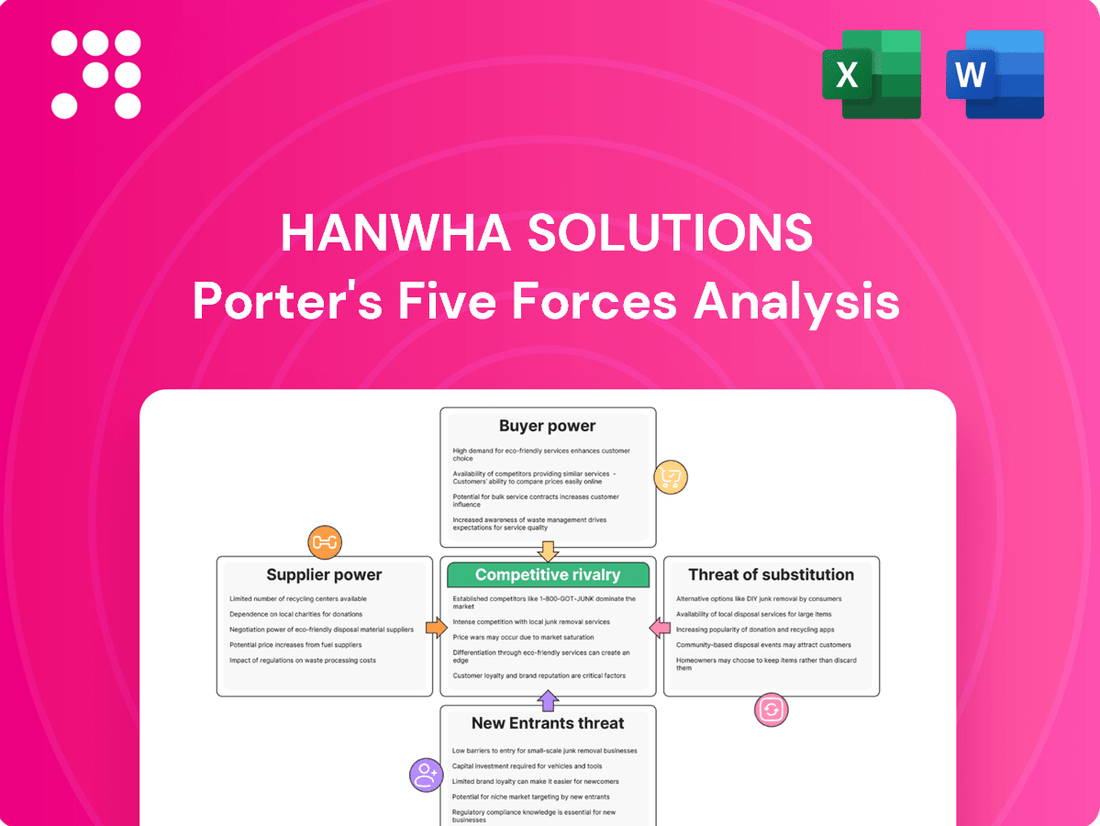

Hanwha Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Hanwha Solutions navigates a complex competitive landscape, facing moderate threats from new entrants and significant pressure from substitute products in its diverse business segments. Understanding the bargaining power of both buyers and suppliers is crucial for strategic planning.

The complete report reveals the real forces shaping Hanwha Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for essential materials like basic petrochemicals, specialized polymers, and polysilicon for solar cells directly influences Hanwha Solutions' leverage. When a few major players dominate the supply of a crucial component, their bargaining power increases, which can translate to higher input costs for Hanwha Solutions.

Hanwha Solutions' strategic investment in REC Silicon, a polysilicon manufacturer, highlights a proactive approach to securing vital raw materials. This move aims to bolster supply chain stability and potentially reduce the bargaining power of external suppliers within the solar energy market.

The availability of substitute inputs significantly influences the bargaining power of suppliers for Hanwha Solutions. For instance, in its chemical division, if alternative petrochemical feedstocks are readily available and cost-competitive, Hanwha Solutions can exert more pressure on its primary suppliers. This is crucial as the price of key raw materials like naphtha can fluctuate; in early 2024, naphtha prices saw volatility influenced by global energy markets, impacting input costs.

