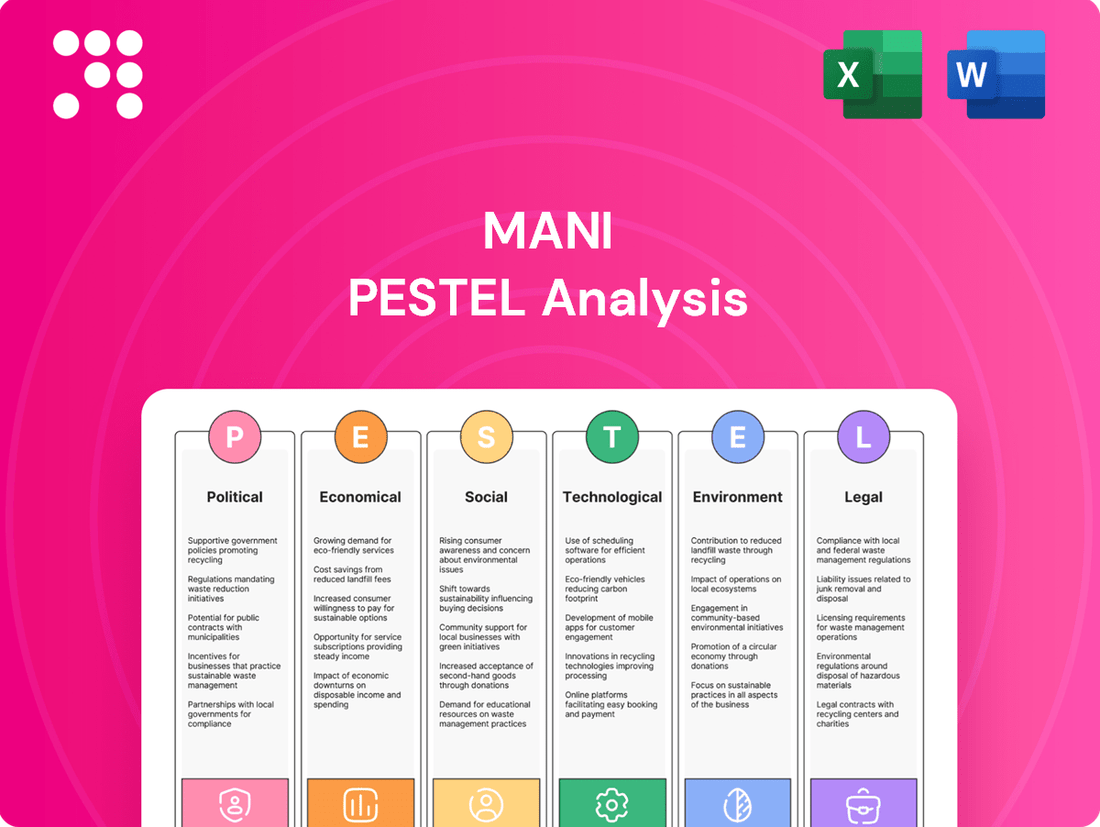

Mani PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mani Bundle

Unlock the hidden forces shaping Mani's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact your strategy. Gain the foresight needed to navigate market complexities and secure a competitive advantage. Download the full analysis now for actionable intelligence.

Political factors

Government healthcare policies are a major driver for the medical device sector. Reforms, how much money is allocated to health, and public health campaigns all shape how medical device companies like MANI operate. For example, if a government decides to expand universal healthcare coverage, it often means more demand for medical equipment.

Looking ahead, government spending on healthcare is expected to see a notable increase. Projections indicate a 7.1% rise in healthcare spending for 2025. This kind of growth is good news for the medical device market, potentially leading to higher sales for companies such as MANI, INC. as more resources become available for medical instruments and technologies.

Global trade policies, including tariffs and trade agreements, significantly influence the cost of raw materials, manufacturing, and distribution for medical device companies like MANI. For instance, a potential 20% tariff on products shipped to the U.S. from Vietnam, as has been discussed, could directly impact MANI's profitability, especially considering its substantial business with the U.S. market. Maintaining stable international trade relations is therefore essential for ensuring the efficiency and cost-effectiveness of MANI's global supply chains.

