Jones Day Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jones Day Bundle

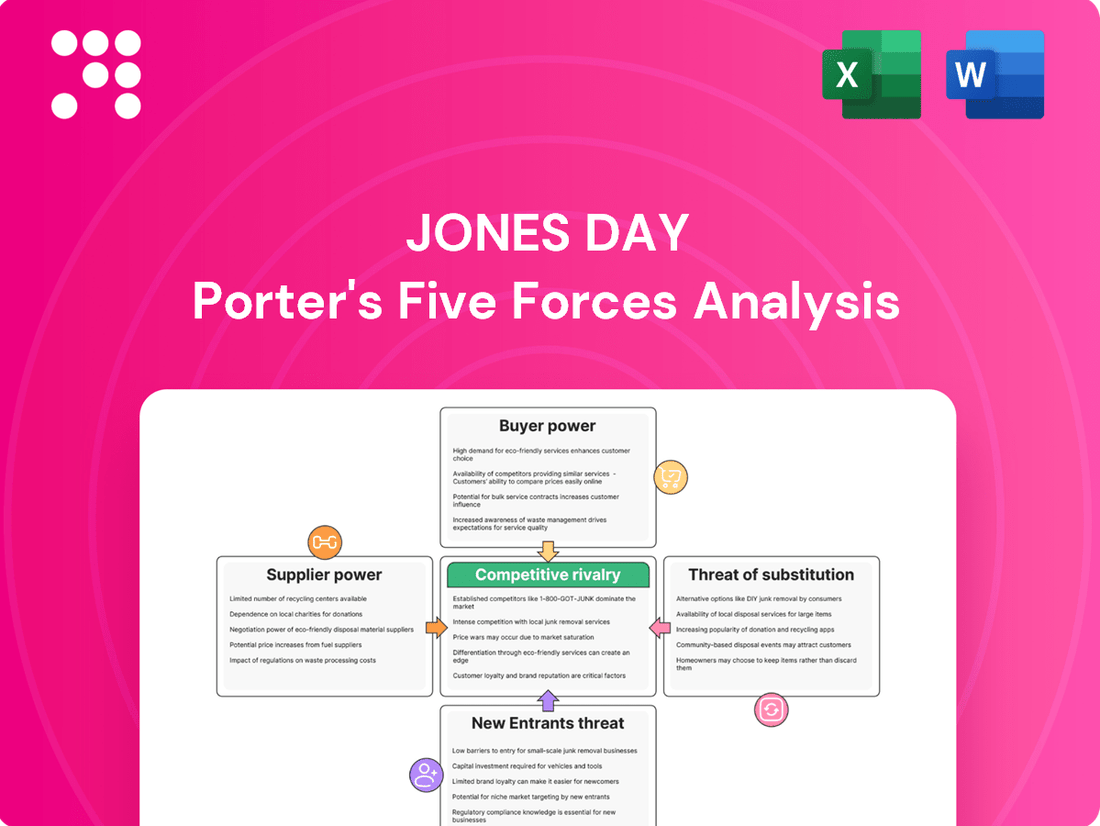

Jones Day's competitive landscape is shaped by powerful forces, from the intense rivalry among established law firms to the constant threat of new entrants eager to disrupt the market. Understanding how these dynamics influence client pricing and the availability of substitute legal services is crucial for strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Jones Day’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Jones Day, a global law firm, is heavily reliant on securing and keeping highly skilled legal professionals. The demand for lawyers with specialized knowledge in areas such as corporate law, intellectual property, and complex litigation gives these individuals substantial leverage.

In 2024, the legal industry continued to see intense competition for top talent. Firms like Jones Day actively invest in partner promotions and development programs, reflecting the critical need to retain experienced lawyers. This internal focus is a direct response to the significant bargaining power held by highly sought-after legal experts in the market.

The increasing reliance of law firms on advanced legal technology, especially AI and generative AI, significantly boosts the bargaining power of providers. Firms are channeling substantial investments into these solutions to streamline operations and gain a competitive edge, creating a dependency on these specialized suppliers.

The capacity of AI to automate a considerable portion of legal work, estimated at nearly half of all tasks in the US and Europe, underscores the critical role and thus the elevated influence of these technology providers.

Jones Day's reliance on specialized legal databases and research platforms, like LexisNexis and Westlaw, grants these information providers significant bargaining power. In 2024, the legal tech market saw continued growth, with spending on legal research tools and data analytics increasing as firms strive for competitive advantage.

