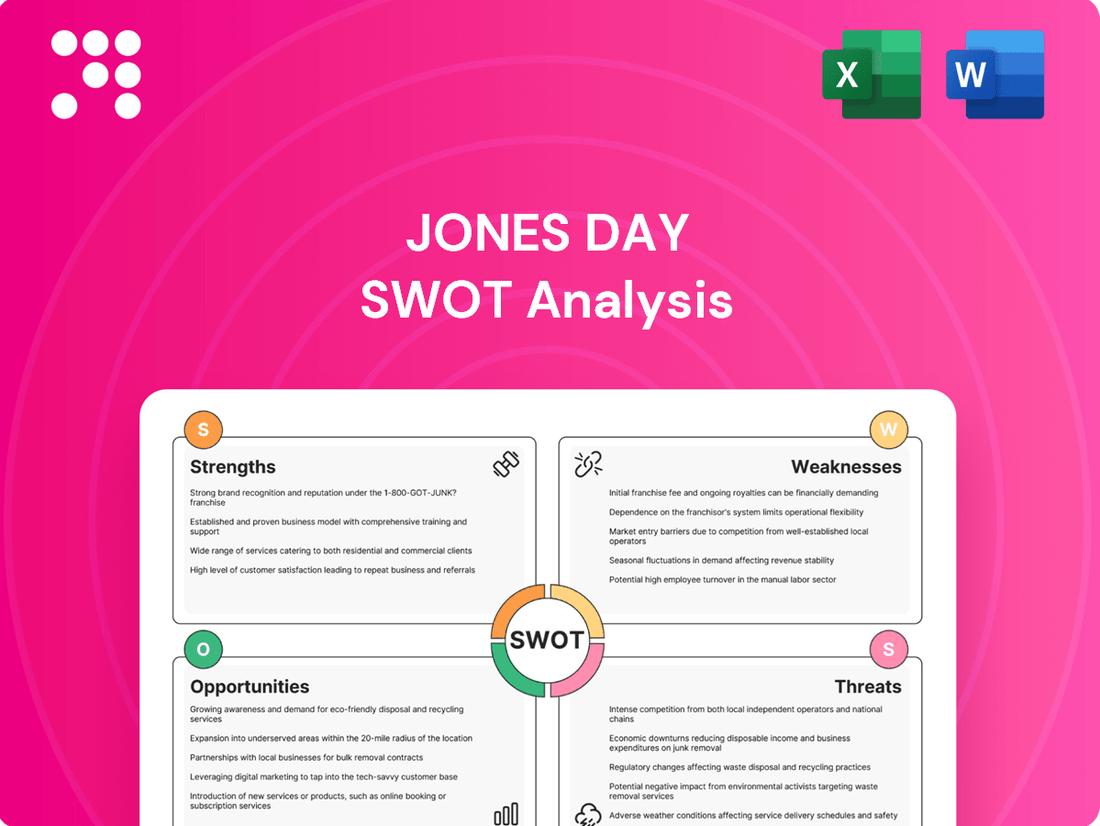

Jones Day SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jones Day Bundle

Jones Day's robust global presence and strong reputation for handling complex litigation are significant strengths, while potential challenges lie in adapting to evolving legal tech and client demands. Our comprehensive SWOT analysis delves into these factors, providing a clear roadmap for understanding their competitive edge and potential vulnerabilities.

Want the full story behind Jones Day's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Jones Day boasts a formidable global presence, with approximately 2,500 lawyers strategically positioned across 40 offices on five continents. This expansive network is a significant strength, allowing the firm to deliver seamless, integrated legal services to clients operating on an international scale. Their ability to navigate diverse legal landscapes and offer consistent counsel worldwide is a key differentiator.

Jones Day boasts a comprehensive suite of highly-regarded practice areas, covering everything from intricate litigation and major corporate deals to intellectual property, regulatory challenges, and bankruptcy proceedings. This breadth ensures the firm can handle a wide array of client needs.

The firm's expertise is consistently validated by leading legal directories. For instance, Chambers USA and The Legal 500 United States frequently place Jones Day and its attorneys in their top tiers, underscoring the depth of their legal talent and extensive experience across various practice groups.

