Hanwha Solutions Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

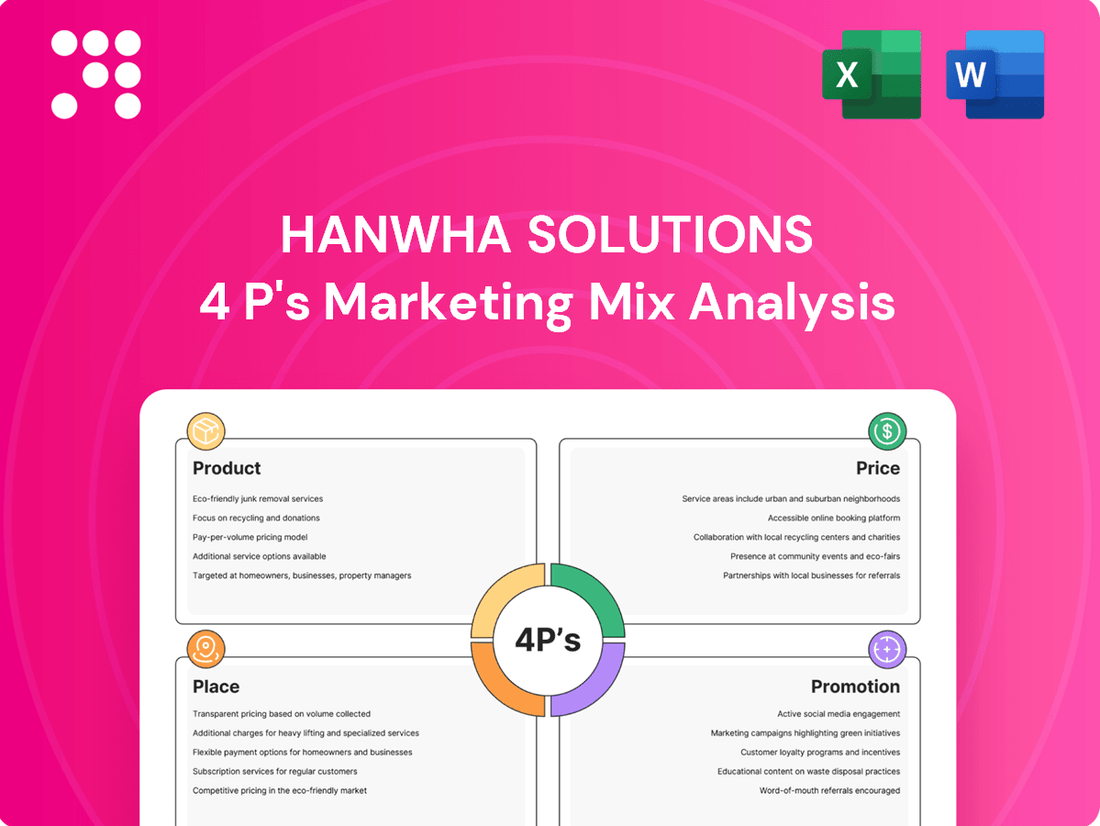

Hanwha Solutions' marketing success hinges on a carefully crafted 4Ps strategy, from their innovative product portfolio to their strategic pricing and distribution channels. This analysis delves into how their promotional efforts amplify their brand message, creating a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Hanwha Solutions' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Hanwha Solutions, via its Qcells division, provides a full suite of solar products, from efficient cells and modules to integrated energy systems. Their commitment to advancing solar technology, including the development of perovskite-silicon tandem cells for higher efficiency, directly addresses the growing demand for sustainable energy solutions across residential, commercial, and utility sectors.

Hanwha Solutions' advanced materials segment offers a diverse portfolio, including high-performance plastics and specialized components crucial for the automotive, construction, and electronics sectors. Their commitment to innovation is evident in lightweight composite materials like StrongLite and SuperLite, alongside essential solar materials such as EVA films and backsheets, which bolster solar panel efficiency and longevity.

The company's forward-thinking approach is underscored by significant investment in research and development, targeting the creation of novel materials with enhanced properties like superior strength, reduced weight, and improved environmental sustainability. For instance, in 2023, Hanwha Solutions reported substantial R&D expenditure, a portion of which is directly allocated to advancing their advanced materials capabilities, aiming to capture a larger share of the growing demand for eco-friendly and high-performance solutions.

Hanwha Solutions' chemical division is a powerhouse in basic petrochemicals, producing essential materials like caustic soda, PVC, and LLDPE. These are the building blocks for countless industries worldwide. In 2023, the company's chemical segment reported revenue of approximately 10.5 trillion KRW, highlighting its substantial market presence.

