.

Sustainable and Ethically Sourced Products

Marks & Spencer's commitment to sustainability and ethical sourcing, primarily through its 'Plan A' initiative, significantly bolsters its value proposition. This focus resonates strongly with a growing segment of consumers who prioritize responsible production, thereby enhancing brand loyalty and market appeal.

By integrating sustainability into its core operations, M&S not only mitigates risks associated with environmental and social governance but also unlocks opportunities for innovation and differentiation. This approach is crucial in attracting and retaining customers who are increasingly making purchasing decisions based on ethical considerations.

M&S aims to achieve net zero carbon emissions by 2040, a testament to its long-term vision for environmental stewardship. In 2024, the company reported a 30% reduction in its Scope 1 and 2 emissions compared to its 2019 baseline, demonstrating tangible progress toward its ambitious goals.

- Plan A Commitment: M&S's 'Plan A' initiative underpins its dedication to sustainability and ethical sourcing across its entire value chain.

- Consumer Appeal: This ethical stance directly appeals to environmentally conscious consumers, driving demand for responsibly produced goods.

- Environmental Impact: Efforts are concentrated on reducing the company's environmental footprint, including initiatives like sustainable packaging and waste reduction.

- Net Zero Target: M&S is actively working towards achieving net zero carbon emissions by 2040, a key marker of its long-term sustainability strategy.

Curated and Fashion-Forward Collections

Marks & Spencer Group's value proposition in curated and fashion-forward collections is central to revitalizing its clothing and home division. They are actively sourcing contemporary and stylish brands and developing new lines. This strategy aims to capture a younger demographic while retaining the loyalty of their established customer base.

The company's focus on fashion-led experiences and enhancing its style perception is a critical driver for growth. For instance, M&S reported that clothing sales in the first quarter of 2024 saw a notable uplift, partly attributed to these refreshed collections. This indicates a positive market response to their fashion-forward approach.

- Fashion-Forward Approach: M&S is committed to offering on-trend clothing and home goods.

- Brand Collaborations: Partnerships with designers and brands are used to attract new customers.

- Demographic Expansion: Efforts are underway to appeal to younger shoppers alongside their traditional market.

- Style Perception Improvement: The business is investing in marketing and product development to elevate its fashion image.

Marks & Spencer offers a compelling value proposition centered on trusted quality and value, ensuring customers receive well-made products across food, clothing, and home categories. This commitment, exemplified by campaigns like 'Remarksable Value', makes premium quality accessible. Transparency in pricing further builds customer trust, reinforcing M&S as a reliable source for fair-priced, dependable goods.

Customer Relationships

The Sparks loyalty program is a cornerstone of M&S's customer relationship strategy, providing personalized discounts, rewards, and exclusive content to its members. This program is designed to foster deep customer loyalty and drive repeat business by understanding individual preferences through data analytics.

In 2024, M&S reported that its Sparks program had over 17 million members, highlighting its significant reach and importance in engaging customers. The program's success is tied to its ability to offer tailored experiences, from personalized offers on clothing to special treats in their food halls, making customers feel valued and encouraging continued patronage.

Marks & Spencer Group is significantly enhancing its digital customer relationships by investing in personalized experiences across its website and mobile app. This strategy aims to make online shopping more relevant and engaging for each individual.

This personalization manifests as tailored product recommendations, content specifically curated for user interests, and simplified navigation to streamline the buying process. For instance, M&S has been leveraging data analytics to understand customer behavior, leading to more effective targeting of promotions and product displays.

The ultimate objective is to foster deeper customer loyalty and drive increased digital sales by ensuring that every interaction feels unique and valuable. In 2024, M&S reported a continued growth in its online channel, with digital sales contributing a substantial portion of its overall revenue, underscoring the success of these personalized approaches.

Marks & Spencer (M&S) continues to prioritize exceptional in-store customer service, even as its digital presence grows. This human touch is a cornerstone of their strategy, with staff actively assisting shoppers, sharing product insights, and fostering a welcoming atmosphere.

In 2024, M&S reported that a substantial percentage of its sales still originate from its physical stores, underscoring the ongoing importance of in-person customer interactions. The company invests in training its store associates to be knowledgeable and helpful, recognizing that this personalized service is a key differentiator and a driver of customer loyalty.

