Innospec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

Unlock the critical external factors shaping Innospec's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full analysis now to make informed decisions.

Political factors

Governmental regulations significantly shape Innospec's landscape, particularly concerning its fuel additives and oilfield chemicals. Policies around chemical production, usage, and disposal directly influence operational costs and product development. For instance, evolving environmental protection laws or stricter health and safety standards can mandate expensive compliance efforts or necessitate product redesigns, impacting Innospec's cost structure and market competitiveness.

The political stability of regions where Innospec operates is also a crucial factor. A stable political climate generally translates to a more predictable regulatory environment, fostering market access and investment confidence. Conversely, political instability can introduce uncertainty, potentially disrupting supply chains and market access for Innospec's specialized chemical products.

Global trade policies, including tariffs and non-tariff barriers, directly influence Innospec's international operations. For instance, the US imposition of tariffs on certain chemical imports in 2018, though later adjusted, highlighted the potential for increased raw material costs. Similarly, the EU's ongoing trade negotiations and regulations can affect Innospec's access to key European markets and the competitiveness of its specialized chemical products.

Geopolitical instability, particularly in regions like the Middle East, poses a significant risk to Innospec's operations. For instance, the ongoing conflicts in Eastern Europe and the Middle East have already contributed to price volatility in crude oil, a key input for many of Innospec's products. In 2024, Brent crude oil prices have fluctuated significantly, often trading above $80 per barrel, directly impacting Innospec's cost of goods sold and the demand for its fuel additives.

Regional conflicts can disrupt the supply chains for essential raw materials, such as those derived from petroleum. This can lead to increased lead times and higher procurement costs for Innospec. Furthermore, political unrest in oil-producing nations can directly affect the demand for oilfield chemicals, a segment that contributed approximately 30% to Innospec's revenue in 2023. Diversifying manufacturing and sourcing locations, as Innospec has done with facilities in the US, UK, and Germany, is crucial for mitigating these supply chain vulnerabilities.

Industrial Policies and Subsidies

Government industrial policies, such as subsidies for green technologies, could significantly impact Innospec's traditional fuel additive business by encouraging a shift towards more sustainable alternatives. Conversely, policies promoting domestic manufacturing might offer advantages to Innospec's regional production facilities, potentially lowering operational costs and improving supply chain resilience.

For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, includes substantial funding for sustainable chemistry and alternative fuels, which could create both competitive pressures and new market opportunities for Innospec's specialty chemicals. Similarly, the United States' Inflation Reduction Act of 2022, with its focus on clean energy manufacturing, could influence Innospec's investment decisions and market focus.

- Innospec's exposure to evolving environmental regulations and incentives for sustainable chemical production presents a key area for strategic monitoring.

- Government support for domestic manufacturing could bolster Innospec's regional operational efficiency and market access.

- Shifts in industrial policy, particularly concerning energy transition and chemical production, require proactive adaptation by Innospec.

Political Agendas on Sustainability

Governments worldwide are increasingly prioritizing sustainability, with many setting ambitious decarbonization and circular economy targets. This political focus directly impacts companies like Innospec, as it shapes the demand for solutions that enhance performance and efficiency while minimizing environmental impact. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, creates a strong incentive for industries to adopt cleaner technologies and processes, potentially boosting Innospec's offerings in fuel additives that improve combustion and reduce emissions.

These climate goals can translate into significant market opportunities. For example, the global market for sustainable fuels and additives is projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 8% through 2028, driven by regulatory push and consumer demand for greener alternatives. Innospec's investment in developing and marketing products aligned with these trends, such as advanced fuel additives that enable lower sulfur content or improved engine efficiency, positions them to capitalize on this evolving political landscape.

- Growing Regulatory Push: The EU's Fit for 55 package aims to cut emissions by at least 55% by 2030, influencing demand for Innospec's emission-reducing technologies.

- Circular Economy Initiatives: Policies promoting resource efficiency and waste reduction could favor Innospec's chemical solutions that enable recycling or extend product lifecycles.

- Climate Finance and Investment: Government incentives for green technologies may encourage investment in Innospec's sustainable product development.

- Potential for Stringent Chemical Regulations: Conversely, evolving regulations on specific chemical components could necessitate adaptation or pose challenges for Innospec's product portfolio.

Governmental policies significantly influence Innospec's operational landscape, particularly regarding environmental regulations and trade agreements. For instance, the EU's stringent chemical regulations, like REACH, necessitate ongoing compliance efforts and can impact product formulation. Similarly, trade tariffs or barriers, as seen with past US tariffs on certain chemicals, can affect raw material costs and market access for Innospec's specialized products.

