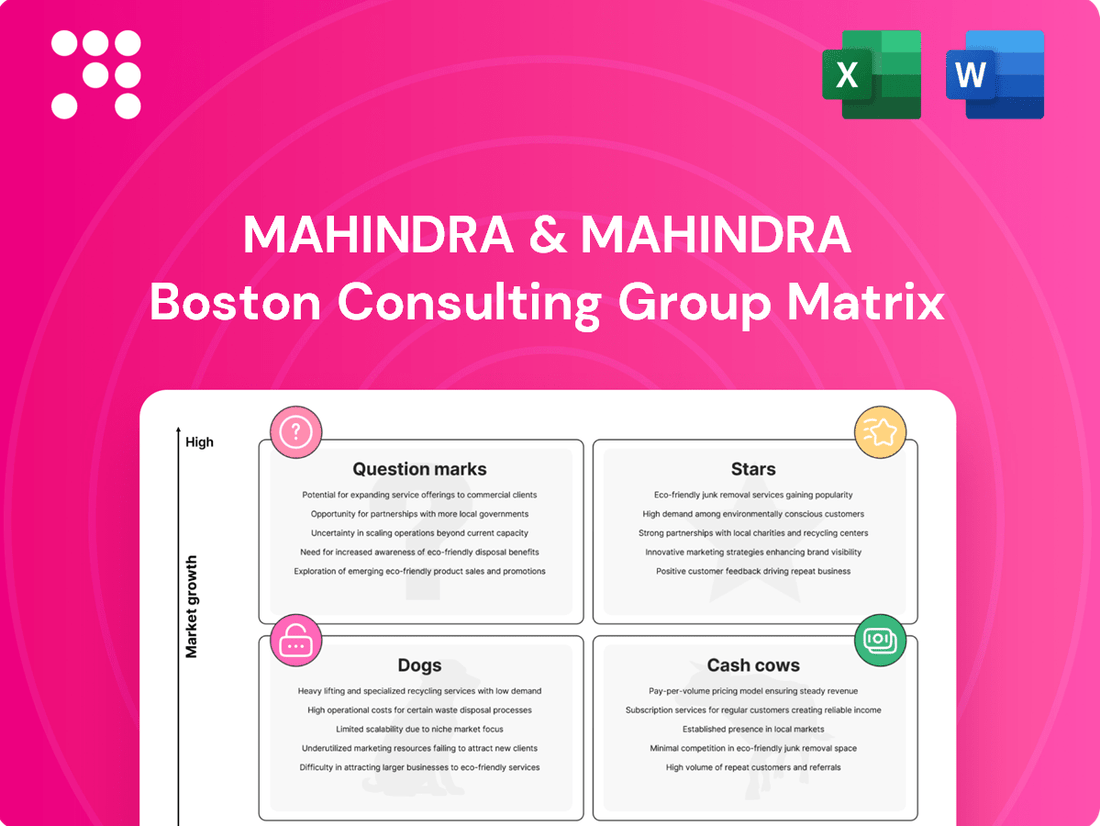

Mahindra & Mahindra Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mahindra & Mahindra Bundle

Mahindra & Mahindra's product portfolio is a dynamic landscape, with some segments likely shining as Stars and others acting as reliable Cash Cows. Understanding these positions is crucial for strategic growth.

This preview offers a glimpse into their market standing. Purchase the full BCG Matrix to unlock detailed quadrant placements and actionable insights that will guide your investment decisions and product development strategy.

Stars

Mahindra's SUV segment, featuring popular models like the Scorpio-N, Thar, XUV700, and the new XUV3XO, is a powerhouse for the company. This segment's performance is a key driver of Mahindra & Mahindra's overall success in the automotive market.

The company's dominance is evident as it became the second-largest carmaker by retail sales in April 2025, overtaking Hyundai. This surge is significantly fueled by its SUV offerings, which saw a strong 20% year-on-year growth in sales volumes for FY25 and an 18% increase in June 2025, underscoring their market appeal.

Mahindra is projecting a robust 15-19% growth in SUV sales for FY25, a pace that outstrips industry expectations. Crucially, the company has solidified its standing as the number one SUV player when measured by revenue, showcasing the profitable nature of its SUV strategy.