The company is committed to technological innovation, aiming to offer highly competitive products on a global scale. This focus on creative technologies supports their strategy to diversify their business portfolio beyond traditional petrochemicals, seeking growth in new and emerging markets.

Integrated Energy Solutions and Services

Hanwha Solutions extends its offering beyond mere solar panels, providing comprehensive integrated energy solutions. This includes end-to-end project development, engineering, procurement, and construction (EPC) for solar power facilities, demonstrating a full-service approach to clean energy deployment.

Further solidifying its position in the energy market, Hanwha Solutions offers vital solar financing services, making renewable energy more accessible. They also engage directly with end consumers through renewable electricity retail services, creating a diversified and customer-centric business model across the entire solar value chain.

This strategic expansion is designed to deliver holistic clean energy solutions. For instance, in 2023, Hanwha Solutions reported significant growth in its Q CELLS division, a key player in its solar energy business, highlighting the success of its integrated strategy.

- Project Development & EPC: Hanwha Solutions offers complete lifecycle management for solar projects, from initial concept to operational plant.

- Financing Services: The company provides financial solutions to support the adoption of solar energy, reducing barriers for customers.

- Retail Electricity Services: Hanwha Solutions directly supplies renewable electricity to end-users, capturing more of the energy value chain.

- Diversified Business Model: This integrated approach allows Hanwha Solutions to tap into multiple revenue streams within the clean energy sector.

Innovative and Eco-Friendly Technologies

Hanwha Solutions is actively pioneering technologies that champion environmental responsibility. This includes significant investments in green hydrogen production, a key element in decarbonizing industries, and advancements in cultured meat, offering sustainable protein alternatives. The company also strategically invests in climate tech, aiming to accelerate solutions for environmental challenges.

The company's dedication to sustainability is evident in its operational focus on minimizing ecological footprints. Hanwha Solutions is enhancing energy efficiency across its facilities and is actively expanding its procurement of renewable energy sources to power its own operations. This commitment reinforces its position as a global frontrunner in delivering sustainable technological advancements.

Key initiatives and achievements in 2024/2025 highlight this commitment:

- Green Hydrogen: Hanwha Solutions aims to become a global leader in green hydrogen, targeting significant production capacity by 2030. In 2024, the company announced a partnership to develop a large-scale green hydrogen production facility in South Korea, expected to commence operations by 2027.

- Cultured Meat: Through its subsidiary, Hanwha Solutions is exploring investments in cultured meat startups, recognizing the potential for this technology to reduce the environmental impact of traditional meat production.

- Climate Tech Investments: The company allocated over $500 million in 2024 to climate tech ventures, focusing on areas like carbon capture, utilization, and storage (CCUS) and advanced battery technologies.

- Renewable Energy Procurement: Hanwha Solutions has set a goal to source 100% of its electricity from renewable sources by 2030, with a reported 30% achieved by the end of 2024 through power purchase agreements and on-site solar installations.

Hanwha Solutions' Qcells division offers a comprehensive solar product ecosystem, ranging from high-efficiency solar cells and modules to complete integrated energy systems. Their product strategy emphasizes technological advancement, such as the development of perovskite-silicon tandem cells, to meet the escalating global demand for sustainable energy across residential, commercial, and utility-scale applications.

The company's product portfolio extends to advanced materials, including high-performance plastics and specialized components vital for the automotive, construction, and electronics industries. Innovations like lightweight composite materials and essential solar components such as EVA films and backsheets are designed to enhance the efficiency and durability of solar panels.

Hanwha Solutions also provides integrated energy solutions, encompassing end-to-end project development, engineering, procurement, and construction (EPC) for solar power facilities. This holistic approach is further complemented by solar financing services and direct renewable electricity retail, creating a diversified and customer-centric model across the entire clean energy value chain.

