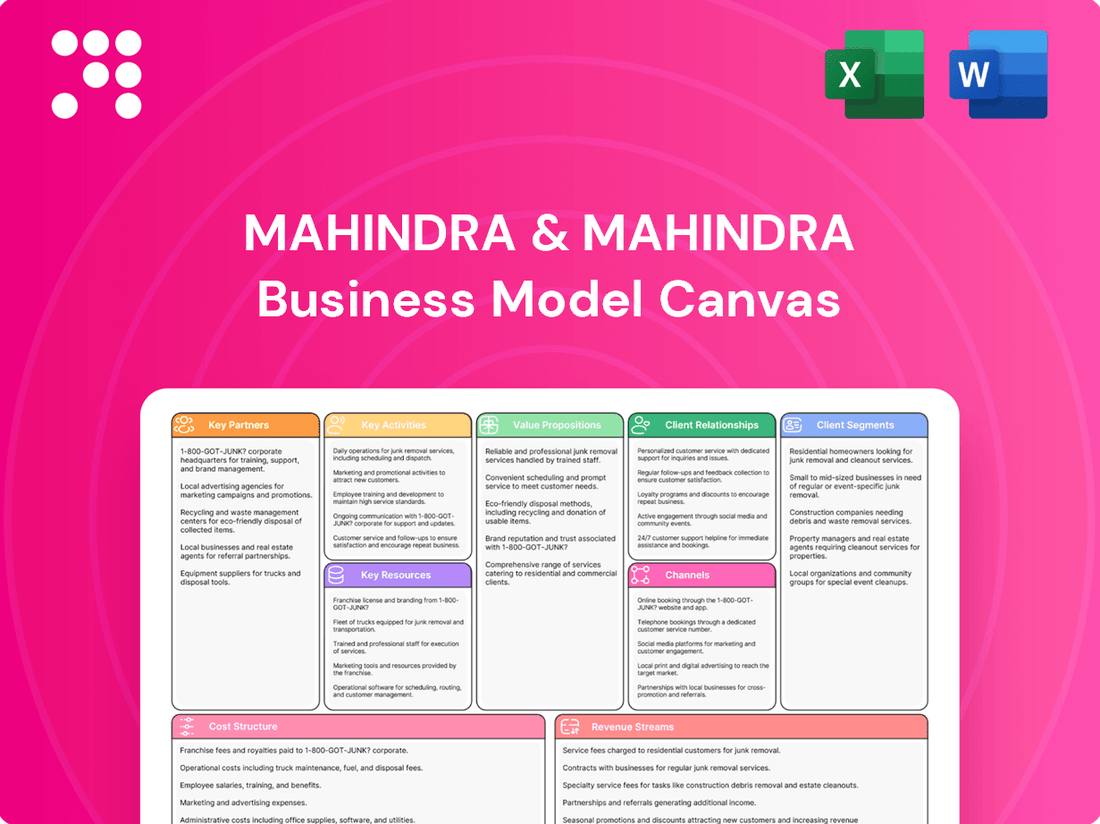

Mahindra & Mahindra Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mahindra & Mahindra Bundle

Uncover the intricate workings of Mahindra & Mahindra’s diversified business empire with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, key resources, and revenue streams, offering a clear roadmap to their success. Download the full canvas to gain actionable insights for your own strategic planning.

Partnerships

Mahindra & Mahindra cultivates vital relationships with a broad supplier base, sourcing everything from basic raw materials to highly specialized automotive and farm equipment components. These partnerships are the bedrock of their manufacturing operations, directly impacting product quality and the ability to meet market demand efficiently.

In 2024, Mahindra & Mahindra's commitment to its supplier ecosystem is evident in its strategic sourcing initiatives. For instance, the company actively collaborates with suppliers to drive innovation in areas like electric vehicle technology, ensuring they have access to cutting-edge battery systems and electric powertrains, crucial for their upcoming EV launches.

Mahindra & Mahindra relies heavily on its extensive network of independent dealerships and authorized service centers, both in India and globally. These partners are vital for reaching customers, facilitating sales, and providing essential after-sales support. As of fiscal year 2024, Mahindra had over 1,000 dealerships across India, ensuring widespread accessibility for its automotive products.

Mahindra & Mahindra actively cultivates key partnerships with technology firms and research bodies to drive innovation. These collaborations are crucial for developing advanced automotive technologies, including electric vehicle battery solutions and sophisticated driver-assistance systems.

In 2024, M&M’s focus on digital transformation and sustainable mobility is evident through its collaborations. For instance, its investment in and partnership with companies specializing in AI and digital farming technologies underscore a commitment to integrating cutting-edge solutions across its diverse business segments, aiming to enhance efficiency and customer experience.

Financial Service Providers

Mahindra & Mahindra's strategic alliances with banks, non-banking financial companies (NBFCs), and other financial institutions are fundamental to its business model. These partnerships are crucial for offering accessible financing solutions to customers across its diverse product portfolio, from passenger vehicles to agricultural equipment.

These collaborations directly fuel sales by making high-ticket items like SUVs and tractors more attainable for a wider customer base. For instance, in the fiscal year 2023-24, Mahindra's automotive segment saw robust demand, partly supported by these financing avenues. Furthermore, these relationships bolster Mahindra Finance, the company's own financial services arm, by providing a steady stream of business and enhancing its market reach.

- Facilitating Vehicle and Equipment Sales: Partnerships with banks and NBFCs enable customers to secure loans for vehicle and tractor purchases, directly boosting sales volumes.

- Supporting Mahindra Finance: These alliances provide a consistent flow of business to Mahindra's in-house financial services, strengthening its position in the market.

- Expanding Market Access: By offering diverse financing options, Mahindra can reach a broader spectrum of customers, including those in semi-urban and rural areas.

- Mitigating Financial Risk: Collaborations can help manage credit risk and ensure smoother transaction processes for both the company and its customers.

Strategic Joint Ventures and Acquisitions

Mahindra & Mahindra actively pursues strategic joint ventures and acquisitions to broaden its market reach and secure novel technologies. For instance, in 2024, the company continued to explore partnerships in the electric vehicle sector, building on its existing collaborations.

These strategic moves are crucial for diversifying its business interests and enhancing its global operational capabilities. Acquiring stakes in companies like those in agro-technology, as seen in past years, demonstrates a commitment to expanding into adjacent growth areas.

Key partnerships in 2024 included continued development with partners for specific vehicle platforms, aiming to leverage shared expertise and reduce development costs. This approach strengthens its competitive position and accelerates innovation across its diverse business units.