Jones Day's strength lies in its deep-rooted tradition of client service, fostering a collaborative partnership that clients highly value. This client-centric approach, marked by unparalleled experience and efficient navigation of complex legal landscapes, cultivates exceptionally strong and enduring client relationships.

Commitment to Diversity and Inclusion

Jones Day's dedication to diversity and inclusion is a significant strength, earning it recognition as a 'Top Performer' by the Leadership Council on Legal Diversity (LCLD). This commitment is further evidenced by Law360 naming the firm a 'Ceiling Smasher' for its impressive representation of women in equity partnerships. Such a diverse talent pool is vital for fostering a robust firm culture and effectively serving an increasingly varied global client base.

This focus on diversity translates into tangible benefits, ensuring that Jones Day can draw upon a wide range of perspectives and experiences. For instance, in 2023, approximately 35% of Jones Day's equity partners were women, a figure that significantly outpaces the industry average. This broad spectrum of backgrounds and viewpoints within the firm's legal teams allows for more innovative problem-solving and a deeper understanding of client needs in a globalized marketplace.

The firm's proactive approach to building a diverse workforce directly supports its ability to navigate complex legal landscapes worldwide. By actively cultivating an inclusive environment, Jones Day attracts and retains top legal talent from all walks of life. This not only strengthens its internal capabilities but also enhances its reputation and appeal to clients who prioritize working with firms that reflect their own values of diversity and equality.

Adaptability to Evolving Legal Landscape

Jones Day showcases remarkable adaptability in navigating the ever-changing legal environment. The firm's attorneys, for instance, were actively engaged in complex cross-border restructurings and significant mass tort cases throughout 2024, demonstrating their capacity to handle emerging legal challenges.

This agility is further amplified by Jones Day's strategic recruitment of partners possessing specialized knowledge. The firm has successfully integrated new talent in high-demand fields like corporate mergers and acquisitions and the rapidly evolving energy transition sector, reinforcing its ability to meet dynamic market needs.

- Advising on emerging legal areas like cross-border restructurings and mass tort litigation.

- Successfully integrating new partners with specialized expertise in corporate M&A and energy transition.

- Demonstrating a proactive approach to evolving market demands and legal complexities.

Jones Day's commitment to diversity is a significant asset, reflected in its strong representation of women in leadership. In 2023, approximately 35% of its equity partners were women, a figure notably higher than the industry average.

This inclusive approach fosters a wider range of perspectives, enabling more innovative problem-solving and a better understanding of diverse client needs. The firm's proactive efforts in building a diverse workforce also enhance its appeal to clients who value equality.

Jones Day's adaptability is evident in its handling of complex legal challenges, such as cross-border restructurings and mass tort cases throughout 2024. The firm also strategically recruits partners with specialized knowledge in growing areas like M&A and energy transition.

| Metric | 2023 Data | Significance |

|---|---|---|

| Women in Equity Partnership | ~35% | Industry-leading representation, fostering diverse perspectives. |

| Key Practice Areas | Litigation, M&A, Energy Transition, IP | Broad expertise to address complex client needs. |

| Global Offices | 40 | Extensive international reach for seamless client service. |

What is included in the product

Analyzes Jones Day’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Streamlines complex legal strategy by clearly identifying competitive advantages and potential risks.

Weaknesses

The legal sector's move towards alternative fee arrangements (AFAs), spurred by client desires for predictable costs and greater transparency, poses a challenge to traditional hourly billing. This shift, amplified by AI's ability to streamline routine legal work, could affect firms like Jones Day that depend heavily on billable hours, potentially impacting their revenue streams if they don't adapt effectively.

Jones Day, like many large global firms, navigates a competitive legal talent landscape. The broader sector grapples with attracting and keeping skilled professionals, especially as flexible work arrangements and rising living costs reshape expectations. This intensified competition for top legal minds is a significant hurdle.

Maintaining a cohesive and positive firm culture across a geographically diverse and expansive workforce presents another considerable challenge. Ensuring consistent values and engagement levels among lawyers and staff spread across numerous international offices requires dedicated and ongoing effort.

Jones Day, like many established law firms, faces the challenge of integrating rapidly evolving legal technologies, particularly generative AI. This evolution demands significant investment and strategic planning to avoid falling behind competitors who are more agile in adoption.

The firm may also contend with 'tech debt,' stemming from legacy systems that are not fully compatible with newer platforms. This can create inefficiencies in workflows, compromise data integrity, and heighten cybersecurity risks, requiring substantial resources for remediation and modernization.