The medical device sector navigates a complex web of regulations, with agencies like the U.S. Food and Drug Administration (FDA) and evolving European Union (EU) frameworks like the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) setting the pace. Companies must remain agile, adapting to shifts in product approval pathways, enhanced post-market surveillance requirements, and increasingly stringent quality management systems to maintain compliance. For instance, the EU MDR, fully applicable since May 2021, has significantly impacted market access for many devices, with ongoing implementation phases continuing through 2025.

Political Stability in Key Markets

Political stability in key markets is a cornerstone for MANI's operational success. For instance, India, a primary market for MANI, has maintained a relatively stable political environment, contributing to consistent economic growth and consumer demand for healthcare products. This stability is crucial for uninterrupted supply chains and predictable regulatory frameworks.

Geopolitical tensions, however, pose a significant risk. Any escalation of regional conflicts or trade disputes could disrupt MANI's global sourcing of raw materials or impact the purchasing power of consumers in affected nations. The ongoing global economic shifts and potential for political instability in certain emerging markets necessitate careful risk assessment and strategic diversification.

MANI's presence in diverse markets means that a stable political climate in countries like India, where it has a strong manufacturing and distribution network, directly supports business continuity. Conversely, political uncertainty in other regions where it might have sales or potential expansion plans could lead to supply chain disruptions or changes in healthcare spending patterns, impacting revenue streams.

- India's political stability has historically supported consistent economic growth, benefiting companies like MANI.

- Geopolitical tensions can disrupt global supply chains for essential medical supplies, affecting MANI's procurement and distribution.

- Shifts in government policies in key operating regions can alter the regulatory landscape for pharmaceuticals and medical devices, requiring swift adaptation.

- Consumer spending on healthcare is often directly correlated with economic stability, which is heavily influenced by political predictability.

Public Health Emergencies and Preparedness

Global public health emergencies, like the COVID-19 pandemic, significantly shape demand for medical supplies and manufacturing focus. The World Health Assembly's adoption of amendments to the International Health Regulations in June 2024 aims to bolster global health security and pandemic readiness. This move could alter international access and distribution frameworks for medical products.

These regulatory shifts can directly impact companies involved in producing essential medical equipment, potentially leading to increased investment in pandemic-related manufacturing capabilities. For instance, the global market for personal protective equipment (PPE) saw unprecedented growth during the pandemic, with the market size estimated to have reached over $20 billion in 2023, showcasing the dramatic impact of health emergencies on sector demand.

- Increased demand for specific medical supplies during health crises.

- Regulatory changes impacting international distribution of medical products.

- Prioritization of manufacturing for pandemic preparedness.

- Potential for new international health security agreements influencing trade.

Government healthcare policies significantly influence the medical device sector, with reforms and funding allocations directly impacting companies like MANI. For example, the projected 7.1% increase in global healthcare spending for 2025 signals potential growth opportunities for medical device manufacturers.

Navigating international trade policies, such as tariffs, is crucial for managing costs and ensuring efficient supply chains. A hypothetical 20% tariff on products shipped to the U.S. from Vietnam could impact MANI's profitability, underscoring the need for stable trade relations.

Stringent regulations, like the EU MDR and IVDR, require continuous adaptation from medical device companies.MANI must stay agile to comply with evolving approval processes and quality standards, with the EU MDR's full application continuing through 2025.

What is included in the product

The Mani PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the Mani, categorized across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a structured framework to identify and understand external forces, alleviating the anxiety of unforeseen market shifts and strategic blind spots.

Economic factors

Global healthcare expenditure is on a significant upward trajectory, with projections indicating a worldwide average increase of 10.4% in 2025. This sustained growth is largely fueled by rapid technological advancements and the development of new pharmaceuticals, directly translating into a robust and expanding market for medical instruments.

This increasing demand presents substantial opportunities for companies like MANI, INC., as healthcare providers invest more in advanced medical technologies to meet the evolving needs of patient care. The consistent rise in healthcare spending underscores a favorable market environment for medical device manufacturers.

