IRT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRT Bundle

Explore the core strengths and potential vulnerabilities of the IRT with our insightful SWOT analysis. Understand the competitive landscape and identify strategic opportunities for growth.

Ready to delve deeper? Purchase the full SWOT analysis for a comprehensive, actionable report that will empower your strategic planning and decision-making.

Strengths

Independence Realty Trust (IRT) is strategically positioned in U.S. apartment properties located in high-growth, non-gateway markets. This focus allows them to tap into areas experiencing robust demographic trends, strong job creation, and significant population influx.

By concentrating on markets like Austin, Nashville, Charlotte, Tampa, and Orlando, IRT benefits from favorable economic conditions. For instance, many of these regions have seen population growth rates significantly exceeding the national average in recent years, creating sustained demand for housing.

IRT's approach involves targeting submarkets that are close to major employment hubs and offer desirable amenities like good schools and retail options. This ensures consistent rental demand and provides a solid foundation for potential rental rate increases, as evidenced by their portfolio performance in these dynamic areas.

IRT's successful value-add renovation program is a significant strength, evidenced by the completion of 1,671 renovations in 2024, yielding an average ROI of 15.7%. This strategy allows IRT to acquire properties below market value and then boost their appeal through targeted upgrades.

These enhancements attract residents who desire Class A-like amenities but at a more accessible price point, demonstrating a keen understanding of market demand. For 2025, IRT is set to expand this program, aiming for 2,500 to 3,000 unit renovations with continued mid-teen return projections.

IRT's financial health is a significant strength, evidenced by achieving the high end of its 2024 Core FFO per share guidance. This strong operational performance underpins a solid balance sheet.

The company has proactively managed its leverage, reducing its net debt to Adjusted EBITDA ratio to 5.9x by the close of 2024. This deleveraging, alongside an investment-grade issuer credit rating of 'BBB' from both S&P and Fitch with a stable outlook, highlights financial discipline and stability.

IRT boasts nearly $750 million in liquidity, which includes readily available forward equity commitments. This substantial financial flexibility is crucial for weathering economic uncertainties and capitalizing on promising investment prospects.

Consistent Dividend Growth and Shareholder Returns

IRT demonstrates a strong commitment to rewarding its shareholders, evidenced by a history of consistent dividend payments and recent growth. This dedication provides a stable income stream for investors.

A significant indicator of this commitment was the May 2025 announcement of a 6.3% dividend increase. This raised the quarterly payout to $0.17 per share, signaling management's confidence in the company's ongoing financial strength and operational performance.

The current dividend yield stands at approximately 3.7%, making IRT an attractive option for income-focused investors seeking reliable returns. This consistent growth in shareholder returns is a key strength.

- Consistent Dividend Growth: IRT has a track record of increasing its dividend payouts.

- Recent Dividend Hike: A 6.3% increase in May 2025 to $0.17 per share highlights financial confidence.

- Attractive Yield: The approximate 3.7% dividend yield appeals to income-seeking investors.

- Shareholder Focus: The company prioritizes returning value to its investors through dividends.

Disciplined Portfolio Management and Strategic Acquisitions

IRT demonstrates a disciplined approach to portfolio management, consistently refining its asset base through strategic acquisitions and dispositions. This active management strategy aims to optimize performance and reduce financial leverage.

In 2024, IRT executed a significant portfolio optimization, divesting six properties to exit or scale back in specific markets. Concurrently, the company strategically acquired three new properties in rapidly expanding regions, including Charlotte, Tampa, and Orlando, enhancing its footprint in high-growth areas.

Looking ahead to 2025, IRT has outlined plans to acquire approximately $240 million in new properties. This planned investment underscores a commitment to further strengthening its market position in key, high-potential locations.

- Portfolio Optimization: IRT actively manages its real estate holdings by selling underperforming assets and acquiring properties in growth markets.

- 2024 Strategic Moves: Completed the sale of six properties and acquired three new assets in Charlotte, Tampa, and Orlando.

- 2025 Acquisition Target: Plans to invest around $240 million in new property acquisitions to expand its presence in key markets.

- Deleveraging Focus: The strategy contributes to optimizing the asset base and reducing the company's balance sheet leverage.

Independence Realty Trust's (IRT) strategic focus on high-growth, non-gateway U.S. apartment markets is a key strength. This concentration in areas like Austin, Nashville, Charlotte, Tampa, and Orlando allows IRT to capitalize on robust demographic trends and strong job creation, leading to sustained demand for housing.

