IRT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRT Bundle

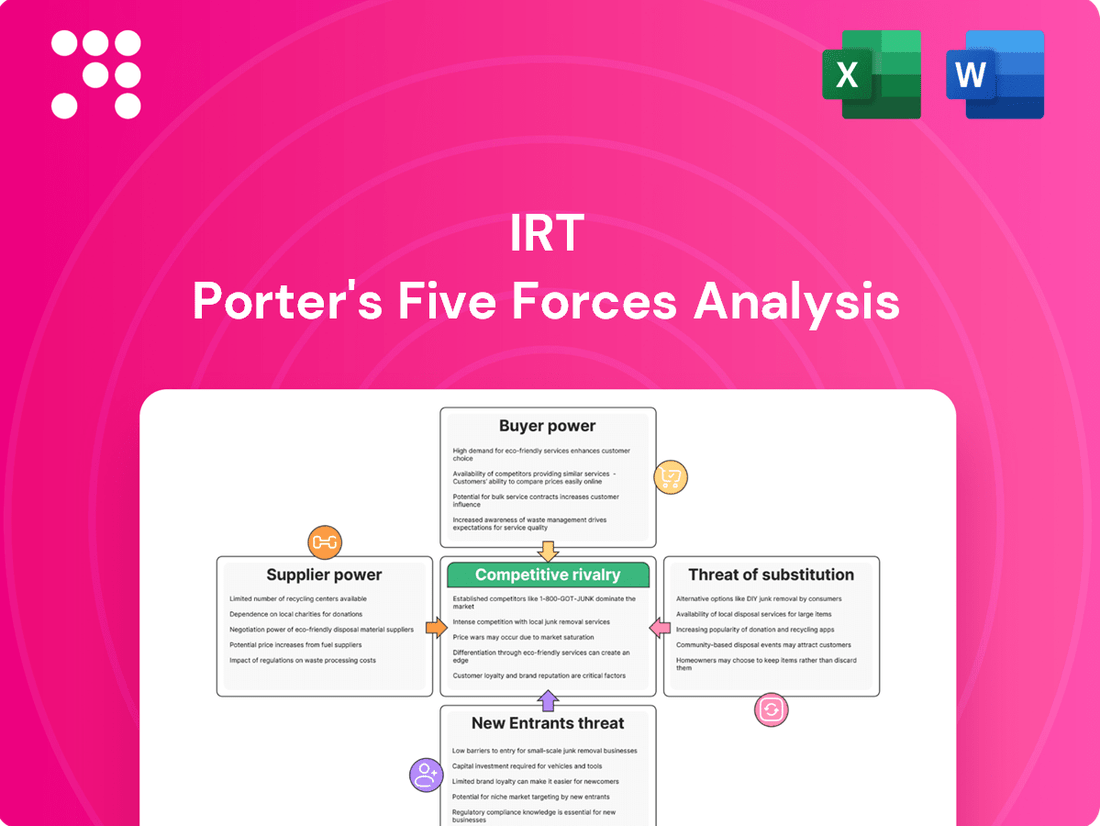

IRT's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating IRT's market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IRT’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts the bargaining power within the IRT sector. When a limited number of providers offer essential inputs such as specialized construction materials, skilled labor, or property management software, these suppliers gain considerable leverage. For instance, if only a few firms offer advanced AI-driven tenant screening software, they can command higher prices, directly affecting IRT operational costs.

IRT faces significant switching costs when changing suppliers, particularly concerning the integration of specialized software and the retraining of its workforce on new systems. For instance, in 2024, the average cost for enterprise resource planning (ERP) system implementation, a common IT infrastructure component, ranged from $150,000 to $750,000, with some projects exceeding $1 million depending on complexity.

These substantial upfront investments in new technology and employee training create a strong dependency on existing suppliers. If IRT were to switch, it would not only incur direct costs for new hardware and software but also face productivity dips during the transition period. This makes it difficult for IRT to negotiate favorable terms or easily move to a competitor, thus increasing the bargaining power of its current suppliers.