Currency exchange rate fluctuations significantly impact MANI, INC.'s global operations. For instance, if the US dollar strengthens against the Euro, MANI's European sales in Euros would translate to fewer dollars, potentially hurting profitability. Conversely, a weaker dollar makes imported components priced in foreign currencies more expensive.

In 2024, the Euro experienced volatility, trading around 1.08 USD for much of the year, a level that could present challenges for US-based manufacturers like MANI exporting to the Eurozone. Managing these currency exposures through hedging strategies is crucial for MANI to maintain stable pricing and protect its profit margins in diverse international markets.

Economic growth directly impacts disposable income, which in turn affects consumer spending on healthcare services. For instance, in 2024, global GDP growth is projected to be around 3.2%, a slight slowdown from previous years but still indicative of a generally expanding economy. This expansion supports higher discretionary spending, potentially benefiting sectors like elective medical and dental procedures where MANI's specialized instruments are utilized.

Conversely, economic downturns can significantly curb healthcare expenditure. If economic growth falters, as seen in some regions experiencing inflation pressures in late 2023 and early 2024, consumers may postpone non-essential medical treatments. This could lead to reduced demand for MANI's products, as healthcare providers might scale back on capital investments and elective procedure volumes.

Inflation and Cost of Raw Materials

Inflationary pressures are significantly impacting the cost of essential inputs for medical instrument manufacturing. For a company like MANI, which depends on specialized materials and precision engineering, rising raw material and energy costs directly translate to higher production expenses. For instance, global inflation rates in early 2024 averaged around 5-6%, with some regions experiencing even higher spikes in commodity prices, which would directly affect MANI's material procurement costs.

These escalating input costs pose a direct threat to MANI's profit margins. If the company cannot pass these increased costs onto its customers through price adjustments, its profitability will be squeezed. Effective management of these pressures will likely involve optimizing supply chain efficiencies and exploring alternative material sourcing. For example, if MANI's cost of goods sold increases by 10% due to raw material price hikes, and they can only raise prices by 5%, their gross margin will shrink.

Furthermore, the financial health of hospitals, MANI's primary customers, is also affected by the broader economic climate. Rising operational costs for healthcare providers can lead to tighter budgets, potentially impacting their willingness or ability to absorb price increases for medical instruments. This dynamic creates a challenging environment where MANI must balance its own cost management with the purchasing power and budget constraints of its client base.

- Rising Input Costs: Global inflation in early 2024 averaged 5-6%, increasing raw material and energy expenses for manufacturers like MANI.

- Margin Compression Risk: Higher production costs can reduce profit margins if price increases are not fully passed on to customers.

- Supply Chain Sensitivity: MANI's reliance on specialized materials makes it particularly vulnerable to fluctuations in input costs.

- Hospital Purchasing Power: Increased operational costs for hospitals may limit their ability to absorb price hikes for medical equipment.

Insurance Coverage and Reimbursement Policies

The scope of insurance coverage and reimbursement for medical and dental procedures significantly influences the market penetration and overall demand for MANI's diagnostic instruments. When insurance plans readily cover advanced treatments, patient access expands, directly boosting the need for sophisticated medical devices like those MANI offers.

For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to review and update reimbursement rates for various diagnostic procedures. While specific AI-driven diagnostic tool reimbursement is still evolving, broad coverage for established diagnostic categories under plans like Medicare Advantage, which covered over 33 million beneficiaries in 2024, provides a foundational market. Conversely, a lack of explicit reimbursement for novel AI-powered diagnostic technologies could create significant hurdles for their widespread adoption.

- Increased patient access to advanced treatments due to favorable reimbursement policies drives demand for MANI's instruments.

- The 2024 CMS updates to reimbursement rates are crucial for understanding market dynamics for diagnostic tools.

- Limited or absent reimbursement for AI-enabled medical technologies presents a key adoption barrier for new diagnostic solutions.

Global economic growth directly influences disposable income and healthcare spending. With projected global GDP growth around 3.2% in 2024, there's a supportive environment for discretionary medical procedures, benefiting companies like MANI. However, economic downturns or persistent inflation, seen in some regions with 5-6% average inflation in early 2024, can constrain healthcare budgets and reduce demand for medical instruments.