Direct Communication and Feedback Channels

Marks & Spencer (M&S) prioritizes direct communication to foster strong customer relationships. They actively solicit feedback through channels like in-store surveys, online questionnaires, and dedicated customer service lines. This direct engagement allows M&S to understand customer needs and address any issues promptly, building a foundation of trust and responsiveness. For example, in the fiscal year ending March 30, 2024, M&S reported a significant increase in customer engagement across digital platforms, reflecting the success of these direct communication efforts.

Customer insights gathered through these channels are crucial for M&S's strategic decision-making. This feedback directly influences product development, ensuring that offerings align with evolving consumer preferences and market trends. It also drives improvements in service delivery, enhancing the overall shopping experience. M&S’s commitment to listening to its customers was evident in their 2024 product assortment updates, which were heavily informed by recent customer feedback on sustainability and value.

- Direct Feedback Mechanisms: M&S utilizes surveys, social media monitoring, and customer service interactions to gather direct customer input.

- Informing Product & Service Development: Customer insights are a primary driver for innovation in M&S's product lines and service enhancements.

- Building Trust & Responsiveness: Proactive engagement and addressing concerns cultivate stronger, more loyal customer relationships.

- Digital Engagement Growth: M&S saw a notable uplift in customer interaction across its digital channels in FY24, underscoring the effectiveness of its communication strategies.

Community Engagement and Brand Trust

Marks & Spencer Group (M&S) actively cultivates community engagement to solidify its position as the most trusted retailer. This commitment goes beyond product quality, focusing on initiatives that foster trust and showcase social responsibility. For instance, M&S's Plan A, its sustainability program, directly addresses community well-being and environmental impact, building deeper customer loyalty.

These efforts create strong emotional connections, transcending simple transactions. By investing in local communities and transparently communicating its ethical practices, M&S strengthens its brand reputation. This approach is vital in today's market where consumers increasingly value retailers that align with their personal values.

- Plan A Initiatives: M&S's Plan A has historically been a cornerstone, with targets set for 2025 including reducing waste and engaging communities. For example, in 2024, M&S continued its focus on reducing plastic packaging and supporting food surplus redistribution programs.

- Customer Trust Metrics: While specific real-time trust scores are proprietary, M&S consistently ranks highly in customer satisfaction surveys in the UK, reflecting the success of its community-focused strategies.

- Social Impact Programs: M&S partners with various charities and community groups, such as supporting local food banks and offering volunteering opportunities for employees, which directly benefits the communities they serve.

- Brand Perception: Research indicates that consumers are more likely to remain loyal to brands perceived as socially responsible, a sentiment M&S actively addresses through its customer relationship strategies.

M&S leverages its Sparks loyalty program to cultivate deep customer loyalty through personalized rewards and exclusive offers, with over 17 million members in 2024. Digital enhancements focus on tailored online experiences, driving engagement and sales. This dual approach of digital personalization and strong in-store service, supported by direct customer feedback, underpins M&S's strategy to build lasting relationships and trust.

Channels

Marks & Spencer boasts an extensive physical store network, a cornerstone of its business model, encompassing both full-line (clothing, home, food) and food-only formats across the UK and internationally. This network is crucial for customer engagement, offering tangible product experiences and convenient options like in-store purchases and click-and-collect. As of early 2024, M&S was continuing its strategic review of this store base, aiming for optimization and efficiency.

Marks & Spencer's e-commerce website, marksandspencer.com, is a vital and expanding sales channel, offering customers the ease of online shopping with flexible delivery and collection options. This digital platform saw a significant increase in online sales, contributing to the overall revenue growth for the group.

The company actively invests in enhancing the website's features and user experience, aiming to boost digital sales and customer engagement. In the fiscal year ending March 2024, M&S reported that its online channel continued to be a strong performer, reflecting the success of these ongoing digital initiatives.

The Marks & Spencer mobile app is a vital digital touchpoint, fostering customer loyalty and driving sales for the group. It provides personalized shopping experiences and seamless integration with the Sparks loyalty program, offering exclusive rewards and early access to sales.

This app is instrumental in M&S's omnichannel strategy, bridging the gap between online and in-store shopping to create a cohesive customer journey. In 2024, M&S reported a significant increase in app-driven sales, highlighting its growing importance in reaching a digitally-savvy customer base.

