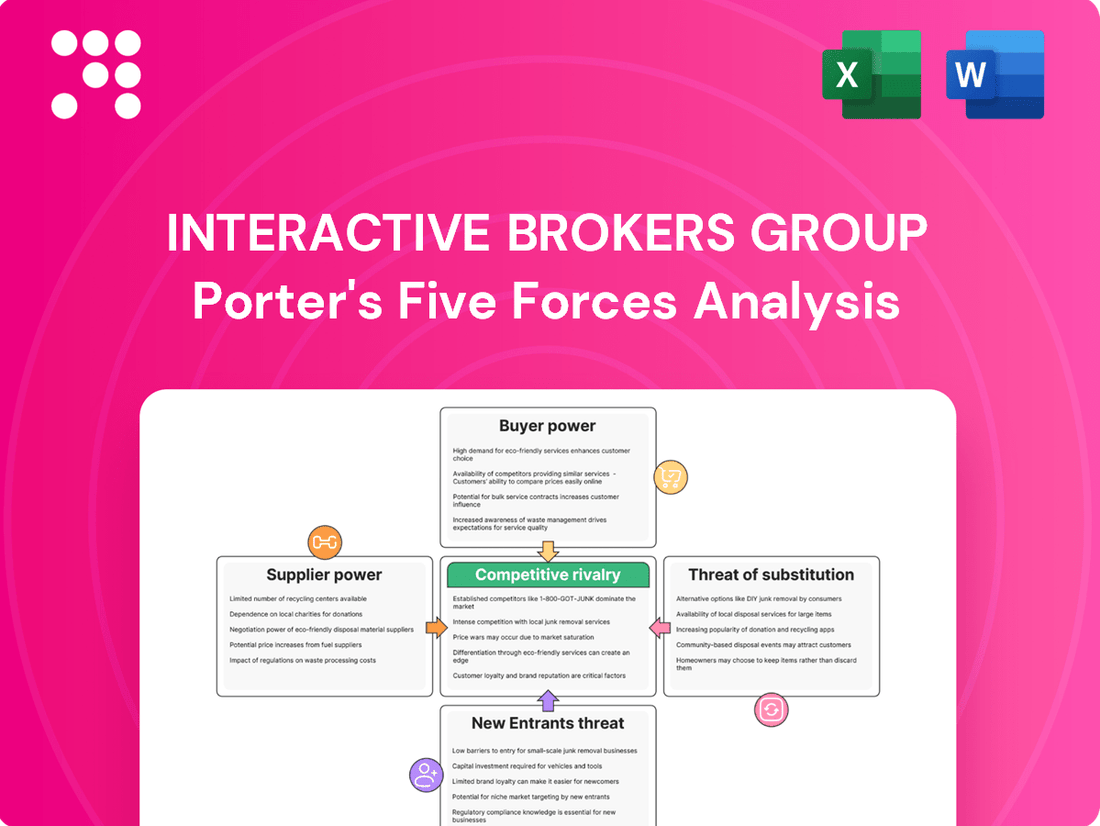

Interactive Brokers Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interactive Brokers Group Bundle

Interactive Brokers Group operates in a highly competitive financial services landscape, facing intense pressure from rivals and the constant threat of new entrants disrupting the market. Understanding the delicate balance of buyer power and the availability of substitutes is crucial for navigating this dynamic environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Interactive Brokers Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Interactive Brokers Group, like many financial institutions, relies on a select few critical suppliers for its operations. These include providers of real-time market data, essential technology infrastructure, and crucial liquidity services. For instance, obtaining comprehensive, up-to-the-minute market data from major exchanges often involves agreements with a limited number of authorized vendors.

The specialized nature of these services means there aren't many readily available substitutes. This scarcity of alternatives can empower these suppliers, giving them a stronger negotiating position. In 2024, the increasing demand for sophisticated trading platforms and data analytics further solidifies the importance of these specialized vendors.

Consequently, this concentration of key suppliers can translate into higher costs for Interactive Brokers or less favorable contract terms if these relationships are not managed with strategic foresight. For example, a significant increase in data licensing fees from a primary provider could directly impact the firm's operating expenses.

