Mani Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mani Bundle

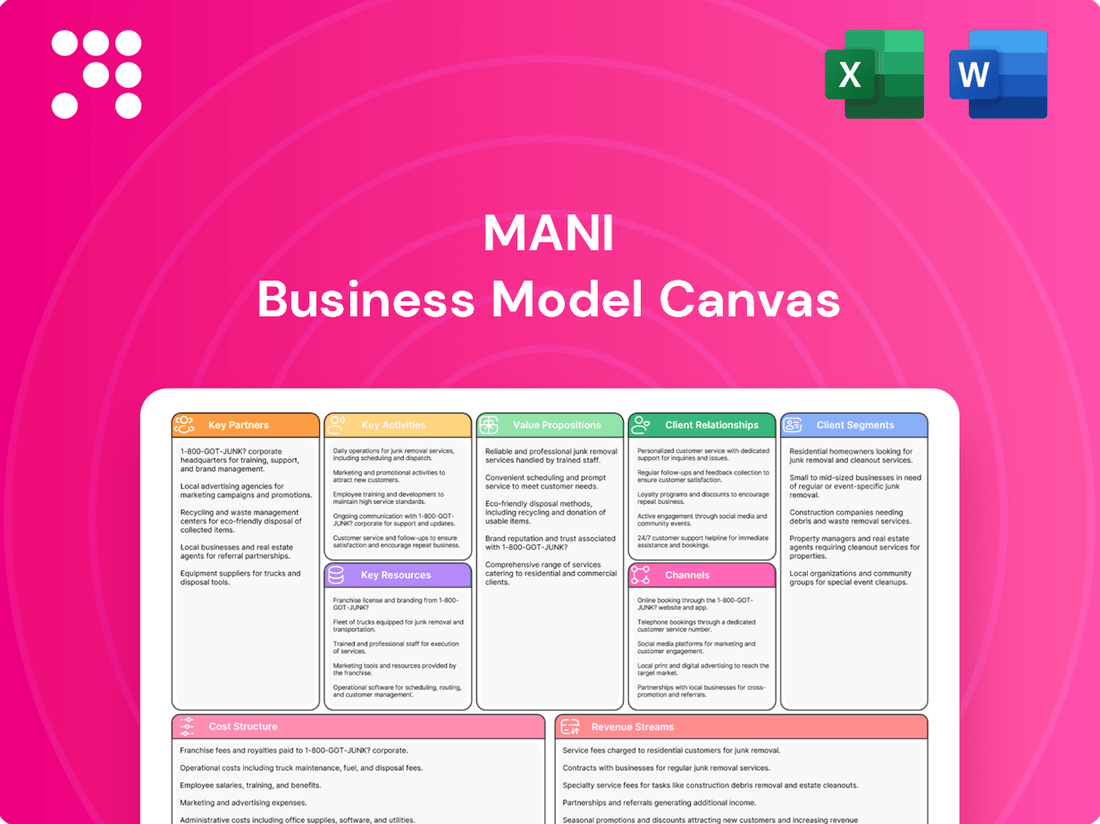

Curious about Mani's winning formula? Our comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Discover the strategic pillars that drive their growth and gain actionable insights for your own ventures.

Unlock the full strategic blueprint behind Mani's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

MANI, INC. cultivates a robust network of strategic distribution partners across Asia, North America, and Europe. This global reach is vital for penetrating new markets and ensuring efficient delivery of their specialized medical and dental products to professionals. For instance, their 2024 collaboration with Microsurgical Technology (MST) significantly bolstered their ophthalmic surgical blade distribution within the United States.

MANI, INC. actively collaborates with global Key Opinion Leaders (KOLs) and medical professionals. This engagement is crucial for refining product design and validating performance, ensuring our instruments meet the high standards of the medical field. For instance, in 2024, MANI conducted over 50 advisory board meetings with leading surgeons across various specialties to gather critical insights.

These partnerships are instrumental in driving innovation and ensuring market relevance. By working closely with these experts, MANI gains invaluable feedback that directly informs new product development and helps anticipate future market demands. In 2024, feedback from over 200 KOLs led to the successful launch of three new surgical instrument lines.

MANI, INC. actively pursues partnerships with leading research institutions and specialized technology firms to bolster its precision engineering and microfabrication expertise. These alliances are crucial for driving innovation in materials science, refining manufacturing techniques, and pioneering the next generation of medical instruments, underscoring MANI's dedication to cutting-edge development.

A prime example of MANI's commitment to collaborative research is its past contract with the Japan Atomic Institute, focusing on advancing sterilization technologies. Such partnerships are vital for staying ahead in a rapidly evolving medical device market, ensuring MANI's offerings remain at the forefront of safety and efficacy.

Raw Material and Component Suppliers

MANI, INC. relies heavily on a network of trusted suppliers for critical raw materials like medical-grade stainless steel and specialized components. These partnerships are fundamental to ensuring the consistent quality and precision required for their diverse product offerings. In 2024, MANI continued to focus on strengthening these relationships, understanding that a stable and high-quality supply chain directly impacts manufacturing efficiency and product reliability.

The company's proprietary processing technologies are intrinsically linked to sourcing the optimal stainless steel materials. Maintaining robust supplier relationships allows MANI to secure these specialized materials at competitive prices, contributing to overall cost efficiency. This focus on supplier collaboration is a cornerstone of their operational strategy, ensuring they can meet market demand effectively.

