Lands' End Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lands' End Bundle

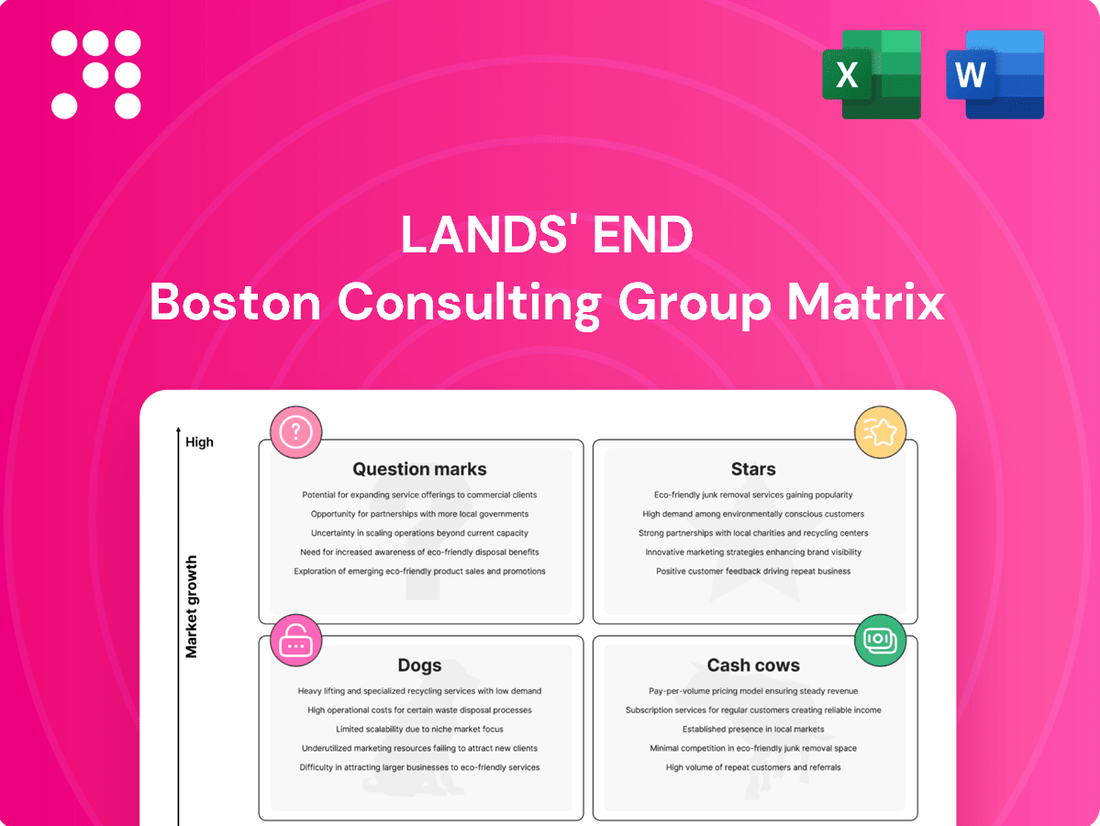

Curious about Lands' End's product portfolio performance? Our BCG Matrix preview highlights key areas, but to truly understand their market position and future potential, you need the full picture. Discover which categories are driving growth and which might need a strategic rethink.

Unlock the complete Lands' End BCG Matrix to gain a clear, actionable understanding of their Stars, Cash Cows, Dogs, and Question Marks. This comprehensive report provides the detailed insights and strategic recommendations you need to make informed decisions about resource allocation and future investments.

Don't miss out on the full strategic advantage. Purchase the complete BCG Matrix report for Lands' End to receive a detailed breakdown of each product category's market share and growth rate, empowering you to optimize your business strategy.

Stars

Lands' End's licensing business is a star performer, demonstrating impressive growth. In the first quarter of fiscal 2025, licensing revenue surged by over 60% compared to the previous year. This asset-light strategy, which has seen product lines like kids and footwear move to licensing, was a significant driver of Gross Merchandise Value (GMV) in fiscal 2024.

Outerwear and swimwear are significant contributors to Lands' End's performance, bolstering gross margins and fueling sales growth. The company actively capitalizes on the robust demand for these categories, introducing fresh designs and innovations. This strategic emphasis on core product lines ensures a sustained high market share in these essential, albeit seasonal, segments.

