Lands' End Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lands' End Bundle

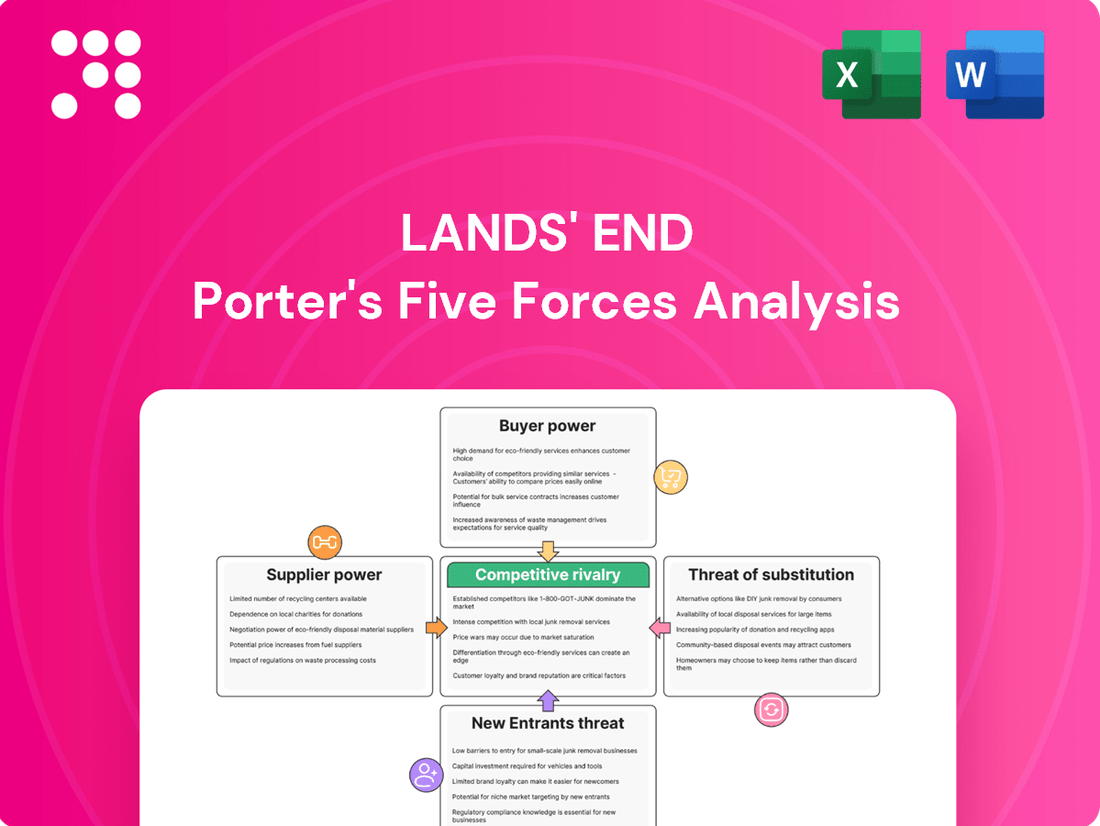

Lands' End faces a dynamic retail landscape, with intense rivalry and shifting buyer power significantly impacting its market position. Understanding these forces is crucial for navigating the apparel industry.

The complete report reveals the real forces shaping Lands' End’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Lands' End's suppliers is significantly shaped by supplier concentration and specialization. Lands' End relies on a diverse range of materials and finished goods, and for specialized fabrics or components meeting its quality benchmarks, the market might be dominated by a limited number of manufacturers. For instance, if only a handful of textile mills can produce a particular high-performance or proprietary fabric essential to Lands' End's product differentiation, these suppliers gain considerable leverage, potentially driving up costs for the company.

The ease with which Lands' End can switch suppliers significantly influences the bargaining power of those suppliers. If transitioning to a new supplier for fabrics, manufacturing, or logistics incurs substantial costs, such as retooling production lines or lengthy material re-certification processes, current suppliers can exert greater leverage. For instance, if a key fabric supplier requires extensive quality assurance testing for new clients, Lands' End faces higher switching costs, strengthening that supplier's position.

