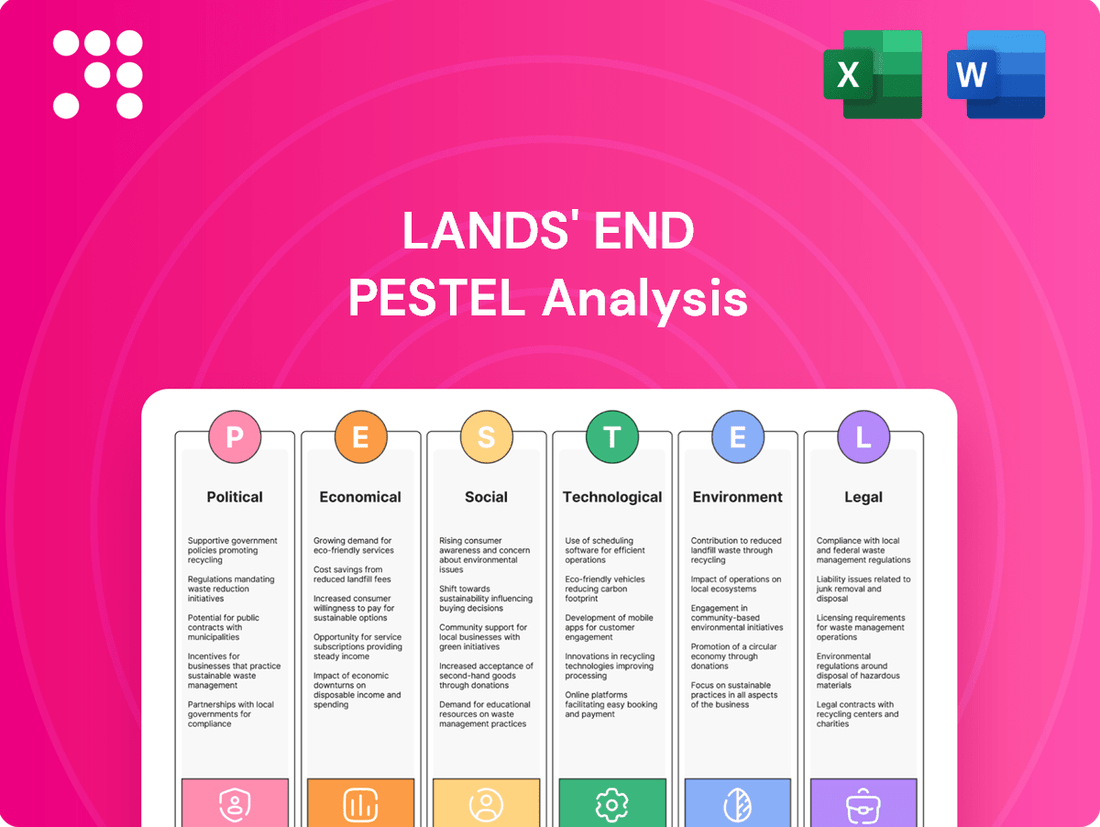

Lands' End PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lands' End Bundle

Navigate the complex external forces shaping Lands' End's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting the apparel industry. Gain a strategic advantage by leveraging these critical insights. Download the full analysis now to unlock actionable intelligence and refine your market approach.

Political factors

Global trade policies, including tariffs on apparel and consumer goods, directly influence Lands' End's sourcing expenses and how it prices its products. For instance, the company has factored in the expected effects of current global tariffs into its fiscal year 2025 financial projections, highlighting the tangible impact of these trade dynamics.

In response to evolving trade landscapes and potential policy shifts, many retailers, including those in the apparel sector, are actively broadening their network of suppliers. This diversification strategy aims to cushion the business against the financial repercussions of unexpected tariff changes or trade disputes.

Governments are increasingly scrutinizing the fashion industry's environmental impact, with new regulations emerging globally. For instance, the European Union's Extended Producer Responsibility (EPR) schemes are pushing brands to take ownership of their product's lifecycle, including waste management. Similarly, in the United States, states like California with its Responsible Textile Recovery Act are implementing measures to curb textile waste and promote circularity.

