JD.com PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JD.com Bundle

JD.com operates within a dynamic Chinese market, significantly influenced by evolving political landscapes and economic fluctuations. Understanding these external forces is crucial for any investor or strategist looking to capitalize on the e-commerce giant's growth. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence to inform your decisions. Download the full report now to gain a competitive advantage.

Political factors

The Chinese government exerts considerable influence over its e-commerce landscape, and JD.com, like other major players, navigates a dynamic regulatory environment. Recent policy shifts, particularly those slated for implementation by October 2025, signal a focus on curbing commission fees charged by platforms. This move is intended to bolster small businesses and foster a more equitable competitive arena.

These impending regulations could directly impact JD.com's financial performance by potentially compressing revenue derived from merchant fees. For instance, if platforms are restricted from charging commissions above a certain threshold, JD.com's established revenue streams may need to be re-evaluated and adapted to the new operational framework.

Chinese regulators are actively enforcing anti-monopoly laws, creating a dynamic environment for major tech firms like JD.com. While JD.com has largely navigated recent high-profile anti-monopoly actions with less direct impact compared to some peers, the overarching regulatory focus on fair competition remains a significant consideration.

This ongoing emphasis on market fairness means JD.com must remain vigilant regarding its market share and business practices. Potential future scrutiny could target areas of perceived market dominance or exclusive arrangements, requiring proactive adaptation of its strategies to ensure ongoing compliance and mitigate risks of penalties.

The Chinese government's strong backing for the digital economy and logistics is a significant political factor for JD.com. The 14th Five-Year Plan, covering 2021-2025, specifically targets the creation of a safe, efficient, smart, and green logistics system by 2025. This aligns perfectly with JD.com's operational strengths and its continuous investment in advanced logistics technology.

This strategic government focus on digital transformation and enhanced competitiveness directly benefits JD.com's vast logistics network. Initiatives like Made in China 2025 further underscore this commitment, creating a favorable environment for companies like JD.com that are at the forefront of integrating technology into their supply chains.

Geopolitical Tensions and Trade Relations

Geopolitical tensions, especially the ongoing US-China trade relationship, create significant uncertainty for global supply chains and technology access. These tensions can lead to disruptions that directly impact JD.com's ability to source products and manage its international operations. For instance, the imposition of tariffs can increase costs for imported goods, potentially affecting JD.com's pricing strategies and profit margins.

While direct tariffs might impact international suppliers more, a broader economic slowdown stemming from trade disputes can dampen domestic consumer spending. In 2024 and 2025, this economic climate could translate into reduced purchasing power for JD.com's customer base, impacting overall sales volumes. Navigating these cross-border complexities and potential shifts in consumer behavior is crucial for JD.com's sustained performance.

- US-China Trade Tensions: Ongoing trade disputes create supply chain vulnerabilities and impact technology access, a critical component for e-commerce operations.

- Tariff Impact: Tariffs on imported goods can increase operational costs for JD.com, potentially affecting pricing and competitiveness.

- Economic Slowdown: Trade disputes can lead to broader economic slowdowns, reducing domestic consumer spending and demand for JD.com's services.

- Supply Chain Resilience: JD.com must focus on building resilient supply chains to mitigate risks associated with geopolitical instability and trade disruptions.

Policies on Intellectual Property Protection

China's commitment to bolstering intellectual property (IP) protection is a significant political factor for JD.com. This strengthened legal framework is vital for an e-commerce giant like JD.com, which manages an extensive array of products. Stricter enforcement directly aids JD.com in its fight against counterfeit items, thereby safeguarding its reputation for product authenticity.

The enhanced IP protection measures are not only about product integrity but also about safeguarding JD.com's own innovations. This includes protecting its proprietary technologies and advanced logistics infrastructure, which are key competitive advantages. For instance, China's Supreme People's Court reported a 20% increase in IP-related cases handled in 2023, indicating a more robust legal environment.

- Strengthened IP Laws: The Chinese government is actively reinforcing IP protection laws, creating a more secure operating environment for e-commerce.

- Combating Counterfeits: Stricter enforcement empowers JD.com to more effectively tackle the pervasive issue of counterfeit goods on its platform.

- Protecting Innovation: JD.com's own technological advancements and unique logistics solutions are better shielded under these improved IP regulations.