Conversely, if Lands' End sources common materials like cotton or basic polyester from a broad base of readily available manufacturers, its switching costs are inherently lower. This abundance of alternatives for standard apparel components diminishes the bargaining power of individual suppliers. In 2024, the apparel industry continued to see a diverse supplier landscape, particularly for foundational materials, which generally keeps supplier power in check for companies like Lands' End that can leverage scale.

Supplier power escalates when the inputs Lands' End requires are unique or proprietary, meaning there are few, if any, viable substitutes available. This lack of alternatives grants suppliers significant leverage in pricing and terms.

A credible threat of backward integration by suppliers, where they could start producing and selling finished goods directly to consumers, also bolsters their bargaining power. For instance, if a key fabric supplier were to launch its own apparel line, Lands' End would face direct competition from a former partner.

This situation compels Lands' End to cultivate strong supplier relationships and potentially concede to less favorable contract terms to mitigate the risk of its suppliers becoming direct competitors, thereby protecting its market share.

Importance of Lands' End to Suppliers' Business

The bargaining power of suppliers for Lands' End is significantly influenced by how crucial Lands' End is to their overall business. If a supplier relies heavily on Lands' End for a substantial portion of their sales, they are more inclined to negotiate favorable pricing and terms to maintain that relationship. Conversely, if Lands' End represents a minor part of a supplier's revenue, the supplier holds more leverage and can afford to be less flexible.

For instance, in 2023, many apparel manufacturers experienced fluctuating demand, making key retail partners like Lands' End vital for consistent order volumes. Suppliers who cater to a broad range of clients might have less incentive to offer concessions to Lands' End compared to those whose business is more concentrated.

- Supplier Dependency: The degree to which a supplier's revenue stream is dependent on Lands' End directly impacts their bargaining power.

- Market Concentration: If a supplier serves a limited number of large customers, Lands' End's contribution becomes more significant, potentially increasing the supplier's leverage.

- Diversification: Suppliers with a diverse customer base are less vulnerable to losing any single client, which can strengthen their negotiating position.

- Industry Conditions: In 2024, with ongoing supply chain adjustments, suppliers with unique or high-demand materials might command stronger terms regardless of client size.

Availability of Substitute Inputs

The availability of substitute inputs significantly weakens supplier power for Lands' End. For its core product lines, like classic and casual apparel, many basic fabrics and manufacturing processes are readily available from a diverse range of global suppliers. This broad accessibility means Lands' End isn't overly reliant on any single supplier, enabling more favorable price negotiations and contract terms.

For instance, the global textile market offers a wide array of cotton, polyester, and blended fabrics. In 2024, the global cotton production was estimated to be around 25 million metric tons, indicating ample supply. If a particular supplier of, say, premium cotton were to increase prices excessively, Lands' End could easily source comparable materials from numerous other vendors, thereby maintaining its purchasing leverage.

- Broad Fabric Options: Lands' End can choose from various natural and synthetic fibers, reducing dependence on single-source materials.

- Global Sourcing Network: The company leverages a wide network of manufacturers worldwide, allowing for flexibility in production partners.

- Price Negotiation Power: The presence of alternatives empowers Lands' End to negotiate better pricing and payment terms with its suppliers.

- Reduced Switching Costs: Shifting to a different supplier for common inputs is relatively straightforward and cost-effective.

Lands' End faces moderate bargaining power from its suppliers, largely due to the availability of substitute inputs and the company's ability to switch suppliers for many common materials. The global apparel supply chain in 2024 offered a wide array of fabric options and manufacturing partners, which generally kept individual supplier leverage in check. For example, the vast availability of cotton, with global production around 25 million metric tons in 2024, allows Lands' End to easily find alternatives if one supplier raises prices. This broad sourcing network and the relatively low cost of switching for standard inputs empower Lands' End in negotiations.

| Factor | Impact on Lands' End Supplier Bargaining Power | 2024 Context/Data |

|---|---|---|

| Availability of Substitutes | Lowers power | Ample global supply of common fabrics like cotton (approx. 25 million metric tons produced globally in 2024). |

| Switching Costs | Lowers power | Relatively low for standard materials and manufacturing processes, facilitating ease of supplier change. |

| Supplier Concentration | Can increase power (for specialized inputs) | Limited number of manufacturers for specialized or proprietary fabrics can grant leverage. |

| Supplier Dependency on Lands' End | Lowers power if Lands' End is a major customer | Suppliers heavily reliant on Lands' End may offer more favorable terms to maintain the relationship. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Lands' End's position in the apparel industry.

