Jones Day Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jones Day Bundle

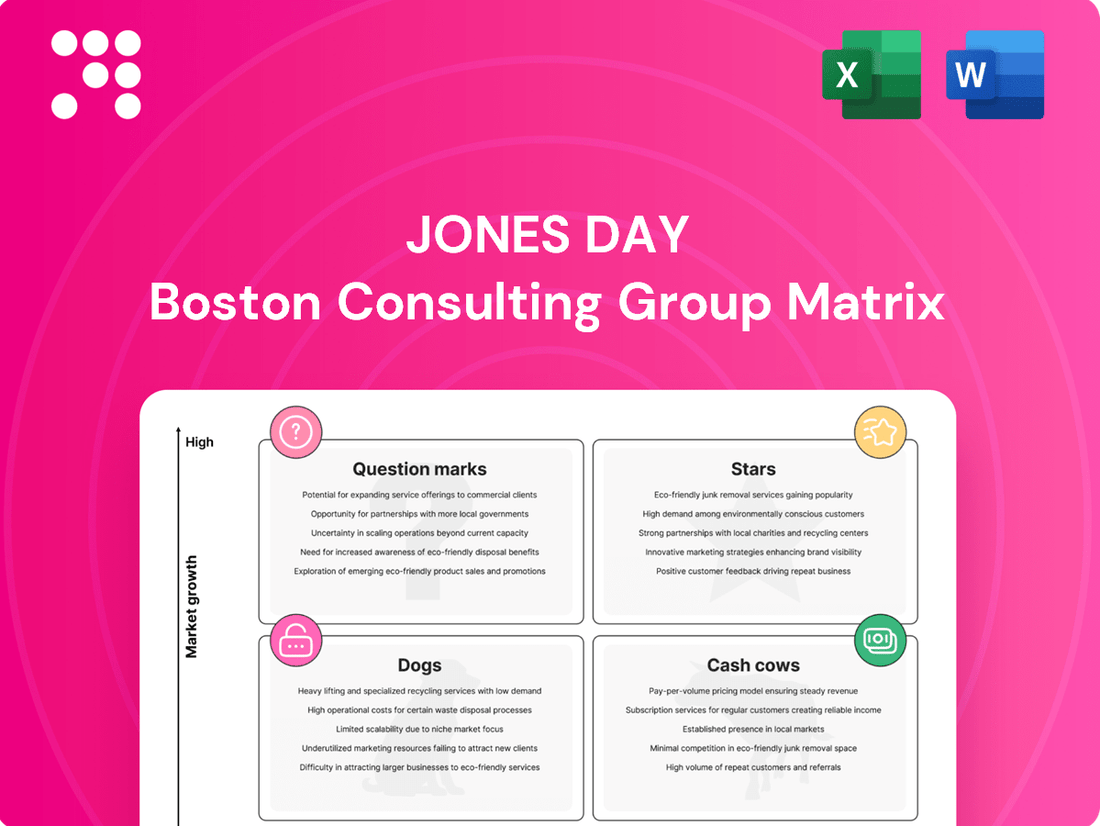

This preview offers a glimpse into how Jones Day strategically categorizes its diverse portfolio. Understand which of their services are market leaders (Stars), which consistently generate revenue (Cash Cows), which are underperforming (Dogs), and which hold potential for growth (Question Marks). Purchase the full Jones Day BCG Matrix for a comprehensive breakdown and actionable insights to optimize their product and service offerings.

Stars

Jones Day's Business Restructuring & Reorganization practice is a clear Star within the BCG Matrix, earning the prestigious 'Practice Group of the Year' award from Law360 in 2024. This recognition highlights the practice's exceptional performance and market leadership in a critical legal sector.

The practice's strength is particularly evident during economic downturns, where it expertly navigates complex mass tort and cross-border restructurings for prominent global clients. This capability positions Jones Day as a go-to firm for businesses facing significant financial challenges.

With a robust global team exceeding 100 dedicated restructuring lawyers, Jones Day commands a substantial market share. This extensive legal talent pool ensures the firm can effectively manage the growing demand for sophisticated restructuring services, solidifying its position as a leader in this vital area.

Jones Day's Intellectual Property litigation practice is a clear Star, boasting 220 professionals worldwide. Their dominance in patent and trade secret litigation, especially within the fast-paced technology and life sciences industries, is undeniable.

