GlobalData PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

Uncover the hidden forces shaping GlobalData's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting their operations and future growth. Equip yourself with actionable intelligence to navigate the competitive landscape. Download the full report now and gain a decisive advantage.

Political factors

Governments worldwide are enacting more stringent data privacy and localization regulations, directly influencing how GlobalData gathers, processes, and stores data internationally. For instance, the European Union's General Data Protection Regulation (GDPR) and similar national laws in China and India mandate that data be kept within specific geographic borders, potentially altering GlobalData's operational approaches and its capacity for data analysis.

These data localization requirements push companies to adjust their infrastructure and cloud service agreements to ensure adherence. This adaptation can introduce higher operational expenses and more intricate logistical challenges for businesses like GlobalData. For example, by mid-2024, over 100 countries had implemented or were considering data localization laws, a significant increase from previous years, impacting cross-border data flows for global data providers.

Escalating geopolitical tensions, such as the ongoing US-China rivalry and conflicts in the Middle East and Ukraine, cast a long shadow of uncertainty over multinational corporations like GlobalData. These global flashpoints directly impact market stability and operational predictability.

Such tensions frequently translate into protectionist trade policies and tariffs, as seen in the trade disputes between the US and China, which have imposed significant duties on billions of dollars worth of goods. This can lead to disruptions in global supply chains, affecting market access and the strategic planning of companies like GlobalData.

As a data and analytics firm, GlobalData's business is intrinsically linked to the economic and political health of the regions it covers. Shifts in international relations and trade policies directly influence the data it collects and the insights it provides, making it particularly sensitive to these geopolitical dynamics.

Political stability in major economies directly shapes the business landscape for data analytics and consulting. For instance, the 2024 US presidential election and upcoming elections in numerous other nations in 2024 and 2025 could lead to policy shifts impacting technology adoption and data privacy regulations, influencing demand for GlobalData's services.

Changes in government leadership or policy priorities can create both opportunities and challenges. A focus on digital transformation by a new administration, as seen with some initiatives in the EU in late 2023, could boost demand for market intelligence, while increased protectionist trade policies might create operational hurdles.

GlobalData's strategic planning must account for evolving political climates, particularly in regions with heightened instability. For example, monitoring geopolitical tensions in Eastern Europe or shifts in economic policy in emerging markets is crucial for forecasting client spending and identifying potential risks to GlobalData's global operations.

Government Investment in Digital Infrastructure and AI

Governments worldwide are significantly increasing their investment in digital infrastructure and artificial intelligence (AI). For instance, the United States' CHIPS and Science Act, enacted in 2022, allocates over $52 billion for semiconductor manufacturing and research, including substantial funding for AI development. This surge in public spending creates a fertile ground for data analytics firms like GlobalData, as it implies a greater volume of data generated and a heightened demand for sophisticated insights to navigate this evolving digital landscape.

However, these government initiatives also introduce complexities. New regulations are emerging around AI ethics, data privacy, and cybersecurity, directly impacting how data can be collected, processed, and utilized. For example, the European Union's AI Act, expected to be fully implemented in 2025, categorizes AI systems by risk level, imposing stricter requirements on high-risk applications. These policy shifts will shape the types of data analytics services that are in demand and permissible for GlobalData.

- Increased Data Availability: Government investments in digital infrastructure, such as 5G networks and cloud computing, are expected to generate vast amounts of data, creating opportunities for data analysis.

- AI Regulation Impact: Emerging regulations on AI development and data usage, like the EU's AI Act, will influence the permissible scope and methods of data analytics services.

- Demand for Specialized Insights: The focus on AI and digital transformation necessitates specialized data analytics services that can interpret complex datasets and inform strategic decision-making in these areas.

