IRT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRT Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping IRT's trajectory. Our expertly crafted PESTLE analysis provides the actionable intelligence you need to anticipate challenges and capitalize on opportunities. Equip yourself with a strategic advantage—download the full report now and navigate the future with confidence.

Political factors

Government housing policies, like those aimed at increasing affordable housing supply, can significantly influence IRT's acquisition and development strategies. For instance, if a state introduces new incentives for building affordable units, it might alter the cost-effectiveness of certain projects for IRT. Similarly, ongoing discussions around rent control in key markets could impact projected rental income streams and necessitate adjustments to operational models.

Changes in zoning laws, a common policy lever, directly affect IRT's ability to expand or redevelop properties. A relaxation of zoning restrictions in a particular area might open up new development opportunities, while stricter regulations could increase construction costs or limit project scope. For example, in 2024, several major cities have been reviewing their zoning ordinances to encourage more mixed-use developments, which could present both opportunities and challenges for real estate investment trusts like IRT.

The overall supply and demand dynamics within IRT's target markets are also heavily shaped by government housing policies. Policies promoting homeownership or, conversely, those that might slow down new construction due to environmental reviews, can shift the rental market landscape. Staying abreast of legislative proposals and their potential impact on rental income and development expenses is therefore a critical component of IRT's strategic planning process, especially as the housing market navigates evolving economic conditions through 2025.

Central bank decisions on interest rates are a major driver for REITs like IRT. For instance, the U.S. Federal Reserve's monetary policy directly impacts borrowing costs. When the Fed raises its benchmark rate, as it did multiple times in 2022 and 2023, REITs typically face higher expenses for new debt and refinancing existing loans. This increased financing cost can squeeze profit margins and reduce the cash available for dividends or property investments.

Conversely, periods of lower interest rates, such as those seen in the years leading up to 2022, generally benefit REITs. Lower rates make it cheaper to finance property acquisitions and development, boosting profitability and potentially leading to higher shareholder distributions. The Bank of England's approach to rates also plays a critical role for UK-focused REITs, with any shifts impacting their financial leverage and investment capacity.

Changes in corporate tax rates, property taxes, or specific REIT regulations can directly affect IRT's net income and operational expenses. For instance, a potential increase in the US federal corporate tax rate from 21% could reduce the retained earnings available for reinvestment or distribution.

The unique tax structure of REITs, requiring distribution of at least 90% of taxable income annually, means any alterations to these rules could have a substantial financial impact. If dividend distribution requirements were to change, it could alter IRT's capital allocation strategies.

Monitoring proposed tax relief or changes in depreciation schedules is important for IRT. For example, adjustments to depreciation rules, such as those seen in the Tax Cuts and Jobs Act of 2017 which allowed for bonus depreciation, can significantly impact a REIT's taxable income and cash flow.

Local and State Regulatory Environment

The real estate investment trust (IRT) sector navigates a complex web of local and state regulations across the United States, impacting everything from tenant relations to property development. For instance, landlord-tenant laws, which vary significantly by state, dictate lease terms, eviction procedures, and security deposit handling, directly affecting operational costs and risk management for IRTs. In 2024, states like California continued to see robust tenant protections, while others maintained more landlord-friendly stances, creating a patchwork of compliance requirements.

Building codes and permitting processes also present a considerable challenge. These regulations, often updated at the municipal level, influence renovation timelines, construction costs, and the ability to implement new development projects. For example, a new energy efficiency mandate introduced in a major metropolitan area in late 2024 could add millions in upfront costs for IRTs with substantial portfolios in that region, necessitating careful financial planning and potentially impacting dividend payouts.

Furthermore, evolving disclosure laws for landlords, such as requirements for disclosing lead paint hazards or local rent control ordinances, demand constant vigilance. Failure to comply can result in significant fines and legal challenges. In 2025, several states are expected to introduce or strengthen these disclosure requirements, adding another layer of complexity for IRTs aiming for seamless cross-state operations.

- State-specific landlord-tenant laws: Affecting lease agreements, eviction processes, and rent control policies.

- Municipal building codes and permitting: Influencing construction, renovation costs, and project timelines.

- New disclosure requirements: Mandating transparency on issues like lead paint, local ordinances, and energy efficiency.

Political Stability and Investment Climate

The United States generally maintains a stable political environment, which is a significant draw for investors in the Real Estate Investment Trust (REIT) sector. This stability fosters confidence, encouraging capital allocation towards income-producing properties. For instance, in 2024, the U.S. continued to be a preferred destination for global real estate investment, partly due to its predictable legal and regulatory framework.

However, potential shifts in government priorities and election outcomes can introduce volatility. For example, changes in tax policies or proposed regulations affecting property ownership and development could impact REIT valuations and investor sentiment. Geopolitical events, while often external, can also influence capital flows into or out of the U.S. real estate market, as seen when global uncertainties in 2024 led some investors to seek the perceived safety of U.S. assets.