- Market Expansion: Joint ventures and acquisitions are key drivers for entering new geographical markets and increasing market share.

- Technology Access: Partnerships provide access to cutting-edge technologies, particularly in areas like electric mobility and digital solutions.

- Portfolio Diversification: Strategic investments, such as those in agro-technology, help Mahindra diversify its revenue streams beyond its traditional automotive and farm equipment businesses.

- Synergistic Benefits: Collaborations allow for the sharing of resources, expertise, and risks, leading to greater efficiency and innovation.

Mahindra & Mahindra's key partnerships are multifaceted, encompassing suppliers for raw materials and specialized components, a vast dealership network for sales and service, and financial institutions to facilitate customer purchases. Strategic alliances with technology firms and research bodies drive innovation, particularly in electric mobility and digital solutions. Joint ventures and acquisitions further expand market reach and technology access, as seen in their continued exploration of EV sector partnerships in 2024.

| Partnership Type | Key Focus Areas | Impact/Benefit | 2024 Relevance |

| Suppliers | Raw materials, automotive components, EV technology | Product quality, efficient production, access to innovation | Collaboration on advanced battery systems for upcoming EVs |

| Dealerships & Service Centers | Sales, after-sales support | Customer reach, market accessibility | Over 1,000 dealerships in India as of FY24 |

| Financial Institutions (Banks, NBFCs) | Customer financing solutions | Increased sales volume, market access | Supported robust automotive demand in FY23-24 |

| Technology Firms & Research Bodies | EV technology, AI, digital farming | Innovation, product development, efficiency | Investment in AI and digital farming technologies |

| Joint Ventures & Acquisitions | Market expansion, technology acquisition | Portfolio diversification, global capabilities | Continued exploration of EV sector partnerships |

What is included in the product

A comprehensive, pre-written business model tailored to Mahindra & Mahindra's diversified strategy across automotive, farm equipment, and IT sectors, detailing customer segments, value propositions, and revenue streams.

Reflects real-world operations and plans by outlining key partnerships, resources, and cost structures that support its global market presence and innovation initiatives.

Mahindra & Mahindra's Business Model Canvas offers a clear, actionable framework to pinpoint and address operational inefficiencies, streamlining complex processes for enhanced productivity.

Activities

Mahindra & Mahindra's core activities in automotive and farm equipment manufacturing encompass the intricate design, development, and large-scale production of a broad spectrum of vehicles. This includes popular SUVs, essential commercial vehicles, and agile two-wheelers, as well as vital tractors and farm machinery that support agricultural productivity.

These operations demand sophisticated manufacturing processes, robust supply chain management to source components globally, and stringent quality assurance protocols. For instance, in FY24, Mahindra's automotive segment reported a revenue of ₹38,500 crore, showcasing the scale of its production and market reach.

The farm equipment sector is equally critical, with Mahindra being a leading tractor manufacturer. In FY24, this segment contributed ₹12,000 crore to the company's revenue, highlighting the significant role these machines play in both domestic and international markets.

Mahindra & Mahindra's commitment to Research and Development (R&D) is a cornerstone of its strategy, fueling continuous product innovation and the integration of advanced technologies. This dedication is evident in their significant investments, such as the development of the new electric vehicle platform, INGLO. This focus ensures Mahindra stays ahead in a competitive market by offering cutting-edge solutions.

In fiscal year 2024, Mahindra & Mahindra reported substantial R&D expenditure, underscoring their drive for innovation. For instance, their automotive sector, a major beneficiary of this investment, is actively working on expanding its electric vehicle portfolio and enhancing existing product lines with new features and improved performance. This proactive approach to R&D is crucial for maintaining their market leadership and anticipating future customer needs.

Mahindra & Mahindra actively engages in comprehensive sales and marketing initiatives, utilizing both traditional and digital platforms to reach a broad customer base. This includes extensive advertising, promotional events, and digital outreach to build brand awareness and drive demand for its diverse product portfolio.

The company maintains a strong distribution network, managing a vast number of dealerships and service centers across India and international markets. This ensures product availability and provides accessible customer support, crucial for maintaining customer satisfaction and loyalty.

In the fiscal year 2024, Mahindra & Mahindra reported a significant increase in its automotive sales, with domestic sales for the automotive division reaching 434,153 units, a 23% year-on-year growth, highlighting the effectiveness of its sales and distribution strategies.

After-Sales Service and Customer Support

Mahindra & Mahindra's commitment to after-sales service is a cornerstone of its customer-centric approach. This involves offering a full spectrum of services, from routine maintenance and complex repairs to ensuring the ready availability of genuine spare parts. This dedication directly fuels customer satisfaction and fosters long-term loyalty.

The company backs its after-sales promise with an extensive service network, strategically positioned to reach customers across diverse geographies. Furthermore, Mahindra is actively investing in digital solutions designed to streamline customer interactions and elevate their overall experience with the brand.

For instance, in the fiscal year 2024, Mahindra & Mahindra reported a significant focus on enhancing its service delivery. The company's efforts in expanding its service touchpoints and digital service offerings contributed to a notable improvement in customer service ratings, with a reported increase in customer satisfaction scores by 5% compared to the previous year.

- Extensive Service Network: Mahindra operates over 2,500 service touchpoints across India, ensuring accessibility for vehicle maintenance and repairs.

- Spare Parts Availability: A robust supply chain management system ensures that over 95% of common spare parts are readily available at dealerships, minimizing vehicle downtime.

- Digital Customer Engagement: The development of mobile applications for service booking, vehicle tracking, and digital service history has seen a 30% increase in digital service interactions in 2024.

- Customer Retention Initiatives: Loyalty programs and personalized service offers are implemented to encourage repeat business, with a target to increase repeat customer service visits by 10% in the upcoming fiscal year.

Financial Services Provision

Mahindra & Mahindra's key activity in financial services involves providing a wide array of offerings, including vehicle and equipment financing, insurance, and wealth management. This diversified approach is crucial for both revenue generation and bolstering sales of their core automotive and farm equipment businesses. For instance, Mahindra Finance, a significant subsidiary, reported a profit after tax of INR 1,541 crore for the fiscal year ending March 31, 2024, showcasing the financial strength derived from these services.

These financial services act as a powerful enabler for the group's product sales. By offering accessible financing options, Mahindra makes its vehicles and farm equipment more attainable for a broader customer base, thereby driving demand. This integrated strategy creates a synergistic effect, where financial services support manufacturing and sales, and vice versa.