The Chinese government's regulatory approach significantly shapes JD.com's operational landscape. Anticipated policy shifts by October 2025 aim to cap platform commission fees, potentially impacting JD.com's revenue streams. Simultaneously, ongoing enforcement of anti-monopoly laws necessitates JD.com's vigilance regarding market practices and dominance.

Government support for the digital economy, as outlined in the 14th Five-Year Plan (2021-2025), directly benefits JD.com's logistics infrastructure. This strategic alignment, coupled with strengthened IP protection, as evidenced by a reported 20% rise in IP cases handled by China's Supreme People's Court in 2023, creates a more favorable operating environment.

Geopolitical factors, particularly US-China trade tensions, introduce supply chain risks and potential impacts on consumer spending. These tensions could affect JD.com's ability to source goods and manage costs, with potential economic slowdowns in 2024-2025 impacting purchasing power.

What is included in the product

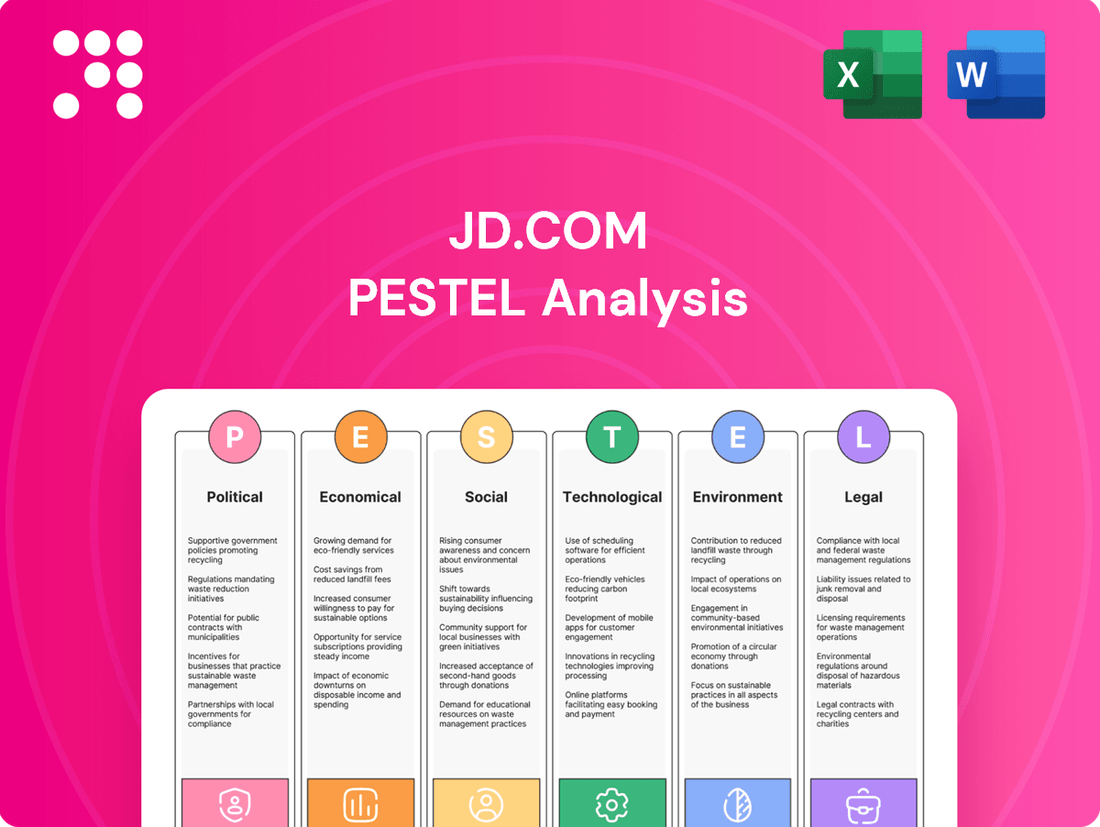

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing JD.com, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, equipping stakeholders with the knowledge to navigate opportunities and mitigate risks.

A concise, actionable JD.com PESTLE analysis that highlights key external factors impacting the company, enabling strategic decision-making and mitigating potential risks.

Economic factors

China's economic growth, while moderating, is projected to remain robust, with forecasts indicating a GDP expansion of around 4.5% for 2025. This sustained growth underpins the overall economic environment for businesses operating within the country.