Switching core technology platforms or market access providers for a global electronic broker like Interactive Brokers is a significant undertaking. The intricate integration of systems, potential for service disruptions during transition, and the need for extensive staff retraining all contribute to substantial switching costs.

These high switching costs effectively strengthen the bargaining power of incumbent suppliers. For Interactive Brokers, this means that changing providers isn't a simple or inexpensive process, giving existing suppliers leverage in negotiations. For instance, in 2024, the global fintech sector saw continued investment in specialized trading infrastructure, with many firms opting for bespoke solutions that are difficult to replicate or replace quickly.

The inputs Interactive Brokers Group relies on, like real-time market data feeds and sophisticated trading technology, are absolutely essential for its business. These aren't just nice-to-haves; they are the backbone of its automated execution and clearing services. Without reliable data and robust platforms, Interactive Brokers simply couldn't function as it does.

This deep reliance means suppliers of these critical inputs hold significant sway. For instance, data providers who offer the granular, real-time price feeds necessary for high-frequency trading are indispensable. Similarly, technology vendors supplying the core trading infrastructure have considerable leverage due to the specialized nature and high switching costs involved.

In 2024, the demand for low-latency data and advanced trading platforms remained exceptionally high, driven by institutional investors and active retail traders. Companies providing these services often operate in concentrated markets, further amplifying their bargaining power. Interactive Brokers' ability to secure competitive pricing and favorable terms from these key suppliers is therefore a crucial factor in its operational efficiency and profitability.

Limited Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into brokerage services, like those offered by Interactive Brokers, is generally limited. While some technology or data providers possess the technical capability, the substantial regulatory compliance, extensive capital investment, and the need for a strong, trusted brand in financial services present significant barriers.

Most suppliers in this ecosystem, such as market data vendors or trading platform developers, find it more strategic to focus on their core competencies rather than venturing into the highly competitive and regulated brokerage landscape. This specialization allows them to serve multiple brokerage clients effectively. For instance, in 2023, the global fintech market, which includes many of Interactive Brokers' suppliers, saw significant investment, but this primarily fueled innovation within existing niches rather than a mass exodus into direct brokerage operations.

- High Regulatory Barriers: Obtaining licenses and adhering to strict financial regulations (e.g., SEC, FINRA in the US) is a major deterrent for potential forward-integrating suppliers.

- Capital Intensity: Establishing and maintaining a brokerage firm requires substantial capital for technology infrastructure, compliance, and operational support.

- Brand Reputation and Trust: Building the necessary trust and brand recognition in the financial industry takes considerable time and effort, which suppliers typically lack.

- Focus on Specialization: Suppliers often prefer to leverage their expertise in areas like data provision or software development, which are critical to brokers but distinct from the core brokerage function.

Regulatory and Compliance Requirements

Suppliers offering regulatory compliance solutions, cybersecurity, and legal expertise wield significant influence over Interactive Brokers. The financial industry's stringent and ever-changing regulatory environment means that failure to comply can lead to substantial fines and reputational damage. This dependency makes Interactive Brokers reliant on these specialized providers to effectively manage complex compliance obligations.

In 2024, the financial services industry continued to face a dynamic regulatory landscape. For instance, increased data privacy regulations, such as those evolving from GDPR and similar frameworks globally, necessitate specialized services from external providers. Companies like Interactive Brokers must invest in compliance solutions to meet these demands, highlighting the bargaining power of suppliers in this critical area.

- Regulatory Burden: Financial institutions globally are subject to an increasing number of regulations, impacting everything from data handling to capital requirements.

- Specialized Expertise: Suppliers offering niche compliance, cybersecurity, and legal services possess unique knowledge that is difficult and costly to replicate internally.

- Risk of Non-Compliance: The severe financial and reputational penalties associated with regulatory breaches amplify the dependence on reliable suppliers.

The bargaining power of suppliers for Interactive Brokers Group is moderate, primarily due to the essential nature of their services and the limited number of specialized providers. Critical inputs like real-time market data and advanced trading technology are indispensable, and switching costs for these services are high, strengthening supplier leverage.

In 2024, the demand for low-latency data and robust trading infrastructure remained elevated, with concentrated markets for these specialized services. This environment grants suppliers significant negotiating power, as demonstrated by the continued investment in bespoke fintech solutions that are difficult to replace quickly.