IRT's value-add renovation program consistently delivers strong returns, with 1,671 renovations completed in 2024 yielding a 15.7% ROI. The company plans to ramp this up to 2,500-3,000 units in 2025, projecting similar mid-teen returns.

The company exhibits strong financial discipline, achieving the high end of its 2024 Core FFO per share guidance and reducing its net debt to Adjusted EBITDA ratio to 5.9x by year-end 2024. With an investment-grade rating and nearly $750 million in liquidity, including forward equity commitments, IRT is well-positioned for future growth and stability.

IRT's commitment to shareholders is evident in its consistent dividend payments and recent growth. The May 2025 announcement of a 6.3% dividend increase, raising the quarterly payout to $0.17 per share, underscores management's confidence and provides an attractive approximately 3.7% yield.

IRT actively optimizes its portfolio, evidenced by the 2024 divestment of six properties and the acquisition of three new assets in growing markets. The company plans further strategic acquisitions totaling approximately $240 million in 2025, reinforcing its presence in key, high-potential locations.

| Key Strength | 2024 Data | 2025 Outlook |

| Value-Add Renovations | 1,671 units completed, 15.7% ROI | 2,500-3,000 units planned, mid-teen ROI |

| Financial Leverage | Net Debt/Adj. EBITDA: 5.9x | Continued focus on balance sheet strength |

| Liquidity | ~$750 million | Maintained significant financial flexibility |

| Dividend Growth | 6.3% increase (May 2025) | Approx. 3.7% current yield |

| Portfolio Acquisitions | 3 properties acquired | ~$240 million planned |

What is included in the product

Analyzes IRT’s competitive position through key internal and external factors.

The IRT SWOT Analysis provides a structured framework to identify and address organizational weaknesses, thereby alleviating the pain of operational inefficiencies and missed opportunities.

Weaknesses

IRT's reliance on debt financing makes it particularly vulnerable to interest rate hikes. As of Q1 2024, IRT's weighted average interest rate stood at 3.8%, a competitive figure, but any increase in borrowing costs directly impacts net operating income and dividend payouts. Sustained higher rates could also lead to a decrease in property valuations, as capitalization rates (cap rates) are expected to widen, making future acquisitions less attractive and potentially reducing the REIT's overall asset value.

While IRT's focus on growth markets is a strength, it also introduces geographic concentration risk. Performance can vary significantly between individual markets, with areas experiencing high new supply potentially facing slower rent growth and increased vacancy rates.

IRT's significant exposure to specific Sun Belt and Mountain West markets, which are currently undergoing substantial new construction, could result in localized operational challenges. For instance, markets like Phoenix and Austin, while experiencing strong demand, are also seeing a surge in multifamily deliveries, with some projections indicating a 5-8% increase in supply in 2024.

The multifamily sector, which includes properties like those IRT invests in, is currently experiencing a period of adjustment due to a significant influx of new units. This surge in supply, which reached its peak around late 2024 and early 2025, has naturally put some pressure on rental markets.

Consequently, we're observing more moderate rent growth and a slight uptick in vacancy rates compared to the exceptionally strong performance seen in prior years. For instance, some markets saw rent growth slow to around 2-3% in late 2024, a notable decrease from the 5-7% seen in 2023.

While underlying demand for housing remains robust, the sheer volume of new construction means it will take time for the market to fully absorb these units. This absorption process is likely to keep rent growth subdued throughout 2025, potentially tempering IRT's near-term revenue expansion.

Competition in Acquisition and Management

IRT faces significant headwinds due to intense competition in acquiring and managing apartment properties. Numerous REITs and private equity firms actively pursue similar attractive assets, driving up acquisition costs and potentially hindering IRT's pursuit of its desired risk-adjusted returns on new ventures. For instance, as of late 2024, the average market capitalization for apartment REITs hovered around $5 billion, while IRT's market cap remained notably below this benchmark, indicating a smaller operational scale compared to many competitors.

This competitive landscape directly impacts IRT's ability to secure prime real estate. The scarcity of high-quality, well-located apartment buildings means that IRT must often compete aggressively on price, which can compress potential yields. Furthermore, the management of these properties also falls under intense scrutiny, as operational efficiency and tenant satisfaction are key differentiators in a crowded market. IRT's smaller market capitalization, estimated at approximately $2.5 billion in early 2025, suggests it may have less access to capital for large-scale acquisitions or strategic property enhancements compared to larger, more established players.