These evolving legal landscapes necessitate significant adaptation from companies like Lands' End. Compliance with these mandates, which often involve detailed tracking of environmental footprints and investment in sustainable practices, will be crucial. Failure to adapt could lead to penalties and reputational damage, impacting market position and consumer trust.

The expanding web of data privacy legislation, including the California Privacy Rights Act (CPRA) and newly enacted laws in states like Iowa, Delaware, and New Jersey throughout 2023 and into 2024, presents a significant challenge for Lands' End. These regulations, alongside the established General Data Protection Regulation (GDPR) in the EU, necessitate robust compliance measures for managing customer data. Failure to adhere to these often-divergent rules can result in substantial penalties, impacting operational costs and brand reputation.

Geopolitical Instability

Ongoing geopolitical instability, exemplified by the Red Sea disruptions in early 2024, significantly impacts global supply chains. These events, which saw shipping costs surge by as much as 150% on certain routes, directly translate into increased operational expenses and potential delays for retailers like Lands' End.

This heightened risk environment compels companies to bolster supply chain resilience. Strategies include diversifying shipping routes and exploring alternative sourcing locations to mitigate the impact of unforeseen geopolitical events. For instance, many apparel companies began investigating nearshoring options in 2024 to reduce reliance on long-haul shipping.

Consequently, agile operational planning becomes paramount for retailers. Maintaining product availability and managing inventory effectively in the face of such volatility requires flexible logistics and proactive risk management. This adaptability is crucial for navigating the unpredictable landscape of international trade in 2024 and beyond.

- Red Sea shipping costs increased by up to 150% in early 2024 due to geopolitical disruptions.

- Retailers are exploring nearshoring and diversifying sourcing to counter supply chain vulnerabilities.

- Agile operational planning is essential for maintaining product availability amidst geopolitical instability.

Consumer Protection Laws

Consumer protection laws are increasingly shaping how retailers operate, with a notable focus on product safety and clear labeling. For instance, the European Union's General Product Safety Regulation (GPSR), which came into effect in December 2024, mandates stricter oversight and accountability for product safety throughout the supply chain. Lands' End, as a global retailer, must navigate these evolving regulations to ensure all its apparel and home goods meet these enhanced safety and disclosure standards in every market it serves. This means providing unambiguous product information, necessary safety warnings, and robust systems for managing any product recalls or issues with defective items.

The growing emphasis on consumer rights translates into tangible operational requirements for companies like Lands' End:

- Enhanced Product Safety Compliance: Meeting stringent safety standards, such as those outlined in the GPSR, requires rigorous testing and quality control processes for all products sold.

- Transparent Labeling and Disclosure: Clear and accurate information regarding materials, origin, and care instructions is paramount to comply with consumer protection directives.

- Effective Complaint and Recall Management: Establishing efficient procedures for handling customer complaints, managing product returns, and executing product recalls is critical for maintaining consumer trust and legal compliance.

- Cross-Border Regulatory Harmonization: Lands' End must ensure its practices align with varying consumer protection laws across different jurisdictions, adding complexity to its global operations.

Government trade policies, including tariffs and import quotas, directly impact Lands' End's cost of goods sold and pricing strategies, with ongoing negotiations in 2024 and 2025 creating market uncertainty. Geopolitical events, such as the Red Sea disruptions in early 2024 which led to shipping cost increases of up to 150% on some routes, necessitate adaptive supply chain management and diversification of sourcing locations to mitigate risks and maintain product availability. Increased regulatory scrutiny on environmental impact and consumer protection, exemplified by the EU's General Product Safety Regulation (GPSR) effective December 2024, requires robust compliance measures for product safety and transparency. Furthermore, evolving data privacy legislation across the US and EU demands significant investment in data security and compliance protocols to avoid substantial penalties.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Lands' End, detailing how political, economic, social, technological, environmental, and legal factors present both challenges and strategic advantages.

Provides a concise version of the Lands' End PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Persistent inflation throughout 2025 is notably impacting consumer spending, particularly in discretionary categories like apparel. As purchasing power diminishes, consumers are increasingly prioritizing value, with a significant portion actively seeking ways to economize on fashion purchases. This shift necessitates a careful calibration of pricing and product offerings by companies like Lands' End to maintain customer loyalty.