International Cooperation and Data Flow Agreements

International cooperation and data flow agreements are crucial for GlobalData's global operations. The absence of such agreements can lead to significant hurdles in data sharing and cross-border collaborations, impacting service delivery to its international clientele. For instance, the European Union's General Data Protection Regulation (GDPR) and similar frameworks in other regions necessitate careful navigation of data transfer rules, which can be complex without harmonized international standards.

Fragmented global data governance, characterized by varying privacy standards and market access regulations, presents ongoing challenges. This fragmentation can complicate the seamless transfer of data, a core function for GlobalData's market intelligence services. In 2024, the ongoing discussions around data localization requirements in several key markets, including India and Brazil, highlight the need for adaptable strategies to ensure continued data access and operational efficiency.

Harmonized international frameworks are vital for GlobalData. These frameworks facilitate the legal and efficient movement of data, underpinning the company's ability to serve its global client base effectively. The EU-US Data Privacy Framework, established in 2023, is an example of such an effort, aiming to simplify data transfers between the two regions, though its long-term stability and broader applicability remain subjects of ongoing review.

- Data Transfer Complexity: Navigating differing national data privacy laws, such as GDPR and CCPA, adds layers of compliance for GlobalData.

- Market Access Barriers: Data localization mandates in countries like China can restrict the free flow of information, impacting GlobalData's research capabilities.

- International Agreements: The EU-US Data Privacy Framework (operational since July 2023) aims to streamline data flows, though its effectiveness is continually assessed.

- Geopolitical Impact: Trade tensions and geopolitical shifts can influence data sharing policies, creating uncertainty for global data providers.

Government policies on data privacy and localization are a significant factor, with over 100 countries having data localization laws by mid-2024. Geopolitical tensions, like the US-China rivalry, impact market stability and can lead to protectionist trade policies. Political shifts, such as upcoming elections in 2024 and 2025, could alter regulations affecting technology and data privacy.

Governments are increasing investment in digital infrastructure and AI, with the US CHIPS and Science Act allocating over $52 billion for related research and development. However, emerging AI regulations, like the EU's AI Act expected in 2025, will shape data analytics services. International data flow agreements are crucial, with the EU-US Data Privacy Framework (operational since July 2023) aiming to simplify data transfers.

| Political Factor | Impact on GlobalData | Example/Data Point |

| Data Privacy Regulations | Compliance complexity, potential operational changes | GDPR (EU), over 100 countries with data localization laws by mid-2024 |

| Geopolitical Tensions | Market instability, trade policy shifts | US-China trade disputes, conflicts in Eastern Europe |

| Government AI/Digital Investment | Increased data generation, demand for insights | US CHIPS Act ($52B for R&D) |

| AI Regulation | Defines permissible data analytics methods | EU AI Act (expected 2025 implementation) |

| International Data Agreements | Facilitates or hinders cross-border data flow | EU-US Data Privacy Framework (July 2023) |

