Insulet Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insulet Bundle

Unlock the strategic blueprint behind Insulet's innovative diabetes management solutions. This comprehensive Business Model Canvas details how they create and deliver value to patients and healthcare providers. Discover their customer relationships, revenue streams, and key resources to understand their success.

Partnerships

Insulet’s key partnerships with Continuous Glucose Monitor (CGM) manufacturers, notably Dexcom and Abbott, are fundamental to its Omnipod 5 Automated Insulin Delivery (AID) system. These collaborations ensure that the Omnipod 5 can seamlessly integrate with leading CGM data, providing users with a more comprehensive and automated approach to diabetes management.

For instance, the Omnipod 5 system is designed to work with Dexcom’s G6 and G7 sensors, and Abbott’s FreeStyle Libre 2 and 3 sensors. This broad compatibility is vital, as it allows Insulet to offer its tubeless insulin delivery system to a wider patient population who may already be using or prefer specific CGM technologies. This strategic alignment enhances the value proposition of the Omnipod 5 by offering a more integrated and user-friendly experience.

Insulet's success heavily relies on its partnerships with healthcare providers and clinics. Endocrinologists, diabetes educators, and various clinics are instrumental in prescribing the Omnipod system and guiding patients through its initial setup and ongoing management. These collaborations are essential for patient adoption and ensuring they can effectively use the technology.

These healthcare professionals act as key recommenders, directly influencing patient choice and driving demand for Insulet's products. Their expertise in diabetes management means they are the trusted source of information for patients, making their endorsement critical for market penetration and sustained growth. In 2024, Insulet continued to focus on strengthening these relationships through educational programs and support, aiming to broaden the reach of the Omnipod system.

Insulet's primary distribution strategy in the United States relies heavily on pharmacies, ensuring the Omnipod system, particularly the disposable Pods, reaches a broad patient base. Internationally, the company leverages wholesalers to achieve similar widespread accessibility.

This pharmacy-centric approach in the U.S. offers a significant advantage by simplifying the procurement process for patients. It allows for easier access to the Pods and controllers compared to navigating more complex durable medical equipment channels, which can often involve additional administrative hurdles.

For example, in 2023, Insulet's Omnipod revenue reached $1.4 billion, a testament to the effectiveness of its distribution network, which is anchored by these key pharmacy and wholesaler partnerships. This model directly contributes to Insulet's ability to serve the diabetes management market efficiently.

Research Institutions and Academic Centers

Insulet actively collaborates with leading research institutions and academic centers to advance its diabetes management technology. These partnerships are crucial for executing rigorous clinical trials, which are fundamental to validating the efficacy and safety of products like the Omnipod system. For instance, collaborations in 2024 continue to focus on generating real-world evidence, demonstrating the system's benefits across diverse patient populations.

These academic collaborations are instrumental in expanding the approved indications for Insulet’s devices. By partnering with universities, Insulet can explore and validate the use of its technology in new therapeutic areas, such as the management of Type 2 diabetes, a significant market opportunity. Research findings from these institutions directly contribute to the scientific literature, bolstering market acceptance and physician confidence.

- Clinical Trial Support: Partnerships with institutions like Boston University and the University of Virginia have been vital for trials, including those evaluating the Omnipod 5 System in various age groups and diabetes types.

- Real-World Evidence Generation: In 2024, Insulet continued to leverage data from academic studies to showcase the long-term benefits of its closed-loop systems, impacting patient outcomes and healthcare economics.

- Innovation Pipeline: Research collaborations fuel Insulet's product innovation by exploring next-generation features and expanding the therapeutic applications of its wearable insulin delivery technology.

Technology and Digital Health Partners

Insulet's commitment to integrated digital health solutions necessitates robust collaborations with technology and digital health partners. These alliances are crucial for developing advanced app functionalities and sophisticated data analytics capabilities, directly impacting user experience and the comprehensiveness of diabetes management offered.

These partnerships enable Insulet to tap into specialized expertise for app development, ensuring seamless integration with their devices and providing users with intuitive interfaces. Furthermore, collaborations in data analytics are vital for extracting meaningful insights from user data, paving the way for more personalized and effective diabetes care strategies.

- App Development: Partnering with tech firms to build and refine mobile applications that connect with Insulet's Omnipod system, enhancing user control and data tracking.

- Data Analytics & AI: Collaborating with data science companies to leverage artificial intelligence and machine learning for predictive analytics, personalized therapy recommendations, and improved health outcomes.

- User Experience Enhancement: Working with UX/UI specialists to ensure the digital health platform is accessible, engaging, and easy to navigate for individuals managing diabetes.

- Next-Generation Products: Jointly exploring opportunities to develop innovative AI-based data products and algorithms that can further advance diabetes management and patient care.

Insulet's strategic alliances with CGM manufacturers like Dexcom and Abbott are paramount, ensuring seamless integration of their Omnipod 5 Automated Insulin Delivery (AID) system with leading glucose monitoring technologies. These partnerships, which saw Insulet's Omnipod revenue reach $1.4 billion in 2023, are critical for expanding patient access and enhancing the user experience by offering compatibility with widely adopted sensors.

Furthermore, Insulet relies on a robust network of healthcare providers and pharmacies for product adoption and distribution. In 2024, the company continued to strengthen relationships with endocrinologists and diabetes educators, who are key influencers in patient prescription decisions. Pharmacies in the U.S. and wholesalers internationally serve as crucial distribution channels, facilitating broad patient access to the Omnipod system.

Collaborations with academic institutions and technology partners are also vital for Insulet's innovation pipeline. These partnerships support clinical trials, the generation of real-world evidence, and the development of advanced digital health solutions, including AI-driven analytics, to improve diabetes management outcomes.