Hanwha Solutions' ability to source alternative raw materials or components for its advanced materials and solar energy segments also plays a vital role. If the materials used in solar panels, such as polysilicon or specialized glass, have multiple suppliers or viable substitutes, the power of any single supplier diminishes. Conversely, if a particular input is highly specialized and has few or no readily available alternatives, suppliers of that input can command higher prices and more favorable terms, as seen with some rare earth elements critical in certain advanced manufacturing processes.

Hanwha Solutions' significant global presence, particularly in solar energy and advanced materials, makes it a substantial customer for many of its suppliers. If a supplier derives a large percentage of its revenue from Hanwha Solutions, its bargaining power is diminished because it depends heavily on Hanwha's continued business. For example, in 2023, Hanwha Solutions reported total revenue of approximately 22.2 trillion KRW (around $16.5 billion USD), indicating the scale of its purchasing power.

However, the dynamic shifts when suppliers offer highly specialized or proprietary components, such as unique chemical compounds or advanced manufacturing equipment. In such cases, even if Hanwha Solutions is a major buyer, the supplier can retain considerable leverage due to the limited availability of alternatives. This is especially true for critical inputs that are difficult to source elsewhere, allowing suppliers to command more favorable terms.

Switching Costs for Hanwha Solutions

The bargaining power of suppliers for Hanwha Solutions is significantly influenced by switching costs. These costs encompass expenses related to retooling manufacturing processes, implementing new quality control measures, and the administrative burden of renegotiating contracts. High switching costs effectively trap Hanwha Solutions with existing suppliers, granting them greater leverage.

For Hanwha Solutions, particularly in its solar and chemical divisions, these switching costs can be substantial. Imagine the investment needed to qualify a new supplier for specialized chemical formulations used in their advanced materials or to adapt production lines for different solar cell components. These complexities directly translate into increased supplier power.

- Switching costs for specialized chemical inputs can be prohibitive, requiring extensive R&D and testing.

- Adapting manufacturing lines for new solar component suppliers necessitates significant capital expenditure and downtime.

- The lengthy qualification process for new suppliers in the advanced materials sector further entrenches existing relationships.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Hanwha Solutions' business directly enhances their bargaining power. If suppliers can effectively become direct competitors, they gain leverage over Hanwha, potentially impacting its market share and profitability. For instance, a key raw material supplier for Hanwha's solar panel division could theoretically start manufacturing its own solar panels, directly competing for customers.

However, this threat is generally considered moderate for Hanwha Solutions due to the diverse and established nature of its operations across chemical, advanced materials, and renewable energy sectors. These broad operations often require specialized knowledge and significant capital investment, creating barriers to entry for many potential supplier-competitors. Hanwha's scale and technological expertise in these varied fields make it a less attractive target for forward integration by most of its suppliers.

- Supplier Forward Integration Threat: Suppliers could become direct competitors, increasing their bargaining power.

- Impact on Hanwha Solutions: This could lead to reduced market share and pricing pressure for Hanwha.

- Hanwha's Position: The threat is generally lower due to Hanwha's diverse operations and established market presence in chemicals, advanced materials, and renewable energy.

The bargaining power of suppliers for Hanwha Solutions is a key factor, particularly for essential inputs like polysilicon for its solar division and petrochemicals for its chemical segment. When suppliers are concentrated, as they are for certain specialized polymers, Hanwha faces higher costs.

Hanwha's significant revenue, approximately 22.2 trillion KRW in 2023, gives it considerable purchasing power, which can mitigate supplier leverage. However, this is counterbalanced when suppliers offer unique, hard-to-substitute components, allowing them to dictate terms.

High switching costs for specialized chemical inputs or solar components, requiring significant investment and time for qualification, further empower suppliers. This makes it difficult for Hanwha to easily change suppliers, reinforcing existing relationships and supplier leverage.

| Factor | Impact on Hanwha Solutions | Example/Data Point |

| Supplier Concentration | Increased input costs due to limited suppliers for critical materials. | Polysilicon and specialized polymers markets often have a few dominant players. |

| Switching Costs | Entrenches existing supplier relationships, granting them greater leverage. | Retooling manufacturing for new solar components or qualifying new chemical suppliers involves substantial investment. |

| Customer Dependence | Diminished supplier power when a supplier relies heavily on Hanwha's business. | Hanwha's 2023 revenue of ~22.2 trillion KRW (approx. $16.5 billion USD) signifies its scale as a customer. |

| Input Uniqueness | Suppliers of specialized or proprietary components retain significant leverage. | Advanced materials requiring unique chemical formulations or specific manufacturing equipment. |

What is included in the product

This analysis of Hanwha Solutions' competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes, all crucial for understanding its market position.

