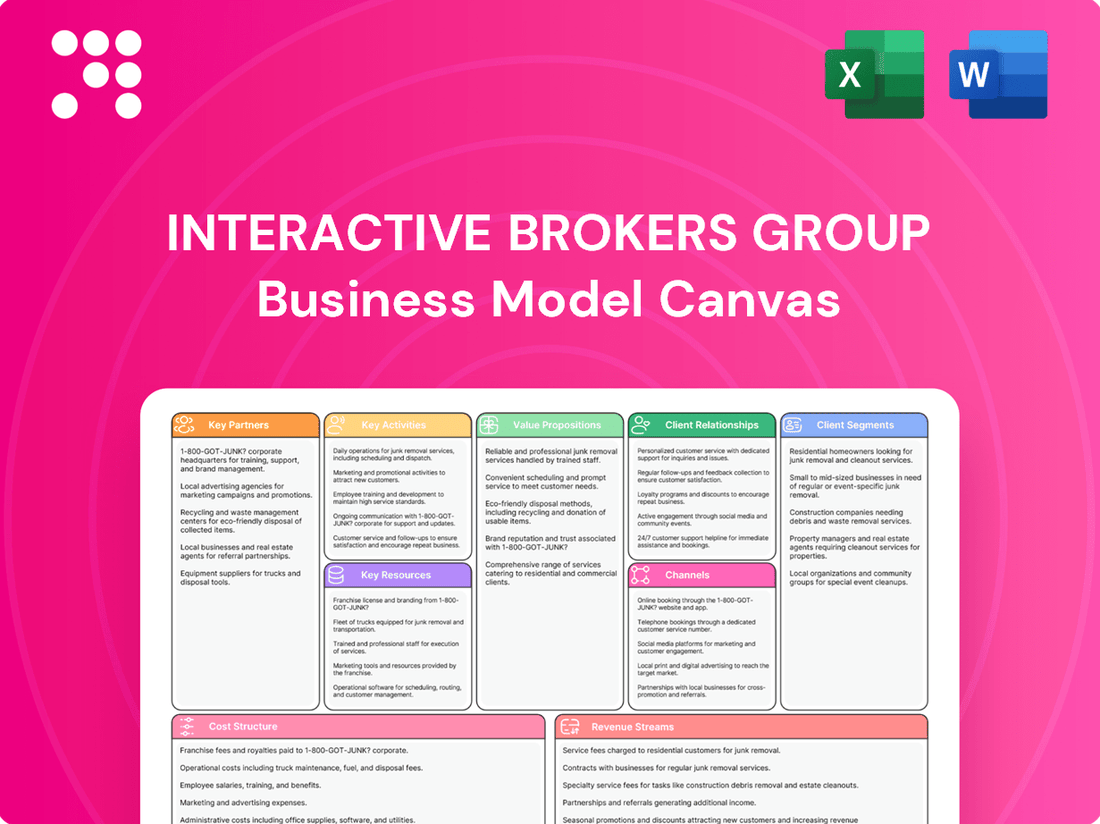

Interactive Brokers Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interactive Brokers Group Bundle

Unlock the strategic blueprint behind Interactive Brokers Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage technology and a vast product offering to serve a global client base, driving significant revenue through trading commissions and interest. Discover their key partnerships and cost structures to understand their competitive advantage.

Partnerships

Interactive Brokers cultivates vital relationships with a multitude of global exchanges and market makers. These collaborations are fundamental to their strategy, enabling them to secure best execution prices and ensure competitive trading costs for their clientele.

These partnerships are instrumental in the efficient routing of client orders and provide access to an extensive universe of financial instruments. For instance, in 2024, Interactive Brokers continued to expand its direct market access to major exchanges worldwide, facilitating trades across equities, options, futures, forex, bonds, and ETFs.

By leveraging these deep-seated connections, Interactive Brokers can offer an exceptionally broad array of tradable assets. This extensive product access, combined with sophisticated order routing technology, allows them to optimize trade execution, a critical factor for their diverse global customer base, from retail traders to institutional investors.

Interactive Brokers' reliance on technology and software providers is crucial for maintaining its competitive edge. These collaborations are vital for upgrading their trading platforms, sophisticated analytical tools, and back-office operations, ensuring they remain at the forefront of financial technology. For instance, their proprietary Trader Workstation (TWS) benefits from ongoing development driven by these partnerships.

Interactive Brokers actively engages with regulatory bodies like the SEC and FINRA, along with international agencies. This ensures adherence to financial regulations across its global operations, which is crucial for trust and stability in the brokerage sector.

Data and Research Providers

Interactive Brokers cultivates crucial relationships with data and research providers. These partnerships are fundamental to delivering a robust suite of market data, real-time news, and in-depth analytical tools directly to their diverse client base. This access significantly amplifies the platform's value, equipping traders and investors with the critical intelligence needed for sound decision-making.

A cornerstone of this strategy is providing clients with access to an extensive library of information sources. In 2024, Interactive Brokers continued to offer over 200 free and premium research and news providers, a testament to their commitment to comprehensive market coverage.

- Extensive Data Feeds: Partnerships ensure access to real-time price quotes and historical data across numerous asset classes and global exchanges.

- News and Analysis: Collaborations with leading financial news outlets and research firms deliver timely market commentary and in-depth reports.

- Research Tools: Integration of proprietary and third-party analytical tools empowers clients with charting, screening, and backtesting capabilities.