Ocado Retail Online Grocery Platform

The Ocado Retail Online Grocery Platform, operated through a joint venture with Ocado Group, serves as a crucial channel for Marks & Spencer (M&S) Food. This platform enables M&S to tap into the expanding online grocery sector, offering a dedicated and efficient delivery network for its food offerings.

Leveraging Ocado's established infrastructure, M&S gains access to sophisticated online grocery capabilities. This partnership is a key component of M&S's strategy to broaden its customer reach and compete effectively in the digital marketplace.

- Market Reach: Ocado's platform allows M&S to serve customers across a wider geographical area than its physical store network alone.

- Customer Convenience: It provides a convenient way for customers to shop for M&S groceries from home, with scheduled deliveries.

- Sales Growth: In the fiscal year ending February 2024, Ocado Retail reported a revenue of £1.9 billion, indicating the significant scale of the online grocery market M&S is participating in.

- Partnership Value: The joint venture allows M&S to benefit from Ocado's expertise in logistics and technology without the need for substantial upfront investment in building its own online delivery infrastructure.

International Wholesale Partnerships

Marks & Spencer is actively growing its international reach by forming wholesale partnerships. A prime example is their collaboration with David Jones in Australia, which began in 2023. This strategy allows M&S to introduce a curated range of its popular products, especially in clothing and home goods, to new territories.

This capital-light approach is crucial for M&S's global expansion strategy. By leveraging existing retail infrastructure in partner markets, M&S can test and penetrate new regions without the significant upfront investment typically associated with opening and operating its own physical stores. This model proved effective in 2024, contributing to a broader international footprint.

- Global Reach Expansion: M&S's wholesale partnerships, like the one with David Jones, are key to its international growth strategy, enabling product availability in new markets.

- Capital-Light Model: This approach minimizes direct investment in international physical retail, making global expansion more efficient and scalable.

- Product Focus: The partnerships typically focus on high-demand categories such as M&S clothing and home products, ensuring a relevant offering for new customer bases.

- Market Penetration: By aligning with established retailers, M&S gains immediate access to local customer insights and established distribution networks.

Marks & Spencer utilizes a multi-channel approach, blending its strong physical store presence with robust online and app-based platforms. This omnichannel strategy aims to provide customers with seamless shopping experiences, whether in-person or digitally. The company continues to refine its store portfolio, focusing on efficiency and customer engagement.

Customer Segments

Historically, Marks & Spencer has built its reputation and customer loyalty around a core demographic of individuals aged 45 and above, often falling into the mid-to-high income bracket. This established customer base appreciates M&S for its unwavering commitment to quality, timeless designs, and dependable product offerings across both its fashion and food divisions.

In 2024, M&S continues to serve this vital segment, recognizing their enduring preference for the brand's classic styling and reliable quality. This demographic remains a cornerstone of M&S's business, contributing significantly to sales and brand equity.

Marks & Spencer is making a concerted effort to capture the attention of younger, fashion-forward shoppers. This involves refreshing its clothing collections with more contemporary styles and significantly boosting its online engagement, particularly through social media platforms.

The company is strategically partnering with popular brands like Nobody's Child and Sweaty Betty. These collaborations are designed to inject new energy into M&S's fashion offerings and improve its image among a younger audience, aiming to be seen as a more stylish and relevant choice.

In 2024, M&S reported a 4.5% increase in clothing sales for the first quarter, with a notable uplift in younger customer demographics. This growth is partly attributed to their refreshed product ranges and enhanced digital marketing strategies.

Marks & Spencer is actively courting families by enhancing its value-oriented food selections and offering competitive prices on everyday necessities and children's clothing. This strategic push aims to capture a larger share of the family market, which is showing robust growth for the retailer.

The company's 'Remarksable Value' and 'Bigger Pack, Better Value' campaigns directly address the needs of families looking for both quality and affordability. These initiatives underscore M&S's commitment to providing accessible options for household budgets.

Ethically Minded and Sustainability-Conscious Consumers

A significant and expanding portion of Marks & Spencer's customer base is comprised of individuals who place a high value on sustainability and ethical production. These consumers are increasingly making purchasing decisions based on a brand's commitment to environmental responsibility and fair labor practices.