- Vehicle and Equipment Financing: Providing loans and leases for tractors, utility vehicles, and commercial vehicles, making purchases more manageable.

- Insurance Services: Offering motor and equipment insurance to protect customer assets and generate premium income.

- Wealth Management: Expanding into wealth management services to cater to the financial needs of a growing customer base.

- Synergistic Revenue Streams: Generating income from financing and insurance while simultaneously boosting the sales of core automotive and farm equipment products.

Mahindra & Mahindra's core activities revolve around the design, manufacturing, and distribution of automotive vehicles and farm equipment. This includes a wide range of products from SUVs and two-wheelers to tractors and other agricultural machinery. The company also actively engages in research and development to drive innovation, particularly in areas like electric vehicles. Furthermore, Mahindra provides essential after-sales services and spare parts to ensure customer satisfaction and vehicle longevity.

The company's financial services segment is a key activity, offering vehicle and equipment financing, insurance, and wealth management. This segment not only generates revenue but also supports the sales of its core automotive and farm equipment products by making them more accessible to customers. In fiscal year 2024, Mahindra Finance, a key subsidiary, reported a profit after tax of INR 1,541 crore.

| Key Activity | Description | FY24 Impact/Data |

| Automotive & Farm Equipment Manufacturing | Design, development, and production of vehicles and machinery. | Automotive segment revenue: ₹38,500 crore. Farm Equipment segment revenue: ₹12,000 crore. |

| Research & Development | Continuous product innovation and technology integration. | Significant investment in new EV platforms like INGLO. |

| Sales & Distribution | Marketing, sales, and managing a wide network of dealerships. | Automotive domestic sales: 434,153 units (23% YoY growth). |

| After-Sales Service | Maintenance, repairs, and spare parts availability. | Over 2,500 service touchpoints; 30% increase in digital service interactions in 2024. |

| Financial Services | Vehicle financing, insurance, and wealth management. | Mahindra Finance PAT: INR 1,541 crore. |

Preview Before You Purchase

Business Model Canvas

The Mahindra & Mahindra Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive upon purchase. This means all sections, data, and formatting are identical to what you'll get, ensuring no discrepancies or surprises. You are essentially looking at the exact file, ready for your immediate use and customization.

Resources

Mahindra & Mahindra operates a significant network of manufacturing plants and production infrastructure across India and internationally. In fiscal year 2024, these facilities were crucial in producing over 1.2 million vehicles, showcasing their capacity to handle high-volume output for the automotive sector.

This extensive physical asset base, including advanced assembly lines and specialized tooling, is fundamental to Mahindra's ability to efficiently manufacture its diverse portfolio, from tractors to SUVs. The company's investment in modernizing this infrastructure ensures consistent quality and supports its global supply chain operations.

Mahindra & Mahindra's intellectual property, encompassing patents, distinctive vehicle designs, and advanced proprietary technologies such as the INGLO EV platform and the MAIA AI system, represents a cornerstone of its business model. These innovations are not merely assets; they are the engines driving competitive advantage and are indispensable for shaping the company's product pipeline and sustaining market leadership in the evolving automotive landscape.

Mahindra & Mahindra's skilled workforce, comprising over 250,000 employees globally as of early 2024, is a cornerstone of its operations. This includes a significant pool of engineers, R&D specialists, and manufacturing talent crucial for product development and production efficiency.

The deep expertise within its design and engineering teams fuels innovation, enabling the company to adapt to evolving market demands, particularly in areas like electric vehicles and connected technologies. This human capital is directly responsible for the company's operational excellence and its ability to maintain a competitive edge.

Furthermore, the extensive sales and service networks, staffed by well-trained personnel, are vital for customer engagement and satisfaction across Mahindra's diverse business verticals, from automotive to farm equipment.

Strong Brand Equity and Reputation

The Mahindra brand, a cornerstone of the company's success, has been meticulously cultivated over many decades. It signifies unwavering reliability, superior quality, and an intimate grasp of both the Indian domestic landscape and international markets, especially within the automotive and farm equipment sectors. This robust brand equity translates directly into heightened customer trust and enduring loyalty, significantly easing market entry and encouraging repeat purchases.

Mahindra's brand strength is not just a qualitative asset; it has tangible financial implications. For instance, in the fiscal year 2024, Mahindra & Mahindra reported a consolidated revenue of approximately ₹2.47 trillion (around USD 29.7 billion), a testament to the market's confidence in its offerings. This strong reputation allows the company to command premium pricing and reduces the cost of customer acquisition.

- Brand Recognition: The 'Mahindra' name is instantly recognizable across India and in many emerging markets, signifying a trusted partner for mobility and agricultural solutions.

- Customer Loyalty: Decades of consistent quality and after-sales service have cultivated a loyal customer base, evident in repeat purchase rates and positive word-of-mouth referrals.

- Market Trust: Mahindra's reputation for durability and value for money underpins its strong market position, enabling it to weather economic fluctuations more effectively.

- Brand Value: In 2023, Brand Finance estimated the Mahindra brand value to be significant, reflecting its substantial contribution to the company's overall valuation and competitive advantage.

Extensive Distribution and Service Network

Mahindra & Mahindra's extensive distribution and service network is a cornerstone of its business model, ensuring customers can easily access vehicles and receive reliable support. This widespread infrastructure, encompassing dealerships, service centers, and spare parts outlets, is vital for reaching a broad customer base across diverse geographies.

As of early 2024, Mahindra boasts a significant footprint. For instance, its automotive division operates over 3,500 customer touchpoints across India, including dealerships and service centers. This vast network facilitates not only sales but also crucial after-sales service, which is paramount for customer retention and brand loyalty in the competitive automotive sector.

- Vast Dealership Network: Mahindra's automotive division alone operates more than 3,500 customer touchpoints in India, providing sales and service.

- Global Presence: Beyond India, Mahindra has established a presence in over 50 countries, supported by a growing network of international dealerships and service facilities.

- After-Sales Support: The network ensures accessibility to genuine spare parts and qualified technicians, enhancing the ownership experience and product longevity.

- Customer Reach: This extensive reach makes Mahindra vehicles readily available and supports customers throughout their ownership journey, fostering strong relationships.