What is included in the product

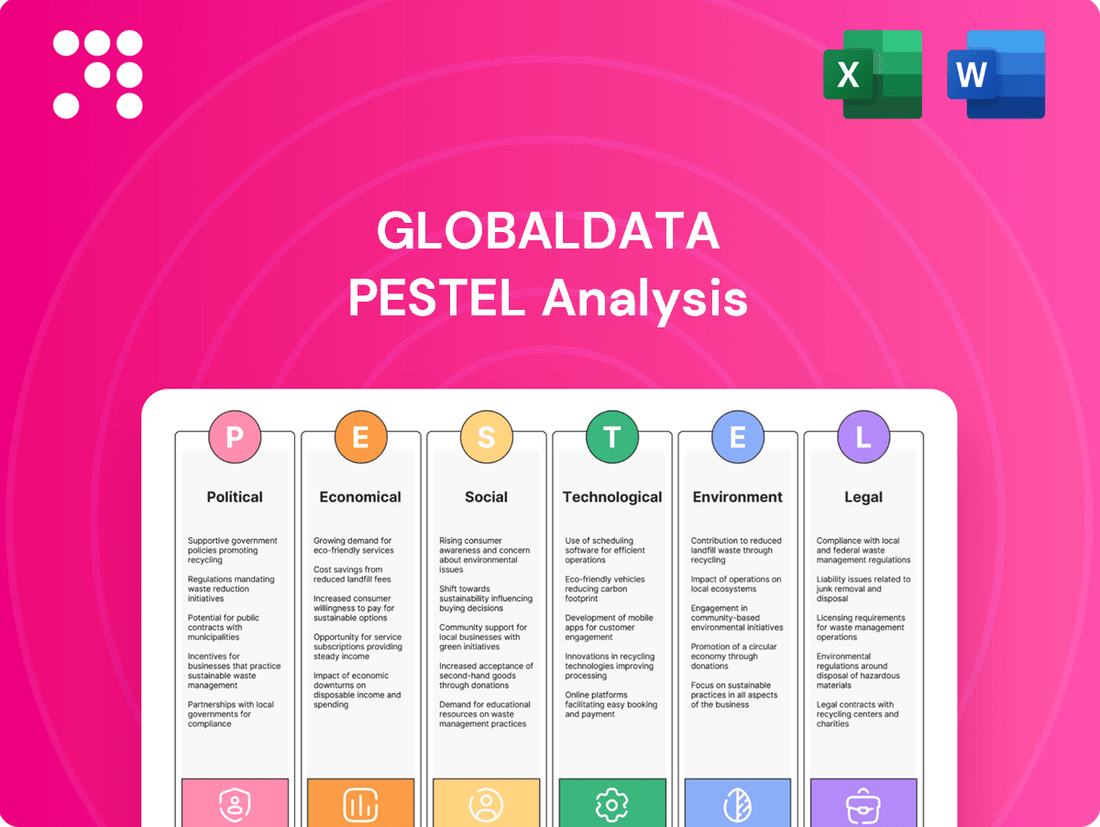

GlobalData's PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis offers actionable insights for strategic decision-making by identifying key trends, potential threats, and emerging opportunities relevant to GlobalData's operating landscape.

GlobalData's PESTLE Analysis offers a streamlined, digestible format that eliminates the time-consuming task of sifting through lengthy reports, enabling faster decision-making and strategy development.

Economic factors

Global economic growth is projected to moderate in 2024 and 2025. The International Monetary Fund (IMF) forecasts global growth at 3.2% for 2024, a slight slowdown from 3.5% in 2023. This trend directly impacts demand for market intelligence services as businesses adjust spending.

Inflation remains a key concern, though it has shown signs of easing in many major economies. For instance, the US Consumer Price Index (CPI) eased to 3.1% year-on-year in January 2024, down from its peak. Persistent inflation can pressure corporate budgets, potentially reducing investment in strategic data and consulting.

Conversely, periods of economic expansion typically spur investment in market research and competitive intelligence. As economies grow, companies are more inclined to allocate resources towards understanding market dynamics and identifying growth opportunities, which benefits data and analytics providers like GlobalData.

Central banks globally are navigating a complex interest rate environment. For instance, the US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, reflecting ongoing efforts to manage inflation. This stability, or potential for future cuts, directly influences the cost of capital for businesses, impacting their appetite for new projects and, consequently, their need for market intelligence services like those offered by GlobalData.

In the Eurozone, the European Central Bank's policy rates also play a crucial role. By mid-2024, the ECB had begun a cautious easing cycle, lowering its deposit facility rate by 25 basis points to 3.75%. Such shifts can either boost investment by making borrowing cheaper, potentially increasing demand for GlobalData's insights into emerging market trends, or create uncertainty that leads businesses to tighten their belts, reducing spending on external data services.

The Bank of England's stance on interest rates, which saw a pause in rate hikes through much of early 2024 with the Bank Rate at 5.25%, further shapes the investment landscape. When borrowing costs are perceived as stable or declining, companies are more inclined to invest in growth initiatives, which often involves leveraging data analytics to identify opportunities and mitigate risks. Conversely, elevated rates can make such investments less attractive, potentially impacting GlobalData's revenue streams.