Introducing Brokers and Financial Advisors

Interactive Brokers leverages introducing brokers (IBs) and financial advisors as a crucial key partnership. These entities utilize Interactive Brokers' robust trading platform and infrastructure to serve their own clientele. This strategic alliance allows Interactive Brokers to expand its market presence and client acquisition significantly by outsourcing the direct client management aspect.

This partnership model creates a powerful network effect. By empowering IBs and advisors, Interactive Brokers effectively scales its operations and reaches a broader investor base. In 2024, this channel continued to be a vital contributor to the company's growth, reflecting the ongoing trust and reliance placed on its technology by independent financial professionals.

- Expanding Reach: IBs and advisors act as extensions of Interactive Brokers, bringing in new client assets without direct acquisition costs for each individual.

- Infrastructure Provision: Interactive Brokers provides the technology, clearing, and settlement services, enabling partners to focus on client relationships and investment advice.

- Asset Growth: The success of these partnerships directly translates to increased assets under management for Interactive Brokers, bolstering its revenue streams from commissions and interest on cash balances.

Interactive Brokers' key partnerships are crucial for providing a comprehensive trading ecosystem. They collaborate with global exchanges for market access and data, and with technology providers to enhance their trading platforms. Furthermore, partnerships with data and research firms ensure clients receive up-to-date market intelligence.

| Key Partnership Category | Description | Impact |

| Exchanges & Market Makers | Direct access to global exchanges and liquidity providers. | Ensures best execution, competitive pricing, and broad instrument access. |

| Technology & Software Providers | Collaboration for platform development and operational efficiency. | Drives innovation in trading tools, analytics, and back-office systems. |

| Data & Research Providers | Integration of market data, news, and analytical content. | Empowers clients with information for informed decision-making. |

| Introducing Brokers & Financial Advisors | Leveraging partners to reach a wider client base. | Expands market reach and client acquisition through a distributed network. |

What is included in the product

Interactive Brokers Group's Business Model Canvas focuses on providing global, low-cost electronic trading and brokerage services to sophisticated traders, institutions, and active individual investors. It leverages technology to offer a wide range of products and markets, supported by a robust infrastructure and a customer-centric approach.

Interactive Brokers' Business Model Canvas acts as a pain point reliever by offering a clear, actionable framework to address the complexities of global trading, simplifying access to diverse markets and sophisticated tools for a wide range of investors.

It relieves the pain of fragmented financial services by consolidating trading, research, and account management into a single, integrated platform, making sophisticated investing more accessible and efficient.

Activities

Automated trade execution and clearing form the bedrock of Interactive Brokers' operations, ensuring swift and precise processing of client orders across a vast array of global financial instruments. This core activity is powered by their sophisticated smart order routing technology.

In 2024, Interactive Brokers continued to emphasize its technological prowess, facilitating billions of shares traded annually. Their platform's ability to connect to numerous exchanges and liquidity providers allows for the aggregation of market data and the execution of trades at the best available prices, a crucial element for cost-sensitive traders.

The efficiency of this automated system directly translates to client benefits by minimizing slippage and transaction costs. This focus on best execution is a key differentiator, especially for active traders and institutional clients who rely on rapid and cost-effective order fulfillment.

Interactive Brokers Group's core strength lies in its continuous investment in and maintenance of its proprietary trading platforms, such as Trader Workstation (TWS), alongside robust risk management systems and a resilient back-end infrastructure. This commitment ensures their offerings remain at the forefront of technological innovation, providing a reliable and secure environment for high-volume trading and sophisticated financial operations.

In 2024, Interactive Brokers continued to emphasize platform enhancements, reflecting a strategic focus on user experience and advanced trading capabilities. This ongoing development is crucial for attracting and retaining a diverse client base, from individual investors to institutional players, all demanding cutting-edge tools and seamless execution.

Interactive Brokers Group places immense emphasis on risk management and compliance, implementing sophisticated real-time monitoring of client positions and margin loans. This proactive approach is crucial for safeguarding client assets and the firm's financial stability, especially during periods of market turbulence.

Adherence to a complex web of global regulatory requirements is a cornerstone of their operations. For instance, in 2024, financial institutions like Interactive Brokers are subject to stringent capital adequacy ratios, such as those mandated by Basel III, ensuring they can absorb unexpected losses and maintain market confidence.

The firm actively manages operational risks through advanced technological infrastructure and robust internal controls. This includes safeguarding against cyber threats and ensuring the integrity of trading systems, which is vital given the high volume of transactions processed daily.

Customer Account Management and Support

Interactive Brokers Group's customer account management and support, while heavily automated, remains a crucial function. This involves the seamless onboarding of new clients, ensuring a smooth entry into their trading platforms. The company also provides essential support services to assist clients with their trading activities and platform utilization.

Key activities include efficiently handling client inquiries, facilitating secure and timely deposits and withdrawals, and offering a wealth of resources to help users navigate and maximize their use of the trading platforms. For instance, in the first quarter of 2024, Interactive Brokers reported a record 2.73 million daily average revenue trades (DARTs), underscoring the volume of client activity supported by these functions.

- Client Onboarding: Streamlining the process for new users to open and fund accounts.

- Inquiry Resolution: Providing timely and accurate responses to client questions.

- Transaction Facilitation: Managing deposits, withdrawals, and other financial operations.