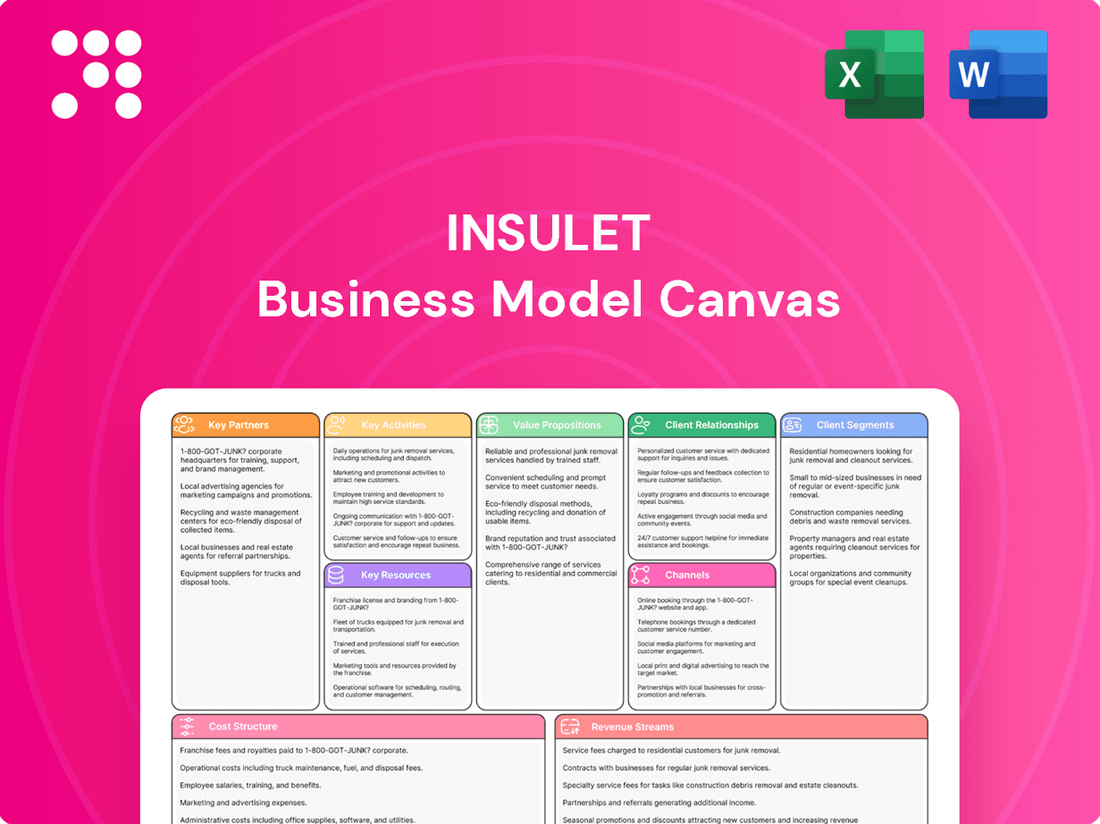

What is included in the product

A detailed Insulet Business Model Canvas outlining their direct-to-consumer sales channels and unique value proposition of convenient insulin delivery for diabetes management.

The Insulet Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of how their innovative insulin delivery systems address the challenges faced by people with diabetes, simplifying complex operations into an easily understandable format.

Activities

Insulet's commitment to Research and Development is a cornerstone of its business model, focusing on continuous innovation in insulin delivery. The company actively invests in enhancing its Omnipod 5 Automated Insulin Delivery system, a key product that has seen significant advancements. This includes refining the underlying algorithms for better glucose control and expanding compatibility with various continuous glucose monitoring (CGM) devices.

A significant portion of Insulet's R&D efforts are directed towards developing next-generation hardware and software. This involves creating more user-friendly smartphone control applications, which empower users with greater autonomy over their diabetes management. The company's pipeline also includes exploring new features and functionalities to address evolving patient needs and improve therapeutic outcomes.

In 2024, Insulet continued to prioritize R&D, with significant investments aimed at strengthening its market position. For instance, the company reported spending $249.6 million on R&D in 2023, a figure that underscores its dedication to innovation. This ongoing investment is crucial for maintaining a competitive edge and ensuring that Insulet's products remain at the forefront of diabetes technology, addressing critical unmet needs for individuals with diabetes.

Insulet's manufacturing and supply chain management centers on producing its innovative Omnipod system, which includes the disposable Pods. This requires highly automated and robust manufacturing facilities to meet demand.

Efficient supply chain management is absolutely critical for Insulet to ensure its global customers have uninterrupted access to their life-changing diabetes management devices.

In 2023, Insulet continued to invest in enhancing both manufacturing and supply chain resilience and capacity. This includes expanding its facilities and optimizing logistics to support continued growth and product availability for its user base.

Insulet's sales and marketing strategy focuses on reaching both patients and healthcare professionals. Direct-to-consumer advertising, including digital campaigns and patient testimonials, aims to build brand recognition and drive demand for the Omnipod system. This approach was evident in their 2024 efforts to highlight the ease of use and improved quality of life associated with their products.

Engaging with clinicians and healthcare providers is crucial for Insulet's market penetration. They actively work to educate physicians, diabetes educators, and other key opinion leaders on the clinical benefits and patient outcomes associated with the Omnipod platform. This professional outreach is vital for securing prescriptions and ensuring proper patient onboarding.

Expanding market awareness across diverse patient populations, including pediatric and adult users, is a continuous effort. Insulet's marketing initiatives in 2024 emphasized the Omnipod's versatility and its ability to cater to a wide range of diabetes management needs, thereby broadening its appeal and market share.

