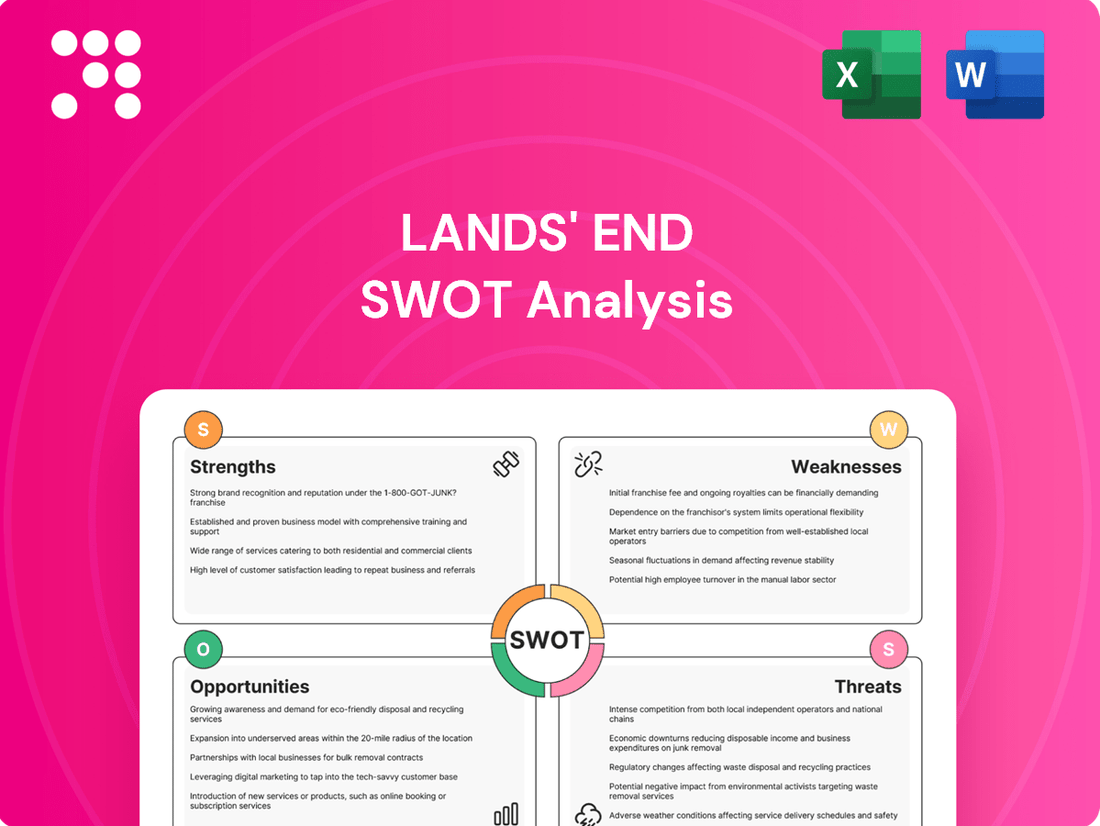

Lands' End SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lands' End Bundle

Lands' End leverages its strong brand recognition and loyal customer base as key strengths, while facing challenges like increasing competition and evolving consumer preferences. Understanding these dynamics is crucial for any strategic decision-making.

Want the full story behind Lands' End's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Lands' End benefits from a deeply rooted heritage as a catalog retailer, cultivated over decades. This history has fostered a globally recognized brand name that is now a cornerstone in their omnichannel strategy. This established brand power is crucial for gathering valuable customer data.

Lands' End has made significant strides in boosting its gross margin, achieving a 210 basis point increase to 50.8% in Q1 2025, following a substantial 550 basis point improvement in fiscal 2024. This success stems from a strategic focus on higher-margin sales, a deliberate reduction in promotional discounting, and a faster turnaround for new products.

Furthermore, the company has successfully reduced its inventory for eight consecutive quarters. This consistent inventory management improvement highlights enhanced operational efficiency and better productivity across the business.

Lands' End is experiencing robust growth in its licensing segment, with a remarkable increase of over 60% in the first quarter of 2025 and more than 50% for the entirety of fiscal 2024. This expansion is fueled by strategic new partnerships, such as the one with Delta Air Lines, highlighting the brand's appeal across different sectors.

This asset-light licensing model is particularly beneficial as it generates higher-margin revenue streams while significantly reducing the company's exposure to inventory risk. It allows Lands' End to leverage its brand equity without the direct costs associated with product manufacturing and holding.

