Insulet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insulet Bundle

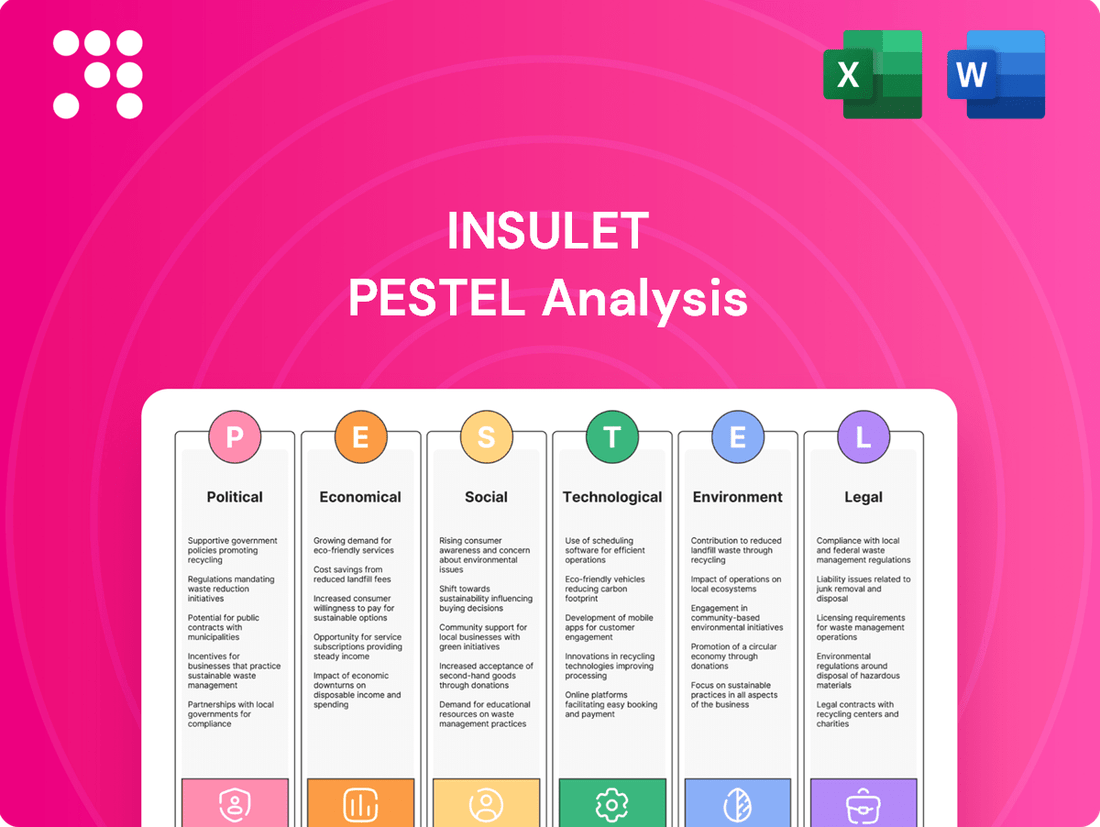

Unlock Insulet's strategic landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping their market. Gain actionable intelligence to inform your own business strategy and investment decisions. Download the full report now for a competitive edge.

Political factors

Government healthcare policies are a major force shaping Insulet's business, especially how its Omnipod system gets paid for. These policies directly influence whether patients can afford the device and how much revenue Insulet can generate.

Changes in big government health programs like Medicare and Medicaid in the U.S., and similar international programs, can really move the needle on patient access and Insulet's financial results. For example, adjustments to payment rates, like those seen with the Medicare Diabetes Prevention Program (MDPP) in 2025, show how policy shifts can affect provider incentives for adopting new diabetes management tools.

The political climate significantly influences the speed and rigor of medical device approvals. A consistent and clear regulatory process, exemplified by the FDA in the United States, is vital for Insulet to bring new or improved products to market efficiently. For instance, the Omnipod 5 received FDA clearance in early 2022, demonstrating the importance of a streamlined approval process.

International trade policies, including tariffs and trade agreements, directly impact Insulet's global supply chain and manufacturing expenses. Fluctuations in these policies can alter the cost of components sourced internationally and the pricing of finished goods in different markets.

With Insulet's strategic expansion targeting over 10 additional country launches in 2025, navigating trade landscapes becomes paramount. Favorable trade relations and predictable import/export regulations are crucial for maintaining cost-effective operations and successfully penetrating new markets.