Data from early 2025 surveys reveal that more than 60% of consumers are actively looking to save money on clothing. This trend manifests in a growing preference for more affordable brands, private label options, and a significant uptick in the popularity of the second-hand and resale market. Lands' End must therefore strategically position its merchandise, emphasizing durability and timeless style as key value propositions to counter the allure of lower-priced alternatives.

Lands' End's financial performance in the first quarter of fiscal year 2025 showed a decrease in net revenue by 8.5% compared to the previous year. This dip was influenced by strategic inventory adjustments.

Despite the revenue decline, the company saw positive momentum with growth in Gross Merchandise Value (GMV) and an improvement in its gross margins, indicating better cost management and product profitability.

Looking ahead to fiscal year 2025, Lands' End projects mid-to-high single-digit GMV growth. The company anticipates net revenue to fall between $1.33 billion and $1.45 billion, with an expected net income ranging from $8.0 million to $20.0 million.

Lands' End experienced a notable dip in its global e-commerce net revenue during fiscal year 2024. This trend continued into the first quarter of fiscal year 2025, with a significant decline observed in European e-commerce revenue.

These figures underscore the ongoing challenge for the digitally native company in effectively translating online traffic into actual sales. It emphasizes the critical need for refined strategies in managing online promotions and customer conversion.

Looking ahead, Lands' End is prioritizing investments to bolster its digital operations and expand its reach through licensing agreements. These initiatives are seen as vital for driving future e-commerce revenue growth and navigating the competitive online retail landscape.

Supply Chain Costs and Efficiency

Rising fuel, raw material, and transportation expenses continue to squeeze retail profit margins. For instance, the US Producer Price Index for refined petroleum products saw a significant increase in early 2024, impacting transportation costs. Lands' End, like its competitors, must navigate these persistent supply chain disruptions and cost escalations.

Effectively managing these challenges requires strategic focus. Retailers are investing in supply chain resilience and optimizing inventory management to protect profitability.

- Increased Fuel Prices: Global oil prices, a key driver of transportation costs, remained volatile throughout 2023 and into early 2024, impacting inbound and outbound logistics for retailers like Lands' End.

- Raw Material Volatility: The cost of cotton, a primary material for apparel, experienced fluctuations due to weather patterns and global demand, directly affecting production expenses.

- Logistics Expenses: Elevated freight rates, particularly for ocean and trucking, continued to be a significant factor in the overall cost of goods sold for many apparel companies.

Licensing Business Growth

Lands' End is actively growing its licensing retail business, a strategic move that has shown promising results. This expansion into areas like children's apparel, footwear, and home furnishings is a key driver of its growth strategy. The company reported significant increases in its licensing segment during fiscal 2024 and into the first quarter of 2025.

This asset-light approach is particularly beneficial as it boosts gross profit margins and broadens the reach of the Lands' End brand. By partnering with other companies, Lands' End can expand its product offerings without the significant capital investment typically required for direct manufacturing and retail operations.

While the shift of some product lines to licensing partners has affected net revenue figures, it is a deliberate part of a larger plan. The ultimate goal is to funnel more customer traffic back to Lands' End's primary e-commerce platform, strengthening its direct-to-consumer channel.

- Licensing Growth: Significant expansion in fiscal 2024 and Q1 2025 across categories like kids, footwear, and home goods.

- Asset-Light Model: Contributes positively to gross profit and brand expansion.

- Strategic Revenue Impact: Transition of product lines to licensing partners impacts net revenue but aims to drive e-commerce traffic.

- Brand Extension: Leverages partnerships to increase market presence and product diversity.

Economic headwinds, including persistent inflation in 2025, are pressuring consumer discretionary spending on apparel, forcing brands like Lands' End to emphasize value. Data from early 2025 indicates over 60% of consumers are actively seeking savings on clothing, favoring more affordable options and the resale market.

Lands' End reported an 8.5% decrease in net revenue for Q1 fiscal year 2025 compared to the prior year, partly due to strategic inventory adjustments. However, the company projects mid-to-high single-digit Gross Merchandise Value growth for fiscal year 2025, with net revenue anticipated between $1.33 billion and $1.45 billion.

Rising costs for fuel, raw materials, and transportation continue to impact profit margins, with elevated freight rates and volatile cotton prices affecting the cost of goods sold. Lands' End is navigating these challenges by focusing on supply chain resilience and optimizing inventory.