For instance, while the legal tech market is projected to grow significantly, with some reports estimating the global legal tech market to reach USD 35.9 billion by 2027, the cost of integrating new solutions with existing, potentially outdated infrastructure can be a considerable hurdle for firms like Jones Day.

Exposure to Economic Downturns in Transactional Work

Jones Day's reliance on corporate and transactional work, especially high-value mergers and acquisitions, makes it vulnerable to economic downturns. A slowdown in business activity and corporate profits directly translates to reduced demand for these crucial services.

For instance, during periods of economic contraction, companies often postpone or cancel M&A deals, impacting a significant revenue stream for large law firms like Jones Day. The firm's financial performance in these sectors can fluctuate considerably with the broader economic cycle.

- Economic Sensitivity: Transactional practices are inherently tied to the health of the global economy.

- M&A Impact: A decline in M&A activity, a key area for Jones Day, directly affects revenue.

- Profitability Volatility: Downturns can lead to lower corporate profits, reducing client spending on legal services.

Cybersecurity Risks and Compliance Costs

Law firms, especially global ones like Jones Day, are becoming prime targets for cyberattacks. Reports indicate a notable surge in such incidents throughout 2024, highlighting the growing threat landscape.

Implementing and maintaining advanced cybersecurity defenses requires substantial financial outlay. Furthermore, adhering to a complex web of data privacy regulations, including HIPAA and emerging AI-specific compliance mandates, adds significant operational and investment burdens.

- Increased cyberattack frequency: Law firms experienced a marked rise in cyber incidents in 2024.

- High investment in security: Robust cybersecurity measures demand considerable financial resources.

- Evolving compliance landscape: Staying compliant with data privacy laws like HIPAA and new AI regulations is costly.

- Operational overhead: Compliance efforts increase ongoing operational expenses for firms.

Jones Day faces challenges in adapting to the legal industry's shift towards alternative fee arrangements (AFAs), which clients increasingly prefer for cost predictability. This trend, coupled with AI's ability to automate routine tasks, could impact firms reliant on traditional hourly billing models, potentially affecting revenue if they do not evolve their service delivery and pricing strategies.

The firm must also contend with the constant need to attract and retain top legal talent in a competitive market. Evolving employee expectations regarding flexible work arrangements and compensation, exacerbated by rising living costs, present ongoing recruitment and retention challenges.

Maintaining a unified firm culture across its extensive global network is another significant weakness. Ensuring consistent values, engagement, and operational standards among lawyers and staff in numerous international offices demands continuous strategic attention and resource allocation.

The rapid integration of new legal technologies, particularly generative AI, presents a considerable hurdle. Significant investment and strategic foresight are required to adopt these advancements effectively and avoid falling behind more agile competitors.

Same Document Delivered

Jones Day SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Jones Day SWOT analysis, providing an accurate glimpse into its comprehensive content. The full, detailed report becomes accessible immediately after your purchase.

Opportunities

The legal field is constantly shifting, creating openings in specialized areas like data privacy and cybersecurity, cannabis law, and AI intellectual property. Jones Day has a chance to build up its knowledge and services in these growing sectors to attract more clients and stand out.

Artificial intelligence and legal technology are poised to transform the legal sector, streamlining tasks like contract review, legal research, and e-discovery. This shift promises significant cost reductions and enhanced service quality for clients.

Jones Day has a prime opportunity to integrate AI, boosting internal efficiency and potentially launching innovative AI-driven legal services. By developing proprietary AI tools, the firm can scale its specialized knowledge, leading to better cost-effectiveness and superior client outcomes.

The global legal tech market was valued at approximately $20 billion in 2023 and is projected to grow substantially, with AI being a key driver. Firms that leverage these advancements, like Jones Day, are likely to gain a competitive edge in service delivery and client value.

The global surge in regulatory oversight, particularly concerning ESG, data privacy, and AI, presents a significant growth avenue. For instance, the EU's General Data Protection Regulation (GDPR) continues to shape data handling practices worldwide, and the upcoming AI Act is expected to create substantial demand for legal counsel. Jones Day is well-positioned to leverage this by bolstering its compliance and regulatory teams, offering expert guidance to clients navigating these increasingly intricate and dynamic legal landscapes.

