JD.com Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JD.com Bundle

JD.com navigates a dynamic e-commerce landscape, facing intense rivalry and significant buyer power from price-sensitive consumers. Understanding the threat of new entrants and the bargaining power of suppliers is crucial for its sustained growth and competitive edge.

The complete report reveals the real forces shaping JD.com’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

JD.com's direct procurement strategy is a cornerstone of its operational efficiency, allowing it to purchase vast quantities of goods directly from brands and manufacturers. This substantial purchasing power enables JD.com to negotiate favorable pricing and payment terms, effectively lowering its cost of goods sold. For instance, in 2023, JD.com's net revenues reached RMB 1.1 trillion, underscoring the sheer scale of its procurement operations.

For many brands, particularly international ones aiming to penetrate or grow within the Chinese market, JD.com provides unparalleled access to a vast customer base and a sophisticated logistics infrastructure that is exceptionally challenging to establish independently. This significant dependence on JD's platform for crucial market entry and efficient product distribution inherently curtails suppliers' bargaining leverage.

JD.com's commitment to authenticity is a cornerstone of its brand, requiring robust relationships with reputable suppliers. This reliance on genuine brands, especially in categories like electronics and luxury goods, can grant significant bargaining power to key suppliers who offer exclusive or high-demand products. For instance, JD's extensive electronics marketplace relies heavily on partnerships with major manufacturers, ensuring a steady supply of sought-after items.

This focus on authenticity means JD must maintain strong ties with these suppliers to uphold its quality promise. While this can empower certain brands, JD actively counters this by diversifying its supplier base and forging deeper international partnerships. In 2024, JD.com continued to emphasize global sourcing, announcing new procurement agreements aimed at expanding its selection of international brands and reducing reliance on any single supplier, thereby mitigating supplier leverage.

Diversified Supplier Base

JD.com's extensive product catalog, spanning electronics, home goods, groceries, and apparel, necessitates sourcing from a vast and diverse supplier network. This broad base significantly dilutes the bargaining power of any single supplier, as JD can readily substitute one for another across many product lines. For instance, in 2023, JD.com reported over 500,000 merchants on its platform, a testament to its wide supplier ecosystem.

The sheer volume of products JD.com offers means it engages with thousands of suppliers, from large manufacturers to smaller producers. This diversification inherently limits the leverage any individual supplier holds, as JD's operations are not critically dependent on a concentrated few. In 2024, JD.com continued to expand its supplier relationships, particularly in fresh produce and private label goods, further fragmenting supplier influence.

- Vast Product Categories: JD.com operates across numerous sectors, reducing reliance on any single supplier.

- Large Merchant Base: Over 500,000 merchants were on JD.com's platform in 2023, indicating a highly fragmented supplier landscape.

- Substitution Potential: The ability to switch suppliers for many goods diminishes individual supplier leverage.

- Ongoing Supplier Expansion: JD's continued growth in supplier partnerships in 2024 further solidifies its position against concentrated supplier power.

Backward Integration into Logistics

JD.com's backward integration into logistics significantly curtails the bargaining power of external suppliers. By operating its own vast logistics network, JD.com reduces its dependence on third-party providers, thereby gaining greater control over delivery costs and operational efficiency. This strategic move directly counters the leverage that logistics companies might otherwise exert.

This self-sufficiency in logistics translates into a more predictable and manageable cost structure for JD.com. It allows the company to absorb fluctuations in transportation costs more effectively, diminishing the impact of any potential price hikes from external logistics partners. For instance, JD Logistics' expansion into international markets in 2024 further solidifies this control, offering a comprehensive global supply chain solution.

- Reduced Reliance: JD.com's in-house logistics minimizes its need for external providers, weakening supplier bargaining power.

- Cost Control: Backward integration allows JD.com to manage and potentially lower delivery expenses, negating supplier price leverage.

- Operational Efficiency: Owning the logistics chain enhances JD.com's ability to optimize delivery times and service quality.

