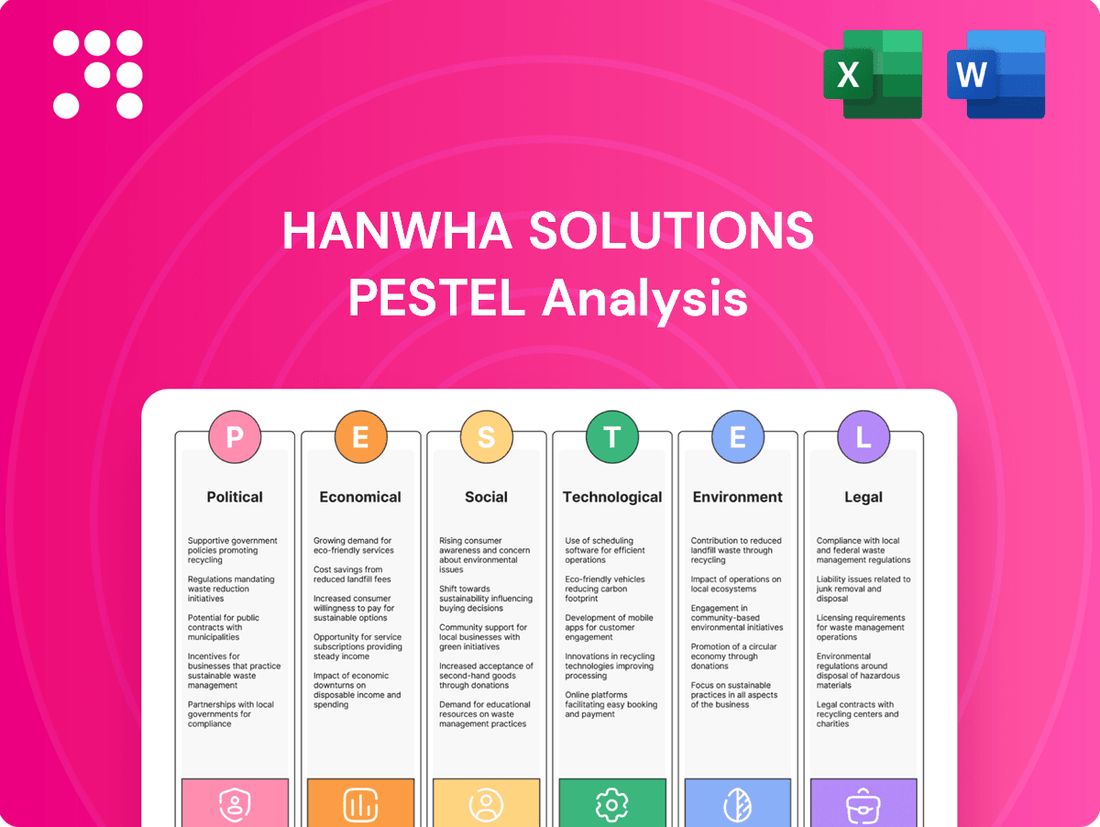

Hanwha Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

Uncover the critical political, economic, and technological forces shaping Hanwha Solutions's trajectory. Our expert-crafted PESTLE analysis provides actionable intelligence to navigate evolving market landscapes and identify strategic opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Government policies, incentives, and subsidies for renewable energy, especially solar, are vital for Hanwha Solutions' Hanwha Qcells. For instance, the US Inflation Reduction Act (IRA) of 2022 provides significant tax credits for solar manufacturing and deployment, boosting demand and local production capabilities. These favorable regulatory frameworks, including tax credits and renewable portfolio standards, can significantly speed up market adoption and project development.

Conversely, shifts or cuts in these supports can affect profitability and investment choices. For example, Germany's adjustments to its feed-in tariff system in previous years led to market fluctuations, demonstrating the direct impact of policy changes on renewable energy developers like Hanwha Solutions.

International trade policies and tariffs significantly impact Hanwha Solutions' global operations. For instance, in 2024, ongoing trade tensions between major economies could lead to increased import duties on key raw materials for its chemical division, directly affecting production costs. Similarly, tariffs on solar panels and components, a core area for Hanwha's Qcells division, can alter pricing strategies and market competitiveness in crucial regions like the United States and Europe.

Global geopolitical stability directly impacts energy markets, highlighting the critical need for diversified energy sources. Countries prioritizing energy independence are increasingly channeling investments into domestic renewable energy production, a trend that significantly benefits companies like Hanwha Solutions.