Government Funding for Diabetes Initiatives

Government investment in public health initiatives aimed at diabetes prevention and management fosters a more favorable landscape for companies like Insulet. For instance, the U.S. government's commitment to tackling chronic diseases, including diabetes, has seen significant financial allocations. In fiscal year 2024, the National Institutes of Health (NIH) continued to fund extensive diabetes research, with a substantial portion directed towards understanding and mitigating its impact, which indirectly benefits companies developing advanced delivery systems.

Increased funding for diabetes research, awareness campaigns, and the adoption of new technologies directly benefits Insulet by expanding the market for its innovative insulin delivery systems. The Centers for Disease Control and Prevention (CDC) actively supports programs that promote diabetes self-management and technology use, potentially increasing patient and provider familiarity and acceptance of devices like Insulet's Omnipod. This aligns with broader political objectives to alleviate the long-term healthcare costs associated with chronic conditions.

- Government investment in diabetes research: The U.S. government, through agencies like the NIH, allocated approximately $2.6 billion to diabetes research in fiscal year 2023, a figure expected to remain robust in 2024, supporting advancements that could benefit Insulet's product pipeline.

- Public health campaigns: Initiatives funded by the CDC, such as the National Diabetes Prevention Program, aim to reduce the incidence of type 2 diabetes, potentially leading to earlier diagnosis and management, thus increasing the addressable market for insulin delivery solutions.

- Healthcare burden reduction: Political will to reduce the economic strain of chronic diseases drives policies that encourage efficient and effective treatment modalities, favoring innovative solutions that improve patient outcomes and potentially lower overall healthcare expenditures.

Political Stability in Key Markets

Political stability in Insulet's key operating regions, including the United States and Europe, is crucial for its global expansion plans. For instance, the U.S. presidential election cycle in 2024 and potential policy changes could influence healthcare regulations and reimbursement policies affecting Insulet's diabetes management devices. Similarly, geopolitical tensions in Europe, such as the ongoing conflict in Ukraine, can create supply chain disruptions and impact consumer spending on medical devices.

Insulet's reliance on global manufacturing and distribution means that political instability in any of its major markets can pose significant risks. For example, a sudden imposition of trade tariffs or export restrictions in a key market could directly impact Insulet's revenue streams and profitability. The company's 2023 annual report highlights its operations in over 100 countries, underscoring the broad exposure to diverse political landscapes.

- United States: Continued focus on healthcare policy stability is key for market access and reimbursement.

- Europe: Navigating diverse national healthcare systems and potential regulatory harmonization efforts presents both opportunities and challenges.

- Emerging Markets: Political stability and regulatory clarity are critical for successful market entry and long-term growth in regions like Asia-Pacific.

Government healthcare policies significantly influence Insulet's market access and reimbursement for its Omnipod system. Changes in major programs like Medicare and Medicaid in the U.S., and similar international initiatives, directly impact patient affordability and Insulet's revenue. For instance, policy adjustments affecting diabetes management technology adoption, such as those debated for 2025, are critical.

The political climate also dictates the pace of medical device approvals. A predictable regulatory environment, like that provided by the FDA, is essential for Insulet's product launches, as seen with the Omnipod 5's clearance in early 2022. Furthermore, international trade policies and tariffs affect Insulet's global supply chain costs, a factor heightened by its 2025 expansion plans into over 10 new countries.

Government investment in diabetes prevention and management, including research funding from agencies like the NIH (which allocated around $2.6 billion to diabetes research in FY2023), directly benefits Insulet by expanding the market for its innovative solutions. Public health campaigns promoting diabetes self-management also increase awareness and acceptance of devices like the Omnipod.

| Factor | Impact on Insulet | Supporting Data/Event |

|---|---|---|

| Healthcare Policy (U.S.) | Reimbursement rates, market access | Potential policy shifts impacting diabetes tech in 2025 |

| Regulatory Approvals | Speed to market for new products | Omnipod 5 FDA clearance (early 2022) |

| International Trade | Supply chain costs, market entry | Expansion into 10+ countries in 2025 |

| Government Research Funding | Market growth, product pipeline | NIH diabetes research funding ~$2.6 billion (FY2023) |

What is included in the product

This Insulet PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic decisions.

It provides actionable insights into external forces, enabling Insulet to identify potential risks and capitalize on emerging opportunities in the dynamic medical device market.

Provides a clear, actionable overview of external factors impacting Insulet, enabling proactive problem-solving and mitigating potential disruptions.

Economic factors

Global economic growth is a significant driver for Insulet, as it directly correlates with consumer disposable income and healthcare spending. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady rate that generally supports increased investment in health technologies.

