Innospec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

Innospec navigates a complex landscape shaped by powerful industry forces, from the bargaining power of its customers to the constant threat of new competitors entering the market.

Understanding these dynamics is crucial for any stakeholder looking to grasp Innospec's strategic positioning and future growth potential.

The complete report reveals the real forces shaping Innospec’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Innospec's reliance on specific chemical inputs for its specialty formulations directly impacts supplier bargaining power. The availability and uniqueness of these raw materials are critical. For instance, if a particular chemical component is only produced by a handful of global manufacturers, those suppliers hold significant leverage over Innospec.

This concentration means suppliers can dictate terms and pricing, especially if Innospec cannot easily substitute the material. In 2023, the global specialty chemicals market saw price fluctuations driven by supply chain disruptions, highlighting the vulnerability of companies like Innospec to raw material dependency.

The bargaining power of suppliers for Innospec is significantly influenced by the switching costs associated with changing suppliers. If Innospec faces substantial hurdles in finding and integrating new suppliers, such as the need for extensive re-qualification of raw materials or re-engineering of product formulations, suppliers gain considerable leverage. For instance, in 2024, Innospec's reliance on specialized chemical components, which often require rigorous testing and regulatory approval for new sources, makes switching between suppliers a costly and time-consuming process, thereby increasing supplier power.

When the number of suppliers is small and they are highly concentrated, they gain significant leverage to dictate terms to companies like Innospec. This concentration means fewer alternatives for Innospec to source critical materials, thereby increasing supplier bargaining power.

If Innospec relies on suppliers who provide highly differentiated or patented raw materials essential for its custom formulations, this further amplifies supplier power. Innospec's business model, which emphasizes innovative and tailored solutions, inherently requires specialized inputs, making it more dependent on these unique suppliers.

Threat of Forward Integration by Suppliers

Suppliers who can credibly threaten to move into manufacturing specialty chemicals themselves gain considerable leverage over Innospec. This is especially true if Innospec's manufacturing processes are not overly complex or if a supplier already has superior technological know-how. For example, if a key raw material supplier to Innospec has developed proprietary synthesis methods, they could potentially leverage this to produce finished specialty chemicals, directly competing with Innospec.

The complexity of Innospec's custom formulations and the intellectual property embedded within them can act as a significant deterrent to suppliers considering forward integration. Many of Innospec's products are tailored to specific customer needs, requiring deep application knowledge and advanced R&D capabilities that are difficult for suppliers to replicate quickly. This specialization limits the number of suppliers who could realistically integrate forward without substantial investment and expertise.

- Supplier Integration Risk: The potential for suppliers to integrate forward into Innospec's business operations poses a significant threat, as it could lead to increased competition and reduced margins for Innospec.

- Technological Barriers: The highly specialized nature of Innospec's chemical formulations and manufacturing processes can create substantial technological barriers, making it difficult for suppliers to effectively integrate forward.

- Customization as a Defense: Innospec's focus on custom-tailored solutions for its clients, requiring deep application knowledge, serves as a strong defense against supplier forward integration, as replicating this expertise is challenging.

Importance of Innospec's Volume to Suppliers

The significance of Innospec's purchasing volume to its suppliers directly shapes their bargaining power. When Innospec represents a substantial portion of a supplier's revenue, that supplier is more inclined to offer competitive pricing and favorable contract terms to retain such a valuable client. For instance, if a key raw material supplier derives 15% of its annual sales from Innospec, Innospec’s ability to negotiate is enhanced.

Conversely, if Innospec's orders constitute only a minor percentage of a supplier's overall business, say less than 2%, the supplier holds considerably more leverage. In such scenarios, the supplier is less dependent on Innospec and can dictate terms with less concern about losing the business. This dynamic is crucial in understanding the supplier's influence on Innospec's cost structure and operational continuity.

- Supplier Dependence: The percentage of a supplier's total sales attributed to Innospec is a key determinant of supplier bargaining power.

