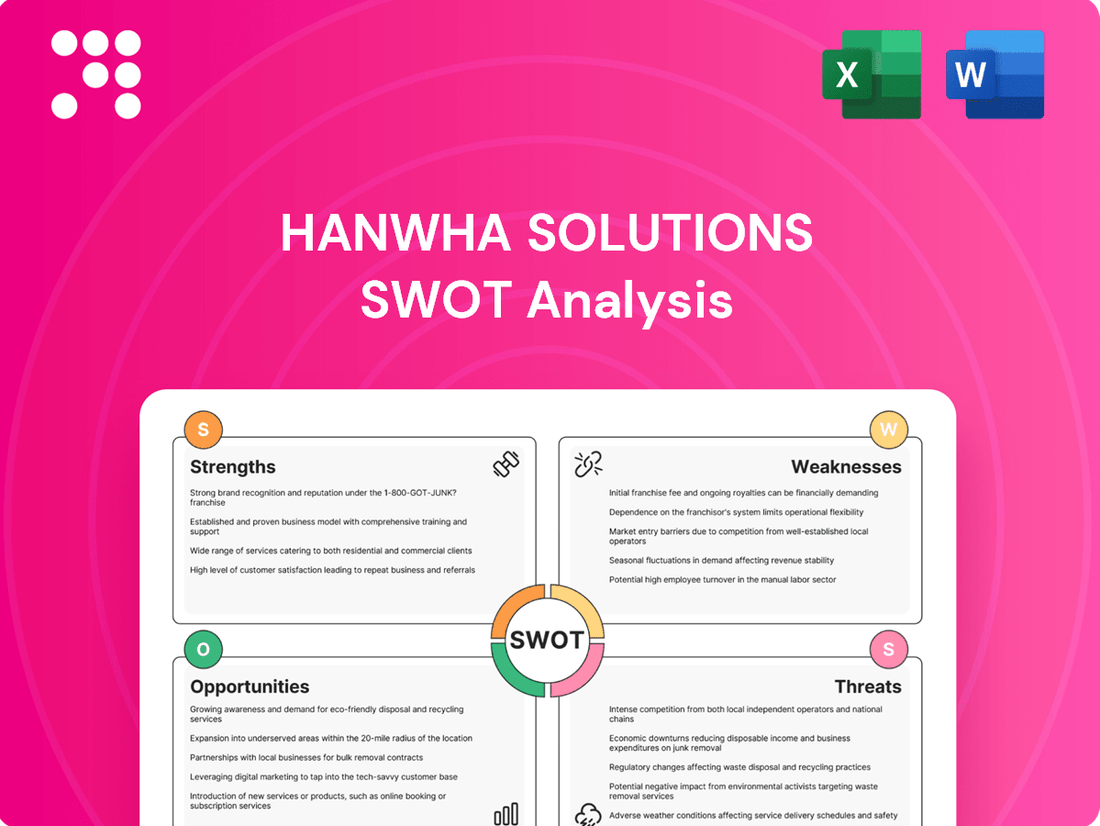

Hanwha Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Hanwha Solutions boasts significant strengths in its diversified portfolio, particularly in renewable energy and advanced materials, positioning it for growth in key global markets. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for maximizing opportunities.

Want the full story behind Hanwha Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hanwha Solutions boasts a diversified business portfolio spanning chemicals, advanced materials, and renewable energy, notably through its Hanwha Qcells division. This multi-sector approach mitigates risks associated with reliance on any single market, offering a robust defense against industry-specific downturns and facilitating strategic capital deployment across its various operations.

The company's strategic diversification allows for the exploitation of cross-divisional synergies; for instance, innovations in materials can directly benefit solar technology development within the renewable energy segment. In 2023, Hanwha Solutions reported total revenue of approximately KRW 23.5 trillion (around $17.5 billion USD), with its Qcells division showing strong growth in the solar energy market, contributing significantly to this overall performance.

Hanwha Solutions, through its Qcells brand, stands as a dominant force in the global solar energy market, recognized for its comprehensive offerings from solar cells and modules to integrated energy systems. This leadership translates into a robust brand reputation and well-established market access within the burgeoning renewable energy industry.

The company's significant market share, particularly in the U.S. and Europe, enables substantial economies of scale, contributing to cost competitiveness and a strong ability to influence industry direction. In 2023, Hanwha Qcells reported a substantial increase in module shipments, exceeding 12 GW globally, underscoring its market leadership and operational capacity.