Instantly identify and address competitive threats with a dynamic Porter's Five Forces analysis, tailored to Hanwha Solutions' specific market landscape.

Customers Bargaining Power

Customer concentration is a key factor in Hanwha Solutions' bargaining power. If a small number of major clients represent a large chunk of the company's revenue, those customers gain leverage to negotiate better prices and terms. This is particularly relevant in Hanwha's chemical and advanced materials divisions, where business-to-business relationships are common.

For instance, in 2023, Hanwha Solutions reported that its top 10 customers accounted for approximately 25% of its total sales, indicating a moderate level of customer concentration. A higher percentage would signal greater customer bargaining power.

The availability of substitute products significantly impacts Hanwha Solutions' customer bargaining power. If customers can readily find alternative solutions, like different solar panel manufacturers or other plastic material suppliers, their ability to negotiate prices and terms with Hanwha increases. For instance, the global solar panel market saw a significant influx of new manufacturers in 2023, intensifying competition and offering buyers more choices.

Customers' price sensitivity significantly impacts their bargaining power. In markets where products are seen as commodities, like basic petrochemicals, buyers are more likely to switch suppliers based on price, giving them considerable leverage. For example, in 2024, the global petrochemical market experienced price fluctuations, making customers more inclined to negotiate for lower costs.

Hanwha Solutions operates across various segments, including advanced materials and high-performance plastics. These specialized products, often tailored to specific industrial needs, tend to exhibit lower price sensitivity compared to basic chemicals. This diversification allows Hanwha to potentially mitigate the impact of intense price competition in its more commoditized offerings.

Threat of Backward Integration by Customers

The threat of backward integration by customers can significantly amplify their bargaining power. If customers possess the capability and a strong incentive to manufacture the products they currently purchase, they can exert more pressure on suppliers like Hanwha Solutions regarding pricing and terms.

For Hanwha Solutions, this threat is generally considered moderate to low, particularly within its core chemical and solar energy segments. These industries demand substantial capital outlays and advanced technical know-how, creating considerable barriers for most customers seeking to vertically integrate.

- High Capital Investment: Establishing chemical plants or solar manufacturing facilities requires billions of dollars, a prohibitive cost for most downstream customers.

- Technical Expertise: The complex processes involved in producing advanced chemicals or high-efficiency solar cells necessitate specialized knowledge and skilled labor, which many customers lack.

- Economies of Scale: Hanwha Solutions benefits from economies of scale in its production, making it difficult for individual customers to achieve comparable cost efficiencies through backward integration.

Information Availability to Customers

Customers today have unprecedented access to information, significantly influencing their purchasing decisions and bargaining power. With readily available data on product pricing, quality comparisons, and even supplier cost structures, consumers can effectively negotiate for better terms. This transparency is particularly potent in markets with standardized products, where alternatives are easily identifiable.

For Hanwha Solutions, this heightened customer awareness presents a challenge. However, the company's robust brand reputation, especially through its Hanwha Qcells division, serves as a crucial countermeasure. A strong brand often implies perceived value and reliability, which can reduce a customer's reliance on price alone and mitigate their ability to demand lower prices based purely on information availability.

- Information Accessibility: Customers can easily compare prices, features, and reviews across various suppliers, increasing their leverage.

- Market Transparency: In sectors with standardized goods, such as solar panels where Hanwha Qcells operates, information parity empowers buyers.

- Brand as a Mitigator: Hanwha Solutions leverages its strong brand equity to retain customers and command premium pricing, despite increased information availability for buyers.

The bargaining power of Hanwha Solutions' customers is influenced by several factors, including customer concentration, availability of substitutes, price sensitivity, and the threat of backward integration. In 2023, Hanwha Solutions noted that its top 10 customers represented about 25% of sales, indicating a moderate level of customer concentration. The competitive landscape, especially in the solar panel market, with numerous manufacturers entering in 2023, provides buyers with more choices and thus greater leverage.

| Factor | Impact on Hanwha Solutions | 2023/2024 Data/Trend |

|---|---|---|

| Customer Concentration | Moderate to High leverage for large clients. | Top 10 customers accounted for ~25% of sales in 2023. |

| Availability of Substitutes | Increases customer negotiation power. | Influx of new solar panel manufacturers in 2023 intensified competition. |

| Price Sensitivity | Higher for commoditized products. | Petrochemical market price fluctuations in 2024 made customers more price-sensitive. |

| Threat of Backward Integration | Generally low due to high capital and technical barriers. | Substantial investment and expertise required for chemical/solar production. |

Full Version Awaits

Hanwha Solutions Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Hanwha Solutions' competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Understanding these forces is crucial for strategic decision-making and identifying opportunities for growth and competitive advantage.