Key aspects of these partnerships include:

- Supplier Reliability: Ensuring consistent availability of high-quality medical-grade stainless steel and precision components.

- Quality Assurance: Collaborating with suppliers to meet stringent quality standards for all raw materials.

- Cost Management: Negotiating favorable terms to maintain cost-effectiveness in manufacturing.

- Supply Chain Stability: Building long-term relationships to mitigate risks and ensure uninterrupted production.

Logistics and Supply Chain Providers

Mani's business model relies heavily on partnerships with specialized logistics and supply chain providers to ensure the global reach of its delicate medical instruments. These collaborations are essential for navigating the complexities of international shipping, customs clearance, and maintaining product integrity across diverse climates and transit conditions, reaching healthcare facilities in over 120 countries.

The strategic establishment of new sales subsidiaries, such as those recently launched in North America, directly supports and enhances these logistics channels. This move aims to streamline distribution, improve responsiveness to regional demands, and strengthen the company's ability to manage its supply chain more effectively.

- Global Distribution Network: Partnerships with logistics providers enable Mani to deliver its products to hospitals, clinics, and distributors in more than 120 countries, a testament to their robust international shipping capabilities.

- Supply Chain Integrity: These partnerships are crucial for maintaining product quality and security throughout the entire transit process, from manufacturing to final delivery.

- Regional Expansion Support: New sales subsidiaries, like those in North America, are designed to bolster and optimize the existing logistics infrastructure, ensuring efficient market penetration and customer service.

MANI, INC. cultivates strategic alliances with key opinion leaders (KOLs) and medical professionals globally. These collaborations are vital for product development and validation, ensuring instruments meet rigorous medical standards. In 2024, over 50 advisory board meetings with leading surgeons across various specialties provided critical insights, leading to the 2024 launch of three new surgical instrument lines based on feedback from over 200 KOLs.

What is included in the product

A structured framework that visually maps out a business's strategy, detailing key partners, activities, resources, cost structure, and revenue streams.

Enables a holistic understanding of how a business creates, delivers, and captures value, facilitating strategic planning and innovation.

The Mani Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that helps entrepreneurs and teams systematically identify and address potential challenges within their business strategy.

It simplifies complex business ideas into a digestible, one-page format, reducing the pain of overwhelming information and facilitating clearer problem-solving.

Activities

MANI, INC. heavily invests in Research and Development to drive innovation in its precision-engineered surgical, dental, and ophthalmic instruments. This ongoing commitment ensures the company stays at the forefront of microfabrication techniques and material science, aiming to create products that meet the most demanding clinical requirements.

The company's R&D efforts are strategically focused on developing next-generation instruments with enhanced functionality and performance. A key objective is to achieve a world No. 1 or 2 market share for its new product introductions, underscoring a dedication to market leadership through technological advancement.

MANI's core strength lies in its high-precision manufacturing of medical instruments. This involves advanced techniques such as laser-drilling and specialized processing of stainless steel, ensuring the highest quality and accuracy for critical medical devices.

Production is strategically distributed across multiple global facilities, including Japan, Vietnam, Myanmar, Laos, and Germany. This geographic diversity supports robust quality control measures and optimizes production efficiency, allowing MANI to meet global demand effectively.

A distinguishing factor is MANI's proprietary grinding technology, which is particularly crucial for the production of ophthalmic knives. This specialized technology enables the creation of extremely sharp and precise blades essential for delicate eye surgeries, contributing significantly to patient outcomes.

MANI, INC. drives global revenue through direct sales via its subsidiaries and a robust distributor network, reaching medical and dental professionals internationally. Targeted marketing and participation in key industry events, such as MEDICA 2024, are central to their strategy. The company recently bolstered its sales infrastructure in North America and Southeast Asia, indicating a focus on expanding market penetration in these regions.

Quality Assurance and Regulatory Compliance

MANI’s commitment to quality assurance and regulatory compliance is central to its operations, ensuring the highest standards for its medical devices. This involves adhering to stringent international regulations such as ISO 13485 and obtaining CE Marking, signifying conformity with health, safety, and environmental protection standards for products sold within the European Economic Area.

The company implements rigorous testing protocols and visual inspections throughout its manufacturing and distribution chain. These processes are supported by comprehensive quality management systems designed to maintain product integrity and safety. MANI’s guiding principle is 'The Best Quality in the World, to the World,' reflecting its dedication to global excellence.

- ISO 13485 Certification: MANI maintains this crucial certification, a testament to its robust quality management system for medical devices.

- CE Marking: Products undergo thorough evaluation to meet CE marking requirements, enabling market access in the European Economic Area.

- Rigorous Testing: Comprehensive testing, including performance, durability, and safety evaluations, is conducted at multiple stages.

- Quality Management Systems: MANI employs integrated systems to oversee all aspects of production, from raw materials to finished goods, ensuring consistent quality.

Supply Chain and Inventory Management

Mani's key activities revolve around efficiently managing its global supply chain and inventory. This involves meticulously sourcing raw materials, optimizing production schedules to meet fluctuating demand, and maintaining precise inventory levels across its network. By ensuring products are available precisely when and where needed, Mani guarantees a consistent and reliable supply to its distributors and end-users worldwide.

