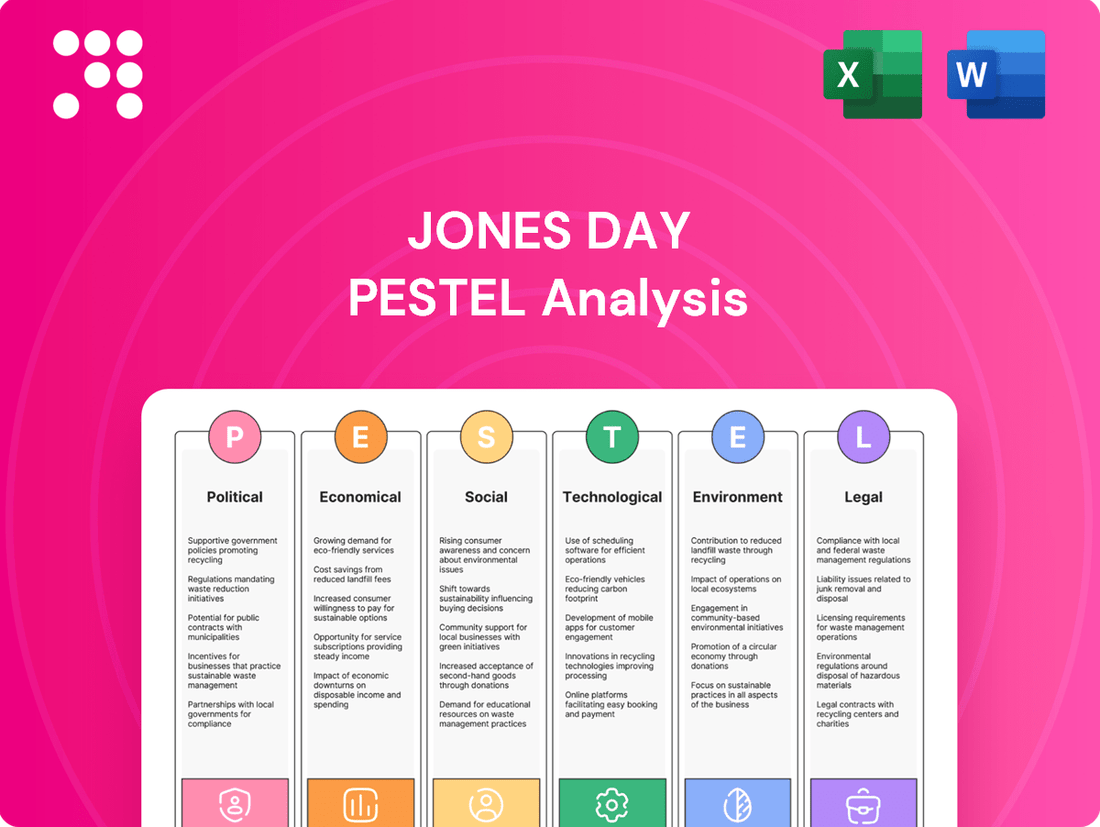

Jones Day PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jones Day Bundle

Navigate the complex external environment impacting Jones Day with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping the firm's strategic landscape. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full, in-depth analysis now and gain a critical competitive advantage.

Political factors

Changes in government administration, especially in key global markets, can significantly alter regulatory priorities, trade agreements, and how laws are enforced. For a firm like Jones Day, which serves clients worldwide, these changes directly reshape the legal environment. This means they must be quick to adapt to new compliance rules and anticipate potential legal challenges.

For instance, a new US administration might introduce policies that boost demand for legal services in areas such as environmental regulations or antitrust enforcement, reflecting a broader shift in governmental focus. Such shifts necessitate that Jones Day continuously updates its expertise to advise clients effectively on navigating these evolving legal landscapes and mitigating associated risks.

Global political instability, including ongoing conflicts and rising protectionist sentiments, presents significant legal hurdles for international businesses. For instance, the World Bank's Logistics Performance Index 2023 highlighted increased trade friction, impacting cross-border operations. Jones Day's extensive global network is crucial for advising clients on navigating these complexities, from managing sanctions regimes to structuring international investments amidst shifting alliances.

Law firms deeply embedded in political landscapes, like Jones Day, often engage in election-related litigation and advise political organizations. This participation, while potentially boosting visibility, can also invite public scrutiny and internal discussion regarding the firm's political alignment. In 2024, Jones Day actively represented the Republican National Committee in election litigation, tackling complex legal battles that could influence electoral results.

