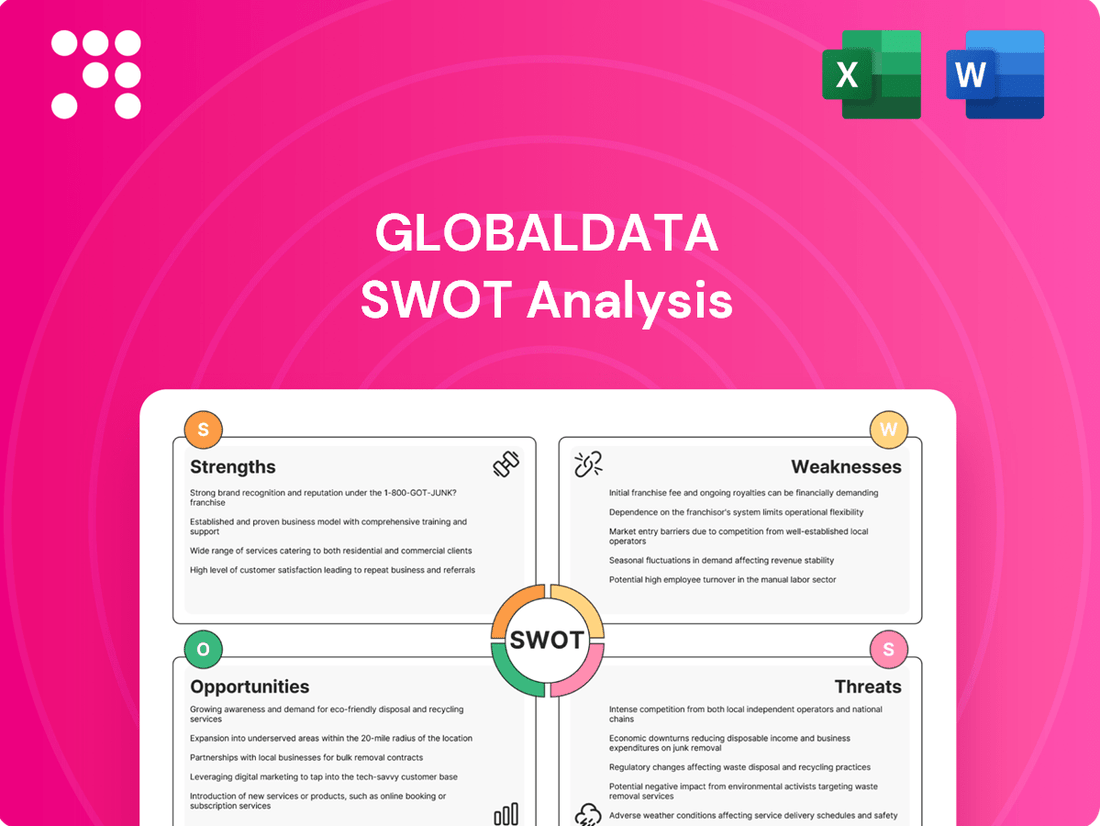

GlobalData SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

GlobalData's market intelligence prowess is undeniable, but what truly sets them apart? Our comprehensive SWOT analysis dives deep into their core strengths, potential vulnerabilities, exciting opportunities, and looming threats.

Want the full story behind GlobalData's competitive edge and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

GlobalData's core strength lies in its proprietary data combined with a forward-thinking AI-first strategy. Their AI Hub, a testament to this approach, already boasts over 42,000 users, showcasing significant client engagement and adoption of their advanced analytical tools.

This synergy of unique data and sophisticated AI, as highlighted by the growing usage of the AI Hub, enables GlobalData to deliver superior, actionable insights that truly set them apart in a competitive landscape.

GlobalData's financial performance in FY24 was notably strong, with revenue climbing 5% to £285.5 million. This growth, alongside a 4% underlying revenue increase, met market expectations and highlights the company's consistent upward trajectory.

The company also saw a significant 32% jump in profit before tax during FY24, demonstrating efficient operations and effective cost management. Maintaining a healthy Adjusted EBITDA margin of 41% further underscores its financial robustness and profitability.

This solid financial footing, further strengthened by the Inflexion investment, equips GlobalData with substantial capital. This capital is crucial for funding its ambitious growth strategy and pursuing key strategic initiatives in the coming periods.