This practice group consistently tackles high-stakes, 'bet-the-company' IP disputes. Their recognition as 'Outstanding' by World IP Review for Global Trade Secrets in 2024 underscores their leading edge.

With a remarkable track record of over 150 cases argued before the Federal Circuit, Jones Day has cemented a formidable market position in this constantly evolving legal landscape.

Cybersecurity & Data Privacy is a clear Star within Jones Day's BCG Matrix. The market is booming, driven by a relentless rise in cyberattacks and a growing web of data privacy laws worldwide. In 2023 alone, the global cost of cybercrime was projected to reach $8 trillion, highlighting the immense need for specialized legal counsel.

Jones Day's strong track record in advising clients on navigating these complex issues, from ensuring GDPR and CCPA compliance to managing data breach responses and protecting valuable digital assets, places them at the forefront of this high-demand sector. The increasing regulatory scrutiny and the sheer volume of sensitive data businesses handle create a fertile ground for the firm's expertise.

Complex Commercial Litigation

Complex Commercial Litigation is a clear Star within Jones Day's BCG Matrix. The legal landscape in 2024 saw a significant uptick in intricate commercial disputes, including bet-the-company cases and class actions. These surges are largely attributed to economic volatility and evolving regulatory frameworks.

Jones Day's litigation practice is exceptionally strong in this high-demand area. In fact, the firm was recognized as the top Litigation Department in Pennsylvania for 2024, underscoring their expertise. Their proven ability to navigate and win these challenging, high-stakes matters solidifies its position.

- High Volume of Complex Cases: Economic uncertainties and new regulations fuel a growing number of intricate commercial disputes.

- Top Industry Recognition: Jones Day was named the top Litigation Department in Pennsylvania in 2024.

- Strategic Acumen Under Pressure: The firm excels at providing strategic legal counsel in demanding, high-stakes litigation environments.

Labor & Employment

The Labor & Employment sector is experiencing robust expansion, fueled by new regulations, a resurgence in union organizing, and growing employee advocacy. This dynamic environment presents significant opportunities for legal service providers specializing in this area.

Jones Day's global Labor & Employment practice, a recognized leader with 130 lawyers across its network, consistently achieves notable successes in high-stakes cases. These include complex litigation concerning employment discrimination, wage and hour disputes, and critical labor relations issues.

- Sector Growth Drivers: Regulatory shifts, increased unionization efforts, and heightened employee activism are propelling the Labor & Employment legal market forward.

- Jones Day's Strength: The firm's extensive global team of 130 lawyers excels in handling intricate employment discrimination, wage-hour, and labor relations matters.

- Market Position: The combination of this sector's rapid growth and Jones Day's established market leadership solidifies its status as a Star performer for the firm.

Jones Day's Business Restructuring & Reorganization practice is a clear Star, recognized as Law360's 'Practice Group of the Year' in 2024. This practice excels in navigating complex mass tort and cross-border restructurings for global clients, especially during economic downturns. With over 100 dedicated restructuring lawyers, Jones Day commands a significant market share in this critical legal sector.

Jones Day's Intellectual Property litigation practice is a definitive Star, with 220 professionals globally. Their expertise in patent and trade secret litigation, particularly in technology and life sciences, is paramount. The firm's extensive experience, including over 150 cases argued before the Federal Circuit, solidifies its market leadership.

Cybersecurity & Data Privacy is a Star, driven by increasing cyberattacks and global data privacy laws. The projected global cost of cybercrime reaching $8 trillion in 2023 underscores the demand for specialized legal counsel. Jones Day's proficiency in GDPR, CCPA compliance, and breach response positions them at the forefront.

Complex Commercial Litigation is a Star, with a notable increase in intricate disputes and class actions in 2024 due to economic volatility. Jones Day's litigation strength is recognized, evidenced by their designation as the top Litigation Department in Pennsylvania for 2024. Their success in high-stakes matters is a key differentiator.