The company is strategically expanding its licensing retail business, which saw significant growth in fiscal 2024 and Q1 2025 across categories like kids, footwear, and home goods, contributing positively to gross profit margins and brand expansion.

| Financial Metric | FY 2024 (Reported) | Q1 FY 2025 (Reported) | FY 2025 Projection |

|---|---|---|---|

| Net Revenue Change (YoY) | - | -8.5% | $1.33B - $1.45B |

| Gross Merchandise Value (GMV) Growth | - | - | Mid-to-High Single Digits |

| Net Income | - | - | $8.0M - $20.0M |

Full Version Awaits

Lands' End PESTLE Analysis

The preview you see here is the exact Lands' End PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, offering a comprehensive PESTLE analysis of Lands' End, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the political, economic, social, technological, legal, and environmental factors affecting Lands' End.

Sociological factors

Consumer trust in brands, particularly within the apparel sector, has seen a notable decline. A recent survey indicated that over 60% of consumers are more hesitant to spend on clothing and accessories compared to previous years, citing concerns about the value offered by higher-priced items. This widespread skepticism directly impacts brands like Lands' End.

This erosion of trust stems from a perception that many fashion brands, especially those with premium pricing, are not delivering commensurate quality or durability. Consumers are increasingly scrutinizing their purchases, seeking tangible value and authenticity. For Lands' End, this necessitates a focused effort on transparent communication about product quality and sourcing.

To navigate this challenging landscape, Lands' End must actively work to rebuild and solidify customer loyalty by emphasizing its core strengths: reliable quality, timeless style, and a clear value proposition. Highlighting customer testimonials and demonstrating commitment to ethical practices can help counter the prevailing consumer skepticism and reinforce brand authenticity.

Consumers are definitely becoming more mindful of their spending, actively seeking out the best bang for their buck. This is fueling the growth of private label brands, clever 'dupe' products that mimic higher-end items, and a booming secondhand apparel market. For instance, the global secondhand apparel market was valued at approximately $177 billion in 2023 and is expected to reach $351 billion by 2027, highlighting a strong consumer preference for value.

This societal shift towards value-consciousness presents an opportunity for Lands' End. The company's long-standing reputation for offering quality and durable clothing at competitive prices aligns well with these evolving consumer priorities. If Lands' End can effectively communicate this value proposition, it could attract a larger segment of these price-aware shoppers.

Consumers are increasingly seeking out fashion brands that prioritize sustainability and ethical production. This trend means shoppers are more likely to choose companies that show genuine environmental responsibility in their operations. For instance, a 2024 report indicated that over 60% of consumers consider a brand's sustainability efforts when making purchasing decisions.

While price remains important, this growing segment of the market views sustainability as a crucial element in their buying choices. Lands' End's commitment to its stated sustainability goals, such as reducing waste and sourcing materials responsibly, directly addresses this consumer preference. This focus can attract and retain customers who align with these values.

Prioritization of Experiences Over Goods

A significant shift in consumer behavior highlights a growing preference for spending on experiences, such as travel and events, over the acquisition of material possessions, including fashion items. This trend directly impacts how fashion retailers must position themselves to capture consumer attention and discretionary income. For instance, a 2024 report indicated that over 60% of consumers planned to increase spending on travel and experiences compared to the previous year.

To remain competitive, companies like Lands' End need to demonstrate tangible value and highlight unique selling propositions that resonate with this experiential mindset. This could involve emphasizing the durability and versatility of their apparel, framing it as essential gear for life's adventures and journeys.

- Shifting Consumer Spend: Consumers are increasingly allocating budgets towards experiences, impacting traditional retail sectors.

- Value Proposition for Fashion: Retailers must clearly articulate the enduring value and unique benefits of their products.

- Alignment with Experiential Trends: Lands' End can leverage its brand narrative of durable, reliable apparel for active lifestyles and travel.

Generational Spending Habits

Generational spending habits present a dynamic landscape for Lands' End. Younger consumers, particularly Gen Z and Millennials, are noted for their willingness to explore new brands and allocate more of their budget to apparel. For instance, a 2024 report indicated that Gen Z consumers are significantly more likely to purchase clothing online compared to previous generations, often influenced by social media trends.

