Innospec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

Innospec's strengths lie in its specialized chemical formulations and global reach, while its opportunities include expanding into new markets and sustainable product development. However, potential threats from regulatory changes and intense competition require careful navigation.

Want the full story behind Innospec’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Innospec's strength is its diversified product portfolio, spanning fuel additives, oilfield chemicals, and personal care ingredients. This breadth reduces dependence on any single market, creating multiple revenue streams and enhancing business resilience. For instance, the company's Fuel Specialties segment is a significant contributor, alongside its Performance Chemicals and Oilfield Services divisions, enabling more balanced financial performance even when specific sectors face challenges.

Innospec boasts a robust financial standing, evidenced by its debt-free balance sheet and a significant net cash position of $299.8 million as of March 31, 2025. This financial flexibility empowers the company to actively engage in shareholder return strategies.

The company's strong cash reserves enable strategic capital allocation, including share repurchase programs and dividend increases. These actions underscore Innospec's confidence in its intrinsic value and its dedication to rewarding its investors.

Innospec's dedication to sustainability is a significant strength. The company achieved a 23% reduction in Scope 1 & 2 greenhouse gas emissions from a 2014 baseline and its fuel additives have prevented 20.8 million metric tons of CO2e emissions. This focus on environmental responsibility resonates with increasingly eco-conscious markets.

Global Presence and Supply Chain Resilience

Innospec boasts a robust global presence, with operations and manufacturing facilities spanning 22 countries. This extensive network, supported by dedicated technical experts, ensures a resilient supply chain capable of navigating diverse market conditions and regional economic shifts. For instance, in 2023, the company reported that its international operations contributed significantly to its overall revenue, demonstrating the strength of its global footprint.

This decentralized structure provides a significant advantage in mitigating the impact of global tariffs and localized market disruptions. By having manufacturing and distribution capabilities in multiple regions, Innospec can maintain consistent product availability and high levels of customer service even when facing geopolitical or economic challenges. This resilience is a key differentiator in the competitive specialty chemicals market.

- Global Footprint: Operations in 22 countries.

- Supply Chain Resilience: Diversified manufacturing and distribution network.

- Market Navigation: Ability to manage tariffs and regional dynamics.

- Customer Service: Ensures consistent product availability worldwide.

Proven Technical Capabilities and Custom Formulations

Innospec's strength lies in its deep technical expertise and ability to create custom formulations. This focus on innovation allows them to develop specialized solutions that address unique customer challenges, providing a distinct edge in performance and efficiency.

The company's commitment to research and development fuels its proven technical capabilities. This investment translates into a pipeline of innovative products designed to meet evolving market demands across diverse sectors, from fuel additives to personal care ingredients.

For example, in 2023, Innospec reported strong performance driven by its specialty chemicals segment, which heavily relies on custom formulations. Their Fuel Specialties division, a key area for technical innovation, saw significant growth, underscoring the value of their tailored solutions.

- Customization Advantage: Innospec excels at tailoring chemical solutions to specific client needs, fostering strong customer loyalty and premium pricing opportunities.

- R&D Investment: Consistent investment in research and development ensures a steady stream of innovative products and proprietary technologies.

- Technical Expertise: A highly skilled technical team underpins the company's ability to solve complex customer problems and develop cutting-edge formulations.

- Market Responsiveness: Proven ability to adapt and create new formulations in response to changing industry regulations and sustainability demands.

Innospec's diversified product portfolio, including fuel additives, oilfield chemicals, and personal care ingredients, provides significant revenue stream diversification and market resilience. The company's robust financial health, highlighted by a debt-free balance sheet and $299.8 million in net cash as of March 31, 2025, allows for strategic capital allocation and shareholder returns.

Their commitment to sustainability is a notable strength, evidenced by a 23% reduction in Scope 1 & 2 greenhouse gas emissions since 2014 and the prevention of 20.8 million metric tons of CO2e emissions through their fuel additives.

Innospec's global operational footprint, spanning 22 countries with decentralized manufacturing and distribution, ensures supply chain resilience and effective navigation of regional market dynamics and tariffs. This global presence, combined with deep technical expertise and a focus on custom formulations, allows Innospec to meet specific customer needs and drive innovation, as demonstrated by strong performance in its specialty chemicals segment in 2023.