The Labor & Employment sector is a Star, experiencing growth from new regulations and increased union activity. Jones Day's global practice, comprising 130 lawyers, is a leader in complex litigation, including discrimination, wage-hour, and labor relations cases. This sector's expansion combined with the firm's expertise confirms its Star status.

| Practice Area | BCG Category | Key Strengths/Recognition | Market Drivers | Jones Day Team Size/Reach |

|---|---|---|---|---|

| Business Restructuring & Reorganization | Star | Law360 'Practice Group of the Year' 2024; Expertise in mass tort & cross-border restructurings | Economic downturns, complex financial challenges | 100+ lawyers globally |

| Intellectual Property Litigation | Star | 220 professionals worldwide; Dominance in patent & trade secret litigation; 150+ Federal Circuit arguments | Fast-paced tech & life sciences industries | 220 professionals worldwide |

| Cybersecurity & Data Privacy | Star | Expertise in GDPR, CCPA compliance, data breach response | Rising cyberattacks, evolving data privacy laws, $8 trillion projected cybercrime cost (2023) | Global team |

| Complex Commercial Litigation | Star | Top Litigation Department in Pennsylvania 2024; Proven success in high-stakes cases | Economic volatility, evolving regulatory frameworks, class actions | Global team |

| Labor & Employment | Star | 130 lawyers globally; Success in discrimination, wage-hour, labor relations cases | New regulations, union organizing, employee advocacy | 130 lawyers globally |

What is included in the product

Strategic guidance on investing, holding, or divesting business units based on their market share and growth.

Jones Day BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Jones Day's Mergers & Acquisitions practice is a cornerstone of its business, consistently performing as a Cash Cow. The firm's extensive experience spans a wide range of deal complexities and geographic markets, reflecting its deep bench of talent in corporate law and finance.

In 2023, Jones Day advised on numerous significant M&A transactions globally, contributing to the firm's robust revenue streams. For instance, the firm was a key advisor on several multi-billion dollar cross-border deals, underscoring its capability in handling high-value, complex international matters.

The M&A market, while subject to economic cycles, remains a vital and mature sector where Jones Day leverages its established reputation and broad client base. This consistent demand for sophisticated legal counsel in transactions solidifies its position as a reliable revenue generator for the firm.

Jones Day's extensive general corporate practice acts as a stable cash cow, providing essential legal advice to a wide range of clients, from Fortune 500 giants to emerging startups. This consistent demand stems from businesses needing ongoing support for daily operations, corporate governance, and contractual agreements.

The firm's ability to handle diverse corporate needs, coupled with its global presence, cultivates a loyal client base and ensures predictable revenue streams from these foundational services. For instance, in 2024, major law firms reported that corporate law services remained a significant revenue driver, with many seeing a steady uptick in M&A advisory and general corporate counseling throughout the year.

Jones Day's Real Estate practice operates as a significant cash cow for the firm. Its extensive global reach and deep expertise in transactions, finance, and development cater to a broad spectrum of clients, including major institutional investors and Real Estate Investment Trusts (REITs).

This practice consistently earns top rankings in legal directories, reflecting its strong market presence. In 2024, the firm advised on numerous high-profile real estate deals globally, solidifying its position in a mature yet robust market.

Government Regulation & Compliance

Government Regulation & Compliance stands as a strong Cash Cow for Jones Day. The firm's expertise in navigating complex global regulatory landscapes ensures consistent demand for its services. This practice area benefits from the non-discretionary nature of compliance, generating stable, high-margin revenue streams.

Businesses worldwide are grappling with an ever-expanding web of regulations. Jones Day's Government Regulation practice offers critical guidance, helping clients manage these evolving compliance requirements effectively. The ongoing need for regulatory adherence across industries solidifies this as a reliable revenue generator.

- Steady Demand: Regulatory compliance is a continuous necessity, not a cyclical expense, ensuring a consistent client base.

- High Margins: Specialized knowledge and the critical nature of compliance allow for premium service pricing.

- Risk Mitigation: Businesses invest heavily in compliance to avoid costly penalties and reputational damage, driving service utilization.

- Global Reach: Jones Day's international presence allows it to advise on a wide array of cross-border regulatory challenges.

Antitrust & Competition

Jones Day's Antitrust & Competition practice is a significant contributor, reflecting a mature and stable legal market. This practice area consistently attracts major corporations needing expertise in market dynamics, mergers, and regulatory compliance. Its established reputation and ongoing demand from large clients solidify its position as a cash cow, generating reliable revenue streams.

The practice benefits from a high market share within the antitrust legal sector. This dominance, coupled with consistent client engagement, points to a strong, predictable revenue base. For instance, in 2024, major antitrust litigation and merger review filings remained robust, underscoring the continuous need for specialized legal counsel in this domain.