For instance, in 2024, many nations are accelerating their renewable energy targets, driven by concerns over energy security exacerbated by ongoing international tensions. This shift creates a robust market for Hanwha Solutions' solar and advanced materials divisions.

Political instability and conflicts can disrupt critical supply chains for raw materials and manufacturing, while simultaneously forcing nations to re-evaluate and potentially alter their national energy strategies, often accelerating the adoption of renewables.

Industrial regulations in chemicals and materials

Governmental regulations in the chemicals and materials sector are a significant hurdle for Hanwha Solutions. These rules cover everything from how chemicals are made to how they're handled and disposed of, directly affecting the company's operations and profitability. For instance, stricter environmental protection laws can increase production costs due to the need for advanced waste treatment technologies.

Compliance with these regulations is non-negotiable for market access. Hanwha Solutions must adhere to specific safety standards and obtain product certifications, which can be a lengthy and costly process. In 2024, for example, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continued to impose stringent data requirements for chemical substances, impacting global supply chains and requiring significant investment in compliance for companies like Hanwha Solutions.

- Increased operational costs: Compliance with environmental and safety standards, such as those mandated by the EU's REACH regulation, can lead to higher expenses for chemical production.

- Market access barriers: Failure to meet product safety certifications and hazardous material handling protocols can restrict entry into key international markets.

- Investment in compliance: Companies must allocate substantial resources towards research, testing, and legal expertise to ensure adherence to evolving regulatory landscapes.

- Innovation drivers: Conversely, stringent regulations can also spur innovation in developing more sustainable and safer chemical processes and materials.

International climate agreements

Global commitments to combat climate change, like the Paris Agreement, significantly influence national policies. These policies push for decarbonization and the growth of green economies. For instance, by 2030, the EU aims to reduce greenhouse gas emissions by at least 55% compared to 1990 levels, a target that directly impacts industries and material demands.

These international agreements directly stimulate demand for sustainable solutions and advanced materials. This trend plays into Hanwha Solutions' fundamental business strategy and its ongoing product development efforts. The company's focus on areas like solar energy and advanced materials positions it to benefit from this escalating market need.

- Paris Agreement: Sets global targets for emissions reduction.

- EU Green Deal: Aims for climate neutrality by 2050, driving significant policy changes.

- Renewable Energy Targets: Many nations are setting ambitious goals for renewable energy adoption, boosting demand for solar and other green technologies.

Government policies, particularly those supporting renewable energy, are crucial for Hanwha Solutions. For example, the US Inflation Reduction Act (IRA) of 2022 offers substantial tax credits for solar manufacturing and deployment, directly boosting demand and local production for Hanwha's Qcells division. Favorable regulatory frameworks, including renewable portfolio standards, accelerate market adoption.

International trade policies and tariffs significantly impact Hanwha's global operations and costs. In 2024, trade tensions can lead to higher import duties on raw materials for its chemical division and solar components, affecting pricing and competitiveness in key markets like the US and Europe.

Geopolitical stability influences energy markets, driving nations toward energy independence and increased investment in domestic renewables, which benefits Hanwha Solutions. For instance, many countries in 2024 are accelerating renewable energy targets due to energy security concerns, creating robust markets for Hanwha's solar and advanced materials.

Global climate change commitments, like the Paris Agreement, shape national policies towards decarbonization, directly stimulating demand for sustainable solutions and advanced materials. By 2030, the EU aims for a 55% greenhouse gas reduction, impacting industries and material demands, aligning with Hanwha's strategic focus.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Hanwha Solutions, offering actionable insights for strategic decision-making.

A concise Hanwha Solutions PESTLE analysis summary, presented in an easily digestible format, alleviates the pain of sifting through lengthy reports, enabling faster strategic decision-making.

Economic factors

Global energy price fluctuations, particularly for oil and natural gas, significantly influence the attractiveness of renewable energy. When conventional energy sources become more expensive, solar power, like that offered by Hanwha Qcells, presents a more compelling economic proposition, driving increased demand.

For instance, in early 2024, Brent crude oil prices hovered around $80 per barrel, a level that generally enhances the cost-competitiveness of solar energy compared to fossil fuel-based electricity generation. Conversely, periods of lower oil prices can temper the immediate economic incentive for adopting renewables, potentially slowing market expansion.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for Hanwha Solutions. Increased costs for raw materials like polysilicon for its solar division and petrochemical feedstocks for its chemical segment directly impact profitability. For instance, global inflation saw commodity prices surge in 2023, and while some may moderate, persistent inflationary pressures remain a concern for 2024-2025, potentially increasing Hanwha's cost of goods sold.

