Innospec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

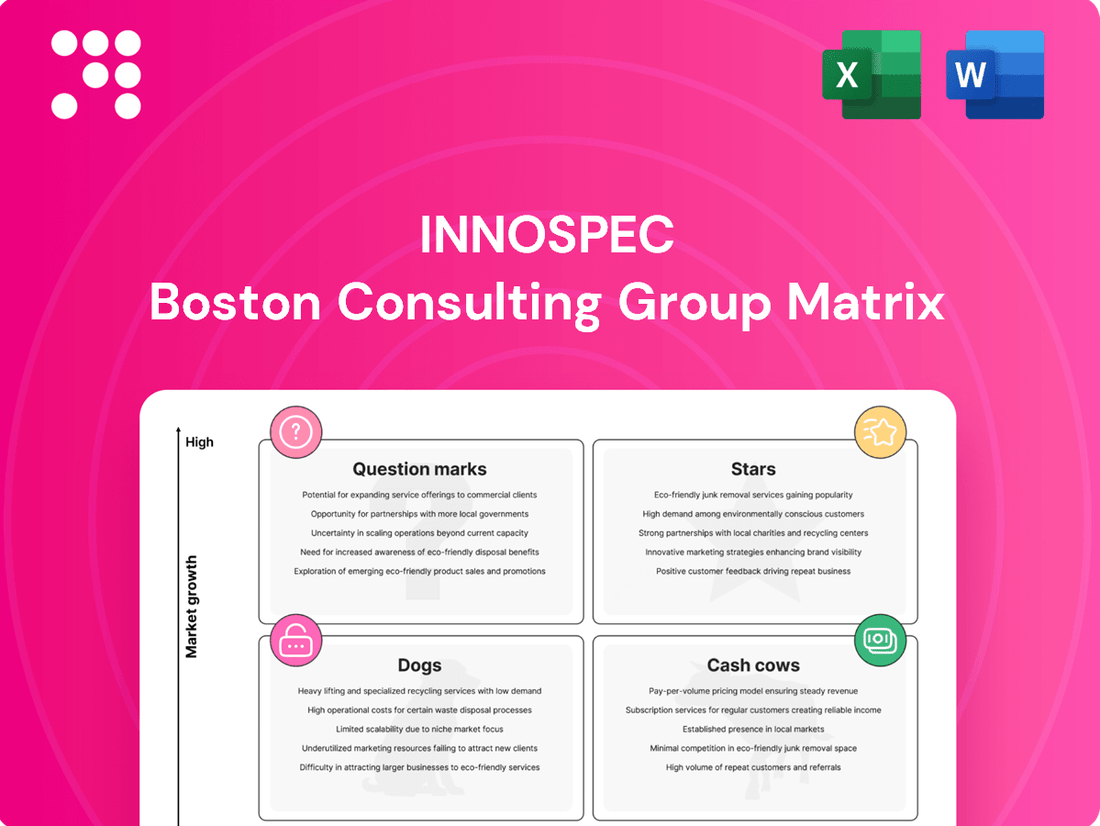

Uncover the strategic positioning of Innospec's product portfolio with our insightful BCG Matrix preview. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for growth and investment.

This glimpse into Innospec's market dynamics is just the start. Purchase the full BCG Matrix for a comprehensive breakdown, including detailed quadrant analysis and actionable strategies to optimize your investment decisions and product development.

Stars

Innospec's sustainable fuel technologies, primarily their fuel additives designed to cut CO2e emissions and boost efficiency, are strong contenders for the Stars category in the BCG Matrix. These products directly address the global push for environmental responsibility.

The company's 2024 Sustainability Report underscores this, stating their fuel additives prevented the release of 20.8 million metric tons of CO2e. This impressive figure demonstrates substantial real-world impact and a clear market advantage in the burgeoning sustainability sector.

With industries worldwide actively seeking ways to reduce their carbon footprint and improve fuel economy, this segment is poised for significant growth. Innospec's offerings are well-positioned to capitalize on this increasing demand.

High-performance personal care ingredients represent a significant growth area within the Innospec portfolio, aligning with robust market trends. The personal care ingredients market is expected to see substantial expansion, with projected compound annual growth rates (CAGRs) between 2.4% and 6.4% starting in 2025. This growth is fueled by consumers increasingly seeking natural, organic, and multifunctional product options.

Innospec's Performance Chemicals segment, which encompasses its personal care offerings, demonstrated impressive operating income growth in 2024. The company is strategically focusing on developing 'dried, natural and biodegradable products,' directly responding to prevailing consumer preferences and market demands. This strategic direction positions Innospec to capitalize on the innovation and expansion within the personal care sector.