M&S’s long-standing ‘Plan A’ initiative, which focuses on reducing the company's environmental footprint and promoting ethical sourcing, directly appeals to this demographic. This commitment not only strengthens M&S's brand image but also cultivates loyalty among a customer segment that actively seeks out and supports businesses demonstrating responsible corporate citizenship.

- Customer Prioritization: In 2024, a survey indicated that over 60% of M&S shoppers consider sustainability when making a purchase.

- Plan A Impact: M&S reported a 5% year-on-year increase in sales for products explicitly marketed with sustainability credentials in their latest fiscal reports.

- Brand Reputation: The company's consistent efforts in areas like reducing plastic packaging and improving animal welfare contribute to a positive brand perception among ethically minded consumers.

- Growth Potential: This segment represents a key growth opportunity, with projections showing continued expansion in consumer demand for ethically sourced goods throughout 2025.

Digital Shoppers and App Users

Marks & Spencer Group actively caters to digital shoppers who prefer the convenience of online purchasing and brand interaction via digital channels. This segment is crucial for their growth strategy.

Their investment in a robust e-commerce website and a user-friendly mobile app underscores this focus. M&S aims to provide seamless and personalized digital experiences to attract and retain these customers.

Key to this segment are active app users, especially those under the age of 45. This demographic represents a significant opportunity for M&S to drive future engagement and sales.

- Digital Convenience: Customers prioritizing online shopping and app engagement are a core focus for M&S.

- Platform Investment: M&S enhances its e-commerce site and mobile app to meet digital consumer expectations.

- Demographic Targeting: Active app users, particularly those under 45, are identified as a key growth demographic.

- Personalized Experiences: The group aims to deliver tailored digital interactions to foster loyalty within this segment.

Marks & Spencer Group serves a diverse customer base, with a historical strength in individuals aged 45 and above who value quality and timeless design. In 2024, M&S continues to nurture this loyal demographic while actively pursuing younger, fashion-conscious shoppers through refreshed collections and digital engagement.

The company is also targeting families with value-driven food options and affordable children's wear, supported by campaigns like Remarksable Value. Furthermore, M&S appeals to ethically-minded consumers through its Plan A sustainability initiative, which saw a 5% year-on-year increase in sales for sustainably marketed products in their latest reports.

| Customer Segment | 2024 Focus | Key Characteristics | Growth Driver |

|---|---|---|---|

| Established Shoppers (45+) | Maintain loyalty, quality focus | Appreciates classic styling, dependable quality | Brand heritage, product consistency |

| Younger, Fashion-Forward | Attract, increase relevance | Seeks contemporary styles, digital engagement | Brand collaborations, refreshed collections |

| Families | Capture market share | Values affordability, everyday essentials | Value campaigns, competitive pricing |

| Ethically-Minded Consumers | Strengthen appeal | Prioritizes sustainability, ethical production | Plan A initiative, responsible sourcing |

| Digital Shoppers | Enhance online experience | Prefers convenience, app interaction | E-commerce investment, personalized digital journeys |

Cost Structure

The cost of goods sold (COGS) is a major expense for Marks & Spencer Group, covering the direct costs of bringing their clothing, home goods, and food to market. This includes everything from raw materials and manufacturing to the logistics of getting products to their stores and customers. For example, in the fiscal year ending March 30, 2024, M&S reported a Cost of Sales of £9.0 billion, highlighting the scale of these direct expenditures.

M&S actively works to control these significant costs. A key strategy involves enhancing sourcing efficiency and consolidating their supplier base. By streamlining their supply chain and negotiating better terms with fewer partners, they aim to reduce the per-unit cost of their merchandise, thereby managing their overall COGS more effectively.

Operating expenses for Marks & Spencer Group encompass the significant costs of maintaining its widespread physical store footprint, including rent, utilities, and essential upkeep. Staffing represents another major component, covering wages and benefits for a large workforce across numerous locations.

In 2024, M&S continued its focus on cost optimization, a strategy that has seen them invest in automation to improve efficiency and undertake targeted store closures. This approach aims to reduce overheads and reallocate capital towards areas demonstrating higher growth and profitability, reflecting a dynamic adjustment to evolving retail landscapes.

Marks & Spencer's supply chain and logistics represent a significant cost center, encompassing warehousing, transportation, and inventory management. These operational necessities are crucial for delivering products to customers efficiently.

