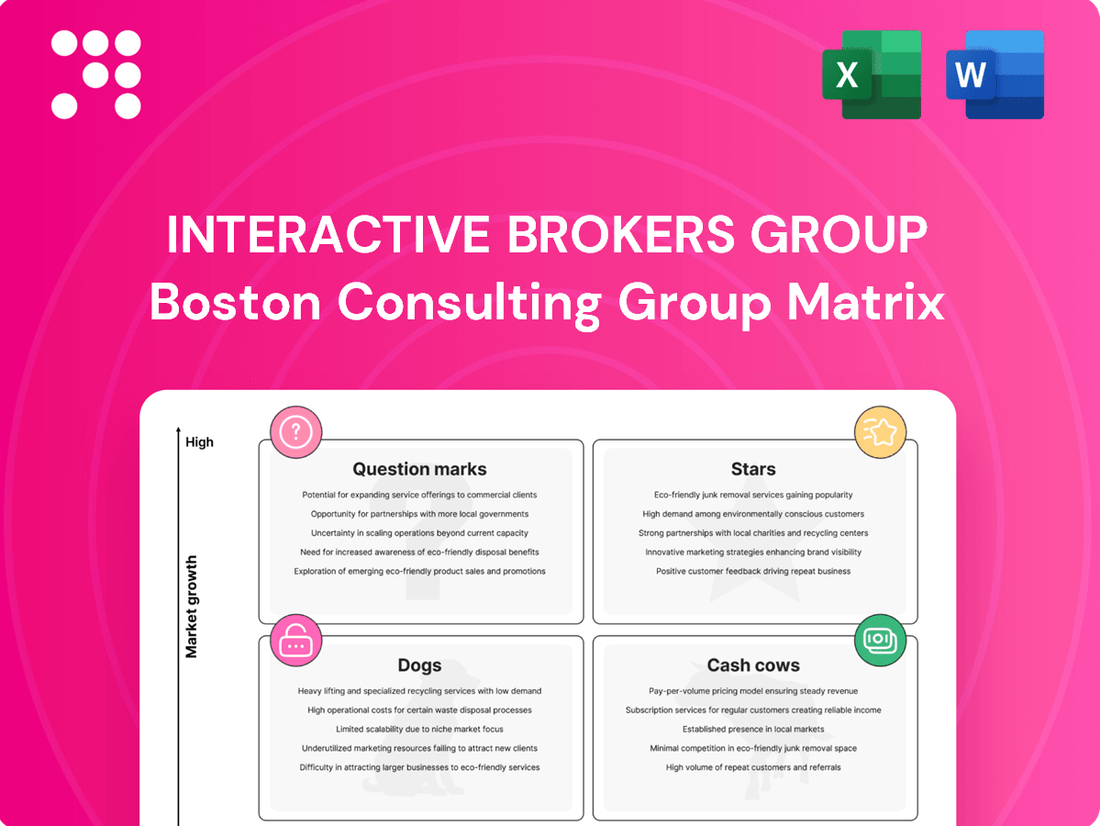

Interactive Brokers Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interactive Brokers Group Bundle

Curious about Interactive Brokers Group's strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Interactive Brokers Group.

Stars

Interactive Brokers Group has seen impressive expansion in its client base, with a significant 32% year-over-year surge in customer accounts by Q1 2025, reaching 3.62 million. This upward trend continued into Q2 2025, bringing the total to 3.87 million.

The company is well-positioned to welcome its four millionth customer in Q3 2025, underscoring its growing appeal to a global audience of investors. This consistent client acquisition reflects Interactive Brokers' success in capturing market share by offering robust global access and sophisticated trading tools.

Interactive Brokers' advanced automated trading platforms, like the newly launched IBKR Desktop and the established Trader Workstation (TWS), are cornerstones of their offering. These platforms are renowned for their speed, sophisticated tools, and extensive automation capabilities, catering to professional and active retail traders. They provide access to over 160 global markets, ensuring best-in-class order execution.