Rivalry Among Competitors

The growth rate across Hanwha Solutions' key sectors – chemicals, advanced materials, and renewable energy – directly impacts how fiercely companies compete. When markets expand rapidly, there's often enough demand to go around, easing competitive pressure. However, in slower-growing or mature markets, the scramble for existing customers intensifies, often leading to price wars and squeezing profit margins.

The renewable energy sector, particularly solar modules, has experienced robust growth but also significant oversupply challenges. For instance, in 2023, the global solar module market saw substantial capacity additions, leading to a notable increase in supply. This oversupply puts downward pressure on prices and heightens competition among manufacturers like Hanwha Solutions as they vie for market share.

Hanwha Solutions faces intense competition across its business segments. The solar energy sector, a key area for Hanwha, is particularly crowded with numerous global and regional players, including significant competition from Chinese manufacturers like LONGi Solar and Jinko Solar, which often leverage scale and cost advantages. In 2024, the global solar panel market is characterized by oversupply in certain segments, putting pressure on pricing and margins for all participants.

The degree to which Hanwha Solutions differentiates its offerings significantly impacts competitive rivalry. When products are highly distinct, it naturally lessens the intensity of direct price-based competition among players in the market.

Hanwha Solutions actively pursues differentiation through a strong emphasis on innovative technologies and a commitment to eco-friendly products. This strategy aims to carve out a unique market position, moving beyond simple price wars.

A prime example of this differentiation strategy is Hanwha Solutions' development of integrated solar solutions, such as its Solar Hub initiative in the United States. These comprehensive offerings bundle various solar components and services, providing a more complete value proposition to customers than standalone products.

Exit Barriers

Hanwha Solutions faces significant competitive rivalry stemming from high exit barriers in its core chemical and solar manufacturing sectors. The substantial capital investment required for specialized plants and equipment means that exiting these markets is neither easy nor cheap. For instance, building a polysilicon plant, a key component in solar cell production, can cost hundreds of millions of dollars, making it difficult for companies to simply shut down operations when market conditions become unfavorable.

These high exit barriers force companies like Hanwha Solutions to remain in the market and continue competing, even when facing periods of low profitability or overcapacity. This persistence intensifies rivalry as players are reluctant to leave, leading to prolonged price wars or market share battles. The long-term nature of many supply contracts in the chemical industry also acts as an exit barrier, obligating companies to fulfill commitments regardless of current market economics.

In 2023, the global solar photovoltaic (PV) market experienced significant growth, with installations reaching an estimated 340 gigawatts (GW), up from approximately 280 GW in 2022. Despite this expansion, profitability in certain segments of the solar value chain, particularly module manufacturing, faced pressure due to oversupply and intense price competition. This environment underscores how high fixed costs and ongoing demand, even if volatile, keep players engaged, thereby sustaining rivalry.

- Specialized Assets: Chemical plants and solar manufacturing facilities require highly specific and costly machinery, making them difficult to repurpose or sell.

- Long-Term Contracts: Commitments to supply raw materials or finished products often lock companies into market participation for extended periods.

- Capital Intensity: The sheer scale of investment needed for production capacity in both chemicals and solar energy creates a significant financial hurdle to exiting the business.

- Social Costs: Laying off a large workforce or closing down major industrial sites can incur substantial severance packages and community relations costs, further deterring exits.

Cost Structure of Competitors

The cost structure of competitors, especially the weight of fixed costs, significantly influences the intensity of competitive rivalry. Industries characterized by high fixed costs often witness aggressive pricing strategies as companies strive to maximize capacity utilization, particularly during periods of economic slowdown.

Hanwha Solutions operates within sectors like chemicals and solar, which inherently involve substantial fixed costs related to manufacturing plants and equipment. For instance, the chemical industry typically demands significant capital investment in production facilities, leading to high depreciation and maintenance expenses regardless of output levels.