- Negotiation Leverage: A higher proportion of sales to Innospec typically translates to greater willingness from suppliers to negotiate terms.

- Market Concentration: If Innospec is a dominant customer for a specialized supplier, its bargaining power is amplified.

- Supplier Diversification: Suppliers with a broad customer base are less susceptible to pressure from any single client like Innospec.

Innospec's bargaining power with its suppliers is significantly influenced by the concentration of suppliers for its key chemical inputs. When the supply base is limited, suppliers gain considerable leverage to dictate terms and pricing, especially if Innospec faces high switching costs for specialized materials. In 2024, the specialty chemicals market continues to grapple with supply chain vulnerabilities, making raw material dependency a critical factor.

The company's reliance on unique or patented raw materials further amplifies supplier power, as finding viable alternatives can be challenging and costly. For instance, Innospec's commitment to custom formulations necessitates specialized inputs, which are often controlled by a few key manufacturers. This dependence means suppliers can command higher prices and more favorable contract terms, impacting Innospec's cost structure.

The bargaining power of suppliers is also tied to their own integration risks and Innospec's ability to deter forward integration through its proprietary knowledge and customization capabilities. For example, the complex R&D and application expertise required for Innospec's tailored solutions act as a barrier for suppliers looking to enter its market directly.

| Factor | Impact on Innospec | 2024 Market Context |

| Supplier Concentration | High leverage for few suppliers | Continued supply chain tightness in key chemical inputs |

| Switching Costs | Increases supplier power due to re-qualification needs | Regulatory hurdles and testing requirements make sourcing changes difficult |

| Uniqueness of Inputs | Amplifies supplier leverage for specialized materials | Proprietary chemical synthesis methods limit alternatives |

| Supplier Forward Integration Risk | Threat of competition if suppliers can replicate Innospec's processes | Innospec's customization and IP act as a defense |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Innospec's specialty chemicals and fuel additives markets.

Instantly visualize Innospec's competitive landscape with a dynamic, interactive dashboard, allowing for rapid assessment of market pressures.

Customers Bargaining Power

Innospec's customer base spans several key sectors like personal care, fuel additives for transportation, agriculture, and oilfield chemicals. The bargaining power of customers is significantly influenced by their concentration within these end markets.

If a substantial portion of Innospec's sales are concentrated with a few large buyers in any of these segments, those key customers gain considerable leverage. This concentration allows them to negotiate for lower prices or more favorable contract terms, directly impacting Innospec's profitability.

Customer price sensitivity is a key factor in the bargaining power of buyers. When Innospec's products make up a large part of a customer's expenses, or if the customer's own products are easily substituted, they will push harder for lower prices.

For instance, if a customer in the automotive sector, a significant market for Innospec's fuel additives, faces intense competition and low margins, they will be more inclined to seek price reductions. In 2023, the global automotive market saw continued pressure on pricing due to economic uncertainties, making cost-conscious purchasing a priority for many OEMs.

However, Innospec's strategy of emphasizing product performance and operational efficiency can mitigate this sensitivity. By offering solutions that lead to cost savings or improved output for their customers, Innospec can justify its pricing and reduce the direct impact of raw material cost fluctuations on customer demand.

The ease with which Innospec's customers can switch to alternative specialty chemical suppliers significantly influences their bargaining power. If numerous competitors offer comparable products, customers gain leverage.

In 2023, the specialty chemicals market saw increased competition, with new entrants in regions like Asia-Pacific. This heightened competition means customers have more options, potentially increasing their ability to negotiate prices or terms with Innospec.

Innospec strives to mitigate this by focusing on custom formulations and a robust global delivery network, aiming to create switching costs and differentiate its value proposition, thereby reducing customer bargaining power.

Threat of Backward Integration by Customers

Customers might consider producing specialty chemicals themselves, particularly for simpler, high-volume products. This potential for backward integration strengthens their negotiating position. For instance, a large automotive manufacturer might evaluate producing certain fuel additives if the complexity is low and the cost savings are significant.

