JD.com Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JD.com Bundle

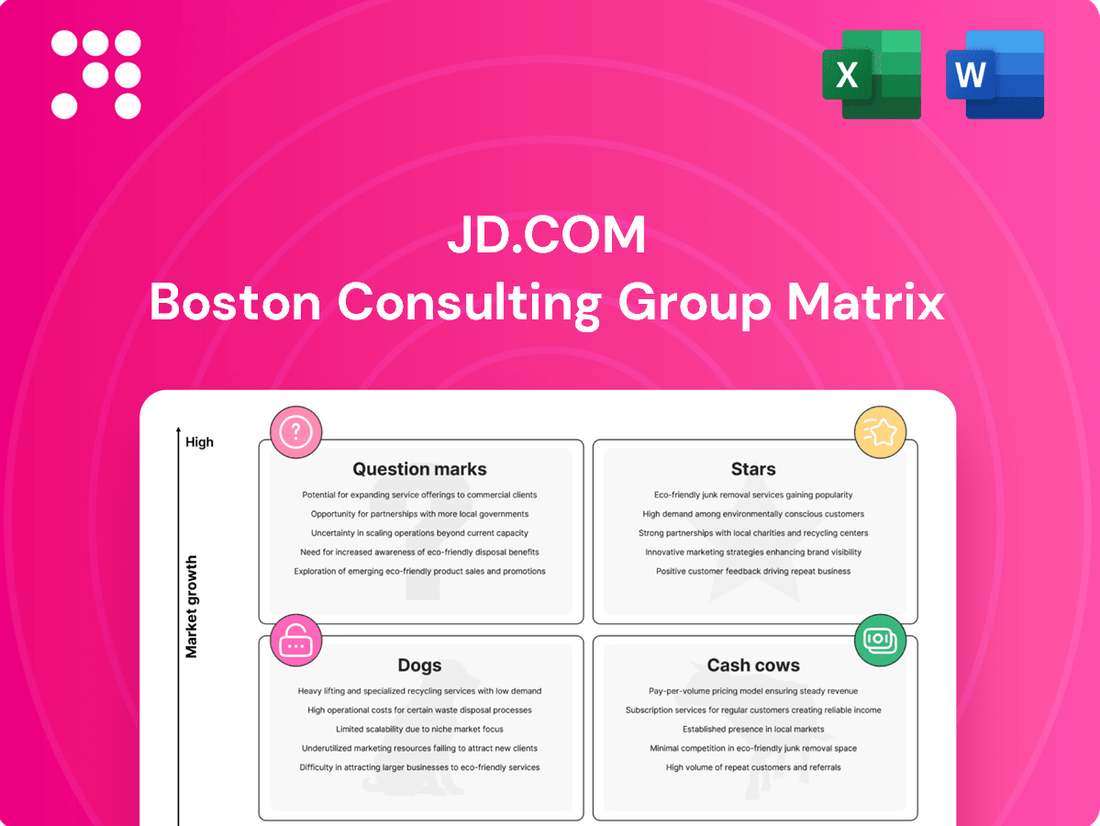

JD.com's BCG Matrix offers a critical look at its diverse product portfolio, highlighting which segments are poised for growth and which require careful management. Understand the strategic implications of its Stars, Cash Cows, Dogs, and Question Marks. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize JD.com's market position.

Stars

JD Logistics' externalized services represent a star in the BCG matrix for JD.com. By the close of 2025, the company plans to significantly expand its overseas warehouse footprint and international express delivery capabilities, reaching almost 80 countries. This strategic move taps into the booming cross-border logistics market, an area poised for substantial growth.

Leveraging JD.com's robust existing infrastructure, JD Logistics is effectively extending its advanced logistics solutions to external clients. This not only diversifies revenue streams but also capitalizes on the company's operational strengths. In 2023, JD Logistics reported a revenue of 155.5 billion yuan, with its integrated supply chain and logistics services segment showing strong performance, indicating the growing demand for its external offerings.