Lands' End has seen a significant boost in new customer acquisition, reporting a 5% increase globally. This growth is largely attributed to their strategic investments in digital marketing, a key indicator of their success in reaching new audiences in today's competitive retail landscape.

The company's commitment to digital transformation and fostering stronger customer engagement has clearly resonated, attracting a larger pool of new buyers. This focus on digital channels is vital for expanding their market presence and driving future sales.

Solution-Based Product Innovation

Lands' End's strategy heavily leans into product newness, especially in areas offering tangible solutions to customer needs. This includes items with sun protection, waterproofing, and body-shaping capabilities. These innovative, solution-based products now represent a significant portion of their offerings, around 33% of the total product mix, reinforcing their identity as a lifestyle brand.

This strategic emphasis on functional innovation allows Lands' End to command higher price points for these specialized items. Consequently, this approach supports ongoing margin expansion by directly addressing specific consumer demands with value-added products.

- Solution-Based Product Innovation: Focus on functional features like sun protection and waterproofing.

- Market Positioning: Approximately one-third of the product mix is now in these solution-based categories.

- Pricing Power: Higher price points are achievable due to the added value and specific consumer needs addressed.

- Margin Expansion: This strategy directly contributes to continued growth in profit margins.

Strategic Partnerships within Outfitters

The Outfitters segment at Lands' End, focusing on customized products for businesses and schools, stands as a market leader and a key growth driver. This division leverages its established business-to-business (B2B) expertise to secure significant, high-volume contracts.

Strategic partnerships are central to Outfitters' expansion. A notable example is the new collaboration with Delta Air Lines, set to launch in the second quarter of fiscal year 2025. This alliance is anticipated to be a substantial contributor to revenue growth.

- Market Leadership: Outfitters is a dominant player in the customized apparel market for businesses and educational institutions.

- Growth Vector: Strategic alliances are identified as a primary engine for expanding Outfitters' market reach and revenue.

- Key Partnership: The upcoming collaboration with Delta Air Lines in Q2 FY2025 is expected to unlock significant new business opportunities.

- B2B Strength: This segment capitalizes on Lands' End's existing robust capabilities in serving corporate and institutional clients.

Lands' End's licensing business is a clear star, showing remarkable growth. In the first quarter of fiscal 2025, licensing revenue climbed by over 60% year-over-year. This asset-light approach, which includes moving product lines like kids and footwear to licensing, was a major driver of Gross Merchandise Value (GMV) in fiscal 2024.

The Outfitters segment, focused on customized apparel for businesses and schools, is a market leader and a key growth area. This division leverages its strong B2B expertise to secure large, high-volume contracts. A significant new partnership with Delta Air Lines, launching in Q2 FY2025, is expected to be a substantial revenue contributor.

| Category | Growth Indicator | Fiscal Year 2025 (Q1) | Fiscal Year 2024 | Notes |

| Licensing | Revenue Growth | Over 60% YoY | Significant GMV Driver | Asset-light strategy |

| Outfitters | Market Position | Market Leader | N/A | B2B expertise, Delta partnership |

What is included in the product

This BCG Matrix analysis of Lands' End highlights which product categories are Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear Lands' End BCG Matrix visually identifies underperforming "Dogs" and resource-draining "Cash Cows," enabling strategic divestment or optimization.

Cash Cows

Lands' End's U.S. e-commerce core business functions as a Cash Cow within the company's BCG Matrix. This segment commands a significant market share for its established lines of classic and casual apparel, benefiting from a loyal customer base and a strong online infrastructure.

Despite broader company-wide revenue shifts, the U.S. e-commerce net revenue demonstrated resilience, remaining stable during the first quarter of fiscal 2025. This stability underscores the segment's consistent ability to generate substantial cash flow, a hallmark of a successful Cash Cow.

Despite the ongoing digital transformation, Lands' End's catalog sales channel continues to be a robust and reliable revenue stream, serving a dedicated and long-standing customer base. This established channel is a key contributor to the company's stability.

Lands' End is actively refining its catalog approach, aiming to attract a younger demographic, underscoring the channel's enduring importance as a direct consumer engagement tool. This strategic evolution demonstrates its continued viability.

Compared to high-growth segments, this catalog channel demands less intensive promotional spending, thereby generating consistent and predictable cash flow for the business. In 2023, direct-to-consumer sales, which include catalog, represented a substantial portion of Lands' End's revenue.