When economies are strong, individuals and healthcare systems have more capacity to adopt innovative diabetes management tools like Insulet's Omnipod system. For instance, a rise in disposable income allows patients to prioritize convenience and advanced features, boosting demand.

Conversely, economic slowdowns can create headwinds. During periods of recession or high inflation, such as the economic challenges seen in late 2022 and into 2023, both patients and insurers may become more price-sensitive, potentially delaying or reducing the adoption of premium diabetes solutions.

Global healthcare expenditure, particularly the segment dedicated to chronic disease management, directly shapes Insulet's market potential. Countries with robust healthcare budgets and comprehensive insurance coverage tend to foster greater adoption of advanced medical technologies like the Omnipod system.

The affordability of Insulet's Omnipod system is a key economic driver. Factors such as national healthcare spending, the extent of insurance reimbursements, and patient co-pays critically influence its accessibility and widespread use. This economic landscape directly impacts Insulet's revenue streams and market penetration strategies.

The economic burden of diabetes is substantial, with global diabetes-related health expenditure estimated to have exceeded one trillion US dollars in 2024. While this highlights a significant market opportunity for diabetes management solutions, it also underscores the potential for cost pressures and the importance of demonstrating value and cost-effectiveness for Insulet's products.

The economic viability of Insulet's products hinges on the insurance coverage for insulin pumps and continuous glucose monitoring (CGM) systems. In the US, for instance, Medicare Part D coverage for insulin pumps has expanded, with an estimated 400,000 individuals with Type 1 diabetes potentially benefiting, according to 2024 projections. This broadens market access significantly.

Favorable reimbursement policies from major private insurers, such as UnitedHealthcare and Blue Cross Blue Shield, directly fuel Insulet's sales volumes. For example, Insulet reported that its Omnipod 5 system achieved broad commercial payer coverage, reaching over 90% of commercially insured lives in the US by early 2024. This widespread access is a critical economic driver.

Conversely, any tightening of reimbursement policies or increased patient co-pays by these insurers presents a substantial economic hurdle. A shift towards more restrictive coverage for advanced diabetes technologies could directly impact Insulet's revenue growth and market penetration in key regions, potentially slowing adoption rates.

Inflation and Cost of Goods

Inflationary pressures directly affect Insulet's operational costs. Rising prices for raw materials, components, and transportation can squeeze gross margins. This makes efficient cost management a critical factor for maintaining profitability in the dynamic economic landscape of 2024 and 2025.

For instance, Insulet reported a strong gross margin of 71.9% in the first quarter of 2025. This improvement suggests successful navigation of inflationary headwinds through enhanced operational efficiencies and strategic sourcing.

- Rising Input Costs: Inflation can increase expenses for essential materials, manufacturing processes, and supply chain logistics.

- Margin Pressure: Higher costs directly impact Insulet's ability to maintain its profit margins on products like the Omnipod system.

- Operational Efficiency: Achieving a 71.9% gross margin in Q1 2025 demonstrates Insulet's capability to offset inflationary impacts through internal improvements.

Currency Exchange Rate Fluctuations

Insulet, operating globally, faces risks from fluctuating currency exchange rates. A stronger U.S. dollar can increase the cost of its products for international customers or decrease the dollar value of its overseas earnings, impacting reported profits. For example, Insulet's Q1 2025 financial results indicated a negative foreign currency impact of 100 basis points.

These fluctuations can significantly affect Insulet's revenue and profitability. When the dollar strengthens, international sales translate into fewer dollars, potentially hurting the company's top and bottom lines. Conversely, a weaker dollar can boost reported international earnings.

- Unfavorable Currency Impact: Insulet's Q1 2025 report highlighted a 100 basis point negative impact from foreign currency movements.

- Revenue Translation: A stronger USD makes Insulet's products more expensive in foreign markets, potentially dampening demand.

- Profitability Concerns: When international revenues are converted back to USD, a strong dollar reduces their reported value, impacting earnings per share.

Global economic growth, projected at 3.2% for 2024 by the IMF, directly influences Insulet by impacting disposable income and healthcare spending. Strong economies enable greater adoption of advanced diabetes management tools like the Omnipod system, while slowdowns can lead to price sensitivity and delayed purchases.

Insulet's market potential is closely tied to global healthcare expenditure, with diabetes-related costs exceeding one trillion US dollars in 2024, presenting both opportunity and cost-pressure risks. Favorable reimbursement policies are critical; for example, over 90% of commercially insured lives in the US had Omnipod 5 coverage by early 2024, significantly boosting market access.