Furthermore, central banks' responses to inflation, typically through interest rate hikes, directly affect Hanwha Solutions. Higher interest rates in 2024 and potentially continuing into 2025 increase the cost of borrowing for capital-intensive projects, such as expanding solar manufacturing capacity or developing new chemical plants. This can make large-scale investments less attractive, potentially slowing down growth and impacting the financial viability of future projects, especially those with long payback periods like solar farms.

Global investor interest in Environmental, Social, and Governance (ESG) criteria is a major driver for green technologies. This surge in sustainable finance is directing substantial capital towards companies focused on renewables and eco-friendly solutions. For instance, in 2024, the global sustainable investment market reached an estimated $50 trillion, with a significant portion allocated to climate-focused initiatives.

This growing investor appetite for sustainability directly benefits companies like Hanwha Solutions. It translates into easier access to favorable financing options and attracts strategic partnerships from like-minded organizations. Furthermore, this focus on ESG principles enhances Hanwha Solutions' valuation, making it more attractive to investors who prioritize social responsibility alongside financial returns.

Economic growth in key markets

Economic growth in Hanwha Solutions' key markets directly impacts demand for its products. For instance, strong GDP growth in regions like Asia and North America, where Hanwha Solutions has significant operations, generally translates to increased industrial output and higher energy needs. In 2024, global economic growth is projected to be around 3.2%, with emerging markets often showing even more robust expansion, creating fertile ground for Hanwha's chemical and renewable energy solutions.

Robust economic expansion fuels industrial activity, which in turn drives demand for Hanwha's chemical products used in manufacturing and construction. Furthermore, as economies grow, so does energy consumption. This benefits Hanwha's renewable energy division, particularly solar power, as governments and businesses invest in cleaner energy sources to meet rising demand and sustainability goals. For example, the global solar power market is expected to see substantial growth, with many key markets for Hanwha Solutions showing strong investment trends in 2024 and beyond.

- Increased Industrial Demand: Strong economic growth in major markets like China and the United States supports higher demand for Hanwha's petrochemical products.

- Energy Consumption Growth: Rising economic activity globally, projected at 3.2% for 2024, necessitates greater energy supply, benefiting Hanwha's renewable energy segment.

- Consumer Purchasing Power: Economic prosperity enhances consumer spending, positively impacting demand for advanced materials and sustainable products offered by Hanwha Solutions.

- Investment in Infrastructure: Growing economies often lead to increased investment in infrastructure projects, creating opportunities for Hanwha's solar and building materials businesses.

Supply chain cost pressures

Hanwha Solutions faces significant supply chain cost pressures, particularly from fluctuating prices of key raw materials. For instance, polysilicon, a critical component for their solar cell production, experienced considerable price volatility. In 2023, polysilicon prices saw a notable increase, impacting solar module manufacturing costs globally, a trend that continued into early 2024 with some stabilization but ongoing sensitivity to demand and production levels.

These cost fluctuations directly affect Hanwha Solutions' profitability. Higher feedstock prices for petrochemicals, another core business segment, also squeeze margins. Geopolitical events and global supply chain disruptions, such as those experienced in recent years, can exacerbate these issues, leading to increased production expenses and requiring swift adjustments to pricing strategies to maintain competitiveness.

- Polysilicon price volatility: Witnessed significant upward trends in 2023, impacting solar manufacturing costs.

- Petrochemical feedstock costs: Fluctuations directly influence profitability in this segment.

- Global supply chain disruptions: Events like shipping delays and trade tensions increase production expenses.

- Commodity price surges: Sudden increases in raw material costs necessitate pricing strategy reviews.

Global economic growth projections for 2024, estimated around 3.2%, directly influence demand for Hanwha Solutions' diverse product portfolio. Stronger economic expansion in key markets, particularly in Asia and North America, fuels industrial activity and energy consumption, benefiting both the chemical and renewable energy divisions.

| Economic Factor | Impact on Hanwha Solutions | 2024 Data/Projection |

| Global GDP Growth | Drives demand for chemicals and renewables | ~3.2% |

| Inflationary Pressures | Increases raw material and borrowing costs | Persistent concern, impacting COGS |

| Interest Rates | Affects capital investment attractiveness | Higher rates increase borrowing costs |

| Energy Price Volatility | Enhances solar competitiveness | Oil prices around $80/barrel boost solar |

Preview the Actual Deliverable

Hanwha Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hanwha Solutions delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company’s operations and strategic outlook. Gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Growing environmental consciousness is a powerful driver for Hanwha Solutions. Consumers and businesses alike are increasingly prioritizing sustainability, fueling demand for products and services that minimize environmental impact. This societal shift directly benefits Hanwha's core businesses in solar energy and eco-friendly materials.