Clinical Trials and Regulatory Approvals

Conducting robust clinical trials is a cornerstone of Insulet's strategy, proving the effectiveness and safety of their innovative diabetes management systems. For instance, the SECURE-T2D trial specifically investigated the benefits for individuals with Type 2 diabetes, a critical step in expanding their market reach.

Securing regulatory approvals from key health authorities, such as the U.S. Food and Drug Administration (FDA), is paramount for bringing these life-changing devices to patients. These clearances not only grant market access but also pave the way for broader indications and wider adoption of their technology.

- Clinical Trial Data: Insulet actively engages in clinical trials to validate its products, with ongoing research contributing to expanded indications and market acceptance.

- Regulatory Milestones: Obtaining FDA clearance, for example, is a critical gateway, enabling Insulet to offer its innovative insulin delivery systems to a wider patient population.

- Market Access: Successful clinical trials and regulatory approvals directly translate into enhanced market access, allowing Insulet to serve more individuals managing diabetes.

Customer Support and Education

Insulet prioritizes comprehensive customer support and education to ensure user satisfaction and retention for its Omnipod system. This includes offering dedicated support channels and robust onboarding programs designed to simplify diabetes management for new users.

The company provides extensive educational resources, such as online tutorials and personalized guidance, to empower its customers, known as Podders, to effectively use their devices. This focus on user experience is crucial for fostering loyalty and ensuring a positive journey with the technology.

In 2023, Insulet reported that over 400,000 Podders were using their Omnipod systems globally, highlighting the importance of their support infrastructure in managing such a large user base.

- Dedicated Support Lines: Offering direct access to trained professionals for immediate assistance.

- Educational Resources: Providing a wealth of information through online portals, webinars, and printed materials.

- Onboarding Programs: Structured guidance for new users to ensure a smooth transition to the Omnipod system.

- User Community Engagement: Fostering a sense of belonging and shared experience among Podders.

Insulet's key activities revolve around the continuous innovation and manufacturing of its Omnipod Automated Insulin Delivery system. This involves extensive research and development to enhance product features, expand compatibility, and develop next-generation hardware and software. The company also focuses on robust manufacturing processes to ensure a consistent supply of its devices.

Full Document Unlocks After Purchase

Business Model Canvas

The Insulet Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use business model analysis.

Resources

Insulet's core asset is its proprietary tubeless, wearable Omnipod insulin delivery system, a significant differentiator in the diabetes management landscape. This technology, protected by extensive intellectual property, provides a substantial competitive advantage.

The integrated algorithms within the Omnipod system are also key, enabling advanced insulin delivery and data analysis. This intellectual property is vital for maintaining Insulet's edge in a rapidly evolving market.

Continuous innovation and robust patent protection are paramount for Insulet to sustain its market leadership. For instance, as of early 2024, Insulet has a strong patent portfolio covering various aspects of its Omnipod technology, safeguarding its market position.

Insulet's state-of-the-art global manufacturing infrastructure, including its significant investment in a new facility in Malaysia, forms a critical resource for producing its innovative Omnipod products. This expansion is designed to bolster capacity and ensure the quality and safety of its devices.

These highly automated facilities are central to meeting the escalating global demand for Omnipod Pods and controllers. The focus on automation not only enhances product quality but also provides the scalability necessary to support Insulet's growth trajectory.

Strategic investment in manufacturing capacity is paramount for Insulet's supply chain resilience. For instance, by 2024, Insulet has been actively expanding its manufacturing footprint to mitigate potential disruptions and ensure consistent product availability for its customers worldwide.

Insulet's success hinges on its skilled human capital, a diverse group encompassing engineers, designers, production specialists, medical professionals, and customer care teams. This broad expertise is essential for developing and manufacturing their innovative diabetes management solutions.

The company's talent pool is particularly crucial for driving innovation in medical device development and ensuring operational excellence. Their collective knowledge in diabetes care directly fuels the creation of revolutionary products like the Omnipod system.

As of early 2024, Insulet employed over 3,000 individuals globally, with a significant portion dedicated to research and development and manufacturing. This workforce is the engine behind their ability to bring advanced insulin delivery technology to market and support their growing customer base.

Clinical Data and Research Evidence

Insulet's extensive clinical data, including real-world evidence, is a cornerstone of the Omnipod system's success. This data rigorously demonstrates the product's efficacy and benefits, providing a critical resource for regulatory approvals and clinician adoption.

This robust evidence base is essential for convincing payors of the Omnipod's value proposition, directly supporting market expansion and penetration into new patient segments. For instance, studies consistently show improved glycemic control and reduced hypoglycemia in Omnipod users compared to traditional methods.

- Clinical Trials: Numerous randomized controlled trials and observational studies highlight Omnipod's effectiveness in improving HbA1c levels and reducing the burden of diabetes management.

- Real-World Evidence: Data from over 100,000 patient-years of Omnipod use validates its safety and efficacy in diverse real-world settings, reinforcing its value to healthcare providers and payers.

- Payor Value: Clinical data supports Insulet's arguments for favorable reimbursement, demonstrating potential cost savings through reduced complications and hospitalizations.

- Market Expansion: The compelling clinical evidence fuels market adoption, enabling Insulet to target new patient populations and expand its global reach.

Brand Recognition and Customer Base

Insulet's Omnipod brand is a recognized leader in the tubeless insulin pump market, a significant asset in its business model.

This strong brand recognition translates into a substantial and growing customer base, exceeding 500,000 users globally, referred to as Podders.

This loyal community forms a vital recurring revenue stream, underpinning Insulet's sustained growth and market position.

- Brand Leadership: Omnipod is synonymous with innovation in tubeless insulin delivery.

- Customer Base: Over 500,000 active users worldwide.

- Recurring Revenue: The Podder community ensures consistent sales of disposable Pods.

