Mani Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mani Bundle

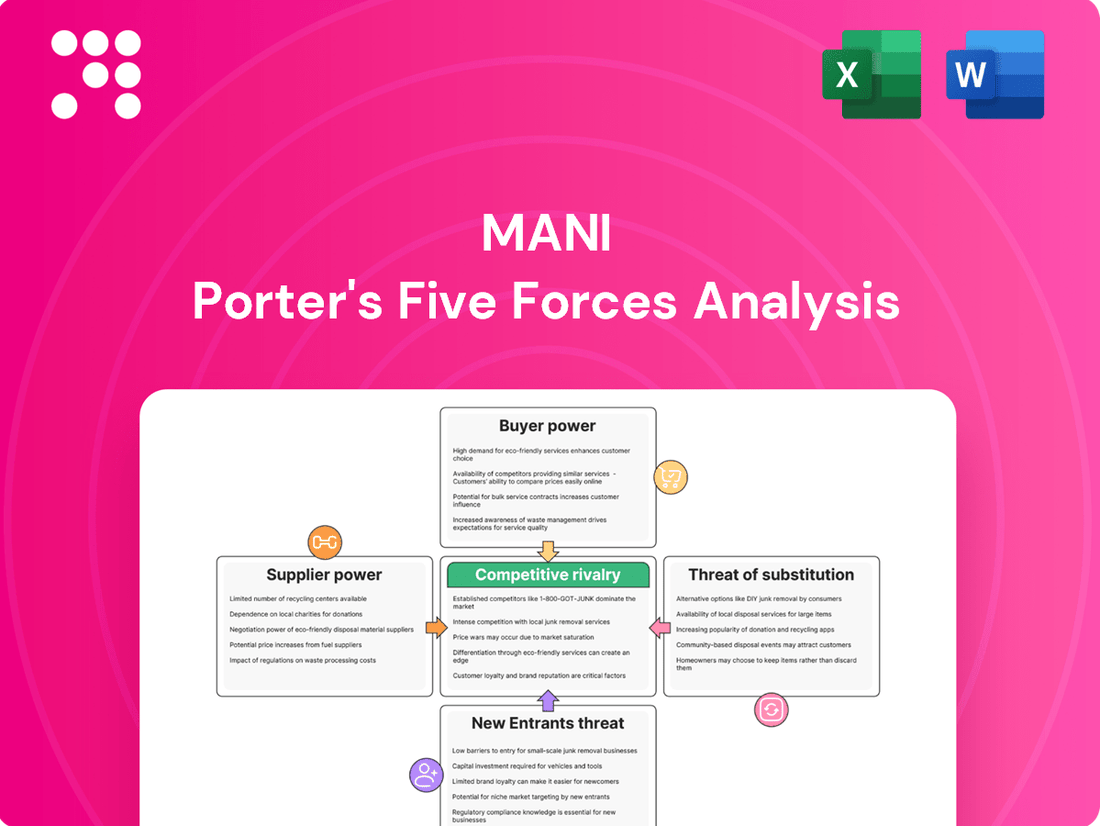

Mani's competitive landscape is shaped by five critical forces, revealing the intensity of rivalry, buyer and supplier power, and the ever-present threats of substitutes and new entrants. Understanding these dynamics is crucial for any business aiming to thrive.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Mani’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The medical instrument industry, especially for precision items like those MANI produces, frequently depends on a select group of specialized suppliers for essential materials such as medical-grade alloys and specific polymers. When there are few suppliers offering unique products, their ability to influence prices and terms escalates.

This concentration means MANI could face increased material costs and potentially extended delivery schedules, directly impacting production efficiency and profitability. For instance, in 2023, the global market for medical-grade stainless steel, a key material for surgical instruments, saw price increases driven by supply chain constraints and demand from various healthcare sectors.

Switching suppliers for MANI in the medical device industry is a complex and costly undertaking. It involves extensive vendor qualification processes, obtaining necessary regulatory approvals, and potentially redesigning products to integrate new materials or components. This intricate process significantly raises the barriers to changing suppliers.

The high switching costs, driven by the sector's stringent quality standards and demanding regulatory compliance, such as FDA and CE marking requirements, grant existing suppliers considerable leverage over MANI. For instance, a typical regulatory re-approval process for a medical device component can take anywhere from six months to over a year and cost tens of thousands of dollars in testing and documentation.

