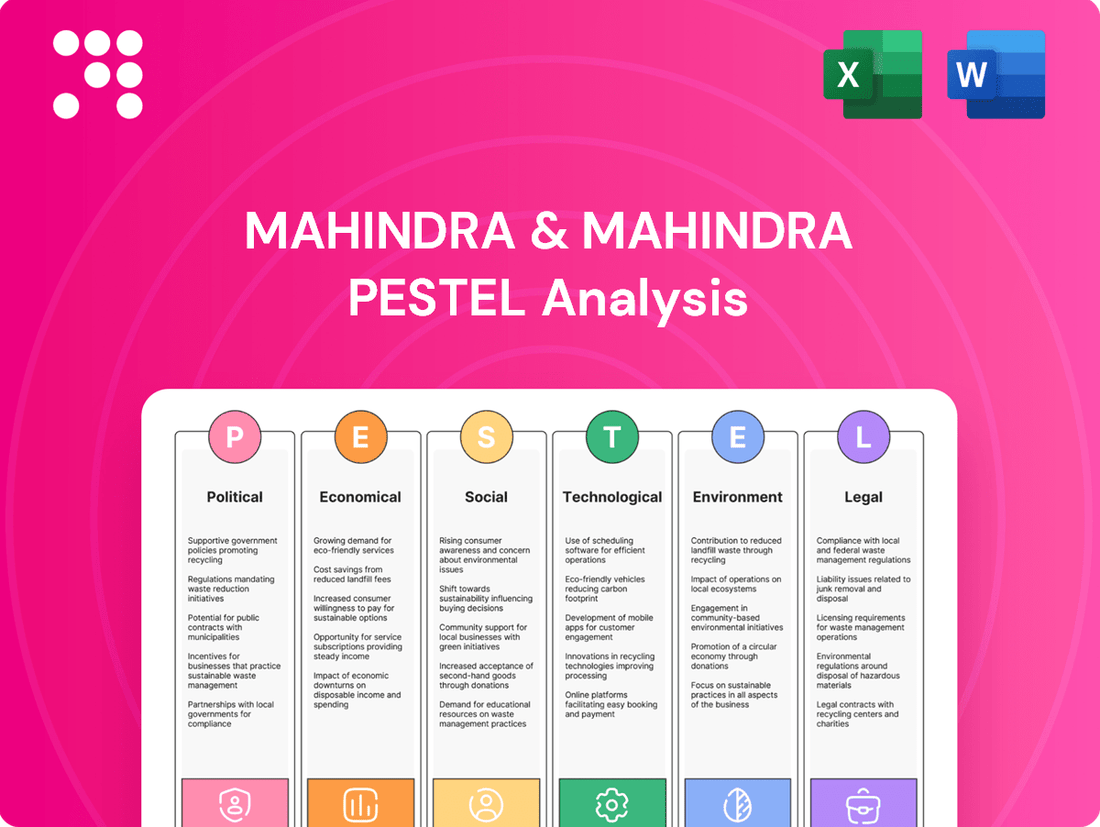

Mahindra & Mahindra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mahindra & Mahindra Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Mahindra & Mahindra's trajectory. Our expert PESTLE analysis reveals how these external forces present both opportunities and challenges for the automotive giant. Gain a strategic advantage by understanding the complete external landscape. Download the full version now for actionable intelligence to inform your decisions.

Political factors

Government policies and regulations are a major force shaping Mahindra & Mahindra's trajectory. India's ambitious target of achieving 30% electric vehicle (EV) sales by 2030 directly impacts the company's strategic focus on its EV offerings.

The recent approval of the Scheme for Manufacturing of Electric Cars (SMEC) in March 2024 is a key development. This scheme provides concessional import duties for new greenfield EV manufacturing facilities, a move designed to attract foreign direct investment and bolster India's position as a global EV manufacturing hub.

Mahindra & Mahindra's operations are significantly bolstered by the political stability within India. This stability translates into a more predictable policy environment, which is crucial for long-term strategic planning and capital investments in the automotive and agricultural sectors. For instance, the Indian government's continued focus on infrastructure development, a key area for M&M's tractor and utility vehicle sales, indicates a supportive political backdrop.