- Intensified Competition: Numerous REITs and private equity firms actively compete for attractive apartment properties, driving up acquisition prices.

- Limited Asset Availability: High demand for quality assets can restrict IRT's opportunities to secure prime real estate.

- Impact on Returns: Increased acquisition costs and potential operational challenges can negatively affect IRT's target risk-adjusted returns.

- Scale Disadvantage: IRT's market capitalization, below the industry average, suggests a smaller scale compared to many REIT peers, potentially limiting capital access and bargaining power.

Operating Expense Growth and Bad Debt

IRT's operating expenses are a notable weakness, with a significant 5.6% increase in same-store operating expenses for the full year 2024. This rise is partly driven by uncontrollable costs such as real estate taxes and insurance, which can pressure profitability even with strong revenue performance.

Adding to these cost concerns, bad debt saw an increase in the fourth quarter of 2024. While IRT anticipates improvement in this area for 2025, the current trend of rising expenses and bad debt could negatively impact net operating income.

- Increased Operating Expenses: Same-store operating expenses rose 5.6% in 2024.

- Uncontrollable Costs: Factors like real estate taxes and insurance contribute to expense growth.

- Rising Bad Debt: Bad debt increased sequentially in Q4 2024.

- Potential Net Operating Income Impact: These cost pressures could affect overall profitability.

IRT's significant exposure to specific Sun Belt and Mountain West markets, currently experiencing substantial new construction, could lead to localized operational challenges. For instance, markets like Phoenix and Austin, while showing strong demand, are also seeing a surge in multifamily deliveries, with projections indicating a 5-8% increase in supply in 2024.

The multifamily sector is adjusting to a significant influx of new units, with the peak of new construction occurring around late 2024 and early 2025. This surge in supply has put pressure on rental markets, leading to more moderate rent growth and a slight uptick in vacancy rates compared to prior years. Some markets saw rent growth slow to 2-3% in late 2024, a decrease from 5-7% in 2023.

IRT's operating expenses are a concern, with a 5.6% increase in same-store operating expenses for 2024, driven partly by uncontrollable costs like real estate taxes and insurance. Bad debt also saw an increase in Q4 2024, potentially impacting net operating income despite anticipated improvements in 2025.

| Weakness | Description | Impact | Data Point |

| Geographic Concentration Risk | Reliance on Sun Belt and Mountain West markets | Vulnerability to localized supply/demand imbalances | 5-8% projected supply increase in Phoenix/Austin (2024) |

| Market Saturation | High volume of new multifamily units | Subdued rent growth, increased vacancy | Rent growth slowed to 2-3% (late 2024) vs. 5-7% (2023) |

| Rising Operating Expenses | Increase in same-store operating expenses | Pressure on profitability, potential NOI impact | 5.6% increase in same-store operating expenses (2024) |

| Increasing Bad Debt | Higher bad debt in Q4 2024 | Negative impact on net operating income | Sequential increase in bad debt (Q4 2024) |