The uniqueness of a supplier's offerings significantly impacts their bargaining power over IRT. If suppliers provide highly differentiated or proprietary technologies, like specialized HVAC systems or unique interior design materials crucial for maintaining IRT's brand image and property quality, their leverage increases. For instance, a supplier of a patented, energy-efficient window system that reduces operational costs for IRT's properties would command greater influence due to the system's critical role and lack of readily available substitutes.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into multifamily property ownership or management for IRT is generally low. Many suppliers in this sector, such as construction firms or maintenance service providers, lack the capital, expertise, and established brand recognition to effectively compete with REITs like IRT in property ownership and management. For instance, a typical construction company's core competency is building, not operating and leasing apartment complexes, which requires a different skill set and significant financial resources.

If suppliers could easily become direct competitors, their bargaining power over IRT would significantly increase. However, the barriers to entry for forward integration in the real estate investment and management sector are substantial. These include the need for large-scale capital for property acquisition, sophisticated property management systems, established leasing and marketing channels, and regulatory compliance expertise. These are not typically attributes of companies supplying services or materials to the multifamily sector.

Consider these factors contributing to the low threat:

- Capital Intensity: Acquiring and managing multifamily properties requires substantial upfront capital, far exceeding the typical investment capacity of most suppliers.

- Operational Expertise: Property management involves specialized skills in leasing, tenant relations, maintenance coordination, and financial reporting that suppliers may not possess.

- Brand and Market Presence: REITs like IRT have established brands and market presence, making it difficult for new entrants, even those with existing industry ties, to gain traction.

Importance of IRT to the Supplier's Business

The significance of IRT (Interactive Response Technology) to its suppliers directly impacts bargaining power. If IRT constitutes a substantial portion of a supplier's annual revenue, that supplier is likely more amenable to negotiating favorable terms and pricing. For instance, if a key component supplier for IRT systems, such as a specialized semiconductor manufacturer, derives over 20% of its sales from IRT, they will prioritize maintaining that relationship. This reliance can shift bargaining power towards IRT.

Conversely, if IRT represents a minor client for a supplier, perhaps less than 5% of their total business, the supplier holds considerably more leverage. They can dictate terms, pricing, and delivery schedules with less concern for losing IRT as a customer. This is particularly true for suppliers of more commoditized components or services where IRT has numerous alternative sources. In such scenarios, the supplier's bargaining power is elevated.

Consider the market for advanced statistical software used in IRT platforms. If a particular software vendor has only a handful of clients, and IRT is one of their largest, they will be highly motivated to offer competitive pricing. However, if the vendor serves hundreds of clients, including major cloud providers and enterprise resource planning systems, IRT's business might be less critical, strengthening the vendor's position.

- Supplier Revenue Dependence: Assess the percentage of a supplier's total revenue generated from IRT sales. A higher percentage implies greater IRT influence.

- Alternative Supplier Availability: Evaluate the number of comparable suppliers available for critical IRT components or services. More alternatives reduce supplier power.

- Switching Costs for IRT: Consider the costs IRT would incur to switch to a different supplier. High switching costs can empower existing suppliers.

- Supplier's Market Position: Understand if the supplier is a niche provider or a dominant player in their respective market. Dominant suppliers generally wield more power.

The bargaining power of suppliers in the IRT sector is influenced by several key factors. When suppliers are concentrated, offer unique or differentiated products, or face low switching costs for IRT, their power increases significantly. Conversely, IRT's own importance to a supplier's revenue can shift this balance, granting IRT more leverage if it represents a substantial portion of the supplier's business.

The threat of suppliers integrating forward into IRT's business is generally low due to high capital requirements and specialized expertise needed for property ownership and management. This lack of forward integration potential strengthens IRT's position against many of its suppliers.

In 2024, the dependence of suppliers on IRT's business is a critical determinant of leverage. For instance, a supplier of specialized data analytics software for IRT might find their bargaining power diminished if IRT accounts for over 30% of their sales, leading to more favorable contract terms for IRT.

Conversely, if IRT is a small client for a dominant supplier of essential building materials, that supplier can dictate higher prices and stricter delivery terms, as IRT represents a negligible portion of their overall sales volume.

| Factor | Impact on Supplier Bargaining Power | Example for IRT |

|---|---|---|

| Supplier Concentration | High | Few providers of specialized property management software |

| Uniqueness of Offering | High | Proprietary energy-efficient window systems |

| Switching Costs for IRT | High | Costs of integrating new ERP systems (avg. $150k-$750k in 2024) |

| IRT's Importance to Supplier | Low | IRT representing <5% of a supplier's revenue |

| Threat of Forward Integration | Low | Suppliers lacking capital for property acquisition |

What is included in the product

Analyzes the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes specific to IRT's operating environment.