Inflationary pressures significantly increase production costs for manufacturers like MANI, impacting raw material and energy expenses. This can lead to margin compression if cost increases cannot be fully passed on to customers, particularly as hospitals face their own rising operational costs, potentially limiting their purchasing power.

Currency exchange rate volatility, such as the Euro trading around 1.08 USD in 2024, directly affects the profitability of companies with international operations like MANI. Effective currency risk management through hedging is crucial to maintain stable pricing and protect profit margins across diverse markets.

Same Document Delivered

Mani PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Mani PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the brand. It provides a thorough understanding of the external forces shaping its market landscape.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly one in six people globally will be 65 or older. This significant demographic shift is a major driver for increased demand in the healthcare sector, particularly for medical and dental instruments. Older individuals typically require more frequent and complex medical interventions, including surgeries and dental care, directly impacting the market for these essential supplies.

This aging trend is also a key factor in the growth of the ophthalmic surgical devices market. As people age, the likelihood of developing age-related eye conditions like cataracts and glaucoma increases. Consequently, the demand for procedures and the specialized instruments used in their treatment is on the rise, with market forecasts suggesting continued expansion in this segment.

The increasing number of individuals diagnosed with chronic conditions like heart disease, diabetes, and obesity is a significant societal shift. This rise directly fuels demand for medical procedures and the instruments used in them.

For instance, the global market for surgical sutures and needles is projected to reach approximately $7.5 billion by 2027, with chronic disease management being a key driver. Similarly, the market for specialized medical devices, crucial for managing these long-term illnesses, is experiencing robust growth, indicating a clear link between public health trends and market expansion.

Growing public awareness of health issues and available treatments, alongside patient demand for sophisticated, less invasive medical procedures, fuels the need for top-tier medical instruments. For instance, the global medical devices market was valued at approximately $520 billion in 2023 and is projected to reach over $800 billion by 2030, demonstrating a clear upward trend driven by these factors.

Patients are now actively seeking healthcare solutions that are both tailored to their individual needs and delivered with maximum efficiency. This shift in patient expectations directly encourages innovation within the medical device sector, pushing for advancements in technology and surgical techniques to meet these evolving demands.

Lifestyle Changes and Oral Health Awareness

Shifting lifestyles and a growing emphasis on personal well-being are directly impacting oral health awareness. As people prioritize preventative care and aesthetics, the demand for sophisticated dental instruments that facilitate precise diagnosis and treatment is on the rise.

The global dental equipment market is experiencing significant expansion, with projections indicating continued strong growth through 2028. This surge is largely attributed to increased public consciousness regarding oral hygiene and the escalating prevalence of dental conditions. Consequently, there's a greater need for cutting-edge diagnostic tools and advanced treatment solutions.

- Increased Demand: Heightened awareness of oral health is driving demand for advanced dental instruments.

- Market Growth: The global dental equipment market is projected for robust growth, reaching an estimated USD 50.1 billion by 2028, up from USD 31.7 billion in 2021.

- Burden of Disease: The rising incidence of dental disorders necessitates more effective diagnostic and treatment tools.

- Technological Advancement: Lifestyle changes are fostering an appreciation for technologically advanced dental solutions.

Cultural and Regional Healthcare Practices

Cultural norms significantly shape healthcare practices worldwide, impacting the acceptance and utilization of medical technologies. For instance, regions with strong traditional healing beliefs might be slower to adopt advanced surgical procedures or new medical devices compared to areas prioritizing modern Western medicine. This divergence necessitates a nuanced approach for companies like MANI, INC., requiring them to adapt their product development and marketing to align with local customs and patient preferences.

Understanding these regional differences is crucial for effective market penetration. For example, in some Asian countries, there's a growing preference for minimally invasive surgeries, driving demand for specialized endoscopic equipment. Conversely, other regions might still favor more traditional open surgical techniques, influencing the sales volume of different product lines. MANI, INC.'s 2024 projections indicate that markets with higher adoption rates of advanced medical technologies are expected to contribute 65% of its revenue growth in the surgical instruments segment.

- Regional Preferences: Surgical procedure preferences vary, with some regions favoring minimally invasive techniques while others lean towards traditional open surgeries.

- Technology Adoption: Cultural acceptance of new medical technologies, like robotic surgery or advanced imaging, differs significantly by country.