- Global Expansion: JD Logistics' international growth in 2024 further consolidates its control over the supply chain, diminishing external supplier influence.

JD.com's bargaining power with suppliers is generally strong due to its massive scale and direct procurement model, which allows for significant price negotiations. However, certain key suppliers of exclusive or high-demand products can exert considerable influence. JD's strategic expansion of its supplier base, particularly in 2024 with new international sourcing agreements, aims to further dilute individual supplier leverage.

| Factor | Impact on JD.com | Supplier Leverage |

|---|---|---|

| Scale of Procurement | High (e.g., RMB 1.1 trillion net revenues in 2023) | Low |

| Market Access for Suppliers | High (critical for international brands) | Low |

| Supplier Diversification | High (over 500,000 merchants in 2023) | Low |

| Dependence on Key Brands | Moderate (for exclusive/high-demand items) | Moderate to High |

| Logistics Control | High (in-house network) | Low |

What is included in the product

This analysis delves into JD.com's competitive environment, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the e-commerce sector.

Quickly identify and mitigate competitive threats in JD.com's e-commerce landscape with a visualized breakdown of buyer power and the threat of new entrants.

Customers Bargaining Power

Chinese consumers exhibit significant price sensitivity, a factor amplified by the fiercely competitive e-commerce landscape. JD.com operates in an environment where platforms like Alibaba and Pinduoduo offer comparable goods, enabling customers to readily compare prices and find the best deals.

This ease of comparison directly translates to increased bargaining power for customers. In 2024, the average online shopper in China likely spent a considerable portion of their disposable income on e-commerce, making price a primary driver in purchasing decisions. For instance, reports from early 2024 indicated that promotional events, such as those during the Lunar New Year, saw significant year-over-year growth in sales volume, underscoring the importance of competitive pricing.

Customers of JD.com face a significant number of substitutes and alternatives. Beyond direct e-commerce rivals like Alibaba's Taobao and Tmall, consumers can also turn to social commerce platforms, live-streaming sales, and traditional brick-and-mortar stores. This wide array of choices directly impacts JD.com's pricing power and ability to retain customers if their expectations for value and service are not consistently met.

In 2023, China's e-commerce market continued to be highly competitive, with platforms constantly vying for consumer attention. For instance, the gross merchandise volume (GMV) of online retail sales in China reached trillions of yuan, indicating a vast and fragmented market where customer loyalty can be easily swayed by better offers or improved user experiences elsewhere.

While price remains a significant consideration for Chinese shoppers, the demand for authentic and high-quality products has surged. JD.com has cultivated a robust reputation for authenticity, which is a key driver of customer loyalty. In 2023, JD.com reported that over 90% of its self-operated merchandise was sourced directly from brands or authorized distributors, reinforcing this trust.

This emphasis on quality and authenticity grants customers considerable bargaining power. If JD.com's assurances are perceived to weaken, consumers can readily switch to competing platforms that offer similar guarantees or opt for direct purchases from manufacturers. This was evident in early 2024 when a minor product authenticity scare on a rival platform led to a noticeable shift in consumer traffic towards JD.com, highlighting the sensitivity to perceived quality.

Enhanced User Experience and Service Expectations

JD.com's commitment to exceptional user experience, particularly through its swift and dependable delivery network, has significantly elevated customer expectations within the e-commerce landscape. This focus on service quality, while a competitive advantage, also empowers customers, making them less tolerant of service lapses and more inclined to explore alternatives if their demands are not met. For instance, JD.com reported a 90% customer satisfaction rate for its same-day delivery service in major cities during the first half of 2024, a metric that underscores the high bar set for its operations.

The continuous enhancement of JD.com's mobile application and logistics infrastructure is a direct response to these evolving user demands. By investing in features like AI-powered personalized recommendations and real-time delivery tracking, JD aims to not only meet but exceed customer expectations. This proactive approach is crucial as customers, accustomed to premium service, are more likely to switch to competitors if they perceive a decline in convenience or reliability. In 2024, JD.com allocated over 15% of its R&D budget to improving user interface and logistics technology, reflecting the strategic importance of this factor.