Interactive Brokers' overnight trading capabilities are a clear Star in its BCG portfolio. The company saw its overnight trading volumes skyrocket by over 170% from the second quarter of 2024 to the second quarter of 2025. This impressive growth highlights the strong demand for continuous market access, particularly from its extensive international clientele.

This service allows global investors to trade U.S. stocks and ETFs seamlessly, regardless of their local time zone. The robust Alternative Trading System (ATS) is a key enabler, demonstrating its capacity to manage significant surges in trading volume, a crucial factor for a Star in a rapidly evolving market.

Institutional and Professional Trading Services

Interactive Brokers Group's Institutional and Professional Trading Services segment is a significant player, holding a commanding market position. This segment caters to a sophisticated clientele, including hedge funds and proprietary trading firms.

Clients in this category are attracted to Interactive Brokers' advanced trading platforms, which offer exceptional order execution speeds and reliability. Furthermore, the company's competitive margin lending rates and extensive product universe, spanning global equities, options, futures, and forex, are key differentiators. In 2024, Interactive Brokers reported that its Electronic Brokerage segment, which encompasses these professional services, handled an average of 2.5 million trades per day.

This high-volume trading activity, driven by complex strategies employed by institutional clients, translates into substantial commission revenue for the company. The segment's profitability is bolstered by the sheer scale of transactions and the specialized needs of these professional traders.

- Market Dominance: Interactive Brokers commands a substantial share of the institutional and professional trading market.

- Client Appeal: Superior execution, low margin rates, and broad product access draw major clients like hedge funds.

- Revenue Driver: High trading volumes from sophisticated strategies contribute significantly to commission revenue.

- Daily Volume: In 2024, the Electronic Brokerage segment averaged 2.5 million trades daily, underscoring the segment's activity.

Global Market Access and Expansion

Interactive Brokers' (IBKR) extensive global market access positions it as a Star in the BCG Matrix. With access to over 160 market centers spanning 36 countries, IBKR facilitates international trading for a vast client base.

Approximately 84% of IBKR's customers are located outside the United States, underscoring its significant international presence. This global footprint is crucial as it taps into the growing trend of cross-border investing.

- Global Reach: Access to 160+ market centers in 36 countries.

- International Customer Base: Roughly 84% of customers are non-US based.

- Market Trend Alignment: Capturing the increasing demand for global investing.

- Competitive Advantage: Localized offerings support high international trading market share.

Interactive Brokers' (IBKR) robust overnight trading capabilities are a clear Star in its BCG portfolio. The company experienced a remarkable surge in overnight trading volumes, increasing by over 170% between Q2 2024 and Q2 2025. This growth highlights the significant demand for continuous market access, especially from its international clientele, who benefit from seamless trading of U.S. stocks and ETFs regardless of their local time zones.

The company's advanced Alternative Trading System (ATS) effectively manages these increased volumes, a critical factor for a Star in a dynamic market. This service is a key differentiator, attracting a global user base that values 24/7 market participation.

IBKR's Institutional and Professional Trading Services segment also shines as a Star. This segment, serving hedge funds and proprietary trading firms, benefits from IBKR's superior execution speeds, competitive margin rates, and extensive product offerings. In 2024, IBKR's Electronic Brokerage segment, which includes these professional services, processed an average of 2.5 million trades daily, demonstrating its dominance and revenue-generating power from sophisticated trading strategies.

Interactive Brokers' extensive global market access, covering over 160 market centers in 36 countries, firmly establishes it as a Star. With approximately 84% of its customer base located outside the United States, IBKR is perfectly positioned to capitalize on the growing trend of cross-border investing.

| Segment | BCG Category | Key Metrics | Growth Drivers |

| Overnight Trading | Star | 170%+ volume growth (Q2 2024-Q2 2025) | Global demand for 24/7 trading, robust ATS |

| Institutional & Professional Trading | Star | 2.5M avg. daily trades (2024) | Superior execution, low margin rates, broad product access |

| Global Market Access | Star | 160+ market centers, 36 countries | 84% non-US customer base, cross-border investing trend |

What is included in the product

Interactive Brokers' BCG Matrix analysis provides strategic insights into its diverse product portfolio, guiding investment decisions.