However, the highly specialized and proprietary nature of Innospec's core chemistry often presents a substantial barrier to customer backward integration. Developing and scaling such complex formulations requires significant R&D investment and specialized manufacturing expertise, which most customers lack.

- Customer Integration Barrier: The technical complexity and R&D intensity of Innospec's specialty chemicals make in-house production by customers challenging.

- Negotiating Leverage: The *threat* of backward integration, even if not fully realized, provides customers with leverage in price and supply negotiations.

- Innospec's Defense: Innospec's continuous innovation and focus on highly specialized, performance-driven chemistries serve as a strong deterrent against customer integration.

Product Differentiation and Value Proposition

Innospec's focus on product differentiation significantly curtails customer bargaining power. By offering innovative solutions that boost performance, efficiency, and sustainability, Innospec creates indispensable value. For instance, their Fuel Specialties segment, which accounted for approximately 39% of Innospec's revenue in 2023, provides additives that improve fuel economy and reduce emissions, making these products difficult for customers to substitute without compromising their own operational goals.

When Innospec's offerings are perceived as unique and essential, customers find it challenging to negotiate lower prices or switch to competitors. This is particularly true in specialized markets where Innospec holds a strong technological edge. Their ability to tailor solutions to specific customer needs further solidifies this advantage, making price a less dominant factor in purchasing decisions.

The company's commitment to research and development, evidenced by its consistent investment in new product innovation, ensures a continuous pipeline of differentiated offerings. This strategy directly counters the threat of customers leveraging price competition, as the unique benefits provided often outweigh cost considerations.

- Product Differentiation: Innospec's advanced fuel additives and specialty chemicals offer unique performance enhancements, reducing customer reliance on alternative, less effective options.

- Value Proposition: By delivering solutions that improve efficiency and sustainability, Innospec creates a high perceived value, diminishing customers' ability to demand price concessions.

- Innovation Investment: Continued R&D spending, a core part of Innospec's strategy, fuels the development of proprietary technologies that further differentiate its product portfolio.

- Customer Loyalty: The indispensable nature of Innospec's specialized products fosters strong customer loyalty, limiting the bargaining power of individual buyers.

The bargaining power of Innospec's customers is moderate, influenced by factors like customer concentration and price sensitivity. While Innospec's differentiated products and strong R&D create a buffer, the competitive landscape and the potential for customers to seek alternatives mean they still hold some leverage.

Innospec's strategy of emphasizing performance and custom solutions helps to anchor customer loyalty. For instance, in 2023, their Fuel Specialties segment, a significant revenue driver, continued to benefit from demand for additives that enhance fuel efficiency, a key customer concern.

However, the increasing availability of competing specialty chemicals, particularly from emerging markets in 2023, provides customers with more options. This competitive pressure means customers can more readily negotiate for better pricing or terms if Innospec's offerings are not perceived as uniquely essential.

| Factor | Impact on Bargaining Power | Innospec's Mitigation Strategy |

|---|---|---|

| Customer Concentration | Moderate to High (if few large buyers) | Focus on diverse end markets (personal care, fuel, oilfield) |

| Price Sensitivity | Moderate (depends on product cost share) | Highlighting performance benefits and cost savings for customers |

| Switching Costs | Moderate (due to product differentiation) | Custom formulations, strong R&D, global delivery network |

| Threat of Backward Integration | Low (due to technical complexity) | Proprietary chemistries and R&D intensity |

