Interactive Brokers Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interactive Brokers Group Bundle

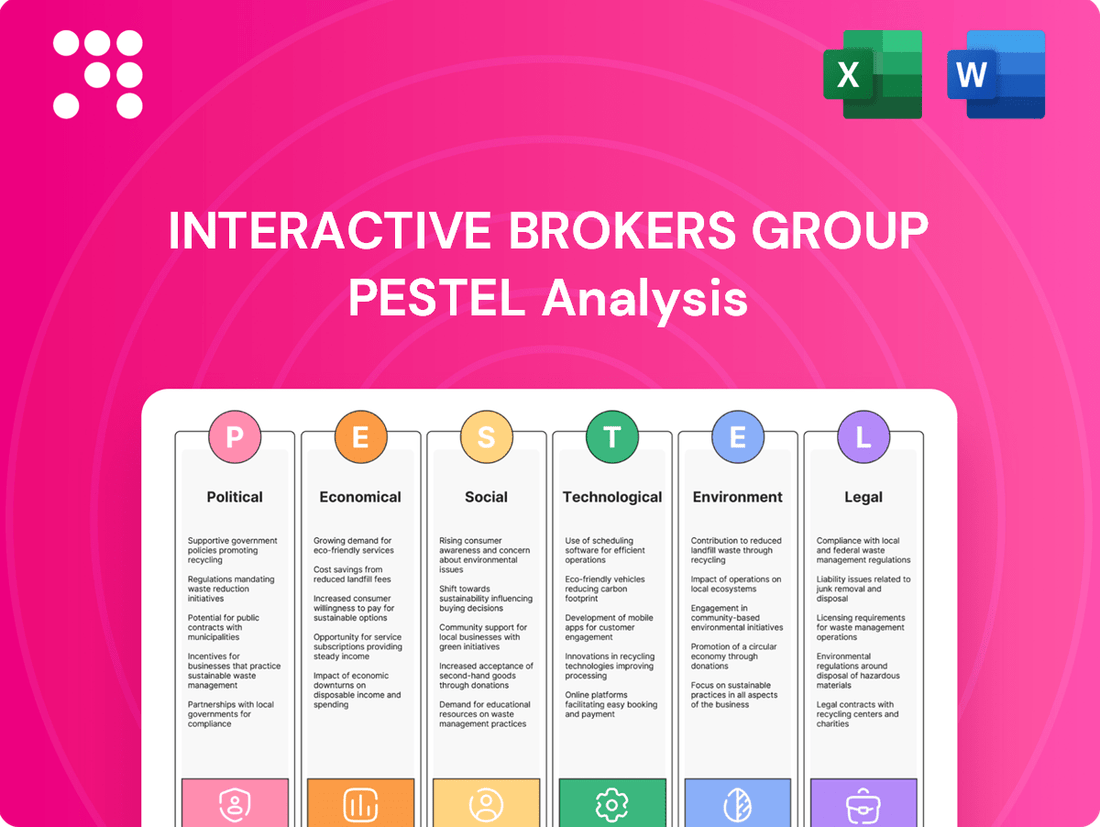

Interactive Brokers Group operates within a dynamic global landscape, heavily influenced by evolving political regulations, economic volatilities, and rapid technological advancements. Understanding these external forces is crucial for anticipating market shifts and strategic opportunities. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to inform your decisions.

Gain a critical advantage by exploring the intricate web of political, economic, social, technological, legal, and environmental factors shaping Interactive Brokers Group's future. This expertly crafted analysis provides the clarity you need to navigate challenges and capitalize on emerging trends. Unlock these vital insights by downloading the full version today.

Political factors

The global financial industry continues to see significant shifts in its regulatory frameworks. For Interactive Brokers, this means adapting to evolving capital requirements and trading rules across various jurisdictions, impacting their operational compliance and associated costs. For instance, in 2024, the European Securities and Markets Authority (ESMA) continued its focus on market transparency and investor protection, potentially leading to increased reporting burdens.

Global political stability and international trade relations are critical for Interactive Brokers, directly impacting capital flows and investor confidence. For instance, the ongoing geopolitical tensions in Eastern Europe, which intensified in early 2022, led to significant market volatility throughout 2022 and into 2023, affecting trading volumes across various asset classes.