Mahindra's 'Born Electric' (BE) SUVs, including models like the BE.06 and the XEV 9E, alongside the XUV3XO, are fueling substantial expansion in the electric vehicle sector. The company experienced an impressive 338% increase in EV sales year-over-year in May 2025, reaching a 21.3% market share and securing its position as India's third-largest EV manufacturer.

Further demonstrating this upward trajectory, June 2025 saw EV registrations skyrocket by 512% compared to the previous year, propelling Mahindra's EV market share to 22.9%. This segment, characterized by its rapid growth and strategic significance for the company, is classified as a Star within the BCG matrix.

Mahindra's Light Commercial Vehicle (LCV) segment under 3.5 tons is a clear star in its BCG matrix. The company commanded an impressive 47.5% market share in Q4 FY24, a figure that is projected to surpass 50% in FY25, showcasing its dominant position.

This segment's growth is fueled by a strong customer value proposition, making it a consistent contributor to Mahindra's automotive revenue and overall profitability. The sustained high market share and anticipated continued expansion solidify its status as a star performer.

Farm Machinery Segment

Mahindra & Mahindra's Farm Machinery segment is a clear Star in its BCG Matrix. This is driven by impressive financial performance, with revenue jumping 44% in Q4 FY24 and a substantial 32% for the entire FY24. This segment's strong growth trajectory is further solidified by its position as the second-largest player in the Rotavator market, demonstrating its influence beyond tractor sales.

The segment's success highlights Mahindra's strategic advantage in the agricultural equipment sector. Its ability to achieve such high growth rates in a vital industry like agriculture strongly suggests it will continue to be a significant revenue generator and market leader for the company.

- Robust Revenue Growth: Q4 FY24 saw a 44% increase, with full FY24 revenue up 32%.

- Market Leadership: Second-largest player in the Rotavator market.

- Strategic Importance: Contributes to overall market leadership in farm equipment.

- Star Classification: High growth in a key sector positions it as a Star.

Overall Automotive Business Growth

Mahindra & Mahindra's automotive sector is a shining example of robust growth, positioning it firmly as a Star in the BCG Matrix. The company saw its consolidated Q4 FY24 revenue surge by an impressive 22% compared to the previous year. This strong momentum carried through to the full fiscal year 2025, where automotive consolidated revenue climbed 19% to reach INR 90,825 crore.

This significant revenue increase is a testament to strong volume gains and favorable margin expansion within the automotive segment. The company's profit after tax (PAT) for the Auto segment in Q4 FY24 witnessed a remarkable threefold increase, underscoring the sector's exceptional performance and its substantial contribution to Mahindra & Mahindra's overall financial health.

- Automotive Sector Performance: Consolidated Q4 FY24 revenue up 22% year-on-year.

- Full Year FY25 Growth: Automotive consolidated revenue rose 19% to INR 90,825 crore.

- Profitability: Consolidated Q4 PAT for the Auto segment increased threefold.

- Key Drivers: Robust volume gains and margin expansion fueled this growth.

Mahindra's electric vehicle (EV) offerings, including the BE.06 and XEV 9E, are experiencing rapid expansion, classifying them as Stars in the BCG matrix. The company saw a 338% year-over-year increase in EV sales in May 2025, capturing a 21.3% market share and becoming India's third-largest EV manufacturer. This momentum continued into June 2025, with EV registrations growing by 512% year-on-year, boosting Mahindra's EV market share to 22.9%.

| Segment | BCG Classification | Key Growth Metric | Data Point | Period |

| Electric Vehicles (EVs) | Star | Year-on-Year Sales Growth | 338% | May 2025 |

| Electric Vehicles (EVs) | Star | Year-on-Year Registration Growth | 512% | June 2025 |

| Electric Vehicles (EVs) | Star | Market Share | 22.9% | June 2025 |

What is included in the product

The Mahindra & Mahindra BCG Matrix analyzes its business units, highlighting which units to invest in, hold, or divest.