Consumer spending, a critical driver for many sectors, is exhibiting a positive trend in early 2025. Data shows a notable increase in retail sales of consumer goods, signaling a gradual recovery in consumer confidence and purchasing power.

JD.com's business trajectory is intrinsically linked to these domestic consumption trends. The company's performance is expected to benefit from this revival in consumer sentiment, even as broader economic sentiment may still carry a degree of caution.

China's economic landscape has seen a notable shift, moving from deflationary worries in 2024 to a more modest inflationary environment in 2025, with food prices being a key driver. This change presents a complex scenario for JD.com.

Despite the overall inflationary trend, a sluggish economy and fierce price competition within the e-commerce sector continue to impose deflationary pressures on specific product categories. This dynamic can directly impact JD.com's profit margins and influence consumer purchasing decisions.

To navigate these fluctuating economic conditions effectively, JD.com must remain agile in its pricing strategies, balancing the need to maintain competitiveness with the imperative to protect its profitability in a dynamic market.

JD.com navigates a highly competitive e-commerce environment, facing formidable rivals like Alibaba and rapidly growing platforms such as PDD Holdings and Douyin. This dynamic market necessitates constant adaptation, as evidenced by JD.com's strategic investments in logistics and its focus on private labels to differentiate itself.

The intense rivalry puts pressure on JD.com's profitability and market position, compelling the company to employ aggressive pricing strategies and explore new growth avenues. For instance, in the first quarter of 2024, JD.com reported revenue of RMB 222.7 billion, demonstrating its scale amidst this competitive pressure.

Supply Chain Resilience and Global Economic Uncertainties

Global economic uncertainties and the potential for supply chain disruptions pose significant challenges for JD.com's vast logistics operations. These external factors can directly affect the efficiency and cost-effectiveness of delivering goods across its extensive network.

Despite these headwinds, JD.com has proactively strengthened its supply chain capabilities. By the close of 2024, the company reported a notable 12% year-on-year increase in its supply chain infrastructure assets, underscoring a commitment to resilience. This investment aims to buffer against the volatility inherent in the current global economic climate.

JD.com's strategy hinges on its robust, self-owned logistics network and sophisticated inventory management. These core strengths are designed to mitigate the impact of potential disruptions, ensuring consistent and reliable delivery services for its customers.

- Increased Infrastructure Investment: JD.com's assets related to its supply chain infrastructure grew by 12% year-on-year by the end of 2024.

- Logistics Network Strength: The company operates a comprehensive, self-owned logistics network, providing a significant competitive advantage.

- Risk Mitigation Focus: Strategic inventory allocation and network optimization are key to JD.com's approach to managing supply chain risks.

Government Stimulus and Trade-in Programs

The Chinese government's push to boost domestic consumption through expanded subsidies and trade-in programs for electronics and appliances in 2025 directly benefits JD.com. These initiatives are designed to encourage consumers to upgrade their devices, leading to increased sales volumes for JD.com, particularly in categories like consumer electronics and home appliances where it holds a significant market share. For instance, the government's 2024 stimulus measures, which are expected to continue and potentially expand into 2025, have already shown a positive impact on retail sales, with e-commerce platforms like JD.com being primary beneficiaries.

JD.com is well-positioned to capitalize on these government-led programs. The company's established logistics network and strong relationships with brands enable it to effectively implement and promote these trade-in and subsidy schemes. This strategic alignment with national economic policies is projected to drive higher customer engagement and sales growth. In 2024, similar programs saw a notable uptick in participation, suggesting a strong consumer appetite for such incentives.

- Government Focus: China's 2025 economic strategy prioritizes stimulating domestic demand.

- JD.com's Role: The company is a key player in facilitating government subsidy and trade-in programs.

- Projected Impact: Expect increased sales volumes and consumer spending on electronics and appliances.

- Market Advantage: JD.com's infrastructure supports efficient program execution and customer reach.