JD Health is positioned as a Star in the BCG matrix due to its strong performance in China's booming online healthcare sector. In the first quarter of 2025, the company saw a significant 25.5% revenue growth and a remarkable 47.7% increase in non-IFRS profit. This growth is fueled by its leading position in healthcare e-commerce and ongoing innovation in areas like drug launches and artificial intelligence.

JD.com is significantly boosting its omnichannel strategy, blending online and offline experiences through substantial investments. This includes forging new product growth avenues and deepening partnerships with a wide array of brands.

Initiatives like JD NOW, which promises swift delivery, and a dedicated new product incubation program are central to this expansion. These are designed to capitalize on the dynamic shifts in retail and elevate the overall customer journey.

In 2024, JD.com continued to emphasize its commitment to integrating its online presence with physical retail touchpoints. This strategy is crucial for capturing market share in evolving consumer behavior patterns.

Supply Chain Technology Solutions

JD.com's supply chain technology solutions represent a significant 'Star' in its BCG Matrix. The company leverages substantial R&D, particularly in AI and automation, to offer advanced logistics and retail services to external clients. This segment is characterized by high growth and JD.com's strong market position.

The company's commitment to innovation in its supply chain, including extensive use of robotics and AI, allows it to provide a robust 'Retail as a Service' (RaaS) offering. This not only optimizes JD.com's own operations but also generates new revenue streams by licensing its technology and expertise.

In 2023, JD Technology, the company's technology arm, reported significant growth, contributing to JD.com's overall performance. For instance, JD Logistics, a key component of this strategy, has been expanding its cloud-based supply chain solutions, aiming to serve a broader market beyond e-commerce.

- High Growth Potential: The global market for supply chain management software and automation is experiencing rapid expansion, driven by the need for efficiency and resilience.

- JD.com's Leadership: JD.com's proprietary technology, including its intelligent fulfillment centers and AI-powered logistics platforms, positions it as a leader in this space.

- Retail as a Service (RaaS): This offering allows JD.com to monetize its advanced supply chain capabilities, providing a scalable and high-margin revenue stream.

- Investment in R&D: Continued investment in AI, IoT, and automation underpins the ongoing development and competitiveness of JD.com's technology solutions.

Specific High-Growth Product Categories

JD.com's focus on specific high-growth product categories is a key driver of its success. Fresh produce, exemplified by the surge in demand for items like Peruvian blueberries, is a prime example of this strategic expansion. JD's direct sourcing capabilities and robust partnerships are instrumental in capturing significant market share and accelerating sales within these burgeoning sectors.

The fashion segment also represents a critical area of high growth for JD Retail. This category benefits from JD's investments in logistics and customer experience, leading to impressive sales figures and expanding market dominance.

- Fresh Produce Growth: JD.com has seen substantial year-over-year growth in its fresh produce segment, with categories like imported fruits experiencing double-digit increases. For instance, in 2024, sales of premium imported fruits like Peruvian blueberries on JD.com saw a remarkable uplift, directly attributed to their direct sourcing initiatives.

- Fashion Segment Expansion: The fashion category on JD.com continued its upward trajectory in 2024, driven by strategic brand partnerships and personalized shopping experiences. JD's fashion sales in 2024 outpaced the overall e-commerce fashion market growth in China.

- Direct Sourcing Impact: JD's direct sourcing model for categories like fresh produce and fashion has been a significant factor in their high growth. This approach allows for better quality control, fresher products, and often more competitive pricing, directly translating to increased customer acquisition and retention in 2024.

JD Logistics' expansion into international markets and its offering of externalized services firmly place it as a Star in JD.com's BCG matrix. The company's strategic push into nearly 80 countries by the close of 2025 highlights its ambition in the growing cross-border logistics sector. JD Logistics' 2023 revenue of 155.5 billion yuan, with its integrated supply chain services showing robust performance, underscores the increasing demand for its externalized capabilities.

JD Health is also a Star, capitalizing on China's expanding online healthcare market. Its first-quarter 2025 performance, with a 25.5% revenue increase and a 47.7% rise in non-IFRS profit, showcases its strong market position and innovative approach. This growth is driven by its leading e-commerce platform and advancements in areas like AI and drug launches.