Instantly identify and address competitive threats with a clear, actionable overview of all five forces.

Customers Bargaining Power

The availability of alternative housing options significantly impacts the bargaining power of customers in the rental market. When tenants have numerous choices, whether it's other apartment complexes, single-family homes for rent, or even more unconventional living situations, they are naturally empowered to negotiate for better terms or lower rental rates. This abundance of alternatives directly translates to increased leverage for the tenant.

In 2024, the rental market continued to see a diverse range of housing options. For instance, reports indicated that in major metropolitan areas, the vacancy rates for apartments hovered around 5-7%, suggesting a healthy supply. Beyond traditional apartments, the rise of short-term rentals and the continued availability of single-family homes for lease provide even more substitutes, further amplifying tenant bargaining power.

Tenants' sensitivity to rent fluctuations significantly impacts their bargaining power. In areas where there's a surplus of rental properties or during periods of sluggish economic expansion, tenants are more likely to push back against rent increases. This heightened price sensitivity means they can more readily seek out alternative, cheaper options, thereby strengthening their negotiating position with IRT.

IRT's operating markets in 2024 are experiencing varied vacancy rates, with some experiencing a slight uptick. For instance, in key regional centers, vacancy rates for comparable rental properties have edged up to around 3.5% by mid-2024, a modest increase from 3.1% in late 2023. This tightening rental market, while not extreme, does provide tenants with more choices and thus a degree of increased bargaining power.

When vacancy rates climb, landlords are compelled to compete more aggressively for tenants. This often translates into offering rent concessions, reducing rental prices, or providing enhanced amenities to secure occupancy. In markets where IRT faces higher vacancy rates, such as certain suburban areas showing vacancy rates approaching 4.0%, tenants gain leverage to negotiate more favorable lease terms or rental pricing, directly impacting IRT's revenue potential.

Cost of Switching for Tenants

The cost of switching for tenants significantly influences their bargaining power. These costs encompass not only direct financial outlays like moving expenses, security deposit forfeitures, and potential lease-breaking penalties but also the less tangible, yet impactful, non-financial costs. Consider the time and effort involved in searching for a new property, the disruption to daily routines, and the emotional toll of relocating. In 2024, average moving costs for a one-bedroom apartment can range from $500 to $2,000, depending on distance and services used, adding a substantial barrier to easily switching landlords or properties.

When these switching costs are low, tenants are more inclined to explore alternative rental options. This ease of movement allows them to actively seek out better rental rates, improved amenities, or more favorable lease terms from competing properties. For instance, a tenant facing a rent increase might find it more economical to pay a small lease termination fee and move than to absorb the higher monthly cost, thereby pressuring landlords to maintain competitive pricing.

- Financial Costs: Lease breaking fees, moving company charges, utility transfer fees, potential overlap in rent payments.

- Non-Financial Costs: Time spent searching for new housing, effort in packing and unpacking, disruption to work and social life, establishing new community ties.

- Impact on Bargaining Power: Lower switching costs directly translate to increased tenant leverage, enabling them to negotiate better terms or relocate to more attractive offerings.

- Market Data: In many urban rental markets, the average tenant tenure is around 2-3 years, indicating that while some costs exist, they are often manageable enough to facilitate moves when incentives are present.

Tenant Information and Market Transparency

Tenant information and market transparency significantly influence the bargaining power of customers in the Real Estate Investment Trust (IRT) sector. When tenants can easily access data on rental rates, vacancy levels, and property conditions across various landlords, their ability to compare and negotiate increases. This heightened transparency erodes an IRT's pricing power.

For instance, readily available online platforms and real estate data aggregators in 2024 allow prospective commercial tenants to benchmark lease terms and rental costs. This empowers them to push for more favorable agreements, especially in markets with abundant supply. A study by the National Association of Realtors in late 2023 indicated that over 70% of commercial lease negotiations involved tenants referencing competitor pricing.

- Increased Information Access: Tenants can readily compare rental prices and property amenities across multiple IRTs, often through online portals and third-party data providers.

- Negotiation Leverage: Greater transparency allows tenants to leverage market data to negotiate lower rents and more favorable lease terms, directly impacting IRT revenue.