Further underscoring their commitment, Innospec actively participates in key industry events such as in-cosmetics Global 2025. This engagement highlights their dedication to staying at the forefront of innovation and their focus on the dynamic and expanding personal care ingredients market.

Innospec's Drag Reducing Agents (DRAs) are a key component of their Oilfield Services segment. The company achieved record sales for DRAs in 2024, demonstrating strong demand for these efficiency-boosting products.

Despite potential market volatility in oilfield services, DRAs offer a high-growth niche. Their ability to improve pipeline operations and cut costs positions them as a valuable, high-performance product where Innospec seems to hold a solid market standing, with continued focus on this momentum into 2025.

Specialized Additives for Renewable Fuels

Innospec's Fuel Specialties segment is strategically focusing on renewable fuel additives, recognizing the accelerating global energy transition. This initiative positions the company to capitalize on the anticipated substantial growth in demand for specialized additives that enhance the performance and stability of biofuels and other renewable fuel types. The company's existing expertise in fuel additive technology provides a strong foundation for capturing significant future market share in this evolving sector.

The market for renewable fuel additives is experiencing robust expansion. For instance, the global biofuel market was valued at approximately $168.6 billion in 2023 and is projected to reach over $270 billion by 2030, indicating a significant opportunity for additive suppliers like Innospec.

- Market Growth: The renewable fuels sector is a key growth area for Innospec, driven by global decarbonization efforts.

- Performance Enhancement: Innospec's additives are designed to improve the efficiency and longevity of renewable fuels.

- Strategic Focus: The company is actively investing in and developing solutions for this expanding market segment.

- Competitive Advantage: Leveraging existing additive expertise allows Innospec to offer differentiated products in the renewable fuel space.

Innovative Agrochemical and Mining Solutions

Innospec's Performance Chemicals division actively engages in the Agrochemical and Mining sectors, focusing on developing innovative, technology-driven solutions. While precise growth figures for these specific markets within Innospec are not publicly delineated, the company's substantial commitment to Research & Technology is a key indicator of potential future performance.

The company's investment of $47.8 million in R&T during 2024, which resulted in a notable 22% increase in patent filings, strongly suggests a pipeline of novel, high-value products. These advancements are likely designed to address specific, evolving needs within both the agricultural and mining industries, positioning these segments for potential growth.

- Agrochemical Innovations: Innospec's R&T focus could lead to new formulations that enhance crop protection or yield, capitalizing on the global demand for sustainable agriculture.

- Mining Sector Advancements: Investments may yield improved mineral processing chemicals or more environmentally friendly extraction technologies, a critical area for the mining industry.

- Patent Filings as a Growth Indicator: The 22% surge in patent filings in 2024 signals a proactive approach to intellectual property, often a precursor to market-leading product introductions.

- Technology-Driven Solutions: The emphasis on technology-based solutions implies a strategy to differentiate Innospec's offerings in competitive markets through superior performance and efficacy.

Innospec's sustainable fuel technologies, particularly their fuel additives designed to reduce CO2e emissions and improve efficiency, are strong Stars. The company's 2024 Sustainability Report highlighted that these additives prevented the release of 20.8 million metric tons of CO2e, showcasing significant environmental impact and market leadership in a growing sector.

High-performance personal care ingredients also represent a Star, driven by consumer demand for natural and biodegradable products. Innospec's Performance Chemicals segment saw impressive operating income growth in 2024, with a strategic focus on these preferred product types, further reinforced by their active participation in industry events like in-cosmetics Global 2025.

Drag Reducing Agents (DRAs) within the Oilfield Services segment are another Star. Innospec achieved record DRA sales in 2024, indicating strong demand for these efficiency-enhancing products. Their ability to improve pipeline operations and reduce costs positions DRAs as a high-value offering with a solid market standing.

Renewable fuel additives are also positioned as Stars, aligning with the global energy transition. The company is investing in this area, capitalizing on the significant growth in the biofuel market, which was valued at approximately $168.6 billion in 2023 and is projected for substantial future expansion.

| Product Category | BCG Matrix Classification | Key Growth Drivers | 2024 Performance Highlight | Future Outlook |

| Sustainable Fuel Technologies | Star | Global decarbonization efforts, demand for efficiency | Prevented 20.8 million metric tons of CO2e emissions | Continued strong growth expected |

| Personal Care Ingredients | Star | Consumer preference for natural/biodegradable products | Strong operating income growth in Performance Chemicals | High growth potential in expanding market |

| Drag Reducing Agents (DRAs) | Star | Pipeline efficiency improvement, cost reduction | Record sales in 2024 | Sustained demand and market leadership |

| Renewable Fuel Additives | Star | Energy transition, biofuel market expansion | Strategic investment in a growing sector | Significant market share capture anticipated |

What is included in the product

The Innospec BCG Matrix analyzes its business units based on market growth and share, guiding strategic decisions.