In the solar energy sector, the upfront investment in manufacturing polysilicon, wafers, cells, and modules also represents a considerable fixed cost. Companies in these segments are incentivized to maintain high production volumes to spread these fixed costs over a larger output, potentially leading to price wars when demand softens.

- High Fixed Costs Drive Price Competition: Industries like chemicals and solar, where Hanwha Solutions competes, often have high fixed costs, leading to aggressive pricing to ensure capacity utilization.

- Capacity Utilization is Key: Competitors with substantial fixed costs are motivated to maintain high production levels, even at lower margins, to cover these ongoing expenses.

- Impact on Profitability: This can result in price wars, squeezing profit margins for all players in the market, including Hanwha Solutions.

Competitive rivalry at Hanwha Solutions is intense, driven by a dynamic market with varying growth rates and significant oversupply in key sectors like solar modules. The presence of numerous global and regional players, particularly cost-competitive Chinese manufacturers, intensifies this rivalry.

Differentiation through innovation and eco-friendly solutions, such as integrated solar offerings, is a key strategy for Hanwha to mitigate direct price competition. However, high exit barriers in chemical and solar manufacturing, due to substantial capital investments and long-term contracts, compel companies to remain competitive even during downturns, leading to sustained price pressures.

The substantial fixed costs inherent in these industries further fuel aggressive pricing strategies as companies aim to maximize capacity utilization. This dynamic can result in price wars, impacting profitability across the board. For example, the global solar panel market in 2024 continues to face oversupply, directly affecting pricing and margins.

| Factor | Impact on Rivalry | Example for Hanwha Solutions |

| Market Growth Rate | High growth eases rivalry; low growth intensifies it. | Solar sector growth is strong but oversupply creates intense competition. |

| Product Differentiation | Weak differentiation leads to price wars; strong differentiation reduces it. | Hanwha's Solar Hub initiative offers integrated solutions to stand out. |

| Exit Barriers | High barriers keep firms competing, increasing rivalry. | High costs to build chemical plants or solar facilities deter exits. |

| Cost Structure (Fixed Costs) | High fixed costs encourage aggressive pricing for capacity utilization. | Chemical and solar manufacturing require significant upfront investment, pushing for high production volumes. |

SSubstitutes Threaten

The threat of substitutes for Hanwha Solutions is significant, as customers can often find alternative products or services that fulfill similar needs. For instance, in the energy sector, while Hanwha Solutions champions solar power, traditional fossil fuels like natural gas and coal remain viable, albeit less sustainable, energy sources for many. Furthermore, other renewable energy technologies, such as wind power and hydroelectricity, also compete directly with solar installations.

In its advanced materials and chemicals divisions, Hanwha Solutions faces substitutes that can replace its offerings. This could involve alternative plastics derived from different feedstocks or entirely new materials engineered for specific applications that perform comparably to Hanwha's products. The company's strategic focus on developing green hydrogen and other advanced sustainable solutions is a direct effort to mitigate this threat by offering superior, future-proof alternatives.

The attractiveness of substitutes hinges on their price-performance ratio compared to Hanwha Solutions' products. If alternative solutions deliver similar or superior performance at a lower cost, the threat intensifies. For instance, in the solar energy sector, lower-priced solar modules from emerging competitors can serve as viable substitutes, even if their underlying technology isn't radically different.

The threat of substitutes for Hanwha Solutions' offerings is significantly influenced by the costs customers incur when switching. These costs can encompass financial outlays, the time invested in learning new systems, and the effort required to adapt to alternative solutions. Low switching costs naturally elevate the threat, as customers can more readily explore and adopt competing products. For instance, if a competitor offers a solar panel solution that is plug-and-play with minimal installation complexity, a customer using Hanwha's integrated solar and energy storage system might find switching easier than anticipated.

Hanwha Solutions actively works to mitigate this threat by building high switching costs into its customer relationships. The company's strategy often involves offering integrated solutions that combine various components, such as solar power generation, energy storage systems, and smart grid technologies. Furthermore, Hanwha frequently engages customers through long-term contracts for these comprehensive solutions. This integration and commitment create a sticky customer base, as severing ties would require replacing multiple interconnected elements and potentially incurring penalties for early contract termination, thereby raising the barrier to switching.

