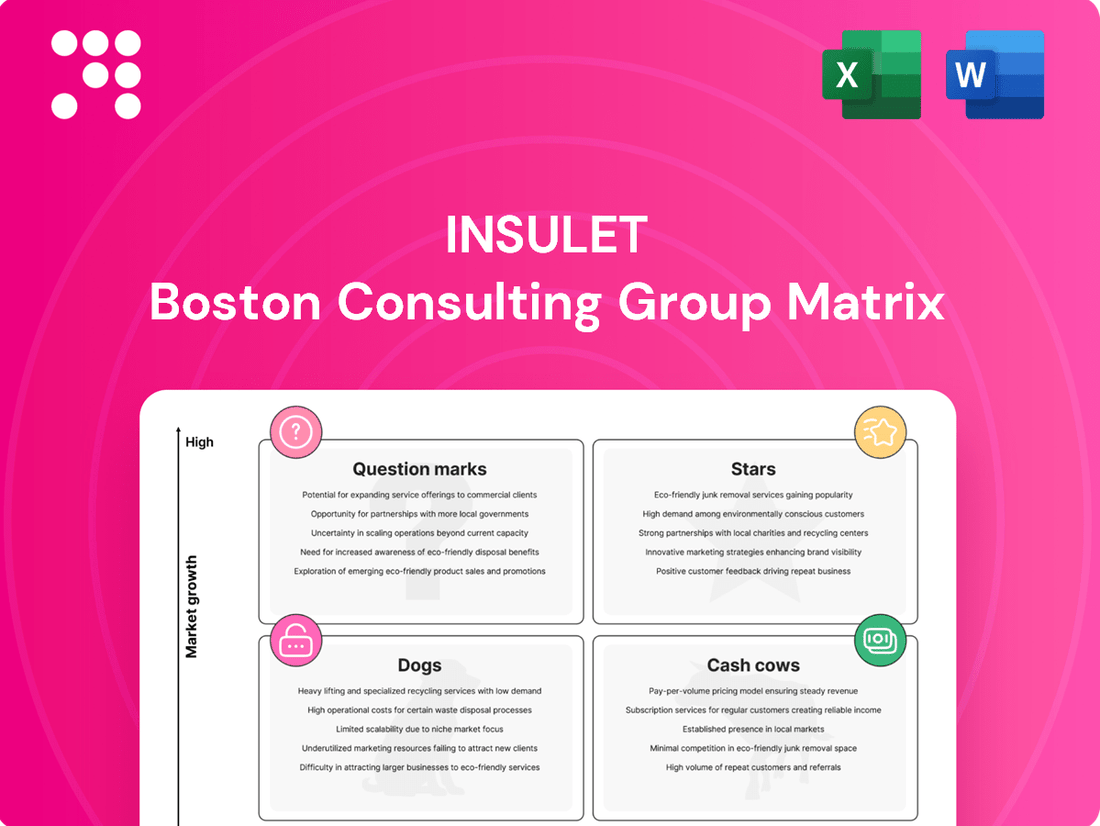

Insulet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insulet Bundle

Curious about Insulet's strategic product positioning? This glimpse into their BCG Matrix reveals how their innovations stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the complete picture; purchase the full report for actionable insights and a clear path to optimizing Insulet's product portfolio.

Stars

The Omnipod 5 Automated Insulin Delivery System (AID) is Insulet's standout product, firmly positioned as a Star in the BCG matrix due to its leadership in the rapidly expanding AID market. It holds the distinction of being the #1 most prescribed AID system in the United States as of 2024, a testament to its strong market penetration and customer adoption.

This momentum is projected to continue into 2025, fueled by its seamless integration with leading continuous glucose monitors (CGMs) such as Abbott's FreeStyle Libre 2 Plus and Dexcom's G6/G7 sensors. This interoperability significantly boosts its clinical utility and market appeal, solidifying its role as a primary engine for Insulet's growth.