Geopolitical stability and industrial policies are also key political factors. Regional conflicts can disrupt supply chains for critical raw materials, as evidenced by the price volatility of crude oil, a key input for Innospec, in 2024. Government incentives for green technologies, such as those within the US Inflation Reduction Act of 2022, can create both opportunities and competitive pressures for Innospec's fuel additive and chemical businesses.

| Political Factor | Impact on Innospec | Example/Data (2024/2025 Focus) |

| Environmental Regulations | Compliance costs, product development, market access | EU Green Deal targets driving demand for emission-reducing additives. |

| Trade Policies | Raw material costs, international sales competitiveness | Potential for tariffs on chemical imports impacting cost of goods sold. |

| Geopolitical Instability | Supply chain disruption, input cost volatility | Fluctuations in crude oil prices (e.g., Brent crude above $80/barrel in early 2024) affecting fuel additive demand. |

| Industrial Policies | Investment decisions, market focus, competitive landscape | US Inflation Reduction Act incentives for clean energy influencing R&D for sustainable chemicals. |

What is included in the product

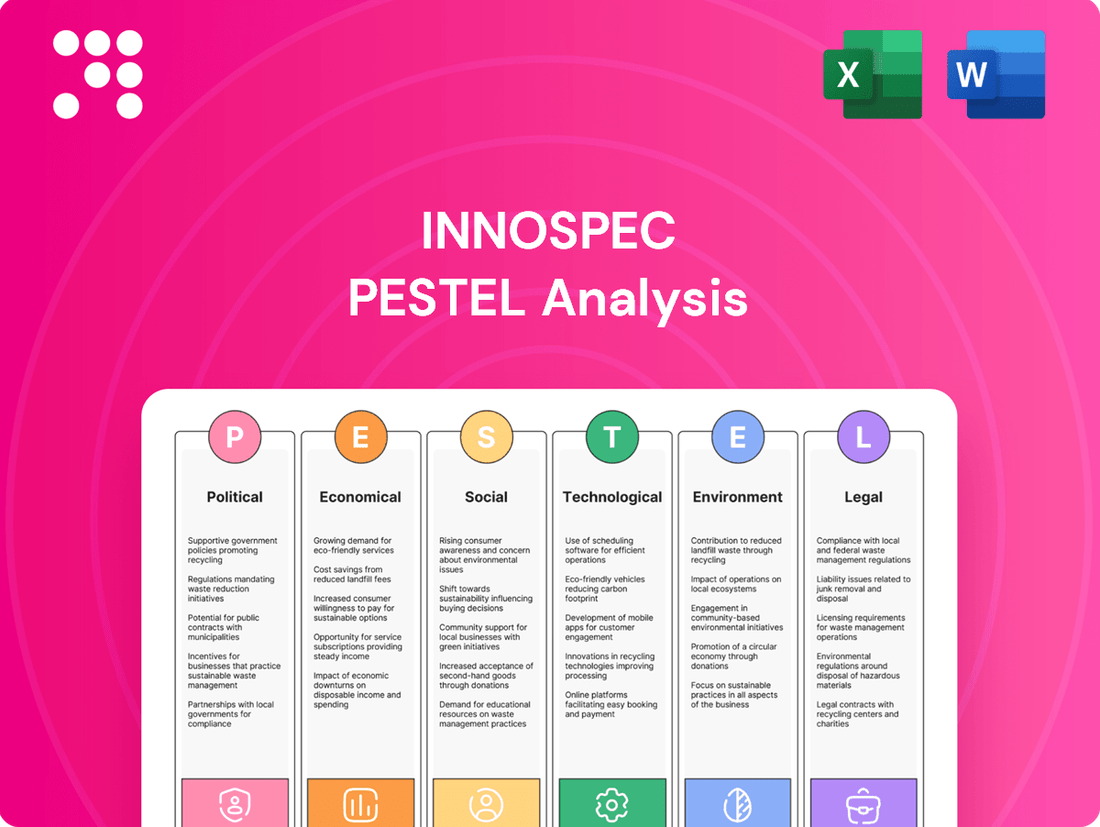

This Innospec PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

The Innospec PESTLE analysis provides a clear, summarized version of external factors for easy referencing during strategic planning meetings.

Economic factors

Global economic growth is a significant driver for Innospec. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.1% in 2024, a slight increase from 3.0% in 2023. This expansion generally translates to higher demand for Innospec's fuel additives and performance chemicals, especially within the oil and gas and manufacturing sectors, as industrial activity picks up.