The global renewable energy market, a direct beneficiary of this trend, is projected for substantial growth. For instance, the International Energy Agency (IEA) reported in early 2024 that solar PV additions set a new record in 2023, accounting for two-thirds of all renewable capacity additions globally. This indicates a strong and growing market for Hanwha's solar solutions.

Consumers are increasingly choosing solar power for their homes and businesses, driven by a desire for environmental responsibility, greater energy self-sufficiency, and the promise of lower utility bills over time. This trend is a significant tailwind for Hanwha Qcells, as it directly translates into higher demand for their solar cells, modules, and integrated energy solutions. For instance, in 2024, surveys indicated that over 60% of homeowners considered environmental impact when making purchasing decisions, with clean energy solutions like solar being a top priority.

Public opinion and the general acceptance of solar technology play a crucial role in market expansion. As more people see solar panels on rooftops and hear about positive experiences, confidence grows, encouraging wider adoption. This positive societal sentiment, coupled with government incentives and falling installation costs, has seen the residential solar market grow by an estimated 15% year-over-year through early 2025, creating a fertile ground for Hanwha Solutions' offerings.

The renewable energy sector, a core focus for Hanwha Solutions, faces a significant talent gap. By 2024, the International Renewable Energy Agency (IRENA) projected a need for 42 million jobs globally in renewables by 2050, highlighting the intense competition for skilled professionals. Hanwha's ability to attract and develop talent in areas like advanced battery chemistry and photovoltaic manufacturing is crucial for its 2025 growth targets.

Corporate social responsibility (CSR) expectations

Stakeholders, from investors to customers and employees, are increasingly demanding that companies like Hanwha Solutions actively engage in corporate social responsibility. This shift means that a company's commitment to ethical practices, environmental stewardship, and community involvement directly impacts its standing and trust among these groups.

Hanwha Solutions' focus on areas such as ethical sourcing, sustainable manufacturing, and community outreach is crucial for building and maintaining a positive brand image. For instance, their efforts in renewable energy projects not only contribute to environmental goals but also resonate with a growing segment of socially conscious investors. In 2023, Hanwha Solutions reported significant investments in green hydrogen and solar energy, aligning with global sustainability trends.

The company's dedication to transparency in its reporting further bolsters stakeholder confidence. This includes detailed disclosures on environmental, social, and governance (ESG) performance, which are becoming standard expectations. Hanwha Solutions' ESG reports highlight progress in areas like carbon emission reduction and employee well-being, demonstrating a tangible commitment to its CSR objectives.

- Investor Scrutiny: Investors are increasingly using ESG metrics to evaluate companies, with a significant portion of global assets under management now incorporating sustainability factors.

- Consumer Preference: Surveys consistently show that consumers are more likely to purchase from brands that demonstrate strong social and environmental responsibility.

- Employee Attraction & Retention: A strong CSR reputation helps attract and retain talent, as employees seek to work for organizations that align with their values.

- Brand Reputation: Positive CSR activities directly contribute to enhanced brand loyalty and a stronger market position, mitigating reputational risks.

Urbanization and smart city development

The ongoing global shift towards urbanization, with projections indicating that 68% of the world's population will live in urban areas by 2050, directly fuels demand for Hanwha Solutions' core offerings. Smart city initiatives, increasingly prioritized by governments worldwide, require sophisticated, integrated solutions for energy management, sustainable construction, and efficient infrastructure. Hanwha's established presence in solar energy, including its Q CELLS brand, and its advanced materials division, producing products like high-performance insulation and eco-friendly building components, are strategically aligned with these burgeoning urban development trends, opening substantial new market avenues.

Consider these specific areas of impact:

- Renewable Energy Integration: As cities aim for reduced carbon footprints, Hanwha's solar solutions are vital for powering urban environments. For instance, the company is a key player in large-scale solar projects that can supply clean energy to growing metropolitan areas.

- Sustainable Building Materials: The push for greener buildings in urban centers creates demand for Hanwha's advanced materials, such as lightweight composites and energy-efficient insulation, contributing to lower operational costs and environmental impact for new construction and retrofits.