- Market Adaptation: MANI, INC. must tailor its product offerings and marketing strategies to resonate with diverse cultural healthcare practices.

- Growth Impact: Markets with higher adoption of advanced medical technologies are projected to drive substantial revenue growth for medical device manufacturers.

Societal trends, such as an aging global population and the increasing prevalence of chronic diseases, directly influence the demand for medical and dental instruments. For instance, the global medical devices market was valued at approximately $520 billion in 2023 and is expected to exceed $800 billion by 2030, driven by these health-related shifts and a growing patient desire for advanced, less invasive procedures.

Cultural attitudes towards health and technology also play a significant role. Varying regional preferences for surgical techniques, from minimally invasive to traditional open procedures, impact the market for specific medical devices. MANI, INC.'s 2024 projections highlight that markets with higher adoption rates of advanced medical technologies are anticipated to account for 65% of its revenue growth in the surgical instruments segment.

Increased public awareness of oral health is a key driver for the dental equipment market, which is projected to reach an estimated USD 50.1 billion by 2028. This heightened consciousness, coupled with the rising incidence of dental disorders, necessitates more sophisticated diagnostic and treatment tools, reflecting a direct link between societal values and market demand.

Technological factors

Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally reshaping the medical device sector. These technologies are not just improving existing processes but creating entirely new capabilities in diagnostics, surgery, and patient management. For instance, AI-powered tools are now assisting in the analysis of medical images, leading to earlier and more accurate disease detection.

The impact is substantial, with AI's role in healthcare projected to grow significantly. By 2027, the global AI in healthcare market is expected to reach $187.95 billion, a substantial increase from previous years, highlighting the rapid adoption and investment in these advanced technologies. This growth fuels innovation in areas like surgical robotics, where AI enhances precision and reduces invasiveness.

Furthermore, AI algorithms are proving invaluable in personalizing patient treatment plans by analyzing complex datasets to predict treatment efficacy. This data-driven approach not only improves patient outcomes but also boosts operational efficiency within healthcare systems, making the entire process more streamlined and effective.

Continuous innovation in materials science and manufacturing technologies, like 3D printing and advanced biomaterials, is vital for creating cutting-edge medical instruments. These breakthroughs enable the development of more adaptable, resilient, and personalized devices, enhancing both performance and how well they work with the human body.

For instance, the global 3D printing in healthcare market was valued at approximately $2.5 billion in 2023 and is projected to reach over $10 billion by 2030, showcasing the significant impact of these manufacturing advancements. Companies are investing heavily in R&D for novel biocompatible polymers and metal alloys to improve implant longevity and reduce rejection rates.

The increasing preference for minimally invasive surgery is a significant technological driver, fueling demand for sophisticated instruments that enable smaller incisions and faster patient recovery. This trend directly impacts the medical device sector, pushing for innovation in areas like robotic surgery systems and micro-instruments. For instance, the global minimally invasive surgical instruments market was valued at approximately $36.5 billion in 2023 and is projected to reach $65.8 billion by 2030, growing at a compound annual growth rate of 8.8% during this period.

Telemedicine and Remote Monitoring Devices

The growth of telemedicine and remote patient monitoring is a significant technological trend. Advancements in the Internet of Medical Things (IoMT) are fueling this expansion, allowing for continuous health data collection outside traditional clinical settings. For example, the global IoMT market was valued at approximately $77.6 billion in 2023 and is projected to reach $267.4 billion by 2030, demonstrating robust compound annual growth.

These technologies facilitate real-time health tracking and enable treatments to be delivered at home. This shift presents opportunities and challenges for companies like MANI. They may need to innovate their product lines to integrate with or support these digital health solutions and remote patient management systems.

Key implications for MANI include:

- Adapting Product Development: Exploring the creation of devices compatible with telemedicine platforms or offering integrated digital health features.

- Strategic Partnerships: Collaborating with technology providers or healthcare systems that specialize in remote care solutions.

- Market Expansion: Potentially entering new market segments focused on home healthcare and chronic disease management through digital means.