Industrial production, a key indicator of economic health, directly influences Innospec's sales. In 2024, manufacturing output is expected to see moderate growth, reflecting increased consumer spending and business investment. This uptick in production typically means greater energy consumption and a higher need for Innospec's specialized chemical solutions to optimize performance and efficiency.

However, the inverse is also true. Economic slowdowns or recessions can severely impact Innospec. For example, if global GDP growth falters, as seen in some regions during past downturns, industrial activity contracts, leading to reduced demand for fuel additives and specialty chemicals. This can also create downward pressure on pricing, affecting Innospec's revenue and profitability.

Innospec's profitability is closely tied to the cost and availability of its various raw materials, many of which are derived from petrochemicals. For instance, the price of crude oil, a key feedstock, saw significant fluctuations in 2024, impacting the cost base for many chemical manufacturers.

Changes in crude oil and natural gas prices directly influence Innospec's production expenses. The company actively manages these input cost swings through strategies like hedging, optimizing its supply chain to secure favorable terms, and adjusting its product pricing to reflect market realities.

Innospec, operating globally, is significantly impacted by currency exchange rate fluctuations. For instance, a stronger US dollar can increase the cost of its US-manufactured products for international buyers and diminish the reported value of its overseas profits when translated back into dollars. This exposure is a critical element in managing the company's financial health.

As of late 2024 and into early 2025, the US dollar has shown resilience against major currencies like the Euro and the British Pound, partly due to interest rate differentials. This trend could potentially affect Innospec's international sales volumes and the profitability of its overseas subsidiaries, necessitating robust hedging strategies to mitigate adverse currency movements.

Energy Prices and Supply

Energy prices, particularly for electricity and natural gas, represent a substantial operational cost for Innospec's manufacturing sites. For instance, in 2024, global natural gas prices experienced fluctuations, with the TTF benchmark averaging around $30 per megawatt-hour for much of the year, impacting chemical production costs. Volatile or elevated energy expenses directly influence Innospec's production expenses and its ability to remain competitive in the market.

A secure and consistent energy supply is paramount for Innospec's uninterrupted operations, especially given the energy-intensive nature of chemical manufacturing. Disruptions or shortages can halt production, leading to significant financial losses. The company's reliance on stable energy sources underscores the importance of strategic energy procurement and management.

- Manufacturing Costs: Energy is a key input cost for Innospec's chemical processes.

- Price Volatility: Fluctuations in oil and gas prices directly affect Innospec's profitability.

- Operational Continuity: Reliable energy supply is essential to prevent production downtime.

- Competitiveness: High energy costs can disadvantage Innospec compared to competitors with lower energy expenditures.

Consumer Spending and Industry Cycles

Consumer spending is a significant driver for Innospec's personal care ingredients. For instance, in 2024, global consumer spending on beauty and personal care products was projected to reach over $600 billion, indicating a robust market. Higher discretionary income generally translates to increased demand for premium or specialized ingredients used in these products, directly impacting Innospec's revenue from this segment.

Beyond personal care, Innospec’s performance is also tied to broader industry cycles. The automotive sector, a key market for their fuel additives, experienced a rebound in 2024, with global vehicle sales expected to increase by approximately 3% compared to 2023. Similarly, fluctuations in the oilfield services industry, which uses Innospec's performance chemicals, directly affect demand. Understanding these cyclical patterns is crucial for Innospec to effectively manage inventory and production levels, ensuring they can meet market demand without overcapacity.

- Consumer Spending Growth: Global spending on beauty and personal care is a key indicator, with projections for 2024 exceeding $600 billion.

- Discretionary Income Impact: Increased consumer confidence and disposable income often lead to higher demand for specialized personal care ingredients.

- Automotive Sector Influence: A projected 3% increase in global vehicle sales for 2024 suggests a positive outlook for Innospec's fuel additives.

- Oilfield Services Volatility: Demand for performance chemicals in the oilfield sector is directly linked to the cyclical nature of oil and gas exploration and production.

Global economic growth directly impacts Innospec's demand. The IMF projected 3.1% global growth for 2024, signaling increased industrial activity and a higher need for Innospec's fuel additives and performance chemicals.

Consumer spending, particularly in personal care, is vital. Global spending in this sector was expected to surpass $600 billion in 2024, boosting demand for Innospec's specialized ingredients.