Interactive Brokers Group's BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Interactive Brokers' core brokerage services, encompassing stocks, options, and futures, are firmly positioned as cash cows within its business model. These offerings benefit from mature markets and a substantial, loyal client base, consistently generating high commission revenue from ongoing trading activity. For instance, in 2023, Interactive Brokers reported average daily volume of 10.7 million equity trades, a testament to the sustained demand for these foundational services.

Net interest income from customer balances is a significant cash cow for Interactive Brokers Group. This revenue stream, generated from customer margin loans and credit balances, demonstrates a robust and reliable performance, especially in supportive interest rate environments. In 2023, Interactive Brokers reported net interest income of $4.1 billion, a substantial increase from $1.7 billion in 2022, highlighting its strength.

This segment holds a high market share within the mature financial services industry. It consistently generates more cash than is needed for its own operational upkeep, effectively funding other business initiatives. The strong performance in net interest income underscores its position as a stable and predictable contributor to the company's overall financial health.

Interactive Brokers' proprietary technology and automation infrastructure are undeniable cash cows. This sophisticated system allows them to handle massive trading volumes and onboard new clients with remarkable efficiency.

This automation is the bedrock of their impressive financial performance, contributing to an industry-leading pretax profit margin of 74-75% as of their latest reports. It means they can grow without a proportional increase in staff or operational expenses, creating a powerful competitive advantage and a steady stream of profits.

Securities Lending Program

Interactive Brokers' securities lending program is a cornerstone of its revenue generation, functioning as a mature and highly efficient operation. This program leverages fully paid-for securities held in customer accounts, lending them to market participants like short-sellers and market makers. In return, Interactive Brokers earns substantial revenue through fees and interest, which significantly bolsters its net interest income.

The efficiency of this program is a key driver of its success. By utilizing existing customer assets, the company generates consistent cash flow with relatively low incremental operational costs. This strategic approach maximizes the profitability of customer holdings, turning dormant assets into active revenue streams for the firm.

- Mature and Efficient Operation: Interactive Brokers' securities lending is a well-established and streamlined process.

- Revenue Generation: The program generates significant income by lending customer securities, contributing to net interest income.

- Leveraging Customer Assets: It effectively utilizes existing customer assets to create cash flow.

- Low Overhead: The program operates with minimal additional operational expenses, enhancing profitability.

Global Clearing and Execution Services

Interactive Brokers' Global Clearing and Execution Services are indeed a classic Cash Cow within their business model. These operations hold a significant market share, acting as the backbone for a vast number of trades across global exchanges. This established position means they generate consistent revenue through execution and clearing fees, providing a stable financial foundation for the company.

The sheer volume and consistent demand for these services underscore their Cash Cow status. Interactive Brokers leverages its extensive infrastructure and decades of experience to efficiently process trades, making them a go-to provider. This operational excellence translates directly into reliable profitability.

- Market Share Dominance: Interactive Brokers consistently ranks among the top brokers for trade volume, indicating a substantial share in the clearing and execution market.

- Revenue Stability: Fees generated from executing and clearing millions of trades daily provide a predictable and robust revenue stream.

- Operational Efficiency: Advanced technology and a global network allow for cost-effective processing of high volumes, maximizing profit margins.

- Industry Trust: Their long-standing reputation for reliability and security fosters continued client loyalty and attracts new business.

Interactive Brokers' core brokerage services, including stocks, options, and futures, are established cash cows. These mature offerings benefit from a large, loyal client base, consistently generating high commission revenue from consistent trading activity. For example, in the first quarter of 2024, Interactive Brokers reported an average of 19.0 million equity trades per day, demonstrating sustained demand for these fundamental services.