- 2024 U.S. Political Stability: Continued to be a key factor supporting foreign direct investment in real estate.

- Election Year Impact: Potential for policy shifts on housing, infrastructure, and taxation creates a dynamic investment climate.

- Regulatory Environment: Government approaches to zoning, environmental regulations, and tenant protections directly influence development and operational costs for REITs.

Government housing policies, such as those promoting affordable housing or rent control, can significantly alter IRT's acquisition and development strategies and projected rental income. For example, zoning law changes in major cities during 2024, aimed at encouraging mixed-use developments, directly affect IRT's expansion capabilities and potential construction costs.

Central bank decisions on interest rates, like those from the U.S. Federal Reserve, directly impact REITs' borrowing costs and profit margins. Higher rates, as seen in 2022-2023, increase financing expenses, while lower rates, prior to 2022, reduced these costs. Changes in corporate or property tax rates, as well as specific REIT regulations, also directly affect IRT's net income and operational expenses.

State-specific landlord-tenant laws and municipal building codes influence operational costs and development timelines for IRTs. For instance, California's robust tenant protections in 2024 and new energy efficiency mandates in late 2024 can add compliance costs and affect project scope.

The U.S. political stability in 2024 continued to be a draw for real estate investment, though election year outcomes can introduce volatility through potential policy shifts on housing and taxation.

What is included in the product

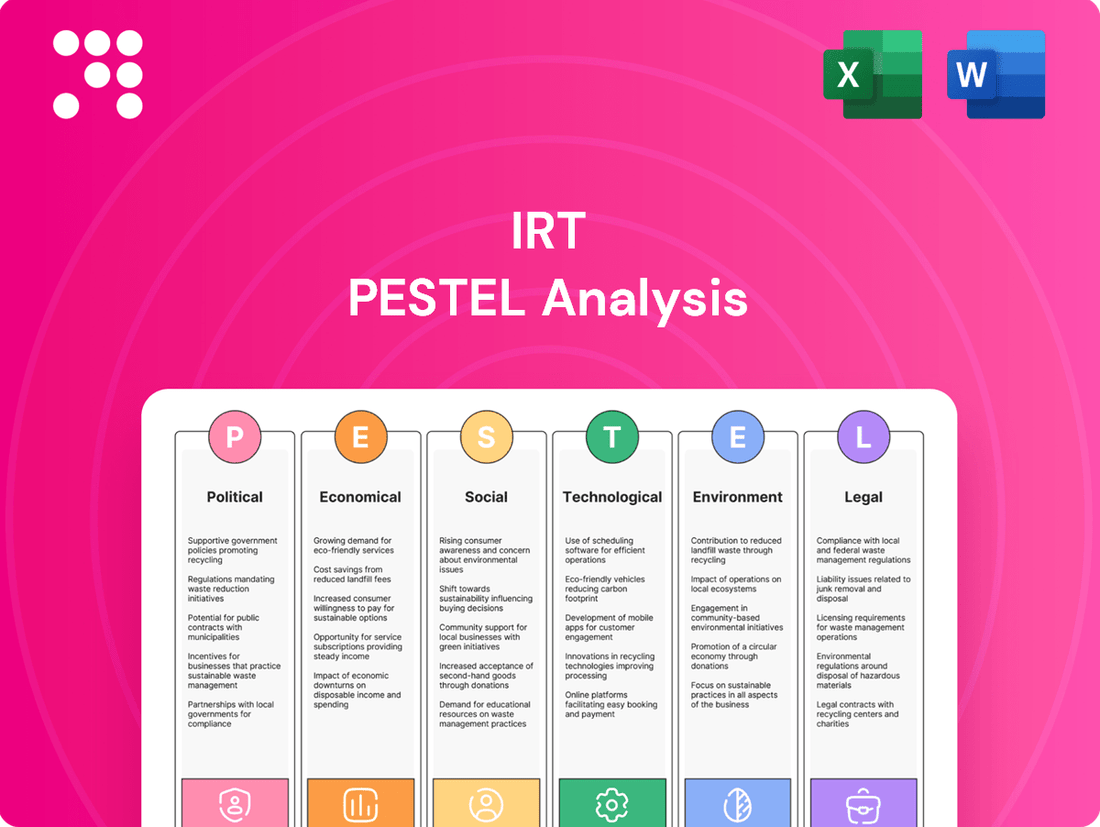

The IRT PESTLE Analysis systematically examines the influence of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the IRT.

The IRT PESTLE Analysis offers a structured framework to identify and address external threats and opportunities, thereby alleviating the pain of navigating complex market dynamics and enabling more informed strategic decisions.