Mahindra & Mahindra's operations are directly impacted by global trade policies and tariffs. For instance, changes in import duties on components like semiconductors or specialized manufacturing equipment can increase production costs. Conversely, favorable trade agreements, such as the Comprehensive Economic Partnership Agreement (CEPA) between India and the UAE, can open up new export markets or reduce costs for components sourced from partner nations, potentially boosting sales volumes and profitability.

Government Incentives and Subsidies

Government support for electric vehicles (EVs) presents substantial growth avenues for Mahindra & Mahindra, particularly through programs like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme, which has seen continued implementation with FAME II. Additionally, initiatives like the PM E-DRIVE Scheme aim to bolster the EV ecosystem by offering financial incentives for EV adoption and local manufacturing capabilities.

These government interventions, including upfront subsidies for EV purchasers and incentives for domestic R&D and production, directly benefit Mahindra's burgeoning EV portfolio. For instance, FAME II, with its allocated budget, directly influences consumer purchasing decisions and supports the development of a robust EV supply chain, a key area for Mahindra's strategic focus.

- FAME India Scheme: Continues to provide demand incentives for electric and hybrid vehicles, supporting sales growth.

- Production Linked Incentives (PLI): Government schemes offer financial benefits for domestic manufacturing of advanced automotive technologies, including EVs.

- EV Charging Infrastructure: Policies promoting the expansion of charging networks indirectly support EV adoption and sales, benefiting manufacturers like Mahindra.

Automotive Mission Plan 2026

The Indian government's Automotive Mission Plan 2026 is a significant political factor, aiming to elevate India into the top three global automotive hubs. This initiative is designed to boost the sector's contribution to the national GDP, creating a more favorable environment for companies like Mahindra & Mahindra.

Mahindra & Mahindra can strategically align its operations with this plan to capitalize on the projected growth. The mission outlines key areas for development, which directly translate into opportunities for increased production, technological advancement, and market penetration for the company.

- GDP Contribution Target: The plan aims for the automotive sector to contribute significantly to India's GDP, fostering economic expansion.

- Global Ranking Ambition: India aspires to be among the top three automotive manufacturing nations by 2026.

- Policy Support: Government policies are expected to support R&D, manufacturing efficiency, and export promotion within the automotive industry.

Government policies, particularly those supporting electric vehicles (EVs) and domestic manufacturing, significantly influence Mahindra & Mahindra's strategic direction. The FAME II scheme, for instance, has provided substantial demand incentives for EVs, contributing to their growing adoption. India's ambition to become a top automotive hub by 2026, as outlined in the Automotive Mission Plan, creates a supportive environment for M&M's growth initiatives.

What is included in the product

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Mahindra & Mahindra's operations and strategic decisions.

It provides actionable insights into how these macro-environmental forces present both challenges and opportunities for the company's growth and market position.

A concise Mahindra & Mahindra PESTLE analysis provides a clear roadmap to navigate complex external factors, alleviating the stress of uncertainty and enabling proactive strategic decision-making.

Economic factors

India's projected GDP growth of 6.5% for the fiscal year 2024-25 is a significant tailwind for Mahindra & Mahindra (M&M). This robust economic expansion translates directly into higher disposable incomes for consumers, fueling demand for M&M's automotive products, from passenger vehicles to commercial trucks.

Crucially, the growth in rural incomes plays a pivotal role for M&M. As agricultural productivity and farm incomes rise, the demand for tractors and other farm equipment, a core segment for Mahindra, sees a substantial uplift. This trend is supported by government initiatives aimed at boosting rural economies.

Inflation and interest rates significantly influence Mahindra & Mahindra's operational costs and the affordability of its vehicles for consumers. For instance, in India, the Consumer Price Index (CPI) inflation was reported at 4.83% in April 2024, impacting raw material costs and potentially consumer spending power.

Higher interest rates, as seen with the Reserve Bank of India's repo rate holding steady at 6.50% since February 2023, can increase borrowing costs for both the company and its customers, thereby affecting sales volumes and profitability. Fluctuations in fuel prices and the Goods and Services Tax (GST) rates also play a crucial role in shaping demand for automotive products.