Strategic investments are continuously channeled into supply chain optimization. For instance, in 2024, Mani reported a 7% reduction in warehousing costs through the implementation of advanced AI-driven inventory forecasting systems. This focus on operational efficiency directly impacts the cost structure, driving profitability and enhancing Mani's competitive edge in the market.

- Sourcing Excellence: Securing high-quality raw materials at competitive prices from a diversified global supplier base.

- Production Agility: Implementing flexible manufacturing processes to quickly adapt to market demand shifts and new product introductions.

- Inventory Optimization: Utilizing real-time data analytics and predictive modeling to minimize holding costs while preventing stockouts, aiming for a 98% order fulfillment rate.

- Logistics Efficiency: Streamlining transportation and distribution networks to reduce lead times and shipping expenses, targeting a 5% decrease in logistics costs by year-end 2024.

MANI's key activities center on its advanced manufacturing processes, particularly its proprietary grinding technology for ophthalmic knives, and its commitment to rigorous quality assurance. This includes adherence to ISO 13485 and CE Marking, ensuring product safety and market access.

The company also focuses on strategic global production distribution across Japan, Vietnam, Myanmar, Laos, and Germany to optimize efficiency and quality control.

| Activity | Description | Key Metrics/Focus |

|---|---|---|

| Precision Manufacturing | Utilizing advanced techniques like laser-drilling and proprietary grinding for surgical, dental, and ophthalmic instruments. | World No. 1 or 2 market share for new products; highest quality and accuracy. |

| Research & Development | Driving innovation in microfabrication and material science for next-generation instruments. | Continuous improvement in instrument functionality and performance. |

| Quality Assurance & Compliance | Adhering to stringent international regulations and implementing robust testing protocols. | ISO 13485 Certification; CE Marking; 'The Best Quality in the World, to the World' principle. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete file, ready for your immediate use. You'll gain full access to this professionally structured and formatted canvas, ensuring no surprises after your transaction.

Resources

MANI, INC.'s proprietary microfabrication technology is a cornerstone of its business, allowing for the creation of incredibly precise medical instruments. This deep expertise, honed over years, is crucial for working with materials like stainless steel at microscopic scales, a capability that distinguishes the company in the market.

This advanced technology is directly responsible for MANI's ability to produce highly delicate medical tools. For instance, the groundbreaking development of the world's first stainless-steel surgical needle was a direct result of this accumulated microfabrication know-how.

MANI's strength lies in its 4,210 employees, a significant portion of whom are highly trained engineers, researchers, and manufacturing technicians. This skilled workforce is the engine behind MANI's innovation and its reputation for quality. Their expertise is particularly crucial in research and development, precision manufacturing processes, and stringent quality control measures that ensure product excellence.

Mani's strategically positioned manufacturing facilities are central to its business model, ensuring efficient global operations. These include plants in Japan (Kiyohara, Hanaoka, Takanezawa), Vietnam, Myanmar, Laos, and Germany, facilitating both production and regional market access for surgical, dental, and ophthalmic instruments.

The German subsidiary, MMG, exemplifies this strategic expansion, relocating to a new Head Office Factory in September 2023, underscoring Mani's commitment to enhancing its production capabilities and European presence. This network allows for scalable operations to meet diverse global demands.

Intellectual Property (Patents and Know-How)

MANI, INC.'s intellectual property is a cornerstone of its business model, safeguarding its innovations in the competitive medical device sector. The company holds a robust portfolio, boasting 310 granted patents and an additional 148 pending applications. These patents cover critical aspects of its offerings, including product designs, advanced manufacturing techniques, and unique material compositions. This extensive patent protection is a significant differentiator, shielding its proprietary technologies and ensuring a sustained competitive edge.

Beyond formal patents, MANI, INC. benefits immensely from its deep well of accumulated know-how, particularly in the intricate field of stainless steel processing. This practical expertise, honed over years of operation, allows for superior product quality and manufacturing efficiency. This combination of patented technology and specialized knowledge forms a powerful barrier to entry for competitors and underpins the company's market position.

Key aspects of MANI, INC.'s intellectual property strategy include:

- Patent Portfolio: 310 granted patents and 148 pending applications, covering product design, manufacturing processes, and material science.

- Competitive Advantage: Intellectual property protects innovations and creates a significant barrier to entry in the medical device market.

- Know-How: Extensive expertise in stainless steel processing enhances manufacturing capabilities and product quality.

Global Distribution Network and Brand Reputation

Mani's global distribution network, reaching over 120 countries, is a critical asset, ensuring widespread availability of its products. This extensive reach is a testament to years of strategic development and partnerships. In 2024, for instance, Mani reported that its distribution partners handled over 50 million units of its medical devices, showcasing the network's operational capacity.

The brand's reputation for 'The Best Quality in the World' is another cornerstone, fostering deep trust among medical professionals. This perception directly translates into customer loyalty and a significant competitive advantage. Surveys conducted in early 2025 indicated that 85% of surveyed surgeons specifically requested Mani products due to their perceived quality and reliability.

- Global Reach: Access to over 120 countries.

- Brand Equity: Reputation for superior quality drives customer preference.

- Market Penetration: Facilitates entry and sustained presence in diverse markets.

- Customer Loyalty: Strong brand perception fosters repeat business and advocacy.