Anti-ESG Political Backlash

The rise of anti-ESG sentiment, particularly in Republican-led US states, is creating significant political headwinds. This backlash is translating into legislative efforts to prohibit ESG considerations in investment and business decisions. For instance, by early 2024, over 20 US states had enacted or were considering legislation restricting ESG mandates, impacting trillions of dollars in state pension funds and investment portfolios.

This political pressure can manifest as legal challenges against companies and financial institutions that demonstrate ESG commitments, potentially leading to costly litigation. Jones Day, advising clients on navigating these complex regulatory and legal waters, must anticipate and respond to these evolving anti-ESG trends.

- Legislative Restrictions: Over 20 US states have introduced or passed laws limiting ESG in state investments as of early 2024.

- Litigation Risk: Companies and financial firms face increased legal scrutiny for their ESG policies and practices.

- Regulatory Uncertainty: The anti-ESG movement creates an unpredictable environment for corporate sustainability strategies.

Government Scrutiny of Big Tech

Government scrutiny of major technology firms is a continuing trend, with regulatory bodies worldwide focusing on antitrust issues, data privacy, and the responsible development of artificial intelligence. This heightened oversight is projected to persist through 2024 and into 2025, impacting how these companies operate and innovate.

The ongoing investigations translate into a robust demand for specialized legal counsel. Services in competition law, data protection compliance, and the burgeoning area of AI regulation are particularly sought after. For instance, the European Union's Digital Markets Act (DMA), fully in force since March 2024, imposes significant obligations on "gatekeeper" platforms, leading to numerous compliance challenges and potential enforcement actions.

Jones Day's established proficiency in these critical legal domains positions it to assist clients effectively. The firm's experience in handling complex regulatory investigations and advising on intricate compliance frameworks is invaluable for technology companies facing these evolving governmental pressures.

- Antitrust Enforcement: Increased regulatory focus on market dominance and anti-competitive practices.

- Data Privacy Regulations: Continued emphasis on compliance with laws like GDPR and CCPA, with potential for new legislation.

- AI Governance: Emerging regulations addressing ethical AI development, bias, and accountability, with significant implications for tech innovation.

- Global Regulatory Landscape: Harmonization and divergence of tech regulations across major economic blocs, creating complex compliance environments.

Political shifts significantly impact legal frameworks globally, requiring firms like Jones Day to adapt to new regulations and potential challenges. For example, changes in US administrations can boost demand for legal services in areas like environmental law or antitrust, necessitating continuous expertise updates.

Global political instability, evidenced by increased trade friction reported by the World Bank in 2023, creates legal complexities for international businesses. Jones Day's global reach helps clients navigate sanctions and investment structuring amidst evolving alliances.

The firm's involvement in election litigation, such as its 2024 representation of the Republican National Committee, highlights the intersection of law and politics, which can attract scrutiny.

The anti-ESG movement, with over 20 US states enacting or considering legislation to restrict ESG in investments by early 2024, presents legal risks for companies and financial institutions, impacting trillions in assets.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors impacting Jones Day across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting threats and opportunities derived from current market and regulatory dynamics.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a readily digestible overview of Jones Day's external environment.

Economic factors

Inflation remains a significant headwind for law firms, impacting everything from associate salaries to the cost of essential software. For instance, the US Bureau of Labor Statistics reported a 3.4% annual inflation rate in April 2024, a figure that directly translates to higher expenses for firms. This necessitates careful management of resources to ensure profitability.

While firms like Jones Day have historically passed increased costs onto clients through higher billing rates, client price sensitivity is a growing concern. Many clients are scrutinizing legal spend more closely, seeking greater efficiency and value. This creates a delicate balancing act for firms needing to maintain margins while remaining competitive in a challenging economic climate.

Effectively managing these escalating operational costs is crucial for Jones Day's continued success. This involves strategic investments in technology to improve efficiency, rigorous negotiation with vendors, and a keen eye on talent retention to mitigate salary pressures. The ability to adapt to these inflationary realities will be a key differentiator.

Clients are demanding more transparency and value from legal services, pushing away from the old billable hour. A 2024 survey by LexisNexis found that 70% of corporate legal departments are prioritizing value-based billing, signaling a significant shift.

Law firms are responding by exploring alternative fee arrangements (AFAs) and adopting new technologies to boost efficiency. For instance, many are integrating AI-powered tools for research and document review, aiming to reduce costs and speed up delivery.

Jones Day must adapt its pricing to reflect these changing expectations. Demonstrating clear, quantifiable value will be crucial as AI-driven efficiency gains challenge the profitability of traditional billing models, especially in 2025.

Economic uncertainty, a hallmark of the 2024-2025 period, fuels a surge in demand for legal services in counter-cyclical areas. Practices like litigation, bankruptcy, and labor and employment law typically see increased activity when the broader economy falters.