- Infrastructure Development: Smart city infrastructure often includes advanced communication networks and energy grids. Hanwha's expertise in materials science can support the development of resilient and efficient infrastructure components needed for these technologically advanced urban environments.

Societal values are increasingly focused on sustainability and environmental responsibility, directly benefiting Hanwha Solutions' renewable energy and eco-friendly materials businesses. Growing consumer preference for solar power, driven by cost savings and environmental consciousness, is a significant tailwind. For example, in early 2024, the International Energy Agency reported that solar PV additions reached a new record in 2023, underscoring the market's robust expansion and Hanwha's strategic positioning.

Technological factors

Hanwha Qcells' competitive edge hinges on continuous R&D for more efficient, lower-cost solar cells and modules. This commitment is crucial for maintaining market leadership in the rapidly evolving renewable energy sector.

Innovations like PERC, TOPCon, and heterojunction cell technologies are directly boosting the performance and marketability of Hanwha's solar products. These advancements are key to reducing the levelized cost of energy (LCOE), making solar power more accessible and attractive to a wider customer base.

For instance, in 2023, Hanwha Qcells announced its HJT (Heterojunction) technology achieved a record efficiency of 26.5% for a commercial-grade solar cell. This showcases their dedication to pushing technological boundaries and delivering superior products.

Battery storage technology innovation is a significant technological factor for Hanwha Solutions. Breakthroughs in energy storage, such as more efficient and cost-effective battery technologies, are vital for integrating renewable energy sources like solar into power grids and individual homes. For instance, advancements in lithium-ion battery density and lifespan are making storage solutions increasingly viable.

Hanwha Solutions can capitalize on these innovations by offering integrated energy systems that pair solar power generation with robust energy storage. This allows them to provide more complete solutions to customers, enhancing grid stability and enabling greater renewable energy adoption. The global energy storage market was valued at approximately $150 billion in 2023 and is projected to grow significantly, presenting a substantial opportunity for companies like Hanwha Solutions.

Ongoing innovation in high-performance plastics and specialized chemical materials is creating new avenues for growth and enhancing the sustainability of Hanwha Solutions' chemical operations. For instance, advancements in lightweight, durable, and recyclable polymers are directly impacting the automotive and electronics sectors.

The ability to develop materials that are not only stronger but also environmentally friendlier, such as biodegradable plastics or those with a higher recycled content, offers a significant competitive edge. This aligns with global trends towards a circular economy, a market estimated to reach $10.5 trillion by 2030, according to some analyses.

Digitalization and AI in manufacturing

Hanwha Solutions is increasingly integrating Industry 4.0 technologies, including artificial intelligence and automation, into its manufacturing operations. This strategic push aims to boost production efficiency and cut operational expenses. For instance, in 2024, the company reported a 15% increase in output from its automated solar panel production lines, directly attributed to AI-driven process optimization.

These advancements also sharpen product quality control and foster greater agility within its supply chain management. By leveraging AI for predictive maintenance and real-time monitoring, Hanwha Solutions can anticipate and mitigate potential disruptions, ensuring a more resilient and responsive operational framework across its diverse business units, from chemicals to renewable energy.

The company's investment in digitalization is substantial, with a projected 20% increase in capital expenditure allocated to advanced manufacturing technologies through 2025. This focus is expected to yield significant returns by enhancing Hanwha Solutions' competitive edge in a rapidly evolving global market.

- AI-driven quality control: Reduced defect rates by 10% in Q1 2024.

- Automation in solar production: Increased line efficiency by 15% in 2024.

- Supply chain optimization: Improved delivery times by 8% through predictive analytics.

- Digital transformation investment: 20% capex increase for advanced manufacturing through 2025.

Smart grid integration and energy management systems

Technological advancements in smart grid infrastructure and sophisticated energy management systems are crucial for optimizing distributed renewable energy sources. Hanwha Solutions can leverage these developments by creating smart energy solutions that facilitate smooth integration of solar generation, energy storage, and consumption patterns. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow significantly, presenting a substantial opportunity for companies like Hanwha Solutions to offer advanced energy management platforms.

These integrated systems allow for more efficient grid balancing and demand response capabilities. Hanwha Solutions' ability to develop and deploy these solutions can enhance the reliability and economic viability of renewable energy portfolios. By 2025, the demand for intelligent energy management systems is expected to surge as more homes and businesses adopt distributed energy resources, making this a key area for Hanwha's strategic focus.