China's economic growth is projected to remain a key driver for JD.com in 2025, with GDP expected to expand around 4.5%. Consumer spending shows a positive recovery trend in early 2025, with retail sales of consumer goods notably increasing, signaling a boost in purchasing power. Despite a modest inflationary environment, deflationary pressures persist in some product categories due to intense e-commerce competition, necessitating agile pricing strategies from JD.com.

| Economic Indicator | 2024 (Estimate/Actual) | 2025 (Projection) | Impact on JD.com |

| GDP Growth | ~5.2% | ~4.5% | Sustained demand, but moderating growth |

| Consumer Spending (Retail Sales) | Positive trend | Continued recovery | Increased sales volume, especially for discretionary goods |

| Inflation Rate | Modest, driven by food prices | Continued modest inflation | Potential margin pressure, requires careful pricing |

| E-commerce Competition | Intense | Intense | Pressure on pricing and margins, need for differentiation |

Full Version Awaits

JD.com PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of JD.com covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the e-commerce giant.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain in-depth insights into JD.com's strategic landscape, enabling informed decision-making.

Sociological factors

Chinese consumers are increasingly embracing online shopping, driven by a desire for convenience, assurance of product authenticity, and dependable delivery services. This shift in preference directly benefits JD.com, whose business model is built around these very consumer demands.

JD.com's commitment to direct sales and its robust, in-house logistics network are key differentiators. This allows the company to guarantee product quality and provide the efficient, reliable service that modern Chinese shoppers expect, further solidifying its market position.

By early 2024, the e-commerce penetration in China had reached significant levels, with mobile commerce accounting for a substantial portion of retail sales. JD.com, as a major player, consistently reports strong growth in its user base and transaction volumes, reflecting these evolving consumer habits.

China's middle class continues to expand, with a notable surge in lower-tier cities. This growth directly fuels increased disposable income and spending power. For JD.com, this means a larger potential customer base eager to purchase a wider array of goods and services, driving demand for its e-commerce platform.

Chinese consumers increasingly prioritize genuine products and dependable delivery, a trend JD.com has masterfully capitalized on. In 2023, JD.com reported that over 90% of its sales were from authentic products, reinforcing consumer trust. This focus directly addresses a key sociological driver, as shoppers are wary of counterfeits and demand assurance of quality.

JD.com's robust self-operated logistics network, a significant differentiator, ensures timely and reliable delivery, meeting the high expectations of its customer base. By the end of 2023, JD Logistics operated over 1,600 warehouses across China, enabling same-day or next-day delivery for a substantial portion of its orders. This operational excellence directly translates into enhanced customer satisfaction and loyalty, as evidenced by JD.com's consistently high customer retention rates.

Shifting Work Culture and Logistics Workforce

China's evolving work culture, marked by a growing preference for flexible arrangements and a shrinking pool of young workers willing to take on physically demanding roles, directly impacts JD.com's logistics operations. Demographic shifts, including an aging population and declining birth rates, are creating a tighter labor market. This necessitates higher wages and improved benefits to attract and retain the hundreds of thousands of couriers essential for JD.com's rapid delivery promises.

The cost of labor is a significant consideration. In 2023, average monthly wages for logistics workers in major Chinese cities saw an increase, putting pressure on JD.com's operational expenses. The company's reliance on a large, in-house courier force means that managing these rising labor costs while maintaining service quality is a critical challenge. Ensuring workforce stability is paramount to upholding JD.com's reputation for efficient and timely deliveries.

- Labor Shortages: Demographic trends point to a tightening labor market for logistics roles.

- Wage Inflation: Increased competition for workers is driving up average wages in the sector.

- Workforce Retention: JD.com must focus on benefits and working conditions to keep its courier force stable.

Rise of Social Commerce and Live Streaming

The integration of payment options within social media platforms has fueled a significant social shopping surge in China. This trend sees creators and brands leveraging live streaming to conduct direct sales, a dynamic that has reshaped consumer behavior. For JD.com, which has historically prioritized direct sales models, adapting to or incorporating these social commerce elements is increasingly vital. This strategic pivot is key to capturing the attention of younger consumers and broadening its overall market presence.

This shift is evident in the rapid growth of live-stream e-commerce. In 2023, China's live-stream e-commerce market was valued at approximately $490 billion, with projections indicating continued expansion. JD.com's own efforts in this space, such as its "Dong Haidong" live streaming channel, have shown promising results, with sales on the platform reportedly reaching over $1.5 billion in a single day during the 2023 618 shopping festival.

- Social Commerce Growth: China's live-stream e-commerce market reached an estimated $490 billion in 2023.

- Creator-Led Sales: Brands and influencers are increasingly using live streaming for direct product sales.

- JD.com's Adaptation: The company is exploring integration with social commerce to engage younger demographics.

- Platform Integration: Embedded payment systems in social media are a primary driver of this trend.