A clear, visual Innospec BCG Matrix instantly clarifies which business units require investment and which can be divested, alleviating strategic uncertainty.

Cash Cows

Innospec's Established Fuel Specialties Portfolio is a prime example of a Cash Cow within the BCG Matrix. In 2024, this segment achieved record financial results, showcasing robust revenue, profit, operating income, and margin growth. This strong performance is projected to continue with stable, albeit continued, growth through 2025.

The segment's maturity is underscored by its consistently high gross margins, reaching 35.7% in the first quarter of 2025. This high profitability reflects a dominant market position and significant cash flow generation capabilities. These essential fuel additives, like those for gasoline and diesel, benefit from widespread adoption and require minimal promotional spending due to their entrenched market presence.

The core personal care and home care surfactants within Innospec's Performance Chemicals segment are clear Cash Cows. This segment demonstrated robust financial health in 2024, reporting a notable 14% increase in operating income compared to the previous year.

These foundational surfactant and additive products, essential for everyday consumer goods, represent a mature, high-market-share business. Their consistent demand ensures a reliable and substantial cash flow generation, underpinning the company's overall financial stability.

Innospec's Refinery Products and Solutions segment boasts a long-standing leadership in creating and supplying comprehensive fuel additive solutions for refiners. This deep market penetration and enduring customer loyalty indicate a strong position in a mature market, generating consistent and dependable cash flow.

Industrial Fuel Additives (e.g., for furnaces/boilers)

Innospec's industrial fuel additives, serving furnaces and boilers, are a prime example of a Cash Cow within their BCG Matrix. These are mature markets where the company leverages its expertise in specialized formulations and robust supply chains.

The demand for these additives is generally stable and predictable, contributing to consistent, strong cash flow for Innospec. This segment likely benefits from long-term customer relationships and the critical nature of fuel efficiency and emissions control in industrial operations.

- Market Position: Likely a leader in specialized industrial fuel additive segments.

- Growth Rate: Mature markets with low to moderate growth.

- Profitability: High, driven by established market share and operational efficiency.

- Cash Flow: Significant and consistent positive cash flow generation.

Mature Oilfield Production Chemicals in Stable Regions

Innospec's mature oilfield production chemicals in stable regions are positioned as cash cows within their business portfolio. These established product lines benefit from consistent demand and a loyal customer base, providing a steady stream of revenue even amidst broader industry fluctuations.

For 2025, Innospec is strategically targeting growth in areas like US completions and production, alongside maintaining momentum in the Middle East. This focus allows them to leverage existing strengths in mature segments while pursuing new opportunities.

- Stable Demand: Mature oilfield production chemicals in regions with established infrastructure and consistent extraction activities offer predictable revenue streams.

- Established Market Share: Innospec's historical presence and strong customer relationships in these segments translate to a defensible market position.

- Revenue Generation: These products act as reliable income generators, supporting investment in higher-growth areas of the business.

- Resilience: Despite challenges in other oilfield segments, these mature offerings provide a stable financial foundation for the company.

Innospec's Fuel Specialties segment, particularly its established additives for gasoline and diesel, continues to perform strongly as a Cash Cow. This segment saw robust revenue and profit growth in 2024, with projections for stable, continued growth through 2025. Its high gross margins, reaching 35.7% in Q1 2025, reflect its dominant market position and minimal need for promotional spending.

| Segment | BCG Category | 2024 Performance Highlight | 2025 Outlook | Key Characteristic |

|---|---|---|---|---|

| Fuel Specialties | Cash Cow | Record financial results, strong revenue & profit growth | Stable, continued growth | High gross margins (35.7% in Q1 2025), entrenched market presence |

| Performance Chemicals (Personal & Home Care Surfactants) | Cash Cow | 14% increase in operating income | Consistent demand, reliable cash flow | Mature, high-market-share business, essential consumer goods |

| Refinery Products and Solutions | Cash Cow | Long-standing leadership in fuel additive solutions | Consistent and dependable cash flow | Deep market penetration, enduring customer loyalty |

| Industrial Fuel Additives | Cash Cow | Stable and predictable demand | Consistent, strong cash flow generation | Mature markets, specialized formulations, robust supply chains |

| Oilfield Production Chemicals (Stable Regions) | Cash Cow | Consistent demand and loyal customer base | Targeting growth in US completions & production, maintaining Middle East momentum | Established infrastructure, predictable revenue streams, defensible market position |