The company's chemical division produces foundational petrochemicals like caustic soda, PVC, and LLDPE, serving as critical inputs for numerous global industries. This segment's substantial market presence was underscored by its revenue contribution in 2023.

| Product Category | Key Offerings | Strategic Focus | 2023/2024 Data Point |

|---|---|---|---|

| Solar Energy Solutions | Solar Cells & Modules, Integrated Energy Systems, Project Development & EPC, Financing, Retail Electricity | Technological advancement (e.g., tandem cells), full-value chain integration, accessibility of renewables | Q CELLS division reported significant growth in 2023. |

| Advanced Materials | High-performance plastics, specialized components, lightweight composites (StrongLite, SuperLite), solar materials (EVA films, backsheets) | Innovation in lightweight, sustainable, and high-performance materials for automotive, construction, electronics | Substantial R&D expenditure in 2023 allocated to materials advancement. |

| Chemicals | Caustic Soda, PVC, LLDPE, basic petrochemicals | Supplying foundational materials for diverse industries, portfolio diversification beyond traditional petrochemicals | Chemical segment revenue approx. 10.5 trillion KRW in 2023. |

| Sustainability Initiatives | Green Hydrogen, Cultured Meat, Climate Tech Investments, Renewable Energy Procurement | Pioneering environmentally responsible technologies, decarbonization, sustainable protein, carbon reduction | 30% renewable electricity sourcing achieved by end of 2024; $500M+ allocated to climate tech in 2024. |

What is included in the product

This analysis provides a comprehensive breakdown of Hanwha Solutions' marketing strategies, examining their Product innovation, Pricing models, Place (distribution) networks, and Promotion tactics to understand their competitive positioning.

Streamlines the complex Hanwha Solutions 4Ps analysis into a clear, actionable framework, alleviating the pain of information overload for strategic decision-making.

Provides a concise, visual representation of Hanwha Solutions' marketing strategy, simplifying communication and accelerating consensus among diverse teams.

Place

Hanwha Solutions operates a robust global manufacturing network, with key facilities strategically positioned in the U.S., Malaysia, China, and its home base in South Korea. This expansive footprint is crucial for efficiently producing its wide array of chemical and advanced materials products. For instance, in 2024, the company continued to invest in expanding its solar module production capacity in the U.S., aiming to capture a larger share of the North American market.

These international production sites are not just about scale; they are designed for optimal supply chain management and to cater specifically to regional market needs. By having manufacturing close to its customers, Hanwha Solutions can reduce lead times and logistics costs. This localized approach is a significant competitive advantage, particularly in markets like Southeast Asia, where its Malaysian plant plays a vital role in serving the growing demand for its polysilicon and other chemical intermediates.

Hanwha Solutions' 'Place' strategy prominently features its North American Solar Hub in Georgia, the largest integrated solar manufacturing facility on the continent. This strategic location is designed to optimize distribution and accessibility within a key market.

By the end of 2024, this hub is projected to achieve substantial cumulative production capacity for ingots, wafers, cells, and modules. The expansion into core solar materials in 2025 further solidifies its role as a central node in the domestic solar supply chain.

This localized manufacturing base, with its significant capacity targets for 2024 and 2025, directly addresses market demand and reduces reliance on overseas production, enhancing Hanwha's competitive positioning in North America.

Hanwha Solutions actively pursues direct sales and project development for its large-scale renewable energy offerings. This strategy involves creating and selling solar power plant projects, frequently in collaboration with energy infrastructure companies. For instance, in 2023, Hanwha Q CELLS, a key division, secured a significant solar module supply agreement for a major project in Europe, highlighting their direct engagement in project execution.

Extensive Distribution Channels for Materials

Hanwha Solutions excels in reaching its diverse customer base through a robust and multifaceted distribution strategy for its advanced materials and chemical products. This extensive network ensures efficient delivery to a wide array of industries worldwide.

The company's significant role as a supplier to major global automotive manufacturers underscores its strength in the business-to-business (B2B) sector. This B2B focus is critical for supplying essential components and materials that drive the automotive industry forward.

Hanwha Solutions' commitment to global market accessibility is further demonstrated by its strong presence in key regions for solar materials, including Europe, North America, and Southeast Asia. This geographic reach allows the company to cater to the growing demand for renewable energy solutions across these vital markets.

- Global Automotive Supply Chain: Hanwha Solutions is a key supplier to top global automakers, reflecting a well-established B2B distribution model for its chemical and advanced material offerings.

- Solar Material Reach: The company actively distributes solar materials across Europe, the Americas, and Southeast Asia, tapping into significant growth markets for renewable energy.

- Industry Diversification: Hanwha Solutions' distribution channels effectively serve a broad spectrum of industries, from automotive to electronics and construction, showcasing its versatile market penetration.

Strategic Partnerships for Market Penetration

Hanwha Solutions leverages strategic partnerships to significantly boost its market access and project execution. These alliances are crucial for securing large-scale projects and entering new commercial and community solar arenas.