While suppliers of regulatory compliance and cybersecurity solutions also hold considerable sway due to the stringent and evolving financial regulatory landscape, their threat of forward integration into brokerage is limited by high regulatory barriers and capital intensity.

| Factor | Impact on IBKR | 2024 Context |

|---|---|---|

| Essential Inputs (Data, Tech) | Moderate to High Bargaining Power | High demand for low-latency data and advanced platforms |

| Switching Costs | Strengthens Supplier Leverage | High integration complexity and retraining needs |

| Supplier Specialization | Concentrated Market Power | Limited viable alternatives for critical services |

| Forward Integration Threat | Low | High regulatory and capital barriers for suppliers |

What is included in the product

This analysis meticulously examines the competitive forces impacting Interactive Brokers Group, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the online brokerage industry.

Instantly assess competitive threats and opportunities within the brokerage industry, allowing for proactive strategy adjustments.

Customers Bargaining Power

Interactive Brokers caters to a wide spectrum of clients, including institutional powerhouses and individual retail investors. This broad reach means that while large institutional clients might wield significant influence due to their substantial trading volumes, the sheer diversity of the customer base as a whole helps to spread out and lessen the bargaining power of any single customer segment.

Retail investors face very low barriers when moving their investments between different online brokerage platforms. The process is typically quick, often with minimal or no fees for transferring accounts, making it simple to switch. For instance, many major online brokers in 2024 continued to offer commission-free trading on stocks and exchange-traded funds, directly lowering the cost of changing providers.

This ease of movement significantly amplifies the bargaining power of individual investors. They can readily explore and adopt platforms offering better pricing, superior technology, or a wider range of services without substantial penalty. This competitive pressure forces brokerages to continuously innovate and offer attractive terms to retain their customer base.

The shift to commission-free trading, particularly prevalent in 2024, significantly amplifies customer bargaining power. This means clients, especially retail investors, now have less friction to switch brokers based purely on cost. Interactive Brokers, like its peers, must continuously justify its value proposition beyond just transaction fees, focusing on platform technology, research, and global market access.

Availability of Numerous Alternatives

The online brokerage landscape is intensely competitive, featuring numerous platforms like Charles Schwab, Fidelity, and Robinhood, all vying for customer attention with comparable services. This abundance of choices empowers customers, as they can readily switch to a competitor if they find better pricing or features. In 2024, the market continues to be characterized by this high degree of substitutability, allowing clients to easily leverage alternative providers.

The ease of switching between online brokers is a significant factor in customer bargaining power. With minimal friction and often the ability to transfer assets seamlessly, clients face little cost or inconvenience in exploring and adopting new platforms. This accessibility to alternatives amplifies their ability to negotiate or seek out more favorable terms and offerings.

- High Market Competition: The online brokerage sector is crowded, with many established and emerging players.

- Feature Parity: Many brokers offer similar core services, including trading platforms, research tools, and educational resources.

- Low Switching Costs: Customers can transfer accounts and assets with relative ease, reducing the barriers to changing providers.

- Price Sensitivity: Investors often seek out the most cost-effective options, driving down margins and increasing customer leverage.

Customer Sophistication and Information Access

Interactive Brokers Group (IBKR) serves a clientele that is exceptionally knowledgeable, including institutional investors and professional traders. This sophisticated customer base leverages access to a wealth of market data, comparative analysis tools, and industry intelligence.

This deep well of information empowers them to scrutinize service offerings and pricing structures meticulously. Consequently, they possess significant leverage to negotiate for superior terms and conditions, directly impacting IBKR's pricing strategies and service development.

- Sophisticated Client Base: IBKR's primary demographic includes hedge funds, proprietary trading firms, and active individual traders who demand advanced tools and competitive pricing.

- Information Advantage: Clients utilize readily available market research, competitor analysis platforms, and real-time data feeds to inform their decisions and negotiate effectively.

- Price Sensitivity: For high-volume traders, even small differences in commission rates or fees can translate into substantial cost savings, amplifying their bargaining power.