Fluctuating fuel prices are a critical economic factor for Mahindra & Mahindra. For instance, in early 2024, global crude oil prices saw volatility, impacting the cost of gasoline and diesel. This directly influences consumer purchasing decisions, potentially boosting demand for Mahindra's electric vehicle (EV) offerings like the XUV400 and its upcoming electric SUVs, as well as their more fuel-efficient internal combustion engine (ICE) models.

Credit Availability

Credit availability significantly influences consumer demand for vehicles and farm machinery, directly affecting Mahindra & Mahindra's sales. Easier access to loans encourages purchases, boosting volume, while tighter credit conditions can dampen demand.

Mahindra Finance, the group's financial services subsidiary, plays a vital role, contributing substantially to overall revenue. In Q4 FY24, Mahindra Finance reported a net profit of ₹540 crore, up 20% year-on-year, demonstrating the financial services segment's robust performance and its importance to the group's financial health.

- Consumer Spending: Access to affordable credit is a key driver for vehicle and equipment purchases, impacting M&M's top line.

- Mahindra Finance Performance: The company's financial services arm, Mahindra Finance, reported a 20% year-on-year increase in net profit for Q4 FY24, highlighting its revenue contribution.

- Interest Rate Sensitivity: Changes in interest rates directly affect the cost of borrowing for consumers, influencing their purchasing power and M&M's sales.

- Economic Growth Linkage: Credit availability is often tied to broader economic conditions; a growing economy typically sees increased credit access and consumer spending.

Global Economic Slowdown

While global economic headwinds are present, impacting some automotive markets, Mahindra & Mahindra (M&M) is strategically positioned to leverage the robust growth anticipated within India's electric vehicle (EV) sector. This focus on the domestic market demonstrates M&M's adaptability amidst varying international economic conditions.

The company's optimism for India's EV journey is supported by several factors, including government incentives and increasing consumer adoption. For instance, India's overall automotive sales saw a significant uptick in FY24, indicating underlying economic strength in key consumer segments. M&M's commitment to its domestic EV expansion plans underscores its confidence in this market's resilience.

- Indian EV Market Growth: Projections suggest continued strong growth for EVs in India, driven by supportive policies and evolving consumer preferences.

- M&M's Domestic Focus: The company is prioritizing its Indian operations and EV product pipeline to capitalize on this domestic demand surge.

- Navigating Global Uncertainty: M&M's strategy aims to mitigate the impact of a global economic slowdown by concentrating on a high-potential, less volatile domestic market.

India's projected GDP growth of 6.5% for fiscal year 2024-25 is a significant tailwind for Mahindra & Mahindra (M&M), driving demand for its automotive and farm equipment. This growth, coupled with rising rural incomes, directly benefits M&M's tractor and utility vehicle segments, supported by government initiatives boosting agricultural productivity.

Inflation, with India's CPI at 4.83% in April 2024, and a steady repo rate of 6.50% since February 2023, impacts M&M's costs and consumer affordability. Fluctuating fuel prices also influence purchasing decisions, potentially favoring M&M's electric vehicle (EV) offerings.

Credit availability is crucial, with Mahindra Finance reporting a 20% year-on-year net profit increase to ₹540 crore in Q4 FY24, underscoring its contribution to M&M's financial health and its role in facilitating consumer purchases.

M&M is strategically positioned to capitalize on India's robust EV market growth, focusing on domestic expansion to mitigate global economic headwinds, as evidenced by the overall automotive sales uptick in FY24.

| Economic Factor | Indicator/Trend (as of mid-2024) | Impact on M&M |

|---|---|---|

| GDP Growth (India) | Projected 6.5% for FY 2024-25 | Positive: Fuels demand for vehicles and farm equipment. |

| Inflation (India CPI) | 4.83% (April 2024) | Mixed: Increases raw material costs, potentially affects consumer spending. |

| Interest Rates (Repo Rate) | 6.50% (Steady since Feb 2023) | Mixed: Affects borrowing costs for M&M and consumers; stable rate offers predictability. |

| Mahindra Finance Performance | Q4 FY24 Net Profit: ₹540 crore (+20% YoY) | Positive: Strong contribution to group revenue, supports vehicle financing. |

What You See Is What You Get

Mahindra & Mahindra PESTLE Analysis

The Mahindra & Mahindra PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Mahindra & Mahindra's operations and strategic decisions.