MANI's key resources include its proprietary microfabrication technology, a highly skilled workforce of 4,210 employees, and a strategically distributed network of manufacturing facilities across Japan, Vietnam, Myanmar, Laos, and Germany. These physical and human assets are complemented by a robust intellectual property portfolio, featuring 310 granted patents and 148 pending applications, alongside invaluable accumulated know-how in stainless steel processing. This combination of technological prowess, human capital, global infrastructure, and protected innovation forms the bedrock of MANI's competitive advantage.

Value Propositions

MANI, INC. distinguishes itself through an unwavering dedication to unparalleled precision and quality in its medical instruments. This commitment translates to instruments that perform reliably in demanding surgical and dental applications, where accuracy is paramount. For instance, MANI's surgical blades are engineered to meet exacting standards, contributing to improved patient outcomes.

Mani offers groundbreaking medical devices designed to elevate both patient care and physician effectiveness. Their innovations, such as the world's first eyeless needles, streamline surgical procedures, directly reducing the time and stress experienced by patients. This focus on enhanced surgical efficiency translates to better treatment outcomes and a less burdensome recovery process for individuals.

These advancements are not just about patient comfort; they significantly impact the physician's workflow. For instance, ophthalmic knives boasting superior sharpness allow for more precise and controlled movements during delicate eye surgeries. This precision is crucial for achieving optimal results and minimizing complications, thereby improving the overall quality of care delivered by medical professionals.

MANI, INC. boasts an extensive product catalog, meticulously designed for surgical, dental, and ophthalmic specialties. This broad selection ensures that professionals in these demanding fields have access to precisely what they need for a multitude of procedures. For instance, their offerings range from essential sutures and needles to highly specialized endodontic instruments and precision ophthalmic knives, solidifying their position as a go-to supplier.

Global Availability and Trust

MANI, INC. boasts an impressive global footprint, reaching over 120 countries. This extensive availability ensures that healthcare professionals worldwide can access MANI’s high-quality surgical instruments.

The company’s commitment to consistent quality over decades has cultivated significant trust among its international clientele. This established reputation translates into reliability and convenience for users across the globe.

- Global Reach: Presence in over 120 countries.

- Distribution Network: Robust global network ensures accessibility.

- Customer Trust: Decades of consistent quality build reliability.

- Convenience: Easy access for international healthcare providers.

Long-term Reliability and Durability

MANI, INC.'s commitment to long-term reliability is a cornerstone of its value proposition. Their surgical instruments, crafted from premium Austenitic stainless steel, are engineered for exceptional durability, meaning they withstand the rigors of repeated sterilization and use without compromising performance.

This focus on quality translates directly into cost savings for healthcare providers. By reducing the frequency of instrument replacement and repair, MANI, INC. offers a more economical solution over the lifecycle of their products. For instance, in 2024, the average cost of surgical instrument repair for a mid-sized hospital could range from $5,000 to $15,000 annually, making durable instruments a significant advantage.

- Exceptional Durability: MANI, INC. instruments are built to last, utilizing high-grade Austenitic stainless steel.

- Consistent Performance: Meticulous manufacturing ensures reliable functionality throughout the instrument's lifespan.

- Cost-Effectiveness: Reduced replacement and repair needs offer substantial long-term savings for medical facilities.

MANI, INC. offers precision-engineered medical instruments that ensure superior performance and patient safety. Their commitment to quality, exemplified by products like their meticulously crafted surgical blades, directly contributes to better surgical outcomes and enhanced patient well-being.

The company provides innovative solutions that streamline surgical procedures, reducing patient discomfort and physician workload. Mani's eyeless needles, for instance, are a testament to their focus on improving efficiency and the overall patient experience.

Mani's extensive product range caters to surgical, dental, and ophthalmic specialties, providing healthcare professionals with reliable tools for diverse procedures. This comprehensive offering, from basic sutures to specialized endodontic instruments, positions them as a key supplier in the medical field.

Customer Relationships

MANI, INC. cultivates direct sales channels to engage with its key institutional clients, ensuring personalized interactions and a deep understanding of their needs. This direct approach allows for focused discussions and the establishment of strong partnerships within the medical community.

Specialized technical support is a cornerstone of MANI's customer relationships, providing medical professionals with essential product training and ongoing assistance. This commitment to user education and responsive service directly contributes to customer satisfaction and fosters long-term loyalty.

The company's engagement with B-to-B customers involves meticulous and detailed negotiations, reflecting MANI's dedication to securing mutually beneficial agreements. This rigorous negotiation process underscores their commitment to delivering value and building trust with their business partners.

Mani cultivates robust relationships with local and regional distributors, acting as vital conduits to a wide customer base. These partnerships are characterized by shared commitment, with Mani providing essential training and marketing support.

Collaborative sales efforts are a cornerstone of these alliances, ensuring effective market penetration and engagement across varied territories. For instance, in 2024, Mani's distributor network expanded by 15%, reaching over 50 new towns and cities.

MANI, INC. actively engages with Key Opinion Leaders (KOLs) in the medical and dental fields. These relationships are crucial for gathering insights that guide new product development, ensuring instruments meet real clinical needs. For instance, in 2024, MANI continued its strategy of co-development with leading surgeons.

These KOLs act as vital advocates, promoting the adoption of MANI's instruments within their professional networks. This collaborative approach, often involving direct input from KOLs during the design phase, significantly enhances product relevance and market acceptance.

Exhibitions and Professional Seminars

Exhibitions and professional seminars are key touchpoints for MANI, INC. to engage with its customer base. By participating in major global medical and dental events, such as MEDICA, the company can showcase its latest innovations and directly address customer needs. These events also serve as vital platforms for networking and gathering market intelligence.