Fluctuations in raw material costs, especially petrochemicals linked to oil prices, significantly affect Innospec's profitability. Energy prices, like natural gas at an average of $30/MWh in 2024, also impact operational expenses and competitiveness.

| Economic Factor | 2024 Projection/Data | Impact on Innospec |

|---|---|---|

| Global GDP Growth | 3.1% (IMF Projection) | Increased demand for fuel additives and performance chemicals |

| Personal Care Spending | >$600 billion | Higher demand for specialty ingredients |

| Automotive Sales | ~3% increase | Positive outlook for fuel additives |

| Natural Gas Price (TTF Avg.) | ~$30/MWh | Influences production costs |

Same Document Delivered

Innospec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Innospec covers all critical external factors influencing the company's operations and strategic decisions. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Consumers are increasingly prioritizing products that are good for the planet, and this is a major shift impacting industries like specialty chemicals. For Innospec, this means their personal care ingredients are under a microscope, with customers wanting to know about their environmental impact and if they come from natural sources. This growing demand for eco-friendly options is pushing companies to develop greener chemical formulations and adopt more sustainable manufacturing methods.

Increasing societal and industrial emphasis on health and safety directly influences how chemical products like those from Innospec are handled, utilized, and perceived. This heightened awareness necessitates rigorous adherence to stringent safety standards across all operations, safeguarding employees, end-users, and the wider public.

Innospec's commitment to responsible product stewardship means proactively managing safety throughout a chemical's entire lifecycle, from development to disposal. This includes clear and open communication regarding product safety data, a crucial element in building trust and ensuring compliance in a health-conscious world.

Global population growth is projected to reach 9.7 billion by 2050, with a significant portion of this increase occurring in developing nations. This expansion, coupled with rapid urbanization, particularly in Asia and Africa, directly impacts demand for Innospec's specialty chemicals. For instance, increased construction activity in burgeoning cities boosts the need for additives in concrete and coatings, while evolving transportation needs in these urban centers can influence demand for fuel additives.

Workforce Dynamics and Talent Acquisition

The availability of skilled labor, especially in chemical engineering, research, and manufacturing, is paramount for Innospec's success. For instance, in 2024, the global demand for chemical engineers remained robust, with projections indicating continued growth through 2025, driven by innovation in specialty chemicals and sustainable solutions.

Sociological shifts, such as increasing demands for work-life balance and flexible work arrangements, significantly influence Innospec's ability to attract and retain top talent. A 2024 survey indicated that over 60% of professionals prioritize flexible work options when considering new employment. Generational differences also play a role, with younger workforces often seeking purpose-driven roles and continuous learning opportunities.

- Talent Demand: High demand for chemical engineers and R&D specialists in the specialty chemicals sector.

- Workforce Expectations: Growing emphasis on work-life balance and flexible working arrangements.

- Generational Shifts: Younger generations prioritizing purpose and development in their careers.

- Retention Strategies: Investment in employee development and fostering inclusive cultures are key to retaining skilled personnel.

Corporate Social Responsibility Expectations

Societal expectations for companies to actively engage in corporate social responsibility (CSR) are on the rise, influencing how businesses operate and are perceived. This encompasses a growing demand for ethical sourcing of materials, ensuring fair labor practices throughout the supply chain, meaningful community engagement, and transparent reporting on environmental and social impacts. Innospec's proactive approach to CSR, as demonstrated by its sustainability reports, can significantly bolster its brand reputation, attract environmentally and socially conscious investors, and foster stronger relationships with all stakeholders.

Innospec's focus on sustainability is evident in its operational strategies. For instance, the company has invested in developing more environmentally friendly fuel additives, aligning with global efforts to reduce emissions. This commitment is not just about compliance; it’s about meeting evolving consumer and regulatory demands for greener products and processes. In 2023, Innospec reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 10% compared to its 2020 baseline, showcasing tangible progress in its environmental stewardship.

- Ethical Sourcing: Ensuring raw materials are obtained responsibly, avoiding human rights abuses and environmental degradation.

- Fair Labor Practices: Upholding safe working conditions, fair wages, and prohibiting child or forced labor across all operations and supply chains.

- Community Engagement: Actively participating in and supporting the communities where Innospec operates through local initiatives and partnerships.

- Transparent Reporting: Providing clear and accessible data on environmental performance, social impact, and governance (ESG) metrics.

Societal demands for sustainability are reshaping the chemical industry, pushing companies like Innospec towards greener formulations and responsible sourcing. This shift is driven by consumer awareness and a growing preference for eco-friendly products, influencing product development and manufacturing processes. Innospec's investment in sustainable fuel additives, for example, directly addresses this trend and aligns with global emission reduction goals.

The increasing global population, projected to reach 9.7 billion by 2050, fuels demand for Innospec's specialty chemicals, particularly in developing regions experiencing rapid urbanization. This growth necessitates robust supply chains and adaptable production to meet the needs of expanding infrastructure and transportation sectors.