Mahindra & Mahindra's key resources include its extensive manufacturing facilities, advanced proprietary technologies like the INGLO EV platform, and a highly skilled workforce of over 250,000 employees globally as of early 2024. The company's strong brand equity, built on decades of reliability and market understanding, is also a critical intangible asset. This combination of physical, intellectual, human, and brand capital underpins its competitive strength.

| Resource Category | Key Assets/Components | Significance |

|---|---|---|

| Physical Assets | Manufacturing plants, production infrastructure | Enables high-volume vehicle production (over 1.2 million in FY24) and global supply chain operations. |

| Intellectual Property | Patents, vehicle designs, INGLO EV platform, MAIA AI | Drives competitive advantage and shapes future product development. |

| Human Capital | Skilled workforce (engineers, R&D, manufacturing) | Fuels innovation, ensures operational excellence, and supports product development. |

| Brand Equity | Mahindra brand recognition, customer loyalty, market trust | Facilitates market entry, encourages repeat purchases, and supports premium pricing. |

| Distribution & Service Network | 3,500+ customer touchpoints in India, presence in 50+ countries | Ensures customer access to vehicles and reliable after-sales support, fostering loyalty. |

Value Propositions

Mahindra & Mahindra's vehicles are built to last, boasting exceptional durability and ruggedness that allows them to tackle tough terrains and demanding work. This inherent robustness is a core value proposition, especially for their automotive and farm equipment divisions, ensuring customers can rely on their products for years to come.

This commitment to reliability translates into a strong return on investment for users, as Mahindra vehicles are designed for longevity and minimal downtime. For instance, their tractors are renowned for their ability to withstand harsh agricultural conditions, a critical factor for farmers who depend on their equipment for their livelihood.

In 2024, Mahindra's automotive segment continued to see strong demand for its SUVs, which are frequently praised for their build quality and off-road capabilities. This enduring appeal underscores the value customers place on vehicles that can consistently perform, even when pushed to their limits.

Mahindra & Mahindra's diverse product portfolio is a cornerstone of its business model, offering everything from rugged utility vehicles and popular SUVs like the XUV700 to essential tractors and a range of commercial vehicles. This breadth ensures they can meet the varied demands of both individual consumers and commercial enterprises across different sectors.

This extensive range allows Mahindra to effectively tap into multiple market segments, from rural agricultural needs with their tractors to urban mobility with their SUVs. For instance, in the fiscal year 2024, Mahindra's automotive sector saw robust sales, with their UV segment continuing to perform strongly, contributing significantly to their overall revenue.

Mahindra & Mahindra's commitment to technological advancement is a core value proposition, evident in their integration of electric powertrains across their automotive and tractor segments. For instance, the Mahindra XUV400, their all-electric SUV, showcases this focus on sustainable mobility, directly addressing growing consumer demand for eco-friendly transportation options.

The company also prioritizes advanced safety features, incorporating Advanced Driver-Assistance Systems (ADAS) into their newer models. This not only enhances driver and passenger safety but also positions Mahindra as a forward-thinking brand in a competitive market, aligning with global automotive safety standards.

Furthermore, Mahindra is actively developing and deploying smart connectivity solutions, enabling features like remote vehicle diagnostics and over-the-air updates. This focus on enhancing the overall user experience through technology is crucial for customer retention and brand loyalty in the digital age.

Value for Money and Affordability

Mahindra & Mahindra's value proposition centers on delivering robust, quality products at prices that resonate with a broad customer base, particularly in price-sensitive regions. This approach ensures that essential features and reliability are not sacrificed for affordability, making their offerings highly attractive.

In 2024, Mahindra continued to emphasize this strategy. For instance, their Scorpio-N, launched with competitive pricing, saw strong demand, reflecting the market's appetite for value-driven SUVs. The company's ability to manage production costs effectively allows them to maintain this accessible pricing structure.

- Competitive Pricing: Mahindra consistently aims to price its vehicles below key competitors while offering comparable or superior features, enhancing its value proposition.

- Feature-Rich Offerings: Despite the focus on affordability, Mahindra vehicles often come equipped with modern technology and comfort features, providing a comprehensive package.

- Market Accessibility: This strategy makes Mahindra products attainable for a larger segment of the population, driving sales volumes and brand loyalty, especially in emerging markets.

- Total Cost of Ownership: Beyond the initial purchase price, Mahindra also focuses on providing good fuel efficiency and lower maintenance costs, contributing to overall affordability for the consumer.

Sustainable and Responsible Solutions

Mahindra & Mahindra is deeply committed to offering sustainable and responsible solutions, a core element of its business model. This translates into a tangible focus on developing and promoting environmentally friendly products, with electric vehicles (EVs) leading the charge. For instance, by the end of fiscal year 2024, Mahindra had invested significantly in its EV division, aiming to capture a substantial share of the growing electric mobility market in India.

This strategic direction resonates strongly with a growing segment of consumers who prioritize eco-conscious purchasing decisions. By aligning with global sustainability goals, Mahindra not only appeals to these environmentally aware customers but also positions itself as a forward-thinking and responsible corporate citizen. This commitment is reflected in their operational practices, which increasingly incorporate resource efficiency and waste reduction measures across their manufacturing facilities.

The company's push for sustainability is not just about product offerings but also about embedding responsible practices throughout its value chain. This includes efforts in areas like renewable energy adoption in its plants and promoting circular economy principles. For example, Mahindra’s automotive sector has been actively exploring ways to reduce its carbon footprint, with specific targets set for emission reductions by 2030.

- Environmentally Friendly Products: A strong emphasis on electric vehicles, like the XUV400, catering to the burgeoning demand for sustainable transportation.

- Sustainable Operations: Implementing eco-friendly manufacturing processes and investing in renewable energy sources for its facilities.

- Consumer Appeal: Attracting environmentally conscious buyers who seek to reduce their ecological impact.

- Global Alignment: Contributing to international sustainability objectives and demonstrating corporate responsibility.

Mahindra & Mahindra's value proposition centers on delivering robust, quality products at prices that resonate with a broad customer base, particularly in price-sensitive regions. This approach ensures that essential features and reliability are not sacrificed for affordability, making their offerings highly attractive. In 2024, Mahindra continued to emphasize this strategy, with offerings like the Scorpio-N seeing strong demand due to competitive pricing.

| Value Proposition Pillar | Description | 2024 Relevance/Data Point |

|---|---|---|

| Competitive Pricing | Offering vehicles at attractive price points relative to features and competitors. | Strong demand for models like the Scorpio-N, indicating market acceptance of value-driven pricing. |

| Feature-Rich Offerings | Equipping vehicles with modern technology and comfort features despite the focus on affordability. | Continued integration of advanced features in new model launches, enhancing customer experience. |

| Market Accessibility | Making products attainable for a larger customer segment, driving volume and loyalty. | Robust sales performance in the automotive sector, particularly in the UV segment, highlights broad market reach. |

| Total Cost of Ownership | Focus on fuel efficiency and lower maintenance costs contributing to overall affordability. | Ongoing efforts to improve powertrain efficiency across the vehicle lineup. |

Customer Relationships

Mahindra & Mahindra cultivates deep customer bonds through its vast dealership network, providing personalized sales consultations and tailored service experiences. This direct interaction ensures solutions are specifically designed for individual needs, fostering strong rapport. For instance, in fiscal year 2024, Mahindra reported a significant increase in customer satisfaction scores, directly attributed to these personalized engagement strategies across its automotive and farm equipment divisions.