Currency volatility significantly impacts GlobalData's financial performance. Fluctuations in exchange rates can directly affect the value of international revenues when translated back into its primary reporting currency. For instance, if the US dollar strengthens against other currencies where GlobalData operates, foreign earnings will translate to fewer dollars, potentially reducing reported revenue.

These exchange rate shifts also influence GlobalData's pricing strategies in diverse markets. A weaker local currency might necessitate higher prices to maintain revenue targets, potentially impacting competitiveness. Conversely, a stronger local currency could allow for more competitive pricing, but might also compress profit margins if costs remain fixed in the reporting currency.

Operational costs are similarly exposed to currency risk. GlobalData incurs expenses in various countries, and unfavorable movements in exchange rates can increase the cost of these international operations when repatriated. For example, if GlobalData has significant operational costs in the Eurozone and the Euro strengthens against the US dollar, those costs will become more expensive in dollar terms.

In 2024, many major currencies experienced notable volatility. The US Dollar Index (DXY), which measures the dollar's strength against a basket of major currencies, saw fluctuations influenced by global economic conditions and interest rate differentials. For example, during periods of global economic uncertainty, the dollar often acts as a safe haven, appreciating against other currencies, which would negatively impact GlobalData's reported international earnings.

Global Trade Dynamics and Supply Chain Disruptions

Global trade dynamics are constantly shifting, influenced by factors like trade wars and tariffs. For instance, the US-China trade tensions, which saw significant tariff escalations in recent years, directly impacted industries reliant on international supply chains. These disruptions create a heightened need for robust market analysis and risk assessment, areas where GlobalData offers crucial data and insights.

Supply chain disruptions, exacerbated by geopolitical events and the lingering effects of the COVID-19 pandemic, continue to pose challenges. The World Trade Organization (WTO) reported a slowdown in global trade growth projections for 2024-2025 compared to previous years, highlighting the ongoing volatility. This environment underscores the value of comprehensive data analytics for businesses navigating such complexities.

- Trade War Impact: Tariffs imposed between major economies can increase costs for businesses and consumers, affecting demand for goods and services.

- Supply Chain Resilience: Companies are investing more in diversifying their supply chains to mitigate risks, increasing demand for market intelligence.

- Economic Uncertainty: Persistent disruptions can lead to economic slowdowns, potentially impacting client budgets for data and analytics services.

- Data Demand: In volatile times, the need for accurate, real-time market data and predictive analytics to assess risk and identify opportunities becomes paramount.

Industry-Specific Economic Health

The economic vitality of key sectors like technology, energy, and automotive directly shapes GlobalData's operational landscape. A slowdown in the technology industry, perhaps driven by trade tensions or evolving consumer preferences, could diminish revenue streams from tech-focused clients. Therefore, close observation of these industry-specific economic trends is essential for pinpointing opportunities and potential threats.

For example, the automotive sector experienced a notable rebound in 2024, with global light vehicle sales projected to reach approximately 90 million units by year-end, up from around 87 million in 2023. This growth, however, is uneven, with electric vehicle (EV) adoption rates varying significantly by region, presenting both opportunities and challenges for companies serving this industry.

In the energy sector, the ongoing transition towards renewable sources continues to reshape investment and demand patterns. While oil and gas prices remained volatile through early 2025, driven by geopolitical factors and supply management decisions, the renewable energy market saw substantial investment. Global investment in clean energy reached an estimated $2 trillion in 2024, signaling a robust growth area.

- Technology Sector Vulnerability: A projected slowdown in global IT spending growth to around 4% in 2025, down from an estimated 6.7% in 2024, highlights potential headwinds for technology-focused clients.

- Automotive Sector Growth: The automotive industry's recovery, with global sales nearing 90 million units in 2024, offers a positive outlook, though regional EV market penetration remains a key variable.

