Marks & Spencer Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marks & Spencer Group Bundle

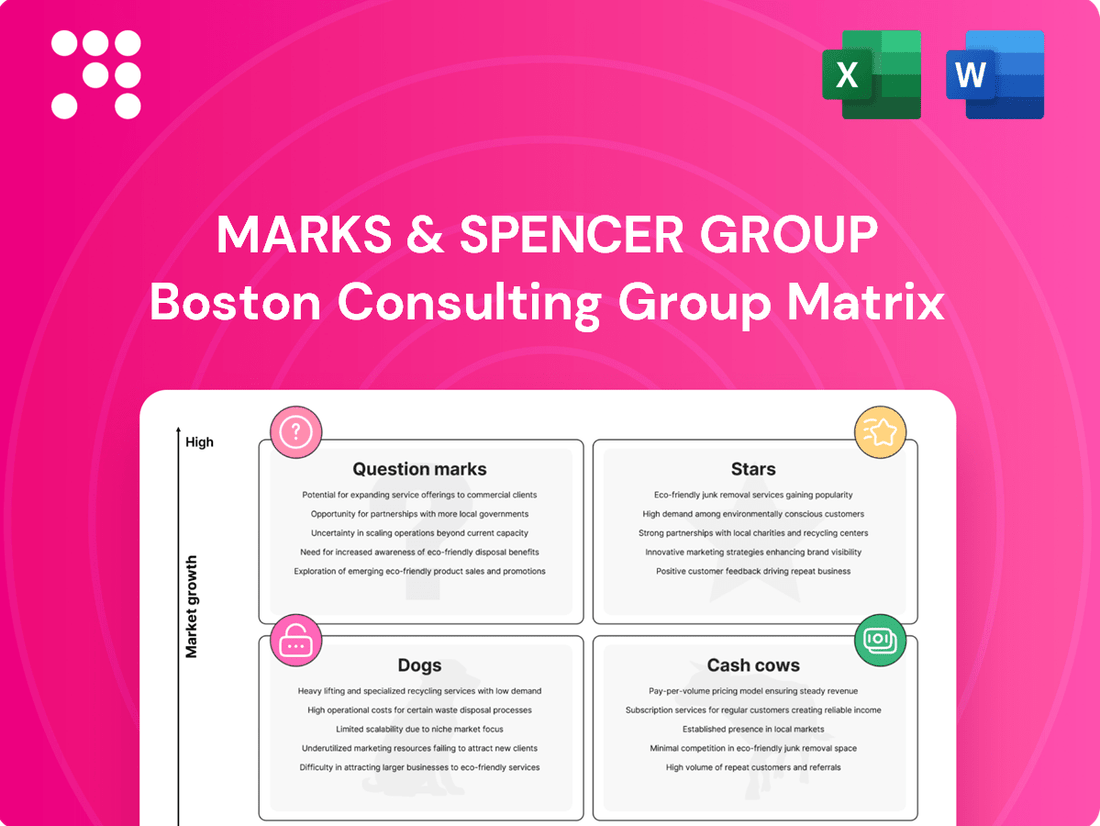

Curious about Marks & Spencer's product portfolio? Our BCG Matrix analysis reveals which categories are their Stars, Cash Cows, Dogs, and Question Marks. This essential strategic tool helps you understand their market position and potential for growth.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The M&S Food division is a significant player, showing robust growth. In the fiscal year 2024/25, its sales jumped by 8.7%, with like-for-like sales also rising by 8.6%. This marks the third consecutive year of volume and value share gains, indicating it's outperforming the broader market.

Further solidifying its position, M&S Food's market share increased by 27 basis points to 3.9% for the 52 weeks ending March 23, 2025. This growth is supported by an enhanced perception of both quality and value among consumers, reinforcing its competitive edge.

M&S.com, representing the online Clothing & Home segment, is a significant growth driver for Marks & Spencer. In Q3 of the 2024/25 financial year, online sales surged by 11.7%, demonstrating robust momentum. This digital channel now accounts for 34% of all sales, a notable increase from 31% in the prior year.

The strategic objective is to elevate online sales to 50% of the total by 2028. This expansion is fueled by an increasing number of customers engaging with M&S online and improved availability of their product range. The company is actively investing in its digital infrastructure to support this ambitious growth trajectory.

Marks & Spencer's womenswear and menswear are key components of its Clothing & Home division. These segments have shown significant improvement, driven by enhanced product offerings in terms of style, quality, and overall value.