- Demand for Advanced Features: Beyond price, these clients expect cutting-edge trading platforms, robust execution capabilities, and comprehensive research, giving them further leverage in their dealings with IBKR.

The bargaining power of customers for Interactive Brokers is substantial due to the highly competitive and transparent nature of the online brokerage industry. With numerous providers offering similar services, clients can easily switch for better pricing or features. For example, in 2024, commission-free trading on stocks and ETFs became a standard offering across many platforms, significantly reducing the cost of switching and empowering retail investors.

Interactive Brokers' sophisticated client base, including institutional investors and professional traders, further amplifies customer bargaining power. These clients possess deep market knowledge and readily compare pricing and service offerings, enabling them to negotiate favorable terms. The demand for advanced trading technology and global market access also gives these clients leverage, as brokerages must compete to meet their specialized needs.

| Factor | Impact on IBKR | Example (2024 Data) |

|---|---|---|

| Low Switching Costs | High | Minimal fees for account transfers, easy online asset movement. |

| Competition | High | Numerous online brokers (e.g., Schwab, Fidelity, Robinhood) offer comparable services. |

| Price Sensitivity (High Volume) | High | Small commission differences translate to significant savings for active traders. |

| Information Availability | High | Clients use data and analysis tools to scrutinize and negotiate pricing. |

What You See Is What You Get

Interactive Brokers Group Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of Interactive Brokers Group, as previewed, is the exact document you will receive immediately after purchase, offering a detailed examination of competitive forces within the brokerage industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all presented in a professionally formatted and ready-to-use file. This preview guarantees that what you see is precisely what you'll get, ensuring no surprises and immediate utility for your strategic planning needs.

Rivalry Among Competitors

The online brokerage landscape is incredibly crowded, featuring a wide array of participants. This includes traditional full-service firms, cost-effective discount brokers, and innovative fintech startups all vying for investor attention. In 2024, the sheer volume of these platforms means Interactive Brokers faces constant pressure to differentiate itself.

The shift towards commission-free trading for stocks and ETFs has intensified price competition, especially among retail brokers. While features and global access are important, pricing remains a key differentiator in attracting and retaining customers.

Interactive Brokers, for instance, has historically offered competitive pricing structures, including low margin rates and tiered commissions for active traders, which puts pressure on rivals to match or offer comparable value. In 2024, the average commission for stock trades among major online brokers remained at or near zero for many retail investors.

While many brokerages offer similar core services, intense competition drives differentiation through technology, global reach, and specialized tools. Interactive Brokers stands out by providing extensive access to global markets and sophisticated platforms designed for active traders, including AI-driven analytics and a wide array of tradable assets.

Firms are increasingly leveraging features like robo-advisors, advanced charting capabilities, and unique research platforms to attract and retain clients. For instance, as of late 2024, the digital brokerage sector continues to see significant investment in AI to personalize trading experiences and offer predictive analytics, a key area where Interactive Brokers has historically focused.

Industry Growth and Market Maturity

The e-brokerage sector is on a strong growth trajectory, with projections indicating a substantial increase in market size between 2024 and 2029. This expansion, fueled by innovations like AI-driven trading tools and the proliferation of mobile-first platforms, offers ample room for market participants. However, established and mature markets, particularly in North America and Europe, continue to exhibit fierce competition among established players.

Despite the overall growth, the intensity of competitive rivalry within the e-brokerage industry is significantly influenced by market maturity. Developed markets, characterized by high internet penetration and a large existing investor base, often see intense price wars and aggressive customer acquisition strategies. For instance, in 2024, many leading e-brokers continued to offer commission-free trading on stocks and ETFs, a trend that compresses margins and heightens rivalry.

- Market Growth & Rivalry Dynamics: The e-brokerage market is expected to grow considerably from 2024 to 2029, potentially easing some competitive pressures by expanding the overall pie.

- Mature Market Competition: In developed regions, where the market is more mature, rivalry remains high, often manifesting as price competition and innovation races.

- Innovation as a Differentiator: Emerging trends like AI integration and mobile-centric platforms are key battlegrounds, driving differentiation and intense competition for user engagement.

- Impact of Commission-Free Trading: The widespread adoption of zero-commission trading models in 2024 continues to pressure profitability and intensify competition for market share.