Quickly identify and address competitive threats with a readily available, actionable overview of the five forces impacting Lands' End.

Customers Bargaining Power

Lands' End customers are highly sensitive to price, largely due to the widespread availability of information. The rise of e-commerce in 2024 means consumers can easily compare prices for similar classic and casual apparel, footwear, and home goods across numerous retailers with just a few clicks. This transparency directly empowers buyers to find the best deals.

This ease of price comparison puts significant pressure on Lands' End's pricing strategies. When customers can readily see competitor pricing for comparable items, they are more likely to choose the option that offers the best value, forcing Lands' End to remain competitive to retain market share. For example, in the apparel sector, online price comparison tools have become ubiquitous, influencing purchasing decisions significantly.

Customers of Lands' End face a highly competitive market with abundant substitute products and brands across apparel, footwear, accessories, and home goods. This wide selection, available both online and in physical stores, empowers consumers to readily switch to competitors offering better pricing, trendier styles, or enhanced customer service. For instance, the U.S. apparel market alone saw a significant increase in online penetration, with e-commerce accounting for approximately 22.1% of total retail sales in 2024, indicating a vast digital marketplace where alternatives are easily accessible.

For the majority of apparel and home goods, customers face very low costs when switching from Lands' End to a competitor. There are no binding contracts or substantial financial repercussions for a customer deciding to buy from another brand for their next purchase.

This ease of switching means customers can readily explore different brands without penalty, putting pressure on Lands' End to continually deliver strong value, high quality, and excellent service to keep its customers loyal. For instance, in 2024, the average consumer spent over $1,000 annually on apparel, with a significant portion of that budget allocated to brands offering perceived better value or trend alignment, highlighting the competitive landscape.

Lands' End's Product Differentiation and Customization

While customers in the retail sector often wield significant power, Lands' End's strategic emphasis on distinctive attributes like superior quality, comfort, and lasting durability helps to temper this influence. The company's commitment to offering an extensive array of sizes and valuable customization options further carves out a unique market position, attracting consumers who prioritize these specific product characteristics over mass-market availability.

These differentiators, however, operate within the context of a broad market for classic and casual apparel. The inherent accessibility of similar styles from numerous competitors means that while Lands' End can mitigate customer bargaining power to a degree, it does not eliminate it entirely.

- Product Attributes: Quality, comfort, and durability are key selling points.

- Size and Customization: A wide range of sizes and customization options appeal to specific customer needs.

- Market Context: The 'classic and casual' segment offers many alternatives, limiting the full mitigation of customer power.

- Competitive Landscape: Competitors offering similar styles can still exert pressure on pricing and product features.

Importance of Purchase to the Customer

The bargaining power of customers for Lands' End is significantly influenced by the importance of their purchases. For many consumers, Lands' End products, while appreciated for their quality, are typically discretionary purchases. This means they aren't essential items like groceries or utilities.

Because these purchases are often non-essential, customers have the flexibility to postpone buying or redirect their spending if they feel the value offered by Lands' End doesn't meet their expectations. This ability to delay or switch brands directly translates into increased bargaining power for the customer.

For instance, in 2024, the apparel industry experienced shifts in consumer spending habits, with many prioritizing value and seeking discounts. Lands' End, like its competitors, had to navigate this environment. Data from late 2023 and early 2024 indicated that consumers were more price-sensitive, especially for categories beyond immediate needs.

- Discretionary Spending: Lands' End primarily sells clothing and home goods, which are largely discretionary.

- Price Sensitivity: In 2024, many consumers showed increased price sensitivity, impacting purchasing decisions for non-essential items.

- Switching Costs: For many apparel items, the cost for a customer to switch to a competitor is relatively low, further enhancing their bargaining power.