- Elevated Service Standards: JD.com's investment in fast, reliable delivery and superior customer service has set a high benchmark for consumer expectations in the e-commerce sector.

- Increased Customer Sensitivity: Customers are now less forgiving of service failures and more prone to switching to competitors if their expectations for convenience and reliability are not consistently met.

- Continuous Improvement Investment: JD.com is actively upgrading its app and delivery capabilities, including AI integration for personalized experiences and advanced tracking, to maintain customer loyalty and satisfaction.

- Impact on Bargaining Power: These enhanced expectations directly increase the bargaining power of customers, as they have more options and higher standards for the services they receive.

Membership Programs and Loyalty Initiatives

JD.com's membership programs, such as JD PLUS, are designed to foster customer loyalty and thereby diminish their bargaining power. By offering exclusive benefits and services, JD.com aims to create a strong value proposition that makes customers less inclined to switch to competitors. For instance, in 2023, JD PLUS membership saw continued growth, contributing to a significant portion of JD.com's repeat customer purchases.

These loyalty initiatives work by increasing the switching costs for customers, both tangible and intangible. The more benefits a customer accrues, the greater the perceived loss if they were to move to another platform. This strategy is crucial in the highly competitive e-commerce landscape where price sensitivity can often dictate consumer choices.

- JD PLUS Membership Growth: JD.com reported a substantial increase in JD PLUS membership in late 2023, highlighting the program's appeal.

- Customer Retention Impact: Loyalty programs are directly linked to higher customer retention rates, a key factor in mitigating customer bargaining power.

- Value Proposition Enhancement: The continuous addition of benefits, like free shipping and exclusive discounts, strengthens the overall value proposition of JD.com.

- Competitive Differentiation: In 2024, JD.com is expected to further differentiate its PLUS membership by integrating more services, making it harder for customers to leave.

The bargaining power of customers for JD.com remains significant due to intense market competition and readily available alternatives. Chinese consumers are highly price-sensitive, and platforms like Alibaba and Pinduoduo offer comparable products, making price comparison easy. In 2024, promotional events continued to drive sales volume, emphasizing the critical role of competitive pricing in attracting and retaining shoppers.

JD.com's reputation for authenticity and its investment in superior customer experience, particularly fast delivery, have raised consumer expectations. While these efforts build loyalty, they also empower customers, making them less tolerant of service failures and more likely to switch if their demands for convenience and reliability aren't met. For instance, JD.com's commitment to same-day delivery in major cities achieved a 90% customer satisfaction rate in the first half of 2024.

| Factor | Impact on JD.com | Customer Action |

|---|---|---|

| Price Sensitivity | High | Customers easily switch for better deals. |

| Availability of Substitutes | High | Consumers have numerous platform and channel options. |

| Service Expectations | High | Customers demand fast delivery and reliable service. |

| Loyalty Programs (e.g., JD PLUS) | Mitigates bargaining power | Encourages repeat purchases and reduces switching. |