Hanwha Solutions is deeply committed to pioneering sustainable technologies, a strategic focus that directly addresses the growing global demand for eco-friendly solutions. This dedication is evident in their significant investments in areas like advanced solar materials and hydrogen energy, aligning with international environmental objectives and anticipating future market trends.

This forward-thinking approach not only positions Hanwha Solutions to meet evolving consumer and industrial needs but also prepares them for increasingly stringent environmental regulations. For instance, in 2023, the company announced plans to invest heavily in expanding its Q CELLS solar division, aiming to solidify its position in the renewable energy sector and capitalize on the projected growth of the green economy.

Integrated Solar Value Chain

Hanwha Qcells leverages a highly integrated solar value chain, encompassing everything from solar cell manufacturing to module production and the deployment of complete energy systems. This vertical integration grants them significant control over product quality, streamlines supply chain operations, and enhances cost efficiency. For instance, in 2023, Hanwha Qcells reported a substantial increase in module shipments, underscoring the operational benefits of their integrated model.

This comprehensive approach allows for quicker innovation cycles and the flexibility to deliver customized, end-to-end solutions to a diverse customer base. The company's ability to manage multiple stages of production internally was a key factor in navigating supply chain disruptions experienced by competitors in the solar industry during 2024. This integration also positions them well to capitalize on the growing demand for distributed energy resources and smart grid technologies.

- Enhanced Quality Control: Direct oversight of each production stage ensures consistent high-quality solar products.

- Supply Chain Resilience: Reduced reliance on external suppliers mitigates risks and improves delivery reliability.

- Cost Efficiencies: Internalizing various processes leads to better cost management and competitive pricing.

- Accelerated Innovation: Seamless integration of R&D and manufacturing facilitates faster product development and market introduction.

Strong R&D and Technological Prowess

Hanwha Solutions significantly bolsters its competitive position through substantial and consistent investment in research and development. This commitment spans its core business areas, including chemicals, advanced materials, and renewable energy, fostering a culture of innovation. For instance, in 2023, the company allocated approximately 1.5 trillion Korean Won (roughly $1.1 billion USD) to R&D, a notable increase from the previous year, underscoring its dedication to technological advancement.

This unwavering focus on R&D empowers Hanwha Solutions to not only develop high-performance products but also to cultivate proprietary technologies. This technological prowess allows the company to stay ahead of market trends and adapt swiftly to evolving customer needs and emerging technological paradigms. The company's Q CELLS division, a leader in solar technology, consistently introduces next-generation solar cells, achieving efficiencies that set industry benchmarks, such as their N-type TOPCon cells reaching over 26% efficiency in 2024.

- Consistent R&D Investment: Hanwha Solutions dedicated around 1.5 trillion KRW ($1.1 billion USD) to R&D in 2023.

- Innovation Across Segments: R&D efforts are focused on chemicals, advanced materials, and renewable energy.

- Proprietary Technology Development: The company actively develops unique technologies to maintain a competitive edge.

- Market Adaptability: Technological prowess enables rapid response to market demands and shifts.

Hanwha Solutions' diversified business model, encompassing chemicals, advanced materials, and renewable energy, provides significant stability and reduces reliance on any single market. This strategic breadth allows for the cross-pollination of innovations, such as material science advancements benefiting their Qcells solar division. In 2023, the company achieved substantial revenue of approximately KRW 23.5 trillion, with Qcells demonstrating robust growth in the global solar market.

The company's leadership in the solar sector, particularly through its Qcells brand, is a major strength, offering comprehensive solutions from cells to integrated systems. This market dominance translates into strong brand recognition and expansive market access in the rapidly growing renewable energy industry. Hanwha Qcells' significant market share in key regions like the U.S. and Europe allows for considerable economies of scale, enhancing cost competitiveness and market influence. In 2023, Qcells shipped over 12 GW of modules globally, highlighting their operational capacity and market leadership.

Hanwha Solutions' commitment to sustainable technology development, including significant investments in advanced solar materials and hydrogen energy, aligns with global environmental trends and regulatory shifts. This forward-looking strategy positions them to meet increasing demand for eco-friendly solutions and capitalize on the growth of the green economy. The company's plans for substantial investment in Qcells in 2023 underscore their dedication to solidifying their renewable energy leadership.