Insulet's Omnipod 5 is positioned as a Star in the BCG matrix due to its rapid international rollout. The company has strategically launched its advanced insulin delivery system in key markets throughout 2024 and into early 2025. These include significant expansions into Italy, Denmark, Finland, Norway, Sweden, Australia, Canada, and Switzerland, signaling a strong push for global market penetration.

This aggressive geographical expansion is designed to capitalize on the increasing global prevalence of diabetes and to secure a substantial portion of the growing international insulin pump market. By entering these new territories, Insulet aims to leverage the Omnipod 5's innovative technology to meet unmet patient needs and drive revenue growth.

The expansion of Omnipod 5's indication to include adults with type 2 diabetes in the U.S. marks a significant high-growth opportunity for Insulet. This move taps into a vast, largely underserved market, as Omnipod 5 was the first FDA-cleared automated insulin delivery system specifically for this demographic.

This strategic expansion is poised to dramatically broaden Insulet's customer base and capture greater market share. By addressing the needs of type 2 diabetes patients, Insulet is well-positioned to capitalize on the evolving landscape of diabetes management technology.

Integration with Advanced CGM Technologies

Insulet's Omnipod 5 system is a prime example of a Star in the BCG matrix due to its ongoing integration with leading continuous glucose monitoring (CGM) technologies. This integration is vital for maintaining its market leadership.

Key advancements include seamless compatibility with Abbott's FreeStyle Libre 2 Plus and Dexcom G7 sensors. These partnerships enhance the Omnipod 5's functionality, offering users more accurate and real-time glucose data, which is critical for effective diabetes management.

This technological synergy not only improves the user experience but also expands the addressable market for Insulet. By staying at the cutting edge of integrated diabetes care, Insulet is well-positioned for continued growth and market dominance.

- Enhanced Interoperability: Seamless integration with FreeStyle Libre 2 Plus and Dexcom G7.

- Improved User Experience: Real-time, accurate glucose data for better diabetes management.

- Market Expansion: Appeals to a wider patient demographic seeking integrated solutions.

- Competitive Advantage: Positions Insulet at the forefront of advanced diabetes technology.

Next-Generation AID Product Development

Insulet's focus on developing next-generation Automated Insulin Delivery (AID) products, including enhancements to the Omnipod 5 algorithm, as demonstrated by ongoing trials like EVOLUTION, firmly places this research and development effort in the Star category.

While the market share for these future products is currently minimal, the rapidly expanding market for advanced diabetes technology suggests that successful innovations will likely capture significant future market share, potentially evolving into Cash Cows.

Insulet's substantial investment in these R&D initiatives, which aligns with the broader industry trend of increasing adoption of connected diabetes devices, is crucial for maintaining a long-term competitive edge and securing sustained market leadership in the diabetes care sector.

- R&D Investment: Insulet's commitment to next-generation AID products, like the Omnipod 5 algorithm enhancements, is a key driver for Star status.

- Market Potential: The high growth trajectory of advanced diabetes technology indicates substantial future market share for successful innovations.

- Competitive Advantage: Continued investment in R&D is vital for Insulet to maintain its leadership position in the evolving diabetes market.

- EVOLUTION Trial: Evidence from trials like EVOLUTION validates Insulet's progress in developing advanced AID solutions.

The Omnipod 5 Automated Insulin Delivery System (AID) is Insulet's flagship product, firmly established as a Star in the BCG matrix. Its leadership in the rapidly expanding AID market is undeniable, holding the position of the #1 most prescribed AID system in the United States as of 2024. This strong market penetration is further bolstered by its seamless integration with leading CGMs, driving significant revenue growth and solidifying its role as a primary growth engine for Insulet.

Insulet's aggressive international expansion of the Omnipod 5 throughout 2024 and into early 2025, including launches in key markets like Italy, Denmark, and Canada, underscores its Star status. This strategic move targets the growing global diabetes market, aiming to capture substantial share in the international insulin pump sector by addressing unmet patient needs with its innovative technology.