Preview the Actual Deliverable

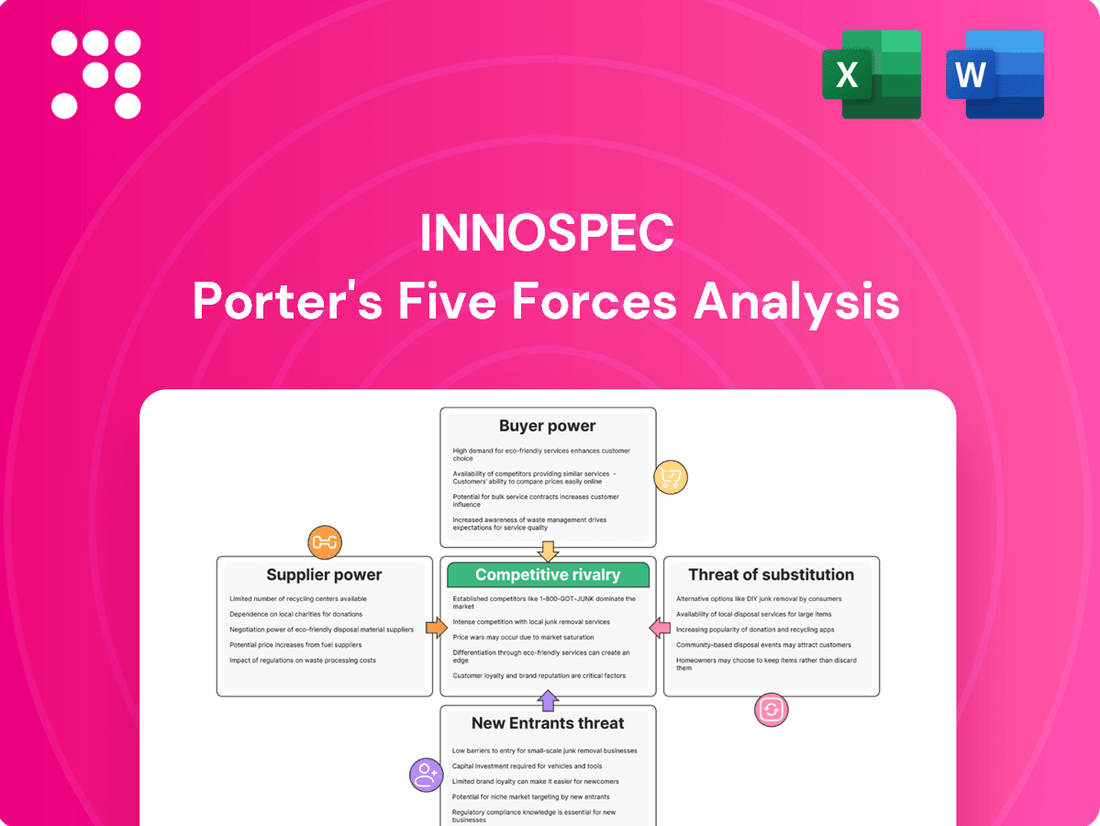

Innospec Porter's Five Forces Analysis

This preview showcases the complete Innospec Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely the same comprehensive report you will receive immediately after purchase, ensuring full transparency and immediate utility.

Rivalry Among Competitors

The specialty chemicals sector, where Innospec operates, is characterized by a substantial number of competitors, ranging from global giants to specialized niche providers. This crowded landscape means Innospec faces constant pressure from a diverse set of rivals across its key business segments, including fuel additives, oilfield chemicals, and personal care ingredients.

Major global chemical companies such as BASF, Dow, and Croda, with their extensive resources and broad product portfolios, represent significant competitive forces. These large players often have economies of scale and established distribution networks that can challenge Innospec's market position. For instance, BASF reported revenue of €65 billion in 2023, showcasing its immense market presence and capacity.

In addition to these industry titans, Innospec also contends with numerous smaller, agile companies that focus on specific product categories or regional markets. These niche competitors can often offer specialized solutions or more tailored customer service, creating localized competitive intensity. The dynamic nature of these markets demands continuous innovation and strategic adaptation from Innospec to maintain its competitive edge.

The growth rate within the specialty chemicals sector directly impacts competitive rivalry. For instance, the overall specialty chemicals market is expected to grow at a compound annual growth rate (CAGR) of 3.66% between 2025 and 2034. This moderate growth means companies are actively vying for a larger piece of an expanding pie, which can intensify competition.