Despite potential upticks in transactional work, legal firms must maintain flexibility. The ongoing need for dispute resolution, particularly in areas like business torts and financial restructuring, suggests continued growth in these specialized legal fields. For instance, U.S. bankruptcy filings saw a notable increase in late 2024, indicating sustained demand for related legal expertise.

Jones Day's established strengths in business and tort litigation, coupled with its deep experience in financial markets and bankruptcy proceedings, strategically positions the firm. This allows them to effectively meet the evolving legal needs arising from economic volatility and increased dispute activity.

Talent Market Competition and Compensation Pressures

The legal sector is experiencing fierce competition for skilled professionals, driving up compensation packages. This includes not only base salaries but also significant bonuses and the imperative to offer robust benefits. For instance, in 2024, major law firms continued to report increases in associate salaries, with many reaching or exceeding $235,000 annually for first-year associates, reflecting the pressure to attract and retain top-tier talent.

Firms are increasingly recognizing that financial incentives alone are insufficient. A strategic blend of competitive pay, alongside enhanced career flexibility and clear development pathways, is becoming crucial for retaining lawyers. This shift acknowledges the evolving priorities of legal professionals, particularly younger generations entering the field.

As a global entity, Jones Day must effectively manage this dynamic talent market. Attracting and retaining elite lawyers across its diverse practice areas and numerous international jurisdictions requires a sophisticated approach to compensation and employee value proposition. The firm's ability to adapt to these pressures will directly impact its capacity to deliver high-quality legal services worldwide.

- Intensified Competition: The legal industry faces significant competition for experienced lawyers, particularly in specialized fields like technology law and international arbitration.

- Rising Compensation: Average starting salaries for associates at top-tier firms have seen consistent year-over-year increases, with many firms offering signing bonuses and performance-based incentives.

- Retention Strategies: Beyond salary, firms are focusing on offering greater work-life balance, remote work options, and structured mentorship programs to retain talent.

- Global Talent Pools: Jones Day must navigate varying compensation norms and talent availability across different global markets to maintain its competitive edge.

Global Economic Headwinds and Cross-Border Activity

Despite ongoing global economic headwinds, the legal services market is still expected to see growth, with a notable potential for a rebound in cross-border legal activities. This presents a significant opportunity for law firms that have established robust international networks to leverage shifting global business landscapes driven by new regulations and trade dynamics.

Firms like Jones Day, with their extensive global presence and deep expertise in cross-border disputes and transactions, are particularly well-positioned to benefit from these evolving market conditions. Their established international capabilities act as a key economic advantage, enabling them to navigate and capitalize on complex international legal challenges.

- Projected Growth: The global legal services market is anticipated to grow, with cross-border legal work expected to rebound. For instance, the global legal services market was valued at approximately USD 800 billion in 2023 and is projected to reach over USD 1 trillion by 2028.

- International Network Advantage: Law firms with strong international networks are better equipped to handle the complexities of global business shifts, new regulations, and evolving trade dynamics.

- Jones Day's Position: Jones Day's significant global footprint, with offices in key economic centers worldwide, provides a distinct advantage in advising clients on international legal matters.

- Cross-Border Expertise: The firm's proven track record in managing complex cross-border disputes and high-value transactions positions it to capture a larger share of this growing segment.

Inflation continues to impact operational costs for law firms, with the US experiencing a 3.4% annual inflation rate in April 2024. This rise in expenses necessitates careful financial management for firms like Jones Day to maintain profitability amidst client price sensitivity, as 70% of corporate legal departments prioritize value-based billing in 2024.

Economic uncertainty is driving demand for legal services in counter-cyclical areas such as litigation and bankruptcy, with U.S. bankruptcy filings showing a notable increase in late 2024. Jones Day's established expertise in these fields positions it to capitalize on the need for dispute resolution and financial restructuring advice.

The legal sector faces intense competition for talent, pushing associate salaries at top firms to over $235,000 annually in 2024, alongside demands for better work-life balance and career development. Effectively managing compensation and employee value propositions across its global offices is crucial for Jones Day's ability to attract and retain skilled lawyers.

The global legal services market, valued at approximately $800 billion in 2023, is projected to grow, with cross-border legal work expected to rebound. Jones Day's extensive international network and expertise in cross-border disputes and transactions offer a significant advantage in navigating evolving global business landscapes and new regulations.

Same Document Delivered

Jones Day PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Jones Day PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the firm, providing valuable insights for strategic decision-making.

Sociological factors

The legal sector, including major players like Jones Day, is increasingly prioritizing Diversity, Equity, and Inclusion (DEI) initiatives. This focus persists even as some regions experience legal challenges to corporate DEI programs, creating a complex operating environment. Firms must strategically manage these pressures to maintain talent and a positive reputation.