Attracting and retaining skilled talent is a key sociological factor for Innospec, with a notable emphasis on work-life balance and flexible arrangements among professionals. Generational preferences also highlight a desire for purpose-driven work and continuous learning, requiring companies to adapt their HR strategies.

Corporate social responsibility (CSR) is increasingly important, with stakeholders expecting ethical sourcing, fair labor, community involvement, and transparent reporting. Innospec's commitment to CSR, as evidenced by its sustainability reports and emission reduction targets, enhances its brand reputation and stakeholder relationships.

| Sociological Factor | Impact on Innospec | Supporting Data/Trend (2024/2025) |

| Sustainability Demand | Drives innovation in eco-friendly products and processes. | Innospec reported a 10% reduction in Scope 1 & 2 GHG emissions (2023 vs 2020 baseline). |

| Global Population Growth | Increases demand for specialty chemicals in emerging markets. | World population projected to reach 9.7 billion by 2050. |

| Talent Expectations | Requires flexible work policies and development opportunities. | Over 60% of professionals prioritize flexibility in 2024. |

| CSR Expectations | Enhances brand reputation and investor appeal. | Growing investor focus on ESG metrics. |

Technological factors

Innospec's commitment to research and development is a cornerstone of its strategy, driving innovation in chemical formulations. The company consistently invests to create advanced fuel additives that promote cleaner combustion and oilfield chemicals that boost extraction efficiency. This focus on R&D allows Innospec to develop novel ingredients for personal care, solidifying its competitive edge.

Innospec's commitment to advanced manufacturing technologies, such as process automation and AI, is a key technological driver. These advancements are projected to boost operational efficiency and product consistency across its global operations. For instance, in 2024, companies in the specialty chemicals sector saw an average efficiency gain of 15% through the implementation of AI-driven process optimization.

Digital transformation is also critical for Innospec, aiming to streamline production schedules and enhance supply chain visibility. By optimizing these areas, the company can achieve significant cost savings and improve its ability to respond to market demands. In 2025, digital transformation initiatives in manufacturing are expected to contribute an average of 8% to revenue growth for leading chemical firms.

Innospec's reliance on custom formulations and innovative solutions makes robust intellectual property (IP) protection through patents and trade secrets a cornerstone of its strategy. This focus is critical for safeguarding its competitive edge in the specialty chemicals sector. For instance, in 2023, Innospec reported significant investment in research and development, underscoring the importance of IP in capturing the value of these advancements.

Emerging Technologies in End-Use Industries

Technological shifts are profoundly reshaping the markets Innospec operates within. In the automotive sector, the rapid rise of electric vehicles (EVs) is altering demand for traditional fuel additives, while also opening avenues for new specialty chemicals in battery technology and lightweight materials. For instance, by the end of 2024, global EV sales are projected to exceed 15 million units, a significant increase from previous years, directly impacting Innospec's Fuel Specialties segment.

The energy industry's pivot towards renewables, including advanced biofuels and hydrogen, necessitates innovation in related chemical solutions. Innospec's expertise in fuel additives can be leveraged to enhance the performance and stability of these emerging fuel sources. The personal care market is witnessing a surge in demand for biotechnology-derived ingredients and sustainable formulations, pushing Innospec's Performance Chemicals division to invest in novel R&D.

To maintain its competitive edge, Innospec must proactively adapt its product development and research strategies. This involves:

- Investing in R&D for EV battery chemicals and sustainable personal care ingredients.

- Developing new additive technologies for biofuels and hydrogen.

- Monitoring and responding to technological obsolescence risks in traditional product lines.

- Exploring partnerships and acquisitions to gain access to cutting-edge technologies.

Sustainable Chemistry Innovations

The drive towards sustainable chemistry is reshaping industries, with innovations in green solvents, bio-based feedstocks, and closed-loop manufacturing processes emerging as key technological shifts. For Innospec, this presents a significant opportunity to enhance its product portfolio and operational efficiency by embracing these greener alternatives, thereby reducing its dependence on traditional fossil-based materials. This aligns with growing global regulatory pressures and increasing consumer preference for environmentally responsible products.

Innospec's strategic integration of these sustainable chemistry advancements can lead to the development of more eco-friendly formulations, a critical factor in maintaining market competitiveness. For instance, the global market for green solvents was projected to reach USD 11.5 billion in 2024, indicating a robust demand for such alternatives. By capitalizing on bio-based feedstocks, the company can mitigate supply chain volatility associated with petrochemicals and potentially improve its cost structure.

The company's commitment to these innovations can be further demonstrated through:

- Investing in R&D for bio-based alternatives to traditional petrochemical ingredients.

- Exploring partnerships with companies specializing in green chemistry technologies.