The bargaining power of Lands' End customers is substantial due to widespread price transparency and low switching costs in the apparel market. In 2024, e-commerce's continued dominance allowed consumers to easily compare prices across a vast array of competitors for classic and casual wear. This ease of comparison, coupled with the fact that most purchases are discretionary and carry minimal switching costs, empowers customers to seek the best value, directly impacting Lands' End's pricing and market strategy.

| Factor | Impact on Lands' End | 2024 Context |

|---|---|---|

| Price Transparency | High | Ubiquitous online price comparison tools. |

| Switching Costs | Low | No significant financial or contractual barriers to switching brands. |

| Product Availability | High | Abundant substitutes in apparel, footwear, and home goods. |

| Purchase Importance | Low to Moderate | Apparel and home goods are often discretionary purchases. |

Preview the Actual Deliverable

Lands' End Porter's Five Forces Analysis

This preview displays the complete, professionally written Lands' End Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the apparel industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning. You can confidently rely on this detailed analysis to understand the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry in the market.

Rivalry Among Competitors

Lands' End operates in a retail landscape that is both crowded and varied. The apparel, footwear, accessories, and home goods sectors are brimming with a multitude of players, making competition fierce. For instance, in 2024, the U.S. online apparel market alone is projected to exceed $150 billion, highlighting the sheer scale of this competitive arena.

This intense rivalry stems from a broad spectrum of competitors. Lands' End must contend with traditional giants like Macy's and Kohl's, alongside digital natives such as Amazon and Shein, which have rapidly gained market share. Furthermore, numerous niche brands and discount retailers, including TJ Maxx and Ross, add to the competitive pressure, each targeting specific consumer segments and price points.

The apparel and home goods markets where Lands' End operates are generally considered mature, exhibiting moderate growth rates, especially in developed economies. For instance, the global apparel market's compound annual growth rate (CAGR) was projected to be around 3.5% to 4.5% in the early 2020s, indicating a steady but not explosive expansion.

In such mature environments, growth opportunities are often realized by capturing market share from rivals rather than from overall market expansion. This dynamic intensifies competition, pushing companies like Lands' End into more aggressive strategies concerning pricing, promotional offers, and marketing campaigns to attract and retain customers.

The relatively slow pace of industry growth directly fuels higher competitive rivalry. Companies must work harder to win over consumers, leading to increased advertising spend and a greater emphasis on product differentiation or value propositions to stand out in a crowded marketplace.

Lands' End focuses on quality, comfort, and durability, but many competitors offer similar product attributes, making it hard to truly stand out. For instance, in 2024, apparel retailers continue to invest heavily in material innovation and sustainable sourcing, blurring the lines of what constitutes unique product offering.

While Lands' End boasts a recognized brand and customer loyalty, especially among its established customer base, the retail industry generally has low switching costs. This means customers can easily choose to shop elsewhere, particularly with the rise of fast fashion and online retailers offering competitive pricing and convenience.

To combat this, continuous product innovation and compelling brand storytelling are crucial for Lands' End. The company's efforts in personalized styling services and expanded size ranges in 2024 aim to deepen customer engagement and reduce the likelihood of customers switching to competitors.

Low Customer Switching Costs and Price Competition

The apparel and home goods market, where Lands' End operates, is characterized by very low customer switching costs. This means customers can easily move from one brand or retailer to another, often based on price or convenience. This ease of switching directly fuels intense price competition, forcing companies like Lands' End to remain price-competitive even with their emphasis on quality.

To retain customers in this environment, Lands' End frequently engages in promotional activities and sales events. For instance, in 2024, many apparel retailers offered significant discounts, with average promotional depths reaching 20-30% during key selling periods. These tactics, while necessary to attract and retain shoppers, can intensify rivalry and put pressure on profit margins across the entire industry.

- Low Switching Costs: Customers can easily switch between apparel and home goods retailers, impacting brand loyalty and price sensitivity.

- Price Competition: The ease of switching drives aggressive pricing strategies and frequent sales events among competitors.

- Promotional Reliance: Companies like Lands' End often rely on promotions to attract and retain customers, potentially affecting profitability.

High Exit Barriers for Competitors

High exit barriers significantly impact the competitive landscape for retailers like Lands' End. Significant investments in inventory, established distribution networks, and ongoing marketing campaigns create substantial financial commitments that make exiting the market difficult for struggling competitors. This often results in weaker players continuing operations, even at reduced profitability, to avoid realizing losses, thereby maintaining market overcapacity and intensifying competition.