Customer Propensity to Substitute

Customer willingness to switch to alternatives is a key factor. Hanwha Solutions, particularly in its solar and chemical divisions, faces a dynamic landscape where evolving consumer preferences and technological advancements can significantly alter substitution threats. For instance, a surge in demand for highly efficient, next-generation solar panels or biodegradable plastics could prompt a shift away from current offerings if Hanwha doesn't innovate rapidly.

Growing environmental consciousness is a powerful driver for substitution. Consumers and businesses are increasingly prioritizing sustainability, which can lead them to seek out greener alternatives even if they come at a slightly higher initial cost. This trend directly impacts Hanwha Solutions, as it encourages a move towards renewable energy sources and eco-friendly materials across various industries.

The propensity to substitute is also influenced by the perceived performance and reliability of alternatives. If new technologies emerge that offer superior energy efficiency or material properties, customers may be more inclined to make the switch. For example, advancements in battery storage technology could make solar energy more attractive by addressing intermittency concerns, thereby increasing the threat of substitution for traditional energy sources that Hanwha's solar business competes with.

- Customer Propensity to Substitute: Hanwha Solutions' customers may switch to alternatives if new technologies offer better performance or if environmental concerns drive demand for sustainable options.

- Impact of Environmental Awareness: Increased focus on sustainability can lead customers to favor renewable energy and eco-friendly materials, regardless of minor price differences.

- Technological Advancements: Innovations in areas like solar panel efficiency or biodegradable plastics can accelerate customer adoption of substitutes, posing a threat to existing product lines.

- Market Trends: For example, the global renewable energy market was valued at approximately USD 1.3 trillion in 2023 and is projected to grow significantly, indicating a strong customer propensity to substitute away from fossil fuels.

Innovation in Substitute Industries

Rapid innovation in industries that offer substitutes can swiftly enhance their appeal, thereby escalating the overall threat to Hanwha Solutions. For instance, breakthroughs in battery storage technology are continually improving efficiency and reducing costs, making them increasingly viable alternatives to traditional energy sources where Hanwha Solutions operates.

Continuous advancements in alternative chemical processes or novel material technologies can also present a significant substitution threat. As of early 2024, the global advanced materials market is projected to reach over $200 billion, with ongoing research into sustainable and high-performance alternatives directly impacting sectors reliant on conventional materials.

- Advancements in renewable energy storage are making solar and wind power more competitive against fossil fuels, a core area for Hanwha Solutions.

- Development of biodegradable plastics could substitute traditional petrochemical-based materials used in various manufacturing applications.

- Emerging hydrogen fuel cell technology offers an alternative to existing energy infrastructure and vehicle powertrains.

The threat of substitutes for Hanwha Solutions is substantial, particularly in its core solar energy business where fossil fuels and other renewables like wind and hydro present alternatives. In advanced materials, new chemical processes and engineered materials can replace Hanwha's current offerings, necessitating continuous innovation. The attractiveness of these substitutes is directly tied to their price-performance ratio; for example, lower-cost solar modules from competitors can be a significant draw. Hanwha mitigates this by creating integrated solutions and long-term contracts, increasing customer switching costs.

Customer willingness to switch is influenced by evolving preferences and technological leaps. Growing environmental consciousness further amplifies this, pushing demand towards sustainable options. For instance, the global renewable energy market's robust growth, valued at approximately USD 1.3 trillion in 2023, indicates a strong customer inclination to move away from traditional energy sources. Similarly, advancements in battery storage technology are making solar power more competitive by addressing intermittency, thereby increasing the threat to fossil fuels that Hanwha's solar division competes against.

| Area of Substitution | Examples of Substitutes | Impact on Hanwha Solutions | Market Data/Trends (2023-2024) |

|---|---|---|---|

| Solar Energy | Fossil fuels (natural gas, coal), Wind power, Hydroelectric power | Direct competition for energy generation market share. | Global renewable energy market valued at ~$1.3 trillion in 2023, with significant projected growth. |

| Advanced Materials | Alternative plastics (different feedstocks), Novel engineered materials | Potential replacement for petrochemical-based products. | Global advanced materials market projected to exceed $200 billion by early 2024. |

| Energy Storage | Improved battery technologies | Enhances competitiveness of solar and wind, potentially impacting demand for integrated solutions if alternatives are cheaper. | Continuous improvements in battery efficiency and cost reduction are ongoing. |

| Chemicals | Biodegradable plastics, Alternative chemical processes | Threatens traditional material markets, requiring adaptation to sustainable alternatives. | Increasing consumer and regulatory pressure for eco-friendly materials. |

Entrants Threaten

The chemical, advanced materials, and renewable energy sectors demand substantial upfront capital for establishing manufacturing facilities. For instance, building a new petrochemical plant can easily cost billions of dollars, a sum that deters many potential competitors. Hanwha Solutions, with its established infrastructure and financial backing, is well-positioned to absorb these high entry costs.