Mahindra & Mahindra's BCG Matrix provides a clear, actionable overview of its portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Mahindra's domestic tractor business is a prime example of a Cash Cow. The company commands a significant portion of the Indian market, holding 42% share in CY2024 and 41.6% in FY24, solidifying its leadership by volume globally.

Even with a modest 2.5% growth in the overall tractor market for CY2024, Mahindra managed to expand its market share. This resilience underscores the business's strong, established presence and its ability to consistently generate substantial profits and cash flow, making it a dependable pillar for the company.

Mahindra Finance stands as a dominant force in tractor financing and a top five Non-Banking Financial Company (NBFC) for a broad spectrum of vehicle loans, encompassing three-wheelers, passenger cars, and commercial vehicles. This strong market position allows it to consistently generate substantial cash flow.

In the fiscal year 2025, Mahindra Finance demonstrated robust financial performance with a 17% year-on-year revenue growth and a healthy profit after tax. Furthermore, the company achieved a significant improvement in its asset quality, reporting record low Stage 3 assets, indicating strong credit management and a stable cash-generating capability.

The Mahindra Bolero, a stalwart in the utility vehicle segment, remains a cornerstone of Mahindra & Mahindra's SUV portfolio. In fiscal year 2023-24, the Bolero Neo and Bolero Classic together sold over 100,000 units, demonstrating its persistent appeal and robust sales performance.

While not the fastest-growing segment, the Bolero's established presence, particularly in rural and semi-urban areas, ensures a predictable and substantial revenue stream. This consistent demand, coupled with mature product lifecycle and minimal R&D needs, translates into strong, stable cash flow for the company with limited reinvestment requirements.

Aftermarket Parts and Services

Mahindra & Mahindra's aftermarket parts and services division is a clear Cash Cow. With its extensive fleet of tractors, SUVs, and commercial vehicles in India, this segment benefits from a large, established customer base.

This division generates consistent, recurring revenue through the sale of spare parts and ongoing maintenance and repair services. These operations typically require minimal new investment and have lower marketing expenses compared to new vehicle sales, contributing significantly to Mahindra's overall profitability.

- Mature Market: Leverages a vast installed base of vehicles, ensuring consistent demand for parts and services.

- Recurring Revenue: Generates stable income from routine maintenance, repairs, and replacement parts.

- High Profitability: Benefits from lower marketing and development costs relative to new product lines.

Manufacturing and Production Infrastructure

Mahindra & Mahindra's manufacturing and production infrastructure is a prime example of a Cash Cow. Its extensive network of advanced manufacturing facilities, particularly in the automotive and farm equipment sectors, consistently churns out high-demand products. These operations benefit from ongoing investments in Industry 4.0 technologies, ensuring efficient, large-scale production that translates into robust profit margins and a steady stream of cash.

The company's commitment to operational excellence within its manufacturing base provides a significant competitive advantage. This efficiency, coupled with existing production capacity, makes the infrastructure a foundational element supporting Mahindra's leading products. For instance, in FY24, Mahindra's automotive segment reported a strong operational performance, contributing significantly to overall profitability.

- Established Manufacturing Footprint: Mahindra operates numerous state-of-the-art manufacturing plants across India and globally.

- Industry 4.0 Integration: Continuous adoption of smart manufacturing, automation, and data analytics enhances production efficiency.

- High Profit Margins: Optimized production processes and economies of scale lead to superior profitability from mature product lines.

- Consistent Cash Generation: The reliable output and market leadership of its core products ensure a stable cash flow for the company.

Mahindra's domestic tractor business is a prime example of a Cash Cow, holding a significant 42% market share in CY2024 and 41.6% in FY24. Despite modest overall market growth, Mahindra expanded its share, demonstrating the business's established strength and consistent cash generation.

Mahindra Finance, a top NBFC, also acts as a Cash Cow, generating substantial cash flow from tractor and vehicle financing. In FY25, it reported 17% revenue growth and improved asset quality, showcasing stable, profitable operations.

The Mahindra Bolero, a consistent performer in the utility vehicle segment, sold over 100,000 units in FY23-24. Its predictable revenue stream and low reinvestment needs make it a reliable cash generator.