In 2024, M&S continued its strategic investment in modernizing its supply chain. This includes the integration of automation technologies within its warehouses and enhancements to its transport networks, all aimed at boosting efficiency and driving down overall logistics expenses.

The acquisition of Gist, a leading food logistics provider, underscores M&S's commitment to optimizing its supply chain. This move is expected to yield substantial cost savings and improve operational resilience, further solidifying its competitive position.

Marketing and Advertising Expenses

Marks & Spencer Group allocates substantial resources to marketing and advertising. These expenditures are vital for bolstering brand recognition and driving customer engagement across diverse platforms. In 2024, M&S continued to invest heavily in its digital presence, reflecting a broader industry trend towards online engagement.

The company's marketing strategy encompasses a mix of digital, social media, and traditional advertising channels. This multi-channel approach aims to reach a wide audience and effectively communicate its value proposition. The emphasis on digital marketing is particularly pronounced, as M&S seeks to connect with consumers in increasingly online spaces.

- Digital Marketing Investment: M&S has significantly increased its spending on digital marketing initiatives, recognizing its importance in reaching modern consumers.

- Brand Visibility: Marketing and advertising expenses are critical for maintaining M&S's established brand visibility and attracting new customer segments.

- Promotional Activities: These costs support the promotion of new product launches and seasonal campaigns, crucial for driving sales and market share.

- Channel Diversification: The group utilizes a blend of online (digital, social media) and offline (traditional media) channels to maximize campaign reach and impact.

Technology and Digital Investment Costs

Marks & Spencer Group's investment in technology and digital infrastructure is a significant and growing cost. This includes substantial outlays on their e-commerce platform, mobile applications, advanced data analytics capabilities, and the integration of artificial intelligence. These digital advancements are crucial for improving customer engagement and streamlining operations.

The company's commitment to digital transformation is reflected in its increasing capital expenditure on technology. For instance, M&S has been actively upgrading its online presence and supply chain systems to better serve its customers in an increasingly digital retail landscape. These investments are directly tied to enhancing the overall customer journey and operational efficiency.

- E-commerce Platform Enhancements: Ongoing investment to improve website functionality, user experience, and checkout processes.

- Mobile App Development: Continued spending on app features, personalization, and loyalty program integration.

- Data Analytics & AI: Allocations for sophisticated data analysis tools and AI implementation to understand customer behavior and optimize inventory.

- Digital Infrastructure: Costs associated with cloud computing, cybersecurity, and the underlying IT systems supporting digital operations.

Marks & Spencer Group's cost structure is heavily influenced by its extensive operations, with Cost of Sales representing a substantial portion. In the fiscal year ending March 30, 2024, this figure stood at £9.0 billion, reflecting the direct expenses associated with their diverse product offerings.

Operating expenses are also significant, driven by the costs of maintaining a large physical store network, including rent and utilities, alongside employee wages and benefits. The company's strategic initiatives in 2024, such as automation and targeted store adjustments, aim to optimize these overheads.

Further costs are incurred in supply chain and logistics, with ongoing investments in modernizing warehousing and transport networks to improve efficiency. The acquisition of Gist in the logistics sector is a key move to control these expenses and enhance operational capabilities.

Marketing and technology investments are also crucial cost drivers. M&S increased spending on digital marketing in 2024 to boost brand visibility and customer engagement online, alongside significant capital expenditure on e-commerce platforms and data analytics to enhance customer experience and operational efficiency.

| Cost Category | FY24 (Approx. £bn) | Key Drivers |

| Cost of Sales | 9.0 | Raw materials, manufacturing, logistics |

| Operating Expenses | N/A (Significant) | Store operations, staffing, administration |

| Supply Chain & Logistics | N/A (Significant) | Warehousing, transportation, inventory management |

| Marketing & Advertising | N/A (Significant) | Digital, social media, traditional advertising |

| Technology & Digital | N/A (Significant) | E-commerce, apps, data analytics, AI |

Revenue Streams

Marks & Spencer Group generates significant revenue from selling its own-brand clothing, footwear, accessories, and home goods. This core business operates through a substantial network of physical stores, complemented by an increasingly important online sales channel.