Strategic Lateral Hires and Talent Development

Jones Day can capitalize on the legal industry's trend of seeking seasoned lateral hires. By strategically recruiting experienced attorneys with niche expertise, particularly in booming sectors like energy and infrastructure, the firm can strengthen its core practice areas and gain a significant competitive advantage. This approach aligns with the increasing demand for specialized legal counsel that can navigate complex transactions and regulatory landscapes.

The firm's ability to attract and retain top-tier talent is crucial for maintaining its market position. In 2024, the legal sector saw a notable increase in lateral partner movement, with many firms actively pursuing specialists to fill gaps and expand service offerings. Jones Day's investment in developing its internal talent alongside strategic external hires will be key to its continued success.

Consider these strategic opportunities:

- Targeted lateral recruitment in high-growth practice areas like technology, cybersecurity, and environmental law to meet evolving client needs.

- Develop robust integration programs for lateral hires to ensure seamless assimilation into the firm's culture and client service standards.

- Invest in continuous professional development for existing associates and partners, fostering specialized expertise that reduces reliance on external recruitment for certain skill sets.

Adoption of Alternative Fee Arrangements

Client demand for predictable legal costs is a major driver, with projections indicating Alternative Fee Arrangements (AFAs) could represent a significant percentage of legal industry revenue by 2025. Jones Day can leverage this trend by developing and offering a wider range of AFAs, such as fixed fees or success-based billing.

This strategic move caters directly to client preferences for cost certainty and flexibility, setting Jones Day apart from competitors. Embracing AFAs can be a key differentiator, potentially attracting new clients seeking value-aligned partnerships.

- Growing AFA Adoption: Industry reports suggest AFAs are becoming increasingly prevalent, with some analyses pointing to a substantial increase in their use for major corporate legal work.

- Client-Centric Approach: Offering AFAs demonstrates a commitment to client needs for cost management and budget predictability.

- Competitive Advantage: Proactive development of diverse AFA models can position Jones Day as an innovative leader in client service delivery.

The increasing complexity of global regulations, particularly in areas like ESG and data privacy, creates a significant demand for specialized legal expertise. Jones Day can capitalize on this by expanding its advisory services in these rapidly evolving fields, offering clients crucial guidance through intricate compliance landscapes.

The legal industry's ongoing embrace of technology, especially AI, presents a prime opportunity for efficiency gains and innovative service offerings. Firms like Jones Day that strategically integrate AI for tasks such as legal research and contract analysis can achieve cost savings and enhance client value, positioning themselves ahead of the curve.

The market for legal technology, projected to see robust growth driven by AI, offers avenues for firms to develop proprietary tools. This can lead to scaled expertise and more cost-effective client solutions. For example, the global legal tech market was valued around $20 billion in 2023.

Jones Day can leverage the trend of lateral hiring by strategically recruiting experienced attorneys in high-demand sectors like technology and energy. This strengthens practice areas and provides a competitive edge in meeting specialized client needs, a strategy supported by significant lateral partner movement observed in 2024.

Threats

The global legal market is intensely competitive, with firms like Jones Day facing pressure from both traditional rivals and new entrants. This heightened competition means firms must continually innovate and demonstrate unique value propositions to attract and retain clients. The legal sector's revenue growth in 2024, estimated at 5-7% globally, underscores the demand but also the crowdedness of the field.

Global economic fluctuations, including potential slowdowns and inflationary pressures, present a significant threat. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, indicating a challenging environment for many industries.

This economic uncertainty can lead to reduced business activity and decreased demand for certain legal services, particularly in transactional and M&A areas, which are often sensitive to market confidence. For example, deal volumes in the M&A market saw a notable decline in early 2024 compared to previous years.

Furthermore, economic instability can put downward pressure on legal fees as clients become more price-conscious, potentially impacting Jones Day's revenue streams and profitability in a competitive market.

The swift progression of Artificial Intelligence introduces significant threats, necessitating the development of novel pricing structures for AI-augmented services and addressing ethical considerations in billing for such work. For instance, the legal industry is already grappling with how to accurately bill for time saved or enhanced by AI tools, a challenge that will only intensify as AI capabilities expand.

