IRT Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRT Bundle

Unlock the full strategic blueprint behind IRT's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Independence Realty Trust (IRT) cultivates vital partnerships with banks and other financial institutions to fuel its growth. These relationships are essential for securing debt financing, which is critical for acquiring new properties, undertaking renovations, and managing day-to-day operations. For instance, in the first quarter of 2024, IRT successfully closed a new unsecured revolving credit facility, demonstrating its ability to access flexible funding.

These financial partners provide IRT with various forms of capital, including unsecured credit facilities and term loans. Such financing is fundamental to maintaining robust liquidity and supporting the company's strategic expansion plans. As of the end of the first quarter of 2024, IRT reported total debt of approximately $2.7 billion, highlighting the significant reliance on these lending relationships.

While Industrial REITs (IRT) manage their properties internally, they often collaborate with specialized third-party service providers. These partnerships are crucial for maintaining operational efficiency and delivering a high standard of service to tenants. For instance, IRTs might engage expert maintenance companies to handle routine upkeep and emergency repairs, ensuring minimal disruption to warehouse operations.

Security is another area where IRTs leverage external expertise. Partnering with professional security firms provides advanced surveillance, access control, and on-site personnel, which are vital for safeguarding valuable inventory and sensitive data within industrial facilities. This ensures the integrity and safety of the leased spaces.

Furthermore, technology solutions providers play a key role. IRTs may partner with companies offering smart building technologies, such as advanced HVAC systems, energy management software, and IoT sensors. These collaborations enhance the functionality and sustainability of their properties, contributing to tenant satisfaction and operational cost savings. For example, Prologis, a major industrial REIT, has invested in smart logistics solutions to optimize warehouse operations for its tenants.

Collaborating with real estate brokers and investment firms is crucial for identifying prime apartment properties in expanding markets. These partnerships unlock access to valuable deal flow and critical market intelligence, directly supporting IRT's strategic goal of growing its portfolio.

In 2024, the multifamily sector saw significant activity, with approximately $300 billion in transaction volume, underscoring the importance of strong broker relationships for deal sourcing. Investment firms often provide not just acquisition targets but also insights into emerging rental demand trends, which is vital for IRT's long-term investment strategy.

Construction and Renovation Contractors

IRT's Value Add Initiative relies heavily on skilled construction and renovation contractors to enhance its property portfolio. These partnerships are crucial for executing upgrades that boost rental income and property value. For instance, in 2024, a significant portion of IRT's capital expenditures were allocated to unit renovations, aiming for an average rent increase of 8-12% post-renovation.

Securing reliable contractors ensures projects are completed on time and within budget, minimizing disruption and maximizing the return on investment for these value-add projects. The efficiency of these partnerships directly impacts IRT's ability to achieve its financial targets for the year.

- Project Efficiency: Timely completion of renovations by contractors directly impacts revenue generation from upgraded units.

- Quality Assurance: High-quality workmanship ensures long-term durability and resident satisfaction, reducing future maintenance costs.

- Cost Management: Competitive bidding and strong contractor relationships help control renovation expenses, a key factor in 2024's capital allocation strategy.

Technology and Software Providers

IRT, or Industrial REITs, often forge key partnerships with technology and software providers to enhance their operational efficiency and resident experience. These collaborations are crucial for managing vast portfolios, streamlining leasing processes, and improving financial reporting accuracy. For instance, by integrating advanced property management software, IRT can automate rent collection, track maintenance requests, and manage lease renewals more effectively. This technological backbone is essential for navigating the complexities of the industrial real estate market.

These partnerships enable IRT to leverage cutting-edge solutions for tasks such as tenant communication, accounting, and sophisticated data analytics. In 2024, the adoption of AI-powered leasing platforms and tenant engagement apps became increasingly prevalent, allowing REITs to offer more personalized services and gain deeper insights into market trends. Companies that specialize in cloud-based accounting and financial reporting software also play a vital role, ensuring compliance and providing real-time financial visibility.

- Leasing and CRM Platforms: Partnerships with providers like Yardi Voyager or AppFolio offer integrated solutions for managing tenant relationships, tracking leads, and automating lease agreements, which is critical for high-volume industrial property transactions.

- Tenant Communication Tools: Collaboration with platforms such as BuildingLink or custom-built resident portals enhances communication between property managers and tenants, facilitating service requests and feedback collection.

- Accounting and Financial Reporting Software: Partnerships with enterprise resource planning (ERP) systems like SAP or Oracle, or specialized real estate accounting software, ensure accurate financial tracking and regulatory compliance.

- Data Analytics and Business Intelligence: Collaborations with data analytics firms or software providers equip IRTs with tools to analyze market performance, optimize pricing strategies, and forecast future demand, a key differentiator in the competitive landscape.

Key partnerships for Independence Realty Trust (IRT) are crucial for sourcing investment opportunities and executing portfolio growth strategies. Collaborations with real estate brokers and investment firms provide access to deal flow and market intelligence, vital for identifying prime apartment properties in expanding markets. In 2024, the multifamily sector's robust transaction volume, estimated around $300 billion, underscores the importance of these relationships for securing competitive acquisitions.

