JD.com SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JD.com Bundle

JD.com, a titan in China's e-commerce landscape, boasts robust logistics and a strong brand reputation, but faces intense competition and evolving regulatory environments. Understanding these dynamics is crucial for anyone looking to navigate this dynamic market.

Want the full story behind JD.com's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

JD.com's extensive self-operated logistics network is a core strength, featuring over 1,600 warehouses and hundreds of thousands of couriers. This robust infrastructure allows for rapid fulfillment, with more than 90% of retail orders in China delivered within 24 hours.

The company's commitment to advanced logistics is evident in its 40 intelligent logistics parks and AI-driven 'Logistics Brain' systems. These investments enhance efficiency and customer experience, significantly reducing stockouts and ensuring reliable deliveries.

JD.com's direct sales model is a cornerstone of its strength, allowing it to source products directly from brands and manufacturers. This control over the supply chain is crucial for ensuring product authenticity and maintaining high quality standards, a significant differentiator in the competitive Chinese e-commerce landscape.

This direct sourcing strategy directly addresses the prevalent issue of counterfeit goods in China, fostering a more trustworthy shopping environment. By guaranteeing genuine products, JD.com cultivates strong customer loyalty and trust, which are invaluable assets in the digital marketplace.

The company's 'Quality Consumption' initiative, launched in recent years, specifically caters to the evolving preferences of China's growing middle class, who increasingly prioritize genuine and high-quality goods. This strategic focus aligns perfectly with JD.com's inherent strengths in product authenticity and quality assurance.

JD.com's strength lies in its strategic diversification beyond traditional e-commerce into promising sectors such as logistics, cloud computing (JD Cloud), and smart technology. This broad business portfolio provides resilience and multiple avenues for growth.

The company's significant investment, exceeding $1.5 billion in 2024, into AI and supply chain automation underscores its commitment to technological advancement. This focus allows JD.com to enhance customer experiences and operational efficiency.

By leveraging AI and big data analytics, JD.com is not only optimizing its internal processes but also creating new revenue streams through its 'Retail as a Service' offerings, demonstrating a forward-thinking approach to market engagement.

Robust Financial Performance and Brand Recognition

JD.com has showcased impressive financial strength, reporting net revenues of RMB 1,158.8 billion (US$158.8 billion) for the full year 2024. This represents a solid 6.8% growth compared to the previous year, accompanied by notable improvements in profitability. The company’s financial resilience is a key asset.

The brand itself is a significant powerhouse, consistently ranking high in market recognition. In 2024, JD.com's brand value was estimated to be over $25 billion. This strong brand equity is particularly evident in its dominant positions within crucial consumer segments like electronics and home appliances, driving customer loyalty and sales.

- Robust Revenue Growth: JD.com's net revenues hit RMB 1,158.8 billion (US$158.8 billion) in 2024, up 6.8% year-over-year.

- Enhanced Profitability: The company has achieved significant improvements in its profit margins.

- High Brand Value: JD.com's brand was valued at over $25 billion in 2024.

- Market Leadership: Strong recognition and market share, especially in electronics and home appliances.

Strategic Partnerships and Omni-channel Integration

JD.com's strategic partnerships with manufacturers are a significant strength, bolstering its product sourcing and supply chain efficiency. This collaboration is key to its expanding omnichannel strategy, which seamlessly blends online and offline retail. Initiatives like JD MALL and its fresh food business, 7FRESH, exemplify this integration, creating a more cohesive customer journey.

The company's 'Retail as a Service' model further amplifies these strengths. It enables real-time inventory synchronization across channels and leverages AI for precise demand forecasting. This technological backbone supports JD.com's aim to enhance its market presence and broaden its customer reach by offering a more responsive and personalized shopping experience.

By the end of Q1 2024, JD.com reported a 7.0% year-over-year increase in revenue, reaching RMB 260.1 billion (approximately USD 36.1 billion). This growth is partly attributable to the success of its integrated retail strategies and strong supplier relationships.

- Strategic Partnerships: JD.com actively collaborates with key manufacturers to secure exclusive product offerings and optimize procurement.

- Omnichannel Integration: Initiatives like JD MALL and 7FRESH merge online convenience with physical retail experiences, enhancing customer engagement.