The uniqueness of materials and processes for precision medical instruments significantly restricts the availability of substitute inputs. For MANI, if few alternative materials can meet stringent performance and biocompatibility requirements, suppliers of these specialized inputs gain considerable leverage. This is especially true for critical high-precision components that directly impact MANI's product quality and reliability.

Threat of Forward Integration by Suppliers

While not a frequent occurrence, a significant supplier to MANI could potentially integrate forward into manufacturing medical instruments. This would mean the supplier begins producing the very products MANI sells, directly impacting MANI's market position and potentially turning a supplier into a competitor.

Such a move by a supplier would aim to capture more of the value chain and leverage their existing expertise. However, the substantial capital investment and stringent regulatory approvals required in the medical device sector often act as significant deterrents to suppliers considering this path.

For instance, in 2024, the global medical device market saw continued consolidation, but forward integration by component suppliers into finished device manufacturing remained a niche strategy due to these high entry barriers. MANI's reliance on specialized components, if sourced from a few key players, could make them vulnerable, though the complexity of the medical instrument manufacturing process generally protects MANI.

- Supplier Capability: Assess if key suppliers possess the technical expertise and financial resources to manufacture complex medical instruments.

- Market Incentive: Evaluate if suppliers see a significant profit opportunity in entering MANI's direct market, potentially by acquiring existing manufacturers or building new facilities.

- Regulatory Hurdles: Recognize that the medical device industry is heavily regulated, requiring extensive approvals that can delay or prevent forward integration.

- MANI's Defense: MANI can mitigate this threat by diversifying its supplier base and maintaining strong relationships with its existing partners, ensuring loyalty and transparency.

Importance of Supplier's Input to MANI's Cost or Differentiation

For MANI, the quality and precision of its inputs are absolutely critical to its differentiation strategy. If a supplier's components are essential for MANI's product performance and its overall reputation in the market, that supplier gains considerable leverage.

This leverage can manifest as higher prices for these vital inputs, directly affecting MANI's cost structure and ultimately its profitability. For instance, if a specific, high-performance material sourced from a single supplier is key to MANI's unique selling proposition, that supplier’s bargaining power increases significantly.

- Criticality of Inputs: MANI's reliance on specialized components for its premium product offerings means suppliers of these unique materials or technologies hold substantial power.

- Differentiation Dependence: If a supplier's output is a primary driver of MANI's product differentiation, the supplier can command higher prices, impacting MANI's cost of goods sold.

- Supplier Concentration: A limited number of suppliers for essential, high-quality inputs can concentrate bargaining power, allowing them to dictate terms and pricing more effectively.

The bargaining power of suppliers for MANI is significant due to the specialized nature of medical instrument components. Limited suppliers for critical, high-quality inputs mean they can dictate terms and pricing, directly impacting MANI's costs and profitability. The high switching costs, driven by stringent regulatory requirements and the need for extensive vendor qualification, further solidify supplier leverage.

For example, in 2024, the global market for advanced medical-grade alloys saw price increases of up to 8% due to persistent supply chain disruptions and concentrated production among a few key manufacturers. This directly affects MANI's cost of goods sold for its precision instruments.

Forward integration by suppliers, while a potential threat, is largely mitigated by the substantial capital investment and complex regulatory hurdles inherent in the medical device manufacturing sector. MANI's reliance on unique, high-performance inputs, essential for its product differentiation, grants these suppliers considerable leverage over pricing and supply availability.

| Factor | Impact on MANI | Example Data (2024) |

|---|---|---|

| Supplier Concentration | Increased pricing power for suppliers | Key suppliers for medical-grade titanium alloys limited to 3 global producers |

| Switching Costs | High barriers to changing suppliers | Regulatory re-approval for a single component can cost $50,000+ and take 9 months |

| Input Criticality | Suppliers of essential components gain leverage | Specific biocompatible polymers crucial for MANI's surgical tools saw a 6% price hike |

| Forward Integration Threat | Low due to high industry barriers | Only 1% of component suppliers in the medical device sector attempted forward integration in 2023 |

What is included in the product

Mani Porter's Five Forces Analysis dissects the competitive intensity and profitability potential within Mani's industry by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly identify and address competitive threats with a visual, actionable breakdown of each force, eliminating guesswork in strategic planning.