The highly integrated solar value chain at Hanwha Qcells, from cell manufacturing to module production and system deployment, is a key advantage. This vertical integration ensures superior product quality, optimizes supply chain efficiency, and improves cost control. For example, their ability to manage multiple production stages internally helped them navigate supply chain disruptions experienced by competitors in 2024.

| Strength | Description | Supporting Data/Facts |

| Diversified Business Portfolio | Operates across chemicals, advanced materials, and renewable energy sectors. | 2023 Revenue: KRW 23.5 trillion. Qcells division shows strong growth. |

| Global Solar Market Leadership (Qcells) | Comprehensive solar solutions from cells to integrated systems. | 2023 Module Shipments: Exceeded 12 GW globally. Strong market share in U.S. and Europe. |

| Commitment to Sustainable Technologies | Focus on R&D for eco-friendly solutions like advanced solar materials and hydrogen. | Planned significant investments in Qcells expansion in 2023. |

| Integrated Solar Value Chain | Controls production from cell manufacturing to system deployment. | Enhanced quality control, supply chain resilience, cost efficiencies, and accelerated innovation. Navigated 2024 supply chain disruptions effectively. |

What is included in the product

Analyzes Hanwha Solutions’s competitive position through key internal and external factors, detailing its strengths in renewable energy and petrochemicals, weaknesses in supply chain reliance, opportunities in green hydrogen and advanced materials, and threats from market volatility and competition.

Offers a clear framework to identify and leverage Hanwha Solutions' strengths and opportunities while mitigating weaknesses and threats.

Weaknesses

Hanwha Solutions' chemical and advanced materials divisions face significant risks from fluctuating raw material prices, particularly petrochemical feedstocks. For instance, crude oil prices, a primary driver for many of these feedstocks, saw considerable swings in 2024, impacting production costs. This volatility directly squeezes profit margins, making consistent financial forecasting difficult for the company.

The unpredictable nature of input costs, such as naphtha or ethylene, can create substantial challenges for Hanwha Solutions' financial planning and operational stability. For example, a sharp increase in feedstock prices in late 2024 could have significantly eroded the profitability of their polyethylene production, a key product line. Effectively managing this exposure often necessitates advanced hedging instruments or agile adjustments to their supply chain to mitigate the impact.

Hanwha Solutions faces significant challenges in its core solar and chemical segments due to intense competition. The solar energy market, for instance, saw global module shipments reach an estimated 140 GW in the first half of 2024, with numerous manufacturers vying for market share. This crowded environment often translates into aggressive pricing, potentially squeezing profit margins and necessitating substantial ongoing investment in innovation and cost reduction to stay ahead.

Hanwha Solutions' Qcells division, a major player in the solar industry, faces a significant weakness in its reliance on government policies and subsidies. These incentives, crucial for driving renewable energy adoption, can fluctuate unpredictably. For instance, changes in feed-in tariffs or the introduction of tariffs on imported solar components directly impact profitability and market stability for Qcells.

This dependence introduces substantial policy risk, as shifts in government support can quickly alter the competitive landscape and financial viability of solar projects. In 2024, the global solar market continues to navigate evolving trade policies, with countries like the United States and European nations implementing measures that can affect component sourcing and project economics, posing a direct challenge to Hanwha's growth strategy.

Capital-Intensive Operations

Hanwha Solutions' operations in chemicals, advanced materials, and solar manufacturing are inherently capital-intensive. This means significant investments are constantly needed for building and upgrading facilities, purchasing advanced machinery, and maintaining existing infrastructure. For instance, expanding solar panel production capacity often requires billions of dollars in new plant construction and equipment.

This high need for capital can lead to substantial debt financing, impacting the company's financial leverage. To manage this, Hanwha Solutions must maintain robust cash flow to cover operational needs, fund growth initiatives, and invest in crucial technological upgrades. In 2023, the company reported significant capital expenditures, reflecting this ongoing investment in its core businesses to maintain competitiveness and scale.

The capital-intensive nature of its sectors can also constrain financial flexibility, particularly during economic downturns. When market demand softens or financing costs rise, the large fixed costs associated with these operations can become a significant burden.

Key considerations regarding capital-intensive operations include:

- High initial investment requirements for manufacturing facilities.

- Ongoing capital expenditure for equipment upgrades and maintenance.

- Potential for increased debt financing and financial risk.

- Need for consistent and strong cash flow generation.