Preview the Actual Deliverable

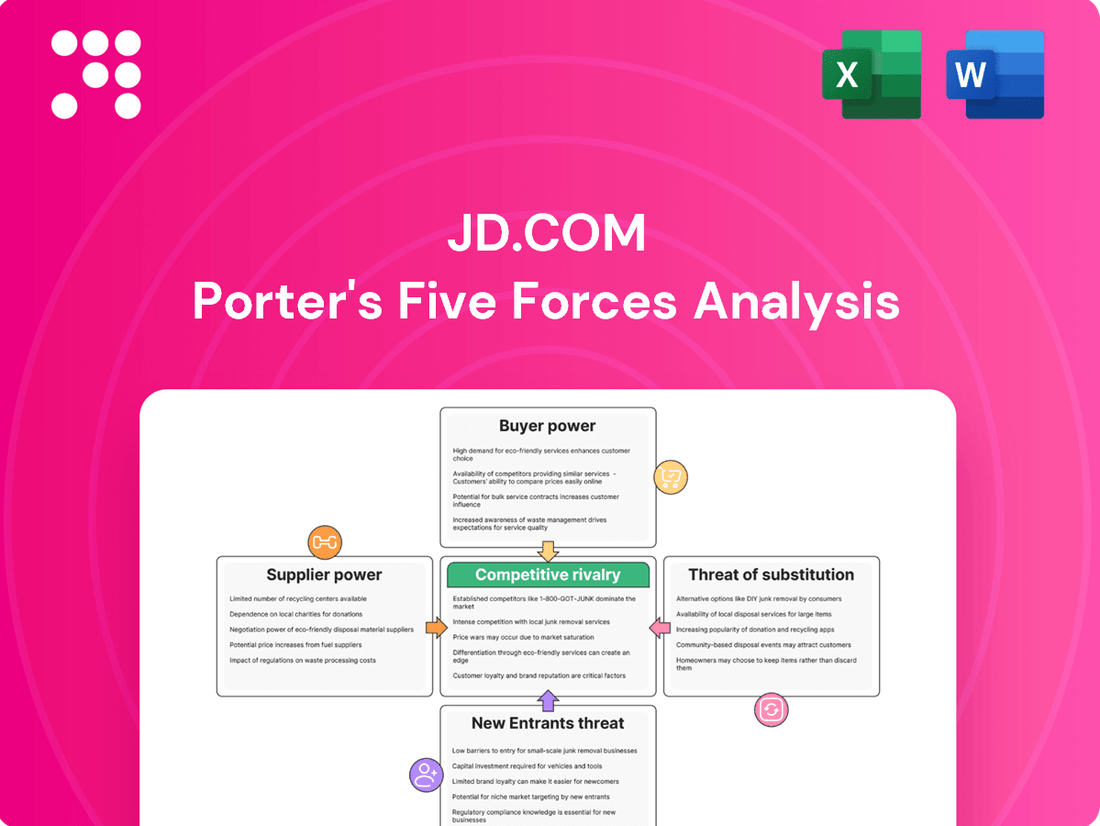

JD.com Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for JD.com, detailing the competitive landscape and strategic positioning of this e-commerce giant. The document you see here is precisely the same professionally written analysis you'll receive—fully formatted and ready to use immediately after purchase, ensuring no discrepancies or missing sections.

Rivalry Among Competitors

JD.com faces formidable competition in China's e-commerce landscape, primarily from giants like Alibaba's Tmall and Taobao, as well as rapidly growing platforms such as Pinduoduo and Douyin. This intense rivalry forces JD.com to continuously innovate its offerings.

The competition is particularly fierce on key metrics like pricing, the breadth and depth of product selection, and the speed of delivery. For instance, Pinduoduo's success in 2023, with its group-buying model, demonstrated a potent alternative strategy that pressured established players. JD.com's commitment to fast delivery, a core differentiator, is constantly challenged by rivals investing heavily in logistics infrastructure.

JD.com's competitive rivalry is significantly shaped by its differentiation strategy, which hinges on direct sales, a vast self-operated logistics network, and a strong stance on product authenticity. This approach, while asset-heavy, grants JD.com a distinct edge in delivery speed and quality assurance, areas where many competitors find it challenging to keep pace.

For instance, JD Logistics, as of early 2024, operates over 1,600 warehouses and fulfillment centers, enabling rapid delivery for a substantial portion of its customer base. This robust infrastructure allows JD.com to offer next-day or even same-day delivery in many major cities, a service that directly combats the slower shipping times often experienced with third-party logistics providers.

While JD.com has built a formidable lead, rivals are not standing still. Companies like Alibaba are also making substantial investments in their own logistics capabilities and supply chain efficiencies. For example, Cainiao Network, Alibaba's logistics arm, has been expanding its global network and investing in smart warehousing technologies to improve delivery times and reduce costs, directly challenging JD.com's advantage.