Inflationary pressures, while a concern, were navigated effectively by Insulet, which achieved a 71.9% gross margin in Q1 2025, indicating strong operational efficiency. However, fluctuating currency exchange rates pose a risk, with a 100 basis point negative impact noted in Q1 2025, affecting the dollar value of international earnings.

| Economic Factor | Impact on Insulet | Data Point/Example |

|---|---|---|

| Global Economic Growth | Influences disposable income and healthcare spending. | IMF projected global growth at 3.2% in 2024. |

| Healthcare Expenditure | Shapes market potential for diabetes management. | Global diabetes-related health expenditure exceeded $1 trillion in 2024. |

| Reimbursement Policies | Critical for product accessibility and sales volume. | Omnipod 5 achieved >90% commercial payer coverage in the US by early 2024. |

| Inflation | Affects operational costs and margins. | Insulet reported a 71.9% gross margin in Q1 2025. |

| Currency Fluctuations | Impacts international revenue translation and profitability. | Q1 2025 saw a 100 basis point negative foreign currency impact. |

Full Version Awaits

Insulet PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Insulet PESTLE analysis provides a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental aspects.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive landscapes, and potential opportunities and threats for Insulet.

Sociological factors

The escalating global prevalence of diabetes, encompassing both Type 1 and Type 2, is a significant sociological factor directly impacting Insulet's market. Estimates suggest that by 2050, the number of adults living with diabetes could surge to 853 million, with Type 2 accounting for over 90% of these cases. This expanding patient demographic necessitates advanced and accessible diabetes management solutions.

This growing incidence translates into a consistently increasing demand for innovative insulin delivery systems like those offered by Insulet. As more individuals are diagnosed, the market for effective tools to manage blood glucose levels expands, presenting a substantial opportunity for companies at the forefront of this technology.

The world's population is getting older, and this trend has a direct impact on health conditions like diabetes. As people age, the likelihood of developing Type 2 diabetes increases significantly. For instance, in 2023, over 27% of adults aged 65 and older in the United States had diabetes, a figure projected to grow.

This demographic shift is a positive development for Insulet, the maker of the Omnipod insulin delivery system. The Omnipod is designed for ease of use and discretion, making it an attractive option for older adults who may find traditional insulin injections cumbersome. This growing segment of the population represents a substantial expansion of Insulet's potential customer base, as they seek simpler ways to manage their diabetes.

Modern lifestyles, marked by evolving dietary patterns and reduced physical activity, are unfortunately fueling an increase in chronic conditions like Type 2 diabetes. For instance, in 2024, global obesity rates continued to climb, directly correlating with the prevalence of diabetes.

This rise in health concerns is paralleled by a significant surge in health awareness and patient empowerment. Individuals are actively seeking more control over their health, driving a demand for sophisticated tools that facilitate effective self-management of conditions like diabetes.

This trend directly benefits companies like Insulet, whose innovative digital health platforms and insulin delivery systems cater to this growing need for advanced, user-friendly diabetes management solutions. The market for connected diabetes devices is projected to reach over $15 billion by 2025, highlighting the strong demand for such technologies.

Patient Preference for Discreet and Convenient Solutions

Societal shifts are increasingly favoring medical technologies that prioritize patient privacy and ease of use, ultimately aiming to improve daily living. Insulet’s Omnipod, a tubeless and wearable insulin delivery system, perfectly aligns with this trend. It offers a less visible and more integrated approach compared to traditional methods, which can significantly boost patient compliance and overall contentment with their diabetes management.

This preference for discretion and convenience is a powerful driver in the medical device market. For instance, Insulet reported a 20% year-over-year increase in new pod shipments in Q1 2024, reflecting strong adoption of its user-friendly technology. The Omnipod system’s design directly caters to individuals seeking to manage chronic conditions without the obtrusiveness of more conventional devices.

- Growing Demand for Wearable Health Tech: The global wearable medical device market is projected to reach $186.6 billion by 2026, indicating a strong consumer appetite for discreet and integrated health solutions.

- Improved Quality of Life Focus: Patient surveys consistently highlight convenience and reduced daily burden as key factors in treatment adherence, with studies showing improved quality of life scores for users of patch pumps like Omnipod.

- Adherence and Satisfaction Link: Insulet’s own data from 2023 indicated that Omnipod users reported higher treatment satisfaction and adherence rates compared to users of traditional insulin pens or syringes.

Cultural Acceptance of Technology in Healthcare

Societal views on technology in healthcare are evolving, with a growing acceptance of digital tools for managing personal health. This trend is particularly evident in developed nations where smartphone penetration is high and individuals are increasingly comfortable with app-based health monitoring. For instance, a 2024 survey indicated that over 70% of adults in the US are open to using digital health tools recommended by their doctor, a significant increase from previous years.