What is included in the product

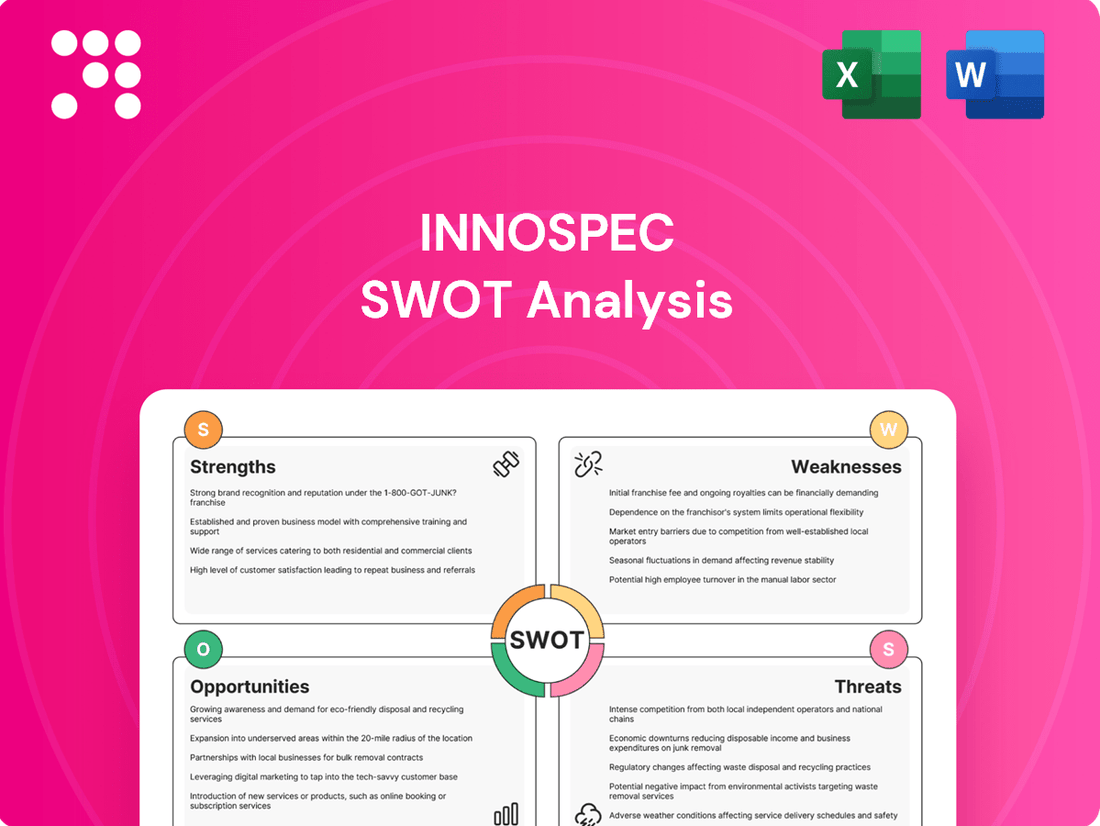

Delivers a strategic overview of Innospec’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Innospec's competitive landscape, simplifying complex market dynamics for focused strategic action.

Weaknesses

Innospec experienced a significant revenue dip in the first quarter of 2025, with total revenues dropping 12% year-over-year to $440.8 million from $500.2 million in Q1 2024. This decline, notably impacting the Oilfield Services and Performance Chemicals segments, highlights potential headwinds in key markets.

Innospec's Oilfield Services segment has been a notable weakness, significantly impacting the company's overall financial health. In the first quarter of 2025, this segment saw revenues drop by a substantial 37% year-over-year, with operating income experiencing an even steeper decline of 76%.

This underperformance is largely due to a slowdown in production chemical demand in Latin America, coupled with ongoing uncertainties related to tariffs. Management has indicated that a swift recovery for this segment is not anticipated, suggesting these headwinds may persist.

While Innospec's Performance Chemicals segment achieved a 5% revenue boost in the first quarter of 2025, this growth was accompanied by a 6% drop in operating income. This divergence points to significant margin pressure within the segment. The decline in gross margins, even with increased sales, suggests that rising raw material costs or an inability to fully pass these costs onto customers are impacting profitability.

Reliance on External Market Conditions and Geopolitical Factors

Innospec's profitability is highly susceptible to fluctuations in global crude oil prices and the demand for its derivatives, making it vulnerable to market volatility. For instance, the company's performance in 2023 was impacted by these external pressures, particularly affecting its Oilfield Services segment.