This strategic focus has translated into tangible market gains. In 2024, M&S's market share in the apparel sector reached 5.2%, marking its highest point since 2017. This growth also reflects a notable shift in consumer perception, with the brand now ranking second for style, a substantial jump from its sixth-place position in 2022.

New Food Halls and Renewed Full-Line Stores

Marks & Spencer Group is strategically focusing on expanding its Food Hall presence and revitalizing its Full-Line stores, a move that positions these ventures as potential Stars in the BCG Matrix. The company has ambitious plans, including the opening of 12 new Food Halls and the refurbishment of two Full-Line stores throughout 2025.

These initiatives are showing promising early results, with the newly opened and renovated locations consistently exceeding performance expectations. Crucially, these stores are generating returns that surpass the company's required hurdle rates, indicating strong potential for sustained sales growth and market share capture.

- Investment in Growth: M&S is channeling resources into expanding its Food Hall footprint and upgrading its Full-Line stores.

- Performance Metrics: New and renewed stores are outperforming projections, achieving returns above hurdle rates.

- Future Outlook: These strategic store developments are expected to drive long-term sales growth for the group.

- 2025 Expansion: Plans include 12 new Food Halls and two Full-Line store renewals within the 2025 fiscal year.

Remarksable Value Product Range

The Remarksable Value product range has become a cornerstone of M&S Food's strategy, demonstrating robust performance. This initiative directly addresses consumer demand for affordability without compromising on the quality M&S is known for.

In the fiscal year 2023/24, the Remarksable Value line experienced an impressive sales surge of 34%. This substantial growth underscores the effectiveness of M&S's approach to strategic pricing and its commitment to delivering superior quality at competitive price points. This has significantly bolstered customer confidence in the M&S value proposition.

- Sales Growth: Remarksable Value saw a 34% increase in sales during FY2023/24.

- Strategic Focus: Driven by strategic price investments and a commitment to quality.

- Customer Perception: Reinforces customer trust in M&S's value for money.

- Market Impact: Positions M&S competitively in the value-conscious market segment.

The M&S Food division and the revitalized Full-Line stores are positioned as Stars within the BCG Matrix due to their high growth and strong market share. The Food division achieved an 8.7% sales increase in FY2024/25, with market share rising to 3.9%. The strategic expansion of Food Halls and refurbishment of Full-Line stores are exceeding performance expectations and hurdle rates, indicating significant future growth potential.

What is included in the product

This BCG Matrix overview details M&S's portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear BCG Matrix visualizes M&S's portfolio, easing the pain of resource allocation by highlighting Stars and Cash Cows.

Cash Cows

Marks & Spencer's established food offerings are a clear Cash Cow within their BCG matrix. This segment, known for its premium quality and innovative product lines, commands a substantial market share and reliably generates significant cash flow for the wider group.

In the fiscal year ending March 30, 2024, M&S Food reported a strong performance, with total revenue reaching £12.7 billion, a testament to its enduring appeal and market position. This consistent financial strength allows M&S to reinvest in its other business units and solidify its leadership in the premium grocery sector.

The Core Clothing & Home division at Marks & Spencer, a key Cash Cow, demonstrated resilience in FY2023/24, achieving adjusted operating profits of £402.8 million. This performance underscores its consistent ability to generate substantial cash flow.

Despite facing a dynamic retail landscape, this segment held a significant market share of 10.5% in FY2024/25. This stability is largely attributed to a dedicated customer base and M&S's established reputation for delivering quality and value.

Marks & Spencer's extensive network of profitable full-line and Simply Food stores across the UK is a significant Cash Cow. These established, well-located stores consistently generate stable revenue and cash flow, serving a broad customer base. For instance, M&S reported a 9.9% increase in total revenue to £12.3 billion for the fiscal year ending March 30, 2024, with their food division showing particular strength.

M&S Own-Brand Products

Marks & Spencer's own-brand products are a cornerstone of its business, acting as significant cash cows. This focus on exclusive offerings in food, clothing, and home goods cultivates deep customer loyalty and supports healthier profit margins than if they relied heavily on third-party brands. These distinctive products provide a consistent and dependable revenue stream for the company.

In the fiscal year 2023-2024, M&S reported a strong performance, with its Food division, heavily reliant on own-brand innovation, showing particular resilience. The company's strategic investment in its own brands continues to pay dividends, contributing substantially to its overall profitability and market position.

- High-Quality Own-Brand Focus: M&S leverages its own brands across key categories like food, apparel, and home.