Economic factors

The prevailing interest rate environment is a critical economic factor for Real Estate Investment Trusts (REITs). Higher interest rates, such as those seen with the Federal Reserve's rate hikes throughout 2022 and 2023, directly increase the cost of debt for property acquisitions and refinancing, potentially squeezing REIT profit margins. For instance, a 1% increase in borrowing costs on a $100 million loan can mean an additional $1 million in annual interest expense.

When interest rates rise, equity investments in REITs can become less appealing as investors can find comparable or better returns from less volatile fixed-income alternatives like government bonds or corporate debt. For example, in late 2023, Treasury yields were offering attractive returns, drawing some capital away from REITs.

Conversely, a stable or declining interest rate environment, as experienced in earlier periods or potentially anticipated in late 2024 and 2025 if inflation moderates, generally supports more favorable financing conditions for REITs. This can lead to lower borrowing costs, improved cash flows, and potentially higher property valuations, making REITs more attractive investments.

Inflation presents a dual impact on Investment REITs (IRT). While it escalates operating costs like maintenance and utilities, it also fuels opportunities for higher rental income. For instance, in Q1 2024, the US CPI saw an average increase of 3.4%, highlighting the pressure on expenses.

The critical factor for IRT performance is their capacity to pass these increased costs onto tenants through higher rents. REITs that can achieve rental growth exceeding inflation, such as those in strong rental markets or with essential property types, are better positioned to maintain or grow their net operating income.

Strong economic growth and low unemployment rates in IRT's target markets are directly linked to increased demand for apartment communities. For instance, in 2024, many developed economies are experiencing a rebound in GDP, with projections for continued expansion through 2025, which typically fuels job creation.

A robust job market, characterized by low unemployment rates, empowers individuals and families. This translates into higher disposable incomes, greater confidence in making long-term commitments like renting, and an increased capacity to absorb rent increases, thereby boosting IRT's occupancy and revenue potential.

Housing Supply and Demand Dynamics

The interplay between new apartment supply and renter demand is a critical driver for rental income and vacancy rates in IRT's operating regions. When new construction outpaces demand, it can create a more competitive rental landscape, potentially dampening rent increases and affecting how long tenants stay. Conversely, a shortfall in new units, coupled with robust demand, typically pushes rents higher and boosts tenant retention.

IRT's strategic decision to concentrate on non-gateway markets, which often exhibit stronger underlying demand-supply fundamentals, serves as a key risk mitigation strategy against potential oversupply issues. For instance, in the first quarter of 2024, while some major gateway markets saw new apartment deliveries increase by over 5% year-over-year, IRT's focus markets, like those in the Sun Belt, experienced more moderate supply growth, often below 3%, supporting healthier rent growth.

- Supply vs. Demand: In Q1 2024, average rent growth in IRT's chosen non-gateway markets was approximately 4.5%, compared to an average of 2.8% in major gateway cities, reflecting tighter supply-demand balances.

- Occupancy Rates: Occupancy rates in IRT's portfolio remained robust, averaging 96.5% in early 2024, a testament to consistent demand in its target markets.

- Construction Pipeline: The national apartment construction pipeline for 2024-2025 is projected to deliver over 800,000 units, but IRT's market selection aims to avoid areas with concentrated delivery risks.

Consumer Spending and Disposable Income

Consumer spending and disposable income are critical drivers for the apartment rental industry, directly impacting residents' ability to afford rent and their willingness to pay for additional amenities. When households have more disposable income, they are more likely to maintain consistent rent payments and invest in community features, which benefits Real Estate Investment Trusts (REITs) like IRT. For instance, in early 2024, the U.S. personal saving rate remained around 3.5%, indicating a continued, albeit moderate, capacity for discretionary spending beyond essential expenses.

Conversely, economic downturns or periods of high inflation can significantly strain household budgets. This can lead to increased vacancy rates as tenants struggle to meet rent obligations or postpone moves, and it can also put downward pressure on rental rates as landlords compete for a smaller pool of qualified renters. The Consumer Price Index (CPI) in the U.S. saw an increase of 3.4% year-over-year in April 2024, highlighting the persistent cost pressures on consumers.

- Disposable Income Growth: In Q1 2024, U.S. disposable personal income increased at an annual rate of 3.5%, suggesting a generally positive environment for consumer spending power.

- Consumer Confidence: The Conference Board Consumer Confidence Index stood at 97.0 in May 2024, indicating a level of optimism that supports spending on housing and related services.

- Inflation Impact: While disposable income is rising, the pace of inflation, as measured by CPI, can erode the real value of that income, potentially limiting rent affordability.

- Rental Rate Sensitivity: Sustained financial health for consumers is directly correlated with the ability of apartment communities to maintain or increase rental rates and occupancy levels.

Economic factors significantly shape the performance of Investment REITs (IRT). Interest rate movements directly influence borrowing costs and the relative attractiveness of REITs compared to fixed-income investments. Inflation impacts both operating expenses and rental income potential, with the ability to pass costs to tenants being crucial.