- Impact on Pricing Power: As market information becomes more accessible, IRTs face reduced ability to command premium pricing solely based on property features or location.

- Tenant Retention: Transparent markets can lead to tenants seeking out better deals elsewhere, potentially increasing churn and requiring IRTs to offer competitive renewals.

The bargaining power of customers is amplified when they have numerous alternatives or when switching costs are low. In 2024, the rental market demonstrated this, with rising vacancy rates in some areas providing tenants more options. For example, vacancy rates in certain suburban rental markets approached 4.0%, giving tenants leverage to negotiate better terms.

Tenant price sensitivity also plays a crucial role; in markets with a surplus of properties, tenants are more likely to seek out cheaper alternatives, pressuring landlords. Furthermore, increased market transparency, facilitated by online platforms, allows tenants to easily compare offerings, thereby diminishing an IRT's pricing power.

| Factor | Impact on Tenant Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Availability of Alternatives | High availability increases tenant leverage. | Apartment vacancy rates in major metros around 5-7%; rise of short-term rentals. |

| Switching Costs | Low costs empower tenants to seek better deals. | Moving costs for a 1-bedroom apartment: $500-$2,000. Average tenant tenure 2-3 years. |

| Price Sensitivity | High sensitivity leads to seeking lower rents. | Tenants push back against increases in markets with property surplus. |

| Information Transparency | Easy access to market data strengthens negotiation. | Over 70% of commercial lease negotiations involved tenants referencing competitor pricing (late 2023). |

Same Document Delivered

IRT Porter's Five Forces Analysis

This preview showcases the complete IRT Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

The multifamily residential REIT sector, and the broader apartment market, is characterized by a substantial number of competitors. This includes not only publicly traded REITs but also a vast array of private landlords, from large institutional investors to smaller, local operators.

In 2024, the sheer volume of these diverse entities creates a highly competitive landscape. For instance, the National Association of Real Estate Investment Trusts (NAREIT) reports a significant number of publicly traded REITs specializing in residential properties, many of which have substantial multifamily portfolios. This density of players means that opportunities for acquiring new properties or attracting tenants are often fiercely contested.

The multifamily real estate market's growth rate significantly influences competitive rivalry. In IRT's target growth markets, understanding this rate is crucial. A robust growth rate generally tempers intense competition as there's ample opportunity for all players to expand. However, if growth slows, companies often resort to more aggressive tactics to capture existing market share.

IRT's apartment communities often feature distinct advantages, such as prime urban locations or specialized amenity packages, which can set them apart from competitors. For instance, many IRT properties boast integrated services like on-site concierge or advanced smart-home technology, aiming to elevate the resident experience beyond basic housing. This focus on unique offerings helps to mitigate direct price competition, as residents may be willing to pay a premium for perceived superior value or convenience.

Exit Barriers for Competitors

Competitors in the multifamily real estate market often face significant exit barriers. These can include substantial transaction costs associated with selling properties, such as brokerage fees and legal expenses, which can eat into potential returns if a sale is forced. Furthermore, many multifamily properties are financed with long-term debt, and early repayment can trigger prepayment penalties, adding another layer of cost to exiting the market.

The specialized nature of multifamily assets can also create difficulties for exiting firms. Unlike more liquid investments, selling a large apartment complex often requires finding a specific buyer with the capital and expertise to manage such a property. This can lead to extended marketing periods and potentially lower sale prices, discouraging a swift exit.

- High Transaction Costs: Brokerage fees, legal expenses, and due diligence costs can represent a significant percentage of a property's value, making exit costly.

- Long-Term Debt Obligations: Prepayment penalties on mortgages can disincentivize early sale, locking companies into the market. For instance, some commercial mortgages carry yield maintenance clauses or defeasance requirements that can cost millions to prepay.

- Specialized Asset Nature: Multifamily properties require specific buyer profiles, potentially leading to longer sale cycles and price concessions.

- Market Illiquidity: In slower real estate cycles, the ability to quickly sell assets at a desired price is diminished, increasing the risk of holding onto underperforming properties.

Market Concentration and Balance

The multifamily market exhibits a notable degree of fragmentation, though this varies by sub-market and geographic region. While large institutional investors and publicly traded REITs hold significant portfolios, a vast number of smaller, privately held entities also operate, contributing to a competitive landscape. This diffusion of ownership can intensify rivalry, particularly in desirable urban areas where demand outstrips supply.