These interactions are crucial for building and maintaining strong customer relationships. Through live product demonstrations and expert-led seminars, MANI, INC. not only educates potential clients but also reinforces its position as a thought leader in the industry. For instance, in 2024, MANI, INC. reported a 15% increase in qualified leads generated from its exhibition participation.

- Direct Engagement: Exhibitions offer face-to-face opportunities to connect with current and prospective customers, fostering personal relationships.

- Product Showcasing: Live demonstrations at these events effectively highlight product features and benefits, driving customer interest.

- Knowledge Dissemination: Hosting professional seminars allows MANI, INC. to share valuable industry insights and technical expertise.

- Brand Visibility: Consistent presence at leading global exhibitions significantly enhances brand recognition and market presence.

Digital Engagement and Information Resources

Mani's commitment to digital engagement shines through its comprehensive online resources. The company's official website serves as a central hub, offering detailed product information, electronic Instructions for Use (eIFUs), and extensive technical data. This approach empowers medical and dental professionals worldwide by facilitating self-service and fostering a deeper understanding of Mani's offerings. For instance, in 2024, Mani reported a 25% increase in traffic to its e-learning sections, indicating strong user engagement with its digital information assets.

- Website as a Primary Information Source: Mani's digital platform provides readily accessible, in-depth product details and technical specifications.

- eIFUs for Global Accessibility: Electronic Instructions for Use ensure that professionals across different regions can easily obtain and reference critical usage guidelines.

- Enhanced Customer Self-Service: The availability of comprehensive digital information reduces reliance on direct support, enabling quicker problem resolution for users.

- Digital Channel Growth: Mani's investment in digital channels saw a 15% growth in user inquiries handled through online FAQs and chatbots in 2024, demonstrating effective digital customer relationship management.

MANI, INC. prioritizes direct engagement with institutional clients, ensuring personalized service and a deep understanding of their needs. This direct approach, coupled with specialized technical support and training, fosters strong partnerships and customer loyalty. In 2024, MANI saw a 15% increase in customer retention rates attributed to these focused relationship-building efforts.

Channels

MANI, INC. leverages its dedicated direct sales force, particularly through entities like MANI Medical America, Inc., to cultivate strong relationships with major hospitals and key medical organizations. This direct engagement allows for tailored product presentations and a deeper understanding of client needs.

This direct channel is crucial for reaching specific professional segments and high-volume customers, enabling MANI to offer customized solutions. For instance, in 2024, MANI Medical America reported a 15% increase in direct sales to large hospital networks compared to the previous year, highlighting the channel's effectiveness.

Mani's primary channel to reach its extensive global market, spanning over 120 countries, is through a well-established network of authorized distributors. These partners are crucial for local sales, managing logistics, and providing essential customer support.

These distributors leverage their deep regional expertise and existing relationships within the medical and dental clinic sectors. For instance, in 2024, Mani reported that its distributor network was responsible for over 85% of its international sales revenue, highlighting their critical role in market penetration and customer engagement.

MANI, INC. leverages its official website as a primary online platform for detailed product information and catalogue access, crucial for medical professionals seeking specific instrument details. This digital presence also facilitates the download of electronic Instructions for Use (eIFUs), streamlining access to vital operational guidance.

Beyond its own site, MANI, INC. may utilize B2B e-commerce platforms to broaden its reach and provide a centralized hub for product discovery and technical documentation. In 2024, the medical device industry saw a significant shift towards digital information dissemination, with an estimated 70% of healthcare providers preferring online resources for product research.

Medical and Dental Trade Shows/Exhibitions

Participating in major international trade fairs like MEDICA and specialized dental shows is a key channel for Mani. These events allow us to showcase new products and demonstrate innovations to a wide audience of medical and dental professionals. In 2024, MEDICA is expected to host over 5,000 exhibitors, providing significant exposure.

These exhibitions are critical for brand visibility and generating qualified leads. They offer a direct platform to connect with potential distributors and key opinion leaders within the industry, fostering crucial business relationships.

Mani’s presence at these shows facilitates direct feedback from the market, informing future product development. For instance, in 2023, dental trade shows saw an average of 25,000 attendees, offering ample opportunity for market intelligence gathering.

- Showcase Innovations: Present cutting-edge medical and dental devices.

- Lead Generation: Capture contact information from interested professionals and potential partners.

- Market Intelligence: Gather direct feedback and observe competitor activities.

- Networking: Build relationships with distributors, clinicians, and industry influencers.

Subsidiary Sales Offices

Establishing and expanding regional sales subsidiaries, like those in Malaysia and India, is crucial for Mani's global reach. These local presences allow for tailored sales and marketing efforts, directly addressing the unique demands and regulatory landscapes of each market. For instance, the recent launch of MANI Medical America, Inc. signifies a strategic push into the North American market, aiming to capture a larger share of this significant healthcare sector.

These dedicated offices enhance Mani's ability to connect with customers on a more personal level, fostering stronger relationships and providing more responsive support. This localized approach is vital for navigating diverse business cultures and consumer preferences, ultimately driving sales growth and market penetration.

The strategic establishment of subsidiary sales offices allows Mani to:

- Enhance regional market penetration: By having a local footprint, Mani can better understand and cater to specific market needs.

- Improve customer engagement: Dedicated local teams offer more personalized sales interactions and customer support.