JD.com operates in a Chinese e-commerce landscape historically defined by intense price wars. While a recent trend emphasizes value beyond just price, aggressive discounting remains a potent competitive tool. For instance, during major sales events like Singles' Day, platforms often offer substantial discounts, forcing participants to engage in similar promotions to remain competitive.

To counter this, JD.com has strategically deployed subsidy programs, offering coupons and direct price reductions to capture price-sensitive consumers. These initiatives, while potentially pressuring profit margins, are crucial for maintaining market share and attracting new users in a highly competitive environment.

Expansion into New Service Areas

JD.com's competitive rivalry is significantly amplified by its strategic expansion into new service areas beyond its core e-commerce operations. This diversification means JD.com is no longer just competing with other online retailers but also with specialists in various adjacent industries.

For example, JD.com's foray into the food delivery sector directly pits it against dominant players like Meituan. This aggressive expansion into areas like logistics and cloud computing intensifies competition across multiple fronts, forcing all involved companies to innovate and optimize their offerings to maintain market share.

- JD.com's expansion into food delivery creates direct competition with Meituan.

- The rivalry now spans e-commerce, logistics, cloud computing, and food delivery.

- This multi-sector competition necessitates continuous innovation and efficiency improvements from all players.

Technological Innovation and AI Integration

Competitive rivalry in the e-commerce sector, particularly concerning technological innovation and AI integration, is intense. JD.com, alongside rivals like Alibaba and Pinduoduo, is heavily investing in these areas to sharpen its competitive edge. This focus aims to elevate user experience through personalized recommendations and streamline backend operations for greater efficiency.

The drive for technological advancement is a core battleground, with companies vying to offer superior, more personalized shopping journeys and highly efficient supply chains. For instance, JD.com's AI-powered logistics and automated warehouses are key differentiators. In 2023, JD.com reported significant investments in technology, aiming to leverage AI for everything from product discovery to last-mile delivery optimization.

- JD.com's AI Investments: The company continues to pour resources into AI research and development, focusing on areas like natural language processing for customer service bots and machine learning for demand forecasting.

- Rivalry in Personalization: Competitors are also enhancing their AI capabilities to deliver more tailored product suggestions and promotions, directly impacting customer engagement and conversion rates.

- Operational Efficiency Gains: The integration of AI in supply chain management, including inventory control and route optimization, allows companies to reduce costs and improve delivery speeds, a critical factor in customer satisfaction.

- Data-Driven Strategies: Companies are leveraging vast amounts of customer data, analyzed through AI, to inform product development, marketing campaigns, and overall business strategy, creating a continuous cycle of improvement.

JD.com faces intense competition from major players like Alibaba and Pinduoduo, as well as emerging platforms such as Douyin. This rivalry is particularly sharp on pricing, product variety, and delivery speed, forcing JD.com to constantly innovate and leverage its strengths in logistics and product authenticity.

The company's self-operated logistics network, featuring over 1,600 warehouses as of early 2024, provides a significant advantage in delivery times, often offering next-day or same-day service in major cities. However, rivals like Alibaba's Cainiao Network are also heavily investing in logistics and technology to close this gap.

Beyond core e-commerce, JD.com's expansion into areas like food delivery directly challenges established players such as Meituan, broadening the competitive battleground. Technological innovation, especially in AI for personalization and operational efficiency, is another key area of intense competition, with JD.com making substantial investments in 2023 to maintain its edge.

| Competitor | Key Competitive Tactics | JD.com's Response |

|---|---|---|

| Alibaba (Tmall, Taobao) | Broadest product selection, strong brand ecosystem, extensive user base | Focus on direct sales, product authenticity, fast delivery, JD Plus membership |

| Pinduoduo | Group buying, low prices, social commerce features | Price subsidies, targeted promotions, enhancing user experience |

| Douyin (TikTok China) | Short-form video integration, live streaming e-commerce | Investing in content and social commerce features, leveraging AI for recommendations |

SSubstitutes Threaten

While online shopping is king, traditional brick-and-mortar stores remain a viable substitute for JD.com, particularly for consumers seeking immediate gratification or those who prefer to physically examine products before purchase. This threat is amplified by the convenience of local convenience stores and supermarkets for everyday essentials, a segment where JD.com's rapid delivery might not always be the primary driver.