JD.com's supply chain technology solutions are a clear Star, fueled by significant R&D in AI and automation. This segment offers advanced logistics and retail services to external clients, benefiting from high market growth and JD.com's leading position. The company's 'Retail as a Service' (RaaS) model, which monetizes its technological expertise, represents a scalable and high-margin revenue stream.

JD.com's strategic focus on high-growth product categories, such as fresh produce and fashion, solidifies their Star status. The company's direct sourcing and strong partnerships, evident in the double-digit growth of imported fruits like Peruvian blueberries in 2024, are key to capturing market share. The fashion segment also saw impressive sales growth in 2024, outpacing the overall market due to strategic brand collaborations and enhanced customer experiences.

What is included in the product

This BCG Matrix analysis offers a tailored view of JD.com's product portfolio, identifying Stars to invest in and Dogs to divest.

The JD.com BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

JD.com's core e-commerce platform, focusing on direct sales, particularly in electronics and home appliances, remains a significant cash cow. This segment consistently delivers robust revenue and profit, underscoring its maturity and stability within the company's portfolio. For instance, in the first quarter of 2024, JD.com reported net revenues of RMB 222.7 billion, with its general merchandise segment, which includes these core categories, being a primary driver.

The enduring strength of this business is rooted in JD's highly efficient supply chain and a well-earned reputation for product authenticity and quality. While the overall market for these goods may be maturing, JD's established infrastructure and customer trust allow it to maintain strong performance and generate substantial cash flow, even in a competitive landscape.

JD.com's advertising and marketing services function as a robust Cash Cow. By leveraging its extensive user base and significant platform traffic, JD.com offers high-margin advertising solutions to brands and third-party sellers. This segment is a consistent contributor to the company's profitability due to its relatively low operational overhead.

In 2023, JD.com reported that its advertising and marketing services, along with other transaction services, generated a substantial portion of its revenue. For instance, the company's net revenue from services grew by 14.1% year-over-year to RMB 130.2 billion in 2023, with advertising being a key driver of this growth.

The JD Plus membership program is a cornerstone of JD.com's strategy, generating consistent revenue through its subscription model. This program not only fosters customer loyalty but also significantly boosts shopping frequency, creating a predictable income stream.

As a mature offering, JD Plus membership contributes a stable and reliable revenue base for JD.com. In 2023, JD.com reported that its retail segment, which heavily benefits from membership programs, saw a 3.5% year-over-year revenue increase, reaching approximately $149.3 billion.

Internal Logistics Network Efficiency

JD.com's self-built logistics network, a cornerstone of its retail operations, functions as a powerful Cash Cow. This extensive infrastructure significantly lowers fulfillment costs for its core e-commerce business, directly enhancing the profitability of JD Retail.

The efficiency of this network allows for rapid delivery, a key competitive advantage that drives customer loyalty and repeat purchases. For instance, JD Logistics reported a 12.1% year-over-year revenue increase in 2023, demonstrating the sustained strength of its logistics services, which in turn bolsters the core retail segment.

- Internal Logistics Network Efficiency: JD's proprietary logistics system is a primary driver of profitability within its core retail operations.

- Cost Reduction: This network leads to substantial savings in fulfillment expenses, directly improving margins for JD Retail.

- Competitive Advantage: Operational excellence in logistics enables faster delivery times, a critical factor for customer satisfaction and market share.

- Revenue Contribution: While a Cash Cow for retail, JD Logistics also generates significant external revenue, with its 2023 revenue growth underscoring its overall business strength.

Third-Party Marketplace Services

JD.com's third-party marketplace is a significant cash cow, demonstrating strong growth and profitability. This segment leverages JD's established infrastructure and vast customer base, allowing it to generate consistent revenue through commissions and service fees without the need for substantial capital investment.

In 2023, JD.com's marketplace business continued to be a powerhouse. The company reported that its net revenue from services, which includes marketplace fees, grew by a healthy percentage, contributing significantly to its overall financial performance. This growth underscores the asset-light nature of the marketplace, as it scales efficiently by onboarding more merchants.