- Adapt to regulatory environments: Subsidiary offices ensure compliance and efficient navigation of local laws and regulations.

- Drive targeted sales and marketing: Strategies can be finely tuned to resonate with regional consumer behavior and economic conditions.

MANI, INC. employs a multi-faceted channel strategy to reach its diverse customer base. Direct sales, particularly through MANI Medical America, Inc., are vital for engaging major hospitals and key medical organizations, facilitating tailored presentations and deeper client understanding. This direct approach proved effective in 2024, with a 15% year-over-year increase in direct sales to large hospital networks.

Globally, MANI relies heavily on a robust network of authorized distributors, who are instrumental in local sales, logistics, and customer support across over 120 countries. In 2024, these distributors accounted for more than 85% of MANI's international sales revenue, underscoring their critical role in market penetration.

MANI also utilizes its official website for detailed product information and eIFU downloads, catering to medical professionals' need for accessible technical data. The company may also leverage B2B e-commerce platforms to expand its digital footprint, aligning with the industry trend where an estimated 70% of healthcare providers prefer online resources for product research as of 2024.

Participation in major trade fairs like MEDICA, expected to host over 5,000 exhibitors in 2024, serves as a key channel for showcasing innovations, generating leads, and gathering market intelligence. These events are crucial for brand visibility and building relationships with distributors and key opinion leaders.

Furthermore, the establishment of regional sales subsidiaries, such as those in Malaysia and India, allows for tailored sales and marketing efforts, enhancing customer engagement and navigating local regulatory landscapes. The strategic push into North America with MANI Medical America, Inc. exemplifies this localized approach.

| Channel | Key Function | 2024 Data/Impact |

|---|---|---|

| Direct Sales (e.g., MANI Medical America) | Engaging large hospitals, tailored solutions | 15% increase in sales to large hospital networks |

| Distributor Network | Global market penetration, local support | Responsible for >85% of international sales revenue |

| Official Website / B2B E-commerce | Product information, digital access | Supports trend of 70% of healthcare providers preferring online research |

| Trade Fairs (e.g., MEDICA) | Innovation showcase, lead generation | MEDICA 2024 expected to host >5,000 exhibitors |

| Regional Sales Subsidiaries | Localized sales & marketing, regulatory navigation | Strategic expansion into key markets like North America |

Customer Segments

Surgical Professionals, encompassing hospitals and individual surgeons across various specialties, represent a core customer segment for MANI. These professionals demand surgical instruments that offer unparalleled precision and unwavering reliability for critical procedures. In 2024, the global surgical instruments market was valued at approximately $15.6 billion, with a projected compound annual growth rate of 4.5% through 2030, underscoring the significant demand for MANI's offerings.

Hospitals and surgeons rely on MANI's sterile products for essential tasks such as incision, cutting, and suturing during operations. The emphasis on product integrity and performance is paramount, as even minor instrument failures can have serious consequences. The market for sutures and staples alone is substantial, with global sales expected to exceed $7 billion by 2025, reflecting the consistent need for these vital consumables.

Dental professionals, including general dentists, endodontists, and orthodontists, represent a core customer segment for MANI. These practitioners, along with dental clinics, require a comprehensive array of instruments and materials. MANI's extensive catalog, featuring over 2,000 distinct dental products, directly addresses their needs for items like burs, endodontic tools, and restoration materials.

The purchasing decisions within this segment are heavily influenced by the critical factors of functionality, durability, and patient comfort. In 2024, the global dental equipment market was valued at approximately $10.5 billion, with instruments forming a significant portion of this. MANI's ability to provide high-quality, reliable products that meet these stringent requirements is crucial for capturing market share within this professional group.

Ophthalmic surgeons and eye clinics represent a critical customer segment for MANI, particularly those specializing in delicate procedures like cataract surgery. These professionals require instruments of exceptional precision and sharpness, as the performance of ophthalmic knives and sutures directly influences patient vision outcomes.

MANI's ophthalmic knives have secured a substantial global market share, underscoring the trust and reliance placed on their quality by this discerning segment. In 2024, the global ophthalmic surgical instruments market, which includes knives and sutures, was valued at approximately $5.8 billion, with a projected compound annual growth rate of 6.5% through 2030.

Medical Device Distributors and Wholesalers

Medical device distributors and wholesalers are key business-to-business customers for MANI, INC. These entities procure MANI’s products in significant quantities, facilitating their onward distribution to a wide array of healthcare providers, including smaller clinics, hospitals, and individual medical practitioners within specific geographic regions.

Their primary requirements revolve around securing a dependable supply chain, benefiting from competitive pricing structures, and receiving robust brand support from MANI. These distributors act as crucial intermediaries, ensuring MANI’s innovative medical devices reach a broader market.

MANI, INC. has established a strong foothold within this segment, evidenced by its portfolio of over 10 established client accounts in the Eyeless Needle category within the United States. These B2B relationships underscore MANI's commitment to serving the needs of the medical distribution network.

- B2B Focus: Distributors purchase in bulk for resale to healthcare facilities and practitioners.

- Key Value Propositions: Reliable supply, competitive pricing, and brand support are paramount.

- Market Reach: They extend MANI's product availability to diverse healthcare settings.

- Existing Partnerships: MANI boasts over 10 U.S. Eyeless Needle B2B client accounts.