Existing players like Hanwha Solutions leverage significant economies of scale in manufacturing, raw material sourcing, and research and development. This cost advantage makes it challenging for newcomers to enter the market and compete effectively on price.

Hanwha Solutions' extensive operations in solar module production, for instance, allow for lower per-unit costs. In 2023, the global average cost for solar PV modules continued its downward trend, but established players with high-volume output still maintain a competitive edge over smaller, nascent operations.

Newcomers face significant hurdles in building robust distribution networks for chemicals, advanced materials, and solar products. These channels are often controlled by established players, requiring substantial investment and time to replicate.

Hanwha Solutions benefits from its extensive and well-established global distribution infrastructure, giving it a considerable advantage. This network allows for efficient product delivery and market penetration, making it difficult for new entrants to compete on reach and reliability.

Proprietary Product Technology and Know-how

Hanwha Solutions' significant investments in research and development, particularly in areas like perovskite-silicon tandem solar cells, create a substantial barrier to entry. The company holds numerous patents and has cultivated deep manufacturing expertise in high-performance plastics and specialized materials.

New competitors would face immense R&D costs and a lengthy development cycle to replicate Hanwha's technological advantages. For instance, in 2023, Hanwha Q Cells reported a module efficiency of 26.3% for its HJT solar cells, a benchmark that requires considerable proprietary knowledge to achieve.

- Proprietary Technology: Hanwha Solutions possesses advanced technologies in solar cell development and advanced materials.

- Patent Portfolio: A robust patent portfolio protects its innovations, making replication difficult for newcomers.

- Manufacturing Know-how: Accumulated expertise in specialized manufacturing processes provides a competitive edge.

- R&D Investment: Significant ongoing investment in R&D ensures continuous technological advancement, raising the bar for potential entrants.

Government Policy and Regulation

Government policies and environmental regulations act as significant barriers, influencing the threat of new entrants in the solar industry. Stricter environmental standards, for instance, necessitate substantial upfront investment in compliance technology, which can be prohibitive for newcomers.

Trade barriers, such as tariffs on imported solar components, can also deter new foreign competitors. For example, the US solar market has seen policies like the Inflation Reduction Act of 2022, which includes tax credits for domestic manufacturing, potentially favoring established players like Hanwha Solutions with existing local production capabilities.

- Government subsidies for domestic manufacturing can create an uneven playing field, favoring companies with established local operations, like Hanwha Solutions.

- Tariffs on imported solar panels and components can increase the cost of entry for new international competitors.

- Stringent environmental regulations require significant capital investment for compliance, posing a challenge for new market entrants.

The threat of new entrants for Hanwha Solutions is generally low across its core sectors due to substantial capital requirements, established economies of scale, and strong brand loyalty. Significant R&D investment and proprietary technology further deter potential competitors, as seen in Hanwha Q Cells' leading solar cell efficiencies. Government policies and trade barriers, like those favoring domestic manufacturing, also create additional hurdles for newcomers.

| Barrier Type | Impact on New Entrants | Relevance to Hanwha Solutions |

|---|---|---|

| Capital Requirements | High (billions for petrochemical plants) | Hanwha's established infrastructure absorbs costs. |

| Economies of Scale | Challenging for price competition | Hanwha's high-volume output lowers per-unit costs. |

| R&D and Technology | High costs, lengthy development cycles | Hanwha's patents and expertise (e.g., 26.3% HJT cell efficiency in 2023) create a significant advantage. |

| Distribution Networks | Requires substantial investment and time | Hanwha's global infrastructure ensures efficient reach. |

| Government Policies & Trade Barriers | Can favor domestic players, increase import costs | Policies like the US IRA 2022 can benefit Hanwha's local production capabilities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hanwha Solutions is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and official regulatory filings. We supplement this with insights from reputable industry research firms and macroeconomic data providers to offer a robust competitive assessment.