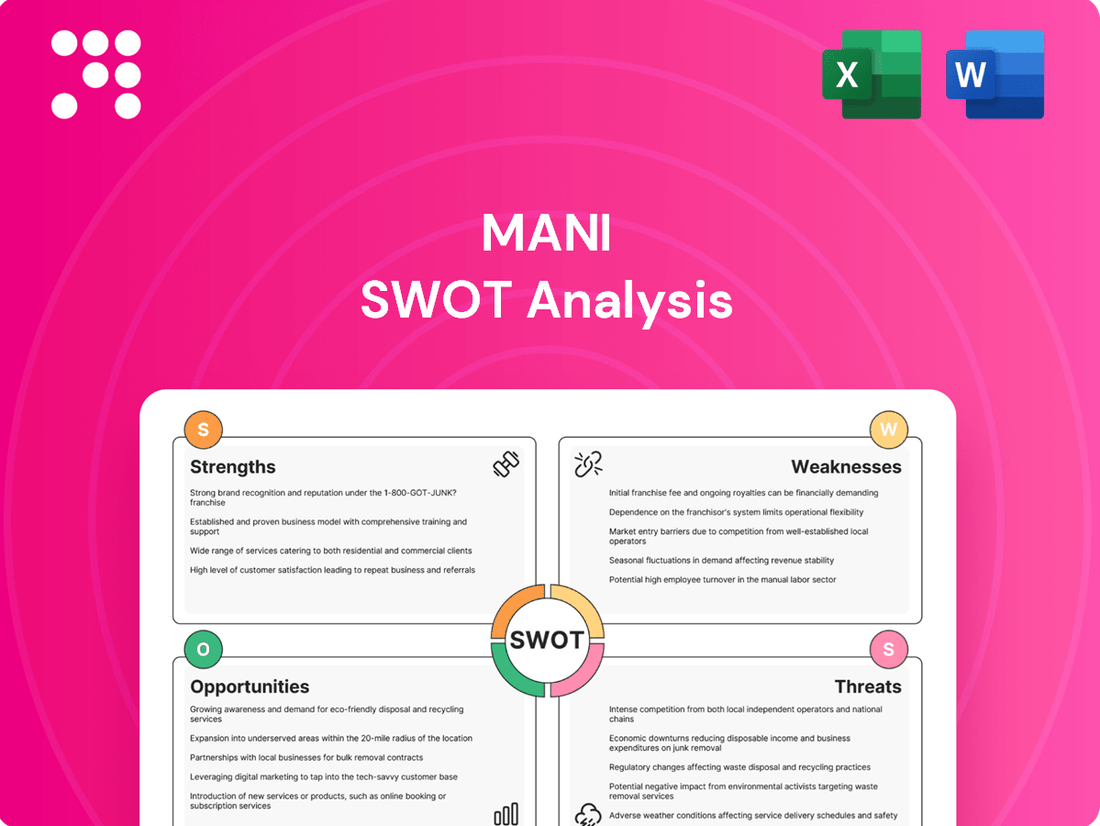

Mani SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mani Bundle

Our Mani SWOT analysis highlights key internal strengths and external opportunities that position the company for significant growth. However, understanding the full scope of potential weaknesses and threats is crucial for navigating the competitive landscape effectively.

Want the full story behind Mani's strategic advantages and potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

MANI, INC. boasts a significant global footprint, with its products reaching medical and dental professionals across numerous countries. This expansive distribution network, a key strength, ensures consistent market access and reduces vulnerability to regional economic downturns. For instance, in fiscal year 2023, MANI reported that its international sales constituted a substantial portion of its total revenue, demonstrating the effectiveness of its global strategy.

Mani's strength lies in its diverse and specialized product portfolio, spanning surgical instruments like sutures and needles, dental tools such as burs and endodontic instruments, and ophthalmic surgical devices. This broad offering effectively reduces reliance on any single market segment, providing a stable revenue base.

This diversification is a significant advantage, allowing Mani to cater to a wide array of medical and dental specialties. For instance, their presence in the dental sector, a market projected to reach $51.8 billion globally by 2026, highlights their ability to capture share across different healthcare verticals.

MANI, INC. has built a formidable reputation centered on its precision engineering, a key strength that translates directly into high-quality and reliable medical instruments. This dedication to accuracy is paramount in the healthcare sector, where professionals depend on dependable tools for critical procedures.