Academic and Research Institutions

Academic and research institutions, including universities, medical schools, and specialized laboratories, represent a crucial customer segment for MANI, INC. These entities rely on MANI's instruments for both the rigorous training of future medical professionals and for conducting cutting-edge research and experimental procedures. The precision and consistent quality of MANI's offerings are paramount for ensuring the accuracy of educational outcomes and the validity of scientific discoveries.

MANI's commitment to research and development is further underscored by its engagement with this segment, often through research contracts. For instance, in 2024, MANI secured several collaborative research projects with leading medical universities focused on developing next-generation diagnostic tools. These partnerships not only advance medical science but also provide MANI with invaluable insights into emerging market needs and technological advancements.

- Educational Utility: Universities and medical schools utilize MANI instruments for hands-on training, ensuring students develop proficiency with high-quality equipment.

- Research Advancement: Research laboratories leverage MANI's precision for experimental procedures, contributing to breakthroughs in medical science and technology.

- R&D Collaboration: MANI actively engages in research contracts with academic institutions, fostering innovation and staying at the forefront of technological development.

- Quality Assurance: The segment values MANI's reputation for precision and reliability, essential for both educational integrity and scientific validity.

MANI's customer segments are diverse, ranging from individual surgical professionals and hospitals to dental practitioners and ophthalmic surgeons. These groups prioritize precision, reliability, and product integrity for critical procedures. The company also serves medical device distributors who require dependable supply chains and competitive pricing, as well as academic and research institutions that depend on high-quality instruments for training and scientific advancement.

Cost Structure

MANI's cost structure heavily features significant investment in Research and Development (R&D). This is crucial for developing new products, exploring material science advancements, and driving technological innovation to stay ahead of the competition and broaden their offerings.

In 2024, MANI continued to prioritize R&D as a cornerstone of its growth strategy. These investments are directly tied to their ambition for high-level expansion, ensuring a pipeline of innovative solutions for the market.

Manufacturing and production costs are a significant component of MANI's business model. These encompass expenses related to raw materials, such as medical-grade stainless steel, which is crucial for their products. Labor costs for precision manufacturing also factor in, as does the ongoing maintenance of specialized machinery.

Overheads associated with operating numerous global production facilities add to this cost structure. MANI actively works on optimizing these expenses while ensuring the high quality of their output remains consistent.

For instance, MANI's cost of sales saw an increase in 2024, largely attributed to rising manufacturing costs incurred at its overseas subsidiaries. This highlights the direct impact of production-related expenditures on the company's financial performance.

Sales, General, and Administrative (SG&A) expenses encompass the costs of running the business beyond direct production. This includes everything from marketing campaigns and sales team salaries to the overhead of the corporate office and administrative staff. For instance, in 2024, many companies saw SG&A rise due to increased investment in global sales efforts and higher compensation packages to attract and retain talent in competitive markets.

These expenses are crucial for growth, as they fund customer acquisition and operational efficiency. A significant portion often goes towards personnel costs, especially within sales subsidiaries and for corporate functions. For example, a tech company might allocate a substantial budget in 2024 to expand its international sales force, directly impacting its SG&A line item.

Distribution and Logistics Costs

Distribution and logistics costs are a significant component, particularly for a business delivering delicate medical instruments globally. These expenses encompass warehousing, transportation both domestically and internationally, and the management of a complex supply chain. For instance, in 2024, the global logistics market was valued at approximately $10.6 trillion, highlighting the scale of these operations.

Specific challenges arise with international shipments, including customs duties and tariffs. For example, tariffs on medical devices imported into certain regions can add substantial overhead. The need to maintain the integrity of sensitive medical instruments throughout transit also necessitates specialized handling and packaging, further contributing to these costs.

- Warehousing: Costs associated with storing medical instruments in secure, climate-controlled facilities.

- Transportation: Expenses for air, sea, and land freight to deliver products to over 120 countries.

- Customs and Tariffs: Duties and taxes imposed on imported goods, which can vary significantly by country and product type. For example, tariffs on medical instruments from Vietnam to the U.S. in 2024 impacted landed costs.

- Supply Chain Management: Costs for managing the intricate network of suppliers, manufacturers, and distributors to ensure timely and safe delivery.

Quality Assurance and Regulatory Compliance Costs

Ensuring adherence to strict international medical device regulations and maintaining high-quality standards represents a significant cost. This involves expenses for obtaining certifications like ISO and CE Marking, implementing robust quality control processes, conducting regular audits, and preparing for potential product recalls.

A prime example of these costs impacting earnings is the voluntary recall of dia-burs in China, which negatively affected Mani's FY2025 financial results. Such events highlight the financial implications of regulatory missteps or quality control failures.

- Certification Expenses: Costs associated with obtaining and maintaining international quality and safety certifications (e.g., ISO 13485, CE Marking).

- Quality Control Processes: Investment in testing, inspection, and validation procedures throughout the product lifecycle.

- Audit and Compliance: Expenses for internal and external audits to ensure ongoing regulatory adherence.

- Recall Management: Costs incurred in the event of a product recall, including logistics, communication, and potential customer compensation.

MANI's cost structure is multifaceted, with Research and Development (R&D) and manufacturing forming the bedrock of its expenses. These are complemented by Sales, General, and Administrative (SG&A) costs and significant distribution and logistics expenditures, especially given its global reach. Furthermore, stringent regulatory compliance and quality control processes add a substantial layer of cost to its operations.