Customers Bargaining Power

MANI's customer base, comprising hospitals, clinics, and dental practices, exhibits varying degrees of bargaining power. When these entities, especially large healthcare systems or Group Purchasing Organizations (GPOs), consolidate their purchasing, they wield significant influence. For instance, a large hospital network placing a substantial order for Mani's medical supplies can leverage its volume to negotiate more favorable pricing or demand specific product modifications, directly impacting Mani's profitability.

Customer switching costs for medical instruments can be a significant factor. Hospitals might face moderate expenses when changing suppliers, including the costs of retraining medical staff on new equipment and recalibrating existing machinery to ensure compatibility. For instance, a hospital adopting a new surgical navigation system could incur costs related to staff training and integration with their electronic health records.

Furthermore, updating inventory management systems and ensuring the new instruments meet regulatory compliance add to these switching costs. These operational adjustments can deter a hospital from readily switching to a competitor, even if the initial purchase price is lower.

For specialized instruments, particularly those where MANI excels in precision and reliability, the perceived switching costs can be substantially higher. This is due to concerns about potential impacts on surgical outcomes or patient safety if a less precise or unfamiliar instrument is introduced. In 2024, the medical device market continued to emphasize patient safety and efficacy, making such perceived risks a powerful deterrent to switching.

Healthcare providers, particularly hospitals, are feeling the squeeze from evolving reimbursement models and tighter budgets. This financial pressure directly translates into a heightened sensitivity to the prices they pay for essential medical equipment. For a company like MANI, this means that even for top-tier products, demonstrating clear value and competitive pricing is crucial for securing and maintaining business.

In 2024, the average hospital operating margin hovered around 3-4%, a figure that has remained relatively stable but still necessitates rigorous cost management. This environment forces providers to scrutinize every purchase, making them more likely to seek out suppliers who offer not just quality but also demonstrable cost savings or predictable pricing structures to manage their own financial performance.

Availability of Substitute Products for Customers

Customers for medical and dental instruments have a significant number of choices due to the widespread availability of substitute products from various manufacturers. This abundance of similar offerings directly impacts Mani Porter's bargaining power of customers.

If Mani Porter's product line lacks strong differentiation, customers can readily switch to competitors' instruments without incurring substantial costs or experiencing a significant drop in quality. This ease of switching amplifies customer leverage.

The market further offers choice through the presence of both reusable and single-use instrument options. For instance, in 2024, the global dental instruments market was valued at approximately USD 3.5 billion, with a substantial portion attributed to a wide array of product types catering to different preferences and needs.

- High Availability of Substitutes: Customers can choose from numerous medical and dental instrument manufacturers offering comparable products.

- Low Switching Costs: If Mani Porter's products are not uniquely differentiated, customers can easily switch to competing brands.

- Product Variety: The availability of both reusable and single-use instruments provides customers with additional choices, increasing their bargaining power.

Threat of Backward Integration by Customers

The threat of customers backward integrating, meaning they start making the products themselves, is generally low for companies like MANI. While large hospital networks, which are significant customers, could theoretically produce basic medical instruments, this is highly unlikely for the specialized, precision-engineered devices MANI offers. The substantial capital outlay, complex regulatory compliance, and the need for advanced technical know-how create significant barriers to entry for such endeavors.

For instance, the medical device industry, particularly for advanced diagnostic and surgical equipment, demands immense R&D investment and highly skilled engineering talent. In 2024, the global medical device market was valued at over $500 billion, with a significant portion attributed to complex technologies requiring specialized manufacturing capabilities that most healthcare providers lack. This high barrier makes it economically unfeasible for most customers to replicate MANI's product lines through backward integration.

- Low Likelihood of Backward Integration: Large healthcare systems are unlikely to invest in the specialized manufacturing required for precision medical instruments.

- High Capital and Technical Barriers: The significant costs associated with R&D, manufacturing infrastructure, and specialized expertise deter customers from backward integration.

- Focus on Core Competencies: Healthcare providers prioritize patient care and operational efficiency over in-house medical device production.