Mahindra & Mahindra prioritizes customer satisfaction through extensive after-sales support, encompassing timely maintenance, efficient repairs, and a consistent supply of genuine spare parts. This commitment ensures vehicle longevity and minimizes downtime for their customers.

To cultivate enduring customer loyalty, Mahindra actively engages its customer base through structured loyalty programs and community-building initiatives. These efforts aim to foster a sense of belonging and reward repeat business, reinforcing strong customer relationships.

In fiscal year 2023-24, Mahindra's automotive segment reported a robust sales performance, reflecting the positive impact of their customer-centric approach. The company's focus on service and loyalty continues to be a key differentiator in the competitive automotive market.

Mahindra & Mahindra actively uses digital channels, including social media and their dedicated Me4U mobile app, to foster real-time customer connections. These platforms streamline processes like vehicle bookings, service appointments, and real-time tracking, significantly boosting customer convenience and interaction.

Customer Feedback Integration for Product Improvement

Mahindra & Mahindra actively cultivates customer relationships by integrating feedback directly into product development and service enhancements. This customer-centric philosophy is a cornerstone of their strategy, ensuring their vehicles and services remain aligned with evolving market demands. For instance, in 2024, Mahindra conducted extensive customer surveys and focus groups across its automotive and farm equipment divisions to gather insights on desired features and performance improvements.

- Feedback Channels: Mahindra utilizes digital platforms, dealerships, and post-purchase follow-ups to collect customer input.

- Product Evolution: Insights gathered in 2024 directly influenced updates to models like the Scorpio-N and Thar, incorporating enhanced infotainment systems and improved fuel efficiency based on user requests.

- Service Enhancement: Customer feedback also drives improvements in after-sales service, aiming for quicker response times and more personalized support.

- Loyalty Programs: Initiatives like the Mahindra Thank You program, enhanced in 2024, reward repeat customers and encourage ongoing engagement, fostering stronger brand loyalty.

Building Community and Brand Advocacy

Mahindra & Mahindra actively fosters a vibrant community around its brands, notably engaging Thar owners. This community focus translates into powerful brand advocacy, with satisfied customers becoming vocal promoters. In 2023, Mahindra reported a significant increase in social media engagement across its platforms, a testament to this strategy.

- Community Engagement: Mahindra organizes exclusive owner events and online forums, creating spaces for enthusiasts to connect and share experiences.

- Brand Advocacy: This strong community fosters organic word-of-mouth marketing and user-generated content, amplifying brand reach.

- Loyalty Building: By nurturing these relationships, Mahindra cultivates a deeply loyal customer base that is less susceptible to competitor offerings.

- Digital Presence: The brand leverages digital channels to maintain ongoing conversations and celebrate customer stories, further solidifying brand loyalty.

Mahindra & Mahindra builds strong customer relationships through a multi-faceted approach, emphasizing personalized experiences and robust after-sales support. Their extensive dealership network serves as a primary touchpoint, facilitating direct engagement and tailored solutions. Loyalty programs and community initiatives further solidify these bonds, encouraging repeat business and brand advocacy.

| Customer Relationship Aspect | Description | Fiscal Year 2024 Impact/Data |

|---|---|---|

| Personalized Engagement | Direct sales consultations and tailored service experiences at dealerships. | Significant increase in customer satisfaction scores. |

| After-Sales Support | Timely maintenance, efficient repairs, and genuine spare parts availability. | Ensures vehicle longevity and minimizes customer downtime. |

| Loyalty & Community | Structured loyalty programs and community-building events. | Fosters a sense of belonging and rewards repeat customers. |

| Digital Interaction | Me4U app and social media for bookings, service, and tracking. | Boosts customer convenience and real-time interaction. |

| Feedback Integration | Incorporating customer input into product and service enhancements. | Influenced updates to models like Scorpio-N and Thar based on user requests. |

Channels

Mahindra & Mahindra leverages an extensive dealership and retail network as its primary channel for both automotive and farm equipment sales. This vast network of authorized dealerships acts as crucial physical touchpoints for customers, offering product displays, opportunities for test drives, personalized sales consultations, and essential after-sales support.

As of the fiscal year 2024, Mahindra & Mahindra boasts over 3,500 automotive dealerships across India, complemented by a significant presence in international markets. For its Farm Equipment Sector, the company maintains a robust network of over 1,000 dealerships nationwide, ensuring widespread accessibility for farmers.

Mahindra operates flagship showrooms and experience centers, notably for its burgeoning electric vehicle (EV) portfolio, offering customers immersive and technology-driven demonstrations. These dedicated spaces are designed to cultivate a premium brand perception and effectively highlight the advanced features of their latest offerings.

In 2024, Mahindra continued to expand its physical retail footprint, with a strategic focus on these experience centers to directly engage potential EV buyers. This approach aims to bridge the gap between online interest and tangible product interaction, a crucial step in accelerating EV adoption.

Mahindra & Mahindra leverages its official website, dedicated e-commerce portals, and user-friendly mobile applications to connect with customers. These digital avenues are crucial for providing detailed product information, facilitating online bookings, and generating valuable sales leads.

These digital channels significantly broaden Mahindra's market reach, offering unparalleled convenience to potential buyers. They streamline the sales journey by providing comprehensive product specifications, pricing, and financing options, thereby enhancing customer engagement and driving sales conversions.

In 2023, Mahindra & Mahindra reported a substantial increase in digital engagement, with its website and app traffic growing by over 30%. This digital push is a key component of their strategy to enhance customer experience and drive sales, especially for their automotive and farm equipment divisions.

Rural Outreach and Specialized Agri-

Mahindra & Mahindra's rural outreach is a cornerstone of its business model, leveraging specialized channels to connect with India's vast agricultural community. These channels are designed to ensure accessibility for farmers, even in remote locations, providing them with essential agricultural equipment and services.

Key initiatives like the 'Krish-e' centers are central to this strategy. These centers act as hubs, offering not just tractors and farm machinery but also innovative 'Farming as a Service' solutions. This integrated approach aims to boost farm productivity and farmer incomes.