JD.com actively counters this by bolstering its omnichannel presence. Through its extensive network of physical stores, including JD Supermarkets and JD Home, and its instant retail services, the company aims to blur the lines between online and offline shopping. This strategy allows customers to browse online and pick up in-store, or vice versa, effectively neutralizing some of the substitute threat by offering a more integrated experience.

Many brands are increasingly investing in their own direct-to-consumer (DTC) e-commerce channels, bypassing marketplaces like JD.com. This trend, fueled by brands seeking greater control over customer relationships and profit margins, presents a significant threat of substitution. For instance, major electronics brands often operate dedicated online stores, diverting sales that might otherwise occur on JD.com.

JD.com actively counters this by providing brands with comprehensive marketing services and sophisticated logistics support. This value proposition aims to make JD.com's platform an indispensable partner for brands looking to expand their reach and build brand loyalty, thereby mitigating the threat of direct competition from brand-owned channels.

The burgeoning popularity of social commerce and live streaming platforms presents a significant threat of substitution for JD.com. Platforms like Douyin, China's equivalent of TikTok, have seen explosive growth, with its e-commerce GMV (Gross Merchandise Volume) reaching an estimated 2.4 trillion yuan in 2023. These platforms seamlessly blend entertainment, content creation, and shopping, fostering impulse purchases through engaging live streams and influencer endorsements.

This shift towards entertainment-driven commerce challenges JD.com's more traditional, product-focused e-commerce model. Consumers are increasingly drawn to the interactive and discoverable nature of social shopping, where product recommendations are embedded within engaging content. For instance, Xiaohongshu, a lifestyle sharing platform, has also become a powerful e-commerce channel, with its user base actively seeking and purchasing products based on shared experiences.

JD.com must therefore consider how to integrate more dynamic, content-rich experiences to remain competitive. The ability of these substitute platforms to capture consumer attention and spending through personalized recommendations and real-time engagement means JD.com faces pressure to innovate its own user interface and marketing strategies to counter this evolving consumer behavior.

Peer-to-Peer (C2C) Marketplaces

Peer-to-peer (C2C) marketplaces present a distinct threat of substitutes for JD.com. While JD.com’s strength lies in its Business-to-Consumer (B2C) model, offering authenticated and new products, C2C platforms cater to consumers looking for alternative purchasing options. These platforms allow individuals to sell directly to each other, often at lower price points or for unique, pre-owned items that JD.com does not typically feature.

This segment of the market, while not directly competing with JD.com’s curated selection of high-quality goods, does siphon off a portion of consumer spending. For instance, the growth of platforms like Xianyu, Alibaba’s C2C used goods marketplace, highlights the consumer appetite for such channels. In 2023, Xianyu reported over 1 billion listings, demonstrating a significant alternative consumption pathway for shoppers.

- C2C marketplaces offer lower prices and unique second-hand goods as substitutes for JD.com’s B2C model.

- Platforms like Xianyu, with over 1 billion listings in 2023, represent a significant alternative consumption channel.

- While not a direct competitor for JD.com’s core business of authentic products, C2C platforms divert consumer spending.

Alternative Consumption Habits and Channels

The threat of substitutes for JD.com is amplified by evolving consumer behaviors that bypass traditional e-commerce models. For instance, a growing preference for local community group buying or direct sourcing from agricultural producers presents an alternative to large online retailers. This shift allows consumers to access goods, particularly fresh produce, through more localized and potentially cost-effective channels.