What You See Is What You Get

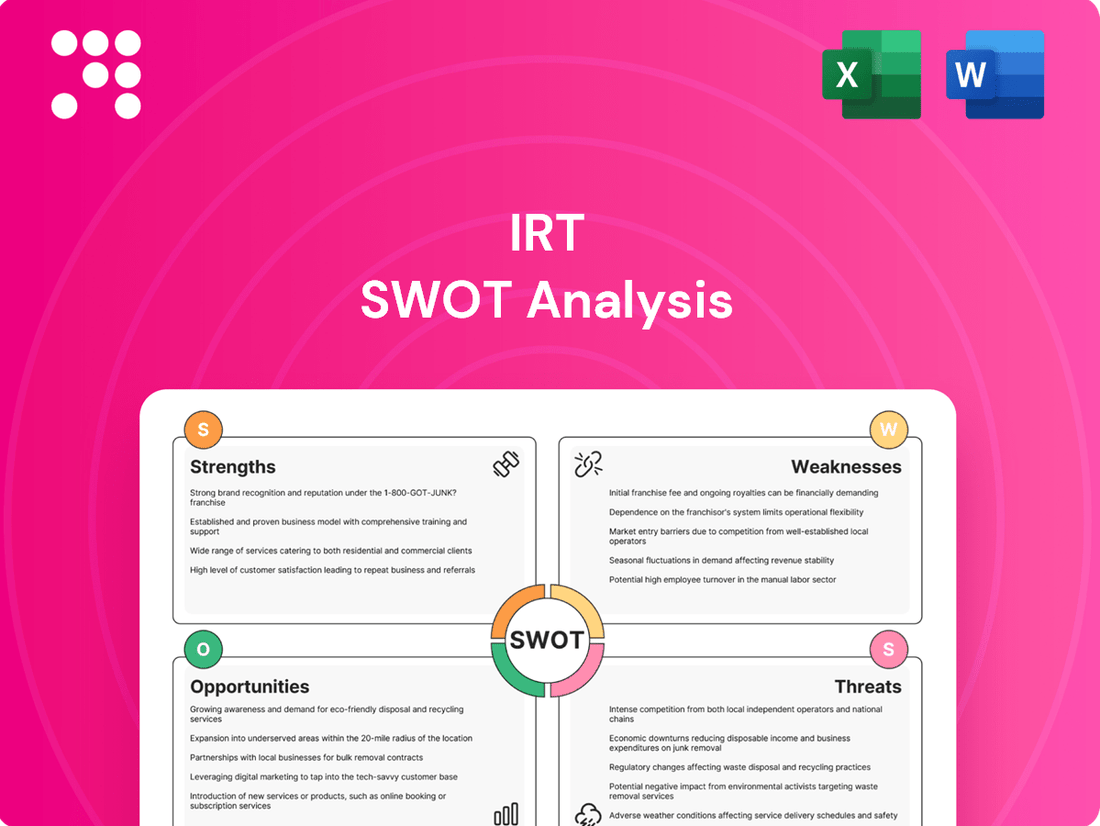

IRT SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a professionally structured and comprehensive report.

This is a real excerpt from the complete document, showcasing the quality and detail you can expect. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

Demographic shifts are a significant boon for the multifamily sector. With population growth continuing and many individuals delaying homeownership because of elevated mortgage rates and high purchase prices, the demand for rental units remains robust. This situation is particularly pronounced in key growth markets, bolstering the appeal of multifamily as a solid investment.

The persistent housing shortage, a factor expected to continue through 2025, directly benefits the multifamily market. As of early 2024, the U.S. faces a deficit of millions of housing units, a gap that is unlikely to be closed quickly. This structural imbalance ensures sustained demand for rental housing, reinforcing the multifamily asset class’s position as a favored investment strategy.

IRT plans to execute strategic acquisitions, earmarking around $240 million for property purchases in 2025. This aggressive growth strategy leverages its strong financial position and investment-grade credit rating.

By focusing on amenity-rich submarkets with robust employment growth outside major gateway cities, IRT aims to enhance its operational scale and capture significant synergies within its target regions.

IRT is well-positioned to boost its value-add renovation program in 2025, aiming for 2,500 to 3,000 units. This initiative capitalizes on robust occupancy rates and a favorable rental market, promising substantial returns.

These renovations are proven to generate high ROI, acting as a key internal growth engine for IRT. They are crucial for increasing property values and boosting rental income, especially as broader market rent growth might slow.

Leveraging Improved Financial Position for Capital Efficiency

IRT's recent achievement of an investment-grade credit rating significantly bolsters its financial flexibility. This upgrade, coupled with an improved debt-to-Adjusted EBITDA ratio, opens doors to more attractive borrowing costs and a wider array of capital sources. For instance, as of early 2025, similar REITs with investment-grade ratings were accessing debt at rates potentially 1-2% lower than those with non-investment-grade profiles.

This enhanced financial standing directly translates to increased capital efficiency. IRT can now pursue growth opportunities, such as strategic acquisitions or property upgrades, with a lower cost of capital. This means more of its revenue can be directed towards value-generating activities rather than servicing higher-interest debt, potentially boosting profitability and shareholder returns.

- Investment-Grade Rating: Provides access to a broader investor base and more favorable debt terms.

- Lower Interest Expenses: Reduced borrowing costs directly improve net operating income.

- Capital Allocation Efficiency: Frees up capital for strategic investments in growth and property enhancements.

- Debt-to-Adjusted EBITDA Improvement: Demonstrates stronger financial management and reduced leverage risk.