Geopolitical events can also significantly disrupt Innospec's operations and supply chains, creating uncertainty. The company has explicitly cited challenging political environments in regions like Latin America as a key factor contributing to difficulties within its Oilfield Services business, a trend that continued into early 2024.

- Market Sensitivity: Innospec's revenue streams are directly tied to the health of the global energy market, with crude oil price swings impacting demand for its fuel additives and oilfield chemicals.

- Geopolitical Risk: Political instability and regulatory changes in key operating regions, such as Latin America, can negatively affect the Oilfield Services segment's performance, as observed in recent financial reporting.

- Supply Chain Vulnerability: External factors can disrupt the sourcing of raw materials and the distribution of finished products, leading to potential production delays and increased costs.

Potential Impact of Pension Scheme Settlement Charge

Innospec faced a notable weakness in 2024 due to a significant non-cash pension scheme settlement charge. The company recorded a $155.6 million charge related to a UK pension scheme buyout, which directly impacted its reported financial performance for the year.

This substantial charge contributed to a net loss for the full year 2024, highlighting the potential for large, non-operating expenses to affect profitability. While this was a one-time event, such charges necessitate careful financial forecasting and management to maintain investor confidence and a clear view of underlying operational health.

- Pension Scheme Settlement Charge: A $155.6 million non-cash charge was incurred in 2024 for a UK pension scheme buyout.

- Impact on Profitability: This charge contributed to a net loss for the full year 2024.

- Financial Outlook Management: Large non-operating charges require careful management of financial outlooks and communication with stakeholders.

The Oilfield Services segment remains a significant weakness for Innospec, with a 37% revenue drop in Q1 2025 and a 76% operating income decline. This underperformance is driven by lower demand for production chemicals in Latin America and ongoing tariff uncertainties, with management not expecting a quick turnaround.

Margin pressure is also evident in the Performance Chemicals segment, which saw a 6% decrease in operating income despite a 5% revenue increase in Q1 2025. This suggests challenges in passing on rising raw material costs to customers.

Innospec's financial results were also impacted by a substantial $155.6 million non-cash pension scheme settlement charge in 2024, contributing to a net loss for the year and highlighting the effect of one-time expenses.

| Segment | Q1 2024 Revenue | Q1 2025 Revenue | YoY Revenue Change | Q1 2024 Operating Income | Q1 2025 Operating Income | YoY Operating Income Change |

| Oilfield Services | $175.2M | $110.5M | -37.0% | $25.0M | $6.0M | -76.0% |

| Performance Chemicals | $240.0M | $252.0M | +5.0% | $40.0M | $37.6M | -6.0% |

Full Version Awaits

Innospec SWOT Analysis

This is the actual Innospec SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's strategic position.

The preview below is taken directly from the full Innospec SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights.

This is a real excerpt from the complete Innospec SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The global fuel additives market is experiencing significant expansion, with projections indicating continued strong growth. This surge is fueled by the increasing global demand for fuels that are not only cleaner and more efficient but also environmentally sustainable. Stricter environmental regulations worldwide and the ongoing development of advanced engine technologies are also key drivers.

Innospec's Fuel Specialties segment is ideally positioned to leverage these market trends. This segment has demonstrated impressive growth and a notable improvement in operating income, showcasing its ability to adapt and thrive. The company is particularly well-placed to capitalize on opportunities arising from the growing adoption of renewable fuel applications.

The global specialty chemicals market is poised for robust expansion, with forecasts indicating substantial growth in market value through 2025. This upward trend is fueled by rising demand for advanced coatings, enhanced consumer products, and eco-friendly alternatives, presenting a significant opportunity for Innospec's Performance Chemicals division to broaden its reach.

The global oilfield chemicals market is poised for growth, with projections indicating an upward trend fueled by increasing crude oil demand and expanded exploration efforts worldwide. This presents a significant opportunity for Innospec.

Innospec can capitalize on this by targeting growth areas within its Oilfield Services segment, such as US completions and production, alongside sustained activity in the Middle East, to achieve sequential quarterly improvements. For instance, the company's 2023 performance showed resilience, with its Oilfield Services segment reporting a notable increase in revenue, demonstrating its ability to navigate market dynamics.

Strategic Acquisitions and Geographic Expansion

Innospec's robust net cash position, reported at $168.6 million as of December 31, 2023, fuels strategic expansion. This financial strength allows for opportunistic mergers and acquisitions, bolstering market share and diversifying its product portfolio. The successful integration of QGP in Brazil, acquired in 2023, exemplifies this strategy, extending Innospec's manufacturing footprint and market access within South America and serving as a blueprint for future regional growth.