- High Demand: Continual need for antitrust counsel from large, established corporations.

- Market Maturity: Operates within a well-defined and stable legal service segment.

- Consistent Revenue: Predictable income generation due to ongoing client needs and complex cases.

- Reputational Strength: Leverages Jones Day's established standing in complex litigation and regulatory matters.

Jones Day's Intellectual Property practice is a significant cash cow, characterized by high demand and specialized expertise. The firm's deep bench of attorneys adept at patent prosecution, litigation, and trademark matters ensures a steady flow of work from innovative companies across various sectors.

The IP market, while competitive, offers consistent revenue opportunities due to the perpetual need for protection and enforcement of intellectual assets. In 2024, the firm continued to secure significant IP portfolios for its clients, demonstrating the enduring value of these services.

Jones Day's Litigation practice, particularly in complex commercial disputes, functions as a robust cash cow. The firm's proven track record in high-stakes litigation attracts a consistent stream of clients, from Fortune 500 companies to those facing significant legal challenges.

The sheer volume and complexity of commercial litigation, coupled with the firm's formidable reputation, create a predictable and substantial revenue base. In 2024, major litigation filings remained a key revenue driver for leading law firms, with Jones Day actively participating in numerous high-profile cases.

| Practice Area | BCG Category | 2024 Revenue Contribution (Estimated) | Market Maturity | Growth Potential |

|---|---|---|---|---|

| Mergers & Acquisitions | Cash Cow | High | Mature | Stable |

| General Corporate Practice | Cash Cow | High | Mature | Stable |

| Real Estate | Cash Cow | High | Mature | Stable |

| Government Regulation & Compliance | Cash Cow | High | Mature | Stable |

| Antitrust & Competition | Cash Cow | High | Mature | Stable |

| Intellectual Property | Cash Cow | High | Mature | Stable |

| Litigation (Commercial) | Cash Cow | High | Mature | Stable |

Preview = Final Product

Jones Day BCG Matrix

The Jones Day BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means you'll get the complete strategic analysis without any watermarks or placeholder text, ready for immediate application. The data and formatting you see are precisely what will be yours, ensuring transparency and immediate utility for your business planning needs. This comprehensive report is designed to provide actionable insights into your product portfolio's strategic positioning.

Dogs

Commoditized legal services, such as basic contract review or simple will preparation, represent areas where standardization and competition from lower-cost providers or online platforms are increasing. For a firm like Jones Day, which typically focuses on complex, high-value work, these services might represent low-growth, low-margin offerings. In 2024, the legal tech market saw significant investment, with companies offering AI-powered contract analysis and automated document generation, further pushing down the cost of these commoditized services.

A continued heavy reliance on traditional hourly billing for legal services, especially for tasks ripe for technological enhancement, positions these service delivery models as potential Dogs within the Jones Day BCG Matrix. This inflexibility, particularly as clients demand more value-based pricing and demonstrable efficiency, directly impacts competitiveness and can erode market share in segments prioritizing cost-effectiveness. Indeed, the legal sector has witnessed a pronounced movement away from the long-standing billable hour structure, a trend that shows no signs of abating as we move further into 2024 and beyond.

Highly specialized niche practice areas within a law firm that cater to industries or legal issues experiencing long-term decline or stagnation can be classified as Dogs in the BCG Matrix. These practices are characterized by low market growth and potentially diminishing client demand, making them less attractive for future investment and resource allocation. For instance, practices focused on certain types of traditional manufacturing litigation or specific, outdated regulatory compliance might fall into this category.

Underinvested Legacy Technology Systems

Underinvested legacy technology systems at law firms like Jones Day can become significant liabilities. These outdated systems often lead to operational inefficiencies, data silos, and increased cybersecurity risks. For instance, a 2024 survey by Legaltech News found that 45% of law firms still rely on manual processes for key tasks, highlighting a widespread issue with legacy tech adoption.

When specific practice groups within a firm are hampered by disparate systems that fail to integrate, the consequences can be severe. This lack of data sharing can inflate operational costs and negatively impact client service delivery. A study by the American Bar Association in 2023 indicated that firms with fragmented technology stacks experienced an average of 15% higher administrative overhead compared to those with integrated solutions.

- Operational Inefficiencies: Legacy systems often lack automation, requiring more manual input and increasing the time to complete tasks.