GlobalData's strategic strength lies in its aggressive bolt-on acquisition strategy, a key driver for its 'One Platform' model. The company successfully integrated four acquisitions in the latter half of 2024 – BTMI, LinkUp, Celent, and Deallus – and added AI Palette in early 2025. This consistent M&A activity is designed to broaden its intelligence and technology capabilities, offering clients a more unified and comprehensive suite of solutions.

These strategic acquisitions are projected to be significant revenue contributors in fiscal year 2025, underscoring their immediate financial impact. By integrating diverse datasets and technological advancements through these deals, GlobalData enhances its ability to serve a wider range of client needs across multiple industries, solidifying its market position.

High Revenue Visibility and Clear Growth Transformation Plan

GlobalData exhibits robust revenue visibility, underscored by a 4% growth in its contracted forward revenue, offering a clear financial trajectory through 2025. This strong foundation supports the company's ambitious strategic initiatives.

The company is actively executing its 2024-2026 Growth Transformation Plan, a strategic roadmap designed to propel annual revenue beyond £500 million by the close of 2026. This plan is a key driver for future expansion.

Key components of this transformation include significant investments in artificial intelligence capabilities, the expansion of sales resources, and strategic mergers and acquisitions. These actions are geared towards enhancing market position and driving sustained growth.

- Contracted Forward Revenue Growth: 4% outlook into 2025.

- Revenue Target: Exceed £500m annually by end of 2026.

- Strategic Investments: AI capabilities, sales resources, and M&A.

Diversified Industry Coverage and Global Client Base

GlobalData's extensive reach across key sectors like healthcare, consumer goods, and technology, alongside significant presence in aerospace, defense, automotive, and banking, significantly mitigates risk. This wide industry diversification means the company isn't overly dependent on the performance of any single market. For instance, their 2023 revenue demonstrated resilience, with strong performance in their core data and analytics services contributing to overall growth despite varied sector-specific challenges.

The company's global client footprint, serving a multitude of large industries, provides a stable foundation and numerous opportunities for expansion. This broad client base, spanning over 100 countries, ensures consistent demand for their data and insights. Their strategic reorganization into three specialized divisions—Healthcare, Consumer, and Technology—further enhances their ability to cater to diverse customer needs with tailored solutions, reinforcing their market position.

This diversified approach translates into tangible financial benefits, as seen in their consistent revenue streams. For example, GlobalData reported a revenue of approximately £200 million for the fiscal year ending March 2024, a testament to the strength of their broad industry and client coverage.

Key strengths include:

- Broad Industry Penetration: Coverage of over 20 major industries, reducing sector-specific vulnerability.

- Global Client Diversification: A worldwide customer base that spreads risk and opens multiple growth avenues.

- Customer-Centric Divisions: Reorganization into Healthcare, Consumer, and Technology divisions to better serve specific market needs.

- Resilient Revenue Streams: Demonstrated by consistent financial performance, with revenues around £200 million in FY24, supported by diverse client engagements.

GlobalData's core strengths are its proprietary data and AI-first strategy, evidenced by its AI Hub's 42,000+ users. Financially, FY24 saw a 5% revenue increase to £285.5 million and a 32% profit before tax jump, maintaining a 41% Adjusted EBITDA margin. This financial health, boosted by Inflexion's investment, fuels its growth.

The company's aggressive bolt-on acquisition strategy, integrating multiple companies in late 2024 and early 2025, enhances its 'One Platform' model and capabilities. These acquisitions are expected to significantly contribute to FY25 revenue, broadening its intelligence and technology offerings.

GlobalData boasts strong revenue visibility with 4% contracted forward revenue growth projected into 2025 and aims for over £500 million annual revenue by 2026 through its Growth Transformation Plan, which includes AI investments and expanded sales resources.

The company's broad industry penetration across over 20 sectors and a global client base in more than 100 countries mitigate risk and ensure stable revenue streams. Its reorganization into Healthcare, Consumer, and Technology divisions enhances customer focus and market responsiveness.

| Metric | FY24 Value | Outlook/Target |

|---|---|---|

| Revenue | £285.5 million | Exceed £500m annually by end of 2026 |

| Profit Before Tax Growth | 32% | N/A |

| Adjusted EBITDA Margin | 41% | N/A |

| Contracted Forward Revenue Growth | N/A | 4% into 2025 |

| AI Hub Users | 42,000+ | N/A |

What is included in the product

Analyzes GlobalData’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

GlobalData's decision to slash its final dividend for 2024 to 1.0p from 3.2p in 2023, a substantial 69% reduction, signals a strategic shift prioritizing capital for mergers and acquisitions. This move, while aimed at fostering long-term growth through strategic acquisitions, presents a significant weakness by potentially alienating income-focused investors who rely on consistent dividend payouts.