- Retail as a Service: This model facilitates real-time inventory management and AI-driven demand forecasting, improving operational efficiency.

- Market Presence: These integrated strategies are designed to expand JD.com's reach and solidify its position in the competitive e-commerce landscape.

JD.com's extensive self-operated logistics network, boasting over 1,600 warehouses and hundreds of thousands of couriers, ensures rapid fulfillment with over 90% of orders delivered within 24 hours in China. Its direct sales model guarantees product authenticity and quality, fostering strong customer trust, a critical advantage in combating counterfeit goods.

The company's financial strength is underscored by RMB 1,158.8 billion (US$158.8 billion) in net revenues for 2024, a 6.8% increase year-over-year, coupled with improved profitability. JD.com's brand value exceeded $25 billion in 2024, reflecting its market leadership, especially in electronics and home appliances.

| Metric | 2024 Data | Significance |

|---|---|---|

| Net Revenues | RMB 1,158.8 billion (US$158.8 billion) | 6.8% year-over-year growth, indicating strong market performance. |

| Brand Value | Over $25 billion | High market recognition and customer loyalty, particularly in key categories. |

| Logistics Efficiency | Over 90% of orders delivered within 24 hours | Competitive advantage through superior delivery speed and reliability. |

| Profitability | Improved margins | Demonstrates effective cost management and operational efficiency. |

What is included in the product

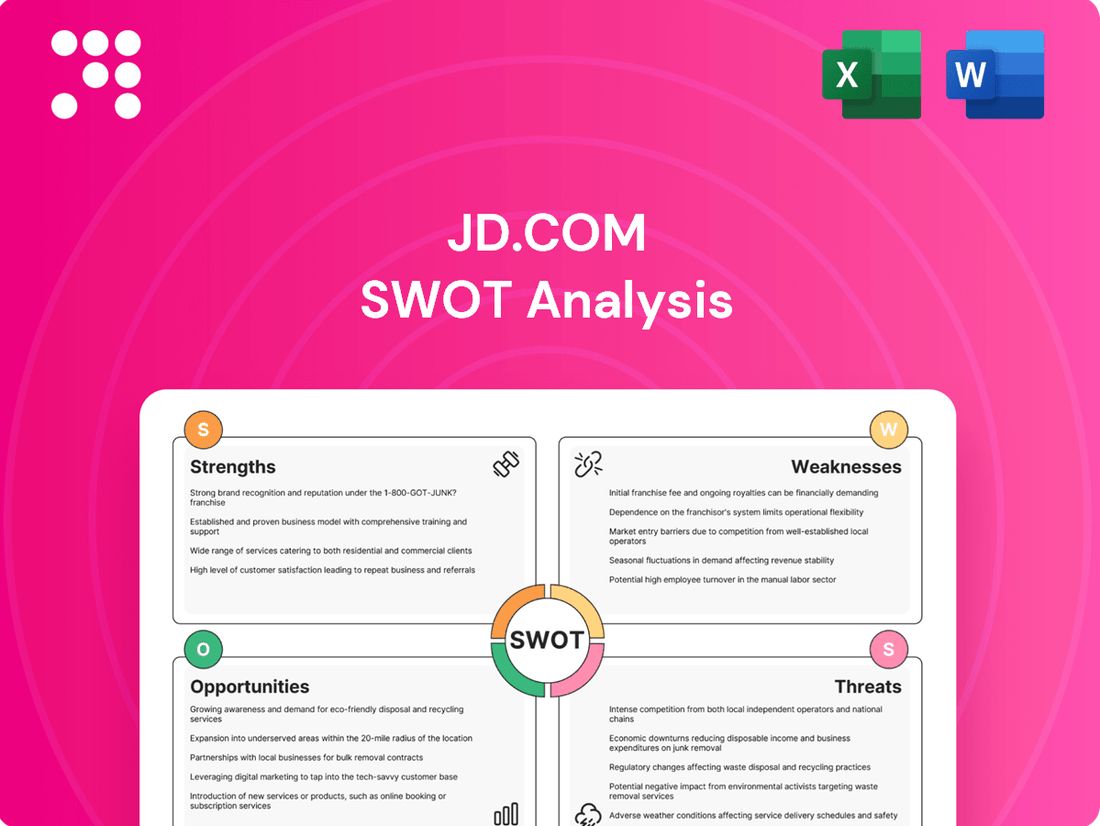

Highlights JD.com's robust logistics and brand reputation as key strengths, while identifying intense competition and regulatory challenges as significant threats.