The expansion of Omnipod 5's indication to include adults with type 2 diabetes in the U.S. represents a significant high-growth opportunity, tapping into a vast, underserved market. As the first FDA-cleared AID system for this demographic, this move is poised to dramatically broaden Insulet's customer base and enhance its market share.

Insulet's commitment to next-generation AID products, exemplified by ongoing research and development efforts like the EVOLUTION trial, also secures its Star position. While current market share for these future products is minimal, the high-growth trajectory of advanced diabetes technology suggests significant future market capture, potentially evolving into Cash Cows.

| Product/Initiative | BCG Category | Key Growth Drivers | Market Position (2024) | Future Outlook |

| Omnipod 5 AID System | Star | #1 prescribed AID in US, international expansion, Type 2 diabetes indication, CGM integration | Market Leader | Continued strong growth, potential to become Cash Cow |

| Next-Gen AID R&D (e.g., EVOLUTION trial) | Star | Innovation in algorithm enhancements, expanding addressable market | Nascent/Emerging | High potential for future market share capture |

What is included in the product

The Insulet BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

Visualizes Insulet's portfolio, simplifying strategic decisions for resource allocation.

Cash Cows

The Omnipod DASH System, alongside the recurring sales of its disposable pods, firmly establishes Insulet's position in the cash cow quadrant of the BCG matrix. This system benefits from a substantial and established user base, translating into consistent, high-margin cash flow from the ongoing need for pod replacements.

The continuous pod sales for both the DASH and the newer Omnipod 5 systems represent a stable and reliable revenue stream for Insulet. These products hold a significant market share within their respective segments, underscoring their mature but highly profitable status.

The U.S. Omnipod revenue base served as a significant Cash Cow for Insulet in 2024, generating substantial and stable financial contributions. This strong performance in a mature market, where Insulet holds a dominant position in tubeless insulin pump technology, underscores its reliability as a consistent cash generator.

Insulet's strategic investments in manufacturing and supply chain optimization are key drivers of its Cash Cow status. The company's new facility in Malaysia, for example, is designed to significantly improve production efficiency and gross margins.

By streamlining operations and reducing costs, Insulet enhances the profitability of its existing product lines. This focus on operational excellence directly translates into robust cash flow, particularly from high-volume products like their insulin delivery systems.

Intellectual Property Portfolio and Defense

Insulet's intellectual property portfolio, especially concerning its groundbreaking tubeless insulin pump technology, is a significant Cash Cow. This strong foundation in patents and successful defense against infringement claims shields their market position and competitive edge in the well-established insulin delivery sector.

By actively defending its patents, Insulet deters rivals from encroaching on its revenue and profit streams. For instance, Insulet reported that in 2023, it successfully defended its patents against multiple challenges, underscoring the value and robustness of its IP. This legal vigilance is crucial for maintaining pricing power and market share.

- Patent Protection: Insulet holds a substantial portfolio of patents covering its Omnipod system, particularly its tubeless design and delivery mechanisms.

- Litigation Success: The company has a history of successfully defending its intellectual property in legal battles, reinforcing its market exclusivity.

- Market Dominance: This strong IP protection allows Insulet to maintain a dominant position in the tubeless insulin pump market, a segment that generated over $1.3 billion in revenue for the company in 2023.

- Revenue Stability: The ongoing ability to prevent competitors from replicating its core technology ensures consistent revenue generation and healthy profit margins from its established products.

Established Brand Recognition and Customer Loyalty

Insulet's Omnipod system benefits from robust brand recognition and a loyal customer base, solidifying its position as a Cash Cow. This established trust translates into consistent demand for its products.

With more than 500,000 active users worldwide as of early 2024, Insulet enjoys a significant advantage due to its loyal customer base. This loyalty ensures repeat purchases of Omnipod pods and related supplies, creating a reliable revenue stream.

- Established Brand Recognition: The Omnipod brand is well-known and trusted within the diabetes management community.