Tensions or conflicts in key regions can cause sharp market swings, influencing investor appetite for riskier assets. Interactive Brokers, operating in over 200 countries and territories, must proactively manage these geopolitical risks to maintain operational continuity and provide uninterrupted trading services to its diverse client base.

The company’s extensive global presence means it is exposed to a wide array of political landscapes. In 2023, for example, trade disputes between major economic powers continued to create uncertainty, which can translate into reduced trading activity and potentially lower commission revenue for platforms like Interactive Brokers.

Government policies on taxation significantly shape the financial landscape for Interactive Brokers and its clients. For instance, changes in capital gains tax rates, like those debated or implemented in various jurisdictions during 2024 and 2025, directly impact investor returns and can influence trading volumes.

The potential introduction or adjustment of financial transaction taxes, which have been considered in several European countries and the US, could add costs to trading activities, potentially reducing retail and institutional participation on platforms like Interactive Brokers.

Furthermore, corporate tax rates influence the profitability of companies listed on exchanges, indirectly affecting investor sentiment and the overall attractiveness of equity markets. Interactive Brokers must remain agile, monitoring these evolving tax policies across its global operating regions to adapt its services and client advice effectively.

International Sanctions and Restrictions

The evolving landscape of international sanctions, particularly those impacting major economies and financial markets, presents a significant political factor for Interactive Brokers. For instance, the extensive sanctions imposed on Russia following its 2022 invasion of Ukraine, which included freezing assets of key entities and individuals, directly affected financial institutions' ability to operate and transact within or with those sanctioned parties. Interactive Brokers, like other global brokers, must meticulously navigate these restrictions to avoid penalties.

Compliance with these ever-changing sanctions regimes is not merely a legal obligation but a critical operational necessity. Failure to adhere to regulations from bodies like the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) or the European Union can result in substantial fines and reputational damage. In 2023, financial institutions globally faced billions in sanctions-related penalties, underscoring the high stakes involved.

- Sanctions Compliance Costs: Interactive Brokers invests heavily in technology and personnel to screen clients and transactions against global sanctions lists, a cost that is ongoing and substantial.

- Market Access Limitations: Sanctions can restrict access to certain markets or client segments, potentially limiting revenue streams and expansion opportunities for the company.

- Geopolitical Risk: Increased geopolitical tensions can lead to the rapid imposition of new sanctions, requiring agile responses and robust risk management frameworks.

Political Stability in Key Markets

Political stability in key markets significantly influences Interactive Brokers' operations. For instance, the 2024 elections in major economies like the United States and India, alongside ongoing geopolitical tensions in regions such as Eastern Europe, can create market volatility. Uncertainty stemming from these events can lead to reduced trading volumes and investor caution, directly impacting the revenue generated from commissions and fees. A stable political landscape, conversely, supports predictable economic conditions, which are crucial for a brokerage firm's consistent performance and client confidence.

Political factors significantly shape Interactive Brokers' operating environment, influencing everything from regulatory compliance to market access. Evolving trade policies and geopolitical tensions, such as those seen in Eastern Europe and between major economic powers throughout 2023 and into 2024, can create market volatility and impact investor confidence, directly affecting trading volumes and commission revenue. Furthermore, changes in government policies, including capital gains and financial transaction taxes, directly influence investor returns and trading activity, necessitating constant adaptation by Interactive Brokers.

| Political Factor | Impact on Interactive Brokers | Example/Data (2023-2024) |

|---|---|---|

| Regulatory Changes | Increased compliance costs, operational adjustments | ESMA's continued focus on market transparency and investor protection in the EU. |

| Geopolitical Instability | Market volatility, reduced trading volumes, risk management needs | Ongoing tensions in Eastern Europe impacting global markets; trade disputes creating uncertainty. |

| Taxation Policies | Influence on investor returns, trading activity | Debates and potential implementations of capital gains tax changes in various jurisdictions during 2024. |

| International Sanctions | Operational restrictions, compliance investments, market access limitations | Navigating sanctions regimes like those imposed on Russia, with billions in penalties for non-compliance in 2023. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Interactive Brokers Group, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making, identifying key external drivers and their implications for the company's future growth and competitive positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Interactive Brokers.

Uses clear and simple language to make the content accessible to all stakeholders, demystifying the PESTLE analysis for broader understanding within Interactive Brokers.