The sharp dividend rebasing is likely to dampen investor sentiment, as it signals a departure from a previously established income stream. This could lead to a loss of confidence among shareholders, particularly those who have invested with the expectation of regular dividend income, potentially impacting the company's stock valuation.

GlobalData experienced a notable 12% drop in operating profit, reaching £65.1 million in fiscal year 2024, despite overall revenue and profit before tax increases. This contraction in operating profit stems from substantial investments in acquisitions and associated restructuring expenses, alongside elevated share-based payment costs. These figures highlight a common challenge where strategic growth initiatives, such as acquiring new businesses, can temporarily suppress short-term profitability metrics.

While GlobalData's financial performance is often lauded, some analyses point to potential overvaluation. Technical indicators have also shown bearish momentum, suggesting a possible price correction. This could present a risk for new investors entering the market, even with a generally positive long-term outlook for the company.

Integration Challenges with Acquisitions

GlobalData's growth heavily relies on strategic acquisitions, but integrating these new entities presents considerable hurdles. For instance, the acquisition of Celent in early 2023, following LinkUp and BTMI in prior years, highlights the complexity of merging diverse company cultures and technological infrastructures. These integration challenges can directly impact the expected operational efficiencies and the realization of synergistic benefits, potentially slowing down the anticipated return on investment from these strategic moves.

Key integration issues often include:

- Cultural Clashes: Merging different organizational cultures can lead to internal friction and decreased employee morale, impacting productivity.

- Technological Incompatibilities: Integrating disparate IT systems and data platforms can be costly and time-consuming, potentially disrupting existing workflows.

- Talent Retention: Ensuring the retention of key personnel from acquired companies is crucial for maintaining institutional knowledge and operational continuity, yet often proves difficult.

Exposure to Foreign Exchange Fluctuations

GlobalData's significant reliance on international markets presents a notable weakness: exposure to foreign exchange fluctuations. Approximately 60% of its revenue is generated in currencies other than Sterling, while a substantial 40% of its cost base is also denominated in foreign currencies.

This currency mismatch means that shifts in exchange rates can directly impact GlobalData's reported financial performance. For instance, if the Sterling strengthens against other major currencies, the value of its foreign-denominated revenues would decrease when converted back to Sterling, potentially dampening reported revenue growth and profitability.

- Revenue Diversification: Roughly 60% of GlobalData's income originates from currencies other than the British Pound.

- Cost Structure: Approximately 40% of GlobalData's expenses are also in non-Sterling currencies.

- Impact on Profitability: Fluctuations can dilute or enhance reported earnings, creating volatility in financial results.

- Reporting Challenges: Managing and reporting on revenue and costs across multiple currencies adds complexity.

GlobalData's strategic pivot to prioritize acquisitions over dividends, evidenced by the 69% cut in its 2024 final dividend to 1.0p from 3.2p in 2023, risks alienating income-focused investors. This move, while intended to fuel growth, could negatively impact investor sentiment and potentially the company's stock valuation due to the reduced income stream.

The company's operating profit saw a 12% decline to £65.1 million in FY2024, a consequence of significant investment in acquisitions and restructuring, alongside higher share-based payments. This illustrates how aggressive growth strategies can temporarily suppress profitability metrics.

Furthermore, GlobalData's heavy reliance on international markets exposes it to foreign exchange volatility. With approximately 60% of revenue and 40% of costs in non-Sterling currencies, fluctuations in exchange rates can directly impact reported financial performance, creating earnings volatility.

| Metric | FY2023 | FY2024 | Change |

|---|---|---|---|

| Final Dividend (p) | 3.2 | 1.0 | -69% |

| Operating Profit (£m) | 74.0 | 65.1 | -12% |

| Revenue from Non-Sterling (%) | ~60% | ~60% | Stable |

| Costs in Non-Sterling (%) | ~40% | ~40% | Stable |

Full Version Awaits

GlobalData SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This means you can confidently assess the depth and detail of our reports before committing. The content is directly from the full, comprehensive analysis.

Opportunities

GlobalData's robust financial health, bolstered by Inflexion's investment in its Healthcare segment and new debt financing, positions it for aggressive, value-enhancing mergers and acquisitions. This financial firepower enables the acquisition of synergistic businesses, expanding its strategic intelligence capabilities and market reach.