The increasing comfort level with technology directly impacts the adoption of advanced systems like Insulet's Omnipod 5, which leverages smartphone connectivity for diabetes management. As more patients and healthcare providers embrace these innovations, market penetration for such devices is expected to deepen. In 2024, Insulet reported a 25% year-over-year growth in its Omnipod division, partly attributed to this rising cultural acceptance and the convenience offered by smartphone control.

Regional differences in technology adoption and cultural norms still play a role, but the overall trajectory points towards greater integration. Emerging markets are also seeing a surge in digital health awareness, driven by mobile-first strategies and government initiatives to improve healthcare access. This broad acceptance is a key enabler for Insulet's global expansion strategies.

Key indicators of this trend include:

- Increased patient willingness to use digital health platforms: A 2024 report by HIMSS found that 65% of patients actively seek out digital tools to manage chronic conditions.

- Provider endorsement of connected health devices: Surveys of endocrinologists in 2024 showed that over 80% recommend or are willing to recommend connected insulin delivery systems.

- Growth in remote patient monitoring adoption: The remote patient monitoring market was valued at over $30 billion in 2024 and is projected to grow at a CAGR of 15% through 2030, reflecting a societal shift towards tech-enabled care.

The increasing prevalence of diabetes globally, projected to affect 853 million adults by 2050, directly fuels demand for advanced insulin delivery systems like Insulet's Omnipod. An aging global population, with over 27% of US adults aged 65+ having diabetes in 2023, further expands Insulet's target market as older individuals seek user-friendly management solutions.

Modern lifestyles contribute to rising obesity and diabetes rates, correlating with a heightened patient desire for self-management tools. This trend is amplified by growing health awareness and patient empowerment, driving demand for sophisticated, connected diabetes devices, a market estimated to exceed $15 billion by 2025.

Societal preferences are shifting towards discreet, convenient medical technologies, aligning with Insulet's tubeless Omnipod system. This preference is evidenced by Insulet's 20% year-over-year increase in new pod shipments in Q1 2024, showcasing strong adoption of its user-centric design.

Cultural acceptance of digital health tools is rising, with over 70% of US adults in a 2024 survey open to using doctor-recommended digital health solutions. This growing comfort with technology supports the adoption of systems like the Omnipod 5, contributing to Insulet's 25% year-over-year growth in its Omnipod division in 2024.

Technological factors

Continuous technological advancements in automated insulin delivery (AID) systems, like Insulet's Omnipod 5, are crucial for maintaining a competitive edge in the diabetes care market. These sophisticated systems, which often link with continuous glucose monitors (CGMs), offer a closed-loop approach to insulin delivery, thereby enhancing glycemic control and streamlining diabetes management for users.

The market for AID systems is experiencing significant growth, with projections indicating a substantial expansion in the coming years. For instance, the global AID market was valued at approximately $3.8 billion in 2023 and is anticipated to reach over $10 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 15%. This rapid expansion underscores the importance of ongoing innovation to meet the evolving needs of patients and the dynamic demands of the market.

Insulet's Omnipod system's seamless integration with leading continuous glucose monitoring (CGM) devices is a key technological advantage. This synergy, particularly with the Omnipod 5, provides users with real-time glucose data and automated insulin delivery, significantly improving diabetes management.

This technological integration is a major catalyst for market expansion in diabetes care devices. For instance, by Q1 2024, Insulet reported that over 100,000 active users were on the Omnipod 5 system, highlighting strong adoption driven by its advanced features.

The diabetes care landscape is rapidly evolving with the integration of digital health solutions and artificial intelligence. Insulet's Omnipod 5 App, available on iPhone, exemplifies this shift, offering users enhanced control and data insights. This trend towards AI-powered systems is a critical technological factor, promising to improve the accuracy and effectiveness of diabetes management for patients.

Miniaturization and Wearable Technology

The ongoing drive for miniaturization directly benefits Insulet's Omnipod system, which is built around a tubeless design. As technology allows for smaller, lighter components, the Omnipod can become even more discreet and comfortable for users. This trend is crucial for enhancing user adoption and satisfaction, reinforcing the core value proposition of Insulet's innovative approach to diabetes management.

Wearable technology is a rapidly expanding market, and Insulet is well-positioned to capitalize on this. The global wearable technology market was valued at approximately $116 billion in 2023 and is projected to grow significantly, reaching over $300 billion by 2029. This growth underscores the increasing consumer acceptance and demand for integrated health monitoring and management devices, aligning perfectly with the Omnipod's functionality.