Chinese consumers increasingly value authenticity and reliable delivery, aligning perfectly with JD.com's core strengths. The company's commitment to a direct sales model and its extensive in-house logistics network directly address these consumer priorities, fostering trust and loyalty.

The expanding middle class, particularly in lower-tier cities, presents a growing customer base for JD.com, boosting demand for its platform and diverse product offerings. This demographic shift directly translates into increased disposable income and a greater propensity to spend on e-commerce services.

JD.com's emphasis on product authenticity is a significant draw, with over 90% of its sales confirmed as genuine in 2023, reinforcing consumer confidence. This focus is crucial in a market where shoppers are wary of counterfeit goods and actively seek assurance of quality.

JD.com's sophisticated logistics infrastructure, encompassing over 1,600 warehouses by the end of 2023, ensures efficient delivery, a critical factor in customer satisfaction and retention. This operational capability is a key competitive advantage, solidifying the company's market leadership.

Technological factors

JD.com is making significant strides in leveraging AI and big data to refine its logistics and supply chain. By early 2025, the company aims to embed AI into a substantial 80% of its supply chain operations. This strategic push is exemplified by their 'Logistics Brain' system, which incorporates advanced technologies like large language models (LLMs) and digital twin capabilities. These innovations are designed to dramatically shorten delivery times and minimize instances of stockouts, directly impacting operational efficiency and customer satisfaction.

JD.com is a major player in developing and using automation for delivery and warehouse tasks. They are actively deploying robots and self-driving vehicles, especially for that crucial final stretch to the customer's door and within their warehouses.

Their advanced 'Asia No.1' intelligent logistics parks showcase this commitment, utilizing AI-driven robots to boost how much they can store and make operations run smoother. This focus on automation is key to their efficiency.

JD Cloud serves as a crucial technological foundation for JD.com, driving intelligent enhancements throughout its supply chain operations. This robust cloud infrastructure is instrumental in facilitating JD.com's digital transformation initiatives.

In 2024, JD.com achieved a significant milestone by migrating its vast trillion-level traffic data assets to its data lake. This strategic move resulted in substantial cost reductions and dramatically improved data processing efficiency, reducing latency to mere minutes.

Integration of IoT and Smart Technology

JD.com is actively embedding the Internet of Things (IoT) and smart technologies throughout its operations, from its advanced automated warehouses to consumer-facing smart devices. This strategic move is designed to significantly boost operational efficiency and offer highly tailored customer experiences, fitting perfectly with the growing demand for interconnected digital lifestyles. For instance, JD Logistics' smart warehouses utilize IoT sensors for real-time inventory tracking and robotic automation, leading to faster order fulfillment.

This technological integration not only streamlines JD.com's supply chain but also fosters the development of its own smart home ecosystem, allowing for seamless interaction between devices and services. By leveraging IoT, JD.com aims to create a more personalized and convenient shopping journey for its customers. The company reported that in 2023, its smart warehouses handled over 90% of its orders, showcasing the tangible impact of this technological adoption on efficiency.

The company's investment in IoT and smart technology is a key driver for its future growth, enabling new service models and enhancing customer loyalty. This focus aligns with the broader market trend where consumers increasingly expect integrated and intelligent solutions in their daily lives. JD.com’s smart appliance sales saw a 25% year-over-year increase in early 2024, demonstrating consumer appetite for these connected products.

Key aspects of JD.com's IoT and smart technology integration include:

- Smart Warehousing: Implementation of IoT sensors and robotics to optimize inventory management and logistics.

- Personalized Customer Experience: Utilizing data from connected devices to offer tailored recommendations and services.

- Smart Home Ecosystem: Developing and promoting a range of smart home products that integrate with JD.com's platform.

Cybersecurity and Data Privacy Technologies

JD.com places a significant emphasis on cybersecurity and data privacy, recognizing the growing volume of sensitive information it handles. The company actively invests in advanced technologies to safeguard customer data and ensure the integrity of its e-commerce platforms. This commitment is crucial given the evolving regulatory landscape in China concerning data protection. For instance, the Personal Information Protection Law (PIPL) enacted in 2021 imposes stringent requirements on how companies collect, process, and store personal data, making robust technological defenses a necessity for compliance and maintaining customer trust.