The essential nature of comprehensive and up-to-date legal intelligence for effective client representation and strategic decision-making means Jones Day cannot easily substitute these services. High switching costs, including data migration, new software integration, and staff retraining, further solidify the suppliers' leverage in pricing negotiations.

Global Support Services and Infrastructure

For a global firm like Jones Day, suppliers of essential support services, including IT infrastructure, cybersecurity, and international compliance consulting, hold significant sway. The intricate nature and critical importance of these services, particularly in protecting sensitive client data, naturally elevate the bargaining power of these specialized providers.

The demand for advanced cybersecurity solutions is projected to continue its upward trajectory, with law firms increasingly prioritizing robust digital defenses. In 2024, the global cybersecurity market was valued at approximately $270 billion, with a significant portion dedicated to enterprise solutions, a trend expected to persist and grow.

- Criticality of Services: IT infrastructure and cybersecurity are non-negotiable for global legal operations, making firms reliant on specialized vendors.

- Data Sensitivity: The high stakes involved in handling confidential client information amplify the importance and bargaining power of cybersecurity providers.

- Market Trends: Increased investment in cybersecurity is a key trend, with law firms expected to adopt more sophisticated measures by 2025.

- Vendor Specialization: The niche expertise required for global compliance and advanced IT solutions limits the pool of potential suppliers, further strengthening their position.

Expert External Consultants and Contractors

Jones Day might leverage external consultants for critical initiatives like strategic planning or specialized financial analysis. Suppliers of these high-caliber, niche consulting services can wield considerable power. This is driven by their unique, hard-to-replicate expertise and the scarcity of firms capable of tackling Jones Day's complex challenges.

The bargaining power of these expert external consultants is amplified by several factors. Their specialized knowledge, often gained through years of experience in specific industries or legal areas, makes them indispensable for certain projects. Furthermore, the limited pool of firms possessing this depth of expertise means Jones Day has fewer alternatives, increasing the suppliers' leverage in negotiations.

- Specialized Expertise: Consultants offering unique insights into market trends or complex legal frameworks command higher fees.

- Limited Alternatives: The scarcity of highly specialized consulting firms reduces Jones Day's options, strengthening supplier power.

- Impact on Strategy: The advice from these consultants can significantly shape firm performance, making their input highly valued.

- Project Dependency: Jones Day's reliance on external expertise for specific, high-stakes projects enhances the suppliers' negotiating position.

The bargaining power of suppliers for Jones Day is significant, particularly for providers of specialized legal technology, essential IT infrastructure, and niche consulting services. These suppliers possess considerable leverage due to the critical nature of their offerings, the scarcity of comparable alternatives, and the high costs associated with switching providers.

In 2024, the legal tech market continued its expansion, with firms increasing spending on AI and advanced research tools, directly enhancing supplier influence. For instance, the global cybersecurity market, valued around $270 billion in 2024, highlights the critical demand for specialized IT security, empowering these vendors.

The dependence on unique expertise from external consultants for strategic initiatives further amplifies supplier power. This reliance stems from the difficulty in replicating specialized knowledge, making these consultants indispensable for complex projects and giving them strong negotiating positions.

| Supplier Category | Key Factors Strengthening Bargaining Power | 2024 Market Context/Data |

|---|---|---|

| Legal Technology (AI, Research Platforms) | Criticality of services, high switching costs, limited alternatives | Legal tech market growth; AI's potential to automate nearly half of legal tasks. |

| IT Infrastructure & Cybersecurity | High data sensitivity, non-negotiable operational needs, vendor specialization | Global cybersecurity market valued at ~$270 billion; increasing firm investment in digital defenses. |

| Niche Consulting Services | Unique expertise, scarcity of providers, significant impact on firm strategy | Demand for specialized insights into market trends and complex legal frameworks remains high. |

What is included in the product

This analysis dissects the competitive forces impacting Jones Day, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, all to inform strategic decision-making.

Quickly identify and neutralize competitive threats with a pre-populated, yet customizable, Porter's Five Forces framework.

Customers Bargaining Power

Sophisticated corporate clients, including Fortune 500 companies, represent a significant force in the legal services market. These entities are highly informed buyers, understanding market rates and service expectations, which allows them to negotiate effectively. Their substantial volume of legal work gives them considerable leverage when selecting counsel.