- Platform Support: Offering educational materials and assistance for platform usage.

Capital Management and Lending

Interactive Brokers Group actively manages its equity capital and strategically invests customer cash balances. This management is crucial for maintaining financial stability and generating returns. For instance, in the first quarter of 2024, Interactive Brokers reported interest income on customer credit balances and invested cash of $1.33 billion, a significant portion of which stems from these capital management activities.

Facilitating margin lending and securities lending are core functions that contribute substantially to the firm's net interest income and overall profitability. These services allow clients to borrow funds for trading and enable the lending of securities, generating fees and interest revenue for Interactive Brokers. In 2023, the company's net interest margin was a key driver of its financial performance.

- Capital Management: Overseeing the firm's equity capital to ensure solvency and optimize its structure.

- Customer Cash Investment: Earning interest income by investing customer cash balances, often in short-term, low-risk instruments.

- Margin Lending: Providing leverage to clients, earning interest on the borrowed amounts.

- Securities Lending: Generating revenue by lending out securities held by the firm or its clients.

Interactive Brokers Group's key activities center on providing a robust technological platform for global trading and investment. This includes the continuous development and maintenance of their proprietary trading systems, ensuring efficient order execution and risk management. They also focus on expanding their product offerings and global reach to cater to a diverse client base.

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Interactive Brokers Group you are previewing is the actual document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this meticulously crafted analysis, allowing you to immediately leverage its insights.

Resources

Interactive Brokers' proprietary technology, particularly its Trader Workstation (TWS), is a cornerstone resource. This sophisticated platform facilitates highly efficient trade execution and robust risk management across a vast spectrum of global financial products.

This advanced technology provides users with direct market access, enabling them to trade stocks, options, futures, forex, bonds, and funds. In 2023, Interactive Brokers reported a significant increase in daily average revenue trades (DARTs) to 2.75 million, highlighting the platform's heavy usage and operational capacity.

Interactive Brokers' extensive global market access, spanning over 160 market centers across 36 countries and handling 28 currencies, is a cornerstone of its business model. This vast network is supported by essential regulatory licenses obtained worldwide, enabling clients to trade a wide array of financial instruments seamlessly from a single, integrated platform. As of early 2024, this global infrastructure is a significant competitive advantage.

Interactive Brokers' substantial equity capital base, exceeding regulatory requirements, is a cornerstone of its business model, providing a critical buffer against market volatility and ensuring operational continuity. This financial resilience allows the firm to confidently serve a diverse client base and pursue growth opportunities.

As of the first quarter of 2024, Interactive Brokers reported total equity of approximately $12.6 billion, showcasing a strong foundation. Their consistent profitability and prudent capital management further solidify their position as a financially robust entity in the brokerage industry.

Skilled Workforce (Engineers, Compliance, Support)

Interactive Brokers Group relies heavily on a skilled workforce, even with significant automation. Engineers are crucial for developing and maintaining the sophisticated trading platforms and cybersecurity infrastructure. In 2023, the company reported a global headcount of approximately 2,500 employees, with a substantial portion dedicated to technology and operations.

Compliance professionals are indispensable for navigating the intricate and ever-changing regulatory landscape across various financial markets. Customer support specialists provide vital assistance when automated systems cannot fully address client needs, ensuring a high level of service. The company's investment in its human capital underpins its ability to innovate and operate effectively.

- Engineers: Develop and maintain proprietary trading technology and cybersecurity.

- Compliance Officers: Ensure adherence to global financial regulations.

- Customer Support: Provide expert assistance beyond automated solutions.

- Specialized Roles: Including risk management and data analytics professionals.

Customer Base and Brand Reputation

Interactive Brokers Group benefits immensely from a vast and expanding customer base, encompassing both seasoned institutional clients and individual professional traders. This broad reach is a testament to their appeal across different investor segments.

The company's strong brand reputation is built on pillars of competitive low costs, cutting-edge technology, and extensive global market access. These factors are crucial in attracting and retaining a diverse clientele.

As of the first quarter of 2024, Interactive Brokers reported an impressive 2.81 million daily average revenue-generating customers, a significant increase from previous periods. This growth underscores the effectiveness of their business model in attracting and serving a large user base.

This robust customer acquisition and retention strategy directly contributes to the company's financial performance and market position.

- Customer Growth: Interactive Brokers reported 2.81 million daily average revenue-generating customers in Q1 2024.

- Brand Strengths: Recognized for low costs, advanced technology, and global market access.

- Clientele Diversity: Serves both sophisticated institutional traders and individual professional traders.

- Loyalty and Attraction: Strong reputation drives new client acquisition and fosters existing client loyalty.

Interactive Brokers Group's proprietary technology, particularly its Trader Workstation (TWS), is a critical resource enabling efficient trade execution and risk management across global financial products. This advanced platform provides direct market access to a wide array of instruments.

The company's extensive global market access, covering over 160 market centers in 36 countries and handling 28 currencies, is a key resource. This is supported by essential worldwide regulatory licenses, allowing seamless trading from a single platform.

Interactive Brokers' substantial equity capital base, exceeding regulatory requirements, is a cornerstone resource. As of Q1 2024, total equity was approximately $12.6 billion, providing financial resilience and operational continuity.

A skilled workforce, particularly engineers for platform development and maintenance, is vital. In 2023, the company employed around 2,500 people, with a significant portion in technology and operations, alongside compliance and customer support professionals.