JD.com's investments in cybersecurity are not just about meeting regulatory demands; they are fundamental to its business operations. Secure transactions and the protection of user information are core to maintaining the confidence of its millions of customers. In 2023, JD.com reported a substantial increase in its IT and R&D spending, with a significant portion allocated to enhancing its security infrastructure and developing innovative privacy-preserving technologies. This proactive approach aims to mitigate risks associated with cyber threats and data breaches, which can have severe financial and reputational consequences.

Key technological factors influencing JD.com's operations include:

- Advanced Encryption: Implementing state-of-the-art encryption protocols to protect customer data both in transit and at rest.

- Threat Detection Systems: Utilizing AI-powered systems for real-time monitoring and detection of potential cybersecurity threats and breaches.

- Compliance Technologies: Employing software solutions designed to ensure adherence to China's PIPL and other relevant data privacy regulations.

- Secure Payment Gateways: Continuously upgrading payment infrastructure to prevent fraudulent transactions and protect financial information.

JD.com is heavily investing in AI and automation to optimize its logistics and supply chain operations, aiming to embed AI in 80% of its supply chain by early 2025. The company's 'Logistics Brain' system, utilizing LLMs and digital twins, is designed to reduce delivery times and stockouts. This technological advancement is crucial for maintaining a competitive edge in the fast-paced e-commerce market.

The company's deployment of robots and self-driving vehicles for last-mile delivery and warehouse automation, as seen in its 'Asia No.1' intelligent logistics parks, significantly boosts operational efficiency. JD Cloud provides the foundational infrastructure for these digital transformation initiatives, enabling seamless data flow and intelligent enhancements across the supply chain.

JD.com's commitment to IoT and smart technologies is evident in its smart warehouses, which handled over 90% of its orders in 2023, and a 25% year-over-year increase in smart appliance sales in early 2024. This integration enhances customer experience and supports the growth of its smart home ecosystem.

Cybersecurity is a paramount concern, with significant investments in advanced encryption, AI-powered threat detection, and compliance technologies to protect customer data and adhere to regulations like China's PIPL. This focus is critical for maintaining customer trust and mitigating risks in an increasingly digital landscape.

| Technology Area | JD.com's Focus | Key Metrics/Data Points |

|---|---|---|

| AI & Big Data | Supply Chain Optimization | Aiming for 80% AI integration in supply chain by early 2025; 'Logistics Brain' system |

| Automation & Robotics | Warehouse & Delivery Efficiency | Deployment in 'Asia No.1' logistics parks; last-mile delivery robots |

| IoT & Smart Technologies | Customer Experience & Ecosystem Growth | Smart warehouses handled >90% of orders in 2023; 25% YoY increase in smart appliance sales (early 2024) |

| Cybersecurity | Data Protection & Compliance | Investment in advanced encryption, AI threat detection; compliance with PIPL |

Legal factors

China's stringent data privacy framework, including the Personal Information Protection Law (PIPL) and Data Security Law (DSL), directly impacts JD.com's operations. These laws, reinforced by upcoming regulations like the 2025 Network Data Security Management Regulations, mandate rigorous standards for how the company collects, stores, and transfers user data.

JD.com must prioritize obtaining explicit user consent for data handling and ensure robust security measures are in place to prevent breaches. Non-compliance can result in substantial fines, with violations of PIPL potentially leading to penalties of up to 5% of the previous year's annual turnover or RMB 50 million, whichever is higher.

China's commitment to fostering fair competition is evident in its evolving legal framework, with the Anti-Unfair Competition Law (AUCL) set to be updated in October 2025. These laws directly impact JD.com's operational strategies, particularly concerning pricing, commission structures, and the use of algorithms to ensure market fairness.

JD.com must navigate these regulations to avoid penalties and maintain consumer trust, ensuring that its platform practices, such as promotional activities and vendor agreements, adhere to anti-monopoly principles. For instance, the State Administration for Market Regulation (SAMR) actively investigates and penalizes companies for monopolistic behavior, as seen with significant fines imposed on other major tech firms in recent years, setting a precedent for e-commerce platforms.

China's E-Commerce Law, enacted in 2019, along with other consumer protection regulations, sets a robust framework for safeguarding consumer rights. These laws cover critical areas such as product authenticity, efficient dispute resolution mechanisms, and the enforceability of electronic contracts, all of which are vital for online marketplaces like JD.com.