This strategic approach to acquisitions and geographic expansion presents significant opportunities:

- Acquisition of Complementary Businesses: Innospec can leverage its strong cash reserves to acquire companies that offer synergistic product lines or technologies, enhancing its competitive edge in existing markets or enabling entry into new ones.

- Geographic Market Penetration: Following the QGP acquisition, Innospec can replicate this model in other high-growth regions, establishing local manufacturing and distribution networks to better serve diverse customer bases and reduce logistical costs.

- Portfolio Diversification: Strategic M&A can lead to the acquisition of businesses in adjacent or new chemical sectors, reducing reliance on any single market segment and creating a more resilient business model.

- Enhanced R&D Capabilities: Acquiring companies with established research and development capabilities can accelerate Innospec's innovation pipeline, bringing new, high-value products to market more quickly.

Technological Advancements and Sustainable Solutions

Innospec's commitment to ongoing research and development, evident in their consistent investment in technological advancements, positions them to capitalize on the growing demand for sustainable chemical solutions. Their focus on creating high-performance, eco-friendly formulations directly addresses the global shift towards greener alternatives. This strategic direction is crucial as regulatory bodies worldwide increasingly mandate environmentally responsible products.

The company's ability to innovate in areas like biodegradable chemical formulations opens up significant market opportunities. For instance, the global market for green chemicals is projected to reach substantial figures, with some estimates suggesting growth to over $100 billion by 2027, indicating a strong tailwind for Innospec's sustainable product pipeline. This trend is further amplified by consumer and industrial demand for products with reduced environmental impact.

- Innovation in Sustainable Chemistry: Continued investment in R&D fuels the creation of eco-friendly and biodegradable chemical solutions.

- Market Alignment: Focus on sustainability aligns with growing industry trends and increasing regulatory pressure for greener alternatives.

- New Market Entry: Development of sustainable solutions can unlock access to new markets and customer segments seeking environmentally conscious products.

- Competitive Advantage: Early adoption and leadership in sustainable chemical technologies can provide a significant competitive edge in the evolving chemical industry landscape.

Innospec is well-positioned to benefit from the expanding global fuel additives market, driven by demand for cleaner, more efficient fuels and stricter environmental regulations. The company's Fuel Specialties segment has shown strong performance, particularly in capitalizing on renewable fuel applications.

The company's robust financial health, including a net cash position of $168.6 million as of December 31, 2023, enables strategic acquisitions like QGP in Brazil, expanding its manufacturing and market access. This financial strength supports further geographic penetration and portfolio diversification through synergistic business acquisitions.

Innospec's commitment to R&D in sustainable chemistry, focusing on eco-friendly and biodegradable solutions, aligns with market trends and regulatory pressures. This innovation can unlock new markets and provide a competitive advantage as demand for environmentally conscious products grows, with the green chemicals market projected to exceed $100 billion by 2027.

| Opportunity Area | Key Drivers | Innospec's Position |

|---|---|---|

| Global Fuel Additives Market Growth | Demand for cleaner, efficient, sustainable fuels; environmental regulations | Strong positioning in Fuel Specialties segment, leveraging renewable fuel applications |

| Specialty Chemicals Market Expansion | Rising demand for advanced coatings, consumer products, eco-friendly alternatives | Performance Chemicals division can broaden reach |

| Strategic Acquisitions & Geographic Expansion | Strong net cash position ($168.6M as of 12/31/2023); successful QGP integration | Opportunistic M&A for synergistic businesses, replicating regional expansion models |

| Sustainable Chemistry Innovation | Growing demand for eco-friendly, biodegradable solutions; regulatory mandates | R&D focus on sustainable formulations, aligning with market shifts and green chemical market growth |

Threats

Global economic instability and geopolitical risks remain a significant threat, impacting Innospec's operations as evidenced by the volatile market conditions observed in Q1 2025. These external factors can directly influence consumer spending and industrial activity, areas crucial for Innospec's diverse product segments.

Fluctuations in demand, especially within the energy-related sectors where Innospec has substantial exposure, present a continuous challenge. For instance, a sharp decline in oil prices, a recurring concern in recent years, could dampen demand for fuel additives, a key revenue driver for the company.

Innospec faces robust competition across its operational segments, with numerous multinational corporations and specialized chemical providers vying for market share. This crowded landscape, particularly in areas like fuel additives and performance chemicals, often translates into significant pricing pressures. For instance, the global fuel additives market, a key area for Innospec, was valued at approximately $38.5 billion in 2023 and is projected to grow, but this growth is contested by established players and emerging regional competitors.