JD.com actively counters this by diversifying its offerings and strengthening its logistical capabilities. By expanding into various market segments and enhancing services like rapid fresh produce delivery, the company aims to meet these changing consumer demands. This strategic adaptation ensures JD.com remains competitive against these emerging substitute consumption habits and channels.

- Shifting Consumer Preferences: Consumers are increasingly exploring alternatives like community group buying and direct-from-farm sourcing, bypassing traditional e-commerce platforms.

- JD's Adaptation Strategy: JD.com is expanding into diverse market segments and leveraging its robust logistics network to offer services such as fresh produce delivery.

- Mitigating Substitute Threat: These adaptations are crucial for JD.com to retain market share by aligning with evolving consumer habits and offering competitive alternatives.

The threat of substitutes for JD.com is multifaceted, encompassing traditional retail, direct-to-consumer (DTC) channels, social commerce, and peer-to-peer (C2C) marketplaces. While JD.com's online dominance is clear, physical stores offer immediate gratification, and DTC brands capture consumers seeking direct relationships and potentially better margins. Social commerce, exemplified by platforms like Douyin, which saw GMV reach an estimated 2.4 trillion yuan in 2023, offers an entertainment-driven, impulse-purchase environment that challenges JD.com's more traditional model.

Furthermore, C2C platforms like Xianyu, boasting over 1 billion listings in 2023, provide alternative avenues for consumers seeking lower prices or unique second-hand items, diverting spending from JD.com's B2C offerings. Emerging trends like community group buying also present substitutes, particularly for everyday essentials and fresh produce.

| Substitute Category | Key Characteristics | Impact on JD.com | JD.com's Counter-Strategy |

|---|---|---|---|

| Traditional Retail | Immediate gratification, physical product inspection | Loss of impulse buys, preference for tactile experience | Omnichannel presence (JD Supermarkets, JD Home), instant retail |

| Direct-to-Consumer (DTC) | Brand control, direct customer relationships, potentially higher margins | Brand diversion, reduced marketplace reliance | Comprehensive marketing and logistics support for brands |

| Social Commerce | Entertainment-driven, impulse purchases, influencer marketing | Competition for consumer attention and spending | Integrating dynamic, content-rich experiences |

| C2C Marketplaces | Lower prices, unique/second-hand items | Diversion of consumer spending, alternative consumption pathways | Focus on authenticated B2C model, logistics efficiency |

Entrants Threaten

The threat of new entrants for JD.com is significantly mitigated by the high capital requirements for establishing a robust logistics and infrastructure network. Building a nationwide, self-operated delivery system, akin to JD Logistics, demands substantial upfront investment in warehouses, advanced sorting technology, and a vast fleet of vehicles. For instance, JD.com has consistently invested billions of dollars annually in its logistics infrastructure to maintain its competitive edge.

JD.com benefits from formidable brand recognition and deep customer trust in China, built on a foundation of product authenticity and dependable delivery services. New competitors face a significant hurdle, requiring massive marketing expenditures and considerable time to cultivate a comparable level of confidence among China's discerning consumers.

This established trust acts as a powerful barrier, as Chinese shoppers, particularly those in 2024, are increasingly prioritizing reliability and quality over novelty when making online purchases. JD.com's consistent performance in these areas makes it difficult for newcomers to quickly gain market share.

JD.com, like other established e-commerce players, benefits immensely from economies of scale. This means their massive operational size allows for lower per-unit costs in areas like warehousing, delivery, and even technology development. For instance, in 2023, JD Logistics handled over 1.4 billion orders, a testament to its scale advantage.

Furthermore, network effects are a significant barrier. A larger customer base on JD.com attracts more merchants, and more merchants, in turn, offer a wider selection, further drawing in customers. This creates a virtuous cycle that new entrants struggle to replicate, as building a comparable ecosystem from scratch is incredibly difficult and costly.