Specific sub-segments also show varied growth trajectories. Personal care ingredients are projected to see a CAGR of 4.40% from 2025 to 2030, while fuel additives anticipate a CAGR of 4.5% from 2025 to 2035. Even oilfield chemicals, with a projected CAGR of 3.27% from 2025 to 2033, contribute to this dynamic. These growth rates, while generally positive, can lead to increased competition as players strive to capture market share within these expanding areas.

When market growth is slower, rivalry tends to become more pronounced. Companies may resort to more aggressive pricing or innovation strategies to secure existing demand, thereby heightening the competitive landscape for established players and newcomers alike.

Innospec's focus on custom formulations and innovative solutions acts as a shield against direct price wars, allowing them to command higher margins. For instance, their Fuel Specialties segment, a significant revenue driver, often involves tailored additive packages designed for specific engine types and fuel blends, making direct comparison difficult.

However, this differentiation strategy faces pressure. If rivals, particularly larger chemical conglomerates with extensive R&D budgets, can swiftly match Innospec's customized offerings or if specific additive categories become more standardized, the competitive intensity in these areas will naturally increase. The Specialty Chemicals market, where Innospec operates, saw global growth of approximately 4.5% in 2024, indicating a dynamic landscape where innovation is constantly challenged.

High Fixed Costs and Capacity Utilization

The specialty chemicals sector, where Innospec operates, is characterized by substantial capital outlays for research and development alongside manufacturing infrastructure. These significant upfront investments create high fixed costs for industry players.

This cost structure incentivizes companies to maximize production output to spread these fixed costs over a larger volume, potentially leading to intensified price competition. When the industry experiences overcapacity or a downturn in demand, this pressure to maintain volume can result in aggressive pricing strategies.

For instance, in 2024, the global chemical industry faced fluctuating demand patterns, which can exacerbate the effects of high fixed costs. Companies often prioritize capacity utilization to offset these ongoing expenses, even if it means accepting lower profit margins on individual sales.

- High R&D and Manufacturing Investment: Specialty chemicals require significant capital for innovation and production facilities.

- Capacity Utilization Pressure: Companies aim for high operating rates to amortize fixed costs, influencing pricing.

- Pricing Aggression: In periods of weak demand or overcapacity, firms may lower prices to maintain sales volume.

- 2024 Industry Context: The chemical sector in 2024 experienced market dynamics that amplified these competitive pressures.

Exit Barriers

Innospec, like many in the specialty chemicals sector, faces considerable exit barriers. These can include highly specialized manufacturing assets that are difficult to repurpose or sell, leading to sunk costs that encourage continued operation even in less profitable periods.

These high exit barriers can trap capital and expertise within the industry. For instance, if a significant portion of Innospec's production facilities are tailored for specific chemical processes, their resale value might be substantially lower than their book value, making closure economically unappealing.

The persistence of firms due to these barriers can lead to prolonged periods of overcapacity. This situation intensifies competitive rivalry, as companies fight for market share even when overall industry profitability is suppressed. Innospec's ability to navigate this environment depends on its cost structure and product differentiation.

- Specialized Assets: Many chemical plants require significant customization for specific product lines, limiting their value if repurposed.

- Long-Term Contracts: Commitments to supply specific chemicals can obligate companies to continue production, even if market conditions become unfavorable.

- Employee Severance Costs: Significant costs associated with laying off a specialized workforce can deter companies from exiting a market.

- Brand Reputation: Maintaining a presence, even at low profitability, can be seen as crucial for long-term brand value and future market re-entry.

Competitive rivalry within the specialty chemicals sector, where Innospec operates, is intense due to the presence of numerous global and niche players. Companies like BASF, with its €65 billion revenue in 2023, and agile smaller firms create a dynamic environment. Innospec's strategy of custom formulations helps mitigate direct price competition, but rivals with larger R&D budgets can challenge this differentiation.