- Enhanced User Experience: Miniaturization leads to smaller, lighter, and more comfortable wearable devices, improving daily living for Omnipod users.

- Discreetness and Portability: Smaller components allow for a more discreet and portable insulin delivery system, a key differentiator for Insulet.

- Market Growth: The expanding wearable technology market, projected to exceed $300 billion by 2029, provides a fertile ground for Insulet's growth.

- Technological Advancements: Continuous innovation in sensor technology and battery life further supports the development of more sophisticated and user-friendly wearable insulin pumps.

Cybersecurity of Medical Devices and Data

As Insulet's insulin delivery systems become increasingly connected, the cybersecurity of these devices and the patient data they handle is paramount. Robust security measures are not just a technological requirement but a fundamental trust factor for users and healthcare providers alike. The company must ensure its systems are protected against evolving cyber threats to maintain device integrity and safeguard sensitive health information.

Compliance with stringent data privacy regulations and proactive defense against cyberattacks are critical. The U.S. Food and Drug Administration (FDA) has emphasized this by releasing updated guidance on medical device cybersecurity in 2025, underscoring the growing importance of this area. This focus reflects the increasing sophistication of threats targeting connected medical technology.

- Data Breach Costs: The average cost of a healthcare data breach reached $10.10 million in 2023, a significant increase that highlights the financial and reputational risks.

- Connected Medical Devices: The number of connected medical devices is projected to reach 117 million by 2025, amplifying the attack surface for cyber threats.

- Regulatory Scrutiny: The FDA's 2025 guidance signals a heightened regulatory environment, demanding proactive cybersecurity strategies from device manufacturers like Insulet.

Technological advancements in automated insulin delivery (AID) systems are central to Insulet's strategy, with its Omnipod 5 system integrating seamlessly with continuous glucose monitors (CGMs). This closed-loop approach enhances glycemic control and user experience, a key driver in the growing AID market, which was valued at approximately $3.8 billion in 2023 and is expected to surpass $10 billion by 2030.

The miniaturization trend benefits Insulet's tubeless Omnipod design, making it more discreet and comfortable, aligning with the expanding wearable technology market, projected to exceed $300 billion by 2029. Furthermore, robust cybersecurity is critical, especially as connected medical devices are expected to reach 117 million by 2025, with healthcare data breaches costing an average of $10.10 million in 2023.

| Factor | Description | 2024/2025 Data/Projections |

| AID Market Growth | Expansion of automated insulin delivery systems | Projected to exceed $10 billion by 2030 (from ~$3.8 billion in 2023) |

| Wearable Technology Market | Increasing adoption of integrated health devices | Projected to exceed $300 billion by 2029 (from ~$116 billion in 2023) |

| Connected Medical Devices | Growth in internet-connected healthcare devices | Expected to reach 117 million by 2025 |

| Healthcare Data Breach Costs | Financial impact of security incidents | Average cost reached $10.10 million in 2023 |

Legal factors

Insulet's operations are heavily influenced by strict medical device regulations, including those set by the U.S. Food and Drug Administration (FDA) and comparable international authorities like the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR). These frameworks are critical for product approval and continued market access.

Adherence to these evolving legal standards is paramount, covering every stage from initial design and manufacturing to product labeling and ongoing post-market monitoring. For instance, recent FDA guidance emphasizes enhanced cybersecurity measures for connected medical devices, a crucial area for Insulet's insulin delivery systems.

The company must also navigate new directives concerning artificial intelligence (AI) in healthcare, ensuring its products meet updated safety and efficacy requirements. Failure to comply with these dynamic regulations can significantly impact Insulet's ability to launch new products and maintain sales in key global markets, potentially affecting its revenue streams which were reported to be over $1.7 billion in 2023.

Intellectual property protection is a cornerstone of Insulet's strategy, with patents and trade secrets safeguarding its innovative diabetes management technologies. The company's commitment to defending its IP was underscored by a significant victory in December 2024, where it secured a $452 million award and a worldwide permanent injunction in a trade secret misappropriation case against EOFlow Co. This legal success highlights the value Insulet places on its proprietary information and its proactive approach to combating infringement.

Insulet's operations are heavily influenced by global data privacy and security laws. Adhering to regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe is critical, especially with Insulet's digital health solutions that handle sensitive patient data. Failure to comply can result in substantial fines and harm to the company's reputation.

The U.S. Food and Drug Administration's (FDA) increasing emphasis on cybersecurity guidance for medical devices further highlights the legal necessity for robust data protection. For instance, in 2023, the FDA issued updated premarket cybersecurity guidance for medical devices, emphasizing the need for manufacturers to address vulnerabilities throughout a device's lifecycle, a direct legal imperative for companies like Insulet.