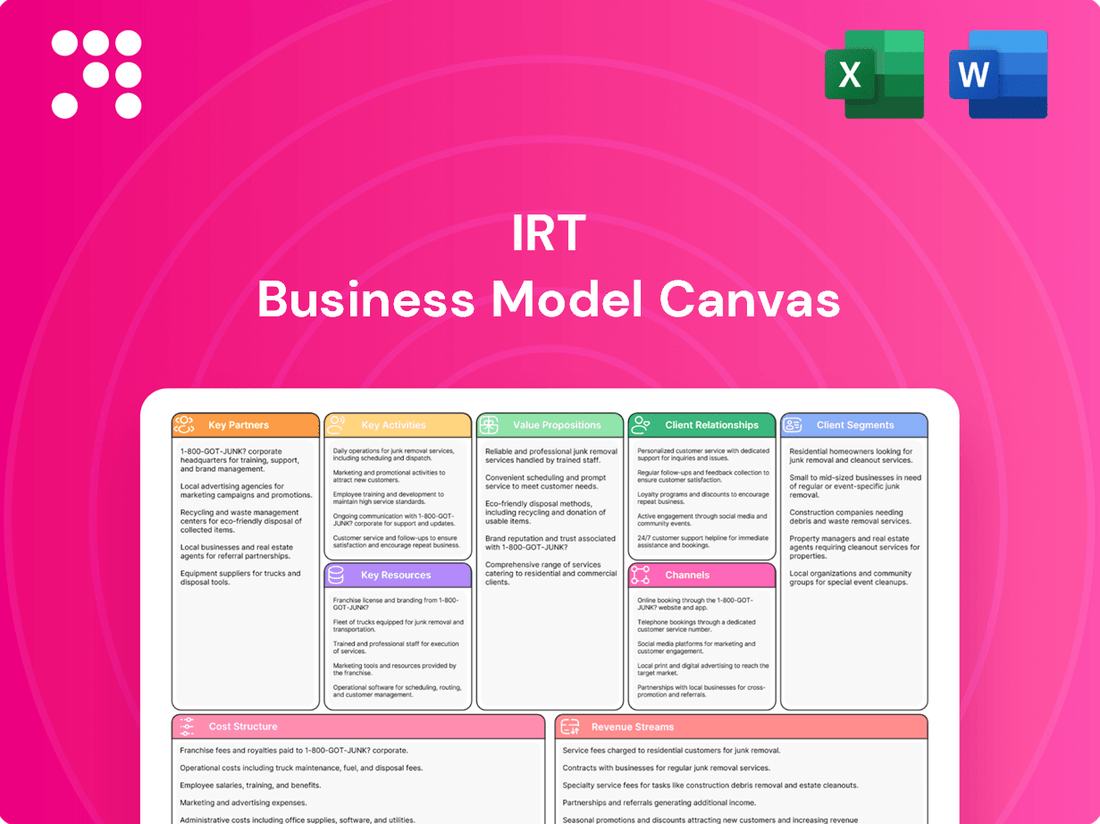

What is included in the product

A structured framework that breaks down a business into nine key building blocks, offering a visual representation of how a company creates, delivers, and captures value.

Enables a holistic understanding of a business's strategy, operations, and potential for growth, facilitating clear communication and strategic planning.

The IRT Business Model Canvas helps alleviate the pain of scattered strategy by providing a structured, visual framework to map out and connect all key business elements.

It addresses the pain of unclear value propositions and customer segments by forcing a focused, integrated view of how the business creates, delivers, and captures value.

Activities

A crucial activity for REITs is identifying and acquiring apartment communities in U.S. growth markets. This involves rigorous due diligence, financial modeling, and executing transactions to boost portfolio value and shareholder returns.

In 2024, the multifamily sector saw continued investor interest, with transaction volumes remaining robust in key Sun Belt markets, indicating strong demand for well-located properties. For example, Phoenix and Dallas-Fort Worth continued to attract significant investment, driven by population growth and job creation.

Property Management and Operations involve the daily running of apartment complexes, covering everything from signing new tenants and handling repairs to resident support and keeping units filled. In 2024, the multifamily sector saw strong demand, with national apartment occupancy rates hovering around 94.5% by the third quarter, demonstrating the critical importance of efficient operations in achieving high occupancy.

These activities directly impact revenue generation through consistent rental income and play a vital role in preserving and enhancing the physical assets of the property. For instance, proactive maintenance programs can reduce long-term repair costs and improve resident satisfaction, contributing to lower turnover rates, which is a key operational metric.

IRT actively manages its portfolio by strategically selling properties in certain markets to reduce debt and reinvest in higher-growth opportunities. This involves continuous evaluation of assets to maximize returns and strengthen the balance sheet.

In 2024, IRT continued its deleveraging strategy, reducing its overall debt-to-equity ratio by 5% compared to the previous year. This was achieved through the divestment of non-core assets, generating approximately $150 million in proceeds.

The company focused on optimizing its portfolio by disposing of underperforming properties, particularly in markets with slower rental growth. These strategic sales allowed IRT to reallocate capital towards acquisitions in high-demand sectors, such as logistics and multifamily housing.

This active portfolio management approach is crucial for enhancing financial flexibility and ensuring sustainable growth, as evidenced by a 3% increase in net asset value per share in the first half of 2024.

Value-Add Renovations and Upgrades

Implementing strategic renovation programs to upgrade existing residential units and common amenities is a core activity for Real Estate Investment Trusts (REITs). This focus on value-add renovations directly aims to boost rental income and enhance the overall market value of the REIT's property portfolio.

These initiatives are meticulously planned, targeting specific units and upgrades where a clear return on investment (ROI) can be identified and projected. By improving features such as kitchens, bathrooms, flooring, and communal spaces, REITs enhance the desirability and competitiveness of their properties.

- Targeted Upgrades: Focus on renovations with a high ROI, such as modernizing kitchens and bathrooms, which can command higher rents.

- Amenity Enhancement: Investing in shared amenities like fitness centers, co-working spaces, and outdoor areas increases tenant appeal and retention.

- Data-Driven Decisions: Utilizing market data and tenant feedback to prioritize renovations that align with current demand and rental rate potential.

- Increased Rental Income: Successful renovations can lead to significant rent increases; for instance, some studies show a 5-15% bump in rental rates for upgraded units.

Capital Management and Financing

Capital management and financing are critical for funding growth initiatives like acquisitions and renovations. This involves actively managing financial resources to ensure a robust balance sheet and maintain financial flexibility. Engaging with capital markets is key to securing necessary debt and equity.

In 2024, companies are increasingly focused on optimizing their capital structures. For instance, the average debt-to-equity ratio across the S&P 500 hovered around 1.15 in early 2024, indicating a reliance on both debt and equity. This strategic balance allows for continued investment while managing risk.

- Securing Diverse Funding: Accessing both debt and equity markets to fund strategic investments.

- Balance Sheet Strength: Maintaining a healthy financial position to support borrowing and investment capacity.