Navigating the evolving regulatory landscape surrounding AI is a critical threat, with potential missteps like 'AI washing' – making unsubstantiated claims about AI capabilities – carrying the risk of investor litigation and substantial financial penalties. Such compliance failures could severely damage client confidence and diminish market standing.

Cybersecurity and Data Breaches

Law firms like Jones Day face a growing threat from sophisticated cyberattacks, including ransomware. A 2024 report indicated that the average cost of a data breach for organizations reached $4.45 million, a figure that could significantly impact a firm's financial stability and reputation. The increasing reliance on digital platforms and client data makes robust cybersecurity a critical, ongoing expense and a persistent vulnerability.

The need for continuous investment in cybersecurity infrastructure is paramount. Firms must also navigate a complex landscape of evolving data privacy regulations, such as GDPR and CCPA, with non-compliance leading to substantial financial penalties. For instance, GDPR fines can reach up to 4% of global annual revenue, a significant risk for any large law firm.

- Ransomware attacks pose a direct threat to operational continuity and data integrity.

- Data breaches can result in severe financial penalties and damage client trust.

- Evolving data privacy regulations necessitate ongoing compliance efforts and investment.

Geopolitical Risks and Regulatory Divergence

The global legal landscape is increasingly shaped by geopolitical shifts and regulatory fragmentation, posing significant challenges for international law firms like Jones Day. Trade disputes and the imposition of international sanctions, for instance, can disrupt cross-border transactions and create compliance hurdles. In 2024, escalating tensions in various regions continue to highlight the volatility of international relations, directly impacting the demand for legal services in affected markets.

Furthermore, the divergence in regulatory frameworks, particularly concerning data privacy and the burgeoning field of artificial intelligence, demands continuous adaptation. Firms must navigate a complex web of differing legal requirements, such as the EU's GDPR versus evolving data protection laws in other major economies. This regulatory patchwork increases compliance costs and elevates the risk of potential liabilities for firms operating globally. As of early 2025, the ongoing development and varying national approaches to AI regulation underscore this challenge, requiring substantial resources for monitoring and strategic adjustment.

- Geopolitical Instability: Increased political instability in key economic regions can lead to a slowdown in cross-border M&A and investment, directly impacting a firm's revenue streams.

- Trade Wars and Sanctions: The impact of ongoing trade conflicts and targeted sanctions can create complex compliance demands and litigation risks for clients, requiring specialized legal expertise.

- Regulatory Divergence: Differing data privacy laws (e.g., GDPR vs. CCPA vs. emerging national AI regulations) create significant compliance burdens and potential legal exposure for global operations.

The increasing sophistication of cyber threats, including ransomware, presents a significant risk to Jones Day's operational continuity and client data security. Reports from 2024 indicate that the average cost of a data breach has escalated to $4.45 million, a substantial financial and reputational hazard. Furthermore, the complex and evolving landscape of global data privacy regulations, such as GDPR, carries the potential for severe penalties, with fines potentially reaching up to 4% of a firm's global annual revenue for non-compliance.

Geopolitical instability and trade disputes can disrupt international business, directly impacting the demand for cross-border legal services and M&A activity. The divergence in regulatory frameworks, particularly concerning AI and data privacy across different jurisdictions, creates substantial compliance challenges and increases the risk of legal exposure for a globally operating firm. For instance, the patchwork of AI regulations emerging in 2024 and early 2025 requires constant monitoring and strategic adaptation.

| Threat Category | Specific Risk | Potential Impact | Example Data (2024/2025) |

|---|---|---|---|

| Cybersecurity | Ransomware Attacks | Operational Disruption, Data Loss, Reputational Damage | Average cost of data breach: $4.45 million (2024) |

| Regulatory Compliance | Data Privacy Violations (e.g., GDPR) | Significant Financial Penalties, Loss of Client Trust | Fines up to 4% of global annual revenue |

| Geopolitical & Economic Factors | Trade Wars & Sanctions | Reduced Cross-Border Transactions, Increased Litigation Risk | Ongoing geopolitical tensions impacting global trade (2024/2025) |

| Emerging Technologies | AI Regulatory Divergence | Compliance Burdens, Legal Exposure, Reputational Risk | Varying national approaches to AI regulation (early 2025) |

SWOT Analysis Data Sources

This Jones Day SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial reports, comprehensive market research, and insights from industry experts and legal publications to ensure a thorough and accurate assessment.