Net interest income from customer balances is another significant cash cow for Interactive Brokers Group. This revenue, derived from customer margin loans and credit balances, shows robust performance, especially in favorable interest rate environments. In Q1 2024, Interactive Brokers reported net interest income of $1.1 billion, a slight decrease from $1.2 billion in Q4 2023 but still a strong contributor.

This segment holds a high market share in the mature financial services industry, consistently generating more cash than needed for operations, thereby funding other business initiatives. The strong net interest income performance reinforces its position as a stable and predictable contributor to the company's overall financial health.

| Business Segment | BCG Matrix Classification | Key Characteristics | 2023/2024 Data Point |

| Core Brokerage Services (Stocks, Options, Futures) | Cash Cow | Mature market, high market share, consistent revenue from commissions | 10.7 million equity trades/day (2023 avg) |

| Net Interest Income (Customer Balances) | Cash Cow | Leverages customer deposits and margin lending, strong in high-rate environments | $1.1 billion (Q1 2024) |

| Securities Lending | Cash Cow | Efficiently monetizes customer assets with low incremental costs | Contributes significantly to Net Interest Income |

| Global Clearing & Execution | Cash Cow | Dominant market share, high volume, stable fee-based revenue | Processes millions of trades daily globally |

Preview = Final Product

Interactive Brokers Group BCG Matrix

The Interactive Brokers Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This ensures complete transparency, as there are no watermarks, demo content, or hidden alterations; you get the exact strategic analysis ready for professional application.

What you see is the actual, uncompromised Interactive Brokers Group BCG Matrix file that will be yours upon completing the purchase. This means the comprehensive market analysis and strategic insights are precisely as presented, ready for immediate download and integration into your business planning.

This preview accurately represents the final Interactive Brokers Group BCG Matrix report you will obtain after your purchase. It is a professionally designed, analysis-ready document, free from any modifications, ensuring you receive the complete strategic tool for your business needs.

Dogs

Basic, low-activity retail accounts at Interactive Brokers Group (IBKR) would likely be categorized as Cash Cows within the BCG Matrix. These customers are drawn to IBKR's low costs but contribute little in terms of commission or margin interest, representing a minimal revenue stream. While IBKR aims for broad market appeal, its primary profitability stems from more active and sophisticated trading clients.

Interactive Brokers' platform, while robust, may house certain legacy analytical tools that have been overshadowed by more modern, intuitive, or AI-driven functionalities. These older tools, though still functional, likely experience diminished user engagement and may not offer the same competitive edge or revenue-generating potential as their newer counterparts. For instance, some of the more complex, less streamlined charting packages or data visualization tools might be considered in this category, especially as the platform continues to integrate advanced AI-powered research and analysis features, which saw significant development and adoption throughout 2024.

Interactive Brokers' (IBKR) focus on global reach and automated trading means its presence in highly localized or illiquid markets is often limited. These niche areas, characterized by low trading volumes and significant regulatory complexities, don't typically align with IBKR's efficiency-driven model. For instance, in 2024, IBKR continued to prioritize its expansion in major, liquid markets, which saw robust growth in user acquisition and trading activity.

Traditional Human-Intensive Client Support Models

Traditional human-intensive client support models would likely be categorized as a 'Dog' within Interactive Brokers Group's BCG Matrix. This is due to the company's core strategy of leveraging technology and automation to drive efficiency and cost savings.

Interactive Brokers aims to minimize human intervention for routine tasks, making high-reliance on manual support less appealing. For instance, while many brokerage firms might staff large call centers, Interactive Brokers' platform is designed for self-service. In 2023, the company reported a significant portion of customer inquiries being resolved through their online help center and automated tools, rather than direct human interaction.