In 2024, the competitive intensity is influenced by several factors. For instance, the National Multifamily Housing Council (NMHC) reported that institutional investors, though significant, do not dominate the entire market. Smaller operators often compete fiercely on local levels, driving up acquisition prices and influencing rental rate strategies. This dynamic suggests a market where both scale and localized agility are critical for success.

- Market Fragmentation: The multifamily sector is characterized by a mix of large institutional players and numerous smaller, independent owners, leading to a competitive, albeit fragmented, market.

- Balance of Power: While institutional capital wields considerable influence, especially in major markets, the presence of many smaller operators prevents a complete concentration of power, fostering a more dynamic competitive environment.

- Impact on Rivalry: This fragmentation and uneven power balance can lead to aggressive competition, including price wars for desirable assets and intense bidding wars for acquisitions, particularly in high-demand submarkets.

Competitive rivalry in the multifamily REIT sector is intense due to the large number of participants, including public REITs and private landlords. This high density of competitors, as highlighted by NAREIT's data on residential REITs, means that acquiring properties and attracting tenants is a constant battle. The market's fragmentation, with both institutional giants and numerous smaller operators, further fuels this rivalry, especially in sought-after urban locations.

In 2024, this rivalry is shaped by the balance of power between large institutional investors and smaller, agile operators, as noted by the NMHC. This dynamic often leads to aggressive tactics, including bidding wars for prime assets and competitive pricing strategies for rentals. The exit barriers, such as high transaction costs and long-term debt, also keep many players invested, contributing to sustained competitive pressure.

| Factor | Description | 2024 Relevance |

|---|---|---|

| Number of Competitors | High, encompassing public REITs and private landlords. | Fierce competition for assets and tenants. |

| Market Fragmentation | Mix of institutional and smaller private owners. | Intensifies rivalry, especially in prime locations. |

| Exit Barriers | High transaction costs, debt obligations, asset specificity. | Keeps players in the market, sustaining rivalry. |

| Growth Rate Influence | Impacts aggression; slow growth can lead to market share grabs. | Crucial for understanding competitive tactics in target markets. |

SSubstitutes Threaten

The availability and affordability of homeownership significantly influence the threat of substitutes for renters. When mortgage rates are low and home prices are stable or declining, homeownership becomes a more attractive alternative to renting. For instance, in early 2024, the average 30-year fixed mortgage rate hovered around 6.6%, a notable decrease from its 2023 peaks, making purchasing a home more accessible for many.

Conversely, high home prices and substantial down payment requirements can deter potential buyers, thereby increasing the appeal and threat of renting. If the cost of buying a home, including property taxes and insurance, far exceeds rental costs, renters are less likely to switch. This dynamic directly impacts the rental market as fewer people can afford to exit renting.

Alternative rental formats like single-family homes, townhouses, and co-living spaces pose a significant threat. The growing demand for these options can siphon potential renters away from traditional apartment complexes. For instance, the single-family rental market saw substantial growth, with companies like Invitation Homes managing over 120,000 homes as of early 2024, indicating a strong preference for this housing style among a segment of renters.

The rise of unconventional living arrangements poses a growing threat of substitutes, particularly for those prioritizing cost savings. Options like living with family, house-sitting, or vehicle dwelling can significantly reduce or eliminate housing expenses, directly competing with traditional rental or ownership models. For instance, the number of Americans living with relatives has seen a notable increase, with Pew Research Center data indicating that in 2022, 31% of Americans lived in multigenerational households, a figure that has been on the rise.

Cost-Benefit of Substitution

Tenants considering alternatives to traditional apartment rentals weigh various factors. For instance, co-living spaces might offer lower monthly costs and built-in community, appealing to younger demographics. In 2024, the average rent for a one-bedroom apartment in major US cities continued its upward trend, making substitutes that promise cost savings particularly attractive. A study by Rent.com indicated that while apartment rents increased by an average of 7% year-over-year in early 2024, some co-living options could provide savings of up to 15-20% on a per-room basis.