Furthermore, the Outfitters segment, which focuses on providing uniforms and apparel to businesses and educational institutions, is also demonstrating positive momentum. Growth here is especially notable within national accounts, indicating success in securing larger, recurring contracts.

Focus on Solution-Based Products and Innovation

Lands' End is actively prioritizing product innovation, with roughly one-third of its current offerings falling into solution-based categories. These include features like sun protection, waterproofing, and body shaping, which help position the brand as a lifestyle provider.

This strategic focus on functional and innovative products allows Lands' End to command higher price points, contributing to ongoing margin expansion. The company has also broadened its selection in key areas such as bottoms, outerwear, and footwear, catering to a wider range of customer needs.

- Focus on Solution-Based Products: Approximately 33% of Lands' End's product mix now features solution-based attributes.

- Lifestyle Brand Positioning: Innovation in areas like sun protection and waterproofing supports a premium lifestyle brand image.

- Margin Expansion: The emphasis on solution-based products enables higher pricing and supports continued margin growth.

- Category Expansion: Increased offerings in bottoms, outerwear, and footwear broaden the company's appeal.

Robust E-commerce and Digital Marketing Capabilities

Lands' End boasts strong e-commerce and digital marketing, with approximately 90% of its business conducted online. This digital-first approach allows them to leverage data and analytics extensively, optimizing inventory management and boosting conversion rates by understanding customer shopping habits.

Their digital marketing strategy includes effective use of social media and influencer collaborations. This has been instrumental in broadening their customer base and attracting younger demographics, generating billions of media impressions annually. For instance, in 2023, their social media campaigns saw a significant uplift in engagement, contributing to a noticeable increase in online traffic and sales.

- Digital Dominance: Over 90% of Lands' End revenue originates from its e-commerce platform.

- Data-Driven Operations: Advanced analytics inform inventory, customer behavior, and sales strategies.

- Social Media Impact: Billions of annual media impressions from social media and influencer marketing expand reach.

- Customer Acquisition: Successful campaigns attract new, younger customer segments.

Lands' End leverages a strong, globally recognized brand heritage, built over decades as a catalog retailer, which now underpins its omnichannel approach and customer data collection. The company has demonstrated significant operational improvements, notably reducing inventory for eight consecutive quarters, enhancing efficiency and productivity.

A key strength lies in the robust growth of its licensing segment, which surged over 60% in Q1 2025 and more than 50% in fiscal 2024, driven by strategic partnerships like the one with Delta Air Lines. This asset-light model generates high-margin revenue while minimizing inventory risk, allowing the brand to capitalize on its equity without manufacturing overhead.

The Outfitters segment is also showing positive momentum, particularly with national accounts, indicating success in securing larger, recurring business. Furthermore, Lands' End's focus on product innovation, with a third of its offerings in solution-based categories like sun protection and waterproofing, allows for premium pricing and margin expansion.

The company's digital-first strategy, with over 90% of business online, enables extensive data utilization for optimized operations and customer engagement. Effective social media and influencer marketing campaigns are successfully attracting younger demographics, generating billions of media impressions annually and driving online traffic.

| Strength | Description | Supporting Data/Fact |

| Brand Heritage & Recognition | Decades-old catalog roots foster global brand awareness, crucial for omnichannel strategy. | Cornerstone of their omnichannel strategy. |

| Gross Margin Improvement | Strategic focus on higher-margin sales and reduced promotions. | 210 bps increase to 50.8% in Q1 2025; 550 bps improvement in FY24. |

| Inventory Management | Consistent reduction in inventory levels. | Reduced inventory for 8 consecutive quarters. |

| Licensing Segment Growth | Expansion through partnerships, generating high-margin revenue. | Over 60% growth in Q1 2025; over 50% growth in FY24. |

| Product Innovation | Focus on solution-based products with functional benefits. | ~33% of offerings are solution-based; enables higher price points. |

| Digital & E-commerce Dominance | Over 90% of business online, leveraging data analytics. | 90% of business conducted online; billions of annual media impressions from digital marketing. |

What is included in the product

Delivers a strategic overview of Lands' End’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Lands' End's SWOT analysis provides a clear roadmap to address challenges like declining sales and brand relevance, offering actionable strategies for improvement.

Weaknesses

Lands' End faces a significant challenge with declining net revenue. For the first quarter of fiscal 2025, the company reported an 8.5% drop in net revenue, following a 7.4% decrease in fiscal 2024.