- High Cost of Manual Support: Human-intensive support incurs higher operational costs compared to automated solutions, impacting profitability.

- Scalability Challenges: Traditional models struggle to scale efficiently with rapid customer growth, unlike automated systems.

- Focus on Technology: Interactive Brokers' competitive advantage lies in its advanced trading platforms and efficient, tech-driven operations.

Services Directly Competing with High-Touch Wealth Management

Interactive Brokers, known for its technology-driven, low-cost brokerage model, strategically sidesteps direct competition with the high-touch wealth management services typically provided by giants like Charles Schwab or Fidelity. These established players often cater to clients seeking extensive personalized advice, financial planning, and dedicated relationship managers, a segment where Interactive Brokers has minimal presence.

For Interactive Brokers, attempting to enter this highly personalized and labor-intensive market would likely be classified as a 'Dog' within a BCG Matrix framework. This is because it represents a significant departure from their core competency and existing business strategy, which centers on providing efficient, automated trading platforms and services to a broad base of self-directed investors and institutions.

The financial commitment and operational shift required to build out a robust high-touch wealth management offering, complete with a large team of financial advisors and extensive client support infrastructure, would be substantial. Given Interactive Brokers' current market share in this specific niche is virtually non-existent, the potential return on investment for such an endeavor is questionable, making it an unlikely strategic fit.

- Low Market Share: Interactive Brokers has a negligible market share in the traditional high-touch wealth management segment.

- Strategic Misalignment: This service area contrasts sharply with their core strategy of automated, low-cost trading solutions.

- High Operational Costs: Building and maintaining a high-touch service model requires significant investment in personnel and infrastructure.

- Limited ROI Potential: The substantial investment needed for this segment likely offers a low return given their current positioning.

Traditional human-intensive client support models at Interactive Brokers Group (IBKR) would likely be categorized as 'Dogs' in the BCG Matrix. This is due to IBKR's core strategy of leveraging technology and automation for efficiency and cost savings, minimizing the need for manual intervention in routine tasks.

In 2023, IBKR reported that a significant portion of customer inquiries were resolved through their online help center and automated tools, rather than direct human interaction, highlighting the limited reliance on and potential profitability of high-cost, manual support systems.

The scalability challenges and high operational costs associated with human-intensive support models further reinforce their classification as 'Dogs', especially when contrasted with the company's competitive advantage derived from advanced, tech-driven operations.

Interactive Brokers' strategic decision to focus on automated, self-service platforms means that traditional, high-touch wealth management services, which require extensive personalized advice and dedicated relationship managers, represent a 'Dog' within their BCG Matrix. This segment has a negligible market share for IBKR and is a significant departure from their core competencies, demanding substantial investment with limited potential ROI.

Question Marks

Interactive Brokers has significantly broadened its cryptocurrency trading capabilities, introducing popular tokens such as Chainlink (LINK), Avalanche (AVAX), and Sui (SUI) to its platform. This strategic expansion targets the rapidly growing digital asset market, aiming to attract a wider range of investors. The firm recognizes the immense potential within this sector, positioning it as a key growth area.

Despite these advancements, Interactive Brokers faces hurdles in securing a substantial market share for its crypto offerings. A notable limitation is the current absence of support for transferring crypto assets into or out of the platform. This lack of transfer functionality presents a significant barrier for users who wish to move their digital holdings freely.

Consequently, cryptocurrency trading on Interactive Brokers is categorized as a Question Mark within the BCG Matrix. This classification signifies a high-growth, high-uncertainty segment. The company must invest further to address its current limitations, particularly the transfer capabilities, to effectively compete and establish a dominant market position.

Interactive Brokers' recent launch of prediction markets, like Forecast Contracts in Canada in April 2025, places them squarely in the Question Mark category of the BCG Matrix. This is a new and potentially high-growth area, aiming to attract different types of clients and boost IBKR's brand visibility.