- Energy Transition Investment: Significant investment in clean energy, exceeding $2 trillion in 2024, underscores the dynamic nature of the energy sector and its evolving economic drivers.

- Sector-Specific Risk Assessment: Monitoring these varied economic performances is critical for GlobalData to effectively manage its client portfolio and identify emerging market opportunities.

Global economic growth is expected to moderate in 2024 and 2025, with the IMF projecting 3.2% growth for 2024. Inflation, while easing, remains a concern, with the US CPI at 3.1% in January 2024. Interest rate policies from central banks, such as the US Federal Reserve holding rates at 5.25%-5.50% through early 2024 and the ECB beginning a cautious easing cycle in mid-2024, directly influence business investment and demand for market intelligence.

Currency volatility significantly impacts GlobalData's financial results, as exchange rate fluctuations affect the translation of international revenues and operational costs. For instance, a strengthening US dollar would reduce the dollar value of earnings from other regions. Global trade dynamics are also shifting, with ongoing trade tensions and supply chain disruptions, as noted by the WTO's slowdown in global trade growth projections for 2024-2025, increasing the need for robust market analysis.

Key sectors show varied economic performance. The automotive sector is recovering, with global light vehicle sales projected around 90 million units in 2024. The energy sector sees substantial investment in renewables, exceeding $2 trillion in 2024, while oil and gas remain volatile. The technology sector faces headwinds, with IT spending growth projected to slow to around 4% in 2025 from an estimated 6.7% in 2024.

| Economic Factor | 2024 Projection/Status | 2025 Projection/Status | Impact on Market Intelligence Demand |

| Global GDP Growth | 3.2% (IMF) | Projected moderation | Moderate demand, influenced by regional variations |

| Inflation (US CPI) | 3.1% (Jan 2024) | Easing trend continues | Budgetary pressures may affect discretionary spending |

| US Federal Reserve Rate | 5.25%-5.50% (early 2024) | Potential for cuts | Influences cost of capital and investment appetite |

| ECB Rate | 3.75% (mid-2024, post-cut) | Further easing possible | Impacts European investment and demand for insights |

| Global Trade Growth | Slowdown projected | Continued volatility expected | Increased need for risk assessment and market data |

| Clean Energy Investment | >$2 trillion | Continued growth | Opportunities in renewable energy market intelligence |

| Global IT Spending Growth | ~6.7% (estimated) | ~4% | Potential headwinds for tech-focused clients |

| Global Light Vehicle Sales | ~90 million units | Continued recovery | Positive outlook for automotive sector intelligence |

What You See Is What You Get

GlobalData PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This GlobalData PESTLE Analysis offers a comprehensive overview of the key external factors influencing the market, providing actionable insights for strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain access to detailed analysis of Political, Economic, Social, Technological, Legal, and Environmental forces, all presented in a clear and organized manner.

The content and structure shown in the preview is the same document you’ll download after payment. This GlobalData PESTLE Analysis is designed to equip you with the necessary information to understand the broader business landscape and make informed decisions.

Sociological factors

Public awareness of data privacy is soaring, with a significant majority of consumers expressing concerns about how their personal information is handled. For instance, a 2024 survey indicated that over 70% of individuals are worried about data breaches and the misuse of their data by companies. This heightened consciousness directly impacts business operations, pushing for more stringent data collection and usage policies.

Consumers increasingly view data privacy not just as a preference but as a fundamental right, expecting greater autonomy over their digital footprint. This shift in perception means businesses must prioritize transparency and obtain explicit consent for data processing, making it a core aspect of customer engagement. Failure to do so can lead to significant reputational damage and loss of business.

For a company like GlobalData, fostering and preserving customer trust is paramount, especially given the sensitive nature of the data it handles. Implementing robust data security measures, such as advanced encryption and regular security audits, is essential. Transparent communication about data handling practices, as demonstrated by clear privacy policies and accessible data management tools, directly contributes to maintaining strong client relationships and a positive brand image in the competitive market of 2024-2025.