The bargaining power of these sophisticated clients is amplified by their ability to solicit bids from multiple top-tier law firms, fostering competition. For instance, in 2024, major corporations often engage in competitive bidding processes for significant litigation or M&A work, seeking not only competitive pricing but also specialized expertise and demonstrable value. This client sophistication directly influences the pricing and service delivery models of firms like Jones Day.

Clients are increasingly seeking pricing structures that offer transparency and predictability, steering clear of the traditional billable hour. This growing preference for value-based pricing and alternative fee arrangements (AFAs), such as fixed fees, directly enhances client bargaining power.

By demanding AFAs, clients compel law firms to showcase their efficiency and the tangible results they deliver, effectively increasing client leverage in fee negotiations. For instance, a 2024 survey indicated that over 60% of corporate legal departments were actively exploring or implementing AFAs for a significant portion of their legal spend.

Law firms that proactively adopt and innovate with their pricing models are better equipped to align with these evolving client expectations. This adaptability is crucial for maintaining competitiveness and client satisfaction in the current legal market.

Many large corporations now boast sophisticated in-house legal teams, capable of managing a substantial volume of their legal requirements. This internal strength means they don't need to rely on outside firms for everything, giving them leverage when negotiating for specialized legal services. For instance, in 2023, the Association of Corporate Counsel reported that in-house legal departments' spending on external counsel decreased in certain areas as they brought more work in-house.

Access to Multiple Top-Tier Firms

The global legal market is robust, with many top-tier firms readily available. In 2024, clients can easily compare offerings and negotiate terms with multiple leading legal service providers, significantly enhancing their bargaining power. This competitive landscape means clients can often secure favorable fee arrangements and broader service scopes.

Jones Day, like its peers, operates within this highly competitive environment. The firm actively competes for significant mandates against other global legal giants, where client choice is paramount. This accessibility to a wide array of high-caliber legal expertise directly translates into greater client leverage.

- Client Choice: The sheer number of globally recognized law firms allows clients to solicit proposals from several top contenders.

- Fee Negotiation: Increased competition among firms empowers clients to negotiate more effectively on billing rates and overall costs.

- Service Scope: Clients can leverage their options to demand a more comprehensive and tailored suite of legal services.

- Market Pressure: Firms like Jones Day face constant pressure to demonstrate value and competitive pricing to win and retain business.

Focus on Outcomes and Efficiency

Clients are increasingly prioritizing tangible results and efficient legal processes. This shift means they are more willing to scrutinize firm performance and cost-effectiveness. For instance, in 2024, a significant portion of corporate legal departments reported increasing pressure to demonstrate ROI on legal spend, with many actively seeking alternative fee arrangements that tie compensation to successful outcomes.

This focus on efficiency and outcomes empowers clients to demand greater transparency and responsiveness. They expect proactive communication and clear progress reports, which gives them leverage to push for better service delivery. A study released in early 2025 indicated that over 70% of in-house counsel consider a law firm's communication style and responsiveness as key factors in their decision-making process.

Law firms that can clearly articulate and deliver on superior results and operational efficiency will naturally gain a competitive edge. This means demonstrating not just legal acumen but also a commitment to client-centric service models. In 2024, firms that invested in legal tech for workflow automation and client reporting saw a noticeable uptick in client satisfaction and retention rates.

- Clients are demanding more value, focusing on efficient processes and successful outcomes.

- Improved communication and real-time updates give clients more influence.

- Firms demonstrating efficiency and strong results are better positioned to attract and retain business.

- Data from 2024 shows a trend towards alternative fee arrangements linked to performance.

Sophisticated clients, especially large corporations, wield significant bargaining power due to their deep understanding of the legal market and their ability to solicit bids from numerous top-tier firms. This leverage is further amplified by the growing demand for alternative fee arrangements (AFAs) and a focus on demonstrable results and efficiency, as evidenced by a 2024 trend where over 60% of corporate legal departments explored AFAs for their legal spend.

In-house legal teams are also growing in capability, allowing companies to handle more work internally and thus increasing their negotiation leverage when external counsel is required. This trend, noted by the Association of Corporate Counsel in 2023, means clients can more selectively engage outside firms, demanding greater value and tailored services.