- Implementing closed-loop manufacturing processes to minimize waste and resource consumption.

- Developing product lines that highlight their reduced environmental footprint.

Innospec's technological strategy centers on robust R&D, advanced manufacturing, and digital transformation to drive innovation and efficiency. The company's investment in new chemical formulations for fuel, oilfield, and personal care sectors is crucial for maintaining its market position. By embracing AI and automation, Innospec aims for enhanced operational performance, with sector-wide efficiency gains from AI optimization averaging 15% in 2024.

The company is also navigating significant technological shifts, such as the rise of electric vehicles, which impacts its fuel additives business. Simultaneously, the demand for biotechnology-derived ingredients in personal care presents new growth avenues. Innospec's focus on sustainable chemistry, including green solvents and bio-based feedstocks, is key to adapting to market demands and regulatory pressures, with the green solvents market projected to reach USD 11.5 billion in 2024.

| Technological Area | Innospec's Focus | Market Trend/Impact | 2024/2025 Data Point |

|---|---|---|---|

| R&D and Innovation | Advanced fuel additives, oilfield chemicals, personal care ingredients | Demand for cleaner combustion, efficient extraction, natural ingredients | Significant R&D investment reported in 2023 |

| Manufacturing Technology | Process automation, AI integration | Increased operational efficiency and product consistency | AI optimization yielding average 15% efficiency gains in specialty chemicals (2024) |

| Digital Transformation | Supply chain visibility, production scheduling | Cost savings, improved market responsiveness | Digital transformation contributing 8% to revenue growth in leading chemical firms (projected 2025) |

| Emerging Technologies | EV battery chemicals, biofuels, hydrogen additives | Shift away from traditional fuels, growth in renewables | Global EV sales projected to exceed 15 million units (end of 2024) |

| Sustainable Chemistry | Green solvents, bio-based feedstocks | Consumer preference for eco-friendly products, regulatory drivers | Green solvents market projected at USD 11.5 billion (2024) |

Legal factors

Innospec navigates a complex global environmental regulatory landscape, including REACH in Europe and EPA rules in the US. Compliance with these mandates on emissions, waste, chemical handling, and product registration is critical to avoid penalties and reputational harm. For instance, in 2023, the chemical industry faced increased scrutiny and enforcement actions related to legacy pollutants, impacting operational costs.

Innospec operates under stringent product liability and safety laws, particularly for its personal care ingredients and specialty chemicals. Failure to meet these standards, such as those set by the Toxic Substances Control Act (TSCA) or the EU Cosmetics Regulation, can result in significant financial penalties and reputational damage. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce TSCA regulations, with penalties for non-compliance often reaching tens of thousands of dollars per violation.

Ensuring product safety and accurate labeling is paramount to avoid costly lawsuits and product recalls. Innospec's commitment to these regulations directly impacts its operational costs and market access. The global chemical industry faces increasing scrutiny, with regulatory bodies worldwide implementing stricter safety protocols, which Innospec must navigate to maintain its competitive edge.

Innospec operates under a strict framework of antitrust and competition laws across all its global markets. These regulations are designed to prevent anti-competitive behaviors such as price collusion and monopolistic activities, ensuring a fair marketplace. For instance, in 2023, the European Commission continued its robust enforcement of competition rules, issuing significant fines for cartels in various sectors, underscoring the critical need for compliance.

Navigating these laws is particularly vital for Innospec during strategic maneuvers like mergers, acquisitions, and the formation of joint ventures. Pricing strategies also fall under scrutiny to prevent any form of unfair competition. Failure to comply can lead to substantial penalties, legal battles, and damage to the company's reputation, as seen with numerous companies facing investigations and sanctions from bodies like the U.S. Federal Trade Commission (FTC) in recent years.

Intellectual Property Laws and Patents

Intellectual property laws, encompassing patents, trademarks, and trade secrets, are critical for Innospec's operations, safeguarding its innovative chemical formulations and proprietary technologies. These legal structures prevent competitors from exploiting Innospec's research and development investments, thereby maintaining its competitive edge in specialty chemicals.

The company's reliance on patents means that navigating patent infringement litigation or defending against challenges to its existing patents is a significant legal factor. For instance, in 2023, the chemical industry saw numerous patent disputes, with companies investing heavily in legal protection for their innovations. Innospec’s own patent portfolio is a key asset, requiring ongoing legal vigilance.

- Patent Protection: Innospec leverages patents to shield its unique product formulations and manufacturing processes.

- Trade Secrets: Confidential information, such as specific additive blends, is protected as trade secrets.