Provides a clear understanding of JD.com's competitive landscape, helping to mitigate risks and capitalize on opportunities by highlighting internal strengths and weaknesses against external threats and market advantages.

Weaknesses

JD.com's commitment to its asset-heavy logistics and direct sales model, while a strength, also presents a significant weakness due to high operating and fulfillment costs. These expenses, encompassing everything from warehousing and delivery to customer service, can directly impact profitability.

For instance, in the fourth quarter of 2024, JD.com's fulfillment expenses climbed to RMB20.1 billion, a 16.4% increase year-over-year. This figure represented 5.8% of its net revenues, highlighting the substantial burden these operational costs place on the company's margins.

JD.com operates in an incredibly crowded Chinese e-commerce landscape, facing formidable rivals. Alibaba's Tmall and Taobao remain dominant forces, while Pinduoduo has rapidly gained traction with its social commerce model. Emerging players, notably Douyin's e-commerce platform, are also intensifying the competition, forcing JD.com to constantly adapt.

This fierce rivalry translates into significant pressure on pricing and marketing expenditures. JD.com, like its competitors, often engages in price wars and offers substantial subsidies to attract and retain customers. For instance, during major shopping festivals like the 618 festival in 2024, promotional activities and discounts were widespread across all platforms, impacting profit margins.

The ongoing battle for market share means JD.com must continually invest in innovation and user experience to differentiate itself. Failure to do so could lead to slower growth rates and a potential erosion of its market position. In the first quarter of 2024, JD.com reported revenue growth of 7.0%, a figure that, while positive, reflects the challenging market dynamics.

JD.com's heavy reliance on the Chinese domestic market presents a significant weakness. In 2023, approximately 96% of JD.com's total revenue was generated within China, highlighting a substantial geographical concentration risk. This deep entrenchment in a single market makes the company particularly vulnerable to fluctuations in the Chinese economy, evolving domestic regulations, and shifts in Chinese consumer behavior.

Profitability Challenges in Certain Segments and Expansion Efforts

While JD.com has seen overall profitability improve, some newer business areas have presented significant hurdles. For instance, their expansion into food delivery has resulted in substantial financial outlays, with reports indicating losses around 10 billion RMB. This situation can put pressure on immediate earnings and tie up valuable capital.

Sustaining consistent profitability across JD.com's increasingly diverse range of services and product categories remains an ongoing challenge. The company must carefully manage the financial performance of each segment to ensure overall health.

- Food Delivery Losses: JD.com's venture into food delivery has incurred significant losses, estimated at approximately 10 billion RMB, impacting near-term profitability.

- Segment Profitability: Maintaining sustained profitability across all diversified business segments presents an ongoing challenge for the company.

- Resource Strain: Substantial losses in new ventures can strain financial resources, potentially limiting investment in other growth areas.

Slower Revenue Growth Compared to Historical Performance

JD.com's revenue growth has notably decelerated when contrasted with its earlier, more aggressive expansion periods. For instance, the company reported a modest 1.7% year-on-year revenue increase in Q3 2023, followed by a 3.6% rise in Q4 2023. While 2024 showed a more robust 6.8% net revenue increase, this figure still reflects a market that has matured, making rapid growth more challenging than in its formative years.

This slowdown can be attributed to several factors:

- Increased Competition: The e-commerce landscape in China has become increasingly crowded, with rivals employing aggressive pricing and marketing strategies.

- Saturated Market: As the Chinese e-commerce market matures, the pool of new customers available for rapid acquisition shrinks.

- Economic Headwinds: Broader economic conditions can impact consumer spending, directly affecting sales volumes for online retailers.