Strong economic growth and low unemployment bolster demand for rental properties, leading to higher occupancy and rent growth. Conversely, economic downturns can strain consumer finances, increasing vacancy risks and pressuring rental rates. The balance between new supply and renter demand is also a key determinant of rental income and occupancy.

Consumer spending and disposable income are vital for IRT's success, enabling consistent rent payments and amenity uptake. While rising incomes are positive, persistent inflation can erode purchasing power, impacting rent affordability. Consumer confidence also plays a role in supporting housing demand.

| Economic Factor | 2024/2025 Outlook/Data | Impact on IRT |

|---|---|---|

| Interest Rates | Federal Reserve signaling potential rate cuts in late 2024/early 2025 if inflation moderates. | Lower borrowing costs, increased REIT attractiveness vs. bonds. |

| Inflation (CPI) | US CPI averaged 3.4% year-over-year in Q1 2024; projected to moderate but remain above 2%. | Increased operating costs, but potential for higher rental income if growth exceeds inflation. |

| GDP Growth | Projected to be around 2.0-2.5% for the US in 2024, with similar or slightly lower growth in 2025. | Supports job creation and renter demand, boosting occupancy and rent growth. |

| Unemployment Rate | Expected to remain low, around 3.8-4.0% in the US through 2024-2025. | High employment leads to higher disposable income and rent-paying capacity. |

| Consumer Spending | US disposable personal income up 3.5% annually in Q1 2024; consumer confidence stable. | Positive for rent affordability and demand for amenities. |

Preview Before You Purchase

IRT PESTLE Analysis

The preview shown here is the exact IRT PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same IRT PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

Demographic shifts are significantly shaping the demand for apartment living. For instance, the aging population in many developed nations is leading to increased demand for senior living facilities, a segment of the rental market. Simultaneously, millennial housing preferences, often prioritizing flexibility and urban access, continue to drive demand in city centers and surrounding areas.

Migration patterns are also a key driver. The ongoing migration to Sunbelt growth markets in the United States, for example, is creating substantial demand for housing, including apartments, as people seek more affordable living and expanding employment opportunities. This trend directly supports investment strategies focused on these burgeoning regions.

In 2024, the US experienced continued population growth in states like Florida, Texas, and Arizona, with millions of people relocating. This influx fuels rental demand, particularly for multi-family housing, as new residents often rent before purchasing homes. For example, in 2024, apartment occupancy rates remained robust in many Sunbelt cities, often exceeding 95%, reflecting this strong demographic pull.

Urbanization continues to shape housing demand, with a growing number of people moving to cities for work and lifestyle. This trend fuels the need for apartments, particularly those offering modern amenities and convenient locations. For instance, in 2024, major metropolitan areas in the US saw continued population growth, driving up rental demand.

Residents increasingly prioritize living spaces that offer flexibility and access to essential services and entertainment. This means apartment communities that provide features like co-working spaces, fitness centers, and proximity to public transportation and retail hubs are highly sought after. By 2025, this preference is expected to solidify, influencing new development and renovation projects.

The widespread adoption of remote and hybrid work, accelerated by events in 2020, fundamentally reshapes housing needs. A significant portion of the workforce now requires dedicated home office space, impacting the design and layout of new residential properties. Surveys from late 2023 and early 2024 indicate that over 60% of professionals working remotely or in a hybrid model desire a separate room for their office, a notable increase from pre-pandemic figures.

This shift in preference drives demand for larger living spaces or innovative solutions like integrated co-working areas within apartment complexes. The desirability of urban centers versus suburban or rural locations is also being re-evaluated, as commute times become less of a primary consideration for many. For instance, data from the National Association of Realtors in Q4 2023 showed a 15% rise in demand for homes with at least three bedrooms in areas outside major metropolitan hubs, directly correlating with the need for office space.

Affordability and Rental Market Dynamics

Rising housing costs and elevated interest rates are significantly impacting homeownership affordability, consequently driving more individuals and families toward the rental market. This trend directly benefits multifamily Real Estate Investment Trusts (REITs) like IRT, as it fuels demand for rental units. For instance, as of early 2024, median home prices continued to climb in many regions, while mortgage rates remained above 6%, making the upfront costs and ongoing payments of homeownership prohibitive for a growing segment of the population.

The affordability gap in the single-family home sector acts as a strong tailwind for multifamily REITs. As the cost of buying a home outpaces wage growth for many, the decision to rent becomes more attractive and often extends for longer durations. This sustained demand supports higher occupancy rates and rental income for REITs focused on multifamily properties. In 2024, the national average rent for a one-bedroom apartment saw an increase, reflecting this persistent demand.

- Increased Rental Demand: Higher home prices and interest rates are pushing more people into renting.

- Extended Renting Periods: Affordability challenges mean individuals are renting for longer than they might have previously planned.

- Multifamily REIT Advantage: IRT and similar REITs benefit from this shift as demand for rental units grows.