Product Liability and Safety Regulations

Insulet operates under stringent product liability and safety regulations, making adherence to quality system standards a critical legal imperative. Failure to meet these standards can expose the company to significant risks, including potential lawsuits and costly product recalls. For instance, in 2023, medical device manufacturers faced increased scrutiny following reports of adverse events, highlighting the importance of robust quality control.

The company must maintain rigorous quality management systems throughout its product lifecycle, from design to post-market surveillance. Any lapse in these systems could trigger regulatory investigations and substantial financial penalties. Insulet's commitment to product safety directly impacts its ability to operate and its legal standing in the market.

Key legal considerations for Insulet include:

- Compliance with FDA regulations: Ensuring all products meet the Food and Drug Administration's stringent safety and efficacy requirements.

- Adherence to international safety standards: Meeting global regulatory body mandates, such as those from the European Medicines Agency (EMA).

- Managing product recalls: Implementing swift and effective recall procedures to mitigate harm and legal repercussions.

- Maintaining robust quality systems: Demonstrating a commitment to quality through ISO 13485 certification and internal audits.

Healthcare Fraud and Abuse Laws

Insulet operates in a highly regulated environment where adherence to healthcare fraud and abuse laws is paramount. Compliance with statutes like the U.S. Anti-Kickback Statute and False Claims Act is essential for any medical device company engaging with healthcare professionals and insurance providers. Failure to comply can lead to significant penalties, including fines and exclusion from federal healthcare programs.

Insulet's sales, marketing, and reimbursement activities must be meticulously structured to avoid any appearance or reality of illegal inducements or fraudulent claims. For instance, the U.S. Department of Justice has actively pursued cases against medical device manufacturers for violations of these laws. In 2023 alone, settlements related to healthcare fraud and abuse reached billions of dollars across the industry, highlighting the substantial financial and reputational risks involved.

- Anti-Kickback Statute (AKS): Prohibits offering, paying, soliciting, or receiving remuneration to induce or reward referrals for items or services covered by federal healthcare programs.

- False Claims Act (FCA): Imposes liability on any person who knowingly submits, or causes to be submitted, false or fraudulent claims for payment to the government.

- Stark Law: Restricts physicians from referring Medicare or Medicaid patients to entities with which the physician or an immediate family member has a financial relationship.

- Enforcement Actions: Significant financial penalties and exclusion from federal healthcare programs are common consequences for non-compliance.

Insulet's legal landscape is defined by rigorous medical device regulations, data privacy laws, and anti-fraud statutes. The company must navigate evolving FDA guidelines, particularly concerning cybersecurity for connected devices, and adhere to international standards like the EU's MDR. Protecting its intellectual property, as evidenced by the $452 million award in December 2024 against EOFlow, is also a critical legal focus.

Compliance with data privacy laws such as HIPAA and GDPR is essential for Insulet's digital health solutions, with significant penalties for breaches. The company also faces scrutiny under healthcare fraud and abuse laws, including the Anti-Kickback Statute and False Claims Act, with industry-wide settlements in 2023 reaching billions, underscoring the financial and reputational risks of non-compliance.

| Legal Area | Key Regulations/Considerations | Impact on Insulet | 2023/2024 Data Point |

|---|---|---|---|

| Medical Device Regulation | FDA, EU MDR/IVDR | Product approval, market access, post-market surveillance | FDA issued updated premarket cybersecurity guidance in 2023. |

| Data Privacy & Security | HIPAA, GDPR | Protection of sensitive patient data in digital health solutions | Industry-wide settlements for healthcare fraud and abuse reached billions in 2023. |

| Intellectual Property | Patents, Trade Secrets | Safeguarding innovative diabetes management technologies | $452 million award secured in December 2024 for trade secret misappropriation. |

| Healthcare Fraud & Abuse | Anti-Kickback Statute, False Claims Act | Ensuring compliant sales, marketing, and reimbursement practices | Continued active enforcement by the U.S. Department of Justice. |

Environmental factors

Insulet's dedication to sustainable manufacturing and operations is a growing environmental consideration. The company is actively working to lower its energy use, cut down on waste, and incorporate more renewable energy sources across its operations.

The 2024 Sustainability Report details significant progress, noting that Insulet met 11% of its annual global electricity demand through renewable sources. Furthermore, the company has installed solar panels at its facility in Malaysia, a key step in reducing its carbon footprint.

The environmental footprint of disposable medical devices, such as Insulet's Omnipod Pods, demands robust waste management. These single-use items contribute to medical waste streams, making responsible disposal crucial.