- Enhanced Profitability: This strategy allows for greater control over pricing and quality, leading to higher profit margins.

- Brand Loyalty Driver: Exclusive products foster a strong connection with customers, encouraging repeat purchases.

- Consistent Revenue Stream: The reliability of these in-demand items ensures a steady income for the business.

Sparks Loyalty Program

The Sparks loyalty program is a significant asset for Marks & Spencer Group, acting as a Cash Cow within its BCG Matrix. With a substantial 5 million users, it's instrumental in driving customer engagement and encouraging repeat business. In fact, 44% of M&S's online sales are directly linked to this program.

This established program plays a crucial role in M&S maintaining a strong market share. By cultivating customer loyalty and generating valuable data for targeted marketing efforts, Sparks ensures a consistent and reliable cash flow for the company.

- Sparks Loyalty Program User Base: 5 million users.

- Contribution to Online Sales: 44% of online sales are attributed to the Sparks program.

- Role in Market Share: Fosters customer loyalty, helping to maintain a high market share.

- Cash Flow Generation: Provides valuable data for personalized marketing, contributing to consistent cash flow.

Marks & Spencer's established food division is a prime example of a Cash Cow, consistently generating substantial revenue and profit. This segment benefits from high brand recognition and a loyal customer base, ensuring a steady cash inflow. For the fiscal year ending March 30, 2024, M&S Food reported a robust revenue of £12.7 billion, highlighting its strong market position and reliable performance.

The Core Clothing & Home division also functions as a Cash Cow, demonstrating resilience and consistent profitability. Despite market fluctuations, it maintains a significant market share, underpinned by customer loyalty and M&S's reputation for quality. In FY2023/24, this division achieved adjusted operating profits of £402.8 million, a clear indicator of its cash-generating capabilities.

M&S's extensive network of physical stores, both full-line and Simply Food, represents another critical Cash Cow. These well-established retail locations consistently deliver stable revenue streams due to their prime locations and broad customer appeal. The company's overall revenue saw a 9.9% increase to £12.3 billion in the fiscal year ending March 30, 2024, with food sales being a significant contributor.

| Business Segment | BCG Category | FY23/24 Revenue (Approx.) | FY23/24 Profit Contribution | Key Strengths |

| Food Division | Cash Cow | £12.7 billion | Significant Profit | Premium quality, brand loyalty, innovation |

| Core Clothing & Home | Cash Cow | N/A (part of total revenue) | £402.8 million (Adj. Operating Profit) | Market share, customer loyalty, quality perception |

| Retail Store Network | Cash Cow | £12.3 billion (Total Revenue) | Consistent Cash Flow | Prime locations, broad customer base |

Preview = Final Product

Marks & Spencer Group BCG Matrix

The preview you see is the exact Marks & Spencer Group BCG Matrix report you will receive upon purchase, offering a comprehensive strategic overview of their business units. This fully formatted document, devoid of watermarks or demo content, is ready for immediate application in your strategic planning and analysis. You'll gain access to a professionally designed, market-backed evaluation, enabling informed decision-making for M&S's diverse portfolio. This is the complete, actionable report you'll download, providing the insights needed to understand M&S's strategic positioning.

Dogs

Marks & Spencer's decision to phase out bulky furniture lines reflects a strategic move away from a segment with low market share. This aligns with the principles of the BCG matrix, which suggests divesting or minimizing 'Dogs' that consume capital without generating substantial returns.

In 2024, M&S continued its focus on streamlining its offerings, a strategy that likely impacted underperforming categories like bulky furniture. While specific divestment figures for this particular line aren't publicly detailed, the company's broader strategy has been to concentrate on core strengths and profitable ventures.

Marks & Spencer's international operations are currently a weak point, falling into the Dogs category of the BCG Matrix. In the first half of 2024, sales in this segment saw a significant drop of 10.3% when measured in constant currency, indicating a persistent struggle.

This underperformance is particularly evident in owned international sales, which declined by 13.2%. A key contributor to this downturn appears to be the performance in India, suggesting that specific international markets are not resonating as expected with consumers or are facing significant operational challenges.

While M&S is implementing a strategic reset for these international ventures, they currently occupy a position of low market share within low-growth markets. This means they require careful consideration regarding resource allocation and future investment to determine if they can be revitalized or if a divestment strategy is more appropriate.