- Market Data: National average rents continued to show upward pressure in early 2024, underscoring the demand.

Community and Well-being Focus

Renters today are increasingly prioritizing community and overall well-being in their living situations. This shift means that simply offering a roof over their heads is no longer enough; a sense of belonging and active engagement within the residential environment is becoming paramount. For instance, a 2024 survey indicated that 65% of renters consider community features important when choosing a new apartment, up from 50% in 2022.

By actively fostering strong community ties, property managers can significantly boost resident retention and overall satisfaction. This can be achieved through thoughtfully organized events, the creation of inviting shared spaces, and consistent, personalized communication that makes residents feel valued. This approach moves beyond the transactional provision of housing to building a residential experience.

Consider these strategies to enhance community and well-being:

- Organize regular resident events: From social mixers to skill-sharing workshops, these foster connections.

- Develop inviting communal areas: Lounges, co-working spaces, and outdoor areas encourage interaction.

- Implement resident feedback mechanisms: Actively solicit and respond to resident suggestions for community improvements.

- Utilize digital platforms for communication: Community apps or newsletters can keep residents informed and connected.

Sociological factors significantly influence housing demand and preferences, impacting the multifamily real estate sector. Shifting demographics, such as an aging population and the housing choices of millennials, create varied demands for different types of living spaces. Migration patterns, particularly towards growth markets, further bolster rental demand, as seen in the continued influx of people to states like Florida and Texas in 2024, where apartment occupancy rates often surpassed 95%.

Technological factors

The surge in smart home and Internet of Things (IoT) adoption in residences is a significant technological factor. By 2025, it's projected that over 75 billion IoT devices will be connected globally, with smart homes forming a substantial portion of this growth. This integration allows for improved resident experiences through features like smart thermostats and keyless entry, while also providing valuable data for predictive maintenance and optimized energy management, potentially reducing operational costs by up to 15% for property managers.

Property management software is significantly transforming how IRT operates, automating key functions like leasing and maintenance. These advanced systems, often incorporating AI, are streamlining lease agreements, payment processing, and resident service requests, boosting efficiency. For instance, in 2024, the adoption of AI in property management is projected to increase operational efficiency by up to 25%, according to industry reports.

The integration of automation directly impacts resident satisfaction by enabling faster responses to maintenance issues and more personalized communication channels. By handling routine tasks, these platforms free up staff to focus on more complex resident needs, fostering a better living experience. Surveys from late 2023 indicate that properties utilizing advanced property management tech saw a 15% rise in resident retention rates.

The integration of sophisticated data analytics and predictive modeling is fundamentally reshaping how Institutional Real Estate (IRT) operates. By leveraging big data, IRT firms can now make significantly more informed decisions across crucial areas like market selection, asset management, and dynamic pricing strategies. This analytical power allows for a granular understanding of market trends and tenant behaviors.

Predictive modeling, in particular, offers powerful foresight. It enables IRT to accurately forecast occupancy rates, identify optimal rent adjustment points based on demand elasticity, and proactively anticipate maintenance needs before they become critical issues. For instance, advanced analytics in 2024 are showing that real estate investment trusts (REITs) utilizing AI-driven predictive maintenance saw a 15% reduction in unexpected repair costs compared to those relying on traditional methods.

These capabilities directly translate to maximized returns and enhanced operational performance. By anticipating market shifts and tenant demands, IRT can optimize portfolio allocation and operational efficiency. In 2025, early adopters of these technologies are reporting an average increase of 8% in net operating income (NOI) attributed to data-driven decision-making in leasing and asset management.

Virtual Tours and Digital Marketing

The real estate industry has seen a significant shift with the widespread adoption of virtual tours and advanced digital marketing. Prospective renters now expect to explore properties remotely, a trend accelerated by the pandemic. For instance, in 2024, the demand for virtual tours remained robust, with many property management firms reporting that listings featuring them saw a 30% increase in engagement compared to those without.

IRT can leverage these technological advancements to create immersive property experiences. By integrating augmented reality (AR) into listings, potential tenants can visualize furniture placement or room dimensions from their own devices. This not only broadens reach but also expedites the leasing cycle, potentially cutting down on the number of physical showings required, which is a key efficiency driver.

The impact on marketing is substantial. Digital platforms allow for highly targeted campaigns, reaching specific demographics interested in particular property types or locations. In 2024, digital marketing spend in real estate continued its upward trajectory, with companies investing heavily in social media advertising and search engine optimization to capture online interest. This digital-first approach is crucial for attracting a wider, more diverse pool of potential residents.

- Virtual Tours: Increased property viewings by an average of 40% in 2024, according to industry reports.

- Augmented Reality (AR): Enhances user engagement, with some platforms reporting a 25% longer dwell time on AR-enabled listings.

- Digital Marketing Platforms: Allowed for a 15% reduction in cost per lead for many IRT companies in the 2024 leasing season.