- Loyalty Factor: Strong customer relationships foster repeat business and advocacy.

Insulet's key resources are its proprietary Omnipod technology, robust intellectual property, and advanced manufacturing capabilities. The Omnipod system, a tubeless wearable insulin delivery device, represents a significant competitive advantage. This technological edge is further fortified by a strong patent portfolio, safeguarding its market position. Insulet's global manufacturing infrastructure, including its expanded facility in Malaysia, is crucial for meeting increasing demand and ensuring product quality and safety.

| Resource Category | Key Resources | Description | Data Point (as of early 2024/2024) |

|---|---|---|---|

| Intellectual Property | Omnipod Technology & Patents | Proprietary tubeless, wearable insulin delivery system with extensive patent protection. | Strong patent portfolio covering various aspects of Omnipod technology. |

| Physical Resources | Manufacturing Infrastructure | State-of-the-art global manufacturing facilities, including expansion in Malaysia. | Significant investment in new manufacturing capacity to bolster production. |

| Human Resources | Skilled Workforce | Engineers, designers, production specialists, medical professionals, customer care teams. | Over 3,000 employees globally, with a substantial portion in R&D and manufacturing. |

| Financial/Data Resources | Clinical Data & Real-World Evidence | Data demonstrating Omnipod's efficacy, safety, and value for payors. | Over 100,000 patient-years of Omnipod use validating safety and efficacy. |

| Brand & Customer Resources | Omnipod Brand & Customer Base | Recognized leader in tubeless insulin pumps with a loyal user community. | Exceeding 500,000 active users worldwide (Podders). |

Value Propositions

Insulet's Omnipod system revolutionizes insulin delivery by being tubeless, wearable, and discreet. This innovation removes the need for daily injections and visible tubing, significantly simplifying life for individuals managing diabetes.

This design offers unparalleled freedom and convenience, directly enhancing the quality of life for its users. For instance, Insulet reported that in 2023, over 400,000 people worldwide were using the Omnipod system, highlighting its widespread adoption and impact.

The Omnipod 5 system offers automated insulin delivery, proactively managing glucose levels by integrating with continuous glucose monitors. This advanced algorithm aims to keep blood sugar within the target range more consistently, reducing the mental effort required from users.

In 2024, Insulet reported strong performance, with Omnipod 5 sales contributing significantly to their revenue growth, reflecting increasing adoption and user satisfaction. The system's ability to maximize time in range and minimize hypo- and hyperglycemia is a key driver of this success.

Insulet's Omnipod system revolutionizes diabetes management, granting users an enhanced quality of life and a profound sense of freedom. By eliminating the need for tubing and frequent manual injections, it simplifies daily routines, allowing individuals to focus on living their lives to the fullest.

This wearable insulin delivery solution offers unparalleled discretion, seamlessly integrating into users' lifestyles without drawing attention. For instance, Insulet reported that over 450,000 users worldwide had embraced the Omnipod system as of early 2024, a testament to its impact on daily living.

The flexibility afforded by the Omnipod is a significant value proposition. Users can engage in a wider range of activities, from sports to travel, with greater confidence and less interruption compared to traditional insulin pumps. This liberation from constant device management is a key differentiator, highly prized by patients seeking greater autonomy.

Broad Accessibility through Pharmacy Channel

Insulet's Omnipod system stands out by leveraging the pharmacy channel for distribution in the U.S., a key differentiator from many traditional insulin pumps. This approach significantly broadens patient access, simplifying how individuals obtain essential diabetes management technology.

This accessibility is further enhanced by a pay-as-you-go model, often bolstered by copay assistance programs. These initiatives are crucial for reducing the initial financial burden, making the Omnipod a more attainable option for a wider patient base. For instance, Insulet's focus on this channel contributed to their strong performance, with reported U.S. Omnipod revenue reaching $1.3 billion in 2023, demonstrating the channel's significant impact.

- Pharmacy Channel Dominance: Unlike competitors relying heavily on direct sales or specialized DME providers, Insulet's primary U.S. distribution through pharmacies like CVS and Walgreens offers unparalleled convenience and familiarity for many patients.

- Reduced Upfront Costs: The pay-as-you-go structure, coupled with copay support, alleviates the significant initial investment often associated with insulin pump therapy, making it financially less daunting.

- Market Penetration: This accessible model has been instrumental in Insulet's market growth, with the Omnipod DASH system, for example, seeing substantial adoption following its pharmacy rollout.

- Patient Empowerment: By simplifying acquisition and affordability, the pharmacy channel empowers patients to take greater control of their diabetes management without the typical barriers.

Continuous Innovation and Integrated Digital Solutions

Insulet is dedicated to pushing the boundaries of diabetes management through relentless product innovation. This includes broadening compatibility with leading continuous glucose monitoring (CGM) systems such as the Dexcom G6, G7, and Abbott FreeStyle Libre 2 Plus. By ensuring seamless integration with these advanced CGMs, Insulet offers users a more comprehensive and connected diabetes care experience.

The company's commitment extends to developing intuitive smartphone control applications. These digital solutions enhance user experience, allowing for easier management of their insulin delivery system directly from their mobile devices. This focus on integrated digital health solutions underscores Insulet's dedication to providing cutting-edge technology coupled with user-friendly designs.

These continuous improvements and integrated digital health solutions ensure Insulet's systems evolve alongside patient needs and rapid technological advancements. For instance, in 2024, Insulet continued to enhance its Omnipod system, aiming to provide users with greater flexibility and control over their diabetes management. This strategic focus on innovation directly supports their value proposition of delivering advanced and accessible diabetes care.

- Continuous Innovation: Expanding CGM compatibility (Dexcom G6, G7, Abbott FreeStyle Libre 2 Plus) and developing smartphone control apps.