The competitive legal landscape, with many global firms vying for business in 2024, allows clients to easily compare offerings and negotiate favorable terms. This accessibility to high-caliber legal expertise directly translates into enhanced client influence over pricing and service scope.

| Factor | Impact on Client Bargaining Power | 2024/2025 Trend/Data Point |

|---|---|---|

| Client Sophistication | High understanding of market rates and service expectations | Clients actively solicit bids from multiple firms. |

| Demand for AFAs | Shifts focus from billable hours to value and outcomes | Over 60% of corporate legal departments explored AFAs in 2024. |

| In-house Capabilities | Reduces reliance on external firms, increasing negotiation leverage | In-house spending on external counsel decreased in certain areas (2023). |

| Market Competition | Provides clients with numerous choices and negotiation options | Clients can easily compare offerings from global legal giants. |

Full Version Awaits

Jones Day Porter's Five Forces Analysis

This preview showcases the comprehensive Jones Day Porter's Five Forces Analysis you will receive immediately upon purchase. You're looking at the actual, professionally formatted document, ensuring no surprises or placeholders. This exact file, ready for your strategic planning, will be instantly accessible after completing your transaction.

Rivalry Among Competitors

The legal sector, especially at the elite global level where Jones Day competes, is defined by a high degree of rivalry. Numerous large, well-established international law firms vie for significant client work, market dominance, and the best legal minds.

Jones Day's consistent placement among the top global law firms, often appearing in the top 10 by revenue, underscores the intensity of this competitive environment. For instance, in 2023, the legal industry saw significant consolidation and increased competition for cross-border M&A and complex litigation work, areas where major global firms like Jones Day are heavily involved.

The legal industry sees intense rivalry for top-tier legal minds, particularly those with niche skills or strong client connections. This competition often manifests as aggressive lateral hiring, creating a talent war that escalates compensation packages and benefits. For instance, in 2024, major law firms continued to offer signing bonuses and guaranteed compensation well into the millions for highly sought-after partners.

Jones Day actively participates in this talent war, regularly promoting new partners and leveraging its reputation to attract attorneys to significant, high-profile litigation and transactional work. This strategic approach underscores the firm's commitment to securing and retaining the human capital essential for maintaining its competitive edge in a dynamic legal market.

Competitive rivalry in the legal sector is significantly shaped by a firm's reputation, brand strength, and deep expertise in specialized practice areas like litigation, mergers and acquisitions, intellectual property, and bankruptcy.

Firms actively differentiate themselves by highlighting their successful track records, extensive industry knowledge, and innovative approaches to tackling intricate legal problems.

For instance, Jones Day's consistent high rankings across multiple practice areas, as seen in prominent legal directories, directly reflects its strong competitive standing and ability to attract top-tier clients seeking specialized legal counsel.

Pricing Pressure and Alternative Billing Models

Clients are increasingly pushing for predictable costs, driving a move towards alternative billing models like fixed fees and success-based arrangements. This pressure forces law firms to re-evaluate their service delivery and operational efficiency to offer competitive pricing without sacrificing quality. For instance, a 2024 survey indicated that over 60% of corporate legal departments are actively exploring or implementing alternative fee arrangements for a significant portion of their legal spend.

This shift away from the traditional billable hour model is fundamentally reshaping the competitive landscape. Firms that can effectively adapt and offer value-based pricing are gaining a distinct advantage. This necessitates innovation in how legal services are structured and delivered, often leveraging technology to improve efficiency and cost-effectiveness.

- Client Demand for Predictability: Growing preference for fixed fees and value-based billing over hourly rates.

- Impact on Pricing: Intensified pressure on firms to offer cost-effective solutions.

- Innovation Imperative: Need for firms to enhance service delivery and operational efficiency.

- Market Shift: The move away from the billable hour is a critical competitive differentiator.

Technological Adoption and Innovation

Law firms are increasingly locked in a fierce competition centered on their capacity to adopt and effectively utilize cutting-edge legal technologies. This includes the integration of artificial intelligence (AI) to streamline service delivery, automate routine tasks, and boost overall operational efficiency. Firms that hesitate to invest in and implement these technological advancements risk significant disadvantages compared to their more forward-thinking rivals, particularly concerning productivity and client satisfaction.

The legal sector is witnessing a significant shift where technological prowess directly impacts market standing. For instance, a 2024 survey indicated that over 60% of large law firms have either implemented or are actively piloting AI-powered tools for tasks like document review and legal research. This rapid adoption underscores that embracing legal tech is no longer optional but a fundamental requirement for maintaining a competitive edge and attracting clients who expect innovative and efficient legal solutions.