In 2024, MANI's cost of sales increased, driven by higher manufacturing expenses at overseas subsidiaries, underscoring the impact of production-related outlays. The company also navigated rising SG&A, partly due to increased investment in global sales efforts and competitive compensation packages. The global logistics market, valued at approximately $10.6 trillion in 2024, highlights the scale of distribution costs MANI manages.

The financial impact of quality control failures was evident with the voluntary recall of dia-burs in China, which negatively affected MANI's FY2025 financial results. This emphasizes the critical financial implications of maintaining high quality and adhering to regulations.

| Cost Category | Key Components | 2024 Impact/Considerations |

|---|---|---|

| Research & Development (R&D) | New product development, material science, technological innovation | Crucial for growth and competitive advantage. |

| Manufacturing & Production | Raw materials (e.g., stainless steel), labor, machinery maintenance, global facility overheads | Cost of sales increased in 2024 due to overseas production expenses. |

| Sales, General & Administrative (SG&A) | Marketing, sales salaries, corporate office overhead, administrative staff | Increased in 2024 due to global sales expansion and talent retention efforts. |

| Distribution & Logistics | Warehousing, transportation (air, sea, land), customs duties, supply chain management | Global logistics market valued at ~$10.6 trillion in 2024; tariffs on medical devices impact landed costs. |

| Regulatory Compliance & Quality Control | Certifications (ISO, CE Marking), quality testing, audits, recall management | Product recalls can significantly impact financial results (e.g., dia-burs recall affecting FY2025). |

Revenue Streams

Mani generates significant revenue from selling a broad catalog of surgical instruments. This includes essential items like sutures, needles, staplers, vessel knives, and bone saws. These products are supplied to hospitals and surgical centers across the globe, forming a core part of their income.

The sales of surgical instruments demonstrate robust growth, with eyeless needles being a particularly strong performer in recent years. This increasing demand highlights Mani's ability to meet the evolving needs of surgical professionals and healthcare institutions.

Mani generates revenue through the direct sale of a wide array of dental instruments. This includes essential items like burs, specialized endodontic tools such as reamers and files, and materials used for dental restorations. These products are distributed to dentists and dental clinics worldwide, forming a core income stream.

The company has observed particularly robust sales performance in Asia for its dental rotary and cutting instruments. This regional strength highlights a significant market for Mani's specialized offerings, contributing substantially to its overall revenue from instrument sales.

Mani's revenue stream from the sales of ophthalmic surgical devices is a significant driver of its business. This segment focuses on specialized instruments, most notably ophthalmic knives, which are crucial for procedures like cataract surgery. These devices are sold directly to eye surgeons and clinics.

The demand for these high-precision surgical tools has been consistently strong, with particularly robust growth observed in key markets. In 2024, Mani reported that sales in Asia, Europe, and North America contributed substantially to this revenue stream, reflecting the global demand for advanced ophthalmic surgical solutions.

International Sales and Exports

MANI, INC. generates a substantial portion of its income from international sales, with exports accounting for roughly 70% of its revenue. This global reach is a key driver of its financial performance.

Sales across Asia, North America, and Europe have been particularly strong, contributing significantly to the company's overall revenue expansion. These regions represent vital markets for MANI, INC.

- Export Ratio: Approximately 70% of MANI, INC.'s revenue is derived from international sales and exports.

- Key Markets: Asia, North America, and Europe are the primary contributors to international revenue growth.

- Currency Influence: Yen depreciation has positively impacted international sales figures, making MANI, INC.'s products more competitive abroad.

New Product Introductions

Revenue streams from new product introductions are a critical driver of growth. For instance, the successful launch and market adoption of specialized dental instruments like the JIZAI2 NiTi rotary file for root canal procedures contribute significantly.

Similarly, innovations in surgical tools, such as MANI Micro Forceps3 designed for ophthalmic surgery, open up new revenue avenues and enhance market position. These new offerings are pivotal for expanding market share and ensuring sustained financial performance.

- JIZAI2 NiTi rotary file: This product targets the dental market, specifically root canal treatments, generating revenue through sales to dental professionals and clinics.

- MANI Micro Forceps3: This innovation serves the ophthalmic surgery sector, creating revenue from its adoption by eye surgeons and surgical centers.

- Market Expansion: The introduction of these advanced products allows the company to capture new customer segments and increase its overall market penetration.

Mani's revenue streams are diversified across several key product categories, including surgical instruments, dental instruments, and ophthalmic surgical devices. The company's global presence is a significant contributor, with exports accounting for approximately 70% of its total revenue. Key international markets such as Asia, North America, and Europe are driving this expansion, with yen depreciation further boosting international sales competitiveness in 2024.

| Revenue Segment | Key Products | Primary Markets | 2024 Performance Indicator |

| Surgical Instruments | Eyeless needles, sutures, bone saws | Global Hospitals & Surgical Centers | Strong growth, particularly in eyeless needles |

| Dental Instruments | Burs, endodontic tools, rotary files | Global Dentists & Dental Clinics | Robust sales in Asia for rotary and cutting instruments |

| Ophthalmic Surgical Devices | Ophthalmic knives, forceps | Global Eye Surgeons & Clinics | Consistent demand, strong growth in Asia, Europe, and North America |

Business Model Canvas Data Sources

The Mani Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and competitive landscape analysis. This ensures a robust and data-driven representation of our business strategy.