High Exit Barriers

The brokerage industry is characterized by significant investments in technology, compliance, and brand development. These high fixed costs create substantial barriers to exiting the market, as firms must absorb these sunk costs and manage ongoing client relationships. This situation often leads to sustained competitive intensity among existing players, as the cost of leaving outweighs the potential benefits.

For Interactive Brokers Group, high exit barriers mean that established firms are less likely to withdraw from the market, even during periods of lower profitability. This can intensify competition as companies strive to maintain market share and recover their substantial investments.

- Substantial Fixed Costs: Brokerages incur significant expenses for advanced trading platforms, cybersecurity, and adherence to stringent financial regulations.

- Client Relationship Management: The cost and complexity of transferring or managing existing client accounts upon exit contribute to higher exit barriers.

- Brand Equity: The significant investment in building a trusted brand in the financial services sector makes an abrupt exit financially unviable for many firms.

The competitive rivalry within the online brokerage sector is fierce, driven by a crowded marketplace and the widespread adoption of zero-commission trading in 2024, which compresses margins. Interactive Brokers differentiates itself through its global market access and advanced trading platforms, catering to active traders and institutional clients. However, the ongoing innovation race, particularly in AI-driven tools and mobile accessibility, means rivals are constantly pushing to capture market share, intensifying the pressure on all participants.

| Metric | 2023 (Approx.) | 2024 (Projected/Early Data) |

|---|---|---|

| Active Online Brokerage Accounts (US) | ~60-70 million | Continued growth, ~70-80 million |

| Average Commission Per Stock Trade (Major Retail Brokers) | Near $0 | Remained near $0 |

| Interactive Brokers' Daily Average Revenue Trades (DARTs) | ~2.1 million | ~2.2-2.5 million (Q1-Q3 2024) |

SSubstitutes Threaten

Investors increasingly bypass traditional brokerage models by directly engaging with alternative investment platforms. For instance, real estate crowdfunding sites allow direct participation in property ventures, while peer-to-peer lending platforms connect borrowers and lenders without intermediary banks. The global real estate crowdfunding market was valued at approximately $12.4 billion in 2023 and is projected to grow significantly.

Robo-advisors and automated investing platforms present a significant threat of substitution for traditional brokerage services like Interactive Brokers. These platforms, offering automated portfolio management and financial advice with lower fees, appeal strongly to passive investors and those with smaller account balances. For instance, by late 2023, assets under management in robo-advisors globally were projected to reach over $2 trillion, highlighting their growing market share and competitive pressure.

Customers seeking a complete financial picture may opt for traditional banks or established wealth management firms. These institutions often bundle investment services with other offerings like savings accounts, loans, and personalized financial planning, presenting a compelling, all-encompassing solution that can serve as a substitute for a standalone brokerage account.

For instance, in 2024, major banks continued to heavily promote their integrated wealth management platforms, aiming to capture a larger share of client assets by offering a one-stop shop for financial needs. This holistic approach can be particularly attractive to individuals who prefer a single point of contact for all their financial dealings, potentially drawing them away from specialized online brokers.

Physical Assets and Collectibles

Physical assets and collectibles, such as precious metals, art, and rare items, present a threat of substitution for traditional financial market investments. During times of economic uncertainty or high inflation, investors may shift capital towards tangible assets as a perceived store of value, diverting funds that might otherwise be allocated to Interactive Brokers' platforms.

For instance, the global market for art and collectibles saw significant activity. In 2023, the total value of art sold at auction reached approximately $13.5 billion, indicating a substantial pool of capital available for these alternative investments.

- Alternative Capital Allocation: Physical assets offer a distinct avenue for wealth preservation and growth, potentially drawing investment away from financial markets.

- Inflation Hedge Appeal: Precious metals like gold often act as a hedge against inflation, making them attractive substitutes when traditional investments face erosion of purchasing power. Gold prices, for example, saw an increase in 2024, reflecting this demand.

- Diversification Beyond Financials: For some investors, collectibles represent a diversification strategy that is entirely separate from the financial system, reducing reliance on market liquidity.