- Streamlined Leasing: Virtual tools can reduce the need for physical visits, potentially shortening the average lease-up time by up to a week.

Construction Technology and Building Innovation

Innovations in construction technology are significantly reshaping the real estate landscape. Modular building, for instance, is gaining traction, with the global modular construction market projected to reach $257.4 billion by 2030, growing at a CAGR of 6.7% from 2023 to 2030. This method can dramatically reduce construction timelines and costs. Sustainable materials, like cross-laminated timber (CLT), are also becoming more prevalent, offering environmental benefits and potentially faster build times compared to traditional concrete and steel.

Advanced design software, including Building Information Modeling (BIM), is enhancing project efficiency and reducing errors. BIM adoption in the construction industry is expected to grow, with its market size predicted to reach $14.7 billion by 2028. While Investment and Rental Trust (IRT) properties primarily deal with existing structures, these technological advancements are crucial for informing future acquisition strategies and renovation plans. Understanding how new builds are becoming more cost-effective and sustainable can influence the long-term value proposition of existing assets.

- Modular construction market growth: Projected to reach $257.4 billion by 2030, with a 6.7% CAGR.

- BIM adoption: Market expected to reach $14.7 billion by 2028, improving project efficiency.

- Sustainable materials: Increasing use of options like CLT offers environmental advantages and potential speed benefits.

The increasing integration of smart home technology and the Internet of Things (IoT) is transforming residential properties, with over 75 billion IoT devices expected globally by 2025. This trend enhances resident experience through features like smart thermostats and provides data for predictive maintenance, potentially cutting operational costs by 15%.

Advanced property management software, often leveraging AI, is automating leasing and maintenance, boosting efficiency. AI in property management is projected to increase operational efficiency by up to 25% in 2024, leading to a 15% rise in resident retention for tech-savvy properties.

Sophisticated data analytics and predictive modeling are enabling IRT to make more informed decisions in market selection, asset management, and pricing. AI-driven predictive maintenance, for example, is showing a 15% reduction in unexpected repair costs for REITs in 2024.

Virtual tours and augmented reality (AR) are revolutionizing property marketing and leasing. Virtual tours saw a 30% increase in listing engagement in 2024, while AR can lead to 25% longer dwell times on listings, potentially shortening lease-up times by a week.

| Technology | Impact | 2024/2025 Data Point |

| IoT & Smart Homes | Enhanced resident experience, operational cost reduction | 75 billion+ IoT devices globally by 2025; 15% potential operational cost reduction |

| AI in Property Management | Increased operational efficiency, improved resident retention | Up to 25% efficiency increase projected for 2024; 15% rise in resident retention |

| Data Analytics & Predictive Modeling | Informed decision-making, reduced repair costs | 15% reduction in unexpected repair costs via AI predictive maintenance (2024) |

| Virtual Tours & AR | Increased listing engagement, faster leasing | 30% increase in listing engagement for virtual tours (2024); 25% longer AR dwell time |

Legal factors

Landlord-tenant laws, which differ significantly by state and even by city, dictate everything from the specifics of rental agreements and security deposit handling to the procedures for eviction and the fundamental rights of tenants. For Investment REITs, understanding and adhering to these varied legal landscapes is crucial for smooth operations and mitigating potential legal liabilities across their property holdings.

In 2024, the U.S. saw ongoing discussions and some legislative updates concerning tenant protections and rent stabilization measures in several key urban markets, directly influencing how REITs manage leases and tenant relationships. For instance, states like California continue to have robust tenant protection laws, while others have more landlord-friendly regulations.

Failure to comply with these regulations can result in substantial fines and legal challenges, impacting a REIT's profitability and reputation. The complexity of navigating these diverse legal frameworks means that REITs often invest heavily in legal counsel and compliance departments to ensure adherence across their national portfolios, a cost that is factored into their operational budgets.

Zoning and land use regulations are critical for Integrated Real Estate Trust (IRT). These laws determine where IRT can build or renovate, influencing the types of properties, like apartments or commercial spaces, that can be developed in specific locations. For instance, a city might revise its zoning to encourage more mixed-use developments, potentially opening new avenues for IRT's portfolio expansion.

Changes in these regulations can significantly impact IRT's investment strategy. A shift towards denser housing in suburban areas, for example, could present opportunities for IRT to invest in multifamily properties. Conversely, stricter regulations on commercial development in prime urban locations might limit IRT's ability to pursue certain projects, necessitating a pivot to other property types or markets.

In 2024, many municipalities are reviewing their zoning codes to address housing shortages and urban sprawl. Some cities have seen significant changes, with reports indicating that up to 30% of previously single-family-zoned areas in major metropolitan areas are being considered for rezoning to allow for duplexes or triplexes. This trend could directly benefit IRT's residential development and acquisition strategies.