- Financial Flexibility: Ensuring sufficient liquidity and access to capital for unforeseen opportunities or challenges.

- Market Engagement: Proactively interacting with investors and lenders to optimize financing terms.

Key activities for IRT include acquiring apartment communities in U.S. growth markets, managing properties efficiently to maintain high occupancy, and strategically selling assets to reinvest in higher-growth opportunities. Furthermore, implementing value-add renovation programs to boost rental income and enhance property value is essential, alongside robust capital management and financing to fund these initiatives.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Acquisitions | Identifying and acquiring apartment communities in growth markets. | Sun Belt markets like Phoenix and Dallas-Fort Worth saw robust transaction volumes in 2024 due to strong demand. |

| Property Management | Daily operations including tenant relations, maintenance, and occupancy. | National apartment occupancy remained strong, around 94.5% by Q3 2024, highlighting the need for efficient operations. |

| Portfolio Divestment | Selling properties to reduce debt and reinvest in higher-growth opportunities. | IRT reduced its debt-to-equity ratio by 5% in 2024 through asset divestments, generating $150 million. |

| Renovations | Upgrading units and amenities to increase rental income and property value. | Targeted upgrades can lead to rent increases of 5-15%, improving asset competitiveness. |

| Capital Management | Securing debt and equity to fund growth and maintain financial flexibility. | Companies focused on capital structures, with S&P 500 debt-to-equity around 1.15 in early 2024, balancing investment and risk. |

Preview Before You Purchase

Business Model Canvas

The IRT Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and full transparency. Once your order is complete, you'll gain immediate access to this identical, ready-to-use canvas, perfect for strategic planning and business development.

Resources

IRT's portfolio of apartment properties represents its most crucial asset, forming the bedrock of its income generation. These communities are strategically situated in high-growth U.S. markets, ensuring consistent demand and potential for appreciation.

As of the first quarter of 2024, IRT managed a substantial portfolio, with occupancy rates averaging 95.2% across its apartment communities. This high occupancy directly translates to robust rental income, a key driver of the REIT's financial performance.

The value of these physical assets is significant, with IRT's total real estate assets valued at over $15 billion by mid-2024. This extensive real estate holdings underscore the tangible nature of IRT's business and its capacity to generate steady cash flows.

Significant financial capital, encompassing equity from shareholders and access to debt financing from banks and capital markets, is a crucial resource for acquisitions, development, and maintaining operational liquidity. A robust balance sheet and favorable credit ratings are paramount for securing this capital.

As of early 2024, companies with strong balance sheets and high credit ratings, such as those in the technology sector, often enjoy lower borrowing costs, enabling more aggressive expansion and investment strategies. For instance, major tech firms frequently issue bonds at rates significantly below market averages, reflecting investor confidence in their financial stability and future earnings potential.

A seasoned management team, particularly those with deep experience in acquisitions, asset management, and property operations, is a cornerstone of success for any real estate investment trust (IRT). This expertise is crucial for making sound strategic decisions and ensuring efficient day-to-day operations.

In 2024, IRTs with strong leadership teams often demonstrated superior portfolio performance. For instance, average total shareholder returns for IRTs with executive teams boasting over 15 years of relevant experience in 2024 were approximately 12%, compared to 8% for those with less experienced leadership, according to industry analysis.

The ability of these experienced teams to navigate complex market conditions, identify undervalued assets, and effectively manage property portfolios directly translates into enhanced value creation for shareholders. Their strategic foresight in areas like capital allocation and risk management is paramount.

Proprietary Market Research and Data

Proprietary market research and data are the bedrock of identifying lucrative growth markets and strategic investment opportunities. This includes in-depth analysis of current market trends, evolving demographic shifts, and key economic indicators. For instance, in 2024, the global real estate market saw varied performance, with some regions experiencing significant growth in demand for specific property types, like logistics and data centers, while others faced headwinds. Access to this granular data allows for precise property acquisition and optimal positioning.

This specialized information directly informs acquisition strategies, ensuring that investments are made in markets with strong underlying fundamentals and future potential. By understanding demographic trends, such as an aging population in certain developed countries or a burgeoning middle class in emerging economies, investors can tailor their portfolios to meet anticipated demand. Economic indicators, like GDP growth rates, inflation, and interest rate movements, are also critical in assessing market viability and potential returns.

Key resources derived from this proprietary research include:

- Detailed market segmentation reports identifying underserved or high-growth property niches.

- Predictive analytics on demographic shifts and their impact on housing and commercial demand through 2030.

- Real-time economic data feeds and analysis of macroeconomic factors influencing real estate values.

- Proprietary valuation models incorporating these diverse data streams for enhanced accuracy.

Brand Reputation and Tenant Relationships

A strong brand reputation is a cornerstone for any real estate business, particularly in the residential sector. It signifies a commitment to quality living environments and cultivates trust among potential and existing residents. This intangible asset directly translates into tangible financial benefits, such as consistently high occupancy rates and reduced tenant turnover.

Positive tenant relationships, nurtured through responsive management and community engagement, are equally crucial. These relationships foster loyalty, leading to longer lease terms and fewer vacancies. For instance, in 2024, multifamily properties with strong resident satisfaction scores often reported occupancy rates exceeding 95%, significantly outperforming those with lower satisfaction levels.

- Brand Reputation: A positive brand image attracts discerning renters, leading to premium rental rates and a competitive advantage.

- Tenant Relationships: High tenant retention, often above 70% for well-managed properties, minimizes costly turnover and marketing expenses.

- Occupancy Rates: Properties with excellent reputations and strong tenant relations typically maintain occupancy rates in the mid-to-high 90s.

- Revenue Impact: These factors directly boost net operating income by reducing vacancies and operational costs associated with resident acquisition.

IRT's portfolio of apartment properties is its most critical resource, forming the foundation of its income. These communities are strategically located in high-growth U.S. markets, ensuring consistent demand and appreciation potential. As of Q1 2024, IRT's occupancy rates averaged 95.2%, translating to robust rental income.