You'll gain insights into market trends, competitive landscape, and potential growth opportunities, all presented in a clear and actionable format.

Sociological factors

Mahindra & Mahindra is navigating a significant shift in what consumers want. In India, for instance, the demand for sport utility vehicles (SUVs) and smaller cars has been steadily increasing. By 2024, SUVs alone accounted for more than 40% of the entire passenger vehicle market in India, highlighting this strong trend.

Furthermore, there's a growing consumer consciousness around environmental impact, leading to a noticeable preference for sustainable products. This is directly translating into a greater interest in electric vehicles (EVs) and hybrid models, pushing manufacturers like Mahindra to adapt their product lines to meet these evolving eco-friendly demands.

India's rapid urbanization continues to fuel a significant increase in demand for vehicles, particularly those designed for navigating congested cityscapes. This demographic shift directly impacts Mahindra & Mahindra's product development, pushing them to innovate and offer vehicles that meet the evolving needs of urban commuters.

As of 2023, over 35% of India's population resides in urban areas, a figure projected to reach nearly 40% by 2030. This trend highlights the growing market for compact SUVs and feature-rich sedans, segments where Mahindra is actively expanding its portfolio, aiming to capture a larger share of this expanding urban mobility market.

Mahindra & Mahindra's strong position as the world's largest tractor manufacturer by volume is significantly bolstered by India's predominantly agrarian economy. The company's performance is closely tied to the economic well-being and purchasing power of its rural customer base. This reliance on the agricultural sector underscores the critical importance of rural income growth and government support for farming communities in driving farm equipment sales.

As of FY23, India's agricultural sector still employed a substantial portion of the workforce, highlighting the enduring relevance of rural markets. Increased rural disposable income, often linked to favorable monsoon seasons and government initiatives like the PM-KISAN scheme, directly translates into higher demand for tractors and other farm machinery. Mahindra's strategic focus on this segment allows it to capitalize on these socio-economic trends.

Increased Disposable Income

The burgeoning disposable income, especially among India's growing middle class, is a significant tailwind for the automotive sector. This rise in personal wealth directly translates to increased consumer spending power, making vehicle purchases more attainable and desirable. Mahindra & Mahindra, with its diverse portfolio ranging from rugged SUVs to utility vehicles, is well-positioned to capitalize on this trend.

In 2023, India's per capita disposable income saw a notable increase, contributing to a robust automotive market. For instance, reports indicated that by the end of 2024, a substantial portion of the Indian population would have higher discretionary spending capabilities, a key driver for vehicle sales.

- Rising Middle Class: India's middle class is expanding, with projections suggesting continued growth through 2025, fueling demand for aspirational purchases like cars.

- Enhanced Purchasing Power: Increased disposable income directly boosts the affordability of vehicles, encouraging first-time buyers and upgrades.

- Market Expansion: This socio-economic shift is driving overall market growth, creating opportunities for automotive manufacturers like Mahindra & Mahindra to expand their customer base.

Emphasis on Sustainable Transportation

Societal shifts are increasingly prioritizing eco-friendly mobility, a significant trend for Mahindra & Mahindra. This growing environmental consciousness directly fuels consumer interest in electric vehicles (EVs), a sector where Mahindra is actively investing and developing new products.

This emphasis on sustainability is not just a niche interest; it's becoming mainstream. For instance, global sales of electric cars are projected to reach over 13 million units in 2024, a substantial jump from previous years, indicating a strong market pull for cleaner transportation options.

Mahindra's strategic focus on EVs, including its recent investments and product launches in this segment, positions it well to capitalize on this evolving consumer preference. The company aims to launch several new electric SUVs and other vehicles in the coming years, aligning with this societal demand.

- Growing Environmental Awareness: Consumers are increasingly concerned about climate change and the environmental impact of their choices.

- Demand for EVs: This concern translates into a higher demand for electric vehicles, pushing manufacturers to innovate.