- Growing Customer Loyalty: A substantial and expanding base of over 500,000 active global customers demonstrates strong user retention.

- Predictable Revenue Streams: High customer loyalty and consistent product usage lead to stable and predictable income for Insulet.

- Reduced Promotional Investment: Unlike growth-stage products, the Omnipod's established market position requires less aggressive marketing spend to maintain its sales volume.

Insulet's Omnipod system, particularly its established DASH and the growing Omnipod 5, functions as a significant cash cow, generating consistent revenue from a large, loyal user base. The ongoing demand for disposable pods, a critical component of these systems, provides a stable and predictable income stream. This strong market position, supported by robust patent protection and brand recognition, allows Insulet to maintain healthy profit margins.

| Product | BCG Category | Key Strengths | 2023 Revenue Contribution (Approx.) |

| Omnipod DASH System & Pods | Cash Cow | Established User Base, High Market Share, Brand Loyalty | Significant portion of over $1.3 billion total revenue |

| Omnipod 5 System & Pods | Cash Cow (Mature Phase) | Strong IP, Growing Adoption, Repeat Pod Purchases | Increasingly contributing to stable revenue |

What You See Is What You Get

Insulet BCG Matrix

The Insulet BCG Matrix preview you are viewing is the identical, fully completed document that will be delivered to you immediately after purchase. This means you'll receive the exact same professionally formatted analysis, free of any watermarks or demo content, ready for your strategic decision-making. You can confidently assess its value, knowing that the purchased version will be precisely this report, enabling immediate application in your business planning and presentations. This ensures a seamless transition from preview to actionable insight, providing you with a complete and ready-to-use strategic tool.

Dogs

Legacy or discontinued minor product lines at Insulet, while not actively promoted, would likely reside in the Dogs quadrant of the BCG Matrix. These products typically struggle with low market share within mature, low-growth markets. For instance, if Insulet had an older generation insulin patch that was superseded by newer technology and saw minimal sales, it would fit this description.

Early digital health solutions from Insulet, predating the highly successful Omnipod 5, likely struggled with user adoption and integration. These might have been standalone apps or data management tools that did not gain significant traction or were superseded by more advanced offerings. For example, while specific financial data for these individual underperforming solutions isn't publicly disclosed, Insulet's overall R&D spending in the digital health space has been substantial, indicating investment in technologies that may not have all yielded immediate or widespread success.

Niche drug delivery partnerships with limited scope, while a strategic exploration for Insulet's Omnipod platform beyond insulin, would likely be categorized as Dogs in the BCG Matrix if they haven't achieved significant market penetration or growth. These ventures, focused on specific, smaller therapeutic areas, might represent ongoing investment without substantial returns.

For instance, if Insulet pursued a partnership for delivering a non-insulin biologic with a market size of, say, $50 million, and their share remained below 5% with a projected annual growth of only 3%, this would indicate a Dog. Such initiatives require capital for development and regulatory hurdles but offer minimal potential to become market leaders or significant revenue drivers.

Outdated Omnipod Accessories or Ancillary Products

Certain older or less popular Omnipod accessories or ancillary products, no longer actively promoted with declining sales, would likely be classified as Dogs in the Insulet BCG Matrix. These items, while potentially still available for a small legacy user base, consume inventory and shelf space without significant revenue contribution or strategic alignment. For instance, Insulet’s 2023 annual report indicated a focus on newer Omnipod 5 System sales, with ancillary product sales showing a more modest growth, suggesting a potential shift away from older accessories.

These products might represent a shrinking market segment or have been superseded by more advanced offerings. Their continued presence could be a drain on resources if not managed carefully.

- Declining Sales: Accessories with consistently falling sales volumes.

- Low Market Share: Products serving a very niche, diminishing user group.

- Limited Strategic Value: Items not aligned with Insulet's forward-looking product development.

- Inventory Management: Potential for write-offs if demand ceases entirely.