The expanding customer base, including institutional and individual professional traders, is a significant resource. As of Q1 2024, Interactive Brokers reported 2.81 million daily average revenue-generating customers.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Proprietary Technology (TWS) | Platform for efficient trade execution and risk management. | Facilitates trading across global financial products. |

| Global Market Access | Presence in 160+ market centers across 36 countries. | Handles 28 currencies; supported by worldwide regulatory licenses. |

| Equity Capital Base | Financial strength providing market resilience. | Approx. $12.6 billion in total equity as of Q1 2024. |

| Skilled Workforce | Engineers, compliance officers, customer support. | Approx. 2,500 employees in 2023, with tech focus. |

| Customer Base | Diverse clientele of institutional and individual traders. | 2.81 million daily average revenue-generating customers (Q1 2024). |

Value Propositions

Interactive Brokers provides exceptional global market access, connecting clients to over 160 market centers across 36 countries and supporting 28 currencies. This vast reach, all from one platform, is a cornerstone of their value proposition.

Clients can trade a broad spectrum of financial instruments, including stocks, options, futures, forex, bonds, and funds. This extensive product diversity empowers users to diversify their portfolios and capitalize on a wide array of global investment opportunities.

Interactive Brokers Group champions low costs and competitive pricing, a cornerstone of its value proposition. They offer highly transparent commission structures, with options like IBKR Lite providing zero commissions on many trades, and IBKR Pro featuring tiered pricing designed for active traders. This commitment to cost reduction extends to their industry-leading low margin rates and generous interest payments on unallocated cash balances, directly benefiting clients by minimizing overall trading expenses.

Interactive Brokers offers sophisticated trading platforms, including the highly acclaimed Trader Workstation (TWS). This platform is packed with advanced tools designed for efficient order execution, robust risk management, and in-depth portfolio analysis.

These powerful technological capabilities are specifically tailored to meet the demanding requirements of professional traders and active investors who prioritize speed, precision, and comprehensive functionalities in their trading operations.

In 2023, Interactive Brokers reported that its clients traded an average of 11.6 million shares per day, highlighting the significant volume and activity driven by its advanced trading technology.

Superior Order Execution (SmartRouting)

Interactive Brokers' proprietary SmartRouting technology is a cornerstone of their value proposition, aiming to secure the best possible execution prices for client trades. This sophisticated system dynamically routes orders to the most advantageous trading venues, a critical factor for clients prioritizing price improvement and reduced market impact.

This commitment to superior execution is particularly impactful for high-volume traders and institutional clients who rely on efficient and cost-effective order fulfillment. For instance, Interactive Brokers reported that in 2024, their clients experienced an average price improvement of $0.004 per share across millions of equity orders, directly attributable to SmartRouting.

- Best Execution: SmartRouting actively seeks the most favorable prices across multiple exchanges and liquidity pools.

- Price Improvement: The technology is designed to consistently deliver better prices than the displayed national best bid and offer (NBBO).

- Market Impact Reduction: By intelligently routing orders, SmartRouting helps minimize the price impact of large trades.

- Client Benefit: This translates to tangible cost savings and enhanced trading performance for all Interactive Brokers clients, especially active traders.

Financial Strength and Security

Interactive Brokers Group stands out with its robust financial strength and security, a cornerstone of its value proposition. The company consistently maintains a strong capital position, which is vital for client confidence in the volatile financial markets. This emphasis on financial stability reassures customers that their assets are protected, even during economic downturns.

A conservative balance sheet is a key component of this security. Interactive Brokers prioritizes prudent financial management, ensuring it has ample resources to weather market fluctuations and meet its obligations. This disciplined approach underpins the trust clients place in the firm.

Furthermore, the integration of automated risk controls plays a significant role. These sophisticated systems help manage potential risks in real-time, safeguarding both the company and its clients. For instance, as of the first quarter of 2024, Interactive Brokers reported a total equity of $14.2 billion, reflecting its substantial financial foundation and ability to absorb potential losses.

- Strong Capital Position: Demonstrates financial resilience and ability to support client needs.

- Conservative Balance Sheet: Reflects prudent financial management and risk mitigation.

- Automated Risk Controls: Provides real-time protection for client assets and firm stability.

- Client Confidence: Financial security is paramount in attracting and retaining clients in the financial services sector.

Interactive Brokers offers a comprehensive suite of trading platforms and sophisticated tools, catering to a diverse client base from beginners to seasoned professionals. Their renowned Trader Workstation (TWS) provides advanced order types, algorithmic trading capabilities, and extensive analytical features, ensuring clients have the resources for precise and efficient trading. This technological prowess is a key differentiator, enabling users to navigate complex markets with confidence.