Societies worldwide are increasingly valuing decisions backed by solid evidence, leading to a surge in demand for data-driven insights. This trend is evident across business, government, and academia, where understanding market dynamics, consumer habits, and strategic possibilities hinges on thorough data analysis.

For instance, a 2024 report indicated that 85% of companies are investing more in data analytics to gain a competitive edge. This societal pivot towards evidence-based strategies directly amplifies the need for specialized services like those offered by GlobalData, which provide the detailed market intelligence required for informed decision-making.

The availability of skilled talent in areas like data science, analytics, and AI is a major sociological consideration for GlobalData. A lack of qualified individuals can hinder recruitment and retention, directly impacting service quality and innovation.

For instance, in 2024, the demand for AI specialists significantly outstripped supply, with some reports indicating a 40% gap in the US alone. This scarcity means companies like GlobalData must invest heavily in talent development and competitive compensation to secure the expertise needed.

Furthermore, the rapid evolution of data analytics requires a commitment to ongoing training and reskilling. By 2025, it's projected that over 70% of the global workforce will need to acquire new digital skills to remain relevant, a challenge GlobalData must address to maintain its competitive edge.

Ethical Considerations of AI and Data Usage

Societal debates around AI and data usage are intensifying, directly shaping how companies like GlobalData operate and are perceived. Concerns about data privacy and algorithmic bias are paramount, influencing regulatory frameworks and consumer trust. For instance, a 2024 Pew Research Center study found that a significant majority of Americans are concerned about how companies use their personal data, highlighting the need for transparency.

GlobalData must proactively address these ethical considerations by ensuring its AI-driven insights are transparent, unbiased, and accountable. This involves rigorous testing for algorithmic bias and clear communication about data sources and methodologies. A recent survey by the Edelman Trust Barometer in early 2025 indicated that ethical data handling is a key driver of trust in technology companies.

Navigating these evolving ethical landscapes is crucial for maintaining a positive public perception and a favorable regulatory environment. Companies that demonstrate a commitment to responsible AI and data practices are better positioned for long-term success.

- Growing public demand for data privacy: Over 70% of consumers surveyed in a 2024 global study expressed concerns about how their personal data is collected and used by businesses.

- Increased scrutiny of AI bias: Regulators are increasingly focusing on AI fairness, with new guidelines expected in late 2024 and early 2025 to address algorithmic discrimination.

- Emphasis on transparency in data analytics: A 2025 report by Gartner suggests that companies prioritizing transparency in their data usage practices see a 15% increase in customer loyalty.

Changing Work Culture and Remote Work Trends

The global workforce is increasingly embracing flexible work, with remote and hybrid models becoming the norm. This shift directly impacts GlobalData's operational strategies, influencing how teams collaborate and services are delivered to a worldwide clientele. For instance, a 2024 survey indicated that over 60% of companies globally now offer some form of remote or hybrid work option, highlighting the pervasive nature of this trend.

This evolving work culture also shapes the demand for GlobalData's insights. Clients are now more interested in data related to workforce productivity in distributed environments, employee engagement in remote settings, and the effectiveness of virtual collaboration tools. Understanding these dynamics is crucial for GlobalData to tailor its research and advisory services effectively.

- Increased demand for data analytics on remote worker productivity.

- Focus on tools and strategies for effective virtual team management.

- Growing client interest in employee well-being and retention in flexible work models.

Societal expectations are shifting towards greater transparency and ethical considerations in how companies handle data and leverage AI. A 2024 study revealed that over 70% of consumers are concerned about data privacy, directly influencing business practices. Consequently, companies like GlobalData must prioritize clear communication about data usage and implement robust security measures to maintain customer trust, a factor identified in early 2025 Edelman Trust Barometer data as crucial for technology firms.