Potential for Environmental and Safety Incidents

Hanwha Solutions' chemical manufacturing and materials production activities carry inherent risks of environmental pollution and safety incidents. These events can lead to substantial financial penalties, operational interruptions, and damage to the company's reputation. For instance, in 2024, the chemical industry globally saw increased focus on environmental compliance, with fines for violations reaching millions of dollars in some cases, highlighting the financial exposure.

Maintaining rigorous environmental, health, and safety (EHS) standards is paramount, but it also represents a significant and ongoing operational cost. The company must invest heavily in advanced safety protocols, pollution control technologies, and employee training to mitigate these risks. Failure to do so can result in more than just financial costs; it can also lead to stricter regulatory oversight and a loss of public trust.

- Environmental Fines: Potential for significant financial penalties due to pollution incidents, mirroring industry trends where environmental violations in 2024 led to substantial fines for chemical companies.

- Operational Disruptions: Accidents can halt production, leading to lost revenue and supply chain disruptions.

- Reputational Damage: Negative publicity from EHS failures can erode customer loyalty and investor confidence.

- Increased Compliance Costs: Ongoing investment in EHS is necessary but adds to the cost of operations.

Hanwha Solutions' heavy reliance on government policies and subsidies for its Qcells division presents a significant weakness. These incentives, critical for renewable energy growth, can be unpredictable, directly impacting profitability and market stability. For example, evolving trade policies in 2024, such as tariffs on solar components in key markets, pose a direct challenge to the company's expansion plans.

What You See Is What You Get

Hanwha Solutions SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global shift towards renewable energy is accelerating, with the International Energy Agency (IEA) projecting that solar PV capacity will more than double by 2030, reaching 2,000 GW. This surge, fueled by climate change mitigation efforts and a desire for energy independence, creates a significant tailwind for Hanwha Qcells, a key player in the solar industry. Governments worldwide are setting ambitious decarbonization targets, such as the EU’s Fit for 55 package and the US Inflation Reduction Act, which directly translate into increased demand for solar products and integrated energy solutions.

Hanwha Qcells is well-positioned to capitalize on this expanding market. The company’s robust manufacturing capabilities and commitment to technological innovation, including advancements in high-efficiency solar cells, allow it to meet the growing needs of both utility-scale projects and distributed generation. By offering comprehensive energy solutions, from solar panels to energy storage systems, Hanwha Solutions can capture a larger share of this burgeoning market, driving revenue growth and market penetration in new geographic regions and project types.

Global industries are increasingly prioritizing sustainability and improved product functionality, driving a significant uptick in demand for advanced materials. Hanwha Solutions is well-positioned to capitalize on this trend, particularly in high-growth sectors such as electric vehicles, aerospace lightweighting, and sustainable packaging.

The company's proficiency in developing innovative material solutions aligns perfectly with the needs of these burgeoning markets. For instance, the electric vehicle market alone is projected to reach over $1.5 trillion by 2030, with advanced materials playing a crucial role in battery technology and vehicle construction. This demand surge for eco-friendly and high-performance materials also allows for premium pricing strategies, enhancing profitability for Hanwha Solutions.

Hanwha Solutions is strategically exploring expansion into emerging economies and underserved regional markets, aiming to unlock new revenue streams. This includes a focus on regions with growing renewable energy demand, such as Southeast Asia and parts of Africa, where solar adoption is accelerating. For instance, in 2024, the company announced significant investments in solar projects in India, a key emerging market.

The company is also actively identifying and developing new applications for its existing materials and solar technologies. This involves venturing into adjacent market segments, such as advanced materials for electric vehicles and energy storage solutions. By leveraging its established technological expertise, Hanwha Solutions aims to broaden its customer base and diversify its income sources, capitalizing on the growing demand for sustainable solutions across various industries.

Strategic Partnerships and Acquisitions for Growth

Hanwha Solutions can significantly accelerate its growth and technological advancement by forging strategic partnerships and pursuing targeted acquisitions. Collaborating with innovative technology startups, renowned research institutions, or acquiring smaller, agile companies offers a direct pathway to integrating cutting-edge technologies and expanding market presence swiftly. This inorganic growth strategy is crucial for enhancing competitive positioning and diversifying capabilities, enabling faster entry into emerging, high-growth sectors.

These strategic moves not only mitigate the inherent risks associated with internal research and development but also provide access to specialized expertise and intellectual property. For instance, Hanwha Solutions' investment in renewable energy startups in 2024 demonstrates this commitment, aiming to bolster its position in the solar and hydrogen sectors. Such partnerships can lead to the co-development of next-generation materials or energy solutions, ensuring Hanwha remains at the forefront of industry innovation.