- Scalable Revenue: The marketplace model allows JD.com to expand its offerings and revenue streams without proportional increases in operational costs.

- Profitability Driver: Commission and service fees from third-party sellers are high-margin, boosting overall profitability.

- User Base Synergy: JD's existing customer traffic and brand trust directly benefit the marketplace, driving sales for merchants and revenue for JD.

JD.com's established direct sales model, particularly in electronics and home appliances, continues to be a major cash cow. This segment benefits from JD's efficient supply chain and strong brand reputation for authenticity, ensuring consistent revenue and profit generation. In Q1 2024, JD.com's net revenues reached RMB 222.7 billion, with general merchandise, including these categories, being a key contributor.

Advertising and marketing services represent another significant cash cow for JD.com. By leveraging its large user base and platform traffic, the company offers high-margin advertising solutions to brands and third-party sellers, contributing substantially to profitability with relatively low overhead. In 2023, JD's net revenue from services, including advertising, grew by 14.1% year-over-year to RMB 130.2 billion, highlighting this segment's robust performance.

The JD Plus membership program acts as a consistent revenue generator through its subscription model, fostering customer loyalty and increasing shopping frequency. This mature offering provides a predictable income stream, with the retail segment, heavily influenced by memberships, seeing a 3.5% revenue increase in 2023.

JD's self-built logistics network is a powerful cash cow for its core retail operations, significantly lowering fulfillment costs and enhancing profitability. This operational efficiency provides a competitive edge through rapid delivery, driving customer loyalty. JD Logistics itself saw a 12.1% revenue increase in 2023, demonstrating the sustained strength of its services.

JD.com's third-party marketplace is a strong cash cow, generating consistent revenue through commissions and service fees. This asset-light model leverages JD's infrastructure and customer base for scalable, high-margin growth. The marketplace's contribution to JD's service revenue in 2023 underscores its profitability and efficient scaling.

| Business Segment | BCG Matrix Category | Key Financial Indicator (2023/Q1 2024) | Contribution to JD.com |

|---|---|---|---|

| Direct Sales (Electronics, Home Appliances) | Cash Cow | Net Revenues (Q1 2024): RMB 222.7 billion (General Merchandise segment) | Primary driver of stable revenue and profit. |

| Advertising & Marketing Services | Cash Cow | Net Revenue from Services (2023): RMB 130.2 billion (14.1% YoY growth) | High-margin, low overhead profitability. |

| JD Plus Membership | Cash Cow | Retail Segment Revenue Growth (2023): 3.5% YoY | Predictable subscription income, drives loyalty. |

| Self-built Logistics Network | Cash Cow (for Retail) | JD Logistics Revenue Growth (2023): 12.1% YoY | Reduces fulfillment costs, enhances retail margins. |

| Third-Party Marketplace | Cash Cow | Service Revenue Growth (2023): Significant contribution | Scalable, high-margin revenue from commissions. |

Delivered as Shown

JD.com BCG Matrix

The JD.com BCG Matrix preview you are currently viewing is the exact, complete document you will receive upon purchase. This means no watermarks or demo content will be present; you'll get a fully formatted, analysis-ready report designed for strategic decision-making. The comprehensive insights into JD.com's product portfolio, categorized by market share and growth rate, are precisely what you'll download. This professional document is ready for immediate integration into your business strategy or presentations, offering a clear and actionable overview of JD.com's market position.

Dogs

Underperforming Niche Smart Hardware represents products within JD.com's portfolio that haven't gained significant traction. These might be experimental smart devices or specialized hardware with limited consumer appeal. For instance, a smart home device launched in early 2024 that saw only a 0.5% market penetration by Q3 2024 would fit here.

These items often require continued investment for development or marketing but are not generating substantial returns. JD.com might be seeing a negative ROI on these niche products, potentially due to high production costs or a lack of clear market demand. This category could include smart pet feeders or advanced wearable tech that didn't capture a broad audience.