The industry's high fixed costs from R&D and manufacturing also fuel rivalry, pushing firms to maximize capacity utilization. This can lead to price competition, especially during demand downturns, as seen with fluctuating market dynamics in the global chemical industry in 2024. High exit barriers, such as specialized assets and severance costs, further contribute to prolonged competition by keeping firms invested even in less profitable times.

| Competitor Type | Example | Impact on Rivalry |

|---|---|---|

| Global Giants | BASF | Economies of scale, established networks |

| Niche Providers | Specialized regional firms | Tailored solutions, localized intensity |

| Market Growth Rate | Specialty Chemicals (3.66% CAGR 2025-2034) | Vying for market share |

SSubstitutes Threaten

Customers in Innospec's diverse end markets, particularly in fuel additives and oilfield services, face increasing pressure to adopt alternative technologies or non-chemical solutions. For example, advancements in internal combustion engine efficiency and the growing adoption of electric vehicles directly threaten the demand for traditional fuel additives, a core Innospec business. In 2024, the global EV market continued its rapid expansion, with sales projected to reach over 17 million units, a significant increase from previous years, impacting the volume of gasoline and diesel requiring additives.

Similarly, in the oilfield services sector, innovations in mechanical extraction techniques and the push for more sustainable, less chemically intensive operations present a viable substitute for some of Innospec's chemical offerings. The increasing focus on environmental regulations and operational efficiency drives exploration into these alternative methods, potentially reducing reliance on chemical treatments for well stimulation and production. This trend is supported by a growing investment in green technologies within the energy sector, with global spending on clean energy expected to surpass $2 trillion in 2024.

The attractiveness of substitute products for Innospec's specialty chemicals hinges on their price-performance ratio. If alternatives can deliver similar functionalities at a lower price point, or even superior performance at a slightly higher cost, the threat intensifies.

Innospec's strategic emphasis on operational efficiency and sustainable product development is designed to present a compelling value proposition to customers, thereby mitigating the appeal of less advanced or environmentally impactful substitutes.

For instance, as of early 2024, the global market for sustainable chemical alternatives is projected to see significant growth, indicating a rising consumer and industrial demand for products offering both performance and environmental benefits, a trend Innospec is actively addressing.

The threat of substitutes for Innospec's chemical solutions is influenced by the costs and complexity customers face when moving to alternative products or processes. For instance, if a customer needs to significantly retool their manufacturing equipment to use a different additive, or undergo extensive retraining for their staff, these high switching costs would make them less likely to consider substitutes.

Innospec's specialty chemicals, particularly in areas like fuel additives and personal care ingredients, often involve intricate formulations and established supply chains. Switching from these can necessitate significant investment in research and development for the customer to validate new formulations, and may also require navigating complex regulatory approval processes, further increasing the barriers to substitution.

While specific switching cost data for Innospec's diverse product lines isn't publicly detailed, the general chemical industry often sees substantial costs associated with product reformulation and process integration. For example, in the automotive sector, changing a fuel additive could require extensive engine testing and emissions certification, representing a significant hurdle.

Regulatory Shifts Favoring Alternatives

Changes in environmental regulations or evolving industry standards can significantly boost the appeal of substitute products or solutions. For instance, increasingly stringent emissions standards, like those being implemented globally, could accelerate the transition to electric vehicles. This shift directly impacts the demand for traditional fuel additives, Innospec's core business, by potentially reducing the overall volume of gasoline and diesel consumed.

Furthermore, a growing emphasis on sustainability and green chemistry is driving innovation in alternative additive technologies. Companies are increasingly exploring bio-based or less environmentally impactful chemical formulations. Innospec itself has noted the trend towards more sustainable solutions in its investor communications, suggesting a proactive approach to this threat.

The regulatory landscape is a key driver here. For example, the European Union's Green Deal and similar initiatives worldwide are setting ambitious targets for emissions reduction and the adoption of cleaner technologies. These policies create a fertile ground for substitutes that offer a more favorable environmental profile, potentially eroding market share for conventional chemical additives.

- Regulatory pressure on fossil fuels: Stricter emissions mandates are a direct threat to demand for traditional fuel additives.

- Rise of electric vehicles: The accelerating adoption of EVs, supported by government incentives, reduces the need for gasoline and diesel additives.