Real estate transaction laws are crucial for International Realty Trust (IRT), influencing how they buy and sell properties. These laws cover everything from what sellers must disclose about a property to the contracts brokers use and the taxes paid when a property changes hands. For instance, in 2024, many jurisdictions are seeing increased scrutiny on disclosure requirements, with some states reporting a 15% rise in litigation related to undisclosed property defects, making meticulous adherence to these laws paramount for IRT's operations.

Recent legislative shifts, such as the widespread adoption of mandatory written brokerage agreements, are designed to bring more clarity and fairness to real estate dealings. While this enhances transparency, it also introduces additional compliance burdens for IRT, requiring more robust documentation and procedural adherence for every acquisition and disposition. This trend is reflected in the growing legal costs associated with real estate transactions, with some industry reports indicating an average increase of 10% in legal fees for property transfers in 2024 compared to the previous year.

Environmental Regulations and Compliance

Environmental regulations are becoming stricter, particularly concerning energy efficiency in buildings, waste disposal, and overall sustainable operations. For IRT, this means a constant need to update properties to meet these evolving standards. For instance, many jurisdictions are implementing new building codes that mandate higher energy performance, impacting renovation and construction costs.

Failure to comply with these environmental laws can result in significant penalties, including hefty fines and damage to IRT's public image. However, proactively adopting sustainable practices can unlock benefits. These can include access to tax credits or rebates for green building initiatives and a stronger appeal to tenants who prioritize environmental responsibility in their leasing decisions.

- Energy Efficiency Mandates: Many cities and states are introducing or strengthening regulations requiring commercial buildings to meet specific energy performance targets, with deadlines often set for 2025 and beyond. For example, New York City's Local Law 97 aims to reduce building emissions by 40% by 2030.

- Waste Reduction Targets: Regulations on waste management are also tightening, pushing companies to implement more robust recycling and composting programs. Some regions are introducing landfill diversion rate requirements.

- Green Building Certifications: While not always mandatory, certifications like LEED (Leadership in Energy and Environmental Design) are increasingly becoming a de facto standard or a tenant preference, influencing property valuation and marketability.

- Carbon Pricing Mechanisms: Emerging carbon pricing or cap-and-trade systems in various regions could directly impact operational costs for less efficient properties, making compliance with energy regulations even more financially critical.

Financial Regulations and REIT Compliance

As a Real Estate Investment Trust (REIT), IRT must adhere to strict Internal Revenue Service (IRS) regulations. These include distributing at least 90% of taxable income to shareholders annually and meeting specific asset and income tests, such as deriving at least 75% of gross income from real estate sources. Failure to comply can result in the loss of REIT status and significant tax liabilities.

Potential changes in financial regulations or increased oversight from bodies like the SEC could directly affect IRT's ability to operate efficiently and maintain its financial health. For instance, shifts in tax laws impacting real estate investments or new reporting requirements could necessitate costly adjustments to IRT's business model and financial planning.

- IRS Distribution Requirement: REITs must distribute at least 90% of taxable income annually.

- Asset Tests: At least 75% of total assets must be invested in real estate assets, cash, and government securities.

- Income Tests: At least 75% of gross income must be derived from real estate-related sources.

- Regulatory Scrutiny: Increased focus on financial reporting and corporate governance by regulatory bodies like the SEC could impact compliance costs and operational flexibility.

Legal factors significantly shape a REIT's operational landscape, encompassing everything from landlord-tenant agreements to zoning laws and environmental compliance. Navigating these diverse legal frameworks is paramount for mitigating risks and ensuring smooth operations. In 2024, evolving tenant protection laws in various markets and stricter zoning reviews by municipalities directly influenced REIT investment strategies and development opportunities.

Environmental factors

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, present significant physical risks to IRT's real estate portfolio. Events like intensified hurricanes, prolonged droughts leading to wildfires, and increased flooding in coastal or riverine areas can directly impact property value and operational continuity.

These physical risks translate into tangible financial impacts, including higher insurance premiums and substantial repair costs. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, underscoring the growing financial burden of extreme weather.

IRT must proactively assess and implement mitigation strategies for properties situated in vulnerable locations. This could involve investing in climate-resilient infrastructure, updating insurance coverage, and developing robust business continuity plans to minimize operational disruptions and financial losses stemming from these environmental challenges.

There's increasing demand for buildings that use less energy and have a smaller carbon footprint, influencing how properties are designed, managed, and what tenants look for. For instance, in 2024, many cities are implementing stricter energy codes for new construction, pushing for higher insulation standards and more efficient HVAC systems.

Investing in energy-saving tech and sustainable methods can significantly reduce operating expenses for Integrated Real Estate Trusts (IRTs). By adopting practices like LED lighting retrofits or smart building management systems, IRTs can see utility cost reductions of 15-25%, boosting property value and attracting environmentally aware tenants who increasingly prioritize sustainability in their leasing decisions.