The Outfitters segment, which supplies uniforms to businesses and schools, acts as a strong Cash Cow for Lands' End. This division consistently generates reliable revenue, benefiting from long-term contracts and a solid foothold in its market.

In fiscal 2024, the school uniform channel experienced a successful back-to-school period, underscoring the segment's stability. While growth may be more modest compared to other business areas, its high market share within its specialized niche ensures predictable and steady cash flow for the company.

Classic Apparel Collections

Classic Apparel Collections at Lands' End are firmly positioned as Cash Cows within the BCG Matrix. These lines, encompassing men's, women's, and children's wear, are celebrated for their enduring comfort, durability, and quality, fostering a dedicated customer base and consistent sales.

The established brand equity and predictable demand for these foundational clothing items mean they generate substantial, reliable profits without requiring significant investment for growth or innovation. For instance, in fiscal year 2024, Lands' End reported net sales of $1.15 billion, with its core apparel categories forming a significant portion of this revenue, reflecting the mature and profitable nature of these offerings.

- Strong Market Share: The Classic Apparel Collections hold a dominant position in their niche, benefiting from brand loyalty.

- Consistent Revenue Generation: These products are the bedrock of Lands' End's sales, providing stable income.

- Low Investment Needs: Mature product lines require minimal R&D or marketing expenditure to maintain their market position.

- Profitability Driver: Their consistent demand and established pricing power make them significant profit contributors.

Home Goods Category

Within Lands' End's broader portfolio, the Home Goods category, encompassing items like bedding and towels, functions as a classic cash cow. While not experiencing rapid expansion, this segment consistently generates reliable revenue by meeting the established needs of its existing customer base, thereby supporting the company's overall financial health.

This mature market segment contributes steadily to Lands' End's revenue stream and reinforces its brand presence. Its role is to provide consistent cash flow, allowing the company to allocate resources to other areas of the business.

- Consistent Revenue: Home goods provide a stable income source for Lands' End.

- Customer Loyalty: This category caters to existing customers, reinforcing brand loyalty.

- Brand Extension: It complements apparel offerings, broadening the brand's reach.

- Mature Market: Operates in a stable, albeit slower-growing, market segment.

The U.S. e-commerce core business, Classic Apparel Collections, and the Outfitters segment all represent strong Cash Cows for Lands' End. These areas benefit from high market share and consistent revenue generation with minimal need for investment, serving as the primary profit drivers for the company.

| Segment | BCG Category | Key Characteristics | Fiscal 2024/2025 Data Points |

|---|---|---|---|

| U.S. E-commerce Core | Cash Cow | Dominant market share in classic/casual apparel, loyal customer base, strong online infrastructure. | Net revenue stable in Q1 FY2025, indicating consistent cash flow generation. |

| Classic Apparel Collections | Cash Cow | Enduring comfort, durability, and quality in men's, women's, and children's wear. | Formed a significant portion of $1.15 billion in net sales in FY2024. |

| Outfitters (School Uniforms) | Cash Cow | Supplies uniforms to businesses/schools, long-term contracts, solid market foothold. | Successful back-to-school period in FY2024, ensuring predictable cash flow. |

What You’re Viewing Is Included

Lands' End BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis of Lands' End's product portfolio, categorized by market share and growth rate, is presented in its final, professionally formatted state. You can confidently use this preview as a direct representation of the actionable insights you will gain, enabling informed decision-making for your business. Once purchased, this report will be instantly downloadable, providing you with a complete tool for competitive strategy and portfolio management.

Dogs

Lands' End has shifted its kids and footwear categories towards licensing agreements, which directly impacts its direct net revenue from these segments. This strategic move suggests that direct management of these product lines was not as financially advantageous or streamlined.

By embracing licensing, Lands' End is effectively lowering its direct capital outlay and inventory exposure in areas that might have shown slower growth or diminished profitability when handled internally. For instance, in the first quarter of 2024, Lands' End reported a net loss of $7.5 million, highlighting ongoing challenges in optimizing its revenue streams.

Lands' End has been strategically reducing its reliance on high promotional and markdown inventory. This shift indicates a move away from a 'dog' quadrant in the BCG matrix, where such sales typically tie up capital with low profitability. For instance, in the first quarter of fiscal 2024, Lands' End reported a focus on improving gross margin, suggesting a deliberate effort to lessen the impact of heavy discounting.