JD.com's business model, which heavily relies on direct sales and a commitment to product authenticity, naturally aligns with these consumer-centric legal requirements. However, maintaining strict adherence to these evolving regulations is an ongoing challenge, demanding continuous vigilance to uphold consumer trust and avoid potential liabilities.

In 2023, China's Supreme People's Court reported a significant increase in e-commerce related disputes, underscoring the importance of robust compliance. JD.com's proactive approach to product sourcing and customer service helps mitigate these risks, but the company must remain adaptable to new legal interpretations and enforcement priorities.

Labor Laws and Employment Regulations

JD.com operates within China's comprehensive labor laws, which mandate specific standards for employee rights, working conditions, and social welfare. These regulations are particularly impactful given JD.com's extensive workforce, which includes a significant number of delivery personnel and warehouse staff. Adherence to these laws is not just a legal necessity but also a cornerstone for maintaining operational continuity and a favorable corporate reputation.

The company must navigate regulations concerning minimum wage, working hours, overtime pay, and employee benefits such as health insurance and retirement contributions. For instance, China's Labor Contract Law requires formal employment contracts and outlines procedures for termination. JD.com's compliance efforts are crucial to avoid penalties and legal disputes, ensuring a stable employment environment for its over 600,000 employees as of late 2023.

- Employee Rights: JD.com must uphold provisions related to fair wages, safe working environments, and freedom from discrimination as stipulated by Chinese labor legislation.

- Working Conditions: Regulations dictate maximum working hours and mandatory rest periods, impacting the scheduling and management of JD.com's logistics and customer service teams.

- Social Welfare: The company is obligated to contribute to social insurance schemes, including pensions, medical care, and unemployment insurance, for its employees.

- Contractual Obligations: Strict adherence to labor contract requirements ensures legal employment relationships and provides a framework for dispute resolution.

Cross-Border E-commerce Regulations

Changes in cross-border e-commerce regulations, particularly around tax policies and product authorization lists, directly affect JD.com's ability to source goods internationally and sell to overseas customers. While JD.com's core operations remain domestic, any international expansion or procurement strategies necessitate strict compliance with these dynamic legal frameworks.

For instance, in 2024, many countries are reviewing and potentially increasing import duties and VAT on e-commerce goods to protect domestic industries and boost tax revenue. JD.com must actively monitor these shifts, as they can influence the cost-effectiveness of its international supply chain and the competitiveness of its cross-border offerings.

- Tax Policy Adjustments: Updates to import duties, VAT, and customs clearance fees in key markets can alter JD.com's procurement costs and pricing strategies for international products.

- Product Authorization and Standards: Evolving product safety, labeling, and import restrictions in different jurisdictions require JD.com to ensure all sourced items meet local legal requirements.

- Data Privacy and Consumer Protection: Stricter cross-border data transfer regulations and enhanced consumer protection laws in various regions necessitate robust compliance measures for JD.com's international platforms.

JD.com's operations are significantly shaped by China's evolving legal landscape, particularly concerning data privacy and fair competition. The Personal Information Protection Law (PIPL) and Data Security Law (DSL) impose strict data handling requirements, with potential fines up to 5% of annual turnover for violations, impacting data collection and user consent practices. Furthermore, updates to the Anti-Unfair Competition Law in late 2025 will influence JD.com's pricing and algorithmic strategies to ensure market fairness, with regulatory bodies like SAMR actively penalizing anti-competitive behavior.

Environmental factors

Growing environmental consciousness among consumers and stricter government regulations are compelling e-commerce giants like JD.com to prioritize sustainable packaging and minimize waste. This shift is driven by a global push for eco-friendly practices, impacting how businesses operate and engage with their customer base.

JD.com is actively addressing this by deploying smart packaging algorithms designed to optimize material usage and reduce excess packaging. Furthermore, the company is investing in paperless operations, a move that not only supports environmental goals but also aims to enhance operational efficiency and cost savings. For instance, JD.com reported a significant reduction in single-use plastic packaging, with over 1 billion fewer pieces used in their logistics network by the end of 2023, showcasing a tangible commitment to waste reduction.

JD.com's vast logistics network, encompassing numerous warehouses and delivery vehicles, is a significant contributor to its carbon emissions. In 2023, the company reported a substantial portion of its Scope 1 and Scope 2 emissions stemmed from its transportation and warehousing operations.