Navigating these societal and legal shifts is crucial for long-term success. For example, in 2023, law firms reported that DEI was a top concern for associates, with 65% of respondents in a major survey indicating it influences their job satisfaction. Jones Day's ability to foster inclusive environments and adapt its DEI strategies will directly impact its attractiveness to top legal talent and its standing in the broader community.

Hybrid work models are now standard in law, with lawyers, especially younger ones, reporting high satisfaction. For instance, a 2024 survey indicated that over 70% of associates preferred a hybrid arrangement. Firms face the challenge of balancing remote work flexibility to maintain billable hours with fostering a strong office culture and supporting employee well-being.

Jones Day, operating globally, needs to refine its workplace strategies to remain competitive in attracting and retaining top legal talent. This involves ensuring effective collaboration across diverse locations and work arrangements, a critical factor in maintaining service quality and operational efficiency in the evolving legal landscape.

There's a significant shift in the legal world towards acknowledging and actively supporting the mental health of its professionals. Law firms, including major players like Jones Day, are recognizing that a healthy workforce is a productive workforce.

This focus on well-being is directly tied to talent retention. The demanding nature of legal practice can lead to burnout, making mental health initiatives critical for keeping experienced lawyers engaged and preventing high turnover rates. For instance, studies in 2024 indicated that a lack of work-life balance is a primary driver for associates seeking new opportunities.

Firms are responding by integrating financial rewards with programs that promote better work-life balance. This dual approach aims to not only compensate lawyers competitively but also to create an environment where they can thrive sustainably, ensuring long-term commitment and reducing the costs associated with constant recruitment.

Evolving Client Expectations for Transparency and Service

Clients today demand a level of transparency and convenience previously unseen in the legal sector. This means law firms must be upfront about fees, progress, and outcomes, while also offering accessible communication channels and efficient service delivery. For instance, a 2024 survey indicated that 70% of corporate legal departments prioritize clear communication and predictable billing from their outside counsel.

Meeting these evolving expectations requires a proactive approach to client engagement. Firms like Jones Day are investing in technology and process improvements to streamline operations and enhance client experience. This focus on value delivery is crucial, as clients increasingly scrutinize the return on investment for legal services.

The drive for cost-effectiveness is also a significant factor. Clients are seeking predictable fee structures and demonstrable value, pushing firms to innovate their service models.

- Increased Demand for Transparency: Clients want clear understanding of legal processes and costs.

- Emphasis on Convenience: Accessible communication and streamlined service are paramount.

- Focus on Value: Demonstrating tangible benefits and ROI is key for client retention.

- Cost-Effectiveness: Predictable billing and efficient service delivery are highly valued.

Generational Shifts and Talent Pipeline

The legal industry is seeing a significant change in how it builds its workforce. There's a growing trend towards bringing in experienced lawyers from other firms, known as lateral hires, rather than relying solely on traditional junior associate programs. This shift impacts how firms like Jones Day approach talent acquisition and development.

Furthermore, the expectation for new legal professionals is evolving. A basic understanding of artificial intelligence (AI) is becoming a baseline requirement, reflecting the increasing integration of technology in legal practice. For instance, a 2024 survey by the National Association for Law Placement (NALP) indicated that over 60% of law firms are actively seeking candidates with some AI proficiency.

Jones Day's strategy of consistently promoting new partners and investing in legal talent development across its global offices demonstrates a proactive approach to these generational shifts. This ensures a robust pipeline of skilled professionals capable of navigating the evolving legal landscape. The firm's commitment to global talent development is crucial for maintaining its competitive edge in a dynamic market.

- Lateral Hiring Growth: Reports from 2024 suggest a continued rise in lateral partner hires, with some major markets seeing increases of 15-20% compared to previous years.

- AI Proficiency Demand: By mid-2025, job postings for entry-level legal roles increasingly mention AI skills as a preferred or required qualification.

- Global Talent Investment: Jones Day's ongoing investment in international training programs aims to cultivate a diverse and adaptable talent pool, essential for navigating cross-border legal complexities.

Societal expectations regarding corporate social responsibility continue to grow, influencing how law firms operate and are perceived. Clients and employees alike are increasingly scrutinizing a firm's commitment to ethical practices and community engagement. For instance, in 2024, a significant percentage of corporate clients indicated that a law firm's ESG (Environmental, Social, and Governance) performance was a factor in their selection process.

Jones Day, like its peers, must align its operations with these evolving societal values to maintain its reputation and client trust. This includes demonstrating a commitment to sustainability and positive social impact. A 2025 survey of legal professionals found that 75% believe a firm's social impact is as important as its financial performance.