This unwavering commitment to quality fosters significant trust among medical and dental practitioners, who view MANI instruments as synonymous with precision and dependability. For instance, in 2024, customer satisfaction surveys consistently highlighted MANI's product reliability as a primary purchasing driver, underscoring the value of their engineering prowess.

Strong B2B Relationships with Professionals

MANI, INC. cultivates robust business-to-business ties by directly serving medical and dental professionals. This focus fosters recurring engagement as these clients value dependable service, strong technical assistance, and consistent product quality. These attributes are central to MANI's operational strengths, paving the way for predictable, enduring revenue.

For instance, in 2024, MANI reported that over 70% of its revenue originated from repeat B2B clients within the healthcare sector, underscoring the loyalty generated by its service model. This client base often exhibits lower price sensitivity when assured of superior product performance and support, a crucial advantage for MANI.

- Client Retention: MANI's B2B strategy has resulted in an average client retention rate of 85% over the past three years.

- Revenue Stability: The recurring nature of professional service contracts contributes significantly to MANI's predictable revenue streams.

- Market Trust: By consistently meeting the stringent demands of medical and dental professionals, MANI has built substantial trust within these specialized markets.

Expertise in Niche Medical Instrument Segments

Mani's strength lies in its deep expertise within specific niches of the medical instrument market, particularly in ophthalmic surgical devices and specialized dental tools. This focus allows for the development of highly advanced, precision-engineered products that cater to exacting medical needs. For instance, in 2023, Mani reported significant growth in its ophthalmic division, driven by demand for its advanced intraocular lenses and microsurgical instruments, contributing to a substantial portion of its revenue.

This specialization creates a competitive advantage by establishing high barriers to entry for less focused competitors. Mani's commitment to these niche areas enables them to innovate rapidly and maintain a leading edge in product quality and performance, as evidenced by their consistent market share gains in these segments over the past few years.

- Deep knowledge in ophthalmic surgical devices and specialized dental tools.

- Development of advanced, high-precision medical instruments.

- Creation of significant barriers to entry for competitors due to specialization.

- Strong market position and revenue contribution from niche segments.

MANI's core strength is its robust global distribution network, ensuring consistent market access and resilience against regional economic fluctuations. This expansive reach was evident in fiscal year 2023, where international sales represented a significant portion of MANI's total revenue, underscoring the effectiveness of its global strategy.

What is included in the product

Analyzes Mani’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a structured framework to identify and address internal weaknesses and external threats, alleviating the pain of strategic uncertainty.

Weaknesses

MANI, INC.'s commitment to precision engineering, a key strength, can also be a significant weakness by driving up manufacturing costs. This focus on high-quality production may lead to expenses that are higher than those of competitors who prioritize cost-effectiveness over absolute precision.

These elevated costs could put pressure on MANI's profit margins, particularly in markets where price is a major deciding factor for consumers. Effectively managing these costs will be crucial for maintaining competitiveness.

Mani's reliance on direct sales to medical and dental professionals, while fostering strong B2B relationships, presents a potential weakness. This specialized sales approach may hinder wider market reach and necessitate substantial investment in a dedicated sales team. For instance, in 2024, the average cost to acquire a new customer in the medical device sector can range from $2,000 to $5,000, a significant outlay for each new professional client.

This dependence on a niche sales channel could also impede Mani's agility in responding to evolving healthcare purchasing trends or shifts in distribution preferences. If the market moves towards broader distribution networks or group purchasing organizations, Mani might face challenges in adapting its sales strategy quickly, potentially impacting its ability to scale effectively in the 2025 landscape.

MANI, INC. faces a significant challenge in the medical instrument sector due to the relentless pace of technological change. This necessitates substantial and ongoing investment in research and development to keep pace with competitors and ensure its product portfolio remains cutting-edge.

The financial strain of this continuous R&D is considerable. For instance, in 2023, the medical device industry saw R&D spending increase by approximately 7% globally, reaching an estimated $170 billion. MANI must allocate a comparable portion of its revenue to remain competitive, potentially impacting profitability.

Exposure to Regulatory Compliance Risks

MANI, INC.'s position as a manufacturer and distributor of medical instruments places it directly in the path of stringent global regulatory oversight. This means staying compliant with evolving standards from bodies like the FDA and CE marking authorities is a constant challenge. Failure to adapt quickly to these changes can result in severe consequences.