Economic factors

Changes in global interest rates, particularly those set by major central banks like the U.S. Federal Reserve and the European Central Bank, significantly influence Interactive Brokers' operations. For instance, the U.S. Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through early 2024, impacting borrowing costs for clients using margin accounts and the yield on uninvested client cash. Higher rates can increase the expense of margin financing, potentially dampening trading activity for leveraged strategies, but also boost net interest income generated from client balances held by the firm.

Global economic growth remains a key driver for Interactive Brokers. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.0% in 2023, indicating a generally positive but moderate economic environment. This steady growth supports increased investor confidence and trading volumes, directly benefiting Interactive Brokers' commission-based revenue streams.

However, recession risks persist, influencing market volatility. While major economies like the US showed resilience through 2024, concerns about inflation and geopolitical tensions could still trigger slowdowns. Such periods often see reduced trading activity as investors become more cautious, potentially impacting Interactive Brokers' top line.

Interactive Brokers' business model is intrinsically linked to the ebb and flow of global economic activity. Higher trading volumes driven by economic expansion translate to greater revenue from commissions and other transaction-based fees. Conversely, economic downturns or heightened recession fears can lead to decreased market participation and, consequently, lower revenues for the company.

Inflation rates significantly influence investment strategies and central bank actions. For instance, in the US, the Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, and remained at that level in May 2024, impacting real returns and prompting adjustments in monetary policy.

Volatile inflation erodes the purchasing power of capital, compelling investors to re-evaluate their portfolios. This can lead to a shift towards assets like Treasury Inflation-Protected Securities (TIPS) or commodities, as seen in periods of elevated inflation, potentially affecting demand for traditional investment vehicles offered by Interactive Brokers.

Interactive Brokers, like any financial institution, must navigate the operational impact of inflation on its costs, from technology infrastructure to employee compensation. Managing these rising expenses while maintaining competitive service fees is crucial for sustained profitability in a fluctuating economic climate.

Currency Exchange Rate Volatility

Currency exchange rate volatility is a critical economic factor for Interactive Brokers given its expansive global reach and its role as a platform for forex trading. Fluctuations in currency values directly affect the worth of client portfolios held in various denominations. For instance, a strengthening US Dollar could diminish the value of a European investor's holdings denominated in Euros when reported in USD terms.

These currency swings also impact the profitability of cross-border transactions executed through Interactive Brokers. If a client buys shares in a company listed on the London Stock Exchange using US Dollars, the profit or loss realized upon selling those shares will be influenced by the GBP/USD exchange rate at the time of the transaction. This necessitates robust risk management strategies for both the company and its clients.

Furthermore, Interactive Brokers' financial performance is subject to translation risk. Revenues generated in foreign currencies must be converted back to the company's reporting currency, typically the US Dollar. For example, in Q1 2024, a significant portion of Interactive Brokers' revenue was derived from international operations. Changes in exchange rates between Q1 2023 and Q1 2024 could have altered the reported USD value of these international earnings, even if the local currency earnings remained constant. The company actively hedges to mitigate these effects.

- Impact on Client Assets: A 5% appreciation of the USD against the Euro in 2024 could reduce the USD value of a European client's USD-denominated assets by 5%.

- Cross-Border Trade Profitability: A trader selling Japanese Yen denominated assets for USD in mid-2024 might see their USD returns reduced if the Yen weakened against the Dollar.

- Financial Reporting Translation: If Interactive Brokers reported €1 billion in revenue from its European operations in Q2 2024, and the average EUR/USD rate was 1.08, this translates to $1.08 billion. A shift to 1.05 in Q3 2024 would mean the same €1 billion would only report as $1.05 billion.

- Forex Trading Volume: The average daily forex volume traded on global platforms, including Interactive Brokers, can surge during periods of high currency volatility, reflecting increased client activity and potential revenue opportunities for the firm.

Market Liquidity and Trading Volumes

Market liquidity and trading volumes are crucial for Interactive Brokers, as they directly impact commission revenue. When markets are liquid and trading volumes are high, more client trades are executed, leading to increased brokerage fees. For instance, in Q1 2024, global equity trading volumes saw a notable uptick compared to the previous year, driven by investor optimism around potential interest rate cuts and strong corporate earnings reports.

Robust trading activity across various asset classes, including stocks, options, futures, and forex, directly benefits Interactive Brokers. Higher volumes mean more transactions processed through their platform. In April 2024, the average daily volume on the New York Stock Exchange (NYSE) was approximately 4.1 billion shares, reflecting significant market participation.