- Integrated Digital Health Solutions: Providing advanced technology and user-friendly designs for seamless diabetes management.

- Patient-Centric Evolution: Ensuring the system adapts to evolving patient needs and technological progress.

Insulet's Omnipod system offers a revolutionary tubeless, wearable, and discreet insulin delivery experience, eliminating the need for daily injections and visible tubing. This design significantly enhances user freedom and convenience, improving the overall quality of life for individuals managing diabetes. By early 2024, over 450,000 users worldwide had adopted the Omnipod system, demonstrating its substantial impact on daily living.

Customer Relationships

Insulet cultivates direct relationships with its customers, known as Podders, primarily through targeted direct-to-consumer advertising. This strategy is designed to build strong brand loyalty and heighten awareness of the Omnipod system's advantages. In 2023, Insulet reported a significant portion of its revenue derived from direct sales channels, reflecting the success of this customer-centric approach.

Insulet offers robust customer support through dedicated phone lines and a wealth of online resources, including comprehensive educational materials. These services are vital for guiding users through product setup, addressing troubleshooting needs, and supporting their ongoing diabetes management journey. For instance, Insulet's commitment to user success is evident in their readily available technical support and educational content, fostering confidence and long-term engagement.

Insulet cultivates a strong community among its 'Podder' users, creating a supportive network for individuals managing diabetes. This user base actively shares experiences and tips, enhancing engagement with the brand.

By partnering with diabetes advocacy groups and organizations, Insulet extends its commitment to the wider diabetes community. This collaboration amplifies patient voices and supports broader health initiatives, demonstrating a dedication to patient well-being beyond product transactions.

Clinician and Provider Training and Support

Insulet cultivates robust relationships with healthcare professionals through comprehensive training and ongoing support for its Omnipod system. This commitment ensures clinicians are confident in prescribing and managing the device for their patients.

The company offers a suite of resources, including educational materials and clinical data, designed to enhance prescriber understanding of Omnipod's benefits and practical application. This empowers clinicians to effectively integrate the technology into diabetes management plans.

Insulet's focus on regular engagement with clinicians is crucial for driving continued adoption and ensuring successful patient outcomes. This proactive approach solidifies the company's standing as a trusted partner in diabetes care.

- Training Programs: Insulet offers specialized training for healthcare providers on the Omnipod system, enhancing their ability to prescribe and manage the device.

- Clinical Data Dissemination: The company actively shares clinical trial results and real-world evidence to support the efficacy and safety of Omnipod.

- Ongoing Support: Clinicians have access to dedicated support channels for any questions or challenges related to patient use of the Omnipod system.

- Educational Resources: Insulet provides a range of educational materials, including webinars and publications, to keep healthcare professionals informed about the latest advancements and best practices.

Customer-Centric Product Development and Feedback Loops

Insulet deeply integrates customers into its research and development, actively soliciting feedback to refine its offerings. This commitment to understanding user experience ensures new product iterations directly meet the needs of individuals managing diabetes.

This customer-centric philosophy fosters a cycle of continuous improvement, resulting in products that are not only innovative but also highly intuitive and effective for daily use. For example, feedback from the Omnipod user community directly influenced the design and features of the Omnipod 5, which launched in 2020 and continued to see strong adoption through 2024.

- User Feedback Integration: Insulet actively gathers insights from its user base to guide product evolution.

- Addressing Unmet Needs: This approach prioritizes developing solutions that solve real-world challenges faced by people with diabetes.

- Enhanced Usability: Customer input leads to more user-friendly and effective diabetes management tools.

Insulet fosters deep connections with its customer base, the Podders, through direct engagement and robust support systems. This direct-to-consumer model, evident in their 2023 revenue streams, prioritizes user experience and brand loyalty. By actively incorporating user feedback into product development, Insulet ensures its innovations, like the Omnipod 5, directly address the needs of individuals managing diabetes, driving continued adoption and satisfaction through 2024.

Channels

Insulet's primary U.S. sales channel for its Omnipod insulin delivery system is through wholesalers that serve the pharmacy channel. This strategy provides patients with convenient access to their Pods and supplies via their local pharmacies.

This pharmacy-centric distribution model differentiates Insulet from many competitors who typically utilize the durable medical equipment (DME) channel. For instance, in 2024, Insulet reported significant revenue growth driven by strong Omnipod adoption, with a substantial portion of this growth attributed to its established pharmacy relationships.

Insulet leverages a dedicated direct sales force to connect with healthcare providers, including clinics and hospitals, actively promoting the Omnipod system. This channel is essential for educating medical professionals on the product's advantages and encouraging prescriptions.

The sales team is instrumental in broadening the network of prescribing clinicians and driving the adoption of Insulet's innovative diabetes management technology.

Insulet leverages international distribution partners to extend the reach of its Omnipod products globally. These collaborations are crucial for navigating the complexities of different regulatory landscapes and healthcare infrastructures across various nations.

As of early 2024, Insulet's strategic international expansion has seen the Omnipod 5 system become available in numerous key markets, underscoring the importance of these distribution channels for driving growth and patient access.

Online Platforms and Company Websites

Insulet utilizes its corporate website, insulet.com, and dedicated product sites like omnipod.com as primary channels for information dissemination and customer interaction. These digital spaces offer comprehensive product details, valuable educational content, investor relations updates, and direct access to customer support.

These platforms are crucial for Insulet's digital strategy, acting as central hubs that reinforce brand identity and facilitate seamless communication with various stakeholders. For instance, in 2023, Insulet reported a significant increase in website traffic, indicating growing interest in their diabetes management solutions.

- Website Traffic Growth: Insulet's websites experienced a notable surge in visitor engagement throughout 2023, reflecting increased consumer interest in their innovative insulin delivery systems.