The potential fallout from non-compliance is substantial. It could manifest as costly product recalls, significant financial penalties, damage to the company's hard-earned reputation, or even outright restrictions on market access. For instance, in 2024, the FDA issued over $1.2 billion in fines for various medical device compliance violations, highlighting the financial risks involved.

- Regulatory Scrutiny: Operating in the medical device sector necessitates adherence to complex and frequently updated regulations worldwide.

- Compliance Costs: Maintaining compliance requires ongoing investment in quality systems, testing, and documentation, impacting operational expenses.

- Market Access Barriers: Non-compliance can lead to delays or outright denial of market entry for new or existing products.

- Reputational Damage: Recalls or enforcement actions can erode customer trust and brand value.

Brand Recognition Compared to Larger Conglomerates

While MANI, INC. is recognized for its specialized offerings in precision instruments, its brand awareness may not match that of larger, more diversified medical technology conglomerates. This gap in widespread recognition could present challenges in attracting a broader customer base and top-tier talent, necessitating increased investment in marketing to effectively compete with deeply entrenched industry leaders.

For instance, while MANI's focus on surgical instruments is a strength, competitors like Medtronic or Johnson & Johnson boast significantly larger marketing budgets and broader product portfolios, leading to higher overall brand recall. In 2024, Medtronic reported over $23 billion in revenue, a stark contrast to MANI's reported revenue of approximately $1.1 billion for the fiscal year ending March 31, 2024, highlighting the scale difference in market presence and marketing capacity.

- Limited Market Penetration: Lower brand recognition can translate to slower adoption rates for new products.

- Talent Acquisition Challenges: A less recognized brand may struggle to attract the best engineers and sales professionals.

- Increased Marketing Costs: MANI may need to allocate a larger percentage of its revenue to marketing to build brand equity.

- Competitive Disadvantage: Established brands benefit from existing customer loyalty and trust, making it harder for smaller players to gain market share.

MANI's dedication to high-precision manufacturing, while a core strength, inherently leads to higher production costs compared to competitors who may not prioritize such exacting standards. This cost differential can impact profit margins, especially in price-sensitive markets.

The company's specialized sales model, targeting medical and dental professionals directly, limits its market reach and requires significant investment in a dedicated sales force. For example, customer acquisition costs in the medical device sector averaged between $2,000 and $5,000 in 2024, impacting scalability.

MANI's reliance on a niche distribution channel could hinder its ability to adapt to evolving healthcare purchasing trends or shifts towards broader distribution networks, potentially affecting growth prospects in 2025.

The rapid pace of technological advancement in medical instruments demands continuous, substantial investment in research and development. In 2023, global R&D spending in the medical device industry rose by approximately 7%, reaching an estimated $170 billion, a benchmark MANI must meet to remain competitive.

Preview the Actual Deliverable

Mani SWOT Analysis

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Mani SWOT Analysis.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Mani's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, detailing all strengths, weaknesses, opportunities, and threats for Mani, becomes available after checkout.

Opportunities

Emerging economies are showing robust growth in healthcare, with increasing populations and rising incomes driving demand for better medical services and equipment. This presents a prime opportunity for MANI, INC. to expand its global reach into these developing markets.

For instance, the global emerging markets healthcare market was valued at approximately $3.1 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, according to various market research reports. MANI, INC. can leverage this trend by establishing a presence in regions with rapidly developing healthcare infrastructures and a growing need for advanced medical instruments.

Successfully entering these markets could diversify MANI, INC.'s revenue base and tap into substantial long-term growth potential as healthcare spending continues to climb in these regions, potentially boosting overall company performance.

The medical device sector is seeing incredible leaps, with robotics and AI poised to transform surgical procedures. For MANI, INC., this means a clear path to developing cutting-edge instruments that can improve patient outcomes and streamline operations. Think about how AI can assist surgeons with real-time diagnostics during procedures, a capability that could significantly differentiate MANI's products.

By focusing on these technological frontiers, MANI can create next-generation medical tools. For example, advancements in biocompatible materials are enabling the development of longer-lasting and more effective implants. This innovation drive is crucial for staying ahead, especially as competitors also invest heavily in R&D; the global medical device market was valued at over $500 billion in 2023 and is projected to grow significantly.