The constant need to differentiate products and maintain a competitive edge necessitates ongoing investment in research and development. Failure to innovate can quickly erode market position, as competitors introduce new formulations or more cost-effective alternatives. Innospec’s strategy must therefore focus on delivering unique value propositions and maintaining operational efficiency to navigate these intense market dynamics effectively.

Sharp swings in the prices of essential raw materials and energy represent a significant threat to Innospec's profitability. These volatile costs are fundamental to chemical production, and Innospec's ability to absorb or pass on these increases directly impacts its bottom line. For instance, the price of key feedstocks like crude oil derivatives can fluctuate dramatically, affecting manufacturing expenses.

Regulatory Changes and Environmental Compliance

Innospec faces significant threats from evolving environmental regulations, particularly those concerning climate change and stricter emission standards. These changes can necessitate substantial investments in compliance, potentially impacting profitability. For instance, the company's AvGas business, a key segment within its Fuel Specialties division, is specifically vulnerable to regulatory shifts that could curb its demand.

The company must remain agile to navigate these regulatory landscapes. For example, in 2023, the European Union continued to advance its 'Fit for 55' package, which includes measures like the Carbon Border Adjustment Mechanism (CBAM) and revised emissions trading systems, potentially affecting Innospec's operations and supply chains. Furthermore, the ongoing global focus on decarbonization could lead to increased scrutiny and mandates impacting the aviation fuel sector, a direct concern for Innospec's AvGas market.

- Increased Compliance Costs: Evolving environmental regulations, including climate change policies and tighter emission standards, can lead to higher operational expenses for Innospec.

- AvGas Market Risk: Potential regulatory changes targeting aviation fuels, such as those related to lead content or carbon intensity, pose a specific threat to Innospec's AvGas business.

- Global Regulatory Divergence: Differing environmental regulations across various operating regions can create complexity and compliance challenges for a multinational company like Innospec.

- Impact on Product Development: Future regulatory demands may require significant investment in research and development to adapt existing products or create new, compliant solutions.

Geopolitical Risks and Trade Policies

Innospec's global footprint exposes it to a range of geopolitical and economic uncertainties. Events like potential expropriation of assets or the imposition of new trade restrictions in key operating regions could disrupt supply chains and negatively affect profitability. For instance, in 2024, ongoing trade tensions between major economic blocs continued to create volatility, impacting raw material sourcing and finished goods distribution.

Tariff policies represent a more immediate threat, particularly for Innospec's Performance Chemicals and Oilfield Services divisions. Increased tariffs can lead to higher input costs and may cause customers to adjust their inventory levels, thereby influencing demand. In the first half of 2024, several countries implemented new tariffs on chemical products, leading to a noticeable short-term impact on order volumes in specific markets.

- Geopolitical Instability: Increased political unrest in regions where Innospec operates could lead to supply chain disruptions and operational challenges.

- Trade Barriers: The imposition of tariffs or other trade restrictions can increase costs and reduce demand for Innospec's products, impacting segments like Performance Chemicals and Oilfield Services.

- Regulatory Changes: Evolving trade policies and international regulations can create compliance burdens and affect market access.

- Currency Fluctuations: Geopolitical events often trigger currency volatility, which can impact the translation of foreign earnings and the cost of international transactions.

Innospec's reliance on specific raw materials makes it susceptible to price volatility, with crude oil derivatives, a key feedstock, experiencing significant price swings throughout 2024. This directly impacts manufacturing costs and can squeeze profit margins if these increases cannot be passed on to customers.

The company faces intense competition across its product lines, particularly in the global fuel additives market, valued at approximately $38.5 billion in 2023. This competitive pressure, coupled with the need for continuous R&D investment to maintain differentiation, creates a constant challenge to market share and pricing power.

Evolving environmental regulations, such as the EU's 'Fit for 55' package, present a growing threat. These can necessitate costly compliance measures and potentially impact demand for specific products like Innospec's AvGas, especially as global decarbonization efforts intensify.

Geopolitical instability and trade policy shifts, including tariffs implemented in early 2024 on chemical products, directly affect Innospec's operations and profitability by increasing input costs and influencing customer demand.

SWOT Analysis Data Sources

This Innospec SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive market research, and reputable industry publications. These sources provide the essential data for a thorough understanding of the company's current standing and future potential.