Marks & Spencer is strategically downsizing its full-line store portfolio from 247 to 180 by 2028. This move directly addresses the underperformance of older, un-renewed physical locations. These stores often struggle with declining customer traffic and higher operational expenses compared to their modern counterparts.

Less Popular Clothing Sub-Categories

Within the Marks & Spencer Group's BCG Matrix, less popular clothing sub-categories are likely positioned as Dogs. While M&S focuses on optimizing core clothing ranges, these niche or slower-moving items may be experiencing low sales velocity and market share.

This strategic focus on reducing options implies that these sub-categories, while perhaps having a small but loyal customer base, are not significant revenue drivers and might be tying up valuable inventory and store space.

For instance, if M&S reports a decline in sales for specific formal wear or niche accessories, these could be examples of Dog categories.

- Low Market Share: These sub-categories likely hold a minimal percentage of the overall clothing market for M&S.

- Low Growth Rate: Demand for these items is probably stagnant or declining.

- Inventory Management Challenge: They can lead to excess stock and markdowns, impacting profitability.

- Strategic Review: M&S's approach suggests a potential divestment or significant overhaul of these underperforming segments.

Legacy IT Infrastructure

Legacy IT infrastructure at Marks & Spencer Group can be considered a 'dog' in the BCG matrix. These systems, while not a direct product, drain resources and hinder progress. The recent cyberattack, which is projected to impact operating profit by an estimated £300 million in FY2025/26, starkly illustrates the vulnerabilities associated with outdated systems.

These legacy systems require substantial investment for remediation and modernization, diverting capital that could otherwise fuel growth initiatives. Their inherent weaknesses lead to operational disruptions and potential revenue loss, offering little to no competitive advantage.

- Resource Drain: Legacy IT systems consume significant financial and human resources for maintenance and security upgrades.

- Vulnerability Exposure: Outdated systems are more susceptible to cyberattacks, as evidenced by the projected £300m impact on M&S's operating profit in FY2025/26.

- Hindered Innovation: The cost and complexity of maintaining legacy IT can stifle investment in new technologies and business strategies.

- Competitive Disadvantage: Inefficient and insecure IT systems can lead to poor customer experience and operational inefficiencies compared to competitors with modern infrastructure.

Marks & Spencer's international operations are a clear example of 'Dogs' within the BCG matrix, characterized by low market share in slow-growing markets. This segment experienced a notable decline of 10.3% in constant currency during the first half of 2024, with owned international sales falling by 13.2%. The underperformance in specific markets like India highlights the challenges M&S faces in these regions.

The company is undertaking a strategic reset for these international ventures, but their current position necessitates a careful evaluation. This includes assessing whether they can be revitalized through targeted investment or if a divestment strategy would be more beneficial for the group's overall performance.

Similarly, certain less popular clothing sub-categories within M&S are likely categorized as 'Dogs'. These items, while potentially having a niche following, are not significant revenue drivers and may occupy valuable inventory and store space, leading to inventory management challenges and impacting profitability.

Legacy IT infrastructure also represents a 'Dog' for M&S, consuming resources and hindering progress, as evidenced by the projected £300 million impact on operating profit in FY2025/26 due to a cyberattack. These systems require substantial investment for remediation, diverting capital from growth initiatives and creating vulnerabilities.

| Category | BCG Classification | Performance Indicator (H1 2024/FY2025/26) | Strategic Implication |

|---|---|---|---|

| International Operations | Dog | -10.3% constant currency sales decline | Strategic reset, potential divestment |

| Underperforming Clothing Sub-categories | Dog | Low sales velocity, minimal revenue contribution | Inventory management, potential overhaul |

| Legacy IT Infrastructure | Dog | £300m projected profit impact (FY2025/26) from cyberattack | Resource drain, vulnerability, hinders innovation |

Question Marks

Marks & Spencer is making significant strides in digital capabilities, particularly with AI and personalization. In 2024, the company continued its substantial investment in digital transformation, aiming to leverage generative AI for tasks like crafting compelling product descriptions. This focus on innovation is designed to create a more tailored and engaging shopping experience for customers across its website and the popular Sparks loyalty app.

These advanced digital initiatives hold considerable promise for revolutionizing how M&S interacts with its customers and boosting online sales. While the potential for growth is high, the exact impact on market share and the ultimate return on these investments are still in the process of being fully realized and measured. The company is actively working to quantify the success of these digital advancements.

Marks & Spencer's food division is a prime example of a "Question Mark" in the BCG Matrix, characterized by high growth potential and a currently low market share in many of its expanding locations. The company's ambitious plan to boost its food-only store count from 316 to 420 by 2028, coupled with scouting over 300 new sites, highlights this aggressive growth strategy.