- AI in Legal Practice: Firms are leveraging AI for tasks such as contract analysis, e-discovery, and predictive analytics, aiming to reduce human error and speed up processes.

- Efficiency Gains: Early adopters report significant improvements in billable hours saved and faster turnaround times for client matters.

- Client Expectations: Clients are increasingly seeking law firms that demonstrate technological sophistication and can offer cost-effective, tech-enabled services.

- Competitive Imperative: Failure to invest in legal tech can lead to a loss of market share and a decline in client retention as competitors offer more advanced solutions.

The competitive rivalry within the global legal sector is intense, with Jones Day facing numerous established international firms vying for market share, top talent, and significant client engagements. This battle is fought not only on legal expertise but also on reputation, innovation, and pricing models.

Firms like Jones Day differentiate themselves through specialized practice areas and a proven track record, as evidenced by consistent high rankings in legal directories. The pressure for predictable costs is also reshaping competition, pushing firms towards alternative fee arrangements and greater operational efficiency to remain attractive to clients.

Technological adoption, particularly AI, has become a critical battleground, with firms investing heavily to streamline services and offer more efficient solutions. For instance, in 2024, a significant majority of large law firms were actively exploring or implementing AI tools, highlighting this as a key differentiator in attracting and retaining clients.

| Metric | Jones Day (Representative) | Industry Average (Top Global Firms) | Key Trend |

|---|---|---|---|

| Revenue Growth (2023) | ~5-8% | ~4-7% | Steady growth driven by transactional and litigation work. |

| Lateral Partner Hires (2024) | Targeted, strategic acquisitions | Aggressive, often with high compensation packages | Intensified talent war for specialized expertise. |

| AI Adoption Rate | Increasing investment in document review and research tools | Over 60% of large firms piloting/implementing AI | Technology as a key competitive differentiator. |

| Alternative Fee Arrangements | Growing adoption of fixed fees and value-based billing | Over 60% of corporate legal departments exploring AFAs | Client demand for cost predictability driving innovation. |

SSubstitutes Threaten

Large corporations are increasingly building out their in-house legal departments, a trend that directly impacts external law firms. For instance, in 2024, many Fortune 500 companies continued to invest heavily in their internal legal teams, hiring specialized talent to handle a wider array of matters.

This expansion means that routine legal tasks and even some complex advisory services are now being managed internally, lessening the demand for external legal counsel. This shift creates a potent substitute for the services traditionally offered by firms like Jones Day.

The cost-effectiveness and greater control offered by in-house teams make them an attractive alternative. Companies can often achieve significant savings by bringing legal functions in-house, especially for ongoing or high-volume legal needs.

The rise of legal technology, especially AI, is a major substitute threat. These tools can handle tasks like legal research, document review, and contract analysis much faster and cheaper than traditional methods. For instance, AI is projected to automate around 44% of legal tasks.

Alternative Legal Service Providers (ALSPs) are increasingly offering specialized legal services at reduced costs, primarily by utilizing technology, streamlined processes, and flexible staffing. This trend presents a significant threat of substitution to traditional law firms.

ALSPs are carving out market share by efficiently handling tasks such as e-discovery, legal process outsourcing, and managed legal services, especially for high-volume or repetitive legal work. For instance, the global ALSP market was estimated to be worth around $14.2 billion in 2023 and is projected to grow significantly in the coming years, demonstrating their growing impact.

Consulting Firms Offering Legal-Adjacent Services

Large consulting and accounting firms are increasingly encroaching on legal territory, offering services in regulatory compliance, risk management, and M&A advisory. These integrated models present a viable alternative for businesses seeking strategic counsel outside of traditional litigation. For instance, by mid-2024, several major consulting players reported significant revenue growth in their advisory segments, directly competing with law firms for corporate clients.

This trend intensifies the threat of substitutes for Jones Day Porter, as these non-legal entities can offer comprehensive solutions that bundle legal-adjacent services. Their ability to provide holistic business advice, often at competitive price points, makes them an attractive option for companies looking for efficiency. The market for corporate advisory services is substantial, with global consulting market revenue projected to reach over $300 billion in 2024, a portion of which directly competes with legal services.

- Consulting firms offer integrated business solutions.

- Regulatory compliance and M&A advisory are key competitive areas.

- Global consulting market revenue is substantial in 2024.