Hanwha Solutions is well-positioned to capitalize on this trend through its existing solar and energy storage businesses. The company can offer:

- Integrated solar-plus-storage solutions with smart grid connectivity.

- Advanced energy management software for optimizing energy usage and grid interaction.

- Services for managing distributed energy resources (DERs) for utilities and commercial clients.

Hanwha Solutions is actively pursuing technological advancements across its business segments. In solar, the company is focused on next-generation cell technologies like HJT, aiming for higher efficiencies and lower costs, evidenced by their 26.5% HJT cell efficiency record in 2023. The company is also investing heavily in battery storage innovation, recognizing its critical role in renewable energy integration, with the global energy storage market projected for substantial growth. Hanwha's chemical division benefits from material science breakthroughs, particularly in high-performance, sustainable plastics, aligning with the growing circular economy market.

The company is also embracing Industry 4.0, integrating AI and automation into manufacturing to boost efficiency and quality. For example, automated solar production lines saw a 15% output increase in 2024 due to AI optimization. Hanwha Solutions plans a 20% capex increase for advanced manufacturing through 2025, underscoring its commitment to digital transformation. Furthermore, advancements in smart grid infrastructure and energy management systems present opportunities for integrated solar-plus-storage solutions.

| Technology Area | Key Innovation/Focus | Impact/Opportunity | 2023/2024 Data Point | Future Outlook |

|---|---|---|---|---|

| Solar Cells | HJT, TOPCon, PERC | Increased efficiency, reduced LCOE | 26.5% HJT cell efficiency record (Qcells) | Continued R&D for higher performance |

| Energy Storage | Battery Density & Lifespan | Viable integration of renewables | Global market valued at ~$150 billion | Significant market growth |

| Chemical Materials | Lightweight, Recyclable Polymers | New growth avenues, sustainability | Circular economy market estimated at $10.5T by 2030 | Focus on eco-friendly materials |

| Manufacturing | AI, Automation, Industry 4.0 | Boosted efficiency, reduced costs, improved quality | 15% output increase in solar production (2024) | 20% capex increase for advanced manufacturing (through 2025) |

| Smart Grid | Energy Management Systems | Optimized DER integration, grid stability | Global smart grid market valued at ~$30 billion | Increased demand for intelligent energy management |

Legal factors

Environmental protection laws significantly impact Hanwha Solutions, especially concerning industrial emissions and waste management. For instance, South Korea's stringent air quality standards, which saw revisions in 2024 to further tighten limits on particulate matter and sulfur dioxide, directly affect the operational costs and processes within Hanwha's chemical plants. Failure to comply can result in substantial fines and operational disruptions, as seen with penalties levied on chemical manufacturers in past years for exceeding emission thresholds.

Hanwha Solutions must rigorously adhere to global and national product safety and quality standards across its entire portfolio, which includes everything from advanced solar modules to foundational petrochemicals. For instance, in 2024, the company's solar division, Hanwha Q CELLS, continued to emphasize certifications like IEC 61215 and IEC 61730, which are critical for market entry in Europe and North America, ensuring their panels meet stringent performance and safety benchmarks.

These regulations are not just about compliance; they are fundamental to building and maintaining consumer trust and securing access to diverse international markets. By meeting these specific performance, durability, and safety criteria, Hanwha Solutions reinforces its brand reputation and reduces the risk of product recalls or market exclusion, a crucial factor in the competitive global landscape of renewable energy and chemical manufacturing.

Intellectual property rights are crucial for Hanwha Solutions, particularly in safeguarding its advanced technologies in areas like solar energy and advanced materials. Patents protect their innovative solar cell designs and chemical processes, preventing competitors from replicating their breakthroughs. For instance, Hanwha Q CELLS, a key division, consistently invests heavily in R&D, with patent filings reflecting their commitment to innovation in photovoltaic technology, a vital aspect of their competitive strategy.

Labor laws and workplace safety regulations

Hanwha Solutions must navigate a complex web of national and international labor laws, covering fair wages, working hours, and non-discrimination. For instance, in South Korea, the minimum wage for 2024 is set at 9,860 KRW per hour, a figure Hanwha Solutions must adhere to across its domestic operations. Compliance is not just a legal necessity but a cornerstone of ethical business practices, directly impacting employee morale and productivity.

Workplace safety regulations are equally critical, with stringent requirements aimed at preventing accidents and ensuring employee well-being. In 2023, South Korea reported a manufacturing industry industrial accident rate of 0.58%, a statistic that underscores the importance of robust safety protocols. Hanwha Solutions invests heavily in safety training and equipment to minimize risks, thereby protecting its workforce and avoiding costly penalties or operational disruptions.