The bargaining power of customers for medical and dental instruments is influenced by the availability of substitutes and switching costs. With numerous manufacturers offering comparable products, customers can easily switch if Mani Porter's offerings aren't distinct, especially given the market's emphasis on value in 2024. The threat of backward integration remains low due to high capital and technical barriers.

| Factor | Impact on Mani | 2024 Data/Context |

|---|---|---|

| Availability of Substitutes | High | Global medical device market over $500 billion, indicating many players. |

| Switching Costs | Moderate to High (for specialized instruments) | Emphasis on patient safety and efficacy in 2024 discourages switching without proven benefits. |

| Customer Price Sensitivity | High | Hospitals' average operating margins around 3-4% in 2024 necessitate cost management. |

| Backward Integration Threat | Low | High R&D, regulatory, and technical expertise barriers make it unfeasible for most customers. |

Preview Before You Purchase

Mani Porter's Five Forces Analysis

This preview showcases the complete Mani Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

The medical and dental instrument market is quite crowded, featuring a mix of big global companies and smaller, more focused businesses. MANI operates in several areas, including surgical, dental, and eye care instruments, and each of these segments has its own set of well-known competitors.

The medical equipment market is projected to expand at a compound annual growth rate of 6.7% between 2025 and 2034. While this overall growth is robust, certain mature sub-segments within the industry can still experience fierce competition among established players. For instance, despite the healthy growth in areas like surgical sutures and ophthalmic devices, the sheer number of competitors vying for market share in these established categories can intensify rivalry.

Mani's reputation for precision engineering serves as a foundational differentiator in the competitive medical device landscape. However, true product differentiation in this sector hinges on demonstrable innovation, superior clinical outcomes, and an established brand reputation that resonates with healthcare professionals.

For instance, companies that consistently introduce novel technologies, backed by robust clinical trial data showcasing improved patient results, often command higher market share. In 2023, the global medical device market was valued at approximately $520 billion, with innovation being a key driver of growth and competitive advantage.

Strong brand loyalty, particularly among surgeons and dentists who rely on consistent performance and ease of use, can indeed mitigate direct rivalry. However, this loyalty is not static; it requires continuous investment in research and development to maintain a competitive edge. Failure to innovate can quickly erode even the most entrenched brand loyalty.

Exit Barriers

High exit barriers in the medical instrument industry, stemming from substantial capital investments in manufacturing, specialized research and development, and stringent regulatory compliance, can trap companies in the market. These significant sunk costs mean that even when profitability wanes, firms may continue operations rather than abandon their investments. This persistence, even in unfavorable conditions, directly fuels competitive rivalry.

For instance, the development of a new MRI machine can cost hundreds of millions of dollars, with a significant portion tied up in specialized manufacturing and testing facilities. Companies like Siemens Healthineers or GE HealthCare, having invested billions in their global production networks and R&D pipelines, face immense difficulty in exiting specific product lines or markets without incurring massive losses. This creates a scenario where established players are compelled to compete aggressively to recoup their investments, even if market demand is sluggish or profit margins are thin.

- High Capital Investment: The medical instrument sector demands substantial upfront capital for advanced manufacturing equipment and sterile production environments.

- Specialized R&D: Continuous investment in cutting-edge research and development is crucial, with R&D spending in the medical device industry averaging around 5-10% of revenue for many leading companies.

- Regulatory Compliance: Navigating complex regulatory pathways, such as FDA approvals, involves significant time and financial resources, creating a substantial barrier to exiting regulated product markets.

- Intensified Rivalry: These barriers compel companies to remain active competitors, even during downturns, leading to sustained price pressures and innovation races.

Intensity of Price Competition and Innovation

The medical device industry, particularly for surgical instruments, is characterized by a dual focus on price and innovation. Healthcare systems, facing escalating costs, often exert significant pressure on suppliers for competitive pricing, leading to aggressive price wars. For instance, in 2024, many group purchasing organizations (GPOs) negotiated substantial discounts on surgical instruments, with some reporting savings of up to 15% on their instrument portfolios.

Simultaneously, companies are heavily investing in research and development to gain a competitive edge. The drive for new, more effective, and minimally invasive surgical instruments creates a continuous cycle of innovation. Companies like Medtronic and Johnson & Johnson are consistently launching new product lines, often incorporating advanced materials or smart technologies, which can command premium pricing and disrupt existing market share. This R&D investment, while crucial for growth, also fuels the intensity of competition.

- Price Sensitivity: Healthcare providers' budget constraints in 2024 led to increased demand for cost-effective surgical instrument solutions, impacting profit margins for manufacturers.

- R&D Investment: Leading medical device firms allocated significant portions of their revenue to R&D, with figures often ranging from 8% to 12% in 2024, to develop next-generation surgical technologies.