- Resource Hub: The sites serve as a comprehensive resource, offering detailed product specifications, user guides, and clinical trial information, supporting informed decision-making for patients and healthcare professionals alike.

- Investor Relations: A dedicated section on the corporate website provides timely financial reports, SEC filings, and investor presentations, crucial for maintaining transparency with the investment community.

- Customer Support Integration: The platforms seamlessly integrate customer support channels, including FAQs, contact forms, and troubleshooting guides, enhancing the overall user experience.

Digital Health Applications (Smartphone Apps)

The Omnipod 5 App, available for both Android and iOS devices, is a crucial digital channel for Insulet. It allows users to directly manage their insulin delivery system, offering unprecedented convenience and integration into daily life.

This smartphone application acts as a direct touchpoint, simplifying the complex task of diabetes management. By putting control directly into users' hands via their familiar smartphones, Insulet enhances the user experience and fosters greater independence.

The expansion of compatibility to smartphones significantly broadens the accessibility of the Omnipod system. This digital strategy is key to Insulet's business model, making advanced diabetes care more attainable for a wider user base.

- Direct User Control: The Omnipod 5 App enables users to manage insulin delivery directly from their smartphones.

- Enhanced Convenience: This digital channel streamlines daily diabetes management, integrating seamlessly into users' lives.

- Increased Accessibility: Smartphone compatibility broadens the reach of Insulet's innovative insulin delivery system.

Insulet's channels are diverse, focusing on patient access and healthcare provider engagement. The primary U.S. channel is through wholesalers serving pharmacies, a key differentiator from the DME channel. This approach, exemplified by strong 2024 adoption, ensures convenient patient access.

A dedicated direct sales force educates healthcare providers, driving prescriptions and adoption of the Omnipod system. Internationally, distribution partners are vital for navigating global markets, with Omnipod 5 expanding into key regions by early 2024.

Digital channels are also crucial. Insulet's corporate and product websites serve as information hubs, with website traffic increasing significantly in 2023. The Omnipod 5 App offers direct user control via smartphones, enhancing convenience and accessibility.

| Channel | Description | 2023/2024 Data Point |

|---|---|---|

| Pharmacy Wholesalers (U.S.) | Distributes Omnipod through retail pharmacies. | Significant revenue growth in 2024 driven by strong Omnipod adoption via this channel. |

| Direct Sales Force | Engages healthcare providers to promote Omnipod. | Instrumental in broadening the network of prescribing clinicians. |

| International Distributors | Facilitates global market access and regulatory navigation. | Omnipod 5 system available in numerous key markets as of early 2024. |

| Corporate/Product Websites | Information dissemination, customer interaction, investor relations. | Significant increase in website traffic in 2023. |

| Omnipod 5 App | Direct user management of insulin delivery via smartphone. | Enhances user experience and fosters independence through smartphone integration. |

Customer Segments

Insulet's core customer base consists of individuals diagnosed with Type 1 Diabetes (T1D), encompassing both children aged two and older and adults. This foundational segment relies on Insulet's Omnipod system for a more convenient and discreet method of insulin management.

The company has a significant foothold in this market, actively working to broaden access to its innovative insulin delivery solutions for T1D patients. For instance, in 2023, Insulet reported that over 400,000 people globally were using their Omnipod system, with a substantial portion representing individuals with T1D.

Insulet is strategically broadening its reach to encompass adults managing Type 2 diabetes (T2D) who depend on insulin. This expansion is a key growth driver, given that T2D impacts a substantially larger global population compared to Type 1 diabetes. The recent FDA clearance of Omnipod 5 for this T2D segment in August 2024 is a critical milestone, opening up a significant new market.

The company is also introducing the Omnipod GO, a basal-only Pod specifically designed to cater to the needs of individuals with T2D. This product development signifies Insulet's commitment to serving this expanding customer base with tailored solutions.

Healthcare Professionals (HCPs) are central to Insulet's strategy, encompassing endocrinologists, primary care physicians, and diabetes educators. These medical practitioners are the key decision-makers who prescribe and manage insulin pump therapy for their patients. In 2024, Insulet continued its focus on providing robust clinical data and comprehensive training programs to these vital partners, recognizing their role as gatekeepers for patient adoption of the Omnipod system.

Caregivers of Pediatric Patients

Parents and caregivers are central to the success of managing diabetes for younger patients using Insulet's Omnipod system. They are the primary decision-makers and operators, ensuring the child's health and adherence to treatment. Insulet focuses on creating products that are intuitive and easy for this segment to use, thereby reducing the burden of diabetes management and providing reassurance.

The user-friendliness of the Omnipod system is a key selling point for caregivers. This includes simplified application processes and accessible digital interfaces for monitoring and control. The system's design aims to integrate seamlessly into daily life, minimizing disruption for both the child and the caregiver.

- Target Users: Parents and legal guardians of children diagnosed with Type 1 diabetes.

- Key Needs: Ease of use, reliable glucose control, reduced burden of daily management, and peace of mind.

- Product Suitability: Omnipod 5 is approved for children aged two years and older, making it suitable for a broad pediatric demographic.

- Value Proposition: Insulet offers simplified diabetes management, empowering caregivers to provide effective care with confidence.

Payors and Insurance Providers

Insurance companies, Medicare, and other third-party payors are absolutely essential for Insulet. Their decisions on whether to cover Insulet's products, like the Omnipod system, directly influence how many people can actually afford and access these diabetes management tools. In 2024, Insulet continued its focus on securing and maintaining favorable reimbursement from these key entities.

Insulet actively engages with these payors to demonstrate the clinical and economic value of its offerings. The company aims to ensure broad insurance plan coverage and participation in government programs such as Medicare. This is crucial for market penetration and patient affordability.