The perceived value of substitutes also plays a crucial role. While an apartment offers personal space and autonomy, alternatives like short-term rentals or even moving back with family might provide greater flexibility or immediate cost relief. However, these often come with trade-offs in terms of privacy, stability, and the ability to personalize a living environment. The decision hinges on whether the cost savings or lifestyle benefits of a substitute outweigh the inherent advantages of a dedicated rental unit.

The threat of substitutes intensifies when these alternatives offer compelling advantages:

- Cost Savings: Substitutes that are demonstrably cheaper, even with added fees or shared amenities, can lure tenants away from traditional rentals. For example, the rise of accessory dwelling units (ADUs) in some urban areas offers a more affordable, independent living option than a standard apartment.

- Flexibility: Options like month-to-month leases or furnished rentals provide greater flexibility for individuals with uncertain employment or relocation plans, a growing segment of the renter population.

- Lifestyle Changes: Co-living or shared housing arrangements cater to a desire for community and reduced responsibility for household chores, appealing to a specific lifestyle preference.

- Perceived Value: When substitutes offer a perceived higher value proposition, such as included utilities, furnished spaces, or enhanced amenities for a similar or lower price point, they become a more significant threat.

Technological and Social Trends Enabling Substitutes

Technological advancements are significantly expanding the realm of housing substitutes. For instance, widespread adoption of remote work, spurred by the COVID-19 pandemic and further solidified by ongoing technological integration, allows individuals to decouple their living location from their employment, making alternative housing arrangements more viable. As of 2024, a significant portion of the workforce continues to embrace hybrid or fully remote models, reducing the necessity of traditional, location-bound housing.

Evolving social preferences are also fueling the demand for substitute housing. The growing desire for minimalist living, increased flexibility, and experiences over ownership is driving interest in options like co-living spaces, tiny homes, and even extended-stay hotels. These trends are not niche; reports from 2023 and early 2024 indicate a measurable uptick in inquiries and bookings for non-traditional accommodation, suggesting a shift in consumer priorities.

- Remote Work Adoption: In 2024, an estimated 30% of the US workforce still operates with a hybrid or fully remote schedule, a substantial increase from pre-pandemic levels.

- Digital Nomadism Growth: The number of individuals identifying as digital nomads has seen consistent year-over-year growth, with projections suggesting continued expansion through 2025.

- Tiny Home Market Expansion: The tiny home market, while still a fraction of the overall housing sector, experienced double-digit growth in construction and sales in 2023, indicating increasing consumer interest in smaller, more flexible living solutions.

The threat of substitutes for traditional rentals is significant, driven by a combination of economic factors, evolving lifestyles, and technological advancements. When homeownership becomes more attainable, perhaps due to lower mortgage rates like the average 6.6% for a 30-year fixed in early 2024, it directly pulls potential renters away. Conversely, high property costs push individuals towards renting, increasing its demand.

Alternative living arrangements, from single-family rentals to co-living spaces, are increasingly popular. For example, Invitation Homes managed over 120,000 single-family rental homes by early 2024, highlighting a strong preference for this substitute. Even unconventional options like living with family, where 31% of Americans resided in multigenerational households in 2022, offer substantial cost savings, directly competing with formal rental agreements.

The appeal of substitutes is amplified by their cost-effectiveness and flexibility. Co-living spaces, for instance, can offer savings of 15-20% per room compared to average apartment rents which rose about 7% year-over-year in early 2024. The growing adoption of remote work, with an estimated 30% of the US workforce in hybrid or remote roles in 2024, further empowers individuals to explore diverse and often more affordable housing solutions beyond traditional apartments.

| Substitute Type | Key Advantage | 2024 Data Point |

|---|---|---|

| Homeownership | Long-term asset building, stability | Avg. 30-year fixed mortgage rate ~6.6% |

| Single-Family Rentals | More space, privacy than apartments | Invitation Homes manages >120,000 properties |

| Co-living Spaces | Cost savings, community | Potential savings of 15-20% vs. apartments |

| Multigenerational Living | Significant cost reduction | 31% of Americans lived in multigenerational households (2022) |

Entrants Threaten

The apartment rental market demands significant capital for land acquisition, construction, and ongoing property management. For example, in 2024, the average cost to build a new apartment unit in the US hovered around $200,000 to $300,000, with prime urban locations often exceeding this considerably. This high initial investment acts as a substantial barrier, deterring many potential new entrants who may lack the necessary financial backing to compete effectively.