Historically, Lands' End's European e-commerce operations presented a significant challenge. In fiscal 2024, this segment experienced a notable decline in sales, indicating a weak market position and limited growth potential. This underperformance firmly placed it in the 'dog' quadrant of the BCG Matrix.

The company's strategic response involves a comprehensive relaunch of its European e-commerce platform. The aim is to reposition the brand as more premium, targeting a higher-value customer segment. This initiative seeks to reverse the declining sales trend and improve market share.

Legacy, Low-Margin Product SKUs

Lands' End's strategic pivot toward "higher quality sales" and improved gross margins naturally leads to a pruning of legacy, low-margin product SKUs. These items, often characterized by their reliance on significant promotional activity to move inventory, align with the characteristics of a 'dog' in the BCG matrix. By reducing the emphasis on these less profitable offerings, the company aims to streamline its product catalog and boost overall financial performance.

This strategic rationalization is a common approach for retailers seeking to enhance profitability. For instance, in 2023, Lands' End reported a gross profit of $517.9 million, a slight increase from $515.4 million in 2022, indicating a focus on margin improvement. The de-emphasis of low-margin SKUs would contribute to this trend by freeing up resources and capital that can be reinvested in more promising product categories.

- Legacy Product De-emphasis: Lands' End is reducing its focus on older, less profitable product lines.

- Margin Expansion Strategy: This aligns with the company's goal to increase gross margins.

- Streamlining Assortment: The company is simplifying its product offerings to improve efficiency.

- Focus on Quality Sales: The strategy prioritizes sales that contribute more significantly to profitability.

Specific Third-Party Marketplace Channels with Declining Performance

While Lands' End leverages various third-party marketplaces, a few specific channels are showing a downward trend in performance. These underperforming areas, despite overall licensing strength, can be categorized as ‘dogs’ within the BCG matrix if they consistently fall short of generating adequate returns.

For instance, one particular marketplace saw a significant dip in Q1 fiscal 2025, with gross profit dollars decreasing by 11% and revenue declining by 9%. This indicates a weakening position for Lands' End within that specific distribution channel.

- Declining Gross Profit: An 11% drop in gross profit dollars in Q1 fiscal 2025 for a specific third-party marketplace.

- Revenue Fall: A 9% decrease in revenue for the same marketplace during Q1 fiscal 2025.

- Underperforming Channels: These specific marketplaces are considered 'dogs' if their returns are consistently insufficient.

- Context of Licensing Success: This decline occurs despite the generally positive performance of Lands' End's overall licensing strategy.

Lands' End's historical focus on certain legacy product lines, often requiring heavy discounting to move inventory, aligns with the characteristics of 'dogs' in the BCG matrix. The company is actively working to de-emphasize these low-margin SKUs to improve overall profitability.

The strategic pruning of these underperforming product categories is a deliberate move to streamline the assortment and concentrate resources on more profitable ventures. This approach is supported by the company's reported gross profit of $517.9 million in 2023, a slight increase from the previous year, signaling a commitment to margin expansion.

Furthermore, specific third-party marketplaces have shown declining performance, with one marketplace experiencing an 11% drop in gross profit dollars and a 9% revenue decline in Q1 fiscal 2025. These channels, if consistently underperforming, can be classified as 'dogs' within the company's portfolio.

The company's European e-commerce operations also historically represented a 'dog' due to declining sales and limited growth potential, prompting a strategic relaunch to reposition the brand and target a more premium customer base.

| Category | BCG Quadrant | Rationale | Key Financial Indicator (Q1 FY25 unless specified) |

| Legacy Product SKUs | Dog | Low profitability, high reliance on promotions | Focus on improving gross margin |

| European E-commerce | Dog | Declining sales, weak market position | Sales decline in fiscal 2024 |

| Specific Third-Party Marketplace | Dog | Consistent underperformance, insufficient returns | Gross profit dollars down 11%, revenue down 9% |

Question Marks

Lands' End is strategically relaunching its European e-commerce presence, focusing on streamlining inventory and preparing for expansion into key markets such as France. This move is designed to pivot a historically underperforming region into a significant growth driver for the company.

The brand's European operations, while currently holding a small market share, represent a high-growth potential opportunity. Success hinges on the effectiveness of its rebranding initiatives and the strategic rollout into new territories.

Lands' End is actively diversifying into new product categories like denim, a soft polish collection, hosiery, intimates, and travel accessories, often leveraging licensing agreements. These expansions target growing market segments where the company's current market share is relatively low.