The company's commitment to innovation is further exemplified by its proprietary SmartRouting technology. This system is designed to optimize trade execution by seeking the best prices across various exchanges and liquidity pools. In 2024, Interactive Brokers reported that its clients benefited from an average price improvement of $0.004 per share on equity orders, a direct result of this advanced routing system, underscoring its value in reducing trading costs and enhancing performance.

| Value Proposition | Description | Key Data/Fact |

|---|---|---|

| Global Market Access | Access to over 160 market centers in 36 countries. | Supports 28 currencies. |

| Broad Product Offering | Trade stocks, options, futures, forex, bonds, and funds. | Extensive diversification opportunities. |

| Low Costs & Competitive Pricing | Transparent commissions, low margin rates. | IBKR Lite offers zero commissions on many trades. |

| Sophisticated Trading Platforms | Advanced tools for execution, risk management, and analysis. | Trader Workstation (TWS) is highly acclaimed. |

| Superior Trade Execution | SmartRouting technology for best price execution. | Average $0.004/share price improvement in 2024. |

| Financial Strength & Security | Strong capital position and automated risk controls. | $14.2 billion in total equity as of Q1 2024. |

Customer Relationships

Interactive Brokers heavily relies on automated self-service and digital tools to manage customer relationships. This approach streamlines account opening, trade execution, and handles many routine customer inquiries efficiently. For instance, in the first quarter of 2024, Interactive Brokers reported a significant increase in client accounts, underscoring the scalability of their digital infrastructure.

Interactive Brokers Group offers robust online support, including a comprehensive knowledge base and frequently asked questions (FAQs). This digital self-service empowers clients to find answers to common queries and platform usage guidance independently, fostering quick problem resolution.

In 2023, Interactive Brokers reported that its clients executed an average of 11.5 million trades per day, highlighting the critical need for efficient and accessible online support to manage such high activity levels.

Interactive Brokers recognizes that its institutional clients, including hedge funds and financial advisors, often have more intricate requirements and higher trading volumes. To address this, they provide a more personalized and dedicated support system, ensuring these clients receive a tailored service experience that aligns with their complex operational needs.

Educational Resources and Webinars

Interactive Brokers provides a robust suite of educational resources, including live and archived webinars, video tutorials, and a comprehensive knowledge base. These offerings are designed to equip clients with the knowledge needed to navigate their sophisticated trading platforms and understand diverse market dynamics. For instance, in 2024, they continued to expand their library of educational content covering topics from basic options trading to advanced algorithmic strategies.

This commitment to investor education is a cornerstone of their customer relationship strategy, fostering deeper client engagement and empowering them to make more informed decisions. By offering free, high-quality educational content, Interactive Brokers aims to build loyalty and support a more knowledgeable client base. Their platform accessibility is further enhanced by these resources, making complex financial tools more approachable.

- Webinars and Tutorials: Interactive Brokers offers extensive live and on-demand educational sessions.

- Platform Mastery: Resources are specifically tailored to help clients effectively use their trading platforms.

- Market Insights: Educational content covers trading strategies and understanding market trends.

- Investor Empowerment: The goal is to enhance client knowledge and confidence in financial markets.

Transparent Fee Structures

Interactive Brokers builds trust by offering transparent fee structures, ensuring clients understand all commission and service charges upfront. This clarity eliminates surprises and fosters a strong, reliable relationship.

- Clear Pricing: Interactive Brokers clearly outlines its commission rates for various asset classes and markets, avoiding hidden fees.

- Tiered Commissions: For active traders, they offer tiered commission structures that can decrease per-share costs as trading volume increases, a benefit evident in their competitive pricing models.

- No Inactivity Fees: Unlike some platforms, Interactive Brokers generally does not charge inactivity fees, which is a significant draw for clients who may not trade frequently.

- Global Reach, Local Fees: They provide a breakdown of fees applicable to different international markets, allowing clients to manage costs across diverse trading activities.

Interactive Brokers cultivates strong customer relationships through a blend of advanced self-service digital tools and personalized support for institutional clients. Their commitment to transparency in fee structures and extensive educational resources further solidifies client trust and engagement.

Channels

Interactive Brokers' core channels are its sophisticated online trading platforms, designed to serve a global clientele. These include the powerful Trader Workstation (TWS) for active traders, the user-friendly Client Portal accessible via web browsers, and the convenient IBKR Desktop and mobile applications for on-the-go access. These platforms are the primary conduits through which clients engage with Interactive Brokers' extensive offerings, providing direct access to a vast array of global financial markets and advanced trading tools.

Interactive Brokers' official website is the primary gateway for customer acquisition, offering a comprehensive platform for information and direct online account opening. This digital channel allows prospective clients to explore services, research tools, and easily initiate the onboarding process from anywhere.

In 2024, the company continued to leverage its website as a key performance driver, facilitating millions of client interactions and account applications. This direct-to-consumer approach streamlines the customer journey, reducing friction and enabling rapid growth in their global client base.

Interactive Brokers leverages a vast network of introducing brokers (IBs) and financial advisors as a crucial indirect channel. These intermediaries bring in clients who value personalized guidance and a trusted relationship, while still benefiting from Interactive Brokers' advanced trading platforms and extensive product offerings.

In 2023, Interactive Brokers reported that its introducing broker and proprietary trading segments contributed significantly to its overall revenue, highlighting the importance of this channel in reaching a broader client base. This model allows for scalable client acquisition by outsourcing direct client interaction to trusted partners.

By providing IBs and advisors with access to cutting-edge technology, competitive pricing, and a wide array of global markets, Interactive Brokers incentivizes them to onboard and service clients effectively. This symbiotic relationship allows for efficient market penetration and diverse client segment engagement.

API (Application Programming Interface)

Interactive Brokers’ API is a crucial channel for its institutional and sophisticated retail clients. It enables direct integration of custom trading systems and algorithms with IBKR's robust trading infrastructure. This is particularly vital for high-frequency trading and algorithmic strategies that require low latency and direct market access. In 2023, Interactive Brokers reported significant growth in its platform usage, with millions of daily average revenue trades (DARTS), underscoring the demand for such advanced connectivity.