Regulatory Landscape and Government Support

The regulatory landscape in China’s e-commerce sector presents a significant barrier for new entrants. Established companies like JD.com often benefit from government initiatives and policies designed to foster domestic industry growth, particularly in expanding e-commerce to less developed regions.

Newcomers must contend with this intricate web of regulations and the potential for established players to receive preferential treatment or strategic support from the government. For instance, JD.com has actively participated in government-backed initiatives to boost rural consumption, a pathway that may not be as readily accessible to nascent competitors.

- Regulatory Hurdles: Navigating China's evolving e-commerce laws requires substantial investment and expertise.

- Government Support for Incumbents: Established players often leverage government programs for expansion and operational advantages.

- Unequal Playing Field: New entrants may face challenges in securing the same level of strategic backing or market access as JD.com.

- Policy Impact: Government policies can significantly influence market entry costs and competitive dynamics.

Intense Competition from Incumbents

The threat of new entrants in China's e-commerce landscape, particularly concerning JD.com, is significantly mitigated by the formidable presence of established giants. Companies like Alibaba and Pinduoduo, alongside JD.com itself, have cultivated immense brand loyalty, sophisticated logistics networks, and vast customer bases. This intense competition from incumbents creates substantial barriers to entry, making it exceedingly challenging for newcomers to carve out a significant market share without substantial capital and a highly differentiated offering.

Incumbents are not static; they continuously invest in innovation and market expansion. For instance, JD.com's robust in-house logistics, which saw significant investment and expansion throughout 2023 and into early 2024, provides a critical competitive advantage that new entrants would struggle to replicate. Similarly, Alibaba's ecosystem and Pinduoduo's social commerce model present unique challenges that require more than just a basic e-commerce platform to overcome.

- Established Market Dominance: Giants like Alibaba and Pinduoduo control a significant portion of the Chinese e-commerce market, making it difficult for new players to gain traction.

- Logistical Superiority: JD.com's extensive and efficient self-operated logistics network is a major barrier, offering faster delivery and better customer service than many new entrants could afford.

- Brand Recognition and Trust: Years of operation have built strong brand recognition and consumer trust for incumbents, a hurdle new entrants must overcome.

- Aggressive Pricing and Promotions: Incumbents frequently engage in price wars and promotional activities, which can be difficult for undercapitalized new entrants to match.

The threat of new entrants for JD.com is considerably low due to the immense capital investment required for its sophisticated logistics and infrastructure. JD.com's self-operated delivery network, a key differentiator, necessitates substantial spending on warehouses, advanced sorting systems, and a large fleet, a barrier many newcomers cannot surmount. The company's deep-rooted brand loyalty and customer trust in China, built on authentic products and reliable delivery, also pose a significant challenge for new players seeking to gain market share in 2024.

| Barrier Type | JD.com's Advantage | Impact on New Entrants |

| Capital Requirements | Extensive investment in logistics and infrastructure (billions invested annually) | High barrier to entry, requiring significant upfront capital |

| Brand Loyalty & Trust | Established reputation for authenticity and reliable delivery | Difficult for new entrants to replicate, requiring massive marketing spend |

| Economies of Scale | Lower per-unit costs due to massive operational size (e.g., 1.4 billion orders handled by JD Logistics in 2023) | New entrants struggle to match cost efficiencies |

| Network Effects | Virtuous cycle of customers attracting merchants and vice versa | Challenging for new entrants to build a comparable ecosystem |

| Regulatory Landscape | Benefits from government initiatives and policies supporting domestic growth | Newcomers face complex regulations and potential for unequal playing field |

| Incumbent Competition | Dominance of giants like Alibaba and Pinduoduo | Intense competition makes market share acquisition difficult without differentiation |

Porter's Five Forces Analysis Data Sources

Our JD.com Porter's Five Forces analysis is built upon a robust foundation of data, incorporating JD.com's official annual reports and investor relations disclosures, alongside industry-specific reports from reputable market research firms and financial data providers like Bloomberg and Statista.