For instance, the global denim market was valued at approximately $60 billion in 2023 and is projected to grow, presenting a significant opportunity for Lands' End to capture market share with its new offerings. Similarly, the intimates market is substantial, with projections indicating continued expansion in the coming years.

Successfully establishing these new categories will necessitate considerable investment in marketing campaigns and robust product development. This strategic move positions these new ventures as potential 'question marks' within the BCG matrix, requiring careful nurturing to achieve growth and market leadership.

Lands' End is actively investing in cutting-edge digital technologies, notably a proprietary AI tool designed to revolutionize product discovery and elevate personalization. This strategic move is geared towards fostering deeper customer engagement and stimulating sales by crafting highly tailored shopping journeys. For instance, in Q1 2024, Lands' End reported a 5.1% increase in digital net revenue, indicating early traction for their tech investments.

This AI initiative, being a relatively recent implementation, is still in its formative stages regarding its influence on overall market share. Consequently, it represents a significant opportunity for high growth, yet currently holds a modest share of the market, fitting the profile of a 'question mark' within the BCG framework. The company's commitment is evident, with digital marketing spend increasing by 8% year-over-year in 2024 to support these innovations.

Social Commerce Channels

The burgeoning social commerce landscape, fueled by platforms like TikTok Shop and the evolving Facebook/Instagram Shops, represents a significant high-growth market. This trend offers Lands' End a compelling opportunity to connect with a wider, digitally native customer base and simplify the purchasing journey.

Lands' End, with its established digital retail presence, is strategically positioned to leverage these social commerce channels. By expanding its footprint here, the company can tap into new demographics and enhance customer engagement, potentially driving substantial sales growth.

- Market Growth: Social commerce sales are projected to reach over $60 billion in the US by 2027, indicating a rapid expansion.

- Platform Evolution: Enhanced features on Facebook and Instagram Shops, alongside the rise of TikTok Shop, are making these platforms increasingly transactional.

- Lands' End Opportunity: As a digital-first retailer, Lands' End can integrate its product offerings directly into these social shopping experiences.

- Strategic Investment: While the growth potential is high, initial market share on these nascent platforms may require focused marketing and operational investment for Lands' End.

Targeting Younger Customer Base via Catalog Evolution

Lands' End is shifting its catalog strategy, moving from purely sales-focused content to a lifestyle-oriented publication. This evolution aims to connect emotionally with a younger demographic by showcasing everyday individuals and complete outfits, effectively revitalizing an established channel for potential new revenue streams. The success of this strategy in converting younger consumers and substantially boosting market share within this segment remains a key area of uncertainty.

- Catalog Transformation: Lands' End is redesigning its catalogs to feature lifestyle content and relatable models, moving away from a purely transactional format.

- Target Demographic: The initiative specifically targets a younger customer base, aiming to capture a new segment of the market.

- Growth Potential: This evolution represents an effort to unlock growth by making an existing marketing channel more appealing to a broader audience.

- Uncertainty: The effectiveness of this catalog evolution in driving sales and increasing market share among younger consumers is still to be determined, posing a significant question mark for the brand's strategy.

New product categories like denim and intimates, alongside the expansion into social commerce and the reimagined catalog strategy, represent significant growth opportunities for Lands' End. These initiatives are currently in their early stages, meaning they have high market growth potential but currently hold a relatively low market share. Their success is not yet guaranteed, requiring substantial investment and strategic execution to transform them from potential question marks into market leaders.

| Initiative | Market Growth Potential | Current Market Share | BCG Category | Key Considerations |

|---|---|---|---|---|

| New Product Categories (Denim, Intimates) | High (Global denim market ~ $60B in 2023) | Low | Question Mark | Requires significant marketing and product development investment. |

| Social Commerce Expansion | High (US social commerce projected > $60B by 2027) | Low | Question Mark | Leveraging platforms like TikTok Shop and evolving social media shops. |

| Catalog Strategy Evolution | High (Targeting younger demographics) | Low | Question Mark | Success hinges on emotional connection and effective conversion of new customer segments. |

| AI-Powered Personalization | High (Digital net revenue up 5.1% in Q1 2024) | Low | Question Mark | Ongoing investment in digital marketing (up 8% YoY in 2024) to support adoption. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and competitor analysis to ensure reliable, high-impact insights.