- Data Quality Issues: Disparate systems can lead to inconsistent or inaccurate data, impacting analysis and decision-making.

- Cybersecurity Vulnerabilities: Outdated software may not receive crucial security updates, leaving sensitive client data exposed.

- Reduced Profitability: Higher operational costs and potential client dissatisfaction directly erode profit margins.

Undifferentiated Basic Compliance Work

Undifferentiated basic compliance work, while a necessary function, can be a challenge within a strategic growth framework. For a firm like Jones Day, known for its sophisticated legal counsel, routine compliance tasks that can be easily managed by internal legal departments or smaller, specialized firms might represent a 'Dog' category in the BCG Matrix. This segment typically exhibits low market share and limited growth potential if not integrated with more complex, value-added services.

The market for basic compliance services is often highly competitive and commoditized. For instance, in 2024, the global legal services market was valued at approximately $800 billion, with compliance being a significant sub-segment. However, the portion of this market focused on undifferentiated, routine tasks might not align with the high-margin, specialized offerings that drive growth for top-tier law firms.

- Low Differentiation: Basic compliance tasks often lack unique value propositions, making them susceptible to price competition.

- Limited Growth Potential: Unless bundled with strategic legal advice, these services may not attract significant new business or command premium pricing.

- In-house Capabilities: Many corporations have developed robust internal compliance departments, reducing their reliance on external firms for routine matters.

- Competitive Landscape: A crowded market of specialized compliance providers and technology solutions can further dilute the market share for undifferentiated services.

Certain practice areas within a law firm that are experiencing a sustained downturn in client demand or are tied to industries facing obsolescence can be categorized as Dogs. These areas typically exhibit low growth and a shrinking market share, making them poor candidates for further investment. For example, practices focused on industries heavily disrupted by technological advancements, like certain aspects of traditional print media law, might fit this description.

The legal sector's ongoing shift towards technology-enabled solutions for routine tasks, such as document automation and AI-driven legal research, can relegate traditional, labor-intensive service delivery models to Dog status. Firms that do not adapt and integrate these efficiencies risk becoming uncompetitive in segments where cost and speed are paramount. By 2024, investments in legal tech aimed at automating basic legal processes continued to surge, underscoring this trend.

Undifferentiated, high-volume transactional work that lacks specialized expertise or strategic value can also be considered Dogs. These services often face intense competition from alternative legal service providers and in-house legal departments, leading to lower margins and limited growth prospects. In 2024, the trend of corporate legal departments insourcing more routine work continued, impacting external firms that rely heavily on such matters.

Legacy IT infrastructure and unintegrated technological systems within a law firm represent significant liabilities, often falling into the Dog category. These inefficiencies lead to higher operational costs and can hinder service delivery. A 2024 report indicated that 30% of law firms identified outdated technology as a major impediment to growth and client satisfaction.

Question Marks

The legal landscape surrounding Artificial Intelligence (AI) and Machine Learning (ML) is a burgeoning field, mirroring the rapid advancements in AI technologies across various sectors. This area presents significant growth opportunities as companies navigate the complex legal implications of AI deployment, from regulatory compliance and intellectual property protection to data privacy and liability concerns for autonomous systems.

While established law firms like Jones Day offer expertise in technology-driven transactions and intellectual property, their dedicated practice in AI and ML law is still solidifying its market position. This emerging specialization fits the profile of a Question Mark in the BCG Matrix, demanding strategic investment to build capabilities and secure a leading role in advising clients on these novel legal challenges.

The global AI market was valued at an estimated $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, indicating substantial commercial interest and, consequently, a growing need for specialized legal counsel. This rapid market expansion underscores the imperative for legal firms to develop robust AI and ML law practices to capitalize on future demand.

The demand for legal services focused on Environmental, Social, and Governance (ESG) compliance is surging, signaling a robust growth opportunity. Reports from sources like the Thomson Reuters Institute in 2024 highlighted that a significant percentage of corporate legal departments are actively seeking external ESG expertise, yet many law firms are still developing their capacity to meet this need. This gap presents a clear indicator of a market in flux, where early movers can capture substantial share.

This burgeoning ESG legal market can be viewed as a Question Mark within the BCG framework for a firm like Jones Day. While the demand is high, indicating strong potential, the actual market share and comprehensive service offerings are still being established by many players, including potentially Jones Day in specific ESG niches. Strategic investment and focused development in ESG legal capabilities are crucial to elevating this area from a Question Mark to a Star performer.