- Krish-e Centers: Mahindra's dedicated rural outreach centers, providing direct access to products and services.

- Farming as a Service (FaaS): Offering modern farming solutions and technology to enhance agricultural practices.

- Distribution Network: Extensive network reaching over 10,000 villages, ensuring product availability and support.

- Market Penetration: In FY23, Mahindra's domestic tractor sales reached approximately 308,000 units, underscoring the effectiveness of its rural reach.

Corporate and Fleet Sales Division

Mahindra & Mahindra’s Corporate and Fleet Sales Division is a crucial revenue stream, directly engaging with businesses and government entities for bulk vehicle acquisitions. This channel is tailored to the unique procurement cycles and volume demands of institutional clients, ensuring a streamlined purchase experience for large orders of commercial and utility vehicles.

In fiscal year 2024, Mahindra’s automotive sector, which includes these fleet sales, saw robust performance. For instance, the company reported a significant increase in its total vehicle sales, with commercial vehicles forming a substantial part of this growth. This division directly contributes to these figures by fostering relationships with major fleet operators and government tenders.

- Direct Engagement: This division focuses on building relationships with corporate clients, government bodies, and large fleet operators.

- Bulk Purchases: It facilitates the acquisition of commercial vehicles and utility vehicles in significant volumes.

- Tailored Solutions: The division understands and caters to the specific procurement processes and needs of institutional buyers.

- Market Penetration: By securing large orders, this channel significantly strengthens Mahindra’s market share in the commercial vehicle segment.

Mahindra & Mahindra's channels are multifaceted, encompassing a vast physical dealership network for automotive and farm equipment, complemented by digital platforms for broader reach and engagement. Specialized rural outreach initiatives, like Krish-e centers, ensure accessibility for the agricultural community, while a dedicated corporate and fleet sales division caters to institutional buyers. This integrated approach ensures comprehensive market coverage and customer interaction across diverse segments.

| Channel Type | Description | Key Data/Focus (FY24 unless specified) | Impact |

|---|---|---|---|

| Dealership & Retail Network | Physical touchpoints for sales, test drives, and after-sales support. | Over 3,500 automotive dealerships; Over 1,000 farm equipment dealerships. | Widespread accessibility, personalized customer experience. |

| Digital Platforms | Official website, e-commerce portals, mobile applications. | 30%+ increase in website/app traffic (2023). | Enhanced market reach, online bookings, lead generation, customer convenience. |

| Experience Centers | Immersive, technology-driven spaces for EV portfolio. | Strategic expansion in 2024. | Premium brand perception, direct EV buyer engagement, bridging online-offline gap. |

| Rural Outreach (Krish-e) | Specialized channels for agricultural community. | Distribution network reaching over 10,000 villages. Domestic tractor sales ~308,000 units (FY23). | Accessibility for farmers, integrated farming solutions, boosted farm productivity. |

| Corporate & Fleet Sales | Direct engagement with businesses and government entities. | Significant contribution to automotive sector growth in FY24. | Bulk vehicle acquisitions, strengthened market share in commercial vehicles. |

Customer Segments

Mahindra & Mahindra's rural and agricultural customer segment includes farmers and agricultural businesses who rely on their tractors and farm equipment. These customers, particularly in India, value durability and fuel efficiency, crucial for operating in diverse and often demanding rural conditions. In 2023-24, Mahindra's Farm Equipment Sector (FES) reported domestic tractor sales of 339,512 units, a slight increase from the previous year, highlighting the continued demand in this segment.

Mahindra & Mahindra's urban and semi-urban personal vehicle buyers are individuals and families looking for SUVs, passenger cars, and two-wheelers. These customers prioritize personal commuting and enhancing their lifestyle. In 2024, the Indian automotive market saw a significant demand for SUVs, with brands like Mahindra experiencing strong sales. For instance, Mahindra's Scorpio-N and XUV700 continued to be popular choices, reflecting the segment's preference for robust design and ample space.

This customer segment places a high value on design aesthetics, ride comfort, and integrated technology features. Safety remains a paramount concern, driving demand for vehicles equipped with advanced driver-assistance systems (ADAS). Furthermore, the growing environmental consciousness is fueling interest in electric vehicle (EV) options, a trend that Mahindra is actively addressing with its upcoming EV portfolio, aiming to capture a larger share of this evolving market.

Mahindra & Mahindra's commercial and fleet operators segment serves businesses, logistics firms, and public transport operators. These customers depend on Mahindra for commercial vehicles, light commercial vehicles (LCVs), and buses crucial for their daily operations. In 2023, Mahindra's automotive division, which includes these vehicles, reported a significant increase in sales, highlighting the demand from this sector.

The primary concerns for these operators are robust payload capacity, maximizing operational efficiency, and ensuring unwavering reliability. Cost-effectiveness is also paramount, as vehicle uptime and fuel efficiency directly impact their bottom line. Mahindra's focus on developing durable and fuel-efficient vehicles directly addresses these critical needs, contributing to their strong market presence.

Value-Conscious Consumers

Mahindra & Mahindra’s value-conscious consumers represent a significant portion of their customer base, actively seeking dependable products that offer excellent bang for their buck. This segment spans across multiple product lines, from automotive to farm equipment, where affordability without compromising on core functionality is paramount. For instance, in the automotive sector, models like the Mahindra Bolero Neo are specifically designed to meet the needs of this demographic, providing robust performance and utility at a competitive price. In 2023-24, Mahindra's automotive division saw strong sales, with SUVs contributing significantly, reflecting the demand for value-driven vehicles.

Mahindra directly addresses this segment by ensuring their product development and pricing strategies align with the expectation of affordability and reliability. They achieve this through efficient manufacturing processes and by focusing on features that are essential for the target user. This approach has consistently positioned Mahindra as a go-to brand for those who need durable and practical solutions without the premium price tag. The company's commitment to this segment is evident in its market share in various categories where price sensitivity is a key purchasing driver.

- Broad Appeal: This segment is not confined to a single product category but rather represents a mindset across Mahindra's diverse offerings, seeking quality at accessible price points.

- Value Proposition: Mahindra ensures a strong value proposition by balancing product features, durability, and cost-effectiveness, making their products attractive to budget-conscious buyers.

- Market Penetration: The focus on value-conscious consumers has been instrumental in Mahindra's market penetration, particularly in rural and semi-urban areas where affordability is a critical factor.

- Product Strategy: Mahindra's product portfolio often includes variants that cater specifically to this segment, offering essential features and reliable performance at competitive price points, contributing to their overall sales volume.