While the potential is significant, these markets are still in their early stages for IBKR. They currently have a small market share, meaning considerable investment in marketing and development is needed to gain traction and widespread use among their client base.

IBKR InvestMentor, launched in July 2025, is positioned as a 'Question Mark' in Interactive Brokers Group's BCG matrix. While it targets the burgeoning market of novice investors, a segment projected to grow by 15% annually through 2028, its current market share within the crowded financial education app space remains minimal.

The app's success hinges on substantial investment to drive user acquisition and enrich its educational content. Without this, it risks remaining a low-share, high-cost venture, failing to ascend to 'Star' status and achieve sustainable growth in the competitive fintech landscape.

Strategic Expansion into New Emerging Geographic Markets

Interactive Brokers' strategic expansion into new emerging geographic markets, such as certain regions in Southeast Asia or Africa, would be classified as Question Marks in the BCG Matrix. These markets often present high growth potential but currently have a low market share for Interactive Brokers.

These initiatives demand significant capital investment. For instance, establishing robust local trading infrastructure and ensuring compliance with diverse regulatory frameworks in markets like India or Brazil requires substantial upfront funding. Interactive Brokers reported a 20.4% increase in diluted earnings per share to $1.47 for the first quarter of 2024, indicating financial capacity for such expansions.

- High Growth Potential: Emerging markets often exhibit faster economic growth and increasing disposable incomes, leading to a larger potential client base for brokerage services.

- Low Market Share: Currently, Interactive Brokers may have limited penetration in these specific new territories, meaning they are not yet dominant players.

- Significant Investment Required: Success necessitates substantial investment in localized technology, marketing campaigns tailored to local cultures, and navigating complex regulatory environments.

- Uncertain Future Returns: While the potential for high returns exists, the outcome is uncertain due to competitive landscapes and market volatility.

AI-Powered Investment Themes Tool

The AI-Powered Investment Themes tool, a recent addition to Interactive Brokers Group's offerings, is currently positioned as a 'Question Mark' within the BCG Matrix. While its AI-driven approach to translating market trends into actionable trade ideas holds considerable promise for improving client research and engagement, its direct contribution to acquiring new clients or significantly boosting trading activity among existing ones remains unproven.

For this tool to ascend to 'Star' status, Interactive Brokers needs to demonstrate a clear, measurable impact on key growth metrics. This involves not only refining the AI's predictive accuracy and breadth of themes but also ensuring seamless integration into the client workflow. For instance, if the tool can demonstrably help a significant portion of users identify profitable trades, it will naturally drive higher engagement and potentially attract new clients seeking an edge.

- Potential for Growth: The tool's ability to identify emerging market trends and translate them into specific investment ideas offers substantial upside.

- Uncertain Market Share Impact: Its effectiveness in driving new client acquisition and increasing trading volumes, key indicators of market share growth, is still under evaluation.

- Developmental Stage: Continued investment in AI refinement and user interface improvements is crucial for its success.

- Client Adoption is Key: The ultimate success hinges on how well clients embrace and utilize the tool for their investment decisions.

Interactive Brokers' foray into prediction markets, like Forecast Contracts launched in Canada in April 2025, places them in the 'Question Mark' category of the BCG Matrix. This represents a new, potentially high-growth area aimed at diversifying their client base and enhancing brand visibility.

Despite this potential, these markets are nascent for IBKR, holding a small market share. Significant investment in marketing and development is crucial for gaining traction and widespread adoption among their clients.

The IBKR InvestMentor, introduced in July 2025, is also a 'Question Mark'. It targets the growing novice investor segment, which is projected for 15% annual growth through 2028. However, its current market share in the crowded financial education app sector is minimal.

For InvestMentor to become a 'Star', substantial investment is needed for user acquisition and content enhancement. Without it, it risks becoming a costly venture with low market share, failing to achieve sustainable growth.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Interactive Brokers' financial reports, market share analysis, and industry growth projections to provide strategic insights.