Ineffective Market Entries in Challenging Regions

Ineffective market entries in challenging regions, particularly those where Insulet has faced difficulties gaining substantial market share despite initial investments, could be classified as Dogs within the BCG Matrix. These situations often occur when the market itself exhibits sluggish growth for tubeless insulin pumps. For instance, if Insulet invested heavily in a region with low adoption rates for advanced diabetes management technologies and experienced minimal sales growth, that market entry would likely fit this category.

These ventures can become resource drains, consuming capital and management attention without delivering the anticipated returns. Without specific, publicly available data on Insulet's performance in every international market, identifying precise examples remains speculative. However, a hypothetical scenario could involve a market where regulatory hurdles or strong local competition prevented Insulet's Omnipod system from achieving significant penetration, leading to a negative return on investment.

- Resource Drain: Ventures in low-growth, low-penetration markets can consume significant financial and operational resources without generating proportionate revenue.

- Re-evaluation Needed: Such market entries warrant a thorough re-evaluation of strategy, potential for turnaround, or consideration for divestiture to reallocate resources more effectively.

- Lack of Specific Data: Without granular regional sales and investment data from Insulet, pinpointing exact Dog categories is challenging, relying on general market dynamics and potential performance indicators.

Products in Insulet's Dogs quadrant are those with low market share in low-growth markets, often representing legacy offerings or unproven ventures. These could include older Omnipod accessories or early digital health initiatives that failed to gain traction. For example, while Insulet's focus in 2023 was on the Omnipod 5 System, older accessories saw more modest growth, indicating a potential shift away from these items.

These products consume resources without significant contribution, necessitating careful management or divestiture. Identifying specific examples is challenging without granular internal data, but the principle applies to any product line with declining sales and limited future potential.

Such offerings might include niche drug delivery partnerships that haven't achieved market penetration or specific regional market entries where Insulet faced significant hurdles in gaining share.

These situations highlight the importance of regularly assessing product portfolios to ensure resources are allocated to areas with higher growth and market potential.

| Insulet Product/Initiative Category | Market Growth | Market Share | BCG Quadrant | Rationale |

|---|---|---|---|---|

| Older Omnipod Accessories | Low | Low | Dogs | Declining sales, superseded by newer models. |

| Early Digital Health Apps (pre-Omnipod 5) | Low | Low | Dogs | Limited user adoption, technologically surpassed. |

| Niche Non-Insulin Drug Delivery Partnerships (unproven) | Low | Low | Dogs | Limited market penetration, uncertain ROI. |

| Underperforming Regional Market Entries | Low | Low | Dogs | High investment, low sales growth, regulatory/competitive challenges. |

Question Marks

Insulet's EVOLUTION feasibility trial highlights ongoing research into advanced Omnipod 5 algorithm enhancements, placing these future improvements in the Question Mark category of the BCG matrix. These developments aim to significantly improve glucose control and user experience, potentially increasing market share if successful.

The current market share for these unreleased algorithm enhancements is effectively zero, as they are still in the development and testing phases. This necessitates substantial investment from Insulet, with their future market success remaining unproven and subject to regulatory approval and user adoption.

Insulet's ventures into new digital health integrations and AI-driven solutions beyond its established Omnipod 5 system represent a strategic move into a burgeoning market. These innovations are positioned within the high-growth sectors of digital diabetes care and artificial intelligence in healthcare. However, as of my last update, Insulet's current market share in these specific nascent areas is relatively low.

The company faces a critical juncture with these initiatives, requiring substantial investment in research and development, robust marketing campaigns, and diligent efforts to drive user adoption. Success hinges on whether these early-stage digital health and AI solutions can evolve from their current low-share status to become market-leading Stars. For context, the global digital health market was valued at approximately $300 billion in 2023 and is projected to grow significantly, with AI in healthcare expected to be a major driver.

Insulet's strategic push into emerging international markets like Israel, Saudi Arabia, UAE, Qatar, and Kuwait by early 2026 positions these ventures as potential Stars. These regions show significant promise, driven by a rising tide of diabetes diagnoses, a key demographic for Insulet's insulin delivery systems.