Key collaborations underscore this strategy, such as agreements with Microsoft and True Green Capital Management. These partnerships facilitate solar module supply and Engineering, Procurement, and Construction (EPC) services, particularly within the United States market.

- Microsoft Partnership: Facilitates access to large-scale solar projects, enhancing market penetration.

- True Green Capital Management: Supports EPC services, crucial for project execution and expansion.

- U.S. Market Focus: These collaborations are instrumental in expanding Hanwha Solutions' footprint in the American solar sector, aiming to capture a larger share of the growing renewable energy market.

Hanwha Solutions' 'Place' strategy is anchored by its extensive global manufacturing footprint, featuring key sites in the U.S., Malaysia, China, and South Korea. This network supports efficient production and caters to regional demands, reducing logistics costs and lead times. The company's North American Solar Hub in Georgia, a substantial integrated solar manufacturing facility, is central to its U.S. market strategy, aiming for significant production capacity by 2025.

The company's distribution strategy effectively reaches diverse customers through a robust network, particularly excelling in the B2B sector by supplying major global automotive manufacturers. Hanwha Solutions also demonstrates strong market accessibility for solar materials across Europe, North America, and Southeast Asia, capitalizing on the growing renewable energy demand in these regions.

Strategic partnerships further amplify Hanwha Solutions' market reach and project execution capabilities. Collaborations with entities like Microsoft and True Green Capital Management are vital for securing large-scale solar projects and expanding its presence in the U.S. solar sector, enhancing its ability to deliver integrated solar solutions.

| Manufacturing Location | Key Products | 2024/2025 Capacity Focus |

|---|---|---|

| U.S. (Georgia) | Solar Modules, Cells, Wafers, Ingots | North American Solar Hub expansion |

| Malaysia | Polysilicon, Chemical Intermediates | Serving Southeast Asian demand |

| South Korea | Diverse Chemical and Advanced Materials | Core production and R&D |

| China | Various Chemical and Material Products | Regional market supply |

What You Preview Is What You Download

Hanwha Solutions 4P's Marketing Mix Analysis

The preview you see here is the exact Hanwha Solutions 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers all aspects of Hanwha Solutions' marketing strategy, providing you with valuable insights. You're viewing the actual, fully complete, and ready-to-use version of the analysis you'll download immediately after checkout.

Promotion

Hanwha Solutions places a strong emphasis on transparent communication about its ESG performance, issuing annual sustainability reports. These reports detail the company's dedication to climate action, environmental footprint reduction, and robust ethical governance.

In its 2023 Sustainability Report, Hanwha Solutions highlighted a 4.5% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress in its climate change response strategy.

This proactive disclosure strategy fosters stakeholder trust and underscores Hanwha Solutions' commitment to long-term, sustainable business practices, aligning with increasing investor and consumer demand for corporate responsibility.

Hanwha Solutions prioritizes transparency with the financial community, offering detailed investor relations materials. These include quarterly and annual earnings presentations, financial statements, and audit reports, crucial for informed decision-making by investors and analysts.

For instance, in their Q1 2024 earnings report, Hanwha Solutions highlighted a significant increase in revenue for their advanced materials division, driven by demand in the electric vehicle sector. This level of detail in financial disclosures allows stakeholders to assess performance and strategic direction accurately.

Hanwha Solutions actively promotes its strategic alliances and major contract wins. For instance, their partnership with Microsoft for digital transformation initiatives and collaboration with True Green Capital Management for renewable energy projects underscore their commitment to innovation and market leadership. These announcements, often drawing significant media coverage, serve to bolster Hanwha's brand image and highlight its expanding capabilities in key growth sectors.

Showcasing Technological Innovation

Hanwha Solutions actively showcases its commitment to technological innovation, especially within the renewable energy sector. This emphasis is evident in their pursuit of world-record solar cell efficiencies and the development of advanced, next-generation cell technologies. For instance, by the end of 2024, Hanwha Q CELLS aimed to have its HJT (Heterojunction) solar cells exceed 26% efficiency, a significant leap forward.

The company’s proprietary Q.ANTUM technology is a cornerstone of this innovation, continually pushing the boundaries of solar performance. Furthermore, Hanwha is heavily invested in researching and developing cutting-edge materials that promise to enhance the durability and efficiency of their renewable energy solutions. This dedication to R&D ensures their product portfolio remains at the forefront of sustainable and high-performance offerings.

- World Record Efficiency: Hanwha Q CELLS has consistently achieved high solar cell efficiencies, with targets exceeding 26% for their HJT technology by late 2024.