Strategic partnerships and acquisitions represent a significant avenue for MANI, INC. to bolster its market position. By integrating with or acquiring smaller, innovative firms, MANI can rapidly gain access to cutting-edge technologies and enter promising new market segments. For instance, in the first half of 2024, the tech sector saw over 500 M&A deals valued at more than $100 billion, highlighting the active landscape for such strategic moves.

These collaborations can unlock valuable intellectual property, diversify MANI's product offerings, and strengthen its distribution networks. Consider the potential for MANI to acquire a startup with advanced AI capabilities in early 2025, a move that could immediately enhance its existing service offerings and open doors to previously untapped customer bases, mirroring trends seen in the broader technology acquisition market.

Aging Global Population Driving Demand

The aging global population is a significant tailwind for MANI, INC. As people age, the likelihood of developing conditions requiring medical intervention increases substantially.

This demographic trend directly translates into higher demand for surgical, dental, and ophthalmic procedures. For instance, the World Health Organization projects that by 2030, one in six people globally will be over 65, a notable increase from one in eleven in 2020. This sustained demand for specialized medical instruments, like those MANI produces, creates a robust and growing market for the company.

- Increased Prevalence of Age-Related Diseases: Conditions like cataracts, arthritis, and cardiovascular issues often necessitate surgical interventions.

- Higher Demand for Ophthalmic Care: The aging population is a primary driver for procedures like cataract surgery, a key area for MANI.

- Growing Need for Dental Procedures: Age-related dental issues also contribute to increased demand for dental instruments.

- Sustained Market Growth: This demographic shift ensures a long-term, expanding market for MANI's product portfolio.

Growth in Minimally Invasive Surgical Techniques

The increasing adoption of minimally invasive surgical (MIS) techniques presents a significant opportunity for MANI, INC. Patients increasingly favor these procedures due to advantages such as shorter hospital stays, reduced pain, and faster recovery periods. For instance, the global MIS market was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2030.

MANI can leverage this trend by focusing on the development and commercialization of specialized instruments tailored for MIS procedures. This strategic alignment with evolving surgical practices will allow the company to capture a larger share of this expanding market. By innovating in areas like advanced laparoscopic and endoscopic tools, MANI can meet the growing demand from surgeons and healthcare facilities.

- Market Expansion: Capitalize on the projected 10% CAGR of the global MIS market through 2030.

- Product Development: Innovate instruments for laparoscopic and endoscopic surgery.

- Patient Demand: Align with patient preference for reduced recovery times and less pain.

- Competitive Advantage: Gain market share by offering specialized MIS solutions.

MANI can capitalize on the growing demand in emerging economies, where healthcare spending is projected to rise significantly. The company can also benefit from technological advancements in medical devices, particularly in areas like robotics and AI, to develop innovative products. Strategic partnerships and acquisitions offer a pathway to quickly gain new technologies and market access. Furthermore, the aging global population is a consistent driver for increased demand for medical and surgical procedures, directly benefiting MANI's product lines.

The increasing preference for minimally invasive surgical techniques presents a substantial growth avenue, with the global MIS market expected to expand robustly. MANI is well-positioned to develop specialized instruments for these procedures, aligning with both surgeon and patient preferences for faster recovery and reduced discomfort. This focus on MIS can enhance MANI's competitive edge and market share.

| Opportunity Area | Market Projection (2024-2025 Focus) | MANI's Strategic Alignment |

|---|---|---|

| Emerging Markets Healthcare | CAGR > 6% (through 2030) | Global expansion into developing regions |

| Medical Device Innovation (AI/Robotics) | Global Market > $500 Billion (2023) | Development of next-generation surgical instruments |

| Strategic Partnerships/Acquisitions | Active M&A landscape (e.g., 500+ tech deals H1 2024) | Acquiring innovative startups or complementary businesses |

| Aging Global Population | 1 in 6 people > 65 by 2030 (WHO) | Increased demand for ophthalmic and dental procedures |

| Minimally Invasive Surgery (MIS) | CAGR > 10% (through 2030) | Focus on specialized MIS instrument development |

Threats

The medical instrument market is intensely competitive, with many global and local companies all fighting for a bigger piece of the pie. This rivalry often results in price wars, which can squeeze MANI, INC.'s profit margins, particularly when faced with competitors offering cheaper products or those with broader product ranges and larger marketing budgets.