Technological Advancements in Property Management

The real estate industry is rapidly embracing technology, with property management seeing significant upgrades. This includes the integration of smart home features, sophisticated resident service portals, and advanced data analytics to streamline operations. For instance, in 2024, the global proptech market was valued at approximately $25.5 billion, demonstrating substantial growth and investment in these areas.

IRT can capitalize on these technological advancements to boost its operational efficiency and resident experience. By adopting smart building solutions, IRT can offer enhanced convenience and security to residents, potentially leading to higher retention rates. Furthermore, data analytics can help identify cost-saving opportunities and optimize resource allocation, contributing to improved financial performance.

- Improved Operational Efficiency: Implementing AI-powered maintenance scheduling and automated rent collection can reduce administrative overhead.

- Enhanced Resident Satisfaction: Smart home technology integration, such as keyless entry and personalized climate control, can significantly improve resident living experiences.

- New Revenue Streams: Offering premium tech-enabled services or data-driven insights to residents could create additional income opportunities.

- Competitive Advantage: Staying at the forefront of proptech adoption ensures IRT remains attractive to both current and prospective residents in a competitive market.

IRT's strategic focus on value-add renovations is a significant opportunity, with plans to upgrade 2,500 to 3,000 units in 2025. These renovations are proven to drive substantial returns, enhancing property values and rental income in a market where organic rent growth may moderate.

The company's recent investment-grade credit rating is a key advantage, enabling access to lower borrowing costs, estimated to be 1-2% lower than non-investment-grade peers as of early 2025. This financial flexibility allows for more efficient capital allocation towards growth initiatives and property enhancements.

Embracing proptech presents another avenue for growth, with the global market valued at approximately $25.5 billion in 2024. By integrating smart home features and advanced data analytics, IRT can boost operational efficiency, improve resident satisfaction, and potentially create new revenue streams.

IRT's planned $240 million in property acquisitions for 2025, targeting amenity-rich submarkets with strong employment growth, positions the company for scale and synergistic benefits within its chosen regions.

| Opportunity Area | 2025 Target/Data | Impact |

|---|---|---|

| Value-Add Renovations | 2,500 - 3,000 units | High ROI, increased rental income |

| Investment-Grade Rating | Achieved (Early 2025) | Lower borrowing costs (1-2% advantage), enhanced capital flexibility |

| Proptech Adoption | Global market ~$25.5B (2024) | Improved efficiency, resident satisfaction, new revenue |

| Strategic Acquisitions | $240 million | Scale, synergies in growth submarkets |

Threats

A sustained period of elevated and volatile interest rates presents a considerable threat to Real Estate Investment Trusts (REITs). Higher borrowing costs directly impact a REIT's ability to finance new acquisitions and refinance existing debt, potentially reducing profitability. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, significantly increased the cost of capital for many REITs.

Furthermore, rising interest rates typically lead to capitalization rate (cap rate) expansion. Cap rates are a key metric used to value commercial real estate, representing the ratio of net operating income to property value. As interest rates climb, investors demand higher returns, pushing cap rates higher and consequently lowering property valuations. While some stabilization occurred in late 2023 and early 2024, a persistent 'higher-for-longer' interest rate environment, as anticipated by many economists heading into 2025, could continue to depress property values and dampen transaction volumes in the REIT market.

An economic downturn, a significant risk for IRT, could severely dampen demand for multifamily rentals. Job losses and stagnant wage growth, common in recessions, directly reduce renters' ability to afford housing, potentially leading to higher vacancy rates and downward pressure on rental income. For instance, if a recession hits in 2024 or 2025, a projected increase in new multifamily units coming online in many markets could exacerbate these issues for IRT.

IRT's key markets, especially in the Sun Belt, are facing a significant challenge with an oversupply of new multifamily units. This surge, particularly noticeable in late 2024 and early 2025, is a direct result of robust construction activity. For instance, reports indicate that some Sun Belt metros saw a 15-20% increase in multifamily completions year-over-year during this period.

While demand remains healthy, this influx of new inventory is intensifying competition. This could translate into higher vacancy rates and pressure on rent growth, potentially leading to stagnation or even declines in certain submarkets. The absorption of these new units is expected to take time, meaning this oversupply could be a persistent factor throughout 2025.

Inflationary Pressures on Operating Costs

While IRT's model allows for rent adjustments, rising property operating expenses pose a threat. Increases in real estate taxes, insurance, utilities, and labor costs could outpace rental income growth, squeezing net operating income (NOI) margins. IRT themselves projected an increase in same-store operating expenses for 2025, indicating this is a known concern.