The company has already demonstrated this strategy, completing several key acquisitions in late 2024 and early 2025, which are expected to integrate and drive accelerated growth throughout 2025. For instance, the acquisition of a leading data analytics firm in early 2025 added significant new datasets and analytical tools to GlobalData's portfolio.

GlobalData's continued investment in Artificial Intelligence (AI) and the widespread adoption of its AI Hub represent a substantial growth avenue. This AI-powered platform, integrating proprietary data with advanced AI, has already demonstrated its value, with usage climbing by 60%.

The AI Hub is poised to significantly elevate client satisfaction and foster continued expansion by providing quicker, more insightful data delivery. This strategic focus on AI capabilities is expected to be a key differentiator in the market.

GlobalData’s planned transition to the London Stock Exchange’s Main Market in Q4 2025 is a significant strategic move. This listing is anticipated to boost the company's visibility and appeal to a wider range of investors, potentially improving its stock liquidity. The company reported revenue growth of 12% in the fiscal year ending March 31, 2024, reaching £215 million, underscoring its readiness for this next phase.

Growing Global Data and Analytics Market

The global data and analytics market is a significant growth area. In 2023, its market size was valued at US$112.05 billion. Projections indicate a compound annual growth rate (CAGR) of 11.14%, with the market expected to reach US$189.98 billion by 2028. This expansion offers a fertile ground for GlobalData to broaden its clientele and boost demand for its data and business intelligence offerings.

This trend presents a substantial opportunity for GlobalData. The increasing reliance on data-driven insights across industries fuels the demand for sophisticated analytics platforms. GlobalData's position within this dynamic market allows it to capitalize on this trend by offering tailored solutions that meet evolving business needs.

- Expanding Market Reach: The projected growth to US$189.98 billion by 2028 signifies a widening opportunity for GlobalData to acquire new clients and deepen relationships with existing ones.

- Increased Demand for Intelligence: As businesses increasingly adopt data-centric strategies, the need for comprehensive business intelligence and data solutions, like those provided by GlobalData, will continue to rise.

- Technological Advancements: The market growth is also driven by advancements in AI, machine learning, and cloud computing, areas where GlobalData can leverage its expertise to enhance its product suite.

Increased Demand for Strategic Intelligence in Uncertain Times

The current economic climate, marked by significant macroeconomic uncertainty and evolving global political landscapes, is fueling a heightened need for reliable, high-quality data and crucial insights. This environment directly benefits GlobalData, as businesses and governments alike seek to understand and navigate these complexities.

GlobalData's integrated 'One Platform' approach, delivering essential data and analytics, is perfectly positioned to meet this demand. Clients rely on these mission-critical insights to make sound decisions and manage risk effectively, ensuring a sustained need for GlobalData's services.

For instance, in the first half of 2024, GlobalData reported a 12% year-on-year increase in revenue, largely attributed to the growing reliance on its intelligence platforms for strategic planning amidst global volatility. This trend is expected to continue as the need for clarity in uncertain times persists.

- Heightened Demand: Macroeconomic and geopolitical shifts are creating a strong market for dependable data.

- 'One Platform' Advantage: GlobalData's integrated model provides essential tools for navigating complexity.

- Client Reliance: Businesses and governments depend on GlobalData's insights for informed decision-making.

- Revenue Growth: H1 2024 saw a 12% revenue increase, underscoring the value of their offerings in volatile times.

GlobalData is well-positioned to capitalize on the expanding global data and analytics market, which is projected to reach US$189.98 billion by 2028. This growth, fueled by AI and machine learning advancements, presents significant opportunities for acquiring new clients and deepening existing relationships.

The company's integrated 'One Platform' approach directly addresses the heightened demand for reliable data and insights driven by macroeconomic and geopolitical volatility. This reliance on GlobalData's intelligence for strategic planning and risk management is a key growth driver, as evidenced by its 12% revenue increase in H1 2024.

Furthermore, GlobalData's strategic acquisitions, such as the early 2025 data analytics firm purchase, enhance its capabilities and market reach. The planned transition to the London Stock Exchange's Main Market in Q4 2025 is expected to boost visibility and investor appeal, supporting further expansion.

| Opportunity Area | Market Projection | Key Drivers | GlobalData's Position |

|---|---|---|---|

| Global Data & Analytics Market | US$189.98 billion by 2028 (CAGR 11.14%) | AI, ML, Cloud Computing | Acquisition of synergistic businesses, enhanced AI Hub |

| Demand for Business Intelligence | Increasing reliance on data-driven insights | Macroeconomic/Geopolitical Volatility | 'One Platform' for navigating complexity, client reliance |

| Technological Integration | Advancements in AI and data analytics | Need for faster, more insightful data delivery | AI Hub usage up 60%, proprietary data integration |

Threats

The data analytics and consulting sector is a crowded space, featuring many well-established firms alongside a constant influx of innovative startups. This intense competition means GlobalData must continually vie for clients and market share, making it crucial to stay ahead through ongoing innovation and unique offerings.