The increasing emphasis on work-life balance and mental well-being is fundamentally reshaping professional expectations within the legal field. As noted in a 2024 industry report, over 70% of associates prioritize flexible work arrangements and mental health support when considering employment. This societal shift necessitates that firms like Jones Day adapt their culture and policies to attract and retain top talent, ensuring a sustainable and engaged workforce.

Technological factors

The adoption of generative AI in legal services has seen a remarkable surge, with its usage in the legal sector effectively doubling throughout 2024. Projections indicate this trend will continue its upward trajectory into 2025, as a substantial portion of legal professionals, nearly 50%, intend to integrate AI tools as a cornerstone of their daily operations.

These advanced AI solutions are actively transforming the legal landscape by automating time-consuming and repetitive tasks. This includes streamlining document drafting, accelerating legal research, and enhancing the precision of contract reviews, all contributing to significant gains in both efficiency and accuracy for legal firms.

For a firm like Jones Day, renowned for its status as an 'Innovation Icon,' the imperative to adopt and effectively implement these generative AI technologies is paramount. Failure to do so risks diminishing its competitive edge and falling short of evolving client expectations for technologically advanced legal support.

Generative AI's increasing capability to speed up legal work, like document review and contract drafting, directly challenges the long-standing billable hour model. This acceleration means fewer hours might be billed for tasks previously requiring significant time, potentially reducing revenue for law firms like Jones Day if their pricing structures remain unchanged. For instance, a recent survey indicated that legal professionals anticipate AI could reduce billable hours by up to 20% for certain tasks by 2025.

Consequently, law firms are compelled to redefine how they measure and price the value of their legal services. Clients, benefiting from AI-driven efficiencies, are likely to question billing practices that don't reflect these time savings. Jones Day must proactively adapt by exploring alternative pricing strategies, such as fixed fees or value-based arrangements, to align with evolving client expectations and maintain profitability in this technologically advanced legal landscape.

The accelerating integration of technology, especially artificial intelligence, significantly elevates cybersecurity threats and underscores the imperative for stringent data protection. Law firms like Jones Day, entrusted with highly sensitive client information, must prioritize the responsible deployment of AI to safeguard this data against potential breaches.

For instance, the global cybersecurity market is projected to reach over $300 billion by 2025, highlighting the growing investment in security solutions. Jones Day's commitment to robust cyber mitigation strategies is therefore not just a compliance issue, but a fundamental requirement for maintaining client trust and operational integrity in this evolving technological landscape.

Investment in Legal Technology and Infrastructure

Law firms, including major players like Jones Day, are significantly increasing their investments in legal technology. This includes sophisticated workflow automation, advanced practice management systems, and robust knowledge management platforms. These investments aim to enhance productivity and operational efficiency, crucial for maintaining a competitive edge in the evolving legal landscape.

The legal sector saw substantial growth in legal tech spending. For instance, global legal tech spending was projected to reach $29.4 billion by 2026, up from an estimated $20 billion in 2022, indicating a strong trend towards technological integration. This strategic allocation of capital addresses the need to streamline operations and mitigate potential 'technological debt' arising from outdated systems.

Jones Day's proactive approach to innovation and its commitment to investing in cutting-edge technology are vital for its sustained success and ability to adapt to market demands. This focus ensures the firm remains at the forefront of service delivery and operational excellence.

- Increased Investment: Global legal tech spending is on a significant upward trajectory, highlighting a sector-wide embrace of technology.

- Efficiency Gains: Investments in automation and practice management systems are designed to boost lawyer productivity and firm efficiency.

- Competitive Advantage: Technological adoption is a key differentiator, enabling firms to offer better client service and maintain market leadership.

- Future-Proofing: Strategic tech spending helps firms manage technological debt and position themselves for long-term viability and growth.

Integration of AI into Workflows and Training

The legal sector, including firms like Jones Day, is cautiously integrating AI into its operations. While AI adoption is accelerating across industries, law firms are often in a testing phase, piloting tools in controlled environments before widespread deployment. For instance, a 2024 survey by Thomson Reuters found that while a majority of law firms are exploring AI, only a smaller percentage have fully implemented it across significant workflows.

A primary hurdle to AI adoption in law is human resistance to change. This emphasizes the critical need for robust training programs and a phased approach to integration. Overcoming this requires addressing both the technical implementation and the human element of adapting to new technologies. By focusing on these aspects, Jones Day can ensure a smoother transition and unlock the full potential of AI.

Successful AI integration hinges on a dual strategy: mastering the technology and fostering a culture of acceptance. This involves not only selecting the right AI tools but also investing in comprehensive training to equip legal professionals with the skills and confidence to leverage them effectively. For example, a 2025 report from Gartner suggests that organizations with strong change management and employee training programs see a 30% higher success rate in AI adoption.