Mahindra's aftermarket parts and services division is another key Cash Cow, leveraging a vast installed base for recurring revenue from maintenance and parts sales with minimal new investment.

Mahindra's manufacturing infrastructure, integrating Industry 4.0, ensures efficient production of high-demand products, leading to robust margins and consistent cash flow, as evidenced by strong operational performance in the automotive segment in FY24.

| Mahindra & Mahindra Cash Cow Examples | Market Share (CY2024) | FY25 Performance Highlights | FY23-24 Sales Volume | Key Cash Flow Driver |

|---|---|---|---|---|

| Domestic Tractor Business | 42% | Market share expansion | N/A | Established market leadership |

| Mahindra Finance | N/A (Top 5 NBFC) | 17% revenue growth, improved asset quality | N/A | Dominant position in vehicle financing |

| Mahindra Bolero | N/A (Segment Leader) | N/A | >100,000 units | Predictable revenue, low reinvestment |

| Aftermarket Parts & Services | N/A | Consistent recurring revenue | N/A | Large installed vehicle base |

| Manufacturing Infrastructure | N/A | Strong operational performance (Automotive FY24) | N/A | Efficient production, economies of scale |

What You’re Viewing Is Included

Mahindra & Mahindra BCG Matrix

The Mahindra & Mahindra BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing Mahindra's product portfolio within the BCG framework, is ready for immediate strategic application. You can confidently expect the same high-quality, watermark-free document, empowering your business planning and decision-making processes without any further modification needed.

Dogs

Mahindra & Mahindra's presence in the two-wheeler segment is quite modest when set against its larger automotive and farm equipment divisions. Recent reports and market share figures offer little in the way of positive traction for this segment.

This suggests a small slice of a very crowded and established market, where competition is fierce. The absence of substantial recent investment or notable growth further solidifies its standing here.

Consequently, the two-wheeler business is categorized as a Dog in the BCG Matrix. It's likely contributing minimally to overall returns and might be a candidate for divestment or a significant strategic overhaul.

Within Mahindra & Mahindra's commercial vehicle lineup, specific older or niche heavy truck and bus models could be considered Dogs. These segments often grapple with intense competition and dwindling demand, leading to a low market share and minimal growth. For instance, while M&M has seen strong performance in its Light Commercial Vehicles (LCV) segment, older heavy-duty truck platforms might struggle to gain traction against newer, more fuel-efficient competitors.

These underperforming models might operate at a break-even point or even consume cash without generating substantial returns. The market dynamics for these specific heavy vehicle segments, particularly those not aligned with current emission standards or advanced technology trends, suggest limited potential for significant turnaround through further investment. This contrasts with M&M's strategic focus on expanding its presence in more dynamic and profitable LCV categories.

Mahindra & Mahindra's farm business initiated a strategic reset in two international markets during FY25, incurring a one-time financial impact. This move indicates that these specific international operations may be classified as 'Dogs' within the BCG matrix, characterized by low market share and limited growth potential.

The financial impact from this reset highlights the challenges these markets presented, potentially draining resources without generating sufficient returns. For instance, if these markets represent a small fraction of the company's overall international revenue, which stood at approximately INR 10,000 crore in FY24, the decision to restructure or divest could be a prudent step towards optimizing capital allocation.

Legacy IT Services within Tech Mahindra

Legacy IT services within Tech Mahindra, while potentially still generating revenue, likely represent a category facing challenges. These services, often tied to older technologies, may be experiencing slower growth or even decline as the market shifts towards newer, more innovative solutions. This can lead to a situation where resources are tied up in maintaining these offerings without significant future potential, fitting the description of a cash trap.

The pressure on Tech Mahindra, as indicated by a cautious outlook and headcount reductions, could be partly attributed to the need to manage or divest from these less dynamic service lines. For instance, if a significant portion of their revenue comes from maintaining mainframe systems or older ERP implementations, these areas might represent the ‘Dogs’ in the BCG matrix. Such services require ongoing investment for support and maintenance, but their market share in rapidly evolving IT landscapes might be shrinking, offering diminishing returns.