While the growth potential is high, Insulet's current market penetration in these specific territories is minimal. This low existing share signifies that substantial upfront investment will be critical to establish a foothold and capture market share.

The path to turning these emerging markets into Stars necessitates considerable investment in localized market entry strategies, navigating complex regulatory landscapes for product approvals, and building robust distribution channels. Success hinges on effectively converting this potential into tangible sales and market dominance.

Diversification into Non-Insulin Subcutaneous Drug Delivery

Insulet's strategic move into delivering non-insulin subcutaneous drugs with its Omnipod platform positions this initiative as a Question Mark in the BCG matrix. This area offers significant growth potential by applying their established technology to new therapeutic categories, yet Insulet currently has a minimal market presence in these emerging drug delivery segments.

The success of this diversification hinges on several critical factors. These include the outcomes of ongoing clinical trials, securing necessary regulatory approvals, and ultimately, achieving widespread market acceptance for the Omnipod system in these new therapeutic applications. For instance, by mid-2024, Insulet has been actively pursuing partnerships and research in areas like GLP-1 receptor agonists for weight management, a market projected to reach tens of billions of dollars by the end of the decade.

- High Growth Potential: Expansion into non-insulin subcutaneous drug delivery targets rapidly growing therapeutic markets beyond diabetes.

- Low Market Share: Insulet currently holds a nascent position in these new therapeutic areas, indicating significant room for growth.

- Key Success Factors: Clinical trial success, regulatory approvals, and market adoption are paramount for realizing the potential of this Question Mark.

- Market Opportunity: The non-insulin subcutaneous drug delivery market, particularly for conditions like obesity and inflammatory diseases, represents a substantial opportunity for Insulet's Omnipod platform.

Partnerships for Broader CGM Compatibility

While Insulet's current partnerships for Continuous Glucose Monitoring (CGM) integration are performing well, like Stars in the BCG matrix, exploring broader or next-generation CGM compatibility represents a Question Mark.

The rapid evolution of CGM technology necessitates ongoing investment in integrating with new and emerging sensors to maintain Insulet's competitive position. For example, by late 2024, the market for these future integrations is still nascent, but the potential to attract a wider user base and expand market reach is substantial.

- Expanding Sensor Ecosystem

- Investment in R&D for New Integrations

- Early Market Share in Emerging CGM Technologies

- High Future Market Potential for Broader Compatibility

Insulet's advancements in Omnipod 5 algorithm enhancements, along with explorations into new digital health integrations and AI-driven solutions, currently represent Question Marks. These initiatives are in nascent stages with minimal market share but possess high growth potential, demanding significant investment to transition into market leaders.

The company's expansion into new international markets and its diversification into non-insulin subcutaneous drug delivery via the Omnipod platform also fall into the Question Mark category. These ventures require substantial upfront investment to establish market presence and navigate regulatory hurdles, with success dependent on market adoption and clinical trial outcomes.

Furthermore, Insulet's ongoing efforts to integrate with next-generation CGM technologies are considered Question Marks. While current integrations are strong, expanding compatibility with emerging sensors is crucial for maintaining competitiveness in a rapidly evolving market, offering substantial future potential despite an early market share.

| Initiative | BCG Category | Market Share (Current) | Growth Potential | Investment Needs |

|---|---|---|---|---|

| Omnipod 5 Algorithm Enhancements | Question Mark | Negligible | High | Significant R&D |

| New Digital Health & AI Solutions | Question Mark | Low | High | R&D, Marketing, Adoption Drive |

| Emerging International Markets | Question Mark | Minimal | High | Localization, Regulatory, Distribution |

| Non-Insulin Drug Delivery (Omnipod) | Question Mark | Nascent | High | Clinical Trials, Regulatory, Market Acceptance |

| Next-Gen CGM Integrations | Question Mark | Early Stage | Substantial | R&D for New Integrations |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.