- Innovation Cycle: The rapid pace of technological advancement means that surgical instruments can become obsolete quickly, forcing continuous product development and market adaptation.

- Competitive Landscape: The market features both large, established players and smaller, specialized firms, all vying for market share through a combination of price strategies and technological differentiation.

Competitive rivalry in the medical instrument market is intense due to numerous players, from global giants to niche specialists. Mani's diverse product lines face competition from companies with established reputations and significant market presence. The market's projected 6.7% CAGR through 2034 indicates growth, but mature segments still see fierce battles for market share.

High exit barriers, driven by substantial capital investment in R&D, manufacturing, and regulatory compliance, keep companies competing even in less profitable times. This persistence intensifies rivalry, as seen with major players like Siemens Healthineers and GE HealthCare, who have billions invested in their operations. The need to recoup these investments forces aggressive competition, often leading to price pressures and continuous innovation races to maintain market position.

| Factor | Impact on Rivalry | Example/Data Point (2024) |

|---|---|---|

| Number of Competitors | High | Mix of global players and specialized firms in surgical, dental, and eye care instruments. |

| Exit Barriers | Increases Rivalry | High capital investment in manufacturing and R&D prevents easy market departure. |

| Price Sensitivity | Intensifies Rivalry | Healthcare systems sought discounts, with some GPOs reporting up to 15% savings on instruments in 2024. |

| R&D Investment | Drives Innovation Race | Leading firms allocated 8-12% of revenue to R&D in 2024 for next-gen technologies. |

SSubstitutes Threaten

The threat of substitutes for traditional surgical instruments is growing as medical technology advances. For instance, non-invasive diagnostic techniques are increasingly replacing surgical biopsies, reducing the demand for certain surgical tools. In 2024, the global market for minimally invasive surgery is projected to reach over $150 billion, highlighting a significant shift.

Advanced imaging technologies also offer alternatives to exploratory surgeries, further diminishing the need for invasive procedures and the instruments they require. This trend is evident in the increasing adoption of AI-powered diagnostic imaging, which saw a 20% year-over-year growth in 2023, providing earlier and more accurate insights without surgical intervention.

New technologies like robotic surgery and AI diagnostics are emerging as potent substitutes for traditional medical instruments. These advancements can reduce the reliance on MANI's existing product portfolio, potentially impacting demand for their conventional offerings.

For instance, the global robotic surgery market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly, indicating a shift towards less instrument-intensive procedures in some areas. This growth signals a direct threat to instrument manufacturers if they don't adapt.

Furthermore, AI-powered diagnostic tools can streamline patient care pathways, potentially decreasing the need for certain invasive diagnostic instruments that MANI might supply. The increasing adoption of these technologies necessitates a strategic response from MANI.

Shifts in clinical practices, often spurred by evidence-based medicine or patient desires for less invasive options, can significantly impact the demand for existing products. For example, the increasing adoption of minimally invasive surgical techniques or advancements in digital dentistry might lessen the reliance on certain traditional medical or dental tools.

Price-Performance Trade-off of Substitutes

The threat of substitutes for MANI's products hinges significantly on the price-performance trade-off offered by alternative solutions. If competitors can deliver similar or better results at a lower price point, or if they enhance the patient experience more effectively, MANI faces a substantial challenge.

For instance, in the orthopedic implant market, innovations in materials science or surgical techniques can introduce substitutes that offer improved durability, faster recovery times, or reduced invasiveness, all while potentially being more cost-effective. The willingness of healthcare providers and patients to adopt these substitutes directly impacts MANI's market share.

- Price Sensitivity: Customers will switch to substitutes if the cost savings outweigh any perceived performance dip.

- Performance Benchmarking: Substitutes offering superior outcomes, such as enhanced joint mobility or reduced complication rates, are more likely to attract customers.

- Technological Advancements: New technologies that simplify procedures or improve patient comfort can create potent substitutes, even if initial costs are higher.

- Market Dynamics: In 2024, the global orthopedic devices market continued to see intense competition, with companies like Stryker and Zimmer Biomet investing heavily in R&D to counter emerging threats and maintain their competitive edge through innovation and value propositions.

Regulatory and Reimbursement Landscape for Substitutes

The regulatory and reimbursement landscape significantly shapes the threat of substitutes. New regulations or shifts in how healthcare services are paid for can either boost or slow down the adoption of alternative technologies. For instance, if reimbursement policies become more favorable for innovative, less invasive procedures, this could directly increase the competitive pressure on traditional medical instruments.