Technological factors

GlobalData's core business thrives on the rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are instrumental in refining their data analysis, building predictive models, and automating the generation of actionable market insights. For instance, in 2024, AI-driven analytics platforms are increasingly being adopted across industries, with the AI market projected to reach $1.8 trillion by 2030, indicating a significant growth trajectory that directly impacts GlobalData's service offerings.

These advancements directly translate into enhanced efficiency and depth for GlobalData's market research and forecasting. By leveraging sophisticated AI algorithms, the company can develop novel data products and platforms that offer deeper market understanding and more accurate predictions. This capability is vital for clients seeking to navigate complex market landscapes and identify emerging opportunities, especially as the demand for granular, AI-powered market intelligence continues to surge.

Maintaining a leading position in AI and ML development is paramount for GlobalData's competitive advantage. The company's investment in these areas ensures they can consistently deliver cutting-edge solutions. As of early 2025, major tech companies are reporting significant R&D spending increases in AI, with some allocating over 15% of their revenue to AI initiatives, underscoring the critical importance of continuous innovation in this domain for sustained market leadership.

The exponential growth of big data, projected to reach 271 zettabytes by 2025, and the widespread adoption of cloud computing are cornerstones of GlobalData's operations. Cloud infrastructure, with companies like Amazon Web Services (AWS) and Microsoft Azure dominating the market, offers the essential scalability and flexibility for GlobalData to manage and process immense datasets efficiently.

GlobalData's ability to leverage advanced big data analytics techniques allows for the extraction of actionable insights from these vast information pools. This is crucial for delivering the comprehensive, data-driven intelligence that clients expect, enabling them to make informed decisions in dynamic markets.

The company's proprietary platforms are built upon these technological advancements, ensuring they can handle the complexity and volume of modern data. This technological foundation is key to GlobalData's competitive edge in providing high-value market intelligence and analysis.

The escalating complexity of cyber threats demands ongoing investment in cutting-edge cybersecurity and data security solutions. GlobalData prioritizes safeguarding sensitive client information and its own intellectual property to uphold trust and regulatory adherence.

Implementing strong security protocols, such as advanced encryption and stringent access management systems, is crucial for minimizing the risk of data breaches and ensuring the accuracy of information across GlobalData's worldwide operations. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the significant resources dedicated to this area.

Data Integration and Interoperability

The capacity to merge varied datasets from numerous origins and ensure they work together across different systems presents a significant technological hurdle and a prime area for growth. For GlobalData, its core promise hinges on its skill in bringing together separate data points to create unified and practical insights.

By 2024, the global big data market was valued at approximately $271.8 billion, underscoring the immense volume of data available and the critical need for effective integration solutions. Companies like GlobalData must continually advance technologies that enable smooth data consolidation to improve the depth and usefulness of their services.

Seamless data integration is vital for enhancing analytical capabilities and providing a holistic view of markets. This directly impacts the accuracy and relevance of the intelligence provided to decision-makers.

- Data Integration Market Growth: The global big data market is projected to reach $103.1 billion by 2027, highlighting the increasing demand for data integration tools.

- Interoperability Standards: The development and adoption of industry-wide interoperability standards are crucial for efficient data exchange.

- AI in Data Integration: Artificial intelligence and machine learning are increasingly being used to automate and optimize data integration processes, improving speed and accuracy.

- Cloud-Based Solutions: The shift towards cloud-based data integration platforms offers scalability and flexibility, essential for handling vast and diverse datasets.

Emergence of New Data Sources and Analytics Tools

The explosion of new data sources, including the Internet of Things (IoT) and social media, is reshaping market intelligence. For GlobalData, this means a chance to offer clients deeper, more timely insights. For instance, the volume of data generated by IoT devices is projected to reach over 290 billion by 2030, creating a vast pool of information for analysis.