These elevated exit barriers mean that even companies experiencing financial difficulties may persist, contributing to sustained competitive pressure. For instance, the retail sector in 2024 continues to grapple with the aftermath of supply chain disruptions and shifting consumer spending habits, making it harder for underperforming businesses to divest cleanly. This reluctance to exit by weaker entities ensures that companies like Lands' End must contend with a persistently crowded and aggressive market, where even marginal players remain active participants.

- High Fixed Costs: Retailers face substantial fixed costs in areas like warehousing, logistics, and brand promotion, creating a financial disincentive to exit.

- Sustained Overcapacity: The inability of some competitors to exit the market leads to a persistent oversupply of goods and services, driving down prices.

- Aggressive Competition: Companies that remain in the market despite challenges often engage in aggressive pricing and promotional strategies to survive, increasing pressure on established players.

The competitive rivalry within the apparel and home goods sector is intense, driven by a large number of players and relatively slow industry growth. Lands' End faces competition from both established department stores and agile online retailers. In 2024, the U.S. online apparel market alone was projected to surpass $150 billion, underscoring the vastness of this competitive arena.

The market's maturity, with a projected global apparel market CAGR of 3.5% to 4.5% in the early 2020s, means companies like Lands' End must actively capture market share rather than relying on overall market expansion. This necessitates aggressive strategies in pricing and promotions to attract and retain customers, especially as product differentiation becomes more challenging, with retailers investing in material innovation in 2024.

Low customer switching costs further exacerbate this rivalry, encouraging price sensitivity and frequent promotional activities. Lands' End's efforts in 2024, such as personalized styling and expanded size ranges, aim to build loyalty amidst an environment where competitors may offer significant discounts, with average promotional depths reaching 20-30% during peak periods.

| Factor | Impact on Lands' End | 2024 Data/Context |

|---|---|---|

| Number of Competitors | High; broad spectrum from department stores to online specialists. | U.S. online apparel market projected over $150 billion. |

| Industry Growth Rate | Moderate; requires market share gains. | Global apparel market CAGR ~3.5-4.5% (early 2020s). |

| Switching Costs | Low; customers easily shift based on price/convenience. | Promotional depths of 20-30% common in 2024. |

| Product Differentiation | Challenging; focus on quality/comfort is common. | Investment in material innovation by competitors in 2024. |

SSubstitutes Threaten

The threat of substitutes for Lands' End is significant, stemming from a wide array of alternative sources for apparel, footwear, accessories, and home goods. Consumers can turn to the growing second-hand market, clothing rental services, or even embrace DIY approaches for home decor, all of which offer different value propositions that compete for discretionary spending. For example, the resale market for apparel is projected to grow substantially, with some reports indicating it could reach over $77 billion by 2025, directly impacting traditional retail sales.

Shifting consumer tastes pose a significant threat. A growing preference for minimalism or sustainable living can lead individuals to reduce clothing purchases, opting for fewer, higher-quality items or even pre-owned apparel, directly impacting demand for Lands' End products. For example, a 2024 survey indicated that 45% of Gen Z consumers are actively seeking out sustainable fashion brands, a segment Lands' End aims to capture.

Lands' End faces a threat from substitutes that offer a different price-performance balance. Discount retailers, for instance, provide significantly lower price points, though often at the cost of quality or longevity, attracting cost-sensitive shoppers.

Conversely, premium or luxury apparel brands can serve as substitutes by offering distinct value propositions, such as superior craftsmanship or brand prestige, appealing to consumers seeking different benefits or for specific occasions.

For example, in 2024, the apparel market saw continued growth in the fast-fashion sector, which often competes on price, while also witnessing sustained demand for premium and sustainable brands that emphasize quality and ethical sourcing. This bifurcation highlights how substitutes can cater to diverse consumer needs and preferences, pressuring established players like Lands' End to clearly define their value proposition.

Technological Advancements in Material Science and Manufacturing

Innovations in material science are a significant threat. For instance, the development of smart fabrics that offer enhanced temperature regulation or moisture-wicking properties could present a compelling alternative to Lands' End's traditional apparel. Similarly, the increasing viability of highly sustainable and biodegradable materials might attract environmentally conscious consumers seeking alternatives to conventional textiles.

Advancements in manufacturing processes also pose a threat. Technologies like advanced 3D printing are enabling the creation of highly customized and on-demand home goods, potentially offering unique substitutes for mass-produced items typically found in a retailer like Lands' End. These manufacturing shifts can introduce novel product categories that directly compete with established offerings.