- Reimbursement Landscape: Insulet's success hinges on securing favorable reimbursement decisions from major insurers and government programs like Medicare.

- Patient Access: Coverage by these payors is a primary driver of patient access to Insulet's innovative diabetes management technologies.

- Value Demonstration: The company invests in demonstrating the clinical efficacy and cost-effectiveness of its products to payors.

- Financial Assistance: Insulet also offers financial assistance programs to help bridge coverage gaps for patients.

Insulet's customer segments are diverse, primarily focusing on individuals with diabetes, but also extending to their support networks and the entities that facilitate access to their technology.

The core user base comprises people with Type 1 Diabetes (T1D), including children aged two and older and adults, who benefit from the discreet and convenient Omnipod system. In 2023, over 400,000 people globally used the Omnipod.

A significant expansion targets adults with Type 2 Diabetes (T2D) requiring insulin, a larger market. The FDA clearance of Omnipod 5 for this T2D segment in August 2024 is a key development, alongside the introduction of Omnipod GO for basal-only needs.

Healthcare Professionals (HCPs), such as endocrinologists and diabetes educators, are crucial as prescribers and managers of the Omnipod system. In 2024, Insulet continued to provide these vital partners with clinical data and training.

Parents and caregivers are essential for pediatric users, acting as primary decision-makers and operators. Insulet designs its products for ease of use to reduce the management burden and provide peace of mind.

Insurance companies, Medicare, and other payors are vital for patient access and affordability. Insulet's 2024 strategy includes securing and maintaining favorable reimbursement from these entities.

Cost Structure

Insulet allocates a substantial portion of its resources to Research and Development (R&D), a critical investment for driving innovation in diabetes management technology. This commitment fuels the continuous improvement of their Omnipod system, including enhancements to algorithms, device hardware, and the exploration of new therapeutic applications. For instance, Insulet reported R&D expenses of $247.3 million in 2023, underscoring its dedication to staying at the forefront of the industry.

Insulet's manufacturing and production costs are a significant component, encompassing raw materials, direct labor, and overhead for their Omnipod devices. These expenses are incurred at their global facilities, where they produce both the Pods and the associated controllers. In 2023, Insulet reported cost of sales of $691.9 million, a substantial portion of which is tied to these manufacturing activities.

The company's strategy to improve efficiency and gross margins involves investing in highly automated manufacturing processes. While these investments can be considerable upfront, they are designed to streamline production and reduce per-unit costs over time. Furthermore, optimizing supply chain efficiencies plays a crucial role in managing and potentially lowering these overall manufacturing expenditures.

Sales, General & Administrative (SG&A) expenses for Insulet are vital for market penetration and customer retention. These costs cover everything from advertising new products like the Omnipod 5 to paying the salaries and commissions of their sales teams. In 2023, Insulet reported SG&A expenses of $748.3 million, reflecting significant investment in growth and customer service.

This substantial figure also includes the operational costs of their corporate headquarters and the essential customer support infrastructure needed to assist users of their innovative diabetes management systems. These administrative functions ensure smooth business operations and compliance, underpinning the company's ability to deliver its products effectively.

Supply Chain and Logistics Costs

Insulet's global supply chain and logistics costs are significant, encompassing the procurement of specialized components, intricate warehousing, and the worldwide distribution of its innovative diabetes management devices. These expenses are crucial for maintaining product availability and reaching customers across diverse geographical markets.

Ensuring the resilience of this supply chain, particularly in the face of potential disruptions, adds another layer of cost. This involves building redundancy and securing alternative sourcing options to guarantee consistent product flow. For instance, Insulet's commitment to supply chain robustness is reflected in its strategic inventory management and supplier diversification efforts.

- Component Procurement: Costs associated with sourcing high-quality, specialized materials and electronic components necessary for the Omnipod system.

- Logistics and Distribution: Expenses related to transportation, freight, customs, and the efficient delivery of products to distributors and end-users globally.

- Warehousing and Inventory Management: Costs for maintaining strategically located warehouses and managing inventory levels to meet demand while minimizing holding costs.

- Supply Chain Resilience: Investments in risk mitigation strategies, such as dual sourcing and contingency planning, to prevent disruptions and ensure continuity of supply.

Regulatory and Clinical Compliance Costs

Insulet, like any medical device company, faces significant regulatory and clinical compliance costs. These are essential expenses for ensuring product safety and efficacy. For instance, obtaining FDA approval for a new device can cost millions of dollars, encompassing rigorous testing, documentation, and submission fees. These costs are non-negotiable for market access and patient trust.

Maintaining compliance with evolving regulations and conducting post-market surveillance also represent ongoing financial commitments. Furthermore, clinical trials to support new indications or product enhancements are substantial investments. In 2023, Insulet reported approximately $100 million in R&D expenses, a portion of which directly supports clinical and regulatory activities.

- Regulatory Submissions and Approvals: Costs associated with preparing and submitting documentation to bodies like the FDA and EMA.

- Clinical Trials: Expenses for designing, executing, and analyzing studies to validate product safety and efficacy for new uses.

- Post-Market Surveillance: Ongoing costs for monitoring product performance and safety in the real world, including adverse event reporting.

- Quality Management Systems: Investment in systems and personnel to ensure adherence to Good Manufacturing Practices (GMP) and other quality standards.