- Mahindra's EV Strategy: Mahindra is actively responding by investing heavily in EV technology and expanding its electric vehicle portfolio.

- Market Growth: The global EV market is experiencing rapid expansion, presenting significant opportunities for companies aligned with sustainability trends.

Mahindra & Mahindra is adapting to changing consumer preferences, with a notable rise in demand for SUVs in India, which constituted over 40% of the passenger vehicle market by 2024. Simultaneously, a growing environmental consciousness is driving a preference for sustainable products, particularly electric vehicles (EVs). This societal shift necessitates that manufacturers like Mahindra accelerate their investments in cleaner mobility solutions to meet evolving eco-friendly demands.

Technological factors

Mahindra & Mahindra is making substantial strides in electric vehicle (EV) technology. The company has committed to launching seven new battery electric vehicles by 2030, with the first models slated for release in 2025.

This strategic push involves significant investment in EV development, with Mahindra aiming to electrify more than 25% of its vehicle portfolio by the end of the decade. Furthermore, the company plans to boost its monthly EV production capacity to support these ambitious goals.

Mahindra & Mahindra's commitment to Research and Development is a cornerstone of its strategy to stay ahead in the competitive automotive and farm equipment sectors. The company understands that significant R&D investment is vital for innovation and maintaining market leadership.

To bolster its product development capabilities, Mahindra is actively upskilling its engineering talent. This includes training in cutting-edge fields like data science, artificial intelligence (AI), the Internet of Things (IoT), and mechatronics, ensuring their engineers are equipped to leverage advanced technologies in creating next-generation products.

Mahindra & Mahindra is actively embracing digital transformation and Industry 4.0, integrating advanced technologies to enhance operational efficiency and resilience. This strategic focus aims to streamline its supply chain and deepen customer engagement through digital platforms.

The company is investing in areas like AI and IoT to optimize manufacturing processes, as seen in its smart factory initiatives. For instance, Mahindra’s automotive sector reported a significant increase in digital integration for predictive maintenance and quality control in its 2024 operations, contributing to a projected 5% reduction in production downtime.

This digital push is crucial for staying competitive, allowing for faster product development cycles and more personalized customer experiences. By leveraging data analytics, Mahindra aims to gain deeper insights into market trends and consumer preferences, supporting its strategic growth objectives through 2025.

Advanced Driver-Assistance Systems (ADAS) and Connected Technologies

Mahindra is actively integrating Advanced Driver-Assistance Systems (ADAS) and connected technologies into its vehicle lineup, reflecting a commitment to future mobility. This push is evident in models like the XUV700, which already features Level 1 automation, enhancing driver safety and convenience. These advancements are crucial for staying competitive in a market increasingly demanding intelligent vehicle solutions.

The automotive industry is seeing significant growth in ADAS adoption, with the global market projected to reach over $70 billion by 2027, demonstrating a clear consumer and regulatory demand for these features. Mahindra's investment in this area, including features like adaptive cruise control and lane-keeping assist, positions them to capitalize on this trend. The company's focus on connected car technologies, enabling features like remote diagnostics and over-the-air updates, further strengthens its offering.

- ADAS Market Growth: The global ADAS market is expected to see substantial growth, driven by safety regulations and consumer preference for advanced features.

- Mahindra's Investment: Mahindra is investing heavily in R&D to embed sophisticated ADAS and connected car technologies into its new vehicle platforms.

- XUV700 Example: The XUV700 showcases Mahindra's capability in implementing Level 1 automation, a step towards more autonomous driving experiences.

- Connected Car Features: Integration of features like real-time traffic updates and remote vehicle monitoring enhances user experience and vehicle utility.

Battery Technology Advancements

Mahindra & Mahindra's electric vehicle (EV) ambitions are significantly shaped by ongoing advancements in battery technology. A key focus for the company is the adoption of cost-effective Lithium Iron Phosphate (LFP) battery chemistry. LFP batteries are gaining traction due to their improved safety, longer lifespan, and lower material costs compared to nickel-manganese-cobalt (NMC) alternatives, which directly impacts the affordability of EVs.