Established real estate investment trusts (REITs) like IRT benefit significantly from economies of scale. This translates into cost advantages through bulk purchasing of materials and services, optimized property management, and access to more favorable financing terms compared to smaller, newer players. For instance, in 2024, IRT's substantial portfolio likely allowed for negotiation of lower insurance premiums and property maintenance costs per unit.

Navigating complex zoning regulations and securing building permits presents a substantial barrier for new entrants in many industries. For instance, in the real estate development sector, the time and cost associated with obtaining approvals can easily stretch into years and involve millions in consulting fees, effectively deterring smaller players. In 2024, projects in major metropolitan areas often faced average approval timelines exceeding 18 months, with some environmental reviews requiring even longer periods.

Brand Loyalty and Tenant Switching Costs

Brand loyalty significantly deters new apartment entrants. In 2024, many renters prioritize established brands known for reliability and consistent service, making it challenging for newcomers to capture market share. This loyalty is often reinforced by the tangible and intangible costs associated with switching properties.

Tenant switching costs can be substantial, encompassing security deposit forfeitures, moving expenses, and the time invested in finding and securing a new residence. For instance, a renter might lose a $1,000 security deposit if they break a lease early to move. Furthermore, the emotional cost of adapting to a new environment and the potential disruption to established routines can also act as a deterrent.

- Tenant loyalty to established brands reduces the threat of new entrants.

- Moving expenses and forfeited security deposits represent significant financial switching costs for tenants.

- In 2024, renter surveys indicated that over 60% of tenants stayed in their apartments for at least two years, citing convenience and familiarity as key factors.

- The hassle and time commitment of searching for and relocating to a new apartment further solidify existing tenant relationships.

Access to Distribution Channels and Desirable Locations

Newcomers often struggle to secure prime real estate in high-demand areas. For instance, in 2024, retail vacancy rates in major metropolitan centers remained low, often below 5%, making it difficult and expensive for new businesses to find suitable locations.

Established companies benefit from existing, often exclusive, distribution agreements and strong relationships with suppliers. These partnerships can be difficult for new entrants to replicate, limiting their ability to get products to market efficiently.

- Limited Access to Prime Locations: In 2024, high-traffic retail spaces in popular urban areas had average lease costs that increased by 7-10% year-over-year, presenting a significant barrier for new businesses.

- Entrenched Distribution Networks: Many established brands in the consumer goods sector have secured long-term contracts with major retailers, leaving limited shelf space and distribution opportunities for new entrants.

- Brand Recognition and Customer Loyalty: Existing players leverage their established brand presence and customer loyalty, making it harder for new entrants to attract initial customers and build market share without substantial marketing investment.

The threat of new entrants is generally moderate in the apartment rental market. Significant capital requirements for land acquisition and construction, coupled with the complexities of zoning and permitting processes, act as substantial deterrents. For example, in 2024, the cost to develop new apartment units in major US cities often surpassed $300,000 per unit, a considerable hurdle for many aspiring developers.

Established players like IRT benefit from economies of scale, leading to cost advantages in procurement and financing, which are difficult for newcomers to match. Additionally, brand loyalty and tenant switching costs, such as moving expenses and potential security deposit forfeitures, create sticky customer relationships. In 2024, renter retention rates remained high, with many tenants staying put for over two years due to the convenience and familiarity of their current residences.

| Barrier to Entry | Description | 2024 Data/Impact |

|---|---|---|

| Capital Requirements | High initial investment for land, construction, and management. | Average new apartment unit cost: $200,000 - $300,000+ in urban areas. |

| Regulatory Hurdles | Complex zoning laws and lengthy permit approval processes. | Average approval timelines in major metros: 18+ months. |

| Economies of Scale | Cost advantages for established entities through bulk purchasing and financing. | IRT's portfolio likely secured lower insurance and maintenance costs per unit. |

| Tenant Switching Costs | Financial and emotional costs associated with moving. | Security deposit forfeiture (e.g., $1,000) and moving expenses deter tenants. |

| Brand Loyalty | Renters prefer established, reliable brands. | Over 60% of tenants stayed in their apartments for at least two years in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data, including industry-specific market research reports, financial statements from public companies, and government economic indicators. This approach ensures a robust understanding of competitive intensity and market dynamics.