- Increased Trading Activity: Higher market liquidity and trading volumes directly translate to more client orders being filled, boosting Interactive Brokers' commission-based earnings.

- Economic Influence: Economic conditions and investor sentiment are primary drivers of market liquidity and trading volumes, impacting the company's revenue streams.

- Asset Class Diversity: The breadth of products Interactive Brokers offers, from equities to forex, means that strong volumes across multiple asset classes contribute to overall revenue growth.

- Market Performance Data: In the first half of 2024, the Cboe Volatility Index (VIX) often remained elevated, indicating increased trading in options and contributing to higher volumes for brokers.

Economic growth and interest rate policies are pivotal for Interactive Brokers. The U.S. Federal Reserve maintained its interest rate between 5.25% and 5.50% in early 2024, impacting margin costs and client cash yields. Global growth, projected at 3.2% for 2024 by the IMF, supports trading volumes, though recession risks due to inflation and geopolitical factors can dampen activity.

Inflation, with U.S. CPI at 3.4% year-over-year in April and May 2024, affects real returns and prompts shifts in investment strategies, potentially altering demand for various financial products. Currency exchange rate volatility also poses risks and opportunities, influencing client portfolio values and cross-border transaction profitability, with Interactive Brokers employing hedging strategies to mitigate these effects.

| Economic Factor | 2024 Data Point | Impact on Interactive Brokers |

|---|---|---|

| Global Growth Projection | 3.2% (IMF) | Supports trading volumes and investor confidence. |

| US Federal Funds Rate | 5.25%-5.50% (early 2024) | Affects margin borrowing costs and client cash yields. |

| US CPI Inflation | 3.4% (April/May 2024) | Influences investment strategies and central bank actions. |

| NYSE Avg Daily Volume | ~4.1 billion shares (April 2024) | Indicates market participation and potential commission revenue. |

What You See Is What You Get

Interactive Brokers Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Interactive Brokers Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Interactive Brokers Group's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. Explore detailed insights into how global trends and regulations influence this leading online brokerage firm.

Sociological factors

The investor landscape is changing, with younger, tech-savvy individuals increasingly entering the market. This demographic shift, coupled with a broader rise in retail investor participation, directly impacts the demand for intuitive and easily accessible trading platforms. For instance, by the end of 2024, it's projected that Gen Z and Millennials will account for a significant portion of new investment accounts, highlighting the need for platforms that resonate with digital natives.

Interactive Brokers must strategically adapt its services and outreach to attract these emerging investor segments without alienating its established institutional and professional clientele. This involves streamlining user interfaces and developing targeted educational resources that simplify complex financial concepts, ensuring broader market appeal.

The growing emphasis on financial literacy is a significant sociological trend. In 2024, a significant portion of the population, particularly younger generations, are actively seeking to understand and manage their personal finances, driving demand for investor education. This trend directly benefits brokerage firms like Interactive Brokers, as it translates into a larger pool of potential clients eager to learn about investing.

Interactive Brokers can capitalize on this by expanding its educational offerings. For instance, the platform's extensive library of webinars, articles, and trading simulators provides valuable resources for both novice and experienced investors. By making these tools easily accessible and continuously updated with 2024/2025 market insights, Interactive Brokers can attract and retain a more informed and engaged client base.

Societal attitudes toward financial risk are constantly evolving. For instance, following the strong market performance of 2021, where the S&P 500 saw a 28.7% gain, there was a noticeable increase in retail investor participation and a greater willingness to embrace riskier assets. However, the market volatility experienced in 2022, with the S&P 500 declining by 19.4%, led to a significant shift towards more conservative investment strategies and a heightened awareness of potential losses.

Interactive Brokers must remain attuned to these shifts. For example, in early 2024, surveys indicated a growing demand for lower-volatility ETFs and fixed-income products among a segment of investors, a direct response to the preceding market turbulence. Understanding these changing risk appetites is crucial for Interactive Brokers to effectively tailor its product suite, from offering more robust risk management tools to adjusting the marketing of higher-risk investment options.

Trust in Digital Financial Platforms

Public trust in digital financial platforms is a cornerstone for success. A 2024 study by Deloitte found that 65% of consumers consider data security a primary concern when choosing a financial service provider. This sentiment directly impacts client acquisition and retention for firms like Interactive Brokers.