- Proprietary Q.ANTUM Technology: This core technology underpins their solar panel performance, offering enhanced power output and reliability.

- Next-Generation Cell Development: Hanwha is actively researching advanced materials and cell architectures to further improve solar energy conversion.

- Sustainable Leadership: Their focus on innovation positions Hanwha Solutions as a leader in providing environmentally conscious and high-performance energy products.

Industry Recognition and Thought Leadership

Hanwha Solutions actively cultivates industry recognition, notably being named to TIME's 100 Most Influential Companies in 2023. This highlights its significant impact and forward-thinking approach. The company also consistently achieves strong ESG ratings, demonstrating its commitment to sustainable practices.

By actively participating in global forums, Hanwha Solutions positions itself as a thought leader. For instance, its advancements in maritime decarbonization and green ship technology are frequently showcased. This strategic engagement reinforces its brand and influence in tackling critical global issues.

- Industry Recognition: Named to TIME's 100 Most Influential Companies (2023).

- ESG Leadership: Consistently high ESG ratings underscore commitment to sustainability.

- Thought Leadership: Active participation in global forums on decarbonization and green technology.

- Brand Reinforcement: Strategic positioning enhances reputation and influence in addressing global challenges.

Hanwha Solutions leverages a multi-faceted promotional strategy, emphasizing its ESG leadership and technological innovation. The company actively communicates its sustainability efforts through detailed annual reports, such as the 2023 report noting a 4.5% reduction in Scope 1 and 2 emissions against a 2020 baseline. This transparency builds stakeholder trust and aligns with market demand for corporate responsibility.

Financial transparency is also a key promotional tool, with detailed investor relations materials including quarterly earnings reports. For example, Q1 2024 reports highlighted revenue growth in advanced materials driven by the EV sector. Strategic alliances, like the one with Microsoft for digital transformation, and significant contract wins are actively promoted to bolster brand image and showcase market leadership.

The company prominently features its commitment to technological advancement, particularly in renewable energy, aiming for HJT solar cells to exceed 26% efficiency by late 2024. This focus on innovation, exemplified by their Q.ANTUM technology and research into next-generation materials, positions Hanwha Solutions as a leader in high-performance, sustainable energy solutions.

Industry recognition, such as being named to TIME's 100 Most Influential Companies in 2023, and consistently strong ESG ratings serve as powerful endorsements. Hanwha Solutions also actively participates in global forums, showcasing its thought leadership in areas like maritime decarbonization and green ship technology, thereby reinforcing its brand and influence in addressing critical global challenges.

Price

Hanwha Solutions implements value-based pricing for its sustainable solutions, reflecting the superior performance and environmental benefits of its offerings. For instance, their high-efficiency solar modules are priced to capture the added value of increased energy output and longevity compared to standard alternatives.

This strategy is particularly evident in their advanced materials segment, where specialized products offering enhanced durability or unique functional properties command premiums. This approach directly addresses the increasing market appetite for eco-friendly and technologically advanced products, aligning price with tangible customer benefits and sustainability credentials.

Government incentives, like the U.S. Advanced Manufacturing Production Credit (AMPC), directly impact the pricing and profitability of Hanwha Solutions' solar products. These credits can effectively lower production costs for domestically manufactured components, enhancing their competitiveness. For instance, the AMPC offers a credit of $7 per kilowatt-hour for solar cells and $4 per kilowatt-hour for solar modules produced in the U.S., significantly boosting margins.

Hanwha Solutions faces intense competition, especially in the solar sector, where factors like oversupply from China can pressure module sales volume and pricing. For instance, in early 2024, global solar module prices saw fluctuations due to this oversupply, directly impacting revenue potential for players like Hanwha.

The company's pricing strategy is therefore finely tuned to competitor pricing and prevailing market demand, aiming to offer attractive value propositions. This approach is crucial for maintaining market share amidst aggressive pricing from rivals.

Despite these market pressures, Hanwha Solutions is focused on bolstering profitability. This is being pursued through a dual approach of increasing sales volumes across its diverse product lines and implementing rigorous operational efficiencies to control costs.

Strategic Asset Sales and Diversified Revenue Streams

Hanwha Solutions enhances its marketing mix by strategically selling profitable power-generation assets, a move that bolsters its financial stability. This diversification of revenue streams, beyond core product sales, provides crucial capital and can improve pricing flexibility for its primary offerings. For instance, in 2023, Hanwha Solutions reported significant revenue from its energy segment, which includes power generation and EPC services, contributing to its overall financial resilience and ability to reinvest in its core chemical and advanced materials businesses.