- Demand for sustainable alternatives: Consumer and corporate preference for eco-friendly products favors bio-based or low-impact chemical solutions.

- Policy-driven market shifts: Global environmental policies are actively reshaping industries, creating opportunities for substitute technologies.

Emergence of Bio-based or Eco-friendly Alternatives

The increasing consumer and regulatory demand for sustainability presents a significant threat of substitution for Innospec's product lines. This is particularly evident in markets like personal care and oilfield chemicals, where greener options are gaining traction.

Bio-based or biodegradable chemical alternatives are becoming more readily available and are seeing wider adoption. For instance, the personal care market is witnessing a surge in demand for natural and plant-derived ingredients, directly challenging traditional synthetic formulations. Similarly, in the oilfield sector, environmental concerns are driving the development and use of more eco-friendly drilling fluids and additives.

- Growing Demand for Sustainability: Consumers and regulators worldwide are pushing for more environmentally friendly products, impacting chemical formulations.

- Bio-based Ingredient Adoption: The personal care industry, a key market for Innospec, is increasingly incorporating plant-derived and biodegradable ingredients.

- Eco-friendly Oilfield Chemicals: Environmental regulations and corporate sustainability goals are encouraging the use of greener alternatives in oil and gas operations.

- Substitution Risk: The rise of these alternatives directly threatens the market share of Innospec's conventional chemical offerings.

The threat of substitutes for Innospec is substantial, particularly as environmental regulations tighten and consumer preferences shift towards sustainability. For example, the accelerating global adoption of electric vehicles, with sales expected to exceed 17 million units in 2024, directly reduces the demand for traditional fuel additives. This trend is further amplified by increasing investments in clean energy technologies, projected to surpass $2 trillion in 2024, which favors alternative solutions over conventional chemical treatments.

Innospec's specialty chemicals, like those used in personal care and oilfield services, face competition from bio-based and biodegradable alternatives. The personal care market, for instance, is seeing a significant rise in demand for natural ingredients, challenging synthetic formulations. Similarly, the oilfield sector is moving towards greener chemicals, driven by both regulation and corporate sustainability goals.

The appeal of substitutes is largely determined by their price and performance. If alternative products offer comparable or superior functionality at a competitive price, the threat to Innospec's market share increases. High switching costs for customers, such as the need for significant R&D or regulatory re-approval, can mitigate this threat, but the overall trend favors more sustainable and efficient alternatives.

| Market Segment | Substitute Trend | Impact on Innospec | Supporting Data (2024) |

|---|---|---|---|

| Fuel Additives | EV Adoption | Reduced demand for gasoline/diesel additives | Global EV sales projected > 17 million units |

| Oilfield Services | Sustainable/Mechanical Solutions | Decreased reliance on chemical treatments | Clean energy investment > $2 trillion |

| Personal Care | Bio-based/Natural Ingredients | Competition for synthetic formulations | Growing market for natural ingredients |

Entrants Threaten

The specialty chemicals sector, where Innospec operates, is inherently capital-intensive. Companies need substantial upfront investment for research and development, state-of-the-art manufacturing plants, and extensive global supply chains. For instance, establishing a new specialty chemical production facility can easily run into hundreds of millions of dollars.

These high capital requirements act as a significant barrier to entry for potential new competitors. It's not just about having the money; it's about having enough to achieve the scale and technological sophistication necessary to compete effectively with established players like Innospec. This financial hurdle deters many smaller or less-funded entities from entering the market.

Innospec's focus on specialized, custom formulations creates a substantial barrier for new entrants. The company's proprietary technologies, backed by patents and trade secrets, are crucial for its competitive edge in areas like fuel additives and personal care ingredients. For instance, Innospec's commitment to innovation is reflected in its consistent investment in research and development, aiming to create unique chemical solutions that are difficult for competitors to replicate quickly or cost-effectively.