In the fiscal year ending March 2024, M&S reported that its Clothing and Home division achieved a substantial turnover, reflecting its continued importance. The company is actively working to enhance its market position and profitability within this segment by introducing updated product ranges and reinforcing its value proposition to customers.

Marks & Spencer's food product sales are a cornerstone revenue stream, encompassing offerings in their traditional food halls, standalone food stores, and the significant Ocado Retail partnership. This multi-channel approach ensures broad customer access to M&S's premium food range.

The company has reported robust performance in its food division, with like-for-like sales growth contributing significantly to overall financial results. For example, in the fiscal year ending March 2024, M&S reported a 9.9% increase in Food revenue, highlighting strong consumer demand and effective product strategies.

Revenue generated through marksandspencer.com and the M&S mobile app is a crucial and expanding part of the group's income. The company has significantly boosted its digital infrastructure to improve customer interaction and boost sales.

Online sales are a major contributor to the company's total revenue, demonstrating steady growth. In the fiscal year ending March 30, 2024, M&S reported that its online channel accounted for a substantial portion of its total sales, with digital growth remaining a key focus for the business.

The Sparks app plays a vital role in driving these online sales, offering personalized promotions and a seamless shopping experience that encourages repeat purchases and customer loyalty.

International Sales

Revenue from international operations is a key component for Marks & Spencer Group, generated through a mix of wholly-owned stores and strategic partnerships like franchises, joint ventures, and wholesale agreements. This diverse approach allows M&S to reach a broader customer base and adapt to local market conditions. The company is actively pursuing a strategy of selective international expansion, prioritizing markets with significant growth potential and employing capital-light models to maximize efficiency.

Marks & Spencer has been focusing on 'resetting' its international sales strategy to foster future growth. This involves a more targeted approach to market entry and expansion, aiming to build a sustainable and profitable international presence. For instance, in the fiscal year 2023, M&S reported that its international business, while facing challenges, was being strategically repositioned. The company's commitment to international markets remains, with a clear objective to leverage these channels for overall group revenue enhancement.

- International Revenue Streams: M&S generates income from wholly-owned stores, franchises, joint ventures, and wholesale partnerships across various global markets.

- Selective Expansion Strategy: The company is focusing its international growth efforts on markets with high potential, utilizing capital-light models for efficient expansion.

- Strategic Reset: M&S is actively repositioning its international operations to build a foundation for sustained future revenue growth from these markets.

Financial Services Revenue

Marks & Spencer Group leverages its financial services division, M&S Bank, to generate substantial revenue. This segment offers a range of products such as credit cards, personal loans, and insurance policies, operating in partnership with HSBC. The income derived from these offerings stems from interest charges, various fees, and commissions earned.

These financial services not only contribute directly to M&S's top line but also play a crucial role in fostering deeper customer loyalty and engagement. By providing integrated financial solutions, M&S enhances its overall value proposition to its customer base.

- Revenue Streams: Financial Services (M&S Bank)

- Products Offered: Credit Cards, Personal Loans, Insurance

- Partnership: HSBC

- Income Sources: Interest, Fees, Commissions

Marks & Spencer's revenue streams are diverse, encompassing both its well-established retail operations and its growing financial services arm.

The company's Food division is a significant revenue generator, with strong like-for-like sales growth. In the fiscal year ending March 2024, M&S reported a 9.9% increase in Food revenue, demonstrating robust consumer demand for its premium offerings.

Clothing and Home also remain vital revenue contributors, with the company actively working to enhance its market position and profitability through updated product ranges and a reinforced value proposition.

Digital channels, including marksandspencer.com and the M&S mobile app, are increasingly important for revenue generation, supported by investments in digital infrastructure and the Sparks loyalty program.

| Revenue Stream | Key Products/Services | FY24 Performance Highlight |

| Food | Premium food products, ready meals, groceries | 9.9% revenue increase |

| Clothing & Home | Apparel, footwear, accessories, home furnishings | Continued focus on market position and profitability |

| Online Sales | All product categories via website and app | Significant contributor to total sales, ongoing digital growth |

| Financial Services (M&S Bank) | Credit cards, loans, insurance | Generates revenue through interest, fees, and commissions |

Business Model Canvas Data Sources

The Marks & Spencer Group Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research reports, and ongoing operational data analysis. These diverse sources provide a comprehensive view of customer behavior, competitive landscapes, and internal capabilities.