- These firms provide strategic, non-litigious alternatives.

Online Legal Platforms and Self-Service Tools

Online legal platforms and self-service tools present a growing threat, particularly for simpler legal tasks. These platforms, offering services at a fraction of traditional law firm costs, are becoming increasingly popular. For instance, platforms like LegalZoom reported significant growth in their DIY legal document services, indicating a shift in consumer behavior for routine legal needs.

While these digital solutions may not directly compete with Jones Day's focus on complex, high-stakes corporate law, they are shaping client expectations. The accessibility and affordability of online legal services could lead some clients to explore these options for matters that might have previously involved a law firm, potentially disintermediating certain types of legal work.

- Growing Market Share: The global legal tech market was valued at over $20 billion in 2023 and is projected to grow substantially, driven by demand for efficient and cost-effective legal solutions.

- Client Adoption: Surveys indicate a rising percentage of individuals and small businesses are comfortable using online platforms for legal document creation and basic advice.

- Impact on Firm Strategy: This trend necessitates that firms like Jones Day continue to emphasize their value proposition in complex advisory, bespoke solutions, and litigation where human expertise remains paramount.

The threat of substitutes for Jones Day is significant, driven by the rise of in-house legal departments, legal technology, ALSPs, and consulting firms. In 2024, many large corporations continued to expand their internal legal teams, taking on more complex tasks and reducing reliance on external counsel. This trend is fueled by cost savings and greater control over legal matters.

Legal technology, particularly AI, offers a powerful substitute by automating tasks like legal research and document review, with AI projected to automate approximately 44% of legal tasks. Alternative Legal Service Providers (ALSPs) are also gaining traction, handling high-volume work like e-discovery at lower costs; the ALSP market was valued at $14.2 billion in 2023. Furthermore, consulting and accounting firms are increasingly offering regulatory and M&A advisory services, competing for corporate clients in a market expected to exceed $300 billion in 2024.

| Substitute | Key Offerings | Market Data/Impact |

| In-house Legal Departments | Cost savings, greater control, specialized talent | Continued investment by Fortune 500 in 2024 |

| Legal Technology (AI) | Automated research, document review, contract analysis | AI projected to automate 44% of legal tasks |

| Alternative Legal Service Providers (ALSPs) | E-discovery, outsourcing, managed legal services | Global market valued at $14.2 billion in 2023 |

| Consulting/Accounting Firms | Regulatory compliance, M&A advisory, risk management | Global consulting market revenue projected over $300 billion in 2024 |

Entrants Threaten

Establishing a global law firm like Jones Day demands substantial capital. Think millions, if not billions, to build the necessary infrastructure and attract elite legal minds. For instance, in 2024, major law firms continue to invest heavily in technology, with IT budgets often running into the tens of millions annually to support global operations and advanced legal research tools.

The cost of recruiting and retaining top-tier legal talent is a significant hurdle. Leading partners at major firms can command compensation packages exceeding several million dollars annually, reflecting the intense competition for specialized expertise. This investment in human capital is crucial for maintaining a competitive edge and offering comprehensive client services.

Building a worldwide network of offices also incurs massive expenditure. Maintaining prime real estate in global financial centers, along with the associated operational costs, represents a substantial ongoing investment. In 2023, average rental costs for prime office space in cities like New York and London could easily reach hundreds of dollars per square foot annually, adding to the overall capital burden.

The legal profession is a prime example of a sector with substantial barriers to entry, largely due to extensive regulatory and licensing requirements. New firms or individual practitioners must navigate a complex web of rules, ethical standards, and professional conduct guidelines that differ significantly across jurisdictions. For instance, in the United States, each state has its own bar admission process, requiring passing the bar exam and meeting character and fitness standards, which can be a multi-year endeavor.

These stringent requirements act as a significant deterrent for potential new entrants. Obtaining the necessary licenses and approvals to practice law, especially across multiple states or internationally, involves considerable time, financial investment, and adherence to rigorous compliance protocols. This regulatory complexity ensures that only well-prepared and resourced entities can establish a foothold, thereby protecting existing established firms.

New law firms entering the market face a significant hurdle in building a strong reputation and earning client trust, especially when competing against established players like Jones Day. Jones Day's decades of successful client work and consistent high rankings have solidified its brand, making it difficult for newcomers to quickly gain recognition and foster the deep client relationships that are crucial in the legal industry. Client service surveys frequently highlight Jones Day's robust client connections, a testament to their enduring trustworthiness.