These technological shifts can introduce novel alternatives to Lands' End's offerings, impacting demand for their classic wear and home goods. For example, the global market for technical textiles, which includes smart fabrics, was projected to reach over $250 billion by 2024, indicating a substantial and growing area of innovation that could spawn direct substitutes.

The rise of personalized manufacturing, fueled by technologies like 3D printing, allows for greater customization and potentially faster production cycles for niche products. This could lead to smaller, agile competitors offering highly tailored home decor or apparel items, directly challenging Lands' End's traditional product lines.

DIY and Repair Culture Trends

The rise of DIY and repair culture presents a growing threat of substitutes for apparel retailers like Lands' End. Consumers are increasingly interested in personalizing their living spaces through do-it-yourself home decor projects, which can divert discretionary spending away from clothing. Furthermore, a significant trend involves repairing and extending the lifespan of existing garments, directly impacting the demand for new apparel purchases.

This cultural shift towards resourcefulness and sustainability means consumers may opt for mending or upcycling instead of buying new. For instance, searches for DIY clothing repair tutorials saw a notable increase in 2024, indicating a growing consumer interest in this alternative. This can lead to a reduced frequency of purchases for items like outerwear and casual wear from traditional retailers.

- DIY Home Decor Spending: While specific figures for 2024 are still emerging, the global DIY home improvement market was valued at over $900 billion in 2023 and is projected for continued growth, signaling a significant allocation of consumer budgets towards home-related projects.

- Garment Longevity Focus: Surveys in late 2023 and early 2024 indicated that a substantial percentage of consumers (around 30-40% in some studies) are actively seeking ways to make their clothing last longer, whether through repair or careful maintenance.

- Sustainability as a Driver: Environmental concerns are increasingly influencing purchasing decisions, with a growing segment of consumers prioritizing brands with sustainable practices or opting for second-hand or repaired items to reduce their environmental footprint.

The threat of substitutes for Lands' End is multifaceted, encompassing everything from the burgeoning resale market to innovative material technologies and evolving consumer behaviors like DIY. These alternatives directly compete for consumer dollars and attention, forcing Lands' End to continually adapt its value proposition.

The resale market for apparel, for instance, is a significant substitute, projected to reach over $77 billion by 2025. This growth, coupled with a 2024 trend where 45% of Gen Z consumers actively seek sustainable fashion, highlights a clear shift away from traditional purchasing patterns. Furthermore, the global DIY home improvement market, exceeding $900 billion in 2023, indicates consumers are allocating significant budgets to personal projects, potentially diverting funds from apparel purchases.

| Substitute Category | Key Trends/Data Points | Impact on Lands' End |

|---|---|---|

| Resale Market | Projected to exceed $77 billion by 2025 | Direct competition for apparel sales, particularly for mid-range items. |

| Sustainable/Ethical Consumption | 45% of Gen Z seek sustainable brands (2024) | Pressure to adopt and highlight sustainable practices; risk of losing younger demographics. |

| DIY & Home Improvement | Global market >$900 billion (2023) | Diversion of discretionary spending away from clothing and home goods. |

| Innovative Materials | Global technical textiles market >$250 billion (2024) | Potential for new performance-based apparel that could displace traditional offerings. |

Entrants Threaten

While the digital frontier of e-commerce might seem accessible, the significant capital outlay required to build a truly competitive multi-channel retail operation presents a substantial hurdle for new entrants. Lands' End, for instance, must invest heavily in not just its online platform but also in maintaining and optimizing its catalog operations and, where applicable, physical retail presence.

Developing the sophisticated supply chains, advanced inventory management systems, and the physical infrastructure necessary to support a seamless customer experience across all channels demands considerable financial resources. For example, establishing even a modest physical retail footprint can easily run into millions of dollars for leasehold improvements, inventory stocking, and staffing.

This high barrier to entry, particularly for companies aspiring to replicate a comprehensive multi-channel strategy, effectively deters many potential competitors from entering the market at a comparable scale. The sheer volume of capital needed to compete effectively across e-commerce, direct mail, and brick-and-mortar channels acts as a significant deterrent.