- Accelerated Innovation: Partnering with startups allows for rapid integration of novel technologies, potentially shortening product development cycles.

- Market Expansion: Acquisitions can provide immediate access to new geographic markets or customer segments, bypassing lengthy organic market entry processes.

- Risk Mitigation: Sharing R&D costs and risks with partners or acquiring established technologies reduces the financial burden and uncertainty of internal development.

- Capability Diversification: Strategic alliances and acquisitions can broaden Hanwha Solutions' technological and business portfolio, creating new revenue streams.

Development of Next-Generation Technologies

Hanwha Solutions is poised to capitalize on the development of next-generation technologies. Continued investment in and successful commercialization of breakthrough innovations, such as highly efficient perovskite solar cells and advanced energy storage solutions, could provide a significant competitive advantage. For instance, Hanwha Q CELLS has been a leader in solar technology, aiming for higher efficiency rates that can outperform traditional silicon cells.

Being an early mover and leader in these emerging fields can secure future market dominance. This strategic positioning allows Hanwha to create entirely new revenue streams, reinforcing long-term growth and market leadership.

- Perovskite Solar Cell Advancement: Hanwha Q CELLS is actively pursuing higher efficiency rates in perovskite solar cells, targeting commercial viability beyond current silicon-based technologies.

- Energy Storage Solutions: Investments in advanced battery technologies and grid-scale energy storage systems are crucial for capturing growth in the renewable energy sector.

- Novel Chemical Processes: Development in areas like eco-friendly chemical production can open new markets and meet increasing global demand for sustainable materials.

- Market Leadership: Early adoption and innovation in these next-generation technologies are key to establishing and maintaining a competitive edge.

The global transition to renewable energy presents a massive opportunity, with solar power capacity expected to more than double by 2030 according to the IEA, reaching 2,000 GW. Hanwha Qcells is strategically positioned to benefit from this growth, driven by government incentives like the US Inflation Reduction Act and the EU’s Fit for 55 package, which are boosting demand for solar solutions.

There's a growing demand for advanced materials in sectors like electric vehicles, with the market projected to exceed $1.5 trillion by 2030, creating significant opportunities for Hanwha Solutions' material innovations. The company is also expanding into emerging markets with high renewable energy adoption rates, such as India, to unlock new revenue streams and diversify its business.

Hanwha Solutions is actively pursuing strategic partnerships and acquisitions to accelerate its growth and technological development, exemplified by its 2024 investments in renewable energy startups. This inorganic growth strategy allows for quicker integration of cutting-edge technologies and faster market entry into high-growth sectors.

The company is a leader in developing next-generation technologies like perovskite solar cells, aiming for higher efficiency rates than traditional silicon cells. Continued investment in and commercialization of these innovations, alongside advanced energy storage solutions, will solidify Hanwha's competitive advantage and create new revenue streams.

Threats

Escalating geopolitical tensions, exemplified by ongoing trade disputes between major economic blocs like the US and China, pose a significant threat to Hanwha Solutions. These tensions can lead to the imposition of tariffs, such as those seen in recent years impacting various manufactured goods, directly increasing operational costs and potentially restricting market access for Hanwha's diverse product portfolio, including its solar and chemical divisions.

Protectionist policies adopted by countries can disrupt the seamless flow of global supply chains, a critical component for Hanwha's international manufacturing and distribution network. For instance, the semiconductor industry, closely linked to Hanwha's advanced materials segment, has faced increased scrutiny and potential restrictions, creating uncertainty and challenges in maintaining a competitive global presence.

Global economic downturns, such as potential recessions in major markets like the US or Europe in 2024-2025, pose a significant threat by curbing industrial activity and consumer spending. This directly affects Hanwha Solutions' core businesses, particularly demand for its chemical products and advanced materials, and can slow down the deployment of new solar energy projects.

Market volatility, including fluctuating commodity prices and interest rates, can also impact Hanwha Solutions. For instance, a sharp rise in interest rates in 2024 could increase the cost of capital for large solar infrastructure investments, potentially delaying or scaling back expansion plans. This economic uncertainty could lead to reduced sales and tighter profit margins across its divisions.