- Compliance with South Korea's Labor Standards Act ensures fair treatment of all employees.

- Adherence to occupational health and safety standards, such as those mandated by the Ministry of Employment and Labor, is paramount.

- International labor conventions, particularly those related to child labor and forced labor, guide Hanwha Solutions' global operations.

- Maintaining a zero-tolerance policy for discrimination protects the company's reputation and fosters an inclusive work environment.

International trade agreements and tariffs

Hanwha Solutions' global business is heavily influenced by international trade agreements and the tariffs they impose. Navigating these complex legal structures is vital for managing the costs associated with moving goods across borders and for gaining entry into new markets. For instance, the United States' tariffs on certain steel and aluminum products, implemented in 2018 and largely maintained through 2024, can affect the cost of raw materials for Hanwha's solar panel manufacturing operations in the US.

Compliance with diverse customs regulations in countries where Hanwha operates, such as South Korea, the United States, and Germany, is paramount. These regulations dictate how products are classified, valued, and documented for import and export, directly impacting supply chain efficiency and profitability. Failure to adhere to these can lead to delays, fines, and reputational damage.

- Trade Agreements: Bilateral and multilateral agreements like the USMCA (United States-Mexico-Canada Agreement) can create preferential trade conditions, reducing tariffs and simplifying customs procedures for member countries, potentially benefiting Hanwha's North American operations.

- Tariff Impact: Global trade disputes and the imposition of tariffs, such as those seen between major economic blocs in recent years, can increase the cost of imported components or finished goods, impacting Hanwha's pricing strategies and competitiveness.

- Regulatory Compliance: Adherence to varying import/export laws, product standards, and chemical regulations in different jurisdictions is critical for seamless international operations and market access.

Legal factors significantly shape Hanwha Solutions' operational landscape, necessitating strict adherence to environmental protection laws, product safety standards, and intellectual property rights. For instance, South Korea's revised air quality standards in 2024 directly influence Hanwha's chemical plant operations, with non-compliance risking substantial fines. Similarly, maintaining certifications like IEC 61215 for its solar modules is crucial for market access in 2024, as emphasized by Hanwha Q CELLS.

The company must also navigate complex labor laws, including South Korea's 2024 minimum wage of 9,860 KRW per hour, and robust workplace safety regulations to prevent accidents, as evidenced by the 0.58% industrial accident rate in South Korea's manufacturing sector in 2023. Furthermore, international trade agreements and customs regulations, such as the ongoing impact of US tariffs on steel and aluminum through 2024, directly affect Hanwha's supply chain costs and market entry strategies.

Environmental factors

Global and national commitments to reduce greenhouse gas emissions are accelerating the shift towards renewable energy and increasing demand for sustainable materials. For instance, the Paris Agreement aims to limit global warming to well below 2, degrees Celsius, with many nations setting ambitious net-zero targets by 2050 or earlier. This creates a significant market opportunity for Hanwha Solutions' solar energy division, Q CELLS, which has been expanding its capacity, and its advanced materials segment focused on eco-friendly products.

These climate targets directly fuel the demand for Hanwha Solutions' solar energy products, as countries invest heavily in clean power generation to meet their emission reduction goals. Furthermore, the push for sustainability is driving innovation in Hanwha’s chemical business, encouraging the development of biodegradable plastics and other environmentally conscious materials, aligning its portfolio with the global imperative for climate action.

The growing global emphasis on resource efficiency and the adoption of circular economy principles directly impact Hanwha Solutions' operations. This trend is pushing the company to rethink its material sourcing and product development strategies, aiming for greater sustainability.

Hanwha Solutions is under increasing pressure to reduce waste generation and boost recycling rates across its value chain. Furthermore, exploring and integrating alternative, renewable feedstocks is crucial for the company to improve its sustainability credentials and lessen its dependence on limited natural resources.

For instance, the global plastics recycling rate, a key area for circularity, stood at approximately 9% in 2023, highlighting the significant room for improvement and the strategic importance for companies like Hanwha Solutions to invest in advanced recycling technologies and bio-based materials.

Hanwha Solutions faces increasing demands for robust pollution control and waste management, driven by stringent environmental regulations. In 2024, the company continued to invest in technologies to reduce emissions and manage byproducts from its chemical and solar divisions, aiming for compliance and enhanced sustainability.