JD.com's intensive asset-heavy model, while ensuring quality, leads to high operating costs. Fulfillment expenses alone reached RMB20.1 billion in Q4 2024, representing 5.8% of net revenues, impacting profitability. Intense competition from Alibaba and Pinduoduo forces aggressive pricing and marketing, further squeezing margins, as seen during the 2024 618 festival. The company's heavy reliance on the Chinese market, generating 96% of revenue in 2023, exposes it to significant domestic economic and regulatory risks.

New ventures, like food delivery, have incurred substantial losses, estimated around 10 billion RMB, straining financial resources. Revenue growth has decelerated, with Q3 2023 seeing only a 1.7% increase, reflecting market maturity and increased competition. This slowdown necessitates continuous investment in innovation to maintain market position amidst economic headwinds.

| Metric | Q4 2023 (RMB billions) | Q4 2024 (RMB billions) | Year-over-Year Change |

|---|---|---|---|

| Fulfillment Expenses | 17.3 | 20.1 | +16.4% |

| Net Revenues | 329.0 | 344.7 | +4.8% |

| Revenue Growth (Overall 2024) | 6.8% |

What You See Is What You Get

JD.com SWOT Analysis

This is a real excerpt from the complete JD.com SWOT analysis. Once purchased, you’ll receive the full, editable version, offering a comprehensive understanding of their strategic position. This preview showcases the same professional quality and in-depth analysis you can expect in the complete document.

Opportunities

JD.com sees a major opportunity in China's less developed cities and rural regions, expecting its user base there to grow by 22% in 2024. This expansion is a key focus for the company.

Through its 'Rural Revitalization 3.0' initiative, JD.com is investing heavily in developing service centers at the county level and enhancing its cold chain logistics. This strategic move aims to capitalize on the increasing adoption of e-commerce in these areas, which represent a significant untapped market.

JD.com's logistics arm, JD Logistics, is actively broadening its reach by offering its sophisticated logistics network to external businesses. Initiatives like 'Chain+' are key to this strategy, aiming to capture a larger share of the burgeoning third-party logistics market.

This expansion is supported by significant investment, with plans to double overseas warehouse space by the end of 2025. This move positions JD Logistics to capitalize on the global demand for efficient retail logistics, a sector anticipated to reach $72.9 billion by 2035.

By providing 'Retail as a Service,' JD.com diversifies its revenue streams beyond its own e-commerce operations. This strategic pivot leverages its existing infrastructure to tap into the growing need for outsourced logistics solutions among other retailers and businesses.

JD.com's ongoing commitment to AI and smart technology presents a substantial opportunity for growth. By continuing to invest in areas like machine learning and automation, the company can significantly boost its operational efficiency and refine the customer experience, potentially unlocking new service avenues.

The application of AI across JD.com's operations, from its advanced warehouses and demand forecasting to dynamic pricing strategies and AI-driven customer support, offers a clear path to cost reduction and enhanced accuracy. This technological integration is key to delivering increasingly personalized shopping journeys for its users.

Cross-Border E-commerce Expansion

JD.com is strategically expanding its cross-border e-commerce operations, establishing a global sales business in key markets such as the United States, Japan, Singapore, and Malaysia. This initiative is designed to capitalize on the increasing global appetite for imported products and penetrate new consumer bases, with further expansion planned for Europe and Oceania. The company is bolstering this strategy by enhancing its overseas warehouse capacity and international express delivery networks, aiming to streamline logistics and improve customer experience for international shoppers.

This global push is crucial for JD.com's growth trajectory, especially as domestic market growth may moderate. By 2024, cross-border e-commerce is projected to represent a significant portion of global retail sales, a trend JD.com is well-positioned to leverage. For instance, in 2023, JD Worldwide, JD.com's cross-border platform, saw a substantial increase in GMV from international markets, demonstrating the viability of this expansion strategy.

- Global Reach: JD.com's presence in the US, Japan, Singapore, and Malaysia, with plans for Europe and Oceania, diversifies revenue streams.

- Market Demand: Tapping into the growing demand for imported goods worldwide offers substantial revenue potential.

- Logistics Investment: Increased overseas warehouse space and international express delivery services enhance operational efficiency and customer satisfaction in new markets.

- Competitive Advantage: Early and aggressive international expansion can secure market share before competitors fully establish their presence.