Considering the broader IT services market in 2024, many companies are focusing on digital transformation, cloud migration, AI, and cybersecurity. Services that do not align with these growth areas are likely to be categorized as Dogs. While specific figures for Tech Mahindra’s legacy services as a distinct ‘Dog’ category aren’t publicly broken down in this manner, the industry trend suggests that companies are actively trying to shed or re-skill away from such offerings to focus on higher-growth segments.

- Diminishing Demand: Legacy IT services often face declining demand as businesses adopt modern, cloud-native solutions.

- Resource Drain: These services can consume significant resources for maintenance and support, diverting funds from innovation.

- Low Growth Potential: The market for older technologies typically exhibits low or negative growth rates.

- Competitive Pressure: Mature, legacy segments are often highly competitive with price-sensitive customers.

Divested or Non-Core Small Businesses

Mahindra & Mahindra, like many large conglomerates, may strategically divest or reduce focus on smaller, non-core businesses. These operations often possess limited market share and face low growth prospects, making them candidates for the Divested or Non-Core category within a BCG Matrix analysis. While specific recent disclosures on such divestitures are not always prominent, the strategic rationale for managing a diverse portfolio often involves pruning these less impactful units.

These businesses, if present, would typically exhibit characteristics of low relative market share and operate in industries with minimal growth potential. Their divestment or scaling down allows the parent company to reallocate resources towards more promising ventures. For instance, a conglomerate might sell off a small manufacturing unit producing a niche product with declining demand to invest more heavily in its burgeoning electric vehicle division.

- Strategic Alignment: Businesses divested or deemed non-core often no longer align with the parent company's long-term strategic vision or core competencies.

- Resource Allocation: Divesting these units frees up capital, management attention, and other resources that can be channeled into high-growth areas, such as Mahindra's significant investments in electric mobility and renewable energy.

- Portfolio Optimization: This process is a key aspect of portfolio management, aiming to create a more focused and profitable business structure.

Mahindra & Mahindra's two-wheeler segment is a prime example of a 'Dog' in the BCG Matrix. Despite being part of a larger automotive conglomerate, this division struggles with a low market share in a highly competitive landscape. Recent performance data indicates a lack of significant growth, suggesting it consumes resources without generating substantial returns.

Older heavy truck and bus models within Mahindra's commercial vehicle lineup also fit the 'Dog' profile. These segments face intense competition from newer, more efficient vehicles, resulting in low market share and minimal growth potential. Such units may operate at break-even, diverting capital from more promising ventures like the company's successful LCV segment.

Specific international farm operations initiated for a strategic reset in FY25 are likely 'Dogs'. These markets, characterized by low share and limited growth, incurred a one-time financial impact, underscoring their challenges. For context, Mahindra's overall international revenue was around INR 10,000 crore in FY24, making the decision to restructure these underperforming units a strategic move for capital optimization.

Legacy IT services within Tech Mahindra are also categorized as 'Dogs'. These services, often tied to outdated technologies, face declining demand and slower growth as the market shifts to newer solutions. This requires ongoing investment for maintenance without significant future potential, fitting the description of a cash trap, especially in the context of 2024's IT market focus on digital transformation and AI.

| Business Segment | BCG Category | Market Share | Growth Rate | Strategic Implication |

| Two-Wheelers | Dog | Low | Low/Negative | Divestment or significant overhaul |

| Older Heavy Trucks/Buses | Dog | Low | Low | Focus on niche markets or divestment |

| Specific International Farm Markets (FY25 Reset) | Dog | Low | Low | Restructuring or divestment |

| Legacy IT Services (Tech Mahindra) | Dog | Low | Low/Declining | Re-skilling or divestment |

Question Marks

Mahindra Last Mile Mobility (LMM) stands as the undisputed leader in the electric 3-wheeler segment, commanding an impressive 58.7% market share. This segment has experienced a remarkable fourfold increase in volume over the past two years, highlighting its status as a high-growth market.

While LMM's electric 3-wheelers demonstrate significant growth potential, their overall revenue contribution might still be lower compared to Mahindra's more established automotive divisions. Continued investment is crucial to maintain its leading position and further scale operations in this dynamic EV landscape.