Security incidents can have a significant ripple effect. For instance, following a major data breach at a competitor in late 2023, industry-wide declines in new account openings were observed for several weeks. Interactive Brokers' proactive investments in advanced cybersecurity measures, including multi-factor authentication and continuous threat monitoring, are crucial for mitigating these risks and fostering client confidence.

- Cybersecurity Investment: Interactive Brokers reported spending over $100 million on technology and cybersecurity in 2024 to protect client data.

- Transparency: Clear communication about data protection policies and incident response plans is vital for maintaining user trust.

- User Education: Empowering clients with knowledge about online security best practices further strengthens the platform's security posture.

Social Responsibility and ESG Investing

Societal expectations are increasingly shaping investment strategies, with a significant rise in demand for Environmental, Social, and Governance (ESG) considerations. By 2024, a substantial portion of global assets under management were expected to incorporate ESG principles, reflecting a clear shift in investor priorities. Interactive Brokers' role in facilitating this trend is crucial.

Investors are actively seeking financial platforms that not only provide access to ESG-compliant investment products but also demonstrate a commitment to transparency and corporate social responsibility. This growing demand presents an opportunity for Interactive Brokers to attract and retain a new demographic of ethically-minded investors. For instance, surveys in late 2023 and early 2024 indicated that over 70% of millennial investors consider ESG factors when making investment decisions.

Interactive Brokers can leverage this trend by:

- Expanding its offering of ESG-screened ETFs and mutual funds.

- Enhancing transparency regarding the ESG credentials of listed companies.

- Showcasing its own corporate sustainability initiatives and social impact.

The demographic shift towards younger, tech-savvy investors is a significant sociological factor. By the end of 2024, Gen Z and Millennials are projected to represent a substantial portion of new investment accounts, necessitating platforms that appeal to digital natives. Interactive Brokers must adapt its services to attract these emerging investors while retaining its existing client base, focusing on user-friendly interfaces and accessible educational content.

Technological factors

Interactive Brokers is actively integrating AI and ML to refine trading algorithms and enhance risk management. For instance, in 2024, the company reported increased investment in AI-driven tools to identify market anomalies and optimize trade execution, aiming for greater efficiency and reduced latency.

These advancements are also crucial for improving customer experience, with AI powering personalized recommendations and faster query resolution. By leveraging machine learning for predictive analytics, Interactive Brokers can anticipate client needs and offer tailored investment solutions, a key differentiator in the competitive landscape.

The ongoing evolution of AI, particularly in areas like natural language processing for sentiment analysis of financial news, presents significant opportunities. Interactive Brokers' commitment to staying ahead in AI adoption is vital for maintaining its edge in areas like fraud detection and regulatory compliance, ensuring a secure trading environment.

As digital platforms become more central to financial services, cybersecurity and data privacy are critical concerns for Interactive Brokers. The company manages extensive sensitive client financial and personal information, making it a significant target for cyber threats. For instance, in 2023, the financial services sector experienced a notable increase in sophisticated phishing and ransomware attacks, highlighting the persistent risks.

Interactive Brokers must consistently invest in cutting-edge cybersecurity defenses and rigorously comply with evolving data privacy regulations, such as GDPR and CCPA. This commitment is vital not only for safeguarding client assets but also for upholding the trust and reputation essential in the financial industry. A data breach could lead to substantial financial penalties and irreparable damage to client relationships.

Blockchain and distributed ledger technology (DLT) are poised to transform financial market operations, particularly in areas like clearing and settlement. These innovations promise enhanced efficiency and transparency, potentially streamlining complex processes. For instance, by 2024, the global blockchain in finance market was valued at over $10 billion, demonstrating significant adoption and growth.

Interactive Brokers must actively monitor and evaluate the integration of DLT solutions. This strategic approach will be crucial for maintaining a competitive edge and identifying opportunities for new, innovative service offerings in an increasingly digital financial landscape.

Cloud Computing Infrastructure

Cloud computing infrastructure is a cornerstone for Interactive Brokers, providing the scalability and flexibility needed to manage a global trading platform. This allows the company to efficiently handle fluctuating trading volumes and quickly roll out new services. For instance, in Q1 2024, Interactive Brokers reported average daily volume of 15.0 million trades, a significant increase from previous periods, underscoring the need for robust and adaptable infrastructure.