Capitalizing on Government Stimulus and Consumption Trends

Government stimulus and trade-in programs, especially for big-ticket items like electronics and home appliances, offer a significant avenue for JD.com to increase sales. These initiatives directly encourage consumer spending, aligning with JD's core business. For instance, in 2024, JD.com actively facilitated subsidies for home appliance trade-in programs, directly tapping into this government-backed consumption boost.

JD.com is also well-positioned to benefit from evolving consumer preferences, including the increasing adoption of online shopping by older demographics. This trend expands the addressable market for JD's services. The company's user-friendly platform and reliable delivery network are key to capturing this growing segment of online shoppers.

- Government Support: JD.com's participation in 2024 home appliance trade-in programs directly leverages government stimulus measures to drive sales.

- Expanding Market Reach: The growing online shopping trend among older generations presents a substantial opportunity for JD.com to attract new customers.

- Alignment with National Goals: By facilitating these programs, JD.com aligns itself with national directives aimed at boosting domestic consumption and upgrading consumer goods.

JD.com's strategic expansion into less developed regions of China, targeting a projected 22% user base growth in 2024, signifies a major opportunity. The company's 'Rural Revitalization 3.0' initiative, coupled with significant investments in county-level service centers and cold chain logistics, aims to unlock the potential of these underserved markets. Furthermore, JD Logistics is actively expanding its third-party services, with initiatives like 'Chain+' poised to capture a larger share of the logistics market, further bolstered by a plan to double overseas warehouse space by the end of 2025.

JD.com is leveraging AI and smart technology to enhance operational efficiency and customer experience, which is projected to reduce costs and improve accuracy across its operations. The company's aggressive expansion into cross-border e-commerce, with a presence in key markets like the US, Japan, Singapore, and Malaysia, and planned expansion into Europe and Oceania, capitalizes on the growing global demand for imported goods. This global push is critical for sustained growth, especially with cross-border e-commerce expected to be a significant part of global retail sales by 2024.

Government stimulus and trade-in programs, particularly for electronics and home appliances, offer a direct avenue for JD.com to boost sales, as seen with its active facilitation of subsidies in 2024. The company is also benefiting from evolving consumer preferences, including the increasing adoption of online shopping by older demographics, expanding its addressable market. JD.com's user-friendly platform and reliable delivery are key to attracting this growing segment of online shoppers.

Threats

JD.com faces intense pressure in China's e-commerce landscape, battling rivals like Alibaba, Pinduoduo, and Douyin. These competitors frequently engage in aggressive price wars and offer substantial subsidies, which directly impacts JD.com's ability to maintain healthy profit margins and defend its market share.

The necessity of participating in these price wars, as seen with JD.com's focus on low-price strategies in late 2022, can significantly compress profitability. For instance, while specific margin impacts from ongoing price wars in 2024 are not yet fully detailed, the trend of increased promotional spending by major players suggests continued margin pressure.

A significant threat to JD.com is the potential for an economic slowdown in China, which could directly impact consumer spending. If economic growth falters, consumers are likely to cut back on non-essential purchases, a key area for JD.com's business.

This reduced consumer discretionary spending could translate into lower transaction volumes for JD.com. Furthermore, in a weaker economic environment, JD.com might face pressure on its pricing power, especially in categories where consumers have more flexibility to delay or forgo purchases, ultimately affecting revenue and profit margins.

JD.com navigates a dynamic regulatory environment in China, particularly concerning e-commerce practices, data privacy, and antitrust measures. New regulations, such as those impacting data collection and usage, could necessitate significant operational adjustments and increase compliance burdens, potentially affecting its business model.

Broader geopolitical tensions also pose a threat, as shifts in international relations or trade policies could disrupt JD.com's cross-border operations and supply chains. For instance, increased scrutiny on Chinese tech companies operating internationally, as seen in various markets in 2023 and early 2024, could limit JD.com's global expansion ambitions and increase operational complexities.

Supply Chain Disruptions and Increased Shipping Costs

Even with JD.com's advanced logistics, global supply chain snags and escalating shipping expenses remain a significant threat. These external pressures can directly squeeze operational efficiency and profitability, impacting the company's bottom line. For instance, a significant surge in global freight rates, as seen periodically in 2023 and early 2024 due to geopolitical events or port congestion, could substantially increase JD.com's cost of goods sold and delivery expenses.