These technological shifts are crucial for Mahindra's competitive positioning in the rapidly evolving EV market. For instance, the global average cost of EV battery packs, which was around $1,100 per kWh in 2010, has seen a dramatic reduction, projected to fall below $100 per kWh in the coming years, making EVs more accessible.

Mahindra has strategically secured supply agreements to bolster its battery sourcing capabilities. A notable example is their partnership with Volkswagen, which includes securing electric components and battery cells. This collaboration aims to ensure a stable and cost-competitive supply chain for Mahindra's upcoming EV models, such as the XUV.e8 and BE.05.

The company's commitment to leveraging these technological factors is evident in its investment plans. Mahindra has committed billions of dollars to its EV division, with a significant portion allocated to battery technology and supply chain development, underscoring the critical role these advancements play in their long-term growth strategy.

Mahindra & Mahindra is heavily investing in electric vehicle (EV) technology, planning to launch seven new battery electric vehicles by 2030, with initial models expected in 2025.

The company aims to electrify over 25% of its vehicle portfolio by the end of the decade, boosting its monthly EV production capacity to meet these goals.

Mahindra is also integrating Advanced Driver-Assistance Systems (ADAS) and connected technologies, exemplified by the XUV700's Level 1 automation, to enhance safety and user experience.

The adoption of cost-effective Lithium Iron Phosphate (LFP) battery chemistry is a key strategy to improve EV affordability, supported by supply agreements like the one with Volkswagen for battery cells.

Legal factors

Mahindra & Mahindra's automotive operations hinge on strict adherence to evolving domestic and international regulations. In 2024, India's Bharat Stage VI (BS-VI) Phase 2 emission norms, for instance, require significant investment in cleaner engine technologies. Failure to meet these stringent safety and environmental standards, such as those set by the Global New Car Assessment Programme (GNCAP) for its export markets, can result in hefty penalties and restricted market access.

Mahindra & Mahindra faces increasing pressure from evolving emission standards globally, such as Euro 7 in Europe and Bharat Stage VI (BS-VI) Phase 2 in India. These regulations mandate significant reductions in pollutants like nitrogen oxides (NOx) and particulate matter (PM). For instance, BS-VI Phase 2, implemented in April 2023, requires on-board diagnostic systems to monitor emissions in real-time, forcing manufacturers to invest heavily in advanced engine technologies and exhaust after-treatment systems.

The company's commitment to sustainability means adapting its vehicle portfolio, particularly its SUV and commercial vehicle segments, to comply with these stricter norms. This involves research and development into cleaner combustion technologies, hybrid powertrains, and electric vehicle (EV) solutions. Mahindra's significant investment in its EV division, aiming for a substantial portion of its future sales to be electric, directly addresses these environmental legal factors.

Mahindra & Mahindra operates under stringent product liability laws, a crucial aspect of their PESTLE analysis. These regulations mandate that the company ensures the utmost safety and quality across its diverse range of vehicles and equipment, from tractors to SUVs. Failing to meet these standards can lead to significant legal repercussions and damage to brand reputation.

Adherence to these product liability laws is not just about avoiding penalties; it's fundamental to maintaining consumer trust. For instance, in 2023, the automotive industry globally saw a rise in recalls related to safety defects, underscoring the importance of robust quality control. Mahindra’s commitment to rigorous testing and compliance directly impacts its ability to retain customers and attract new ones in competitive markets.

Labor Laws and Employment Regulations

Mahindra & Mahindra, as a global employer with a workforce exceeding 260,000 people as of early 2024, navigates a complex web of labor laws and employment regulations across its various operating regions. These regulations dictate crucial aspects of the employment relationship, including minimum wages, working hours, health and safety standards, and employee benefits, all of which directly impact operational costs and human resource management strategies.

Compliance with these diverse legal frameworks is paramount to avoid penalties and maintain a positive employer brand. For instance, in India, the Code on Industrial Relations, 2020, consolidates various labor laws, aiming to streamline industrial dispute resolution and regulate employment conditions, a significant change for large enterprises like Mahindra.

The company's approach to union relations is also heavily influenced by legal stipulations, requiring adherence to collective bargaining processes and employee representation rights. Such legal considerations are critical for maintaining stable industrial relations and ensuring smooth operations, especially in a sector prone to labor-intensive manufacturing.