The cost-efficiency of cloud services is also a major advantage, enabling Interactive Brokers to optimize operational expenses while maintaining high performance. This strategic use of cloud technology directly supports their commitment to providing low-cost trading to clients. Their focus on cloud-native architectures in 2024 and 2025 aims to further enhance agility and reduce infrastructure overhead.

Furthermore, cloud computing is critical for ensuring operational resilience and rapid disaster recovery. This capability is essential for maintaining client trust and uninterrupted service, especially during periods of high market volatility. Interactive Brokers' continued investment in advanced cloud-native solutions in 2024 is designed to bolster these resilience measures.

- Scalability: Supports millions of daily trades and rapid growth in user base.

- Flexibility: Enables quick deployment of new trading tools and features.

- Cost-Efficiency: Optimizes operational expenses through pay-as-you-go cloud models.

- Resilience: Ensures business continuity and disaster recovery capabilities.

Development of New Trading Tools and Platforms

Interactive Brokers consistently invests in cutting-edge trading technology. In 2024, the company continued to enhance its Trader Workstation (TWS) platform, introducing new algorithmic trading tools and expanding its AI-powered research capabilities. This focus on innovation is vital for staying competitive in the rapidly evolving fintech landscape.

The development of sophisticated charting tools and advanced order types is paramount for attracting and retaining a diverse client base, from seasoned professionals to retail investors. Interactive Brokers' commitment to intuitive mobile application design also plays a key role in meeting the demands of today's on-the-go traders.

- Platform Enhancements: Continued development of TWS with new algorithmic trading features and AI-driven research.

- User Interface: Focus on intuitive design for both desktop and mobile trading applications.

- Client Retention: Advanced tools and features are critical for attracting and retaining both institutional and retail clients.

Interactive Brokers is heavily leveraging artificial intelligence and machine learning to sharpen its trading algorithms and fortify risk management practices. In 2024, the company significantly boosted its investment in AI tools designed to spot market irregularities and optimize trade execution, aiming for enhanced efficiency and reduced latency.

These technological strides are also crucial for elevating the client experience, with AI driving personalized investment suggestions and faster issue resolution. By employing machine learning for predictive analytics, Interactive Brokers can anticipate client needs and deliver tailored investment solutions, a key differentiator in a competitive market.

The continuous advancement of AI, particularly in natural language processing for analyzing financial news sentiment, presents substantial opportunities. Interactive Brokers’ dedication to early AI adoption is vital for maintaining its competitive edge in areas like fraud detection and regulatory adherence, ensuring a secure trading environment.

Legal factors

Interactive Brokers navigates a complex web of global financial regulations, with each jurisdiction imposing unique capital adequacy, market conduct, and reporting requirements. For instance, compliance with Europe's MiFID II and the US Dodd-Frank Act remains paramount, alongside adherence to myriad local securities laws.

Non-compliance carries substantial risks, including significant fines and operational limitations. In 2023, financial institutions globally faced billions in regulatory penalties. For Interactive Brokers, maintaining robust compliance frameworks is essential to avoid such repercussions and safeguard its operational integrity and market standing.

The global landscape of data protection and privacy is becoming increasingly rigorous. Laws like Europe's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) significantly influence how Interactive Brokers handles client information, from collection to storage and processing. For instance, GDPR mandates strict consent mechanisms and data breach notification protocols, impacting operational procedures.

Adhering to these evolving regulations is not just a legal necessity but a cornerstone of client trust. Non-compliance can lead to substantial fines; for example, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Interactive Brokers must maintain robust data security measures and transparent privacy policies to safeguard client data and avoid such repercussions.

Interactive Brokers, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are vital in the global effort to prevent financial crime and the funding of terrorism. For instance, in 2023, the Financial Crimes Enforcement Network (FinCEN) in the US reported over 300,000 suspicious activity reports (SARs), underscoring the scale of these efforts.

To comply, Interactive Brokers must maintain robust internal systems for client verification and ongoing monitoring. This includes conducting thorough due diligence to understand their clients' financial activities and promptly reporting any suspicious transactions to regulatory bodies. Failure to adhere to these requirements can result in substantial fines and damage to the company's reputation.