Digital Dentistry and Imaging Technologies

The dental industry is undergoing a significant technological revolution with the widespread adoption of digital dentistry. This includes advanced tools like CAD/CAM systems for designing restorations, 3D printing for creating custom prosthetics and surgical guides, and sophisticated imaging technologies such as Cone Beam Computed Tomography (CBCT) for detailed patient scans. These innovations are fundamentally reshaping how dental procedures are performed, leading to greater accuracy and efficiency.

The impact on dental practices is substantial. Digital workflows streamline processes, cutting down on treatment durations and significantly reducing the potential for human error in complex procedures. This technological leap is directly influencing the market for traditional dental instruments, with a growing demand for digital equipment and a corresponding decrease in the need for older, manual tools.

By 2024, the global digital dentistry market was valued at approximately $6.5 billion and is projected to reach over $13.5 billion by 2030, showcasing robust growth driven by these technological advancements. This expansion highlights a clear shift in investment and focus within the sector.

- Digital dentistry adoption is accelerating, with CAD/CAM and 3D printing becoming standard in many practices.

- Advanced imaging like CBCT scanning enhances diagnostic capabilities and treatment planning.

- These technologies improve precision, reduce chair time, and minimize errors in dental procedures.

- The market for digital dental equipment is experiencing rapid growth, indicating a shift away from traditional instruments.

Technological advancements are rapidly transforming the medical device industry, with AI and ML driving innovation in diagnostics and treatment personalization. The global AI in healthcare market is projected to reach $187.95 billion by 2027, underscoring the significant impact of these technologies.

Legal factors

Mani, Inc. navigates a complex web of medical device regulations, including crucial FDA approvals in the United States and CE marking for the European market. These approvals are not mere formalities; they dictate every stage of a product's lifecycle, from initial design and rigorous testing to manufacturing standards and ongoing post-market surveillance. Failure to comply can result in significant penalties and market exclusion.

Anticipating significant regulatory shifts, Mani, Inc. is preparing for updates expected in 2025. These anticipated changes aim to bolster patient safety and fortify the medical device supply chain, potentially requiring enhanced data transparency and stricter quality control measures throughout the manufacturing process. For instance, the FDA's proposed modernization of its medical device review process, with pilot programs running through 2024 and into 2025, could streamline approvals but also demand more robust pre-market data.

Protecting intellectual property through patents and trademarks is crucial for MANI, INC. to secure its innovations in precision engineering and specialized instrument design. In 2024, the company continued to invest in patent filings to defend its competitive edge against potential infringers in the surgical, dental, and ophthalmic markets.

The legal landscape surrounding intellectual property rights directly impacts MANI's ability to prevent unauthorized replication of its unique technologies. As of early 2025, MANI holds over 150 active patents globally, a testament to its ongoing commitment to innovation and market exclusivity.

Medical device manufacturers like MANI, INC. operate under stringent product liability laws and must meet demanding safety standards to prevent patient harm. Failing to adhere to these regulations can lead to significant legal repercussions, erosion of patient trust, and expensive product recalls or lawsuits. The 2024 recall of MANI DIA-BURS serves as a stark reminder of the critical importance of maintaining robust product safety protocols.

Data Privacy and Cybersecurity Laws (e.g., HIPAA, GDPR)

The increasing digitization of healthcare makes data privacy and cybersecurity laws crucial. Regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe directly impact companies managing patient data or creating connected medical devices. MANI, INC. must prioritize adherence to these laws to safeguard sensitive information and prevent significant penalties.

Compliance with these stringent regulations is not just a legal necessity but also a critical factor in building trust with patients and partners. For instance, in 2023, data breaches in the healthcare sector cost an average of $10.10 million per incident, the highest of any industry, underscoring the financial risks of non-compliance.

- HIPAA Compliance: MANI, INC. must implement robust technical, physical, and administrative safeguards to protect electronic protected health information (ePHI).

- GDPR Adherence: For operations involving EU residents, MANI, INC. needs to ensure lawful processing of personal data, including clear consent mechanisms and data subject rights.

- Cybersecurity Investments: The company should allocate resources for advanced cybersecurity measures, including encryption, access controls, and regular vulnerability assessments.

- Regulatory Monitoring: Staying updated on evolving data privacy and cybersecurity legislation is essential to maintain ongoing compliance.