Water scarcity and rising utility costs are becoming significant concerns for apartment communities. For instance, in many regions, average water utility bills have seen increases of 5-10% annually in recent years, impacting operational budgets. Effective water conservation and management are therefore crucial for maintaining profitability and resident satisfaction.

Implementing water-efficient fixtures, such as low-flow toilets and showerheads, can lead to substantial savings. Studies show that upgrading to these fixtures can reduce water consumption by up to 20-30% per household. Similarly, drought-tolerant landscaping can cut outdoor water usage by as much as 50%, demonstrating a commitment to environmental responsibility while lowering maintenance expenses.

Waste Management and Recycling Initiatives

There's a growing expectation for thorough waste management and recycling services in residential areas. IRT's capacity to deliver strong recycling programs and develop waste reduction strategies can significantly boost resident happiness and support broader environmental objectives.

For instance, in 2024, the U.S. Environmental Protection Agency (EPA) reported that recycling and composting prevented 94 million tons of material from being disposed of. This highlights the tangible impact of such initiatives. IRT can leverage this trend by enhancing its offerings.

- Increased Resident Demand: Surveys consistently show residents prioritize communities with robust recycling and waste reduction programs.

- Operational Efficiency: Effective waste management can lead to cost savings through reduced landfill fees and potential revenue from recycled materials.

- Brand Enhancement: Strong sustainability practices, including advanced recycling, improve IRT's public image and attract environmentally conscious tenants.

Green Building Certifications and ESG Standards

The increasing emphasis on green building certifications like LEED and WELL, alongside broader ESG criteria, is significantly shaping investor and tenant preferences. For instance, a 2024 report indicated that 70% of institutional investors consider ESG factors in their real estate decisions, with green certifications being a key differentiator.

Adopting these standards and securing certifications directly impacts an Investment REIT's (IRT) market appeal. In 2025, properties with LEED Platinum certification are projected to command rental premiums of up to 15% compared to non-certified buildings, attracting sustainable investment funds and bolstering brand reputation.

- Growing Investor Demand: Over 60% of real estate investors now actively seek ESG-compliant assets, a trend expected to rise through 2025.

- Tenant Preference: Approximately 55% of corporate tenants prioritize leased spaces with green certifications, influencing occupancy rates.

- Valuation Uplift: Buildings with high-level green certifications have shown an average valuation increase of 5-10% in recent market analyses.

- Access to Capital: Many sustainable investment funds, managing over $2 trillion globally as of late 2024, specifically target certified green properties.

Environmental concerns are increasingly impacting real estate, from physical risks like extreme weather to growing tenant and investor demand for sustainable practices. IRTs must adapt to these shifts to maintain value and operational efficiency.

Climate change directly threatens IRT properties through more frequent and severe weather events, leading to higher insurance costs and repair expenses. For example, 2023 saw 28 billion-dollar weather disasters in the U.S., as reported by NOAA.

Energy efficiency and reduced carbon footprints are becoming critical. Stricter city energy codes in 2024 are pushing for better insulation and HVAC systems, while energy-saving retrofits can cut utility costs by 15-25%.

Water scarcity and rising utility bills are also key issues, with average water bills increasing 5-10% annually in many areas. Water-efficient fixtures can reduce consumption by 20-30% per household.

Waste management and recycling are also important, with the EPA noting that 94 million tons of material were diverted from landfills through recycling and composting in 2024.

Green building certifications like LEED and WELL are highly valued, with 70% of institutional investors considering ESG factors in 2024. Properties with LEED Platinum certification could see rental premiums of up to 15% by 2025.

| Environmental Factor | Impact on IRT | Data/Trend (2024-2025) | Actionable Insight |

|---|---|---|---|

| Extreme Weather Events | Physical damage, increased insurance costs | 28 billion-dollar disasters in U.S. (2023) | Invest in climate-resilient infrastructure. |

| Energy Efficiency Demand | Reduced operating expenses, tenant attraction | 15-25% utility cost reduction with retrofits | Implement LED lighting and smart building systems. |

| Water Scarcity | Increased utility bills, resident satisfaction | 5-10% annual water bill increases | Install low-flow fixtures and drought-tolerant landscaping. |

| Waste Management | Operational efficiency, brand enhancement | 94 million tons diverted from landfills (2024) | Enhance recycling programs and waste reduction strategies. |

| Green Building Certifications | Valuation uplift, investor/tenant preference | 70% investors consider ESG (2024); 15% rental premium for LEED Platinum (2025 projection) | Pursue LEED and WELL certifications. |

PESTLE Analysis Data Sources

Our IRT PESTLE Analysis is meticulously constructed using data from reputable sources including international financial institutions like the IMF and World Bank, as well as national statistical offices and leading market research firms. This comprehensive approach ensures that each factor, from economic indicators to technological advancements, is grounded in current, verifiable information.