The company is proactively addressing this environmental factor by investing in sustainable logistics solutions. By the end of 2024, JD.com aims to have over 10,000 electric delivery vehicles operating across its network, a notable increase from its 2023 fleet size. Furthermore, its commitment to eco-warehouses, designed for energy efficiency, is expected to reduce operational carbon intensity by an estimated 15% by 2025.

JD.com is actively championing a low-carbon supply chain, integrating cutting-edge green technologies across its operations. This commitment is underscored by its proprietary carbon footprint platform, Jingtanhui, which facilitates carbon asset management for various brands.

The company's dedication to sustainability has earned it a place in China's national green technology promotion catalog, highlighting its role in advancing environmentally friendly practices. For instance, in 2023, JD.com’s logistics arm reported a 15% reduction in carbon emissions per order compared to 2022, a testament to its ongoing green initiatives.

Energy Efficiency and Renewable Energy Adoption

JD.com is actively pursuing energy efficiency and renewable energy adoption across its operations. This strategic focus is crucial for managing operational costs and aligning with global sustainability trends.

JD Property, a key component of JD.com's infrastructure, demonstrated significant progress in 2024 by generating over 38 million kWh from its self-built solar power facilities. This substantial renewable energy output directly contributed to a notable reduction in carbon dioxide emissions, underscoring the company's commitment to environmental responsibility.

- JD Property's solar power generation in 2024 exceeded 38 million kWh.

- This renewable energy directly contributes to reducing JD.com's carbon footprint.

- Investments in energy-efficient infrastructure are a core part of JD.com's sustainability strategy.

Impact of Climate Change on Logistics Operations

Climate change is increasingly impacting global logistics. More frequent and intense extreme weather events, such as typhoons, floods, and heatwaves, directly disrupt transportation routes and warehouse operations. For instance, in 2023, severe flooding in parts of China caused significant delays and damage to infrastructure, affecting supply chain efficiency across various industries.

JD.com, recognizing these environmental risks, has invested heavily in building a resilient logistics network. Their strategy includes developing advanced weather forecasting integration into route planning and establishing strategically located, flood-resistant warehouses. This proactive approach aims to mitigate the impact of climate-related disruptions and ensure the consistent delivery of goods to their customers, even amidst adverse conditions.

- Increased frequency of extreme weather events: Typhoons, floods, and extreme heat are becoming more common, posing direct threats to transportation and storage.

- Supply chain vulnerability: Disruptions can lead to delivery delays, increased costs, and potential damage to goods, impacting JD.com's operational efficiency.

- JD.com's resilience strategy: Investments in advanced weather forecasting, diversified transportation modes, and reinforced infrastructure are key to maintaining service continuity.

JD.com faces growing pressure to adopt sustainable practices, driven by consumer demand and stricter regulations. The company is actively reducing packaging waste, aiming for paperless operations, and has significantly cut single-use plastics, with over 1 billion fewer pieces used by the end of 2023.

Its extensive logistics network is a major source of emissions, but JD.com is investing in electric vehicles, targeting over 10,000 by the end of 2024, and eco-friendly warehouses expected to cut operational carbon intensity by 15% by 2025.

JD.com is also embracing renewable energy, with JD Property generating over 38 million kWh from solar power in 2024, bolstering its low-carbon supply chain initiatives and earning recognition in China's national green technology catalog.

The company is building a resilient logistics network to counter climate change impacts like extreme weather, integrating advanced forecasting and flood-resistant infrastructure to ensure consistent deliveries.

| Environmental Factor | JD.com's Action/Impact | Key Data/Target |

|---|---|---|

| Sustainable Packaging & Waste Reduction | Optimizing material usage, reducing excess packaging, promoting paperless operations. | Over 1 billion fewer single-use plastic pieces used by end of 2023. |

| Carbon Emissions from Logistics | Transitioning to electric delivery vehicles, developing energy-efficient eco-warehouses. | Target: Over 10,000 electric vehicles by end of 2024. Estimated 15% reduction in operational carbon intensity by 2025. |

| Renewable Energy Adoption | Investing in solar power facilities for operations. | JD Property generated over 38 million kWh from solar in 2024. |

| Climate Change Resilience | Integrating weather forecasting into route planning, building flood-resistant warehouses. | Mitigating disruptions from extreme weather events. |

PESTLE Analysis Data Sources

Our JD.com PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing JD.com's operations.