Anti-Trust and Competition Laws

Anti-trust and competition laws are crucial for regulating market behavior, including mergers and acquisitions, to prevent monopolies and ensure a level playing field. These regulations directly impact how companies like MANI, INC. can form strategic partnerships, enter new markets, and pursue potential acquisitions within the competitive medical device sector.

For instance, increased scrutiny from regulatory bodies like the U.S. Federal Trade Commission (FTC) on healthcare mergers in 2024 and early 2025 means MANI, INC. must carefully navigate these laws. A proposed merger between two significant medical device manufacturers in late 2024, for example, faced extensive review, highlighting the need for robust legal compliance in any consolidation strategy.

- Regulatory Scrutiny: Increased enforcement of anti-trust laws by agencies such as the FTC and European Commission in 2024 has led to more thorough reviews of mergers and acquisitions in the medical device industry.

- Market Entry Barriers: Stringent competition laws can create barriers for new entrants or for companies seeking to expand market share through aggressive pricing or exclusive agreements, affecting MANI, INC.'s growth strategies.

- Partnership Constraints: Collaboration agreements and strategic alliances must be structured to avoid anti-competitive practices, potentially limiting the scope of partnerships MANI, INC. can pursue.

- Acquisition Due Diligence: MANI, INC. must conduct thorough legal due diligence on potential acquisition targets to ensure compliance with existing anti-trust regulations, preventing costly legal challenges or divestitures post-acquisition.

MANI, INC. must navigate a complex and evolving legal framework governing medical devices, including stringent FDA and CE marking requirements. Anticipated regulatory updates for 2025 focus on enhanced patient safety and supply chain integrity, potentially impacting product development and manufacturing processes.

Protecting its intellectual property is paramount, with over 150 global patents as of early 2025, safeguarding its innovations in precision engineering. The company must also adhere to strict product liability laws, as demonstrated by the 2024 MANI DIA-BURS recall, emphasizing the critical need for robust safety protocols.

Data privacy and cybersecurity laws, such as HIPAA and GDPR, are increasingly significant due to healthcare digitization, requiring substantial investment in safeguarding sensitive patient information. Furthermore, anti-trust laws demand careful navigation of market strategies, partnerships, and potential acquisitions, with heightened regulatory scrutiny observed in 2024 and early 2025.

Environmental factors

The medical device industry, including companies like MANI, INC., is increasingly prioritizing sustainability. This focus extends from sourcing raw materials to the final delivery of products, impacting production methods and logistics. For instance, by 2024, many manufacturers are aiming to reduce waste by 15% through circular economy principles.

MANI, INC. can significantly lessen its environmental impact by adopting energy-efficient technologies and integrating renewable energy sources into its operations. Optimizing supply chain routes to minimize carbon emissions is also crucial; a 2025 projection suggests a potential 10% reduction in transportation-related CO2 emissions for companies that implement advanced logistics software.

The disposal of medical instruments and packaging creates substantial environmental hurdles. MANI, INC. must consider the full product lifecycle, from designing for recyclability to managing end-of-life responsibly, aiming to cut waste and foster circular economy principles.

While recycling initiatives are a positive step, they may not always offer the most environmentally sound solution when compared to the benefits of reuse or reprocessing of medical materials.

In 2023, the global healthcare waste market was valued at approximately $35 billion, with a significant portion attributed to disposable medical devices and their packaging, highlighting the scale of the waste management challenge.

Environmental regulations on hazardous materials and emissions are becoming more rigorous globally. MANI, INC. must navigate these, for instance, by adopting NMP-free polyimide, to prevent penalties and showcase its commitment to sustainability.

Corporate Social Responsibility (CSR) and Green Initiatives

Stakeholder demand for Corporate Social Responsibility (CSR) and environmental consciousness is significantly shaping business operations. Companies are increasingly expected to demonstrate a commitment to sustainability, influencing everything from supply chains to product development.

MANI, INC. can leverage this trend to its advantage. By adopting eco-friendly practices and openly sharing its sustainability progress, the company can bolster its brand image and appeal to a growing segment of consumers and investors who prioritize environmental stewardship. For instance, in 2024, global ESG (Environmental, Social, and Governance) investments were projected to reach over $50 trillion, highlighting the financial significance of these initiatives.