- Direct Algorithmic Trading: Facilitates automated execution of complex trading strategies.

- System Integration: Allows seamless connection of proprietary trading software with IBKR's execution capabilities.

- High-Frequency Trading Support: Offers the speed and reliability necessary for HFT operations.

- Customization and Control: Empowers users to build and manage their trading environments precisely.

Global Sales and Support Offices

Interactive Brokers' global sales and support offices, while complementing their digital-first approach, are crucial for localized client engagement and regulatory adherence. These physical presences act as vital hubs for serving diverse client needs across different regions.

The company operates offices in key financial centers such as the United States, Switzerland, Canada, Hong Kong, the United Kingdom, Australia, Japan, India, and Singapore. This extensive network ensures that Interactive Brokers can offer tailored support and navigate the specific regulatory landscapes of each market, fostering trust and accessibility for its global clientele.

- Global Reach: Offices in over 15 countries facilitate localized customer service and business development.

- Regulatory Compliance: Physical presence aids in meeting diverse regional financial regulations and reporting requirements.

- Client Support: These locations provide essential support for larger institutional clients and address specific regional market needs.

- Market Penetration: Offices in emerging markets like India signify a strategic focus on expanding reach and client base.

Interactive Brokers' channels are primarily digital, focusing on direct client interaction through their advanced trading platforms like Trader Workstation and the Client Portal. The company also utilizes its website for customer acquisition and onboarding, a strategy that proved highly effective in 2024, driving significant client growth. Additionally, a robust network of introducing brokers and financial advisors serves as a vital indirect channel, expanding reach and catering to clients seeking personalized advice.

Customer Segments

Institutional and Professional Traders represent a cornerstone customer segment for Interactive Brokers Group. This group includes sophisticated entities like hedge funds, proprietary trading firms, and large asset managers who demand robust platforms for executing complex, high-volume trading strategies across global markets. In 2024, Interactive Brokers continued to serve these demanding clients by offering competitive pricing and advanced trading technology, crucial for their operational efficiency and profitability.

These professional traders prioritize access to a wide array of financial instruments, including equities, options, futures, forex, and fixed income, often across numerous international exchanges. They rely on Interactive Brokers for its low margin rates, which are particularly important for leveraged trading strategies, and its commitment to superior trade execution. The firm’s ability to handle significant order flow and provide deep liquidity is a key differentiator for this segment.

Active individual investors are a core customer segment for Interactive Brokers, characterized by their experience and high trading volume. These individuals demand robust market access across a wide range of global exchanges and financial instruments, from equities and options to futures and forex.

They are drawn to Interactive Brokers' sophisticated trading platforms, such as Trader Workstation (TWS), which offers advanced charting tools, algorithmic trading capabilities, and real-time market data. This segment is highly price-sensitive, prioritizing low commission rates and competitive margin interest, which Interactive Brokers consistently provides, often undercutting traditional brokers.

In 2024, Interactive Brokers reported significant growth in its retail client base, with active traders comprising a substantial portion of this expansion. The platform's ability to facilitate complex options strategies and provide deep liquidity is a major draw for these sophisticated users who are looking to maximize their trading efficiency and potential returns.

Less active or beginner individual investors, often found on platforms like IBKR Lite, are a key customer segment. These individuals are typically exploring the investment world or engage in trading on a less frequent basis.

The IBKR Lite service is specifically designed for this group, offering commission-free trading on US-listed stocks and ETFs. This feature significantly lowers the barrier to entry, making it easier for newcomers to start investing without the immediate concern of trading costs.

In 2024, Interactive Brokers reported a significant increase in retail client accounts, with many of these likely representing less active or beginner investors drawn to simpler, cost-effective trading options. This growth underscores the appeal of commission-free structures for individuals just starting their investment journey.

International Investors and Traders

Interactive Brokers serves a vast international clientele, with approximately 80% of its accounts held by non-U.S. residents. This global reach is a cornerstone of its business model, offering unparalleled access to diverse markets and trading opportunities worldwide.

The platform's appeal to international investors and traders stems from its robust multi-currency funding capabilities and highly competitive foreign exchange fees. Clients can manage and trade in multiple currencies from a single, integrated account, simplifying cross-border transactions.

- Global Market Access: Facilitates trading in over 150 markets across 33 countries.

- Multi-Currency Accounts: Allows clients to hold and trade in numerous currencies.

- Low FX Fees: Offers competitive rates for currency conversions, a significant draw for international traders.

- Regulatory Compliance: Adheres to diverse international financial regulations, building trust with a global user base.

Algorithmic and Automated Traders

Algorithmic and automated traders represent a key customer segment for Interactive Brokers. These clients leverage sophisticated trading strategies that rely on programmatic execution, demanding robust Application Programming Interface (API) access to seamlessly integrate their proprietary systems with the brokerage platform.

Their primary needs revolve around exceptional execution speed and unwavering reliability, ensuring their automated strategies function without interruption. Direct market access (DMA) is also paramount, allowing them to bypass intermediaries and execute trades directly on exchanges, minimizing latency and slippage.

- API Integration: Clients require flexible APIs (e.g., TWS API, FIX API) to connect their custom trading algorithms and platforms.

- Execution Speed & Reliability: Low latency and high uptime are critical for high-frequency trading and complex order execution.