This demographic also exhibits a higher propensity for returns, a factor Lands' End must strategically manage through clear policies and efficient logistics. Understanding these nuances is crucial for tailoring effective marketing campaigns. By 2025, digital engagement is projected to be the primary channel for reaching these age groups, necessitating robust online presence and personalized digital experiences.

- Gen Z and Millennial Apparel Spending: These groups are increasing their clothing expenditures and are more open to trying new brands.

- Digital Engagement: A significant portion of younger consumers' apparel purchases are influenced by online channels and social media.

- Return Rates: Younger demographics tend to have higher return rates for clothing purchases, requiring operational adjustments.

- Marketing Tailoring: Lands' End must adapt its strategies to resonate with diverse generational preferences, emphasizing digital channels and brand discovery.

Consumer trust in brands, especially in apparel, has diminished, with many shoppers hesitant to spend on clothing due to perceived value concerns. This skepticism necessitates a focus on transparency and quality assurance from brands like Lands' End.

A growing preference for experiences over material goods impacts fashion retailers, requiring them to highlight the enduring value and versatility of their apparel. Lands' End can leverage its reputation for durable clothing as suitable for active lifestyles and travel.

Generational shifts are significant, with Gen Z and Millennials increasing apparel spending and favoring online channels, though they also exhibit higher return rates. Lands' End must adapt its digital strategies to capture these demographics.

| Sociological Factor | Trend | Impact on Lands' End |

|---|---|---|

| Consumer Trust | Declining, focus on value and authenticity | Need for transparent communication on quality and sourcing |

| Spending Habits | Shift towards experiences, growth in secondhand market | Opportunity to highlight durability and value proposition |

| Sustainability Awareness | Increasing importance in purchasing decisions | Reinforce commitment to ethical production and waste reduction |

| Generational Preferences | Gen Z/Millennials: higher online spending, brand exploration, higher returns | Tailor digital marketing, manage online logistics and returns |

Technological factors

Lands' End is actively pursuing a digital transformation, focusing on innovation to improve its e-commerce capabilities and customer interactions. This strategy involves utilizing data analytics to gain deeper insights into customer preferences and to refine the online shopping journey.

The company's commitment to a robust digital infrastructure is paramount, especially as it supports a multi-channel retail strategy. A seamless and engaging online experience is therefore crucial for driving sales and fostering customer loyalty in the current market landscape.

In 2023, Lands' End reported that its digital segment continued to be a significant driver of revenue, with online sales comprising a substantial portion of its overall business. This trend is expected to accelerate, underscoring the importance of their ongoing digital investments.

Lands' End is leveraging artificial intelligence, including generative AI, to boost efficiency across its operations. This technology enhances customer service, data analysis, and strategic decision-making, aiming to refine go-to-market approaches.

In retail, AI is crucial for accurate demand forecasting and optimizing inventory levels, while also enabling personalized marketing campaigns. Lands' End's deployment of a proprietary AI tool specifically targets improved product discovery on external sales platforms.

Technological advancements are significantly reshaping retail supply chains. For instance, RFID tracking offers real-time inventory visibility, while AI-powered demand forecasting helps retailers anticipate and meet customer needs more accurately. These tools are crucial for building more agile and resilient operations.

Lands' End is actively leveraging these technologies to enhance its supply chain. By implementing advanced visibility tools and focusing on diversification, the company aims to better predict and manage potential disruptions. This strategic focus on technology is key to optimizing inventory levels and ultimately reducing operational expenses.

Data Analytics for Customer Insights

Lands' End heavily relies on data analytics to deeply understand its customer base. The company actively synthesizes insights from its data science teams, alongside input from marketing, product development, and customer service departments. This collaborative, data-informed strategy helps pinpoint nuanced shopping behaviors and segment customers effectively for tailored marketing and product offerings.

By analyzing vast datasets, Lands' End aims to enhance personalization across all customer touchpoints. This focus on understanding individual preferences and past interactions is crucial for boosting customer satisfaction and loyalty. For instance, in fiscal year 2023, Lands' End reported a 6% increase in digital engagement, partly attributed to improved personalization efforts driven by data insights.

- Customer Segmentation: Data analytics enables the categorization of customers based on purchasing history, browsing behavior, and demographic information.