- Litigation Risk: Potential legal battles over patent infringement or validity represent a considerable legal challenge.

- R&D Investment: Strong IP laws encourage Innospec's significant investment in research and development by ensuring a return on innovation.

Labor and Employment Laws

Innospec, operating globally, navigates a complex web of labor and employment laws across its various jurisdictions. These regulations cover crucial aspects such as minimum wage requirements, workplace safety standards, anti-discrimination policies, and the rights of employees regarding unionization and benefits. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay, while the Occupational Safety and Health Administration (OSHA) enforces workplace safety. European countries often have more stringent regulations regarding working hours, parental leave, and employee representation.

Compliance with these diverse legal frameworks is paramount for Innospec. Failure to adhere can result in significant penalties, including hefty fines, costly litigation, and damage to the company's reputation as an employer. For example, a 2023 report by the U.S. Department of Labor highlighted that wage and hour violations remain a common issue for businesses, leading to millions in back wages paid to employees. Maintaining a strong compliance program helps Innospec avoid such pitfalls and fosters a stable, productive workforce.

Key considerations for Innospec regarding labor and employment laws include:

- Wage and Hour Compliance: Ensuring adherence to local minimum wage laws and overtime regulations, which can vary significantly by country and even by state or region within countries.

- Workplace Safety and Health: Meeting or exceeding the safety standards mandated by bodies like OSHA in the US or similar agencies elsewhere to prevent accidents and ensure employee well-being.

- Anti-Discrimination and Equal Opportunity: Implementing policies and practices that prevent discrimination based on race, gender, age, religion, disability, and other protected characteristics, aligning with laws like the Civil Rights Act in the US or the Equality Act in the UK.

- Employee Benefits and Leave: Complying with statutory requirements for benefits such as health insurance, retirement plans, paid time off, and various forms of mandated leave, like parental or sick leave, which are often more generous in European nations than in the US.

Innospec's operations are heavily influenced by environmental regulations like REACH and EPA rules, demanding strict compliance for emissions, waste, and chemical handling to avoid penalties. The company also faces rigorous product liability and safety laws, such as TSCA and EU Cosmetics Regulation, where non-compliance can lead to substantial fines, as seen with EPA enforcement actions in 2023.

Antitrust and competition laws are critical, especially during strategic actions like mergers, with regulatory bodies like the European Commission actively enforcing these rules. Intellectual property laws are vital for protecting Innospec's innovations, with patent disputes being a common challenge in the chemical sector, as evidenced by numerous cases in 2023.

Labor and employment laws across different jurisdictions, covering wages, safety, and anti-discrimination, require careful adherence. For example, US Department of Labor data from 2023 indicated ongoing issues with wage and hour violations, underscoring the need for robust compliance programs.

Environmental factors

Global climate change policies, such as carbon pricing and emissions trading schemes, directly impact Innospec's operational costs and strategic planning. For instance, the European Union's Emissions Trading System (EU ETS) has seen carbon prices fluctuate, with allowances trading around €65-€75 per tonne of CO2 in early 2024, directly affecting energy-intensive industries where Innospec operates.

Innospec faces increasing pressure to lower its carbon footprint throughout its manufacturing processes and supply chain. This necessitates investments in energy efficiency measures and the exploration of lower-carbon alternatives for its production methods and product formulations.

Global concerns over resource scarcity, especially water, pose a significant challenge for Innospec. Its manufacturing operations, particularly in specialty chemicals, are water-intensive, making them vulnerable to supply disruptions and increased costs. For instance, regions where Innospec operates might face stricter water abstraction permits or higher discharge fees, impacting operational efficiency and profitability.

The increasing regulatory landscape around water usage directly affects Innospec's operational continuity. In 2024, many industrial water permits are under review, with a trend towards reduced allocations in water-stressed areas. This necessitates robust water management strategies, such as water recycling and efficiency improvements, to mitigate risks and ensure sustained production capabilities.

Environmental regulations and growing societal demand for sustainability are pushing companies like Innospec to adopt robust waste management strategies and embrace circular economy principles. This means a significant focus on minimizing waste at its source, boosting recycling rates, and actively considering how products are handled at the end of their life cycle.

Innospec's commitment to this shift involves innovating product design for enhanced recyclability or biodegradability, alongside refining manufacturing processes to drastically cut down on by-products. For instance, the global waste management market was valued at approximately $1.6 trillion in 2023 and is projected to reach $2.1 trillion by 2028, indicating a substantial economic driver for these changes.