Embedded Finance and Neo-banks

The proliferation of embedded finance and neo-banks presents a significant threat of substitutes for traditional brokerage services. Non-financial companies increasingly integrate financial offerings, like payments and lending, directly into their platforms. This trend extends to investment capabilities, where neo-banks, such as Revolut and N26, are rolling out user-friendly investment features. These platforms often provide simplified access to a curated selection of stocks, ETFs, and cryptocurrencies, appealing to a segment of users who prioritize convenience over the breadth of options offered by established brokerages like Interactive Brokers.

These digital-first banking alternatives are attracting customers with low fees and seamless integration of banking and investing. For instance, by mid-2024, several prominent neo-banks reported user bases exceeding tens of millions globally, with a notable portion actively engaging with their investment modules. While these offerings might not match the advanced trading tools or extensive market access of a full-service broker, they serve as a viable substitute for retail investors seeking basic portfolio management and occasional trading. This convenience factor, coupled with competitive pricing, directly challenges the market share of dedicated brokerage accounts for less demanding investors.

- Embedded Finance Integration: Companies like Shopify and Square are embedding payment and lending services, with potential for future investment product integration.

- Neo-bank Investment Features: Platforms like Revolut reported over 35 million users globally by early 2024, with a growing percentage utilizing their investment features.

- User Convenience and Cost: Neo-banks often offer commission-free trading on certain assets and simplified interfaces, attracting users away from traditional brokers for basic investing needs.

- Market Share Erosion: The accessibility and ease of use of these substitute platforms could lead to a gradual erosion of market share for traditional brokerages, particularly among younger, less experienced investors.

The threat of substitutes for Interactive Brokers stems from a diverse range of alternatives that offer similar financial services or investment opportunities through different means. These substitutes cater to various investor needs, from passive management to tangible asset diversification.

Robo-advisors and integrated banking platforms represent a growing substitute threat, offering simplified, low-cost investment solutions. For instance, by mid-2024, several major neo-banks reported user bases in the tens of millions, with a significant portion actively using their investment features. These platforms appeal to investors prioritizing convenience and cost-effectiveness for basic portfolio management.

Furthermore, alternative investment avenues like real estate crowdfunding and peer-to-peer lending provide direct access to asset classes previously requiring intermediaries. The real estate crowdfunding market, valued around $12.4 billion in 2023, demonstrates the substantial capital flow into these non-traditional investment channels.

Tangible assets, such as art and precious metals, also serve as substitutes, especially during economic uncertainty. The global art market alone saw approximately $13.5 billion in auction sales in 2023, highlighting a considerable segment of investment capital directed away from financial markets. Gold prices also saw an uptick in 2024, indicating its role as an inflation hedge and a substitute for financial assets.

| Substitute Type | Key Features | Market Indicator (2023/2024 Data) | Investor Appeal |

| Robo-Advisors/Neo-banks | Automated management, low fees, integrated banking | Global robo-advisor AUM projected >$2 trillion (late 2023); Neo-banks with millions of users (mid-2024) | Convenience, cost-efficiency, ease of use |

| Crowdfunding/P2P Lending | Direct investment in property/loans | Real estate crowdfunding market ~$12.4 billion (2023) | Access to alternative asset classes, direct participation |

| Physical Assets (Art, Gold) | Tangible store of value, inflation hedge | Global art auction sales ~$13.5 billion (2023); Gold price increases (2024) | Wealth preservation, diversification, tangible security |

Entrants Threaten

The financial brokerage industry faces substantial regulatory hurdles, acting as a significant deterrent to new competitors. Obtaining the necessary licenses, adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, and implementing robust cybersecurity protocols are all complex and resource-intensive processes.

These stringent requirements translate into high upfront costs and ongoing compliance expenses, making it difficult for smaller, less capitalized firms to enter the market. For instance, in 2024, the cost of compliance for financial institutions globally continued to rise, with many reporting significant portions of their operating budgets dedicated to regulatory adherence.

Establishing a global electronic brokerage, much like Interactive Brokers, requires immense capital. Think about the technology needed to handle millions of trades daily, plus fees to access various global exchanges and the systems for clearing and settling those trades. This alone creates a significant barrier.