Consumer Protection Legislation

Consumer protection laws are a significant legal factor for Interactive Brokers. Regulations focused on fair trading, transparency in disclosures, and effective dispute resolution directly shape how the company engages with its retail investor base. For instance, the Securities and Exchange Commission (SEC) in the US, along with similar bodies globally, mandates strict disclosure rules for financial products and services. Interactive Brokers' commitment to these standards, including those under the SEC's Regulation Best Interest, helps prevent client complaints and potential regulatory penalties.

Adherence to these consumer protection frameworks is crucial for maintaining client trust and avoiding costly legal battles. In 2023, the Financial Industry Regulatory Authority (FINRA) reported that arbitration and mediation filings, often stemming from client disputes, remained a key area of focus for the industry. Interactive Brokers' robust compliance mechanisms aim to minimize such instances, safeguarding its reputation and operational stability.

- Fair Trading Practices: Laws ensuring that financial services are offered without deception or unfair advantage.

- Disclosure Requirements: Mandates for clear and comprehensive information about products, fees, and risks.

- Dispute Resolution: Mechanisms for efficiently and fairly addressing client grievances.

- Regulatory Oversight: The role of bodies like the SEC and FINRA in enforcing these protections.

Cross-Border Regulatory Harmonization

The evolving landscape of cross-border financial regulations presents both opportunities and challenges for Interactive Brokers. A move towards greater harmonization of rules across different jurisdictions, such as recent efforts by the Financial Stability Board (FSB) to standardize crypto-asset regulations, can streamline operations and reduce compliance costs, allowing for more efficient global service delivery. Conversely, regulatory fragmentation, where differing national rules create a complex patchwork of requirements, can significantly increase operational burdens and hinder the seamless expansion of services. For instance, discrepancies in data privacy laws or capital requirements between the EU and the US necessitate tailored approaches for each market.

Interactive Brokers must remain agile in navigating these international regulatory shifts. The company's ability to adapt to varying compliance frameworks directly influences its capacity to maintain robust global market access and offer its diverse product suite to a worldwide clientele. As of early 2025, the ongoing discussions around global prudential standards for large, internationally active financial institutions underscore the critical need for continuous monitoring and strategic adaptation to ensure ongoing operational integrity and market participation.

- Harmonization Benefits: Simplified compliance and reduced operational costs for global service delivery.

- Fragmentation Challenges: Increased complexity and potential hindrances to seamless international market access.

- Adaptation Imperative: Proactive monitoring and adjustment to international regulatory changes are crucial for maintaining global operations.

Interactive Brokers operates under a stringent global regulatory framework, necessitating adherence to diverse rules concerning capital adequacy, market conduct, and reporting. Key regulations like Europe's MiFID II and the US Dodd-Frank Act, alongside numerous local securities laws, dictate operational standards. The firm's commitment to compliance is underscored by the substantial fines levied against financial institutions for non-compliance, with billions in penalties reported globally in 2023.

Data privacy laws such as GDPR and CCPA significantly impact how Interactive Brokers handles client information, requiring robust security measures and transparent policies. Failure to comply can lead to penalties of up to 4% of global annual revenue or €20 million under GDPR, emphasizing the critical need for data protection. The firm must maintain strong internal controls to manage client data effectively and build trust.

Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are paramount for preventing financial crime. Interactive Brokers must implement thorough client verification and ongoing monitoring processes, as evidenced by the hundreds of thousands of suspicious activity reports filed annually by entities like FinCEN in the US. Effective AML/KYC practices are essential to avoid severe penalties and reputational damage.

Consumer protection laws, enforced by bodies like the SEC and FINRA, ensure fair trading practices and transparent disclosures. Interactive Brokers' adherence to regulations such as the SEC's Regulation Best Interest aims to minimize client disputes and regulatory actions. In 2023, FINRA's focus on arbitration and mediation highlights the ongoing importance of robust client protection measures.

Environmental factors

The global shift towards Environmental, Social, and Governance (ESG) investing is profoundly influencing how capital is allocated. By the end of 2023, assets under management in ESG-focused funds reached an estimated $3.8 trillion globally, a significant increase from previous years, demonstrating a clear trend in investor preference.

This growing emphasis translates directly into client demand for investment products that not only aim for financial returns but also adhere to sustainability principles. Investors are actively seeking out companies and funds that exhibit strong ESG performance, pushing for greater transparency in corporate reporting on these metrics.