While a portion of this downturn is linked to strategic shifts like the licensing of its kids and footwear businesses, the overall trend highlights difficulties in boosting top-line sales across the brand. This contraction in revenue, even with gross margin improvements, signals a need for renewed strategies to drive customer spending and market share.

Lands' End has faced significant profitability challenges, reporting a net loss of $8.3 million for the first quarter of fiscal year 2025 and a year-to-date net loss of $12.3 million as of the fourth quarter of fiscal year 2025. These figures highlight ongoing struggles to achieve positive earnings.

The company's financial performance is further underscored by its net margin, return on equity (ROE), and return on assets (ROA), all of which fall short of industry averages. This underperformance suggests potential inefficiencies in managing costs, generating returns for shareholders, and effectively leveraging its asset base.

Lands' End faces a significant hurdle with its high debt-to-equity ratio, which was 1.46 as of October 31, 2024. This figure surpasses the industry average, suggesting the company relies more heavily on borrowed funds than its peers, increasing financial risk.

Further highlighting this concern, as of May 2, 2025, Lands' End reported total debt amounting to $298.62 million. This substantial debt load could strain the company's ability to manage its financial obligations, especially during economic downturns or periods of increased interest rates.

Challenges in European E-commerce and Third-Party Marketplaces

Lands' End faces significant headwinds in European e-commerce, with revenue seeing a sharp decline of 28.4% in the first quarter of 2025. Management has publicly acknowledged these difficulties and is actively reassessing its approach to the European market. This strategic pivot is crucial given the substantial revenue drop.

The company's third-party marketplace business also encountered a setback, reporting an 11% decrease in gross profit dollars during the same quarter. This decline is largely attributed to performance issues within a single key marketplace, highlighting a concentration risk in their distribution channels.

- European E-commerce Decline: A substantial 28.4% revenue decrease in Q1 2025 signals major challenges.

- Strategic Adjustments: Management is planning to revise go-to-market strategies for Europe.

- Third-Party Marketplace Impact: An 11% drop in gross profit dollars was primarily driven by issues in one marketplace.

Potential Customer Attrition from Reduced Promotions

Lands' End's strategic shift towards higher-quality sales and reduced promotional activity, while aimed at boosting gross margins, presents a significant weakness. Analysts express concern that this move could alienate price-sensitive customers, particularly during crucial shopping seasons like the holidays. For instance, in Q4 2023, while the company saw improvements in merchandise margin, a reduction in promotional depth could impact customer acquisition and retention rates.

This strategy risks alienating a segment of their customer base that has become accustomed to frequent discounts. A notable example is the potential impact on customer loyalty programs and the overall perception of value. If competitors maintain more aggressive promotional calendars, Lands' End might experience a noticeable drop in traffic and sales volume from these customers.

- Customer Attrition Risk: Reduced promotions could lead to a decline in customer acquisition and retention, especially among price-sensitive demographics.

- Competitive Disadvantage: Competitors offering more frequent or deeper discounts may attract customers away from Lands' End.

- Impact on Sales Volume: A less promotional stance might negatively affect overall sales figures, particularly during peak shopping periods.

Lands' End faces a significant challenge with declining net revenue, experiencing an 8.5% drop in the first quarter of fiscal 2025. This follows a 7.4% decrease in fiscal 2024, indicating persistent difficulties in driving top-line growth. The company's profitability remains a concern, with a net loss of $8.3 million reported in Q1 fiscal 2025 and a year-to-date net loss of $12.3 million as of Q4 fiscal 2025.

A key weakness is Lands' End's elevated debt-to-equity ratio, standing at 1.46 as of October 31, 2024, which is higher than the industry average. This reliance on borrowed funds increases financial risk. Furthermore, the company's European e-commerce segment saw a substantial revenue decline of 28.4% in Q1 2025, prompting a strategic reassessment of its approach to that market. The third-party marketplace business also underperformed, with an 11% decrease in gross profit dollars, largely due to issues with a single key marketplace.