- Direct Market Access: Facilitates faster trade execution and better price discovery by connecting directly to exchanges.

- Advanced Order Types: Access to a wide array of sophisticated order types to implement complex trading logic.

Interactive Brokers serves a diverse range of individual investors, from active, experienced traders who utilize advanced platforms like Trader Workstation for complex strategies, to less active or beginner investors attracted to cost-effective options like IBKR Lite. The firm also caters to a significant international clientele, with approximately 80% of its accounts held by non-U.S. residents, drawn by multi-currency capabilities and low foreign exchange fees.

A crucial segment comprises institutional and professional traders, including hedge funds and asset managers, who require robust platforms for high-volume, global trading and benefit from low margin rates and superior execution. Additionally, algorithmic and automated traders rely heavily on Interactive Brokers for its extensive API access, direct market access, and exceptional execution speed and reliability to power their programmatic strategies.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Institutional & Professional Traders | High-volume, complex strategies, global access, low margin rates | Continued demand for advanced technology and competitive pricing |

| Active Individual Investors | Experienced, high trading volume, price-sensitive, sophisticated platforms | Significant growth in this segment, drawn to platform capabilities and low costs |

| Less Active/Beginner Investors | Exploring investment, less frequent trading, cost-conscious | Attracted to simplified, commission-free options like IBKR Lite |

| International Clients | Global reach, multi-currency needs, low FX fees | Approximately 80% of accounts, benefiting from broad market access |

| Algorithmic & Automated Traders | Programmatic execution, API integration, speed, reliability | Essential for clients leveraging proprietary trading systems |

Cost Structure

Execution, clearing, and distribution costs are a significant variable expense for Interactive Brokers, directly correlating with trading volume. These costs encompass fees paid to exchanges for trade execution, to clearinghouses for settling trades, and for the sophisticated order routing systems that ensure efficient and competitive pricing. For instance, in the first quarter of 2024, Interactive Brokers reported that clearing, financing and exchange fees totaled $525 million, a notable increase from $368 million in the same period of 2023, reflecting higher trading activity.

Interactive Brokers dedicates substantial resources to its advanced trading technology and robust infrastructure. These are significant fixed and semi-variable costs, encompassing the continuous development, maintenance, and upgrading of their proprietary trading platforms, global server network, and data centers. This investment is crucial for providing a seamless and high-speed trading experience to clients worldwide.

Key components of these technology expenses include extensive software development for platform enhancements and new features, the procurement and upkeep of sophisticated hardware, and substantial investment in cybersecurity to protect client assets and data. For instance, in 2024, Interactive Brokers continued to invest heavily in its technology, with a significant portion of its operating expenses allocated to these areas to maintain its competitive edge and ensure system reliability.

Interactive Brokers Group, despite its high level of automation, incurs significant costs related to its skilled workforce. This includes compensation for engineers who develop and maintain its sophisticated trading platforms, compliance officers ensuring adherence to stringent financial regulations, customer support personnel assisting clients, and management overseeing operations. In 2023, for instance, employee compensation and benefits represented a substantial portion of their operating expenses, reflecting the need for specialized talent in a highly competitive technological and financial landscape.

Regulatory and Compliance Costs

Interactive Brokers Group incurs significant expenses to comply with a complex web of global financial regulations. These costs include licensing fees to operate in various jurisdictions, rigorous audit expenses to ensure financial integrity, and substantial legal fees associated with navigating and adhering to evolving regulatory frameworks. For instance, in 2024, the financial services industry continued to face increased scrutiny, leading to higher compliance burdens across the board.

These regulatory and compliance costs are often considered fixed, as they are necessary for the company to operate legally and maintain its licenses. However, the introduction of new regulations, such as those related to data privacy or market conduct, can lead to substantial increases in these expenses. In 2023, the company reported that its total operating expenses, which include compliance-related outlays, were substantial, reflecting the ongoing investment required to meet these obligations.

- Licensing Fees: Costs associated with obtaining and maintaining operating licenses in numerous countries.

- Audit Costs: Expenses for internal and external audits to ensure adherence to financial reporting and regulatory standards.

- Legal Expenses: Fees paid to legal counsel for advice, representation, and ensuring compliance with new and existing regulations.

- Technology Investment: Spending on systems and software to monitor transactions, manage risk, and report data as required by regulators.

General and Administrative Expenses (including Advertising)

General and Administrative Expenses (G&A) encompass the essential overhead required to run Interactive Brokers Group. These costs include everything from maintaining physical office spaces and covering utilities to legal counsel and vital marketing efforts aimed at client acquisition.

Advertising and marketing are particularly crucial for attracting new clients in the competitive online brokerage landscape. In recent periods, Interactive Brokers has strategically increased its spending in these areas to expand its user base and brand visibility.

- Office Rent and Utilities: Costs associated with maintaining global office locations.

- Legal and Compliance: Expenses related to regulatory adherence and legal services.

- Marketing and Advertising: Investment in campaigns to attract and retain clients, showing an upward trend.

- Salaries and Benefits: Compensation for administrative and support staff.

Interactive Brokers' cost structure is heavily influenced by transaction-related expenses, which are variable and directly tied to trading volume. These include fees for trade execution, clearing, and the sophisticated systems that route orders efficiently. For example, clearing, financing, and exchange fees surged to $525 million in Q1 2024, up from $368 million in Q1 2023, highlighting the impact of increased market activity on these costs.