Each new food hall opening is a strategic investment designed to capture a significant share of a specific local market, a hallmark of Question Marks. While these ventures promise substantial future returns if successful, they necessitate considerable capital outlay to build brand awareness and customer loyalty in previously underserved areas.

Marks & Spencer Group's commitment to sustainability, exemplified by initiatives like invisible UV tags on milk bottles for enhanced recycling tracking, positions them as a potential leader in the circular economy. Their ambitious goal of making all packaging recyclable by 2025 and achieving net zero by 2040 represents significant, high-investment ventures.

While these efforts bolster brand reputation and promise long-term operational efficiencies, their immediate impact on market share within the BCG matrix is still developing. These are essentially question marks, requiring substantial investment to gauge future market potential and competitive positioning.

International Expansion into New Markets/Formats

Marks & Spencer's international expansion, particularly into markets like France and India, positions these ventures as potential Stars or Question Marks in the BCG matrix. The ambitious plan to open 30 new stores in France and over 100 in India by 2025, primarily through franchising, signifies a high-growth market potential. However, M&S's current market share in these specific new territories is relatively low, necessitating significant investment to build brand presence and capture market share.

- France Expansion: M&S aims to open 30 new stores in France by 2025, targeting a high-growth retail environment.

- India Growth: The company plans to open over 100 stores in India by 2025, leveraging franchise partnerships for rapid expansion.

- Investment Needs: These new market entries require substantial capital outlay to establish brand recognition and operational infrastructure, characteristic of Question Mark classifications.

- Market Share Dynamics: Despite high growth potential, M&S faces the challenge of building a significant market share from a low starting point in these international ventures.

Strategic Partnerships (e.g., Ocado Retail Joint Venture)

Marks & Spencer's (M&S) strategic partnership with Ocado, specifically their 50% stake in Ocado Retail, is a calculated move to bolster its presence in the digital grocery market. This joint venture aims to significantly expand M&S's online food sales and refine its digital infrastructure, positioning it as a comprehensive supermarket. The objective is to leverage Ocado's established online platform to reach a wider customer base and integrate M&S's food offerings more effectively. This initiative signifies M&S's ambition to capture a larger share in the rapidly growing online grocery sector, even though it represents a high-growth potential area that is still solidifying its market position.

The financial performance of the joint venture reflects this growth ambition. For the 2024 fiscal year, Ocado Retail reported revenue of £1.9 billion. While the initial phase of the partnership saw M&S account for a share of adjusted losses, the long-term strategy is focused on driving substantial food sales growth through the Ocado platform. This investment is crucial for M&S's transformation into a modern, omnichannel retailer, aiming to capture a significant portion of the online grocery market share.

- Strategic Objective: To increase M&S's digital food market share and enhance online grocery capabilities.

- Financial Performance (2024): Ocado Retail generated £1.9 billion in revenue, with M&S sharing in initial adjusted losses.

- Market Positioning: Aims to transition M&S into a holistic supermarket offering, leveraging Ocado's platform for growth.

- Growth Potential: Represents a high-growth segment with the goal of capturing significant online market share.

Marks & Spencer's food expansion and international ventures are prime examples of "Question Marks" within the BCG Matrix. These areas exhibit high growth potential but currently hold a low market share, necessitating significant investment to capture market dominance.

The company's aggressive strategy to increase its food-only store count and expand internationally, such as in France and India, highlights this classification. These initiatives require substantial capital for brand building and operational setup, with their ultimate success and market share capture still to be determined.

Similarly, the strategic partnership with Ocado Retail, while aiming for significant online grocery market share, represents a high-growth area where M&S is solidifying its position. The £1.9 billion revenue generated by Ocado Retail in 2024 underscores the potential, but the initial shared losses indicate the investment phase characteristic of Question Marks.

| Business Unit/Venture | Market Growth | Relative Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Food Expansion (UK) | High | Low | Question Mark | Increase store count, capture local market share |

| International Expansion (France, India) | High | Low | Question Mark | Build brand presence, leverage franchising |

| Ocado Retail Partnership | High | Low (emerging) | Question Mark | Enhance digital grocery capabilities, drive online sales |

BCG Matrix Data Sources

Our Marks & Spencer Group BCG Matrix is constructed using a blend of internal financial disclosures, market research reports, and industry-specific growth data to provide a comprehensive view.