The relentless pace of technological advancement in solar and advanced materials presents a significant threat. Competitors could introduce more efficient or cost-effective solutions, potentially rendering Hanwha Solutions' current offerings outdated. For instance, in the solar sector, advancements in perovskite solar cells, which promise higher efficiencies and lower manufacturing costs, are rapidly progressing, with some research aiming for commercialization by 2025-2026.

Failing to match this innovation speed or adapt to disruptive technologies risks market share erosion and a weakened competitive position. Hanwha Solutions' commitment to research and development, evidenced by its significant R&D spending, which has historically been in the hundreds of millions of USD annually, is critical to staying ahead and mitigating the impact of such disruptions.

Intensifying Price Competition and Oversupply

The global solar module market is experiencing a significant threat from intensifying price competition, exacerbated by periods of oversupply. This oversupply can lead to substantial price erosion, directly impacting the profitability of companies like Hanwha Solutions. For instance, in early 2024, reports indicated a surplus of solar modules, pushing down average selling prices by as much as 15-20% compared to the previous year in some segments.

Aggressive pricing strategies from competitors, particularly those benefiting from lower production costs or substantial government subsidies, pose a direct challenge to Hanwha Solutions' market share and profit margins. This competitive pressure can create a difficult environment where maintaining profitability becomes a struggle, potentially leading to a race to the bottom in terms of pricing. The industry saw Chinese manufacturers, for example, significantly increase their market share in 2023, partly due to competitive pricing fueled by domestic policy support.

- Oversupply leading to price erosion: Reports in early 2024 highlighted a significant surplus in the solar module market, contributing to a decline in average selling prices.

- Competitor pricing strategies: Competitors with lower cost structures or government backing can implement aggressive pricing, pressuring Hanwha Solutions' margins.

- Impact on market share: Intense price competition risks a decline in Hanwha Solutions' market share if it cannot match the pricing of its rivals.

- Profitability squeeze: The combination of oversupply and aggressive pricing directly threatens Hanwha Solutions' ability to maintain healthy profit margins in the solar sector.

Supply Chain Vulnerabilities and Material Scarcity

Global events, like the lingering effects of the COVID-19 pandemic and geopolitical tensions, continue to pose significant threats to supply chains. For Hanwha Solutions, this translates to potential disruptions in sourcing critical raw materials such as polysilicon for its solar division or specialty chemicals for its advanced materials segment. These vulnerabilities can lead to price volatility and availability issues.

The impact of these disruptions is tangible. For instance, in 2024, many industries experienced increased lead times and elevated costs for key components due to port congestion and labor shortages. This directly affects manufacturing schedules and profitability. Hanwha Solutions, reliant on a global network of suppliers, faces the risk of production slowdowns and an inability to meet burgeoning demand for its products, particularly in the renewable energy sector.

- Disruption Risk: Geopolitical instability in regions supplying critical minerals like rare earth elements or lithium could impact battery material production.

- Cost Escalation: Fluctuations in energy prices and shipping costs, observed throughout 2024, can significantly increase procurement expenses for raw materials.

- Production Delays: A shortage of semiconductor chips, a critical component in many advanced materials and electronic products, can halt production lines.

- Customer Impact: Inability to fulfill orders due to supply chain issues can damage customer relationships and lead to lost revenue opportunities.

Intensifying competition in the solar module market, marked by oversupply in early 2024, directly pressures Hanwha Solutions' profitability, with average selling prices seeing declines of up to 20%. Aggressive pricing from rivals, particularly those with lower costs or subsidies, further erodes market share and profit margins. This dynamic creates a challenging environment where maintaining healthy profitability requires constant adaptation and cost management.

Technological obsolescence is a significant threat, as advancements like perovskite solar cells, aiming for commercialization by 2025-2026, could render current technologies outdated. Hanwha Solutions' substantial R&D investments, historically in the hundreds of millions of USD annually, are crucial to mitigating this risk. Failure to innovate at pace could lead to market share loss and a weakened competitive stance.

Geopolitical tensions and protectionist policies can disrupt global supply chains, impacting Hanwha Solutions' access to critical raw materials and increasing operational costs. For instance, trade disputes can lead to tariffs, affecting its chemical and solar divisions. Furthermore, global economic downturns predicted for 2024-2025 could reduce demand for its products and slow down renewable energy project deployments.

SWOT Analysis Data Sources

This Hanwha Solutions SWOT analysis is built upon robust data from financial reports, comprehensive market research, and insights from industry experts and official company disclosures.