- Personalized Marketing: Insights derived from data allow for customized email campaigns, product recommendations, and website experiences.

- Product Development: Analyzing customer feedback and purchasing trends informs decisions on new product lines and inventory management.

- Improved Customer Service: Understanding customer issues through data analysis helps in providing more efficient and satisfactory support.

Omnichannel Retail Strategies

Lands' End must navigate the growing trend of omnichannel retail, where customers expect a fluid experience across online platforms, mobile apps, and physical stores. This integration is crucial for brands like Lands' End, which already utilizes e-commerce, catalogs, and brick-and-mortar locations. The company's success hinges on its ability to connect these touchpoints effectively, offering a unified brand experience.

The retail landscape is rapidly evolving with advancements in social commerce and mobile shopping, demanding that Lands' End optimize its digital presence. For instance, by mid-2024, global social commerce sales were projected to reach over $2.9 trillion, highlighting the significant revenue potential of integrated social selling. Furthermore, the increasing reliance on mobile devices for purchases means Lands' End needs to ensure its mobile shopping experience is seamless and intuitive, catering to a customer base that expects convenience and accessibility.

Technological innovations like shoppable media and interactive in-store displays offer opportunities to enhance customer engagement and streamline the purchasing journey. By investing in these digital tools, Lands' End can create more immersive and personalized shopping experiences. This can lead to increased customer loyalty and sales, as seen in the broader retail sector where companies employing advanced digital integration often report higher customer retention rates.

- Omnichannel Integration: Seamlessly blend e-commerce, catalog, and physical store experiences for customers.

- Social Commerce Growth: Leverage social media platforms to drive sales and engage with a wider audience.

- Mobile Optimization: Ensure a robust and user-friendly mobile shopping experience to capture a significant market share.

- Digital Innovation: Implement shoppable media and interactive displays to enhance customer engagement and streamline the buying process.

Lands' End is heavily investing in its digital infrastructure, recognizing that a seamless online experience is critical for its multi-channel strategy. This focus on e-commerce innovation aims to improve customer interactions and drive sales. By mid-2024, global social commerce sales were projected to exceed $2.9 trillion, underscoring the importance of digital presence.

The company is leveraging artificial intelligence, including generative AI, to enhance operational efficiency and customer service. AI is also vital for accurate demand forecasting and personalized marketing, with Lands' End deploying proprietary tools to improve product discovery on external platforms. In fiscal year 2023, Lands' End saw a 6% increase in digital engagement, partly due to these personalization efforts.

Technological advancements are reshaping supply chains, with RFID and AI-powered forecasting offering real-time visibility and better demand anticipation. Lands' End is implementing these tools to optimize inventory and reduce costs, aiming for more agile and resilient operations. This technological integration is key to navigating the evolving retail landscape.

Legal factors

The data privacy landscape is tightening, with new US state laws impacting businesses starting in 2025, building on existing frameworks like the California Privacy Rights Act (CPRA) and the EU's General Data Protection Regulation (GDPR). For Lands' End, this means meticulously updating privacy policies and ensuring explicit consent for data collection. Failure to comply could result in substantial fines; for instance, GDPR violations can reach up to 4% of annual global revenue.

New regulations, such as the EU's General Product Safety Regulation (GPSR) effective December 2024, will significantly impact Lands' End by demanding more rigorous product safety protocols. This means conducting mandatory risk assessments and ensuring comprehensive labeling with clear safety warnings for all consumer products.

Lands' End will also need to register with systems like the EU Safety Gate, enabling quicker responses to any defective products identified in the market. This heightened regulatory environment underscores the importance of proactive compliance to avoid potential penalties and maintain consumer trust.

Several US states, including California, New York, and Washington, alongside the European Union, are actively implementing legislation targeting textile waste and promoting environmental accountability. These initiatives often include Extended Producer Responsibility (EPR) schemes, placing the onus on brands to manage their product waste.

These new laws will mandate that companies like Lands' End take responsibility for textile waste management, meticulously track their emissions, and actively participate in product take-back programs. This signifies a growing legal requirement for Lands' End to oversee the entire product lifecycle, from creation to disposal.