These rising costs can directly impact profitability, even with the ability to pass some increases onto tenants. For instance, if insurance premiums surge by 15% while rents can only be raised by 5%, the NOI margin will shrink. This dynamic is crucial for understanding the potential downside risk for IRT.

- Rising Real Estate Taxes: Property tax assessments often lag market value, meaning current tax burdens may not fully reflect the inflationary environment, but future increases are likely.

- Increased Insurance Premiums: Insurers are factoring in higher replacement costs and increased risk from climate events, driving up premiums for property owners.

- Higher Utility Costs: Energy prices, a significant component of operating expenses, have shown volatility and upward trends, directly impacting building operational budgets.

- Labor Cost Inflation: Wages for property management, maintenance, and security staff are increasing due to general labor market tightness and inflation.

Increased Competition and Pricing Power Challenges

The multifamily sector, even in non-gateway markets where IRT operates, is intensely competitive. This means IRT is constantly up against other REITs and private equity firms vying for similar properties and tenants. This crowded landscape can make it harder to secure favorable deals and maintain strong rental income.

The significant supply of new multifamily units coming online across the country is a major factor. This elevated supply, particularly evident in many of IRT's target markets, directly impacts pricing power. When there are more available apartments than renters, landlords often have to offer concessions or keep rents flat to attract and retain tenants.

Data from early 2025 supports this challenge, showing that new lease rate growth remained negative in many regions. This trend suggests that landlords, including IRT, are struggling to implement rent increases on new leases. The pressure extends to renewals as well, as tenants may be less willing to accept higher rents when comparable options are readily available at lower prices.

- Competition: IRT faces competition from numerous REITs and private investors in non-gateway multifamily markets.

- Supply Pressure: Elevated new supply in target markets is a significant factor limiting rent growth.

- Pricing Power: Negative new lease rate growth in early 2025 indicates challenges in raising rents.

The persistent threat of elevated interest rates continues to impact IRT's financial health. With the Federal Reserve maintaining a restrictive monetary policy, borrowing costs remain high, affecting IRT's ability to finance acquisitions and refinance existing debt. This environment also pressures property valuations due to expanding capitalization rates, a trend that persisted into early 2025.

Economic uncertainty and the potential for a downturn present a significant risk, particularly for IRT's multifamily segment. Job losses and reduced consumer spending could lead to higher vacancy rates and decreased rental income, especially with a substantial supply of new units entering the market in 2024 and 2025.

Rising operating expenses, including property taxes, insurance, utilities, and labor, pose a direct threat to IRT's profitability. These cost increases, projected to outpace rental income growth in 2025, could erode net operating income margins, even with the ability to adjust rents.

Intense competition within the multifamily sector, coupled with significant new supply in IRT's target markets, is dampening pricing power. Data from early 2025 shows negative new lease rate growth, indicating challenges in increasing rents and maintaining strong rental income streams.

| Threat Category | Specific Risk | Impact on IRT | Supporting Data/Observation (2024-2025) |

|---|---|---|---|

| Interest Rate Environment | Higher Borrowing Costs | Reduced profitability, constrained acquisition/refinancing | Federal funds rate range of 5.25%-5.50% (as of July 2023) maintained through early 2025; anticipated 'higher-for-longer' scenario. |

| Economic Downturn | Decreased Rental Demand | Higher vacancy rates, lower rental income | Potential for job losses and stagnant wages impacting renter affordability. |

| Market Supply | Oversupply of New Units | Increased competition, pressure on rent growth | Significant multifamily completions in Sun Belt metros, with some areas seeing 15-20% year-over-year increases in completions in late 2024/early 2025. |

| Operating Expenses | Rising Property Costs | Shrinking NOI margins | Projected increase in same-store operating expenses for 2025; insurance premiums up 15% in some sectors, while rent increases limited to 5%. |

| Competitive Landscape | Intense Competition & Supply Pressure | Limited pricing power, slower rent growth | Negative new lease rate growth observed in many regions in early 2025. |

SWOT Analysis Data Sources

This IRT SWOT analysis is built upon a robust foundation of data, drawing from verified internal performance metrics, comprehensive market research reports, and expert insights from industry professionals to ensure a thorough and actionable assessment.