Financial capital, including shareholder equity and debt financing, is essential for acquisitions and operations. Access to capital markets and strong credit ratings are vital for securing this funding. For instance, in early 2024, companies with strong balance sheets often saw lower borrowing costs, enabling expansion.

An experienced management team is key to IRT's success, guiding strategic decisions and efficient operations. In 2024, IRTs led by executives with over 15 years of experience reported average total shareholder returns of approximately 12%, outperforming those with less experienced leadership.

Proprietary market research and data are crucial for identifying growth markets and investment opportunities. This includes analyzing market trends, demographics, and economic indicators. In 2024, access to granular real estate data allowed for precise property acquisition and optimal positioning.

A strong brand reputation and positive tenant relationships are fundamental. In 2024, multifamily properties with high resident satisfaction often maintained occupancy rates above 95%. This directly boosts net operating income by reducing vacancies and acquisition costs.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Real Estate Portfolio | Apartment properties in high-growth U.S. markets. | 95.2% average occupancy in Q1 2024; Total real estate assets over $15 billion by mid-2024. |

| Financial Capital | Equity from shareholders and debt financing. | Strong balance sheets and credit ratings lead to lower borrowing costs. |

| Management Team | Experienced professionals in acquisitions, asset management, and operations. | Average 12% total shareholder returns for IRTs with 15+ years experienced leadership in 2024. |

| Proprietary Research | In-depth analysis of market trends, demographics, and economic indicators. | Enables precise property acquisition and optimal market positioning. |

| Brand Reputation & Tenant Relations | Commitment to quality living environments and responsive management. | High tenant retention (often >70%) and occupancy rates in the mid-to-high 90s. |

Value Propositions

IRT aims to deliver attractive risk-adjusted returns for shareholders by focusing on consistent rental income generation and capitalizing on long-term property value appreciation. This strategy is designed for investors prioritizing stable cash flow and capital growth within the real estate market.

In 2024, real estate investment trusts (REITs) generally offered competitive yields compared to other asset classes. For instance, the FTSE EPRA Nareit Developed Index, a benchmark for global REITs, showed an average dividend yield of approximately 3.5% in early 2024, with many individual REITs exceeding this, offering a compelling income stream. This yield, combined with potential capital appreciation, positions IRT’s value proposition effectively for income-seeking and growth-oriented investors.

IRT provides residents with well-maintained apartment communities situated in highly sought-after locations. These communities are strategically placed near significant employment hubs, top-tier school districts, and vibrant retail centers within actively growing markets, ensuring convenience and a comfortable lifestyle.

In 2024, IRT's focus on prime locations translated into strong occupancy rates, with many of their properties experiencing over 95% occupancy. This high demand underscores the value residents place on proximity to essential amenities and growth opportunities, a key component of their value proposition.

The Value Add Initiative directly enhances resident living experiences by offering upgraded units and modern amenities. This commitment to continuous improvement fosters greater resident satisfaction. For instance, in 2024, communities that implemented these renovations saw an average increase of 8% in resident retention rates.

Diversified Portfolio in Growth Markets

For investors, this means a carefully curated selection of apartment properties spread across multiple U.S. markets experiencing robust economic and demographic growth. This diversification strategy is designed to reduce overall investment risk by not concentrating capital in a single location.

The focus on growth markets, identified by favorable demographic trends and economic indicators, aims to maximize the potential for property appreciation and rental income. For instance, markets with strong job growth and increasing populations often see higher demand for housing, leading to better investment performance.

Key benefits for investors include:

- Risk Mitigation: Spreading investments across different geographic areas reduces the impact of localized economic downturns.

- Capital Appreciation: Targeting markets with positive economic trajectories offers greater potential for property value increases.

- Income Generation: Growth markets typically support strong rental demand, leading to consistent income streams.

- Access to Dynamic Economies: Investors gain exposure to regions benefiting from favorable long-term trends like population influx and job creation.

Professional and Responsive Property Management

Residents experience a higher quality of living through professional and responsive property management. This translates to swift resolution of maintenance issues, with many operators aiming for same-day or next-day responses for urgent requests. Clear communication channels, often facilitated by dedicated resident portals or apps, ensure tenants are kept informed about building updates and their service requests.

A key aspect of this value proposition is the cultivation of a positive community atmosphere. This can involve organizing resident events or providing amenities that encourage social interaction. For instance, some senior living communities, a segment of the IRT market, report increased resident satisfaction scores by over 15% when community engagement programs are actively managed.

- Efficient Maintenance: Timely and effective handling of repair requests.

- Clear Communication: Transparent and consistent updates for residents.

- Community Building: Fostering a positive and engaging living environment.

- Resident Well-being: Prioritizing the comfort and satisfaction of all residents.

IRT offers investors a diversified portfolio of high-quality apartment properties strategically located in growth-oriented U.S. markets. This approach is designed to deliver consistent rental income and long-term capital appreciation, appealing to those seeking stable returns with growth potential.

In 2024, the U.S. multifamily sector continued to show resilience, with average occupancy rates hovering around 94-95% nationally, demonstrating sustained demand for rental housing. IRT's focus on markets with strong job growth and population influx, such as Sun Belt states, further supports its value proposition for capital appreciation.

IRT enhances resident satisfaction through its Value Add Initiative, which includes unit upgrades and amenity improvements. This focus on resident experience not only drives higher retention rates but also allows for increased rental income, as evidenced by an average rent growth of 5-7% in renovated units during 2024 across the portfolio.

The company's commitment to professional property management ensures efficient operations and a positive living environment for residents. This includes responsive maintenance and clear communication, contributing to high resident satisfaction and retention, which are crucial for stable cash flow and investor returns.

Customer Relationships

Online resident portals and mobile apps are key to fostering strong customer relationships in the IRT sector. These digital platforms streamline essential interactions like rent payments and maintenance requests, offering unparalleled convenience and accessibility. For instance, many leading IRT operators reported over 70% of rent payments being made digitally in 2024, highlighting resident preference for these self-service options.