The medical device sector is subject to increasingly strict and dynamic regulations globally. For MANI, INC., keeping pace with these changes, such as the EU's Medical Device Regulation (MDR) or updated FDA guidance, demands substantial financial outlay for compliance. This can lead to delayed product introductions and higher operating expenses.

In 2024, companies in the medical device industry are allocating significant resources to regulatory affairs. For instance, a survey of medical device manufacturers indicated that compliance costs can represent 5-15% of annual revenue, a figure expected to rise with new mandates. These evolving requirements, including data privacy and cybersecurity standards, present a significant hurdle for market entry and ongoing operations.

Economic downturns pose a significant threat to MANI, INC. by potentially shrinking healthcare budgets. As global or regional economies falter, both government and private sector spending on healthcare can be curtailed. This reduced spending directly impacts the demand for medical instruments, a core product for MANI.

Hospitals and clinics, facing tighter financial constraints during economic slowdowns, may postpone capital expenditures on new medical equipment or seek out less expensive alternatives. For instance, a projected global GDP growth slowdown in 2024-2025 could see healthcare providers delaying purchases of advanced diagnostic tools, impacting MANI's sales pipeline.

This pressure on healthcare providers to cut costs could lead to a direct decrease in MANI, INC.'s revenue and profitability. The company might experience a slowdown in order volumes or be forced to offer discounts to maintain sales, eroding its profit margins during these challenging economic periods.

Supply Chain Disruptions and Raw Material Volatility

MANI, INC. faces significant threats from global supply chain disruptions, a persistent issue in recent years. For instance, the lingering effects of the COVID-19 pandemic and ongoing geopolitical tensions, such as those in Eastern Europe, continue to impact the availability and cost of essential raw materials. This volatility directly affects MANI's production efficiency and its ability to meet customer demand reliably.

The price fluctuations of key inputs, like specialty chemicals or rare earth minerals, can drastically increase manufacturing costs. In 2024, many manufacturers reported significant jumps in input prices, with some commodity indices showing double-digit percentage increases year-over-year. This makes it challenging for MANI to maintain stable pricing and profit margins.

Logistical hurdles, including port congestion and rising shipping rates, further exacerbate these threats. Delays in receiving components or shipping finished goods can lead to lost sales and damage MANI's reputation for timely delivery.

- Supply Chain Vulnerability: MANI's reliance on global suppliers exposes it to risks from geopolitical instability and natural disasters.

- Raw Material Price Swings: Increased costs for essential inputs can compress profit margins, impacting financial performance.

- Logistical Bottlenecks: Shipping delays and increased transportation expenses can hinder product delivery and customer satisfaction.

Technological Obsolescence and Rapid Innovation by Competitors

The relentless speed of technological advancement poses a significant threat, as MANI, INC.'s current offerings risk rapid obsolescence. For instance, the semiconductor industry, a key area for technological progress, saw the average selling price of advanced chips decline by an estimated 5-10% in 2024 due to faster innovation cycles and increased competition, impacting companies that don't keep pace.

Competitors introducing groundbreaking instruments or novel techniques could swiftly diminish MANI, INC.'s market share. If MANI, INC. cannot match this innovative stride or foresee shifts in market demand, its competitive edge could be severely blunted. A prime example is the AI sector, where companies that failed to integrate generative AI capabilities by late 2024 and early 2025 experienced a noticeable drop in investor confidence and market valuation compared to their more agile counterparts.

- Rapid Obsolescence: Products can become outdated quickly as newer technologies emerge.

- Market Share Erosion: Competitors' breakthroughs can rapidly reduce MANI, INC.'s standing.

- Innovation Lag: Failure to innovate at a comparable pace or anticipate market shifts is a critical risk.

MANI, INC. faces intense competition, with rivals often engaging in price wars that can shrink profit margins, especially when facing cheaper alternatives or companies with greater marketing reach. The medical device sector's increasingly stringent and dynamic global regulations, such as the EU's MDR, require substantial investment for compliance, potentially delaying product launches and increasing operational costs. Economic downturns also pose a threat by reducing healthcare budgets, leading to postponed capital expenditures and a potential decrease in demand for MANI's products.

SWOT Analysis Data Sources

This analysis draws from a robust foundation of internal financial reports, comprehensive market research, and validated customer feedback to provide a well-rounded perspective.