Insulet is actively tackling product end-of-life concerns through initiatives like its U.S. Pod takeback pilot programs in Massachusetts and California. Globally, the company has processed millions of Pods via its product takeback programs, reflecting a commitment to managing waste.

Insulet actively manages its global supply chain's environmental footprint, a critical factor in its sustainability efforts. This includes evaluating and reducing the impact of raw material sourcing and product distribution, aiming for a lower overall environmental impact.

The company's commitment extends to assessing and mitigating the environmental performance of its suppliers and logistics partners. For instance, in 2023, Insulet continued its focus on reducing Scope 1 and 2 greenhouse gas emissions, reporting a reduction of 10% compared to its 2020 baseline.

Climate Change and Resource Scarcity

Insulet acknowledges the critical nature of climate change and is actively creating a plan to integrate financial disclosures related to climate impacts. This includes establishing goals for reducing greenhouse gas emissions, reflecting a growing commitment to environmental responsibility.

The potential for resource scarcity or supply chain interruptions stemming from climate change presents a tangible risk to Insulet's manufacturing operations and overall resilience. Consequently, proactive climate action is becoming a fundamental business necessity.

- Insulet's Commitment: Developing a roadmap for climate-related financial disclosures and setting greenhouse gas emission reduction targets.

- Supply Chain Risk: Potential resource scarcity due to climate change could impact manufacturing and supply chain stability.

- Business Imperative: Climate action is increasingly vital for ensuring long-term operational resilience and mitigating business risks.

Corporate Social Responsibility and ESG Reporting

Insulet is increasingly focused on corporate social responsibility and Environmental, Social, and Governance (ESG) factors, driven by growing stakeholder and investor interest. This emphasis is crucial for maintaining a positive brand image and attracting investment in a competitive market.

The company actively demonstrates its commitment through various initiatives. For instance, Insulet published its 2024 sustainability report, detailing its progress and future goals in areas like environmental impact and social equity. This transparency is key to meeting evolving investor expectations.

Furthermore, Insulet's engagement in programs such as 'Insulet for Good' highlights its dedication to community well-being and ethical business practices. Such efforts not only enhance brand reputation but also align with the broader trend of prioritizing sustainable and responsible business operations.

- Growing Investor Demand: A significant portion of institutional investors now integrate ESG criteria into their investment decisions, putting pressure on companies like Insulet to perform well on these metrics.

- Reputation and Brand Value: Strong CSR performance, as evidenced by Insulet's sustainability reporting and community programs, directly contributes to a more favorable brand perception and can translate into increased customer loyalty.

- Risk Mitigation: Proactive management of environmental and social risks, often detailed in ESG reports, helps Insulet avoid potential regulatory penalties and reputational damage.

- Talent Attraction and Retention: Employees, particularly younger generations, increasingly prefer to work for companies with a clear commitment to social and environmental responsibility, impacting Insulet's ability to attract and retain top talent.

Insulet is actively reducing its environmental impact by increasing renewable energy use, as evidenced by meeting 11% of its global electricity demand with renewables in 2024 and installing solar panels in Malaysia. The company is also addressing the waste generated by its single-use Omnipod Pods through takeback programs, having processed millions of units globally.

Climate change is a key consideration, with Insulet developing a plan for climate-related financial disclosures and setting emissions reduction targets, aiming for a 10% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 from a 2020 baseline.

Resource scarcity due to climate change poses a risk to Insulet's operations, making proactive climate action essential for resilience. The company also focuses on the environmental footprint of its supply chain, working to reduce the impact of raw material sourcing and distribution.

| Environmental Factor | Insulet's Action/Data | Impact/Relevance |

| Renewable Energy Use | 11% of global electricity demand met by renewables (2024); Solar panels installed in Malaysia. | Reduces carbon footprint and operational costs. |

| Waste Management (Pods) | Millions of Pods processed globally via takeback programs. | Mitigates environmental impact of disposable medical devices. |

| Greenhouse Gas Emissions | 10% reduction in Scope 1 & 2 emissions by 2023 (vs. 2020 baseline). | Demonstrates commitment to climate action and regulatory compliance. |

| Climate Change Risk | Developing climate-related financial disclosures; Assessing resource scarcity impacts. | Ensures operational resilience and mitigates supply chain disruptions. |

PESTLE Analysis Data Sources

Our Insulet PESTLE Analysis is constructed using a comprehensive blend of data from reputable market research firms, government regulatory bodies, and leading industry publications. We incorporate insights from economic forecasts, technological advancements, and socio-cultural trend reports to ensure a robust understanding of the external environment.