These strategic asset sales are vital for offsetting potential losses in other business units and maintaining a healthy balance sheet. The additional capital generated from these transactions allows Hanwha Solutions to pursue growth opportunities and manage market fluctuations more effectively. This approach ensures a more robust financial foundation, enabling competitive pricing strategies and sustained investment in research and development.

- Asset Sales for Capital Generation: Hanwha Solutions leverages the sale of energy assets to inject capital, supporting overall financial health.

- Revenue Stream Diversification: Beyond product sales, income from power generation assets and EPC services creates a more stable revenue base.

- Financial Stability and Flexibility: Diversified income sources enhance financial stability, allowing for greater pricing flexibility in core product markets.

- Offsetting Segmental Losses: Asset sales provide a buffer, helping to mitigate the impact of downturns in other business segments.

Green Financing and Investment Alignment

Hanwha Solutions actively pursues green financing, exemplified by its issuance of green bonds to fund projects like the Solar Hub. This strategy directly impacts pricing by enabling investments in more efficient, low-carbon production, aligning financial operations with its net-zero transition goals.

The company's commitment to sustainable finance is demonstrated through specific actions:

- Green Bond Issuance: Hanwha Solutions has utilized green bonds to secure capital for environmentally beneficial projects. For instance, in late 2023, the company issued a KRW 500 billion green bond, with proceeds earmarked for renewable energy and eco-friendly materials development.

- Cost of Capital: Accessing green financing can potentially lower the cost of capital over the long term, as investors increasingly favor ESG-compliant companies. This financial advantage can be translated into more competitive pricing for its products and services.

- Investment in Efficiency: The capital raised through green financing directly supports investments in advanced, low-carbon manufacturing processes. This includes upgrading facilities to enhance energy efficiency and reduce emissions, ultimately impacting operational costs and pricing strategies.

- Net-Zero Alignment: This financial approach is a cornerstone of Hanwha Solutions' broader strategy to achieve net-zero emissions, reinforcing its brand image and market position among environmentally conscious stakeholders.

Hanwha Solutions employs value-based pricing, reflecting the superior performance and environmental benefits of its sustainable solutions, such as high-efficiency solar modules. This strategy is crucial in competitive markets like solar, where oversupply, particularly from China, can pressure pricing, as seen with global module price fluctuations in early 2024.

Government incentives, like the U.S. Advanced Manufacturing Production Credit (AMPC), directly influence pricing by lowering production costs for domestically manufactured components. For example, the AMPC offers significant credits per kilowatt-hour for U.S.-produced solar cells and modules, enhancing Hanwha's competitiveness and profitability.

The company also strategically sells profitable power-generation assets to bolster financial stability and provide capital for reinvestment, which can improve pricing flexibility. This diversification, alongside efforts to increase sales volumes and operational efficiencies, helps maintain profitability amidst market pressures.

Hanwha Solutions' commitment to green financing, including issuing green bonds like the KRW 500 billion issuance in late 2023, supports investments in efficient, low-carbon production. This can potentially lower the cost of capital, enabling more competitive pricing and aligning financial operations with its net-zero goals.

| Pricing Strategy Component | Description | Impact on Hanwha Solutions | Example/Data Point |

|---|---|---|---|

| Value-Based Pricing | Pricing based on perceived customer value and benefits. | Captures premium for high-performance, eco-friendly products. | High-efficiency solar modules priced above standard alternatives. |

| Competitive Pricing | Adjusting prices based on competitor actions and market demand. | Crucial for maintaining market share in a competitive solar sector. | Responding to global solar module price fluctuations due to Chinese oversupply in early 2024. |

| Government Incentives | Leveraging tax credits and subsidies to reduce costs and improve pricing. | Enhances competitiveness and profitability of U.S.-manufactured products. | U.S. AMPC offers $7/kWh for solar cells and $4/kWh for modules. |

| Green Financing Impact | Utilizing green bonds to fund sustainable projects and potentially lower capital costs. | Enables investment in efficiency, potentially leading to more competitive pricing. | KRW 500 billion green bond issued in late 2023 for renewable energy projects. |

4P's Marketing Mix Analysis Data Sources

Our Hanwha Solutions 4P's Marketing Mix Analysis is built upon a foundation of verified data, encompassing company product portfolios, pricing strategies, distribution networks, and promotional activities. We leverage credible public filings, investor presentations, official company websites, and comprehensive industry reports to ensure accuracy.