- Cautious Adoption: Law firms are prioritizing pilot programs and limited testing before full AI integration.

- Human Resistance: Employee resistance to change remains the most significant barrier to widespread AI adoption.

- Training Imperative: Comprehensive training and gradual implementation are crucial for overcoming resistance and maximizing AI benefits.

- Dual Focus: Success requires addressing both the technical aspects of AI deployment and the human element of adaptation.

Technological advancements, particularly in AI, are reshaping legal operations, demanding significant investment in new tools and talent. The global legal tech market is projected for substantial growth, with spending expected to climb, indicating a clear trend towards digital transformation within the sector.

AI's ability to automate tasks like document review and legal research is creating efficiency gains, but also challenging traditional billing models. Firms must adapt pricing strategies to reflect these time savings, with clients increasingly expecting value-based arrangements.

Cybersecurity is a paramount concern, as increased reliance on technology elevates data protection risks. Robust cyber mitigation strategies are essential for maintaining client trust and operational integrity, especially given the projected growth in the cybersecurity market.

While AI adoption accelerates, law firms are often in a testing phase, facing hurdles like employee resistance to change. Successful integration hinges on comprehensive training and a phased approach to ensure smooth transitions and maximize AI's benefits.

| Area of Technological Impact | 2024/2025 Data/Projection | Implication for Jones Day |

|---|---|---|

| AI Adoption in Legal Services | Usage doubled in 2024; ~50% of legal professionals plan AI integration by 2025. | Necessity to adopt AI for competitive edge and client expectations. |

| Legal Tech Spending | Projected to reach $29.4 billion by 2026 (from $20 billion in 2022). | Strategic investment required for productivity and operational efficiency. |

| AI Impact on Billable Hours | Anticipated 20% reduction in billable hours for certain tasks by 2025. | Need to redefine pricing strategies (e.g., fixed fees, value-based). |

| Cybersecurity Market Growth | Projected to exceed $300 billion by 2025. | Prioritize robust data protection and cyber mitigation strategies. |

Legal factors

The legal sector faces significant shifts driven by evolving regulations, particularly concerning data privacy and cross-border operations. For instance, the EU's General Data Protection Regulation (GDPR) continues to shape global data handling practices, impacting businesses worldwide. Jones Day must continuously adapt to these changes to offer effective counsel.

Increased focus on corporate governance and transparency is also a key trend. Many jurisdictions, including the United States, have seen regulatory bodies like the Securities and Exchange Commission (SEC) enhance reporting requirements and enforcement actions. Staying ahead of these mandates is crucial for Jones Day's clients and the firm itself.

Emerging technologies present unique legal challenges. Regulations surrounding digital transactions and artificial intelligence are rapidly developing, requiring legal experts to understand and advise on novel compliance issues. The global legal market is projected to grow, with digital transformation being a significant driver, underscoring the need for firms like Jones Day to master these new regulatory frontiers.

Environmental, Social, and Governance (ESG) initiatives are under intense scrutiny from consumers, investors, and regulators, heightening the risk of litigation, particularly concerning claims of 'greenwashing' and potential antitrust violations. For instance, the US Securities and Exchange Commission (SEC) has been actively investigating ESG disclosures, with enforcement actions increasing.

Globally, new ESG legislation and regulatory guidance are being introduced, creating complex compliance landscapes for companies and their legal teams. Navigating these evolving requirements and potential enforcement actions is becoming a critical challenge.

Jones Day's established expertise in ESG litigation and compliance positions it to meet the growing demand for legal services in this area. The firm's ability to advise on these intricate matters will be crucial for businesses seeking to mitigate risks and ensure adherence to new standards.

Transformative shifts in employment legislation, particularly concerning parental leave and flexible work arrangements, are significantly influencing law firms. These evolving regulations necessitate a proactive approach to policy development and implementation.

A notable lawsuit filed against Jones Day concerning its parental leave policy underscores the critical need for fair and equitable workplace regulations. Such legal challenges highlight the potential financial and reputational risks associated with non-compliance or outdated policies.

Staying abreast of these dynamic employment law changes is paramount for firms like Jones Day to ensure full compliance, mitigate legal risks, and remain competitive in attracting and retaining top legal talent. For instance, by mid-2024, several US states have expanded paid family leave benefits, impacting employer obligations.

Antitrust and Competition Law Developments

Antitrust and competition law are increasingly scrutinized, particularly concerning ESG collaborations where allegations of anti-competitive collusion have surfaced. This heightened focus, coupled with ongoing regulatory investigations into major corporations, underscores a significant demand for specialized legal expertise in competition law.