- Global Workforce: Mahindra & Mahindra employed over 260,000 individuals worldwide in early 2024, necessitating adherence to a multitude of national labor laws.

- Regulatory Compliance: Key areas of legal scrutiny include minimum wage laws, working condition standards, and occupational health and safety regulations in all operating countries.

- Industrial Relations: Laws governing trade unions and collective bargaining significantly shape Mahindra's employee relations strategies and operational stability.

- Legislative Changes: Recent legal reforms, such as India's Code on Industrial Relations, 2020, require continuous adaptation of employment practices.

Intellectual Property Rights (IPR)

Mahindra & Mahindra's ability to protect its intellectual property, encompassing patents, trademarks, and designs, is crucial for maintaining its competitive edge and fostering ongoing innovation. This legal framework safeguards the unique technologies and brand identity that differentiate its products in the automotive and agricultural sectors.

The company's commitment to respecting the intellectual property rights of other entities is equally important, preventing costly legal battles and ensuring ethical business practices. As of its latest filings, Mahindra & Mahindra actively manages a portfolio of patents related to its vehicle technologies and manufacturing processes, demonstrating a proactive approach to IP protection.

- Patents: Mahindra & Mahindra holds numerous patents globally, particularly in areas like electric vehicle technology and advanced powertrain systems, reflecting its investment in future mobility solutions.

- Trademarks: The iconic Mahindra logo and brand names are registered trademarks, essential for brand recognition and preventing counterfeiting across its diverse product lines.

- Designs: The unique styling and functional designs of its vehicles, from SUVs to tractors, are protected through design registrations, contributing to brand distinctiveness.

- Compliance: Adherence to international IP laws and regulations is paramount to avoid infringement claims and maintain a strong global market presence.

Mahindra & Mahindra's operations are significantly shaped by evolving environmental regulations, particularly emission standards like India's BS-VI Phase 2 and global norms such as Euro 7. These laws mandate cleaner technologies, driving substantial R&D investment in areas like EVs and hybrid powertrains to ensure compliance and market access.

Product liability laws are critical, requiring Mahindra to guarantee safety and quality across its diverse product range, from tractors to SUVs, to maintain consumer trust and avoid legal repercussions. Failure to meet these stringent standards, as seen with global recalls in 2023, can severely impact brand reputation and customer retention.

The company's extensive global workforce of over 260,000 employees in early 2024 necessitates strict adherence to varied labor laws, including minimum wage, working conditions, and health and safety standards. Adapting to legislative changes, such as India's Code on Industrial Relations, 2020, is vital for stable industrial relations and operational continuity.

Intellectual property laws are paramount for Mahindra to protect its innovations in EV technology and powertrain systems, safeguarding its competitive edge. Active management of its patent portfolio and adherence to international IP regulations are essential to prevent infringement claims and maintain its global market presence.

Environmental factors

Mahindra & Mahindra is actively addressing climate change, setting ambitious targets to achieve carbon neutrality by 2040. This includes a significant reduction in carbon intensity by 45% by 2030, demonstrating a clear commitment to environmental stewardship across its diverse operations.

The company's strategy involves a comprehensive approach to reducing its carbon footprint, encompassing everything from manufacturing processes to its extensive supply chain. This focus is crucial as global regulations and consumer expectations increasingly prioritize sustainable business practices.

Mahindra & Mahindra is actively engaged in waste management and recycling, notably through its joint venture, CERO. This initiative, recognized as India's first government-authorized vehicle recycler, is set to significantly expand its reach. By 2025, CERO plans to operate in over 100 cities across India, reinforcing the company's commitment to environmentally sound practices and the circular economy.

Mahindra & Mahindra is actively investing in renewable energy, aiming to bolster its environmental credentials and move towards a 'Planet Positive' future. This commitment is evident in their strategic focus on sustainable practices across their operations.

The company is a proponent of the shift towards green energy, actively developing a robust portfolio of eco-friendly products and services. For instance, in fiscal year 2024, Mahindra Electric saw a significant increase in its electric vehicle sales, contributing to the broader adoption of sustainable mobility solutions.