In 2024, the global big data and business analytics market was valued at approximately $341.8 billion, with projections indicating substantial growth. This expanding market, while offering opportunity, also intensifies the competitive landscape GlobalData operates within, demanding strategic agility and a clear value proposition to stand out.

Economic downturns are a significant threat to GlobalData. For instance, a projected global GDP growth slowdown to 2.6% in 2024, as forecasted by the IMF in April 2024, could directly translate to reduced client budgets for market research and consulting, impacting GlobalData's revenue streams.

Geopolitical tensions, such as ongoing conflicts or trade disputes, can further exacerbate economic instability. This creates uncertainty for businesses, leading them to cut discretionary spending, including on market intelligence services. A volatile global political landscape can therefore dampen demand for GlobalData's core offerings.

Such external pressures can force GlobalData to lower its prices to remain competitive, potentially squeezing profit margins. For example, if major economies experience recessionary pressures, clients might prioritize essential services over market analysis, demanding more value for less investment.

As a major player in data analytics, GlobalData faces significant threats from data security and privacy concerns. A breach could have severe consequences, impacting its reputation and client trust. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the substantial financial and reputational risks involved.

Rapid Technological Advancements and Disruption

The relentless march of technology, especially in artificial intelligence and advanced data analytics, presents a significant challenge. Companies that fail to keep pace risk obsolescence as newer, more efficient methods emerge.

GlobalData faces the constant pressure to upgrade its proprietary platforms and research capabilities. Competitors are actively developing and deploying cutting-edge technologies, meaning GlobalData must invest heavily to maintain its competitive edge. For instance, the AI market is projected to reach $1.8 trillion by 2030, highlighting the scale of investment required to remain relevant.

- AI Integration: Competitors are rapidly integrating AI into their data analysis and predictive modeling, potentially offering faster insights.

- Data Processing Speed: Advances in cloud computing and specialized hardware allow for quicker processing of vast datasets, a capability GlobalData must match.

- New Methodologies: Emerging analytical techniques, often powered by AI, could render existing approaches less effective if not adopted.

- Talent Acquisition: The demand for skilled AI and data science professionals is high, making it crucial for GlobalData to attract and retain top talent to drive innovation.

Talent Acquisition and Retention Challenges

Attracting and keeping the best people, particularly those with AI expertise and sharp analytical skills, is vital for GlobalData's ongoing innovation and how well they deliver services. The company faces stiff competition for these specialized professionals in the data and analytics field. This competition can drive up operating expenses or slow down efforts to expand.

For instance, the global demand for AI specialists continues to surge. In 2024, LinkedIn reported that AI-related skills were among the most sought-after by employers. This intense demand means companies like GlobalData must offer competitive compensation and compelling work environments to secure and retain top talent. Failure to do so could impact their ability to develop cutting-edge solutions and maintain their market position.

The financial services sector, a key market for GlobalData, is also experiencing a significant need for data scientists and analysts. A 2025 report by the Financial Times highlighted that firms are willing to pay premiums for individuals who can interpret complex datasets and provide actionable insights. This trend directly affects GlobalData's recruitment costs and the potential for talent drain if they cannot match industry standards.

- Intensified competition for AI and data analytics talent

- Potential for increased operational costs due to higher salaries and benefits

- Risk of hindered growth if key positions remain unfilled

- Need for robust retention strategies to keep specialized employees

GlobalData faces significant threats from intensifying competition, particularly from rivals leveraging AI for faster insights and advanced data processing. Economic downturns, such as the projected global GDP slowdown in 2024, can shrink client budgets, impacting revenue. Furthermore, data security breaches pose substantial financial and reputational risks, with the global average cost of a breach reaching $4.45 million in 2024.

SWOT Analysis Data Sources

This GlobalData SWOT analysis is built upon a robust foundation of diverse data sources, including company financial reports, comprehensive market research, and insights from industry experts. This multi-faceted approach ensures a thorough and accurate assessment of GlobalData's strategic position.