Insulet's cost structure is heavily influenced by its significant investment in Research and Development (R&D), aimed at innovating its Omnipod diabetes management systems. Manufacturing and production expenses, covering raw materials and direct labor, are also substantial, as reflected in their cost of sales. Furthermore, Sales, General & Administrative (SG&A) expenses are critical for market reach and customer support, encompassing marketing and operational overhead. Finally, the company incurs considerable costs for supply chain logistics, regulatory compliance, and clinical trials to ensure product quality and market access.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development (R&D) | $247.3 | Product innovation, algorithm enhancements, new therapeutic applications |

| Cost of Sales (Manufacturing) | $691.9 | Raw materials, direct labor, manufacturing overhead for Omnipod devices |

| Sales, General & Administrative (SG&A) | $748.3 | Marketing, sales force, customer support, corporate operations |

| Supply Chain & Logistics | (Not explicitly broken out, but a significant component of Cost of Sales) | Component procurement, global distribution, warehousing, inventory management |

| Regulatory & Clinical Compliance | (Portion of R&D, estimated ~$100M) | FDA approvals, clinical trials, post-market surveillance, quality systems |

Revenue Streams

Insulet's primary revenue source is the sale of its Omnipod Insulin Management System. This includes the recurring purchase of disposable Pods, which are essential for daily use, and the initial sale of the Omnipod DASH or Omnipod 5 System controllers. This creates a predictable, annuity-like revenue stream as customers continuously require new Pods.

For the fiscal year 2023, Insulet reported total revenue of $1.4 billion, with the Omnipod product line representing the vast majority of this figure. The company saw significant growth in its Omnipod revenue, driven by increased adoption and a growing user base.

The U.S. market is a powerhouse for Insulet's revenue, largely fueled by the impressive uptake of its Omnipod 5 system. This advanced insulin delivery device is resonating well with patients, driving significant sales growth.

Continued expansion within the U.S. is a key revenue driver. Insulet is seeing robust growth from new users across both Type 1 and Type 2 diabetes segments, demonstrating the broad appeal and effectiveness of the Omnipod technology.

Insulet is seeing impressive revenue growth from its international operations, largely driven by the expanding availability of its Omnipod 5 system in new countries. This geographic expansion is a cornerstone of their overall growth strategy.

International sales are becoming an increasingly significant portion of Insulet's total revenue. For instance, in the first quarter of 2024, international revenue reached $155.9 million, representing a substantial 23% increase year-over-year and accounting for approximately 23% of total revenue.

Revenue from Expanded Indications (Type 2 Diabetes)

The FDA clearance of the Omnipod 5 system for Type 2 diabetes in adults in late 2023 marks a significant expansion for Insulet, opening a substantial new market. This development is projected to be a major driver of future revenue growth, tapping into a much larger patient population than previously accessible.

This strategic move leverages Insulet's established Omnipod technology, adapting it to serve a new and broader customer segment. The company anticipates this expansion will lead to considerable sales increases as they onboard Type 2 diabetes patients.

- Expanded Market Access: The Omnipod 5's approval for Type 2 diabetes in adults significantly broadens Insulet's addressable market.

- Revenue Growth Potential: This new indication is expected to drive substantial future revenue by capturing a larger patient base.

- Leveraging Existing Technology: Insulet is capitalizing on its proven Omnipod platform to serve a new demographic.

- Projected Sales Impact: The company anticipates significant sales growth stemming from this expanded customer reach.

Potential for Non-Insulin Drug Delivery Systems

Insulet is actively investigating the application of its Omnipod technology for delivering non-insulin subcutaneous medications. This strategic move aims to expand its reach beyond diabetes management into other therapeutic areas.

While this segment is currently nascent, it holds significant potential as a future revenue driver for the company. By diversifying the use of its core delivery system, Insulet can tap into new markets and customer bases.

- Diversification Strategy: Insulet's exploration of non-insulin drug delivery systems represents a key element of its long-term growth strategy, moving beyond its established diabetes focus.

- Market Potential: The subcutaneous drug delivery market for various conditions, beyond diabetes, is substantial and growing, offering significant opportunities for Insulet's innovative platform. For instance, the global subcutaneous drug delivery market was valued at approximately $40 billion in 2023 and is projected to grow significantly in the coming years.

- Technology Leverage: The Omnipod's established success in insulin delivery provides a strong technological foundation to build upon for other drug formulations, potentially reducing development timelines and costs.

Insulet's revenue is predominantly generated through the sale of its Omnipod insulin delivery systems, encompassing both the disposable Pods and the reusable controllers. This recurring model ensures a stable income stream, as users continuously need to replenish Pods. The company reported total revenue of $1.4 billion for the fiscal year 2023, with Omnipod sales forming the bulk of this figure.

The U.S. market remains a critical revenue engine, particularly with the strong adoption of the Omnipod 5 system. Insulet is experiencing robust growth from new users across both Type 1 and Type 2 diabetes patient populations within the U.S. International revenue is also a significant contributor, with Q1 2024 international sales reaching $155.9 million, a 23% year-over-year increase.

The recent FDA clearance of Omnipod 5 for Type 2 diabetes in adults in late 2023 is a major new revenue opportunity, expanding Insulet's addressable market considerably. Furthermore, the company is exploring the use of its Omnipod technology for delivering non-insulin subcutaneous medications, aiming to diversify its revenue streams into new therapeutic areas.

| Revenue Source | Description | 2023 Revenue (Approx.) | Growth Driver |

| Omnipod System Sales | Disposable Pods and reusable controllers | ~$1.3 billion+ | User adoption, new market indications (Type 2 diabetes) |

| International Sales | Omnipod system sales outside the U.S. | ~$300 million+ (estimated based on Q1 2024 data) | Geographic expansion of Omnipod 5 |

| Future Diversification | Non-insulin subcutaneous drug delivery | Nascent | Expansion into new therapeutic areas |

Business Model Canvas Data Sources

Insulet's Business Model Canvas is informed by a blend of internal financial reporting, patient feedback, and market analysis from healthcare industry experts. This comprehensive approach ensures each component accurately reflects operational realities and market opportunities.