Environmentally Conscious and Tech-Savvy Buyers

Mahindra & Mahindra is increasingly catering to environmentally conscious and tech-savvy buyers, a segment that prioritizes sustainable transportation and embraces advanced technology. This group is particularly interested in electric vehicles (EVs) and smart mobility solutions, driven by a strong desire to reduce their environmental impact and a keen interest in innovative features. For instance, the global EV market saw significant growth in 2024, with sales projected to exceed 15 million units, a trend Mahindra is actively participating in.

This customer segment is characterized by its willingness to adopt new technologies and its commitment to eco-friendly choices. They are often early adopters of EVs, valuing the lower running costs and reduced emissions. In 2024, consumer surveys indicated that over 60% of potential car buyers in urban India considered electric vehicles, highlighting the growing demand for sustainable options.

- Growing Demand for EVs: The global electric vehicle market is expanding rapidly, with projections indicating continued strong growth through 2025.

- Environmental Consciousness: Buyers in this segment are actively seeking to minimize their carbon footprint through their vehicle choices.

- Tech Integration: They expect advanced features such as connected car technology, advanced driver-assistance systems (ADAS), and intuitive infotainment systems.

- Early Adopter Mentality: This group is often among the first to embrace new automotive technologies and sustainable mobility solutions.

Mahindra & Mahindra's customer segments are diverse, encompassing farmers and agricultural businesses who rely on their durable farm equipment, and urban/semi-urban individuals and families seeking stylish and feature-rich personal vehicles like SUVs and cars. The company also serves commercial and fleet operators with robust vehicles for logistics and transport, alongside value-conscious consumers who prioritize affordability and reliability across various product lines.

| Customer Segment | Key Needs/Preferences | 2023-24 Data/Insights |

|---|---|---|

| Rural & Agricultural | Durability, fuel efficiency, reliability | Domestic tractor sales: 339,512 units (slight increase) |

| Urban/Semi-Urban Personal Vehicle Buyers | Style, comfort, technology, safety, EV interest | Strong demand for SUVs like Scorpio-N, XUV700 |

| Commercial & Fleet Operators | Payload capacity, operational efficiency, reliability, cost-effectiveness | Significant increase in automotive division sales |

| Value-Conscious Consumers | Affordability, dependability, essential features | Bolero Neo popular for utility and price competitiveness |

| Environmentally Conscious & Tech-Savvy | EVs, smart mobility, reduced environmental impact, advanced tech | Growing global EV market, >60% urban Indian buyers consider EVs |

Cost Structure

Mahindra & Mahindra's manufacturing and production costs are heavily influenced by raw material and component procurement. In fiscal year 2024, the company's cost of materials consumed was a substantial figure, reflecting the scale of its automotive and farm equipment operations.

Labor, energy, and factory overheads are also significant cost drivers. These expenses are spread across Mahindra's numerous global manufacturing facilities, impacting the overall cost of goods sold and the efficiency of its production lines.

Mahindra & Mahindra dedicates significant capital to Research and Development, a crucial element for staying ahead in the automotive sector. In the fiscal year 2023, the company reported R&D expenses of approximately ₹2,200 crore, a substantial outlay reflecting their commitment to innovation.

These investments are strategically channeled into developing cutting-edge technologies, particularly in the burgeoning electric vehicle (EV) segment and advanced driver-assistance systems (ADAS). For instance, Mahindra's recent push into EVs, with models like the XUV400, necessitates considerable R&D for battery technology, powertrain efficiency, and software integration.

Furthermore, the company is actively exploring digital solutions to enhance customer experience and operational efficiency, which also contributes to the R&D cost structure. This continuous investment is paramount for maintaining a competitive edge and introducing next-generation products that meet evolving market demands.

Mahindra & Mahindra's cost structure heavily features Marketing, Sales, and Distribution Expenses. These costs are crucial for reaching customers and building brand presence. For instance, in the fiscal year ending March 31, 2024, the company's total selling and distribution expenses amounted to ₹10,613.46 crore, reflecting significant investment in advertising, promotions, and maintaining their vast dealership network.

Employee Remuneration and Benefits

Mahindra & Mahindra's significant investment in its vast and varied workforce is a primary cost driver. This includes competitive salaries, comprehensive benefits packages, and ongoing training to maintain a skilled workforce across its automotive, farm equipment, IT, and financial services divisions.

In fiscal year 2024, employee-related expenses represent a substantial portion of the company's operational outlays. For instance, the automotive sector alone, a major contributor to M&M's revenue, necessitates significant personnel costs to support manufacturing, R&D, and sales operations.

- Employee Remuneration: Salaries and wages form the largest component of this cost.

- Benefits and Welfare: Health insurance, retirement plans, and other employee welfare programs add to the expense.

- Training and Development: Investment in upskilling and reskilling employees ensures competitiveness.

- Statutory Contributions: Employer contributions to provident funds and other mandated benefits are also included.

Capital Expenditures (CapEx) for Expansion and Upgrades

Mahindra & Mahindra's capital expenditures are heavily focused on long-term growth. This includes substantial investments to increase their manufacturing capacity, ensuring they can meet growing demand for their diverse product lines, from tractors to SUVs.

Upgrading production technology is another key area. By adopting advanced manufacturing processes and automation, Mahindra aims to enhance efficiency, improve product quality, and reduce operational costs, keeping them competitive in the global automotive and farm equipment markets.

Modernizing research and development facilities is crucial for innovation. These expenditures support the development of next-generation vehicles, including electric and hybrid models, and advanced agricultural machinery, ensuring a strong product pipeline for the future.

A significant portion of CapEx is also directed towards developing new infrastructure, especially for their burgeoning electric vehicle (EV) segment. This includes investments in EV production lines and the crucial development of charging networks to support EV adoption. For instance, in fiscal year 2024, Mahindra announced plans to invest approximately ₹10,000 crore (around $1.2 billion USD) in their EV business over the next eight years, highlighting the scale of these infrastructure commitments.

- Expansion of Manufacturing Capacity: Increasing production lines for SUVs and tractors.

- Technology Upgrades: Investing in automation and advanced manufacturing for greater efficiency.

- R&D Modernization: Enhancing facilities for developing new vehicle technologies and EV platforms.

- EV Infrastructure Development: Funding the creation of EV manufacturing capabilities and charging solutions.

Mahindra & Mahindra's cost structure is multifaceted, encompassing significant outlays in raw materials, labor, R&D, marketing, and capital expenditures.