- Brand Reputation: Implementing green initiatives can improve public perception and brand loyalty.

- Customer Attraction: Environmentally conscious consumers are more likely to choose brands with strong sustainability credentials.

- Investor Appeal: ESG-focused investors are increasingly allocating capital to companies with robust environmental strategies.

- Operational Efficiency: Many green initiatives, such as energy reduction, can lead to cost savings.

Climate Change Impact on Operations and Resources

Climate change presents significant operational challenges for MANI, INC. Extreme weather events, like the increased frequency of hurricanes and droughts observed in recent years, can severely disrupt supply chains and manufacturing processes. For instance, the global economic impact of natural disasters was estimated to be over $200 billion in 2023 alone, a figure that is expected to rise.

MANI, INC. must proactively assess and adapt its operational resilience to these climate-related risks. This includes evaluating potential resource scarcity, such as water or raw material availability, and anticipating increased energy costs due to shifts in energy production and demand. A recent report from the International Energy Agency in late 2024 highlighted that renewable energy costs are falling, but the transition still presents volatility in traditional energy prices, potentially impacting operational expenses.

- Supply Chain Disruptions: Extreme weather events in key sourcing regions can halt raw material delivery, impacting production schedules.

- Resource Scarcity: Increased droughts or water usage restrictions could affect manufacturing processes that rely on water.

- Energy Cost Volatility: The transition to greener energy sources, while beneficial long-term, can lead to short-term price fluctuations impacting operating budgets.

- Infrastructure Damage: Severe weather can damage critical infrastructure, including transportation networks and company facilities, leading to costly repairs and downtime.

Environmental factors are increasingly shaping the medical device industry, prompting companies like MANI, INC. to prioritize sustainability. This includes reducing waste, with projections for 2024 indicating a 15% reduction goal for many manufacturers through circular economy principles. Furthermore, adopting energy-efficient technologies and renewable energy sources can cut carbon emissions, with advanced logistics software potentially reducing transportation CO2 by 10% by 2025.

MANI, INC. must also address the significant environmental challenge of medical instrument and packaging disposal. The global healthcare waste market was valued at approximately $35 billion in 2023, underscoring the need for responsible end-of-life management and design for recyclability. Stricter environmental regulations on hazardous materials and emissions necessitate proactive adaptation, such as the adoption of NMP-free polyimide.

Stakeholder demand for Corporate Social Responsibility (CSR) is driving a greater focus on environmental consciousness, influencing supply chains and product development. By embracing eco-friendly practices, MANI, INC. can enhance its brand image and appeal to the growing segment of consumers and investors prioritizing environmental stewardship, as evidenced by the projected over $50 trillion in global ESG investments for 2024.

Climate change poses operational risks through extreme weather events, which can disrupt supply chains and manufacturing, with natural disasters costing over $200 billion globally in 2023. MANI, INC. needs to build operational resilience, considering potential resource scarcity and energy cost volatility, even as renewable energy costs fall, according to late 2024 IEA reports.

| Environmental Factor | Impact on MANI, INC. | Mitigation Strategy/Opportunity | Data Point/Projection |

| Waste Management | Disposal of medical devices and packaging | Circular economy principles, design for recyclability, reprocessing | Global healthcare waste market valued at ~$35 billion (2023) |

| Energy Consumption & Emissions | Operational costs, carbon footprint | Energy-efficient technologies, renewable energy integration, optimized logistics | Potential 10% reduction in transport CO2 by 2025 with advanced logistics |

| Climate Change & Extreme Weather | Supply chain disruption, resource scarcity, infrastructure damage | Operational resilience assessment, diversification of sourcing, adaptive infrastructure | Global economic impact of natural disasters >$200 billion (2023) |

| Regulatory Compliance | Adherence to hazardous material and emission standards | Adoption of compliant materials (e.g., NMP-free polyimide), robust environmental management systems | Increasingly rigorous global regulations |

PESTLE Analysis Data Sources

Our PESTLE analysis is built upon a robust foundation of data sourced from reputable government agencies, international organizations, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in credible and current information.