What You’re Viewing Is Included

Innospec BCG Matrix

The Innospec BCG Matrix you are currently viewing is the identical, fully-unlocked document you will receive immediately after your purchase. This means you'll get the complete, professionally formatted analysis without any watermarks or placeholder content. It's ready for immediate integration into your strategic planning, providing a clear and actionable overview of Innospec's product portfolio.

Dogs

Innospec's Oilfield Services segment saw a substantial 37% revenue drop in Q1 2025. This downturn was largely driven by decreased demand for production chemicals in Latin America. Management anticipates no improvement in this sector for the upcoming quarters.

This situation points to Innospec holding a low market share within a stagnant or shrinking regional market. Consequently, these particular product lines or operational areas in Latin America can be classified as a 'Dog' in the BCG matrix, drawing resources without generating substantial returns.

Legacy products with declining demand, like older chemical formulations, often represent Innospec's "Dogs" in the BCG matrix. These are products with low market share in markets that are either stagnant or shrinking. For instance, older fuel additives that don't meet current environmental standards or performance demands would fit here, generating minimal returns and requiring careful management to avoid further losses.

Within Innospec's diverse 'other specialty chemicals' segment, certain niche industrial products may be classified as Dogs. These are likely characterized by low market share and low growth, potentially due to shifts in manufacturing technologies or intensified competition. For instance, if a particular chemical used in an older industrial process sees declining adoption, its sales would be minimal.

Products Affected by Phasing Out Technologies

As industries advance, technologies become outdated, leading to reduced demand for associated chemicals. For Innospec, products linked to these phasing-out technologies, without viable alternative uses, would fall into the 'Dog' category of the BCG Matrix. This classification signifies low market growth and a declining market share.

For instance, consider legacy fuel additives that were once crucial but are now being replaced by more environmentally friendly or efficient alternatives. Innospec's exposure to such segments, if not strategically managed through diversification or innovation, would reflect this 'Dog' status. The company's 2024 financial reports would likely show declining revenues and potentially shrinking margins for these specific product lines.

- Declining Market Share: Products tied to obsolete technologies face shrinking customer bases.

- Low Market Growth: The overall market for these technologies is contracting.

- Reduced Profitability: As demand wanes, economies of scale diminish, impacting profit margins.

- Strategic Challenge: Companies must decide whether to divest, harvest, or attempt to revitalize these products.

Geographically Limited or Niche Products with Low Scalability

Geographically limited or niche products with low scalability, often categorized as Dogs in the BCG Matrix, represent offerings that cater to very specific, non-expanding markets or specialized applications. These products might achieve a break-even point but struggle to generate substantial growth or profits. For instance, a specialized chemical additive designed for a single, small manufacturing plant in a declining industrial region would fit this description. Such products can consume valuable resources, including capital and management attention, that could otherwise be invested in more promising ventures.

Innospec’s portfolio, like many chemical companies, likely contains products that fall into this category. While specific product-level data for 2024 is often proprietary, industry trends suggest that companies are increasingly divesting or minimizing focus on such low-growth, low-margin segments. For example, a report by McKinsey in late 2023 highlighted that companies focusing on portfolio optimization were shedding an average of 5% of their business units, often targeting those with limited scalability and market potential.

- Limited Market Size: These products serve a small customer base or a specific geographic area, restricting revenue potential.

- Low Growth Prospects: The target market is either static or declining, offering little opportunity for expansion.

- Resource Drain: They can tie up capital, R&D, and operational resources that could be deployed more effectively in high-growth areas.

- Strategic Reallocation: Companies often look to exit or divest these segments to improve overall portfolio performance and focus on core competencies.

Dogs in Innospec's portfolio represent products with low market share in slow-growing or declining markets. These segments, often tied to legacy technologies or niche applications, provide minimal returns and can consume resources. For instance, older fuel additives not meeting current environmental standards would fit this classification. Innospec's 2024 performance likely showed these areas contributing minimally to overall revenue, necessitating strategic decisions regarding their future.

| Innospec Product Category (Potential Dogs) | Market Share (Estimated) | Market Growth (Estimated) | Profitability (Estimated) |

|---|---|---|---|

| Legacy Fuel Additives (Obsolete Formulations) | Low | Declining | Low/Negative |

| Niche Industrial Chemicals (Phasing-out Technologies) | Low | Stagnant/Declining | Low |

| Specialized Chemicals for Declining Regions | Low | Declining | Break-even/Low |

Question Marks

Innospec's Performance Chemicals segment is channeling significant R&D into sustainable and biodegradable personal care ingredients, aligning with a growing consumer demand for eco-friendly products. This strategic focus targets a high-growth market, indicating substantial future potential for these innovative formulations.