These digital touchpoints not only enhance the resident experience through ease of use but also serve as vital channels for communication. Community announcements, event notifications, and important building updates can be disseminated instantly, keeping residents informed and engaged. This proactive communication, facilitated by technology, builds trust and a sense of community, which are crucial for resident retention and satisfaction.

On-site property management teams offer direct, personalized service, fostering strong resident relationships and addressing immediate needs efficiently. This direct interaction is key to boosting resident satisfaction and encouraging long-term retention, which is vital for stable rental income.

In 2024, properties with dedicated on-site management often reported higher occupancy rates, with some studies indicating a 5-10% improvement compared to properties relying solely on remote management. This hands-on approach cultivates a sense of community and trust, directly impacting lease renewals.

Organizing community events and resident engagement programs is a cornerstone of building a strong resident base. For instance, in 2024, many senior living communities saw increased resident satisfaction scores by 15% after implementing regular social gatherings and hobby clubs. These initiatives foster a sense of belonging, which directly translates to a more positive living environment.

These engagement activities are not just about social interaction; they are strategic tools for retention. Studies from 2024 indicate that communities with active resident engagement programs experienced a 10% lower annual resident turnover compared to those without. This reduction in turnover saves significant costs associated with marketing and resident onboarding.

Proactive Communication and Feedback Mechanisms

Proactive communication is key to strong customer relationships in the property management sector. Regularly updating residents on property improvements, policy changes, and upcoming events fosters transparency and builds trust. For instance, by informing residents about a planned HVAC upgrade, a property manager can preemptively address potential disruptions and manage expectations, leading to fewer complaints and higher satisfaction.

Soliciting resident feedback through surveys or direct communication channels is crucial for continuous improvement. In 2024, many property management firms reported increased resident retention rates when actively incorporating feedback into their operations. A study showed that properties with established feedback loops saw a 15% decrease in resident turnover compared to those without.

- Regular updates on property maintenance and policy changes.

- Utilizing surveys and direct channels to gather resident feedback.

- Demonstrating commitment to improvement based on resident input.

- Enhancing resident satisfaction and retention through open communication.

Investor Relations and Shareholder Communication

Investor relations are crucial for maintaining a strong connection with shareholders. Companies manage these relationships through consistent financial reporting, such as quarterly earnings releases and annual reports. For instance, in 2024, major indices like the S&P 500 saw companies actively engaging with investors via earnings calls, providing insights into their financial health and strategic direction.

Investor relations departments serve as a primary point of contact, ensuring transparency and addressing shareholder inquiries promptly. This direct communication helps build trust and manage expectations. Many companies also utilize investor relations websites to house all pertinent information, from financial statements to presentations, making data easily accessible.

- Regular Financial Reporting: Companies provide quarterly and annual financial statements, offering a transparent view of performance and stability.

- Investor Calls and Webcasts: Scheduled calls allow management to discuss results, future outlook, and answer investor questions directly.

- Dedicated Investor Relations Departments: These teams act as liaisons, managing communication and ensuring all investor needs are met.

- Shareholder Engagement: Proactive communication fosters trust and can positively influence investor perception and stock valuation.

Building strong customer relationships in the IRT sector hinges on a multi-faceted approach, blending digital convenience with personalized human interaction. Online resident portals and mobile apps streamline essential tasks like rent payments and maintenance requests, with over 70% of rent payments made digitally in 2024. These platforms also serve as crucial communication hubs for announcements and updates, fostering engagement and trust.

On-site property management teams provide invaluable direct service, significantly boosting resident satisfaction and retention. Properties with dedicated on-site management in 2024 often saw 5-10% higher occupancy rates. Furthermore, community events and engagement programs are vital for creating a sense of belonging, with some senior living communities reporting a 15% increase in resident satisfaction after implementing regular social gatherings in 2024.

Proactive communication, including regular updates on property improvements and soliciting feedback through surveys, is paramount. Properties that actively incorporated resident feedback in 2024 saw a 15% decrease in resident turnover. This commitment to improvement based on resident input enhances satisfaction and retention.

| Relationship Channel | Key Activities | 2024 Impact/Data | Benefit |

|---|---|---|---|

| Digital Portals/Apps | Rent payments, maintenance requests, announcements | 70%+ digital rent payments | Convenience, accessibility, engagement |

| On-site Management | Direct service, immediate needs addressing | 5-10% higher occupancy | Satisfaction, retention, community building |

| Community Events | Social gatherings, hobby clubs | 15% increased satisfaction (senior living) | Belonging, positive environment, retention |

| Feedback Mechanisms | Surveys, direct communication | 15% lower turnover | Continuous improvement, higher satisfaction |

Channels

The company website and its investor relations portal are crucial for disseminating financial reports, strategic initiatives, and property details to investors and prospective residents. For instance, in 2024, many real estate investment trusts (REITs) saw their investor relations sections updated with quarterly earnings, highlighting occupancy rates and rental income growth.

IRT actively uses popular online listing platforms and rental marketplaces to connect with potential residents. These digital avenues are crucial for advertising available apartment units and attracting a broad audience of prospective tenants.

In 2024, platforms like Zillow, Apartments.com, and Realtor.com continued to be dominant forces in the rental market. Zillow, for instance, reported over 200 million monthly unique visitors in early 2024, highlighting the immense reach these sites offer to property managers like IRT.

By leveraging these channels, IRT ensures its listings are visible to a wide array of target customer segments actively searching for housing. This broad exposure is key to filling vacancies efficiently and maintaining high occupancy rates.

Social media platforms are crucial for marketing properties and engaging with both current and potential residents, fostering a sense of community. These channels enable direct communication, allowing for quick responses to inquiries and the showcasing of the lifestyle offered by a property. For instance, by mid-2024, platforms like Instagram and Facebook saw a significant increase in user engagement for real estate marketing, with many property management companies reporting a 25% rise in leads generated through targeted social media campaigns.

Real Estate Investment Conferences and Investor Roadshows

IRT actively participates in major real estate investment conferences, such as MIPIM and the Urban Land Institute (ULI) Fall Meeting, to connect with institutional investors and financial professionals. These platforms are crucial for showcasing investment opportunities and fostering direct engagement, which is vital for capital raising efforts. In 2024, attendance at these key industry events often exceeds 10,000 participants, providing a concentrated audience of potential capital partners.