For Interactive Brokers, this means a strategic imperative to expand its offerings to include a wider array of ESG-screened investment options and provide robust data analytics for ESG performance. This adaptation is crucial to meet evolving client needs and maintain a competitive edge in the financial services landscape.

Regulatory bodies and investors are pushing for greater transparency regarding climate change risks. For Interactive Brokers, this means a growing expectation to understand and report on how climate-related factors might impact its operations and the financial markets it serves, covering both physical damage and the economic shifts associated with transitioning to a greener economy.

The financial industry, including brokers like Interactive Brokers, is under scrutiny to assess and disclose its exposure to climate risks. This involves evaluating potential impacts from extreme weather events on assets and liabilities, as well as transition risks stemming from policy changes, technological advancements, and shifts in market preferences towards sustainable investments.

The global push for standardized sustainability reporting, exemplified by the integration of SASB and TCFD recommendations into the International Sustainability Standards Board (ISSB) standards, is intensifying. This evolution directly impacts financial institutions like Interactive Brokers, requiring them to disclose more granular environmental performance data to meet growing investor and stakeholder demands.

Interactive Brokers, as a publicly listed entity, faces increasing pressure to bolster its own sustainability disclosures. This includes providing clearer insights into its operational environmental footprint and demonstrating robust governance practices that align with these emerging global benchmarks, reflecting a broader trend seen across the financial sector.

Operational Carbon Footprint

Even though Interactive Brokers is primarily an electronic brokerage, it still has an operational carbon footprint. This footprint stems from the energy consumed by its data centers, office buildings, and general business operations. As environmental responsibility becomes a bigger focus for companies, Interactive Brokers will likely face increased pressure to evaluate and reduce its impact.

This aligns with broader sustainability trends and growing investor expectations for transparency regarding environmental, social, and governance (ESG) performance. For instance, many large financial institutions are setting ambitious net-zero targets. While specific figures for Interactive Brokers' operational footprint for 2024 or 2025 aren't publicly detailed in the same way as a manufacturing company, the trend for the financial sector is towards greater disclosure and reduction efforts.

- Data Center Energy Use: A significant portion of the operational footprint comes from powering and cooling the servers that run trading platforms and store data.

- Office Space Consumption: Energy for lighting, heating, cooling, and electronic equipment in their global offices contributes to the carbon footprint.

- Business Travel: While less impactful than data centers, employee travel for meetings and conferences also adds to emissions.

- Supply Chain: Indirect emissions from the purchase of goods and services, such as hardware for data centers, are also considered.

Reputation Linked to Environmental Stewardship

Interactive Brokers' reputation is increasingly tied to its environmental stewardship. Younger investors, in particular, are drawn to firms that demonstrate a strong commitment to sustainability. This means that how Interactive Brokers manages its resources and waste directly influences its public image and ability to attract new clients.

Proactive environmental policies can be a significant differentiator. For instance, a company's investment in renewable energy for its data centers or robust waste reduction programs can enhance its appeal. Conversely, a lack of visible environmental action could lead to negative perceptions and potentially hinder client growth.

- Environmental Consciousness: A growing segment of the investor base prioritizes companies with strong environmental, social, and governance (ESG) credentials.

- Brand Perception: Demonstrating responsible resource usage and waste management can bolster Interactive Brokers' brand image and trustworthiness.

- Client Acquisition: Positive environmental performance can attract environmentally conscious clients, while negative perceptions may deter them.

The increasing focus on environmental sustainability is reshaping investment strategies and regulatory landscapes. By the close of 2023, global ESG assets under management were estimated to be around $3.8 trillion, underscoring a significant shift in investor priorities toward companies with strong environmental performance.

Interactive Brokers, like other financial institutions, faces growing pressure to disclose its operational environmental impact and embrace sustainable practices. This includes addressing energy consumption in data centers and offices, with a general industry trend towards setting net-zero targets and improving reporting transparency, as seen with the adoption of ISSB standards.

The company's environmental stewardship directly influences its brand perception and ability to attract clients, particularly among younger demographics who prioritize ESG factors. Demonstrating a commitment to reducing its carbon footprint and adopting eco-friendly operations can enhance its market position.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Interactive Brokers Group is grounded in data from reputable financial news outlets, regulatory filings, and economic forecasting agencies. We incorporate insights from government reports on financial markets, technological advancements, and socio-demographic shifts to provide a comprehensive view.