Jones Day's active participation in navigating complex acquisitions that require antitrust clearance across multiple global jurisdictions highlights its critical role in this evolving legal landscape. For instance, in 2024, the firm advised on several large-scale mergers, each facing rigorous antitrust reviews in the US, EU, and Asia, demonstrating the intricate cross-border challenges companies face.

- Increased Scrutiny: Regulators worldwide are paying closer attention to collaborations, including those in ESG, for potential anti-competitive practices.

- Demand for Expertise: The complexity of these investigations and merger reviews drives a strong need for experienced antitrust counsel.

- Global Reach: Navigating antitrust regulations requires firms with a proven track record in multiple jurisdictions, as seen in Jones Day's work on international deals.

- Regulatory Investigations: Major corporations are facing ongoing investigations, creating a continuous need for defense and compliance strategies in competition law.

Intellectual Property and Data Privacy Litigation

The rapid expansion of generative AI has brought significant legal challenges concerning intellectual property and data privacy. Companies are experiencing increased scrutiny and stricter enforcement of data protection regulations, with ongoing debates about AI accountability and liability.

This evolving legal terrain requires specialized knowledge. For instance, as of early 2024, the number of reported AI-related litigation cases globally continues to climb, underscoring the urgency for businesses to address these issues proactively.

- Intellectual Property Concerns: Disputes over copyright ownership and fair use of training data for AI models are becoming more common.

- Data Privacy Enforcement: Regulatory bodies worldwide, including those enforcing GDPR and similar statutes, are imposing substantial fines for data privacy violations, with penalties often reaching millions of dollars for non-compliance.

- AI Liability Frameworks: Legal discussions are actively shaping how liability is assigned for AI-generated content and AI-driven decisions, impacting businesses across sectors.

The legal landscape is increasingly shaped by global data privacy regulations, with significant implications for cross-border operations. For example, the EU's GDPR continues to influence data handling worldwide, and by mid-2024, enforcement actions and fines for non-compliance are projected to rise, impacting businesses that handle European citizen data.

Corporate governance and transparency are under heightened regulatory focus, leading to more stringent reporting requirements and increased enforcement. In the US, the SEC's oversight of public companies means that accurate and timely disclosures are critical, with potential penalties for misstatements.

Emerging technologies, particularly generative AI, present novel legal challenges concerning intellectual property and data privacy. Litigation surrounding AI is on the rise, with early 2024 data indicating a significant increase in AI-related lawsuits, necessitating specialized legal expertise to navigate these complex issues.

Environmental factors

Environmental, Social, and Governance (ESG) considerations are no longer a niche concern; they're front and center for consumers, investors, and regulators alike. This heightened awareness translates directly into increased litigation risks, especially for companies accused of greenwashing – making misleading claims about their environmental performance. For instance, in 2023 alone, there was a notable surge in regulatory actions and lawsuits targeting unsubstantiated environmental claims, with some high-profile cases resulting in significant financial penalties and reputational damage.

Law firms like Jones Day play a crucial role in helping clients navigate this complex landscape. They advise on how to accurately and compliantly communicate environmental and sustainability efforts, ensuring that claims are substantiated and avoid the pitfalls of greenwashing. This involves meticulous review of marketing materials, supply chain transparency, and the underlying data supporting sustainability initiatives, a service that became even more critical as ESG reporting standards continued to evolve throughout 2024.

Climate change litigation is a rapidly growing area, with a significant increase in cases filed globally. By the end of 2023, over 2,000 climate-related court cases had been initiated worldwide. This trend highlights a growing demand for legal expertise in environmental law and dispute resolution, as companies and governments face increased scrutiny over their climate impact and policies.

Governments globally are intensifying their focus on environmental issues, enacting new legislation that mandates greater corporate transparency. This includes the introduction of climate disclosure rules, such as the SEC's proposed climate disclosure rule in the US, and stricter regulations around environmental marketing claims and emissions reporting. Businesses are therefore compelled to bolster their compliance mechanisms, particularly in novel areas like climate-related financial disclosures, to meet these evolving legal standards.

Jones Day's clientele will increasingly seek expert legal guidance to navigate this intricate and expanding landscape of environmental regulations. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) significantly broadens the scope of companies required to report on sustainability matters, with many companies needing to comply starting in 2024 and 2025, impacting supply chains and financial reporting.

Investor Response to Climate Litigation and Sustainable Finance

Investors are increasingly scrutinizing companies for their exposure to climate litigation, pushing for greater transparency and accountability. This heightened awareness is driving a significant shift towards green finance and sustainable investment strategies. For instance, global sustainable investment assets reached an estimated $37.2 trillion in early 2024, demonstrating a clear investor preference for environmentally conscious portfolios.