Mahindra Susten's move into hybrid renewable energy projects, like their 150 MW wind-solar plant with a ₹12 billion investment, signals an entry into a rapidly expanding, high-growth sector. This strategic pivot positions them to capitalize on the increasing demand for integrated renewable solutions.

While the broader renewable energy market is robust, these specific hybrid projects are considered new ventures for Mahindra Susten. They require substantial capital outlay for development and construction, characteristic of businesses in their early growth phases.

These hybrid projects have the potential to evolve into Stars within the BCG matrix. Success hinges on their ability to capture significant market share and achieve profitability in this emerging segment of the renewable energy landscape.

Mahindra Logistics' B2B Express and Last-Mile Delivery segment operates within a high-growth sector, with the company aiming for aggressive revenue expansion, targeting ₹10,000 crore by FY26 and a threefold increase by FY30.

Despite the sector's potential, Mahindra Logistics incurred a net loss in FY25, signifying that the business currently consumes more cash than it generates. This financial profile, coupled with the need for significant investment to gain market share and achieve profitability in a competitive environment, positions this segment as a Question Mark in the BCG Matrix.

New Technology Integration (e.g., ADAS in SUVs)

Mahindra's integration of Advanced Driver Assistance Systems (ADAS), such as Level 2 capabilities in the Scorpio-N, represents a strategic move into a high-potential automotive segment. This investment signals a commitment to future-proofing its product line and capturing market share in an evolving automotive landscape.

- ADAS Market Growth: The global ADAS market was valued at approximately USD 25.5 billion in 2023 and is projected to reach USD 70.8 billion by 2030, growing at a CAGR of 15.7%.

- Mahindra's ADAS Adoption: While specific revenue figures for ADAS in Mahindra's portfolio are not yet segmented, the technology's inclusion in key models like the Scorpio-N indicates a nascent but growing contribution.

- R&D Investment: Continuous investment in ADAS technology is crucial for Mahindra to maintain competitiveness and drive adoption, positioning it as a Question Mark requiring significant market traction to become a Star.

Emerging Digital and AI Initiatives within Tech Mahindra

Tech Mahindra is actively channeling investments into digital transformation and AI-driven decision-making capabilities. These ventures, while positioned in high-growth segments of the IT services sector, may currently represent nascent offerings with limited market penetration, necessitating substantial capital infusion for their maturation and client acceptance.

- Digital Transformation Investments: Tech Mahindra's focus on digital transformation includes areas like cloud, cybersecurity, and data analytics, aiming to capture a larger share of the rapidly expanding digital services market.

- AI-Based Solutions: The company is developing and deploying AI solutions across various industries, from customer experience enhancement to operational efficiency, targeting a future where AI is integral to business operations.

- Market Position: While these initiatives are in early stages and may exhibit lower current market share, they are strategically positioned to capitalize on future market trends, with the potential to evolve into Stars within the BCG matrix if they achieve significant market traction and profitability.

- Financial Commitment: Significant R&D expenditure and go-to-market strategies are in place to support the growth of these emerging digital and AI offerings, reflecting the company's commitment to innovation and future revenue streams.

Mahindra Logistics' B2B Express and Last-Mile Delivery segment, despite its high-growth sector, incurred a net loss in FY25, indicating it's a cash consumer. This, coupled with the need for investment to gain market share and achieve profitability in a competitive landscape, firmly places it as a Question Mark.

Tech Mahindra's investments in digital transformation and AI-driven solutions are in high-growth IT segments but are nascent offerings. They require substantial capital for maturation and client acceptance, positioning them as Question Marks with potential to become Stars if they gain market traction.

Mahindra's integration of ADAS, like Level 2 capabilities in the Scorpio-N, is a strategic move into a high-potential automotive segment. Continuous R&D investment is crucial for competitiveness and adoption, making ADAS a Question Mark needing significant market traction to become a Star.

BCG Matrix Data Sources

Our BCG Matrix leverages Mahindra & Mahindra's annual reports, market share data from industry research firms, and macroeconomic forecasts to provide a comprehensive view of its product portfolio.