In fiscal year 2024, the company's total expenses were substantial, driven by its expansive operations in automotive and farm equipment manufacturing, alongside investments in future technologies like EVs.

These costs are managed across a global footprint, with strategic investments aimed at enhancing production efficiency, fostering innovation, and expanding market reach.

Key cost components include employee remuneration, marketing and distribution, and substantial capital expenditure for capacity expansion and technology upgrades, particularly in the EV segment.

| Cost Component | FY2024 (Approximate Figures/Trends) | Impact |

|---|---|---|

| Cost of Materials Consumed | Significant portion of revenue, reflecting scale of operations | Directly impacts Cost of Goods Sold (COGS) |

| Employee Expenses | Substantial outlay for salaries, benefits, and training | Supports skilled workforce across diverse divisions |

| R&D Expenses | ~₹2,200 crore (FY2023) and ongoing investment | Drives innovation in EVs, ADAS, and new technologies |

| Selling & Distribution Expenses | ₹10,613.46 crore (FY2024) | Crucial for brand building and market penetration |

| Capital Expenditure (EV focus) | Planned ₹10,000 crore over 8 years | Funds EV manufacturing, technology, and infrastructure development |

Revenue Streams

Mahindra & Mahindra's core revenue originates from the sale of a diverse automotive portfolio. This encompasses popular utility vehicles like the Scorpio and Thar, passenger cars, commercial vehicles for various industries, and their well-established two-wheeler segment.

The company generates significant income from both its traditional internal combustion engine (ICE) vehicles and its growing range of electric vehicles (EVs). For instance, in the fiscal year 2024, Mahindra & Mahindra reported a substantial increase in its automotive segment revenue, driven by strong demand for its UV portfolio.

Mahindra & Mahindra's farm equipment sales represent a significant revenue driver, stemming from its global leadership in tractor volume. This segment is vital, particularly with the company's deep roots in agricultural markets worldwide.

In the fiscal year 2024, Mahindra & Mahindra reported robust performance in its Farm Equipment sector. For instance, the company sold approximately 430,000 tractors in India during FY24, showcasing its dominant market share and the consistent demand for its products.

Mahindra & Mahindra's financial services arm, Mahindra Finance, is a significant contributor to its revenue. This segment generates income through a variety of offerings, including vehicle and equipment financing, which directly complements the sales of Mahindra's automotive and farm equipment divisions.

Beyond loans, Mahindra Finance also earns revenue from insurance products and other financial services, creating a diversified income stream. This financial engine not only supports the core product businesses but also provides a stable and predictable revenue base for the larger Mahindra Group. For instance, in the fiscal year 2024, Mahindra Finance reported a profit after tax of INR 1,570 crore, showcasing its robust financial performance.

After-Sales Service and Spare Parts Sales

Mahindra & Mahindra generates recurring revenue through its comprehensive after-sales service and spare parts sales. This includes scheduled maintenance, repair work, and the provision of genuine Mahindra spare parts, all facilitated by an expansive service network across India and globally. This revenue stream is crucial for fostering long-term customer relationships and ensuring a steady income post-vehicle purchase.

For the fiscal year 2024, Mahindra & Mahindra reported significant contributions from its automotive and farm equipment sectors, with after-sales services and parts forming a vital component of overall profitability. While specific figures for this segment are often embedded within broader financial reports, the company’s consistent focus on expanding its service footprint and genuine parts availability underscores its importance.

- Recurring Revenue: Maintenance, repairs, and genuine spare parts sales provide a consistent income stream.

- Customer Loyalty: High-quality after-sales support enhances customer satisfaction and retention.

- Service Network: An extensive network ensures accessibility for maintenance and parts, driving revenue.

- FY24 Performance: The automotive and farm equipment sectors demonstrated robust performance, with after-sales services playing a key supporting role.

Revenue from Diversified Businesses and New Ventures

Mahindra & Mahindra's revenue streams are significantly bolstered by its diverse business segments. Beyond its well-known automotive division, the conglomerate draws income from information technology through Tech Mahindra, hospitality via Club Mahindra, and logistics through Mahindra Logistics.

These varied ventures create multiple income sources, contributing to overall financial stability and growth. For instance, Tech Mahindra reported revenues of approximately ₹49,725 crore for the fiscal year ending March 31, 2024, showcasing the IT arm's substantial contribution.

Mahindra Susten, the renewable energy arm, is also a key revenue generator, aligning with global sustainability trends. Mahindra Lifespaces, its real estate developer, further diversifies the income portfolio. This broad operational base allows Mahindra & Mahindra to tap into different market demands and economic cycles.

The company's diversified approach is evident in its financial performance:

- Information Technology (Tech Mahindra): A significant contributor to overall revenue, serving global clients.

- Hospitality (Club Mahindra): Generates income through membership fees and services.

- Logistics (Mahindra Logistics): Provides supply chain solutions, adding to the revenue mix.

- Renewable Energy (Mahindra Susten) and Real Estate (Mahindra Lifespaces): These sectors offer growth opportunities and diversified income streams.

Mahindra & Mahindra's revenue streams are multifaceted, stemming from its automotive and farm equipment divisions, financial services, recurring after-sales support, and diversified businesses like IT and real estate.

The automotive segment, including utility vehicles and electric vehicles, saw strong demand in FY24, contributing significantly to overall revenue. Similarly, the farm equipment sector, a global leader in tractor volume, demonstrated robust performance with substantial sales in FY24.

Mahindra Finance provides crucial income through vehicle and equipment financing, insurance, and other financial services, complementing the core product sales. Tech Mahindra, the IT arm, also represents a major revenue contributor, with revenues of approximately ₹49,725 crore reported for FY24.

| Segment | Key Revenue Drivers | FY24 Performance Insight |

| Automotive | UVs, Passenger Cars, Commercial Vehicles, EVs | Strong demand, revenue increase |

| Farm Equipment | Tractors, Farm Implements | Global leadership, ~430,000 tractors sold in India |

| Financial Services (Mahindra Finance) | Vehicle/Equipment Financing, Insurance | Profit After Tax of INR 1,570 crore |

| Information Technology (Tech Mahindra) | IT Services, Consulting | Revenues of ~₹49,725 crore |

| After-Sales & Spares | Maintenance, Repairs, Genuine Parts | Supports core product profitability |

Business Model Canvas Data Sources

The Mahindra & Mahindra Business Model Canvas is constructed using a blend of internal financial reports, comprehensive market research, and insights from industry experts. This multi-faceted approach ensures a robust and accurate representation of the company's strategic framework.