In 2024, the ongoing investment in cybersecurity and regulatory compliance further inflates these initial capital needs. Companies looking to enter this space must be prepared to deploy hundreds of millions, if not billions, of dollars just to get operational and meet stringent financial requirements, effectively deterring most potential competitors.

Interactive Brokers, as a long-standing player, has cultivated a robust brand reputation and deep customer trust, a significant barrier for newcomers. In the financial services industry, where client capital is at stake, this established credibility is paramount. New entrants face the arduous task of building similar levels of confidence, particularly with sophisticated institutional and professional traders who demand unwavering reliability and security in their brokerage partners.

Technological Complexity and Economies of Scale

The threat of new entrants for Interactive Brokers is significantly lowered by the high technological complexity and substantial economies of scale already established by incumbents. Developing and maintaining cutting-edge trading platforms, robust real-time data feeds, and intricate risk management systems demands immense technological prowess and ongoing substantial capital infusion. For instance, in 2023, Interactive Brokers invested heavily in its technology infrastructure, a cost that would be prohibitive for a nascent competitor.

Existing large brokerage firms, like Interactive Brokers, leverage significant economies of scale in their technology development and operational overhead. This allows them to offer competitive pricing and a wider array of features, creating a formidable barrier for any new player attempting to enter the market and match their capabilities or cost efficiencies. The sheer investment required to build comparable systems means new entrants struggle to compete effectively from day one.

- High Capital Investment: Building and maintaining advanced trading technology requires billions in upfront and ongoing investment.

- Economies of Scale: Established players benefit from lower per-unit costs in technology and operations, making it hard for newcomers to match pricing.

- Technological Expertise: The need for specialized talent in areas like AI, cybersecurity, and algorithmic trading creates a significant human capital barrier.

- Regulatory Compliance: Navigating and adhering to complex financial regulations adds another layer of cost and complexity for new entrants.

Customer Switching Costs (for new entrants)

While the direct financial cost for a customer to switch brokers might be minimal, the practical hurdles for new entrants are significant. Interactive Brokers, for instance, has cultivated a loyal customer base through its robust platform and extensive offerings. New entrants need to offer something truly exceptional to entice users away from a familiar and trusted environment.

To overcome this, emerging platforms must present a clear value proposition. This could manifest as significantly lower trading fees, a more intuitive user interface, or access to unique asset classes not readily available elsewhere. For example, a new entrant might offer commission-free trading on all ETFs, a move that directly challenges established players and incentivizes switching.

Consider the competitive landscape in 2024. Many retail investors have become accustomed to the features and reliability of platforms like Interactive Brokers. A new entrant would likely need to invest heavily in marketing and customer acquisition to gain even a small market share. Providing superior educational resources or advanced analytical tools could also serve as a powerful differentiator.

- Low Direct Switching Costs: Customers can often move accounts with minimal fees.

- Established Loyalty: Users are often hesitant to leave familiar, trusted platforms.

- Need for Superior Value: New entrants must offer compelling incentives like lower fees or better technology.

- Market Entry Barriers: Attracting customers away from established brokers requires significant effort and differentiation.

The threat of new entrants for Interactive Brokers is considerably low due to the immense capital required to establish a competitive brokerage. This includes substantial investments in technology, regulatory compliance, and global exchange access, making it difficult for smaller firms to enter. For instance, in 2024, the ongoing need for advanced cybersecurity and adherence to evolving financial regulations meant that new entrants faced upfront costs potentially in the hundreds of millions of dollars.

Economies of scale enjoyed by established players like Interactive Brokers, particularly in technology development and operations, create a significant barrier. This allows them to offer competitive pricing and a wider range of services, which new entrants struggle to match from the outset. The technological sophistication required for platforms handling millions of daily trades, coupled with the need for specialized talent in areas like AI and algorithmic trading, further elevates the entry barrier.

Customer loyalty and brand reputation also play a crucial role, as investors, especially professionals, prioritize reliability and security. New entrants must offer a compelling value proposition, such as significantly lower fees or unique asset access, to entice users away from established and trusted platforms. In 2024, the market continued to see consolidation, reinforcing the dominance of larger, well-capitalized firms.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Interactive Brokers Group is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. We also incorporate data from regulatory filings and reputable financial news outlets to capture a comprehensive view of the competitive landscape.