JD.com's legacy offline retail ventures, particularly those that struggled to integrate with its robust online platform, would likely fall into the Dogs category of the BCG Matrix. These might include experimental physical store formats or past acquisitions that didn't achieve critical mass or profitability. For instance, while JD.com has had success with its "7Fresh" supermarket chain, other, less successful offline initiatives could represent these underperforming assets.

JD.com has historically explored various acquisition avenues, and some smaller ventures may not have yielded the expected strategic benefits or faced integration challenges. For instance, while specific details on all discontinued acquisitions are not publicly disclosed, a company of JD's scale often divests or winds down projects that prove to be cash drains. These ventures, if not aligned with core competencies, can indeed become liabilities, consuming capital without contributing to overall growth or market share.

Non-Strategic Low-Margin Product Categories

JD.com is actively pruning its 1P (first-party) business by removing product categories characterized by intense competition and persistently low profit margins. This strategic move aims to streamline operations and focus resources on more profitable ventures.

These non-strategic, low-margin product categories often lack a clear competitive differentiator for JD, making them less appealing for continued investment. For instance, in 2023, JD.com reported that its gross profit margin hovered around 15-16%, highlighting the pressure in categories where differentiation is minimal.

- High Competition: Categories like basic electronics accessories or generic household goods face numerous players, driving down prices and margins.

- Low Margins: Many of these products offer single-digit gross profit margins, making them unattractive for significant capital allocation.

- Lack of Differentiation: JD struggles to establish a unique selling proposition in these crowded markets, limiting its ability to command premium pricing.

- Strategic Refocus: The de-emphasis allows JD to concentrate on higher-margin categories where it possesses stronger competitive advantages.

Stagnant Smaller Business Units

Stagnant smaller business units within JD.com's portfolio are typically minor, non-core operations that are struggling to gain momentum in their markets. These entities often necessitate ongoing investment but show limited potential for significant growth or profitability. For example, in 2024, JD.com continued to streamline its operations, divesting or scaling back units that did not align with its core e-commerce and logistics strengths. These units can drain valuable resources that could be more effectively deployed in high-growth areas of the business.

These "Dogs" in the BCG matrix represent a challenge for JD.com, as they consume capital without delivering commensurate returns. The company's strategy often involves either revitalizing these units through targeted investment and strategic repositioning or exiting them to focus on more promising ventures. In 2024, JD.com's focus remained on optimizing its business structure, which included evaluating the performance of all its diverse units.

- Low Market Share: These units often possess a small slice of their respective markets, making it difficult to achieve economies of scale.

- Low Growth Rate: The markets these units operate in are typically mature or declining, offering little room for expansion.

- Resource Drain: They require continuous funding for operations, marketing, and development without a clear path to profitability.

- Strategic Re-evaluation: JD.com regularly assesses these units to determine if divestment or a significant strategic pivot is a more prudent course of action.

JD.com's "Dogs" category encompasses underperforming products and business units with low market share and low growth prospects. These are often characterized by high competition and low profit margins, such as basic electronics accessories or less successful legacy retail initiatives. For example, a niche smart hardware product launched in early 2024 that only achieved 0.5% market penetration by Q3 2024 would fit this description, consuming resources without significant returns.

These segments typically require ongoing investment but generate minimal revenue or profit, potentially leading to negative ROI. JD.com's strategy involves either revitalizing these units through focused investment or divesting them to reallocate capital to more promising areas, a process actively undertaken in 2024 to optimize its operational structure.

The company is actively streamlining its first-party business by exiting product categories with intense competition and persistently low profit margins, aiming to improve overall profitability. For instance, in 2023, JD.com's gross profit margin was around 15-16%, underscoring the pressure in undifferentiated markets.

These "Dogs" represent a strategic challenge, demanding careful evaluation for potential turnaround or divestment to enhance overall business performance.

Question Marks

JD Cloud's public cloud services are positioned in the high-growth cloud computing market, but it contends with formidable rivals such as Alibaba Cloud and Tencent Cloud. This intense competition has resulted in JD Cloud holding a comparatively smaller market share, despite the overall market's expansion.