The company's strategic shift towards less promotional activity, while intended to boost margins, risks alienating price-sensitive customers. This could lead to decreased customer acquisition and retention, potentially impacting overall sales volume, especially during critical shopping periods when competitors may offer more aggressive discounts.

| Financial Metric | Q1 Fiscal 2025 | Fiscal 2024 | Industry Average (Est.) |

| Net Revenue Change | -8.5% | -7.4% | N/A |

| Net Loss | $8.3 million | N/A | N/A |

| Debt-to-Equity Ratio | 1.46 (Oct 31, 2024) | N/A | ~1.0 (Est.) |

| European E-commerce Revenue Change | -28.4% | N/A | N/A |

| Third-Party Marketplace Gross Profit Change | -11% | N/A | N/A |

Same Document Delivered

Lands' End SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and that you get exactly what you expect. You're viewing a live preview of the actual SWOT analysis file, and the complete version becomes available after checkout.

Opportunities

Lands' End's licensing model is showing impressive traction. For instance, the partnership with Delta Air Lines for crew uniforms, initiated in 2023, is a prime example of leveraging brand equity. This expansion into new categories and customer segments offers a pathway to significant revenue growth with minimal capital investment, enhancing profitability through higher-margin, asset-light operations.

Lands' End is strategically pivoting its marketing to capture a younger, more affluent audience known as 'Evolvers.' This demographic values not just price, but also fashion-forward styles and a brand's underlying values. By moving towards lifestyle-focused catalogs and showcasing complete outfits, the company aims to resonate with these consumers.

This shift away from a purely price-centric approach is designed to build brand loyalty and reduce the need for constant sales. In 2023, for instance, brands that successfully engaged Gen Z through authentic storytelling and purpose-driven initiatives saw increased customer lifetime value, a trend Lands' End is clearly aiming to capitalize on.

Lands' End has a significant opportunity to further refine its digital presence, especially since its online business accounts for a substantial portion, nearing 90%. This focus can drive growth by optimizing how customers find products, particularly on third-party marketplaces, through the use of custom AI tools.

Improving the overall e-commerce experience is key. By making the online shopping journey smoother and more intuitive, Lands' End can boost customer engagement and increase conversion rates, directly impacting sales performance. For instance, in the fiscal year 2023, digital sales represented approximately 89% of total net revenue, highlighting the critical importance of these enhancements.

Strategic Alternatives for Shareholder Value

Lands' End's Board of Directors is actively exploring strategic alternatives, signaling a proactive approach to enhancing shareholder value. This includes considering a potential sale, merger, or other significant transactions to adapt the business for future growth and profitability. For instance, in the first quarter of fiscal year 2024, Lands' End reported net sales of $281 million, a 7.7% decrease compared to the prior year, underscoring the board's motivation to find avenues for improvement.

The company's willingness to consider these strategic moves suggests a recognition of the current market dynamics and a commitment to unlocking the full potential of the brand. This exploration is a crucial step in navigating the competitive retail landscape and ensuring long-term success. As of May 3, 2024, the company's market capitalization stood at approximately $450 million, providing a benchmark for any potential transactions.

- Sale Consideration: Evaluating a complete divestiture to a new owner who can inject capital and strategic direction.

- Merger Possibilities: Exploring combinations with complementary businesses to achieve synergies and expand market reach.

- Strategic Partnerships: Investigating alliances that could enhance operational efficiency or product offerings without a full sale.

Growth in Outfitters and Uniform Business

The Outfitters segment, encompassing business and school uniforms, stands out as a significant growth driver for Lands' End. This sector is particularly effective at attracting new customers, especially within the school uniform market. Focusing on expanding this established business offers a reliable and consistent revenue stream.

This strategic area presents several key opportunities:

- Market Expansion: Continued investment in the school uniform sector can capture a larger share of this growing market.

- Brand Differentiation: The Outfitters segment serves as a unique selling proposition, setting Lands' End apart from competitors.

- Stable Revenue: The recurring nature of uniform orders provides a predictable and stable income source, bolstering financial predictability.

- Customer Acquisition: The school uniform channel has proven successful in bringing in new, loyal customers to the broader Lands' End brand.

Lands' End has a significant opportunity to leverage its licensing agreements, such as the one with Delta Air Lines for crew uniforms, to expand into new markets and customer segments. This asset-light strategy can drive revenue growth with higher margins. The company is also focusing on attracting a younger, affluent demographic by shifting towards lifestyle-focused marketing and showcasing complete outfits, aiming to build brand loyalty beyond price. Furthermore, refining its digital presence, which already accounts for nearly 90% of sales, presents a clear path to increased customer engagement and conversion rates.

Threats

Lands' End navigates a crowded apparel retail landscape, contending with a multitude of established outdoor apparel and lifestyle brands. This intense rivalry means the company must constantly innovate and differentiate itself to capture consumer attention and market share.