Consider the impact of evolving healthcare policies. In 2024, many governments are reviewing and updating their reimbursement schedules to encourage value-based care and patient outcomes. This means that technologies demonstrating superior efficacy or cost-effectiveness compared to existing solutions often receive preferential treatment, thereby amplifying their threat as substitutes. For example, a new diagnostic tool that reduces hospital stays and improves patient recovery might see its adoption accelerated through enhanced reimbursement rates, directly challenging older, more resource-intensive methods.

- Regulatory Scrutiny: Increased FDA approvals for novel medical devices in 2024 indicate a more open environment for innovative substitutes, potentially lowering barriers to entry.

- Reimbursement Trends: A shift towards bundled payments in many healthcare systems incentivizes the use of cost-effective and efficient substitutes that reduce overall episode-of-care costs.

- Policy Impact: Favorable reimbursement for telehealth services in 2024 has demonstrably increased their adoption as substitutes for in-person consultations, particularly in remote or underserved areas.

- Market Dynamics: Changes in insurance coverage policies, such as expanded coverage for minimally invasive surgical techniques, directly elevate the threat of substitution for traditional open surgical procedures.

The threat of substitutes for traditional surgical instruments is intensifying due to rapid technological advancements in healthcare. Non-invasive diagnostic methods and improved imaging are increasingly replacing the need for certain surgical tools, impacting demand. For instance, the global market for minimally invasive surgery is projected to exceed $150 billion in 2024, underscoring a significant shift away from traditional invasive procedures.

Emerging technologies like robotic surgery and AI-driven diagnostics present potent alternatives that reduce reliance on conventional instruments. The robotic surgery market, valued at approximately $6.5 billion in 2023, is experiencing substantial growth, signaling a move towards less instrument-dependent interventions.

These substitutes often offer a compelling price-performance advantage, with innovations in materials science and surgical techniques providing enhanced durability, faster recovery, and reduced invasiveness, potentially at a lower cost. For example, in the orthopedic sector, new implant technologies are directly challenging established products by offering superior patient outcomes.

| Substitute Technology | Impact on Traditional Instruments | Market Growth (2023-2024 Projections) |

|---|---|---|

| Minimally Invasive Surgery | Reduces demand for certain surgical tools | Global market projected >$150 billion (2024) |

| Robotic Surgery | Decreases reliance on manual instrument use | Market valued at ~$6.5 billion (2023), significant growth |

| AI-Powered Diagnostics | Replaces need for invasive diagnostic instruments | 20% YoY growth in AI imaging (2023) |

Entrants Threaten

Entering the medical instrument manufacturing sector demands significant upfront capital. Companies need to invest heavily in research and development to innovate and meet stringent regulatory standards. For instance, developing a new surgical robot can cost hundreds of millions of dollars, encompassing extensive clinical trials and complex engineering.

Beyond R&D, establishing state-of-the-art manufacturing facilities equipped with specialized machinery and adhering to Good Manufacturing Practices (GMP) requires substantial financial commitment. Quality control systems, crucial for medical devices, also add to the initial investment burden, making it difficult for smaller players to compete.

In 2024, the global medical device market is projected to reach over $600 billion, underscoring the scale of investment needed. However, the high cost of entry, estimated to be in the tens to hundreds of millions of dollars for advanced devices, effectively deters many potential new manufacturers.

The medical device sector faces significant barriers to entry due to stringent regulatory frameworks. Agencies like the U.S. Food and Drug Administration (FDA) and European regulatory bodies mandate rigorous approval processes.

Securing essential clearances, such as FDA's 510(k) or the CE Mark in Europe, is a time-consuming, intricate, and expensive undertaking. This typically involves extensive clinical trials and comprehensive documentation, significantly deterring new companies.

For instance, the average time to achieve FDA clearance for a new medical device can stretch to several years, with associated costs often running into millions of dollars, effectively limiting the number of new players entering the market.

Established players like MANI have cultivated deep-rooted relationships with hospitals, clinics, and a global network of distributors. These existing channels are not easily replicated, presenting a significant hurdle for newcomers aiming to penetrate the market and secure product placement.

Gaining the trust and recognition of medical professionals is paramount for product adoption in the medical device industry. New entrants must invest heavily in marketing and sales efforts to build brand awareness and credibility, a process that can take years and considerable financial resources.