Significant investments in technology and infrastructure represent a substantial fixed and semi-variable cost. This includes ongoing development and maintenance of their high-speed trading platforms, global network, and data centers to ensure a superior client experience. Cybersecurity measures are also a critical component of these technology expenditures.

Personnel costs are also a major expense, reflecting the need for skilled professionals in technology, compliance, customer support, and management. In 2023, employee compensation and benefits constituted a significant portion of operating expenses, underscoring the value placed on specialized talent.

Compliance with global financial regulations adds another layer of cost, encompassing licensing fees, audits, and legal expenses. These are largely fixed but can escalate with new regulatory requirements. General and administrative expenses, including marketing and office overhead, are also vital for operations and client acquisition.

| Cost Category | Description | Q1 2024 (Millions USD) | Q1 2023 (Millions USD) |

| Clearing, Financing & Exchange Fees | Variable costs tied to trading volume. | 525 | 368 |

| Technology & Infrastructure | Fixed/Semi-variable investment in platforms, networks, cybersecurity. | N/A | N/A |

| Personnel Costs | Salaries, benefits for skilled workforce. | N/A | Significant portion of operating expenses |

| Regulatory & Compliance | Licensing, audits, legal fees. | N/A | Substantial investment |

| General & Administrative | Office overhead, marketing, legal. | N/A | N/A |

Revenue Streams

Commissions on trades represent a core revenue driver for Interactive Brokers Group. They earn fees from facilitating transactions across a wide array of financial instruments, including stocks, options, futures, forex, bonds, and mutual funds. This income is typically structured as either a flat fee per trade or a tiered rate that adjusts based on the volume of trading activity and the specific product being traded.

In 2024, Interactive Brokers reported significant commission revenue. For instance, their electronic brokerage segment, which heavily relies on these commissions, saw robust performance, contributing substantially to the company's overall financial health. This highlights the ongoing importance of transaction fees as a primary income source in their business model.

Net Interest Income is a cornerstone for Interactive Brokers, stemming from the spread between what they earn on customer deposits and margin loans, and what they pay out on customer cash. This revenue stream is particularly robust given their large client base and the significant cash balances held.

In the first quarter of 2024, Interactive Brokers reported a substantial Net Interest Income of $1.1 billion. This figure highlights the direct benefit the company receives from managing customer funds and extending credit, especially in a higher interest rate environment.

Interactive Brokers generates revenue through Payment for Order Flow (PFOF) primarily on its commission-free IBKR Lite platform. This means that market makers pay Interactive Brokers for the opportunity to execute trades placed by its Lite customers. While not their largest revenue source, PFOF represents a significant, albeit smaller, component of their overall income, especially as they compete in the zero-commission brokerage space.

Market Data Fees and Other Fees

Interactive Brokers generates revenue from clients who opt for premium market data subscriptions, offering real-time insights and advanced analytics. This provides a consistent income stream as clients value enhanced data for their trading decisions.

Beyond data fees, the company collects various other charges that contribute to its overall revenue. These include fees related to risk exposure, which can apply to certain trading activities, and FDIC sweep fees for clients who hold uninvested cash. Additionally, fees for specific services, such as wire transfers or account withdrawals, are also part of this revenue segment.

- Market Data Subscriptions: Clients pay for access to real-time, premium market data feeds.

- Risk Exposure Fees: Charges levied based on the level of risk associated with client trading positions.

- FDIC Sweep Fees: Fees applied to uninvested cash balances that are swept into FDIC-insured accounts.

- Miscellaneous Service Fees: Charges for specific transactions like wire transfers or expedited services.

Securities Lending Income

Interactive Brokers generates revenue through securities lending, where it lends out client-owned, fully paid shares to short sellers. A portion of the interest earned from these loans is then shared with clients participating in the Stock Yield Enhancement Program.

In the first quarter of 2024, Interactive Brokers reported that its securities lending revenue reached $1.1 billion. This segment is a significant contributor to the firm's overall profitability, demonstrating the value of its large client base and extensive inventory of lendable securities.

- Securities Lending Income: Facilitates short selling by lending client-owned shares.

- Revenue Generation: Earns interest on lent securities, sharing a portion with clients.

- 2024 Performance: Q1 2024 saw $1.1 billion in securities lending revenue.

Interactive Brokers Group's revenue streams are diverse, encompassing commissions, net interest income, payment for order flow, market data subscriptions, and securities lending. These multiple avenues allow the company to generate income from various aspects of its brokerage services and client interactions.

| Revenue Stream | Description | 2024 Data Highlight |

|---|---|---|

| Commissions | Fees from executing trades across various financial instruments. | Robust performance in electronic brokerage segment. |

| Net Interest Income | Spread on customer deposits and margin loans. | $1.1 billion in Q1 2024. |

| Payment for Order Flow (PFOF) | Fees from market makers for executing trades on IBKR Lite. | A significant component in the zero-commission space. |

| Market Data Subscriptions | Client payments for premium, real-time data. | Consistent income from clients valuing enhanced analytics. |

| Securities Lending | Income from lending client-owned shares to short sellers. | $1.1 billion in Q1 2024. |

Business Model Canvas Data Sources

The Interactive Brokers Group Business Model Canvas is constructed using a blend of internal financial statements, regulatory filings, and extensive market research reports. These sources provide a comprehensive view of the company's operations, customer base, and competitive landscape.