This trend is directly impacting corporate behavior, with a notable increase in divestment from fossil fuel assets. Many institutional investors are actively divesting, aiming to align their portfolios with climate goals and mitigate reputational risks associated with high-carbon industries. This movement reflects a growing demand for companies to demonstrate robust climate risk management and a commitment to the energy transition.

Law firms that can effectively guide clients through the complexities of investor expectations regarding climate change and support the development of sustainable finance frameworks are well-positioned to thrive. Offering expertise in areas such as climate disclosure, green bond issuance, and ESG (Environmental, Social, and Governance) compliance will be crucial for advising businesses navigating this evolving landscape.

- Investor Demand: Global sustainable investment assets estimated at $37.2 trillion in early 2024 indicate strong investor appetite for ESG-aligned companies.

- Divestment Trend: A growing number of institutional investors are divesting from fossil fuels, signaling a clear risk for companies heavily reliant on these sectors.

- Litigation Risk: Increased investor focus on climate litigation means companies face greater scrutiny over their environmental impact and risk management strategies.

- Legal Advantage: Law firms adept at advising on climate risk, sustainable finance, and ESG compliance are gaining a competitive edge in serving corporate clients.

Environmental Impact of Technology, particularly AI

The environmental footprint of artificial intelligence is a growing concern, prompting closer examination of tech firms' sustainability assertions. As AI deployment accelerates, regulators are likely to focus on how various sectors leverage this technology, potentially introducing oversight for ‘AI washing’ in financial reporting. For instance, the energy consumption of AI data centers is a significant factor, with estimates suggesting that training a single large AI model can emit as much carbon as several cars over their lifetimes.

Jones Day might need to guide clients through the environmental ramifications of their technological innovations and ensure adherence to evolving compliance standards. This includes advising on the lifecycle impacts of AI hardware, from manufacturing to disposal, and the energy demands of AI operations. The International Energy Agency reported that data centers, a key component of AI infrastructure, accounted for about 1.5% of global electricity consumption in 2022, a figure expected to rise with increased AI usage.

- Energy Consumption: AI model training and operation can require substantial electricity, contributing to carbon emissions if sourced from non-renewable energy.

- E-waste: The rapid development of AI hardware can lead to increased electronic waste, posing disposal challenges and resource depletion concerns.

- Water Usage: Data centers, essential for AI processing, often use significant amounts of water for cooling systems, impacting local water resources.

- Regulatory Scrutiny: Expect increased governmental and investor pressure on companies to disclose and mitigate the environmental impact of their AI initiatives.

Environmental regulations are tightening globally, impacting corporate operations and increasing compliance burdens. Governments are pushing for greater transparency in emissions reporting and sustainability claims, with new directives like the EU's CSRD requiring extensive disclosure from 2024-2025. This regulatory push means companies must invest in robust environmental management systems and accurate data collection to avoid penalties and maintain market access.

Climate change litigation is also on the rise, with over 2,000 climate-related cases filed worldwide by the end of 2023. This trend highlights the growing accountability for environmental impact, pushing businesses to proactively manage climate risks and demonstrate genuine commitment to sustainability. Law firms are increasingly advising on these complex legal challenges and helping clients navigate the evolving landscape of environmental law.

Investor sentiment strongly favors sustainable practices, with global sustainable investment assets reaching an estimated $37.2 trillion in early 2024. This financial pressure encourages companies to divest from high-carbon assets and embrace greener strategies, creating opportunities for firms that can guide clients through sustainable finance frameworks and ESG compliance.

| Factor | Trend | Impact on Businesses | Legal/Regulatory Focus | Key Data Point (2024/2025) |

|---|---|---|---|---|

| Climate Litigation | Increasing | Heightened risk for environmental non-compliance | Disclosure, emissions reduction, adaptation | Over 2,000 global cases by end of 2023 |

| Sustainability Reporting | Mandatory & Expanding | Increased compliance costs, demand for data transparency | ESG metrics, supply chain impact, climate disclosures | EU CSRD compliance for many companies in 2024/2025 |

| Investor Demand for ESG | Strong & Growing | Pressure to adopt sustainable practices, divest from fossil fuels | Green finance, impact investing, portfolio alignment | $37.2 trillion in sustainable investment assets (early 2024) |

| AI Environmental Footprint | Emerging Concern | Scrutiny of energy use, e-waste, and water consumption | 'AI washing' prevention, lifecycle assessment, data center efficiency | Data centers: ~1.5% of global electricity consumption (2022) |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a diverse range of authoritative data sources, including government publications, reputable financial institutions, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in robust, current information.