Public pressure and evolving environmental standards in 2025 will likely require further capital allocation towards advanced abatement systems and circular economy initiatives. Hanwha Solutions' commitment to minimizing its ecological footprint is paramount for maintaining operational licenses and fostering positive stakeholder relationships.

Biodiversity conservation and land use impact

Hanwha Solutions, with its extensive operations including chemical plants and solar farms, must carefully manage its impact on local ecosystems and land use. The company is subject to increasing regulatory scrutiny and public pressure to reduce its environmental footprint. This includes implementing biodiversity conservation measures and adopting sustainable land management practices throughout its project lifecycle, from development to ongoing operations.

In 2024, Hanwha Solutions continued its commitment to sustainability, investing significantly in eco-friendly technologies and land restoration projects. For instance, its solar energy division is actively exploring sites that minimize ecological disruption, a key consideration given the global push for renewable energy expansion. The company reported a 5% reduction in land disturbance per megawatt installed for new solar projects compared to 2023, demonstrating progress in balancing energy production with environmental stewardship.

- Regulatory Compliance: Hanwha Solutions adheres to international and national environmental regulations concerning land use and biodiversity, facing potential fines or project delays for non-compliance.

- Sustainable Land Management: The company implements strategies like habitat restoration and the use of native vegetation in and around its facilities to mitigate land use impacts.

- Renewable Energy Siting: In 2024, Hanwha's solar projects prioritized brownfield sites or areas with lower ecological sensitivity, aiming to reduce the impact on natural habitats.

- Biodiversity Monitoring: Ongoing monitoring programs are in place to assess the effectiveness of conservation efforts and to adapt practices based on ecological feedback.

Corporate sustainability reporting and ESG standards

Growing pressure from investors, regulators, and consumers for transparent environmental reporting and adherence to ESG standards is significantly influencing Hanwha Solutions' operational practices and public image. For instance, by the end of 2023, over 90% of companies listed on major global stock exchanges were reporting on ESG metrics, a trend that continues to accelerate into 2024 and 2025.

Hanwha Solutions' commitment to comprehensive sustainability reporting, including detailed environmental data, directly enhances its appeal to a growing segment of responsible investors. This focus is crucial as sustainable investments are projected to reach $50 trillion globally by 2025, with a significant portion allocated to companies demonstrating strong environmental stewardship.

Adherence to evolving ESG standards, such as those being refined by the International Sustainability Standards Board (ISSB), positions Hanwha Solutions favorably. Companies that proactively align with these standards often see improved access to capital and a stronger competitive edge in markets increasingly prioritizing sustainability.

Key aspects of Hanwha Solutions' environmental reporting and ESG strategy include:

- Renewable Energy Integration: Hanwha Solutions is a major player in solar energy, with significant investments in solar panel manufacturing and solar farm development, contributing to a cleaner energy mix.

- Carbon Footprint Reduction: The company is actively working to reduce its greenhouse gas emissions across its operations, setting targets aligned with global climate goals.

- Circular Economy Initiatives: Hanwha Solutions is exploring and implementing strategies for material recycling and waste reduction within its production processes.

- Supply Chain Sustainability: Efforts are underway to ensure that its suppliers also meet stringent environmental and social standards.

Global climate agreements and national net-zero targets are accelerating the transition to renewable energy, directly benefiting Hanwha Solutions' solar division, Q CELLS. These commitments also drive demand for sustainable materials from its chemical segment, aligning the company with global environmental imperatives.

Hanwha Solutions is actively addressing resource efficiency and circular economy principles, focusing on sustainable material sourcing and product development. The company is also intensifying efforts in waste reduction and recycling, exploring renewable feedstocks to enhance sustainability and reduce reliance on finite resources.

Stringent environmental regulations necessitate robust pollution control and waste management, leading Hanwha Solutions to invest in technologies that reduce emissions and manage byproducts. Public and regulatory pressure in 2025 will likely require further investment in advanced abatement systems and circular economy initiatives to maintain operational licenses and positive stakeholder relations.

Hanwha Solutions must manage its environmental impact, particularly concerning land use and biodiversity, due to increasing regulatory scrutiny. In 2024, the company invested in eco-friendly technologies and land restoration, with its solar division prioritizing sites that minimize ecological disruption, achieving a 5% reduction in land disturbance per megawatt installed for new projects compared to 2023.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hanwha Solutions is built on a robust foundation of data from reputable sources, including government reports, international organizations, and leading industry publications. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.