The specialty chemicals sector, particularly for fuel additives and oilfield chemicals, operates under a heavy cloud of stringent environmental, health, and safety regulations. This means any newcomer must navigate a labyrinth of complex rules and costly compliance procedures.

For instance, in 2024, chemical companies faced increasing scrutiny over emissions and product safety, leading to higher R&D and testing expenses. These significant upfront investments and ongoing compliance burdens act as a substantial deterrent for potential new entrants, favoring established companies like Innospec that have already invested in and mastered these regulatory frameworks.

Access to Distribution Channels and Customer Relationships

New companies entering the specialty chemicals market face significant hurdles in securing access to established distribution channels. Innospec, for instance, has cultivated a global delivery network over years, ensuring efficient product reach to diverse industrial clients. This infrastructure is a substantial barrier for newcomers.

Building and maintaining strong, long-term customer relationships across various sectors like fuel additives, personal care, and performance chemicals requires significant investment in trust and reliability. New entrants will find it challenging to replicate the brand loyalty and established trust that incumbents like Innospec enjoy. For example, in 2023, Innospec reported revenue of $1.95 billion, demonstrating its substantial market presence and customer base.

- Distribution Network: Incumbents possess extensive global logistics and supply chain capabilities.

- Customer Loyalty: Decades of reliable service foster strong brand preference.

- Switching Costs: Customers often face integration challenges and testing requirements when changing suppliers.

- Market Penetration: New entrants need substantial capital to build comparable reach and relationships.

Economies of Scale and Experience Curve

Existing players like Innospec leverage significant economies of scale in their manufacturing, procurement, and research and development efforts. This scale allows them to achieve lower unit costs, a critical advantage in competitive markets. For instance, in 2023, Innospec reported revenue of $1.9 billion, indicating substantial operational capacity that new entrants would struggle to match immediately.

New entrants face a considerable cost disadvantage. Starting operations at a smaller scale means they cannot benefit from the same purchasing power or spread fixed costs as widely as established firms. This disparity makes it challenging to compete on price and achieve profitability without incurring substantial initial losses, effectively raising the barrier to entry.

- Economies of Scale: Innospec's established infrastructure and high production volumes lead to lower per-unit costs, a hurdle for newcomers.

- Experience Curve: Years of operational experience allow Innospec to optimize processes and reduce costs further, creating a knowledge-based advantage.

- Cost Disadvantage for New Entrants: Smaller initial production runs result in higher per-unit costs for new competitors.

- Profitability Challenge: New entrants must overcome significant cost barriers to achieve profitability against incumbents like Innospec.

The threat of new entrants in the specialty chemicals sector, where Innospec operates, is significantly mitigated by high capital requirements, estimated to be in the hundreds of millions of dollars for new production facilities. Stringent environmental and safety regulations, as seen with increased scrutiny in 2024, add substantial compliance costs and complexity for any newcomer. Furthermore, established players like Innospec benefit from deeply entrenched customer relationships and extensive, hard-won distribution networks, making it difficult for new companies to gain market traction. Innospec's 2023 revenue of $1.95 billion underscores its substantial market presence and the scale advantage it holds over potential new entrants.

| Barrier Type | Description | Impact on New Entrants | Innospec Advantage |

| Capital Requirements | High upfront investment for R&D and manufacturing. | Significant financial hurdle. | Established infrastructure and scale. |

| Regulatory Compliance | Navigating complex environmental, health, and safety rules. | Costly and time-consuming. | Expertise and existing compliance systems. |

| Distribution & Relationships | Building global logistics and customer trust. | Difficult to replicate established networks. | Years of market presence and loyalty. |

| Economies of Scale | Lower unit costs due to high production volumes. | Cost disadvantage for smaller new entrants. | Operational efficiency and purchasing power. |

Porter's Five Forces Analysis Data Sources

Our Innospec Porter's Five Forces analysis is built upon a robust foundation of data, including Innospec's annual reports, investor presentations, and SEC filings. We also incorporate industry-specific research from reputable market intelligence firms and trade publications to provide a comprehensive view of the competitive landscape.