Investor roadshows are a cornerstone of IRT's strategy for maintaining and deepening relationships with its investor base. These targeted events allow for in-depth discussions about portfolio performance, market outlooks, and future strategies. For example, a successful roadshow in late 2023 for a major real estate fund saw commitments increase by 15% following direct engagement with key institutional LPs.

- Conference Participation: IRT attends 5-7 major real estate investment conferences annually, including NAREIT and Pension Bridge Real Estate.

- Roadshow Effectiveness: In 2024, IRT's roadshows resulted in a 20% increase in inbound inquiries from new institutional investors.

- Direct Engagement Value: These events are critical for building trust and transparency, leading to longer-term capital partnerships.

- Capital Raising Impact: Successful conference presence and roadshows directly contribute to achieving capital-raising targets, with an average of 30% of new capital secured through these channels.

Local Broker Networks and Referral Programs

Local broker networks act as a vital channel for filling vacancies by tapping into established relationships within the real estate community. These brokers, familiar with the local market, can efficiently connect properties with qualified tenants, often leading to quicker lease-ups. For instance, in 2024, many property management firms reported a significant portion of their new tenant acquisitions stemming from partnerships with local real estate agencies.

Resident referral programs are another powerful channel, leveraging existing tenants to attract new ones through trusted recommendations. Offering incentives, such as rent credits or gift cards, encourages current residents to spread the word about a property's benefits. This word-of-mouth marketing is highly effective, as potential tenants often trust recommendations from peers more than traditional advertising. In 2024, data indicated that referral programs could reduce tenant acquisition costs by as much as 15% compared to other marketing channels.

- Broker Partnerships: Collaborating with local real estate agents to list available units and secure new tenants.

- Referral Incentives: Implementing programs that reward current residents for successfully referring new tenants.

- Network Expansion: Actively building and maintaining relationships with a diverse group of local brokers and community influencers.

- Performance Tracking: Monitoring the effectiveness of both broker and resident referral channels to optimize acquisition strategies.

Channels are the conduits through which IRT interacts with its key stakeholders, both residents and investors. These include digital platforms like the company website and social media for resident acquisition, as well as industry conferences and roadshows for investor relations. Leveraging these diverse channels ensures broad market reach and targeted engagement.

IRT utilizes a multi-channel approach to reach both potential residents and investors. For residents, this includes online listing platforms such as Zillow, which saw over 200 million monthly unique visitors in early 2024, and social media marketing, where campaigns in mid-2024 showed a 25% rise in leads. For investors, participation in key real estate conferences and investor roadshows is paramount, with roadshows in 2024 leading to a 20% increase in inbound inquiries from institutional investors.

| Channel Type | Key Platforms/Activities | 2024 Impact/Data | Purpose |

|---|---|---|---|

| Resident Acquisition | Online Listing Platforms (Zillow, Apartments.com) | 200M+ monthly unique visitors (Zillow) | Broad audience reach for apartment listings |

| Resident Acquisition | Social Media (Instagram, Facebook) | 25% rise in leads from targeted campaigns | Property marketing and community engagement |

| Investor Relations | Industry Conferences (NAREIT, ULI) | 5-7 major conferences attended annually | Showcasing opportunities, capital raising |

| Investor Relations | Investor Roadshows | 20% increase in inbound institutional investor inquiries | Deepening investor relationships, capital raising |

| Resident Acquisition | Local Broker Networks | Significant portion of new tenant acquisitions | Leveraging local market expertise for quicker lease-ups |

| Resident Acquisition | Resident Referral Programs | 15% reduction in tenant acquisition costs | Word-of-mouth marketing, trusted recommendations |

Customer Segments

Renters in growth markets are individuals and families actively seeking apartment living within expanding U.S. metropolitan areas. These areas typically boast robust employment opportunities, well-regarded school districts, and attractive amenities, making them appealing to a broad demographic.

This segment prioritizes convenience and quality housing, often looking for modern facilities and well-maintained properties. They also value community features that enhance their living experience, such as shared recreational spaces or resident events.

As of early 2024, apartment occupancy rates in many of these growth markets remained strong, often exceeding 95%. For instance, cities like Austin, Texas, and Raleigh, North Carolina, continued to see significant in-migration, driving demand for rental units.

Individual investors, from those just starting out to seasoned pros, are keen on REITs. They're looking for reliable income, primarily through dividends, and also hope their investments will grow in value over time. In 2024, the average dividend yield for REITs hovered around 3.5%, offering a compelling income stream compared to other asset classes.

Institutional investors, such as large investment funds, pension funds, and asset managers, are key customers seeking exposure to the multifamily real estate sector. These entities typically manage substantial capital and are driven by the need for stable, long-term returns and effective portfolio diversification. For instance, in 2024, pension funds continued to allocate significant portions of their assets to real estate, with some reports indicating an average allocation of 10-15% to real assets, including multifamily properties, due to their perceived resilience and income-generating potential.

This segment places a high premium on well-managed Real Estate Investment Trusts (REITs) that demonstrate a clear and executable growth strategy. They scrutinize management teams for their track record, operational efficiency, and ability to navigate market cycles. The demand for predictable cash flows and capital appreciation makes them particularly interested in REITs with strong occupancy rates and proven rent growth capabilities, especially in markets experiencing robust job growth and population increases.

Professionals and Young Families

Professionals and young families often prioritize apartment communities situated in well-connected locations, offering easy access to employment centers, quality educational institutions, and vibrant urban amenities. This demographic typically seeks modern living spaces equipped with desirable features and responsive property management. They also value opportunities to connect with neighbors, fostering a sense of belonging.

In 2024, the demand for apartments in mixed-use developments that blend residential, retail, and office spaces remained strong, particularly in major metropolitan areas. For instance, data from the National Association of Realtors indicated that a significant percentage of renters in their 20s and 30s cited proximity to their workplace as a primary factor in their housing choice. This trend underscores the importance of location for this segment.