Chemical Restrictions (e.g., PFAS)

Upcoming regulations, like those in California starting January 2025, are set to ban the intentional use of per- and polyfluoroalkyl substances (PFAS) in textiles. This means Lands' End needs to be vigilant about reducing these chemicals within its supply chain to ensure continued market access.

Compliance with these evolving chemical restrictions is crucial for Lands' End to avoid potential sales prohibitions in key markets.

- California's PFAS ban for textiles takes effect January 1, 2025.

- Brands must actively monitor and reduce hazardous substances in their supply chains.

- Non-compliance can lead to product sales being prohibited in affected states.

Corporate Due Diligence Directives

The EU's Corporate Sustainability Due Diligence Directive (CSDDD), expected to be fully implemented by 2027 with national laws in place by 2025, will mandate that companies disclose their social and environmental impacts across their entire supply chains. This means Lands' End will need to enhance its transparency and diligence concerning its sourcing and manufacturing processes.

This directive will likely require significant investment in supply chain mapping and auditing, potentially impacting operational costs for businesses like Lands' End. Companies will need robust systems to track and report on issues such as human rights and environmental degradation, with non-compliance potentially leading to fines and reputational damage.

- CSDDD Implementation Timeline: National laws by 2025, full force by 2027.

- Key Requirement: Disclosure of social and environmental impact in supply chains.

- Impact on Lands' End: Increased transparency and due diligence in sourcing and production.

- Potential Consequences: Increased operational costs, need for new reporting systems, risk of fines and reputational damage for non-compliance.

Lands' End faces increasing legal scrutiny regarding data privacy, with new US state laws effective in 2025, mirroring stricter global standards like GDPR. Compliance necessitates robust consent mechanisms and updated privacy policies, as violations can incur significant financial penalties, potentially reaching millions based on global revenue. The company must also navigate evolving product safety regulations, such as the EU's GPSR from December 2024, requiring enhanced risk assessments and clear product labeling to avoid market recalls and reputational damage.

Upcoming legislation targeting textile waste and chemical usage, like California's PFAS ban in textiles starting January 2025, mandates Lands' End to actively manage its supply chain's environmental impact. This includes taking responsibility for product end-of-life and phasing out hazardous substances to maintain market access, with non-compliance risking sales prohibitions in key regions.

The EU's Corporate Sustainability Due Diligence Directive, with national laws expected by 2025, will compel Lands' End to disclose its supply chain's social and environmental impacts. This will likely increase operational costs due to enhanced transparency and auditing requirements, with failure to comply posing risks of fines and reputational harm.

| Regulatory Area | Key Legislation/Requirement | Effective Date (or Expected) | Potential Impact on Lands' End |

|---|---|---|---|

| Data Privacy | New US State Privacy Laws | 2025 | Mandatory policy updates, consent mechanisms; fines for non-compliance. |

| Product Safety | EU General Product Safety Regulation (GPSR) | December 2024 | Rigorous risk assessments, enhanced labeling. |

| Environmental/Chemicals | California PFAS Ban (Textiles) | January 2025 | Supply chain chemical reduction, potential sales restrictions. |

| Supply Chain Transparency | EU Corporate Sustainability Due Diligence Directive (CSDDD) | National Laws by 2025, Full Force by 2027 | Increased supply chain mapping, auditing, reporting; potential cost increases. |

Environmental factors

Lands' End is actively pursuing ambitious sustainability goals for 2025, aiming for 100% of polyester fibers to be sourced from recycled materials and 100% of cotton to be from sustainable sources. This commitment extends to their down insulation, with a target of 100% compliance with the Responsible Down Standard.

Achieving these targets is vital for Lands' End to shrink its environmental impact and align with growing consumer demand for ethically produced and eco-friendly products. For instance, by 2023, the apparel industry's global market for sustainable fashion was valued at over $6.5 billion, highlighting the significant consumer preference for brands with strong environmental credentials.

The fashion industry is under growing pressure, with new Extended Producer Responsibility (EPR) laws mandating separate collection for end-of-life textiles. This regulatory shift directly impacts companies like Lands' End, pushing for more sustainable end-of-life solutions for their products.

Lands' End is actively working towards a circular product lifecycle by 2025, integrating recycling from the initial design phase. This initiative includes engaging in take-back programs to ensure garments are either reused, repurposed, or effectively recycled, aiming to divert significant amounts of textile waste from landfills.