Jones Day, like many major law firms, is witnessing the accelerated adoption of legal technology aimed at boosting efficiency. A potential Question Mark within the BCG framework for Jones Day could be the strategic move into offering direct consulting and implementation services for legal tech solutions to its clientele.

This burgeoning sector presents a high-growth opportunity as clients increasingly prioritize optimizing their internal legal operations. However, venturing into this space necessitates the development of new business models and the cultivation of specialized expertise, areas that traditional law firms are still actively integrating into their core offerings.

Space Law & Commercial Space Ventures

The burgeoning commercial space sector, driven by advancements in satellite technology and private exploration, presents a complex legal landscape. Issues such as space property rights, liability for orbital collisions, and adherence to international treaties are becoming increasingly critical, demanding specialized legal expertise.

This nascent but high-growth area offers significant lucrative opportunities. For a firm like Jones Day, if a substantial presence hasn't already been cultivated, space law and commercial space ventures would likely be categorized as a Question Mark within the BCG matrix. This classification indicates a need for considerable, focused investment to establish a robust market position.

- Market Growth: The global space economy reached an estimated $469 billion in 2021, with projections indicating continued strong growth, particularly in commercial sectors like satellite services and launch.

- Legal Needs: As of 2024, the increasing number of satellite constellations and the rise of space tourism are creating new legal challenges related to spectrum allocation, debris mitigation, and national sovereignty in space.

- Investment Requirement: Building expertise in space law requires significant investment in specialized talent and resources, reflecting the high barriers to entry and the need for deep technical and regulatory understanding.

- Strategic Focus: For Jones Day, a strategic decision to invest heavily in this sector would be necessary to transition it from a Question Mark to a Star, capitalizing on its high growth potential.

Decentralized Finance (DeFi) & Blockchain Law

The burgeoning decentralized finance (DeFi) and blockchain legal sector represents a significant growth opportunity, characterized by complex issues such as smart contract enforceability, evolving digital asset regulations, and the increasing volume of cryptocurrency-related litigation. The global DeFi market capitalization reached approximately $100 billion in early 2024, underscoring its rapid expansion and the associated legal complexities.

For a firm like Jones Day, establishing a dominant position in this dynamic legal landscape would be a strategic Question Mark. This necessitates targeted investment in specialized legal talent and continuous development of expertise to navigate the intricacies of blockchain technology and its regulatory environment.

- Market Growth: The DeFi market is projected to grow substantially, with estimates suggesting it could reach over $1 trillion by 2030, creating a vast demand for specialized legal services.

- Legal Challenges: Key legal areas include the regulatory status of various cryptocurrencies and tokens, the legal implications of decentralized autonomous organizations (DAOs), and cross-border enforcement of digital asset transactions.

- Expertise Development: Building a leading practice requires deep understanding of cryptography, distributed ledger technology, and international financial regulations to effectively advise clients.

- Competitive Landscape: While many firms are entering the space, a truly leading market share requires a differentiated approach and a proven track record in handling novel and high-stakes blockchain and DeFi legal matters.

Question Marks in the BCG Matrix represent areas with high market growth potential but low market share. For a firm like Jones Day, these are emerging legal fields where significant investment is needed to build expertise and capture market leadership.

These areas are characterized by rapid development and evolving client needs, demanding a proactive and strategic approach to service offering expansion. The goal is to cultivate these Question Marks into Stars by investing resources to gain a competitive advantage.

Successfully navigating these Question Marks requires a deep understanding of the market dynamics and a commitment to developing specialized legal talent. This strategic focus is crucial for long-term growth and market differentiation.

The firm must carefully select which Question Marks to invest in, considering the potential return on investment and alignment with its overall strategic objectives.

| Area | Market Growth Potential | Current Market Share (Illustrative) | Strategic Imperative |

|---|---|---|---|

| AI & ML Law | Very High | Emerging | Invest to build expertise and client base |

| ESG Legal Services | High | Developing | Focus on niche areas and build track record |

| Legal Tech Consulting | High | Nascent | Develop new service models and partnerships |

| Space Law | High | Nascent | Acquire specialized talent and build practice |

| DeFi & Blockchain Law | Very High | Emerging | Deepen technical understanding and regulatory navigation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial reports, detailed market research, and expert industry analysis to provide a robust strategic overview.