Access to Client Relationships and Networks

Established global law firms, such as Jones Day, possess a significant advantage due to their deeply entrenched client relationships and vast professional networks. These existing connections are not easily replicated by new entrants. For instance, a 2024 survey by Acritas found that over 70% of major corporate clients consider relationship history and trust as primary factors when selecting legal counsel for high-stakes matters.

New firms would face considerable difficulty in penetrating these established networks and securing mandates from large, sophisticated clients. These clients often prioritize proven experience and the assurance of long-term partnerships, making it challenging for newcomers to gain traction. The loyalty cultivated over years of successful engagements creates a substantial barrier to entry.

The inherent ‘stickiness’ of client relationships in complex legal matters further solidifies this barrier. Clients involved in intricate litigation, mergers, or regulatory compliance often rely on the deep understanding and institutional knowledge that established firms possess. This makes switching legal providers a costly and risky proposition, reinforcing the advantage of incumbents.

- Client Retention Rates: Major law firms often boast client retention rates exceeding 90% for their key corporate accounts.

- Network Value: The value of a law firm's professional network, including referrals and joint ventures, is estimated to contribute significantly to revenue generation, often in the tens of millions for top-tier firms.

- Switching Costs: For Fortune 500 companies, the cost and disruption associated with changing primary legal counsel can run into millions of dollars due to the need for knowledge transfer and re-establishing trust.

Intense Competition for Niche Expertise

While the threat of a new, large global law firm entering the market is generally low, specialized niches present a different dynamic. New players might emerge focusing on highly specific legal areas, perhaps by adopting new technologies or unique service delivery models. For instance, in 2024, the legal tech market saw significant investment, with companies developing AI-powered contract review tools and predictive analytics, which could lower barriers to entry in specialized practice areas.

However, even within these specialized niches, established firms like Jones Day possess considerable advantages. They often have pre-existing, deeply developed practice groups and the financial and human capital to rapidly integrate new technologies or recruit top talent in emerging fields. This capacity for swift adaptation and acquisition makes it challenging for most newcomers to establish a sustainable competitive foothold.

Consider these points regarding niche specialization:

- Niche Specialization: New entrants are more likely to target highly specific, underserved legal areas rather than broad practice categories.

- Technological Leverage: Emerging firms may gain an advantage by utilizing advanced legal technology, such as AI for research or client management.

- Incumbent Advantage: Established firms like Jones Day can quickly respond to niche threats by expanding existing practices or acquiring specialized talent.

- Resource Disparity: The significant resources of major global firms often create a substantial barrier for smaller, specialized entrants to compete effectively long-term.

The threat of new entrants for a global law firm like Jones Day is considerably low due to immense capital requirements for infrastructure and talent, alongside stringent regulatory hurdles and licensing across jurisdictions. Building a global presence requires billions in investment, with IT budgets alone often in the tens of millions annually for major firms in 2024.

Established client relationships and professional networks represent a significant barrier. In 2024, over 70% of corporate clients prioritize relationship history and trust when selecting legal counsel, making it difficult for newcomers to gain traction. Switching costs for large corporations can also run into millions, reinforcing client loyalty to incumbents.

While niche specialization might offer an entry point, leveraging advanced legal tech, established firms can quickly adapt by acquiring talent or expanding existing practices. The resource disparity between global giants and specialized startups remains a substantial obstacle to long-term competitive viability.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | Establishing global infrastructure, technology, and talent acquisition. | Very High | Major law firm IT budgets: $10M-$50M+ annually. Prime office space rentals: $100-$300+ per sq ft/year. |

| Regulatory & Licensing | Navigating diverse jurisdictional rules, ethical standards, and bar admissions. | High | US state bar admission: multi-year process, significant fees. International practice requires multiple licenses. |

| Client Relationships & Trust | Building deep connections and a reputation for reliability. | Very High | 70%+ corporate clients prioritize relationship history. Client retention rates for major firms: >90%. |

| Brand Reputation | Achieving recognition and trust against established players. | High | Decades of successful work solidify brands, making rapid client acquisition difficult for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Jones Day Porter's Five Forces analysis is built upon a foundation of robust data, drawing from publicly available company filings, reputable market research reports, and industry-specific trade publications to ensure comprehensive and accurate competitive assessments.