Globally, the textile waste problem is substantial; for instance, in 2023, it was estimated that over 92 million tons of textile waste were generated worldwide, highlighting the urgency for brands to implement robust recycling and waste reduction strategies.

Lands' End has pledged to reach net-zero emissions across all scopes by the year 2050. Their commitment is currently categorized as 'Committed' by the Science Based Targets initiative (SBTi), indicating a serious intent to align with climate science.

While precise current emissions data for Lands' End isn't publicly disclosed, this forward-looking target signifies a proactive stance on addressing climate change. The fashion industry, in general, faces growing pressure to accurately measure and actively reduce its environmental footprint, making such commitments crucial for brand reputation and regulatory compliance.

Water Conservation Initiatives

Lands' End is actively pursuing water conservation, with a target to have 30% of its garments featuring fabric finishes that utilize water-saving techniques by 2025. This initiative directly addresses the significant environmental impact of water usage in the textile industry. By adopting these methods, Lands' End aims to reduce its operational footprint on vital water resources.

The company's commitment to water-saving fabric finishes is a key component of its broader environmental strategy. This focus is particularly relevant given the increasing global awareness and regulatory pressure surrounding water scarcity and responsible resource management.

- Goal: 30% of garments with fabric finishes to use water-saving techniques by 2025.

- Industry Context: Water conservation is a critical environmental concern in textile production.

- Impact: Implementing water-saving techniques minimizes the company's operational impact on water resources.

Sustainable Packaging and Operations

Lands' End is actively pursuing environmental sustainability, with a clear target to achieve 100% sustainable packaging and labeling by 2025. This commitment extends to a continuous evaluation of its operational footprint to identify areas for improvement.

The company's operational initiatives include significant upgrades within its facilities. For instance, Lands' End is in the process of replacing older fluorescent lighting with more energy-efficient LED alternatives. Furthermore, it has pursued TRUE certification for zero waste, demonstrating a dedication to minimizing waste generation.

These combined efforts in packaging and operations are designed to substantially reduce the overall waste produced by Lands' End, both from its direct operations and throughout its supply chain. This focus on environmental responsibility is becoming increasingly critical for consumer brands.

Key environmental initiatives include:

- Goal: 100% sustainable packaging and labeling by 2025.

- Operational Efficiency: Replacing fluorescent lamps with energy-efficient LEDs in buildings.

- Waste Reduction: Pursuing TRUE certification for zero waste operations.

- Supply Chain Impact: Reducing waste across the entire operational and supply chain network.

Lands' End is prioritizing sustainability, aiming for 100% recycled polyester and sustainable cotton by 2025, alongside Responsible Down Standard compliance. This aligns with the growing consumer demand for eco-friendly fashion, a market valued over $6.5 billion in 2023.

The company is also tackling textile waste by integrating circular design principles and take-back programs, crucial given the over 92 million tons of textile waste generated globally in 2023. Lands' End has pledged net-zero emissions by 2050, demonstrating a commitment to climate science, and is implementing water-saving fabric finishes on 30% of its garments by 2025 to conserve water resources.

Furthermore, Lands' End is committed to 100% sustainable packaging and labeling by 2025, alongside operational improvements like LED lighting upgrades and pursuing zero-waste certifications. These efforts collectively aim to significantly reduce waste across its entire value chain.

| Environmental Goal | Target Year | Current Status/Progress | Industry Benchmark/Impact |

|---|---|---|---|

| 100% Recycled Polyester | 2025 | In progress | Growing consumer preference for recycled materials |

| 100% Sustainable Cotton | 2025 | In progress | Reduces environmental impact of cotton farming |

| Responsible Down Standard Compliance | 2025 | In progress | Ensures ethical sourcing of down insulation |

| Water-Saving Fabric Finishes | 2025 | 30% of garments | Minimizes water usage in textile production |

| Sustainable Packaging & Labeling | 2025 | In progress | Reduces packaging waste |

| Net-Zero Emissions | 2050 | Committed (SBTi) | Addresses climate change impact of operations |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Lands' End is informed by a comprehensive review of official government publications, reputable economic indicators, and leading market research reports. We meticulously gather data on political stability, economic trends, technological advancements, and evolving social attitudes to provide a robust understanding of the external factors impacting the business.