Currently, these nascent biodegradable ingredients likely hold a modest market share as they work towards wider market penetration and acceptance. Their position suggests they are in the "Question Marks" category of the BCG matrix, requiring substantial investment to transition into market-leading "Stars."

Innospec's LaZuli™ deepwater subsea production products, a recent launch in the Oilfield Services segment, are positioned within a high-growth market expected to benefit from increased deepwater exploration activity. This suggests LaZuli™ could be a Question Mark in the BCG matrix, indicating high market growth potential.

Despite the promising market outlook, as a new entrant, LaZuli™ likely possesses a low current market share. This characteristic, combined with the substantial investment required for market penetration and development, firmly places these innovative chemical solutions in the Question Mark category.

Innospec's Oilfield Services Business Unit is strategically expanding into the international oilfield intermediates chemical sector, with a particular focus on Europe and the Middle East. This move signifies a push into new, high-potential sub-segments and geographies within the broader oilfield services market.

This expansion into intermediates positions Innospec in a market characterized by high growth potential but currently a relatively low market share. The company will need to make strategic investments to effectively capture market leadership in these new areas.

Advanced Additives for Emerging Fuel Types

Innospec is actively investing in advanced additives for emerging fuel types, positioning itself for future growth in nascent markets. These investments are focused on technologies that are still developing, meaning Innospec currently has a smaller market share in these specific segments.

The company's strategy extends beyond traditional biofuels to include additives for entirely new fuel concepts and non-fuel applications. This forward-looking approach acknowledges the potential for high returns as these emerging fuel technologies gain traction and mature.

- Research Focus: Exploring additives for hydrogen, ammonia, and synthetic fuels.

- Market Position: Low current market share in these developing fuel segments.

- Strategic Outlook: Targeting high-growth potential as new fuel technologies mature.

- Investment Rationale: Building early presence in markets with significant future upside.

Digital and Data-Driven Chemical Solutions

The specialty chemicals sector is increasingly embracing digital and data-driven approaches to enhance product performance and optimize usage. If Innospec is developing software-integrated chemical solutions or advanced analytics platforms, these initiatives would position the company within a high-growth, tech-centric market. This segment is characterized by rapid innovation and a strong demand for intelligent solutions that provide greater efficiency and insights for customers.

Innospec's potential foray into digital and data-driven chemical solutions aligns with broader industry trends. For instance, the global market for industrial analytics, a key component of such strategies, was projected to reach over $10 billion by 2024, demonstrating significant growth potential. Companies offering these integrated solutions are tapping into a market that values predictive maintenance, process optimization, and real-time performance monitoring.

- Market Trend: The specialty chemicals industry is shifting towards digital integration for enhanced performance and efficiency.

- Growth Potential: Digital and data-driven solutions operate in a high-growth tech market.

- Innospec's Position: If Innospec is investing in these areas, it likely holds a low market share currently, indicating early-stage development or market entry.

- Customer Value: These solutions offer customers benefits like optimized chemical usage, improved process control, and data-driven insights.

Innospec's emerging sustainable ingredients for personal care represent a classic "Question Mark" in the BCG matrix. While the market for eco-friendly products is experiencing robust growth, these specific ingredients are likely in their early stages of market penetration, requiring significant investment to capture a larger share.

Similarly, LaZuli™ subsea production products and the expansion into international oilfield intermediates are also positioned as Question Marks. They operate in high-growth segments within Oilfield Services but, as newer offerings or market entries, they would naturally hold a low current market share, necessitating substantial capital to compete effectively.

Innospec's investments in additives for future fuel technologies, like hydrogen and ammonia, and potential digital/data-driven chemical solutions also fall into the Question Mark category. These are high-potential, nascent markets where Innospec is building an early presence, meaning current market share is minimal but future growth prospects are substantial.

These Question Mark initiatives collectively highlight Innospec's strategic focus on innovation and future market opportunities, even though they demand considerable investment and carry inherent risks due to their early-stage market positions.

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market data, encompassing sales figures, competitor analysis, and consumer behavior trends, to provide a comprehensive strategic overview.