While JD.com has proactively built resilience into its supply chain, including expanding its warehousing and last-mile delivery capabilities, it's not entirely immune to widespread disruptions. The company's vast network, while a strength, also presents a larger surface area for potential impacts from events like natural disasters affecting key manufacturing hubs or major international trade route blockades. For example, disruptions in semiconductor supply, critical for many electronic goods sold on JD.com, could still create inventory shortages and affect sales volume.

- Global Freight Rate Volatility: Shipping costs, particularly for ocean freight, experienced significant fluctuations in 2023 and early 2024, with some routes seeing double-digit percentage increases compared to pre-pandemic levels, directly impacting JD.com's import costs.

- Geopolitical Instability: Trade tensions or conflicts can lead to sudden tariffs or restrictions, disrupting established supply routes and increasing the cost of sourcing goods for JD.com's marketplace.

- Natural Disasters Impacting Production: Events like earthquakes or floods in key manufacturing regions in Asia could halt production of popular electronics or consumer goods, leading to stock-outs on JD.com's platform.

Challenges in Diversification and New Market Entry

Expanding into new sectors such as food delivery or online travel presents significant hurdles. JD.com faces substantial initial investment requirements and intense competition from established players in these markets. For instance, the food delivery market in China is dominated by Meituan, which held an estimated 69% market share in 2023, making entry costly and challenging.

Successfully integrating these new ventures and achieving profitability is a key concern. There's a risk of diluting focus and resources away from JD.com's core e-commerce operations. This strategic balancing act is crucial for long-term success. In 2024, JD.com’s focus on its core logistics and retail business is evident, with continued investment in same-day delivery capabilities, a segment where it holds a strong competitive advantage.

The threat lies in the potential for significant financial drain from these diversification efforts without a clear path to sustainable profits. This could impact overall financial performance and shareholder value.

- High initial losses in new markets: Entering competitive sectors like food delivery can lead to substantial upfront costs and prolonged periods of unprofitability.

- Intense competition from incumbents: Established players in new markets possess strong brand recognition, customer loyalty, and optimized operational efficiencies, creating high barriers to entry.

- Risk of diluting core business focus: Diversification efforts may divert management attention and capital away from JD.com's core e-commerce and logistics strengths, potentially weakening its competitive position in its primary markets.

Intensified competition from rivals like Alibaba and Pinduoduo forces JD.com into price wars, squeezing profit margins. An economic slowdown in China could significantly reduce consumer spending, directly impacting JD.com's sales volumes and pricing power.

Navigating China's evolving regulatory landscape and global geopolitical tensions presents compliance challenges and potential disruptions to cross-border operations. Supply chain disruptions and rising shipping costs, as seen with global freight rate volatility in 2023-2024, also pose a threat to operational efficiency and profitability.

Expanding into new sectors like food delivery faces high initial investment needs and fierce competition from established players, risking a dilution of focus on core e-commerce strengths.

| Threat Category | Specific Threat | Impact on JD.com | 2024/2025 Relevance |

|---|---|---|---|

| Competition | Aggressive Price Wars | Margin Compression, Market Share Erosion | Ongoing, with increased promotional spending observed. |

| Economic Factors | Chinese Economic Slowdown | Reduced Consumer Spending, Lower Sales Volume | Potential impact on discretionary purchases. |

| Regulatory & Geopolitical | Evolving Chinese Regulations | Increased Compliance Burden, Operational Adjustments | Data privacy and antitrust measures remain key areas. |

| Supply Chain | Global Freight Rate Volatility | Increased Import Costs, Reduced Profitability | Rates saw significant increases in 2023-2024. |

| Diversification | Competition in New Markets (e.g., Food Delivery) | High Initial Losses, Dilution of Core Focus | Meituan's dominance highlights market entry challenges. |

SWOT Analysis Data Sources

This JD.com SWOT analysis is built upon a foundation of robust data, drawing from official financial reports, comprehensive market intelligence, and expert industry analyses to provide a thoroughly informed perspective.