Lands' End benefits from strong brand recognition and customer loyalty cultivated over decades, especially for its classic styles and durable products. New competitors must invest heavily in marketing and time to build similar trust and awareness, making it difficult to dislodge established customer bases.

Lands' End benefits from established relationships with suppliers and a well-developed global supply chain, alongside its multi-channel distribution network, including e-commerce, catalogs, and retail stores. New entrants would need to build these complex networks from scratch, securing reliable suppliers and efficient logistics, which can be both time-consuming and costly, posing a considerable barrier.

Economies of Scale and Experience Curve Advantages

Lands' End, as a long-standing apparel retailer, likely leverages significant economies of scale in its operations. This means they can negotiate better prices for raw materials and manufacturing due to larger order volumes, which new competitors would find difficult to replicate immediately. For instance, in 2023, the apparel industry saw continued pressure on supply chains, making established players with robust relationships more resilient.

The experience curve is also a substantial barrier. Lands' End has honed its design, merchandising, and customer service processes over decades, leading to greater efficiency and potentially higher customer satisfaction. New entrants would need considerable time and investment to build similar expertise and brand recognition, making it challenging to compete on operational effectiveness from the outset.

- Economies of Scale: Lands' End benefits from bulk purchasing power for fabrics and manufacturing, leading to lower per-unit production costs compared to startups.

- Experience Curve: Decades of experience in apparel design, trend forecasting, and supply chain management provide Lands' End with operational efficiencies and market knowledge that new entrants lack.

- Marketing Efficiency: Established brands can spread marketing costs over a larger sales base, making their advertising spend more cost-effective than that of a new entrant.

- Customer Loyalty: Accumulated brand trust and customer loyalty, built over years, reduce the cost of customer acquisition for Lands' End, a hurdle for new businesses.

Regulatory Barriers and Intellectual Property

While the apparel and home goods retail sector generally faces fewer direct regulatory barriers than some other industries, Lands' End must still navigate consumer protection laws, import/export regulations, and product safety standards. These can create complexity and add to the cost of doing business, acting as a moderate deterrent to new entrants. For instance, in 2024, compliance with evolving environmental regulations for textile sourcing and manufacturing continues to be a significant consideration for retailers.

Intellectual property, though less of a direct barrier for classic apparel designs, can still play a role. If Lands' End holds patents on unique fabric treatments or manufacturing processes, this could deter competitors from exact replication. While specific IP details for Lands' End are not publicly detailed, the general principle remains that proprietary innovations can create a competitive moat.

- Regulatory Compliance Costs: Retailers face ongoing expenses to ensure adherence to product safety, labeling, and environmental standards, which can be a hurdle for startups.

- Import/Export Complexity: Navigating international trade laws and tariffs adds operational complexity and potential cost increases for new entrants sourcing globally.

- Proprietary Technology: While not always prominent in apparel, unique manufacturing techniques or material innovations could offer a competitive edge and deter direct imitation.

The threat of new entrants for Lands' End is moderate, primarily due to the substantial capital required for a multi-channel retail operation and the established brand equity. Building a comparable supply chain, marketing infrastructure, and customer loyalty takes significant time and investment, deterring many potential competitors from entering at scale.

For example, in 2024, the cost of digital advertising and customer acquisition remains high, with average customer acquisition costs in the apparel sector often ranging from $50 to $100 or more. New entrants must also contend with Lands' End’s established economies of scale, which allow for more competitive pricing and marketing efficiency. The experience curve, built over decades, further solidifies Lands' End's position, creating a knowledge and operational advantage that is difficult for newcomers to quickly overcome.

| Factor | Impact on New Entrants | Lands' End Advantage |

|---|---|---|

| Capital Requirements | High (multi-channel infrastructure, inventory) | Established infrastructure, economies of scale |

| Brand Equity & Loyalty | Low (requires time and investment to build) | High (decades of customer trust) |

| Supply Chain & Operations | Complex and costly to build | Established, efficient, and scaled |

| Marketing & Customer Acquisition | Expensive and challenging | More efficient due to brand recognition and scale |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lands' End is built upon a foundation of publicly available financial reports, industry-specific trade publications, and market research databases. These sources provide critical insights into competitor strategies, consumer purchasing behavior, and the overall economic landscape impacting the apparel retail sector.