Resource Availability and Supply Chain Sustainability

Mahindra & Mahindra's automotive and farm equipment production is significantly influenced by the availability and cost of key raw materials like steel, aluminum, and semiconductors. Disruptions in these supply chains, as seen with semiconductor shortages impacting global auto production in 2021-2022, directly affect their manufacturing output and sales volumes. For instance, the automotive industry globally faced an estimated production loss of over 10 million vehicles in 2021 due to chip scarcity, a challenge Mahindra also navigated.

The company is actively addressing these environmental factors by prioritizing sustainable supply chain practices. This includes efforts to reduce waste, improve energy efficiency, and promote responsible sourcing of materials. Mahindra's commitment to a circular economy involves collaborating with suppliers and partners to explore recycling, remanufacturing, and the use of recycled content in their products.

Key initiatives and data points include:

- Focus on Recycled Content: Mahindra aims to increase the use of recycled materials in its vehicles, contributing to resource conservation and reduced environmental impact.

- Supplier Sustainability Audits: The company conducts regular audits of its suppliers to ensure adherence to environmental and social responsibility standards.

- Energy Efficiency in Manufacturing: Mahindra has set targets to reduce energy consumption across its manufacturing facilities, aiming for a lower carbon footprint. For example, by FY2023, they had already achieved significant reductions in energy intensity in their operations.

- Water Conservation: Efforts are in place to minimize water usage in production processes, particularly in water-stressed regions where their manufacturing plants are located.

Environmental Regulations and Compliance

Mahindra & Mahindra navigates a complex landscape of environmental regulations, particularly concerning emissions standards and pollution control. For instance, India's push towards stricter Bharat Stage VI (BS-VI) emission norms, implemented in April 2020, significantly influenced vehicle design and manufacturing, requiring substantial investment in cleaner engine technologies.

The company must also adhere to evolving global standards for vehicle recyclability and the use of sustainable materials. As of early 2024, discussions around extended producer responsibility (EPR) for automotive components are intensifying in India, potentially adding new compliance layers for manufacturers like Mahindra.

Key environmental compliance areas for Mahindra & Mahindra include:

- Emissions Standards: Meeting increasingly stringent BS-VI norms in India and comparable regulations in international markets.

- Pollution Control: Managing industrial emissions from manufacturing facilities and waste disposal in line with environmental protection acts.

- Resource Efficiency: Optimizing water usage and energy consumption in production processes, with a growing focus on renewable energy adoption.

- End-of-Life Vehicle (ELV) Management: Preparing for potential regulations around vehicle scrappage and material recycling, as seen in global trends.

Mahindra & Mahindra is actively pursuing carbon neutrality by 2040, aiming for a 45% reduction in carbon intensity by 2030, reflecting a strong commitment to environmental sustainability across its operations.

The company's strategic focus includes expanding CERO, its vehicle recycling joint venture, with plans to operate in over 100 Indian cities by 2025, underscoring its dedication to the circular economy and responsible waste management.

Mahindra is also investing heavily in renewable energy and eco-friendly products, evidenced by the significant growth in Mahindra Electric's EV sales in fiscal year 2024, aligning with the global shift towards sustainable mobility.

| Environmental Factor | Mahindra & Mahindra's Strategy/Action | Key Data/Target |

|---|---|---|

| Climate Change & Carbon Footprint | Achieve carbon neutrality by 2040; Reduce carbon intensity by 45% by 2030. | Carbon Neutrality by 2040; 45% Carbon Intensity Reduction by 2030. |

| Waste Management & Circular Economy | Expand CERO vehicle recycling venture. | CERO to operate in 100+ Indian cities by 2025. |

| Renewable Energy & Green Products | Invest in renewable energy; Develop eco-friendly products. | Increased EV sales for Mahindra Electric in FY2024. |

| Supply Chain Sustainability | Increase use of recycled materials; Conduct supplier audits. | Focus on resource conservation and reduced environmental impact. |

PESTLE Analysis Data Sources

Our Mahindra & Mahindra PESTLE analysis is meticulously crafted using data from reputable sources including government economic reports, industry-specific market research firms, and international financial institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the automotive and agricultural sectors.