The company faces significant pressure from both legacy competitors and agile new entrants. These disruptors often leverage cutting-edge designs and a strong commitment to sustainability, setting new benchmarks for consumer expectations and forcing established players like Lands' End to adapt quickly.

For instance, in 2024, the global apparel market experienced robust growth, with online channels becoming increasingly dominant. Brands that effectively integrate digital strategies and demonstrate clear value propositions, especially around sustainability, are gaining traction, intensifying the competitive environment for all participants.

Lands' End has faced significant financial challenges, with net revenue declining and the company reporting net losses, even as they've worked to boost gross margins. For the fiscal year ending January 28, 2024, net sales decreased to $1.06 billion compared to $1.13 billion in the prior year.

The company's net loss widened to $125.3 million for fiscal year 2023, a stark contrast to a net loss of $34.1 million in fiscal year 2022, highlighting the severity of their profitability issues.

A difficult economic climate, marked by potential slowdowns in consumer spending, poses a continued threat, likely to further suppress sales and erode profitability in the coming periods.

Lands' End faces ongoing threats from supply chain disruptions and evolving global trade policies, including tariffs. The company's reliance on international sourcing, despite efforts towards diversification, leaves it susceptible to these external pressures, which can directly influence product costs and ultimately affect profitability margins.

In 2023, the apparel industry continued to grapple with elevated shipping costs and lead times, a trend that persisted into early 2024. For Lands' End, this translates to potential increases in the cost of goods sold, especially if tariffs on key sourcing regions are implemented or maintained, impacting their ability to offer competitive pricing.

Dependence on Key Marketplaces and Channels

Lands' End faces significant threats from its reliance on specific third-party marketplaces. Challenges encountered in these key channels have directly impacted the company's revenue and gross profit, as evidenced by a notable decline in sales through certain online platforms in recent reporting periods. This over-dependence creates substantial risk; if these crucial channels underperform or alter their operating terms, it could disproportionately affect Lands' End's overall financial health and market reach.

The company's vulnerability is amplified by:

- Marketplace Performance Fluctuations: Negative impacts on revenue and gross profit have been directly linked to issues within specific third-party marketplaces, highlighting the volatility of these sales channels.

- Channel Partner Dependency: An over-reliance on a limited number of key online retailers or distribution partners exposes Lands' End to significant risks should those partners experience difficulties or change their business strategies.

- Potential for Unfavorable Term Changes: Shifts in commission structures, advertising requirements, or inventory management policies by major marketplaces can directly erode profit margins and operational flexibility for Lands' End.

Brand Perception and Relevance to Younger Consumers

A significant threat for Lands' End is its brand perception, particularly among younger consumers. While the company is making efforts to appeal to a broader demographic, its historical association with an older customer base persists. This can hinder its ability to capture a new generation of shoppers.

Failing to effectively connect with and retain younger consumers poses a direct risk to Lands' End's future growth trajectory and market share. For instance, in 2023, while overall sales saw fluctuations, the challenge of attracting and keeping Gen Z and younger Millennials remains a key hurdle. Brands that fail to adapt their messaging and product offerings to these demographics often see their relevance diminish.

- Brand Legacy vs. Modern Appeal: Lands' End needs to bridge the gap between its established, classic image and the trend-driven preferences of younger shoppers.

- Digital Engagement Gap: The brand must enhance its digital presence and social media strategies to resonate with younger consumers who are highly active online.

- Market Share Erosion: Without a strong connection to younger demographics, Lands' End risks losing market share to competitors who are more successful in capturing this crucial segment.

Lands' End faces intense competition from both established brands and agile new entrants, many of whom are prioritizing sustainability and digital strategies. The company's financial performance remains a concern, with net revenue declining and net losses widening in fiscal year 2023, reporting $1.06 billion in net sales and a net loss of $125.3 million. Furthermore, reliance on specific third-party marketplaces creates significant revenue risk, and challenges in connecting with younger demographics could hinder future growth.

| Metric | FY 2023 (Ended Jan 28, 2024) | FY 2022 (Ended Jan 29, 2023) |

|---|---|---|

| Net Sales | $1.06 billion | $1.13 billion |

| Net Loss | $125.3 million | $34.1 million |

SWOT Analysis Data Sources

This analysis leverages a comprehensive blend of data sources, including Lands' End's public financial filings, detailed market research reports, and expert industry commentary to provide a robust and insightful SWOT assessment.