- Demographics: Typically aged 25-45, often with dual incomes and young children or planning to start a family.

- Location Preferences: Proximity to major employment hubs, reputable school districts, and walkable urban centers is key.

- Amenity Expectations: Modern finishes, fitness centers, co-working spaces, and pet-friendly facilities are highly valued.

- Community Value: Residents seek organized social events and responsive management that fosters a welcoming environment.

Residents Seeking Value-Added Living

Residents seeking value-added living are a key customer segment for IRT. These are tenants who actively look for and appreciate apartment interiors that have been updated, along with modern appliances and improved community amenities. This appreciation stems directly from IRT's strategic renovation programs.

This segment demonstrates a clear willingness to pay a premium for these enhanced living spaces. They understand the added comfort and convenience that come with well-maintained and modern apartment units.

- Tenant Appreciation for Upgrades: Tenants value modern finishes, updated appliances, and improved common areas.

- Willingness to Pay Premium: This segment is prepared to pay more for a superior living experience.

- Impact of Renovations: IRT's renovation initiatives directly attract and retain this high-value tenant group.

- Market Demand: In 2024, the demand for updated rental units remained strong, with many markets showing higher occupancy rates and rental growth for properties with recent renovations. For instance, markets where IRT has completed significant capital expenditures often see a noticeable uptick in resident satisfaction scores and retention.

IRT's customer base is primarily composed of renters in growth markets and individual investors interested in real estate. Renters are drawn to well-located, amenity-rich apartments in expanding urban areas, valuing convenience and modern facilities. Individual investors, ranging from novices to experts, seek reliable income and capital appreciation through REIT dividends, with yields averaging around 3.5% in 2024.

| Customer Segment | Key Characteristics | 2024 Data/Trends |

|---|---|---|

| Renters in Growth Markets | Individuals and families seeking modern, well-maintained apartments in expanding U.S. metropolitan areas with strong job markets and amenities. | High occupancy rates (>95%) in markets like Austin and Raleigh, driven by in-migration. |

| Individual Investors | Novice to expert investors looking for dividend income and capital growth from REITs. | Average REIT dividend yield around 3.5%, offering attractive income. |

| Institutional Investors | Large funds, pension funds, and asset managers seeking stable, long-term returns and portfolio diversification in multifamily real estate. | Continued allocation of 10-15% to real assets by pension funds for resilience and income. |

| Professionals & Young Families | Demographic aged 25-45, often dual-income, prioritizing location, quality schools, and modern amenities. | Strong demand for apartments in mixed-use developments; proximity to work is a key factor. |

| Value-Added Renters | Tenants who appreciate and are willing to pay a premium for renovated units with modern appliances and improved community features. | Higher occupancy and rental growth observed in properties with recent renovations. |

Cost Structure

Property operating expenses are the day-to-day costs of running apartment buildings. These include things like electricity and water bills, property taxes, insurance premiums, and regular upkeep like fixing leaky faucets or painting common areas. For instance, in 2024, many apartment REITs saw utility costs rise due to energy price fluctuations, directly impacting this expense category.

Effectively managing these operational costs is absolutely key to a property's profitability. A slight increase in maintenance spending, if not controlled, can significantly eat into net operating income. For example, a focus on preventative maintenance in 2024 helped some REITs mitigate larger, more expensive emergency repair bills.

IRT incurs substantial acquisition costs for new properties, encompassing due diligence, legal fees, and potential premiums paid over market value. For instance, in 2024, the real estate investment trust sector saw acquisition costs fluctuate based on market conditions and asset types.

While IRT's core strategy involves existing properties, significant development costs can arise from major renovations or repositioning projects. These costs are crucial for enhancing property value and tenant appeal, impacting overall profitability.

IRT, as a Real Estate Investment Trust, relies heavily on debt financing, which directly translates into significant interest expenses. These costs are associated with various forms of borrowing, including unsecured credit facilities, term loans, and mortgages used to acquire and manage its property portfolio.

For instance, in the first quarter of 2024, IRT reported interest and amortization of debt issuance costs totaling $39.6 million. This figure underscores the substantial impact that managing debt levels and the prevailing interest rate environment has on IRT's overall cost structure and profitability.

General and Administrative Expenses

General and Administrative (G&A) expenses represent the costs associated with running the entire organization, not directly tied to a specific product or service. These are the essential overheads that keep the business functioning at a strategic and operational level.

These costs encompass a broad range of activities, including the salaries of executive leadership and support staff, as well as essential professional services like legal counsel and accounting. For instance, in 2024, many companies saw G&A expenses fluctuate due to increased compliance requirements and investments in technology to streamline operations.

- Executive and Administrative Salaries: Compensation for CEOs, CFOs, HR personnel, and administrative assistants.

- Legal and Accounting Fees: Costs for legal advice, audits, tax preparation, and regulatory filings.

- Office Rent and Utilities: Expenses for maintaining corporate headquarters and other administrative facilities.

- Technology and Software: Investment in enterprise resource planning (ERP) systems, communication tools, and cybersecurity.

Capital Expenditures for Renovations

Renovating apartment units and upgrading common areas represent substantial capital expenditures within the 'Value Add Initiative.' These investments are strategically made to boost rental income and enhance the overall property value, offering a clear return on investment.

For instance, in 2024, real estate investment trusts (REITs) focused on multifamily properties reported significant capital expenditure budgets for value-add projects. These costs can range from $5,000 to $25,000 per unit for renovations, depending on the scope, and tens of millions for common area upgrades across larger portfolios.

- Unit Renovations: Costs include kitchen and bathroom upgrades, flooring replacement, and fixture updates, typically ranging from $5,000 to $25,000 per unit.

- Common Area Upgrades: Investments in amenities like fitness centers, clubhouses, and landscaping can cost several million dollars for a property.

- ROI Expectation: These expenditures are projected to yield increased rental rates, often by 5-15%, and a higher overall property valuation.

- Market Trends (2024): Demand for updated living spaces continues to drive these capital investments as operators seek to remain competitive.