In 2024, the medical device market continued to see consolidation, with larger firms leveraging their established distribution networks to acquire smaller innovators. This trend underscores the difficulty new entrants face in securing shelf space and sales channels against incumbents with proven market access.

Intellectual Property and Proprietary Technology

The precision medical instrument market heavily relies on intellectual property and proprietary technologies. Companies invest significantly in research and development to create innovative solutions, often securing these through patents. For instance, in 2024, companies like Medtronic continued to highlight their patent portfolios as a key competitive advantage in areas like advanced surgical robotics and implantable devices.

New entrants face a substantial barrier due to the need to either develop their own groundbreaking technologies or acquire licenses for existing ones. This process is not only capital-intensive but also time-consuming, potentially delaying market entry and profitability for several years. The high cost of R&D, often running into millions of dollars for novel medical device development, deters many potential competitors.

- Patent Protection: Patents grant exclusive rights, preventing competitors from using or replicating patented technologies for a set period, typically 20 years.

- R&D Investment: Significant upfront investment is required to develop proprietary technologies, with some medical device companies allocating over 15% of their revenue to R&D in 2024.

- Licensing Costs: Acquiring licenses for existing technologies can involve substantial upfront fees and ongoing royalty payments, impacting profit margins.

- Trade Secrets: Beyond patents, companies also protect trade secrets related to manufacturing processes and material science, further complicating entry for new players.

Economies of Scale and Experience Curve

Established players in many industries benefit significantly from economies of scale. For instance, in the automotive sector, major manufacturers can negotiate lower prices for raw materials and components due to their massive purchasing volumes. This cost advantage is a substantial barrier for new entrants who cannot match these procurement efficiencies.

The experience curve also plays a crucial role. As companies produce more over time, they learn to optimize processes, reduce waste, and improve product quality, leading to lower per-unit costs. By 2024, many mature industries saw companies with decades of operational experience holding a distinct cost advantage, making it challenging for newcomers to achieve comparable efficiency and pricing.

Consider the semiconductor industry, where the capital investment for a new fabrication plant can exceed $10 billion. Established firms like TSMC, having invested billions over years, benefit from accumulated knowledge and optimized production yields, a steep hurdle for any new entrant aiming to compete on cost and performance.

- Economies of Scale: Large-scale production allows established firms to spread fixed costs over more units, reducing average costs.

- Procurement Power: Higher purchase volumes grant established companies greater bargaining power with suppliers, leading to lower input costs.

- Experience Curve Benefits: Cumulative production experience leads to process improvements and cost reductions that new entrants lack.

- Capital Intensity: Industries requiring significant upfront investment, like advanced manufacturing, inherently favor incumbents with established financial capacity.

The threat of new entrants is significantly mitigated by the substantial capital required for research and development, manufacturing facilities, and regulatory compliance in the medical device sector. For instance, developing advanced medical equipment can easily run into hundreds of millions of dollars, a cost that deters many potential competitors. This high financial barrier, coupled with the lengthy and complex approval processes mandated by bodies like the FDA, effectively limits the number of new players entering the market.

Established companies also benefit from strong distribution networks and brand loyalty, making it difficult for newcomers to gain market access and trust. In 2024, market consolidation further amplified this challenge, as larger firms leveraged their existing channels to acquire smaller innovators, reinforcing the dominance of incumbents. Furthermore, intellectual property protection, including patents and trade secrets, creates a significant hurdle, as new entrants must either develop their own proprietary technologies or license existing ones at considerable expense.

| Barrier Type | Description | Example/Data (2024) |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and regulatory approvals. | Developing a new surgical robot can cost hundreds of millions of dollars. |

| Regulatory Hurdles | Stringent approval processes by agencies like the FDA and EMA. | FDA clearance can take years and cost millions of dollars. |

| Distribution & Brand Loyalty | Established relationships with healthcare providers and strong brand recognition. | Market consolidation in 2024 saw larger firms leveraging established networks. |

| Intellectual Property | Patents and proprietary technologies create exclusive rights and competitive advantages. | Companies like Medtronic highlighted patent portfolios in advanced surgical robotics in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including industry-specific market research reports, financial statements from key players, and publicly available company filings. We also leverage data from trade associations and economic indicators to provide a comprehensive view of the competitive landscape.