To effectively compete and grow, JD Cloud requires substantial investment to broaden its service portfolio and capture a larger segment of the market. For instance, by the end of 2023, the Chinese public cloud market was projected to reach $33.4 billion, a significant increase from previous years, highlighting the opportunity but also the competitive pressure.

JD.com's international e-commerce expansion, especially into promising regions like Southeast Asia and Europe, signifies a strategic push for high-growth opportunities. However, these new ventures currently face the challenge of establishing a significant market share against established local and global competitors.

Significant capital investment is being channeled into building robust infrastructure and logistics networks to support these international operations. For instance, in 2023, JD.com continued to invest heavily in its cross-border logistics capabilities to facilitate smoother delivery and returns for international customers.

JD Takeaway, JD.com's foray into the food delivery sector, is positioned as a high-growth, high-investment venture. This market is intensely competitive, with established giants like Meituan dominating. Despite rapid customer adoption, JD Takeaway is currently operating at a significant loss.

The strategy behind JD Takeaway involves substantial capital expenditure to capture market share. For instance, in 2023, JD.com reported significant investments in logistics and marketing to bolster its e-commerce and delivery segments, which would encompass JD Takeaway's operational costs. This aggressive investment is necessary to challenge entrenched competitors and build a sustainable user base.

Community Group Buying (e.g., Jingxi Pinpin)

Community group buying, exemplified by JD.com's Jingxi Pinpin, operates in a high-growth sector within China, particularly appealing to consumers in lower-tier cities. However, this segment is marked by fierce competition and significant capital requirements as companies vie for market dominance. JD's efforts in this space are ongoing, focused on carving out a substantial market share and achieving sustainable profitability.

- High Growth Potential: China's lower-tier cities represent a significant opportunity for community group buying platforms.

- Intense Competition: The market is crowded with numerous players, leading to aggressive pricing and marketing strategies.

- Capital Intensive: Building and maintaining logistics, supply chains, and customer acquisition requires substantial investment.

- Profitability Challenges: Despite growth, achieving consistent profitability remains a key hurdle for many platforms in this segment.

Emerging AI/Generative AI Applications

Emerging AI and generative AI applications within JD.com’s ecosystem, like the AI Jingyi system in JD Health, are positioned as potential high-growth stars. These innovations are currently in their early stages, demanding significant investment in research and development. For instance, JD Health reported a 20% year-over-year increase in online consultations in the first half of 2024, a growth area where AI integration can further enhance efficiency and user experience.

While these AI-driven solutions offer promising future revenue streams, their market adoption is still developing. JD.com's commitment to AI research is substantial, with the company investing billions in technology development. However, the path to market dominance and significant returns for these nascent applications is not yet guaranteed, placing them in the question mark category of the BCG matrix.

- AI Jingyi System in JD Health: Enhancing medical consultations and diagnostics.

- Generative AI for Content Creation: Automating product descriptions and marketing materials.

- Logistics Optimization with AI: Improving delivery efficiency and route planning.

- Customer Service Automation: Utilizing AI chatbots for enhanced support.

JD.com's emerging AI and generative AI applications, such as the AI Jingyi system in JD Health, represent significant growth potential but are currently in early stages. These ventures require substantial R&D investment and face evolving market adoption, placing them firmly in the question mark category. For example, JD Health saw a 20% year-over-year increase in online consultations in the first half of 2024, a promising area for AI enhancement.

The company's overall investment in AI technology development is substantial, aiming to optimize logistics, automate customer service, and enhance content creation. However, achieving market dominance and realizing significant returns from these nascent AI applications remains uncertain, necessitating careful strategic management and continued capital allocation.

| JD.com Business Unit | BCG Matrix Category | Key Characteristics | 2024 Data/Projections |

|---|---|---|---|

| Emerging AI Applications (e.g., AI Jingyi) | Question Mark | High growth potential, high investment needs, uncertain market adoption, early stage. | JD Health online consultations up 20% YoY (H1 2024). Significant R&D investment ongoing. |

BCG Matrix Data Sources

Our JD.com BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.