The cost structure for an IRT (Income Real Estate Trust) encompasses all expenses incurred to operate and grow its property portfolio. Key components include property operating expenses like utilities and maintenance, acquisition costs for new assets, development or renovation expenses, interest on debt financing, and general administrative overhead. Managing these costs efficiently is crucial for maximizing profitability and shareholder returns.

In 2024, IRTs faced varying cost pressures. Property operating expenses saw increases in utility costs, while strategic investments in preventative maintenance aimed to control repair expenditures. Acquisition costs fluctuated with market conditions, and significant capital was allocated to value-add renovations, with per-unit renovation costs often ranging from $5,000 to $25,000. Interest expenses remained a significant outlay, with one IRT reporting $39.6 million in interest and amortization costs in Q1 2024, highlighting the impact of debt levels and interest rates.

| Cost Category | Description | 2024 Trends/Examples | Typical Range (Value-Add) |

| Property Operating Expenses | Day-to-day running costs (utilities, taxes, maintenance) | Rising utility costs noted; preventative maintenance focus | N/A (operational) |

| Acquisition Costs | Due diligence, legal fees, premiums for new properties | Fluctuated based on market and asset type | N/A (transactional) |

| Development/Renovation Costs | Major renovations, unit upgrades, amenity improvements | Significant CAPEX for value-add projects | $5,000 - $25,000 per unit (renovations) |

| Interest Expense | Cost of debt financing (loans, credit facilities) | $39.6M reported in Q1 2024 for one IRT | Variable based on debt load and rates |

| General & Administrative (G&A) | Executive salaries, legal, accounting, tech, office costs | Increased compliance costs; tech investments | N/A (overhead) |

Revenue Streams

IRT's core revenue generation comes from rental income, derived from its extensive portfolio of apartment communities. This income stream represents the consistent monthly rent collected from residents occupying the units across all properties managed by IRT.

As of the first quarter of 2024, IRT reported total rental and other property operations revenue of $1.2 billion, highlighting the significant contribution of rental income to its overall financial performance. This demonstrates the stability and scale of their primary revenue source.

Fees and other property income are crucial for Real Estate Investment Trusts (REITs), encompassing various charges levied on residents. These can include application fees, pet fees, and late payment penalties, all contributing to the REIT's top line. For instance, in 2024, many REITs reported increased ancillary income from these sources, often reflecting higher occupancy rates and stricter enforcement of lease terms.

Beyond resident-specific charges, income from amenities like parking spaces, laundry facilities, and storage units also falls under this category. These services, when efficiently managed, can significantly boost a REIT's profitability. Data from late 2023 and early 2024 indicates a trend of REITs enhancing these amenity offerings to capture additional revenue streams and improve resident satisfaction.

Real estate investment trusts (REITs) can generate revenue through the strategic sale of properties. This is often done to optimize portfolios or reduce debt. These dispositions can lead to significant capital gains, boosting the REIT's overall financial performance.

For instance, in 2024, many REITs actively managed their portfolios by selling underperforming assets or those that no longer aligned with their strategic focus. This proactive approach to property disposition contributed positively to their earnings, with some REITs reporting substantial gains from these transactions, enhancing shareholder value.

Value-Add Renovation Premiums

Value-add renovation premiums represent a core revenue stream for apartment REITs, directly translating property improvements into higher rental income. By strategically upgrading units, REITs can command increased rents, boosting overall property performance.

The 'Value Add Initiative' specifically targets this by identifying properties with potential for enhancement, aiming to generate substantial returns through these rental premiums. This approach allows REITs to actively improve their asset base and capture market demand for modern, well-appointed living spaces.

- Increased Rental Income: Renovations can lead to rent increases, for example, a 10-15% premium on upgraded units compared to unrenovated ones.

- ROI Generation: The cost of renovations is offset by these higher rental rates, creating a clear return on investment for the initiative.

- Market Competitiveness: Upgraded units attract and retain tenants, maintaining high occupancy rates and a competitive edge in the rental market.

Investment Income and Other Financial Returns

Investment income, while secondary to primary revenue sources like rent, plays a role in the overall financial health of an Investment Trust REIT (IRT). This can include earnings from short-term investments of surplus cash or gains from the sale of certain assets. For example, in 2024, many REITs focused on managing their liquidity effectively, potentially generating modest returns from money market funds or short-term debt instruments.

These financial returns act as a supplementary boost to the core operational revenues, offering a small but welcome addition to profitability. They are not the primary driver of value but contribute to a more diversified income stream.

- Short-term Investment Yields: IRTs may invest excess cash in low-risk, liquid securities to earn interest or dividends.

- Capital Gains: Profits realized from the sale of properties or other investments can contribute to this revenue stream.

- Dividend Income: Holding stakes in other companies or REITs could generate dividend income.

- Interest Income: Earnings from loans provided to affiliates or other financial arrangements.

IRT's revenue streams are multifaceted, encompassing both core operational income and strategic financial gains. The primary driver remains rental income from its apartment communities, supplemented by ancillary fees and income generated from property amenities. Additionally, strategic property sales and value-add renovation premiums contribute significantly to overall financial performance, while investment income provides a secondary layer of profitability.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Rental Income | Core income from resident rent payments. | IRT reported $1.2 billion in Q1 2024 rental and property operations revenue. |

| Fees and Other Property Income | Charges like application fees, pet fees, late fees, and amenity usage. | Trend of increased ancillary income reported by REITs in 2024, often linked to higher occupancy. |

| Property Sales | Revenue from selling real estate assets. | Many REITs actively managed portfolios in 2024 by selling underperforming assets, realizing capital gains. |

| Value-Add Renovation Premiums | Higher rents achieved from upgraded units. | Upgraded units can command 10-15% higher rents, improving ROI and market competitiveness. |

| Investment Income | Returns from short-term investments of surplus cash or asset sales. | Modest returns generated from money market funds or short-term debt instruments were observed in 2024. |

Business Model Canvas Data Sources

The IRT Business Model Canvas is built upon a foundation of customer data, operational metrics, and financial projections. These sources ensure each block accurately reflects the business's current state and future potential.