Pollution Control and Emission Standards

Stricter pollution control regulations for air, water, and soil emissions are a significant environmental factor for Innospec. These evolving standards necessitate continuous investment in advanced abatement technologies and robust monitoring systems to ensure compliance. For instance, the European Union's Industrial Emissions Directive (IED) sets stringent limits for various pollutants from industrial activities, impacting chemical manufacturers like Innospec. Failure to meet these requirements can result in substantial fines and damage to the company's reputation, underscoring the critical importance of proactive environmental management.

Innospec's commitment to sustainability is reflected in its efforts to reduce its environmental footprint. The company aims to minimize emissions and waste across its operations. Specific targets and progress are often detailed in their annual sustainability reports. For example, in their 2023 reporting, Innospec highlighted investments in process improvements designed to lower volatile organic compound (VOC) emissions at key manufacturing sites.

- Stricter Regulations: Environmental protection agencies globally, including the US EPA and European Chemicals Agency (ECHA), are consistently updating emission standards for chemical manufacturing.

- Investment in Technology: Innospec must allocate capital for advanced filtration, scrubbing, and wastewater treatment technologies to meet these new benchmarks.

- Compliance Costs: Adherence to these standards represents a significant operational cost, impacting profitability if not managed efficiently.

- Reputational Risk: Non-compliance can lead to severe penalties and a negative public image, affecting customer trust and market access.

Biodiversity and Ecosystem Protection

While not always immediately apparent, growing global concern for biodiversity and ecosystem health can indirectly impact Innospec's operations. This includes how they source raw materials and the innovation pipeline for new chemical products. For instance, regulations stemming from biodiversity protection efforts could affect the availability or cost of certain natural feedstocks.

There's a heightened focus on the environmental impact of chemicals, particularly concerning their effects on aquatic life and terrestrial ecosystems. Companies like Innospec face increasing scrutiny regarding the ecotoxicity of their product portfolios. For example, a 2024 report highlighted that over 60% of new chemical registrations globally are subject to stricter environmental impact assessments, a trend likely to continue.

Developing products with a lower ecotoxicity profile is becoming a strategic imperative. This aligns with evolving customer demands and regulatory landscapes. Innospec's commitment to creating solutions that minimize harm to natural environments will be crucial for maintaining market relevance and brand reputation in the coming years.

- Growing Ecotoxicity Scrutiny: Increasing regulatory and consumer pressure on the environmental impact of chemicals on ecosystems.

- Raw Material Sourcing: Potential influence of biodiversity protection on the sourcing and sustainability of chemical feedstocks.

- Product Development Focus: Strategic advantage in developing and marketing products with demonstrably lower ecotoxicity profiles.

Innospec's operations are significantly shaped by evolving environmental regulations, including stricter emissions standards and waste management requirements. The company must invest in advanced abatement technologies to comply, as seen with the European Union's Industrial Emissions Directive. Failure to meet these standards, which are continually updated by agencies like the EPA and ECHA, can lead to substantial financial penalties and reputational damage.

Water scarcity presents a direct operational challenge, especially for water-intensive specialty chemical manufacturing. Regions where Innospec operates may face tighter water permits and increased discharge fees in 2024, necessitating robust water management strategies like recycling to ensure production continuity and mitigate cost impacts.

The global push for sustainability is driving demand for products with lower environmental impact, including reduced ecotoxicity. Innospec faces scrutiny regarding its product portfolio's effects on ecosystems, with over 60% of new chemical registrations in 2024 undergoing stricter environmental assessments. Developing greener alternatives is thus a strategic imperative for market relevance.

| Environmental Factor | Impact on Innospec | Key Data/Trend (2024/2025) |

|---|---|---|

| Climate Change Policies | Increased operational costs due to carbon pricing (e.g., EU ETS allowances trading around €65-€75/tonne CO2 in early 2024) and pressure to reduce carbon footprint. | Need for investments in energy efficiency and lower-carbon production methods. |

| Resource Scarcity (Water) | Vulnerability to supply disruptions and higher costs in water-intensive operations. | Stricter water usage permits and potential for reduced allocations in water-stressed areas. |

| Pollution Control Regulations | Necessity for continuous investment in advanced abatement and monitoring technologies. | Evolving emission standards from agencies like EPA and ECHA, impacting compliance costs. |

| Ecotoxicity Scrutiny | Growing pressure to minimize product impact on ecosystems and develop greener alternatives. | Over 60% of new chemical registrations globally subject to stricter environmental impact assessments in 2024. |

PESTLE Analysis Data Sources

Our Innospec PESTLE analysis is meticulously constructed using a combination of public and proprietary data sources. This includes regulatory updates from key geographical markets, economic indicators from reputable financial institutions, and industry-specific market research reports to ensure relevance to Innospec's operational landscape.