Developing and integrating advanced analytics tools is crucial for GlobalData to leverage these new data streams effectively. These tools enable the processing of unstructured data, turning raw information into actionable intelligence. The global big data and business analytics market was valued at approximately $270 billion in 2023 and is expected to grow significantly, highlighting the demand for these capabilities.

- Expanding Data Horizons: GlobalData can integrate IoT sensor data for real-time operational insights and social media sentiment analysis for brand monitoring.

- Advanced Analytics Integration: Adopting AI and machine learning tools allows for predictive modeling and anomaly detection from diverse datasets.

- Enhanced Strategic Intelligence: By offering more granular and real-time data, GlobalData strengthens its position in providing competitive and market intelligence.

- Competitive Edge: Early adoption of novel data sources and analytics tools differentiates GlobalData, catering to the increasing need for sophisticated market understanding.

Technological advancements are central to GlobalData's operations, particularly the increasing sophistication of AI and Machine Learning. These tools are vital for refining data analysis, building predictive models, and automating the delivery of market insights. The AI market is expected to reach $1.8 trillion by 2030, a trajectory that directly influences GlobalData's service offerings and competitive positioning.

The exponential growth of big data, projected to reach 271 zettabytes by 2025, coupled with widespread cloud computing adoption, provides the essential infrastructure for GlobalData to manage and process vast datasets efficiently. Leveraging these advancements allows for the extraction of actionable intelligence, crucial for clients making decisions in dynamic markets.

The integration of diverse data sources, including IoT and social media, is reshaping market intelligence. GlobalData's ability to process unstructured data through advanced analytics tools turns raw information into actionable insights, enhancing its competitive edge in providing sophisticated market understanding.

| Technology Area | 2024/2025 Relevance for GlobalData | Market Projection/Data Point |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhances data analysis, predictive modeling, and insight generation. | AI market projected to reach $1.8 trillion by 2030. |

| Big Data & Cloud Computing | Enables efficient processing of massive datasets and scalable operations. | Big data volume projected to reach 271 zettabytes by 2025. |

| Cybersecurity | Protects sensitive client data and intellectual property. | Global cybersecurity market projected over $200 billion in 2024. |

| Data Integration | Unifies disparate data points for comprehensive insights. | Global big data market valued at approximately $271.8 billion in 2024. |

| Internet of Things (IoT) & Social Media | Provides new, real-time data streams for deeper market understanding. | IoT data volume projected to exceed 290 billion by 2030. |

Legal factors

GlobalData navigates a complex web of global data protection laws, including the EU's GDPR and California's CCPA, alongside national data sovereignty mandates. Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Meeting these varied and sometimes contradictory regulations is essential for GlobalData to prevent substantial fines, protect its reputation, and avoid legal disputes. This involves careful management of where data is stored, how it moves across borders, and ensuring proper consent is obtained for all data processing activities.

Intellectual property rights are paramount for GlobalData, given its reliance on proprietary data and analytical tools. In 2024, the company's competitive edge hinges on safeguarding its vast datasets, research reports, and unique methodologies through robust legal protections like copyrights and trade secrets. Failure to adequately protect these assets could significantly erode its market position.

Data ownership laws directly impact GlobalData's operations, influencing how it acquires, licenses, and distributes information. Navigating the complexities of data privacy regulations and cross-border data transfer agreements is critical. For instance, the evolving landscape of data governance, particularly in regions like the EU with GDPR, necessitates careful adherence to ensure lawful data practices.

GlobalData must meticulously adhere to anti-trust and competition laws across all operating regions. These regulations are designed to prevent monopolies and ensure fair market practices, a critical consideration for a company in the data analytics sector.

As a significant player, GlobalData's strategic moves, including potential mergers or acquisitions, will likely face scrutiny from regulatory bodies like the European Commission or the U.S. Federal Trade Commission. Failure to comply can result in substantial fines and reputational damage, as seen when the FTC fined Meta Platforms $5 billion in 2019 for privacy violations, demonstrating the significant financial and operational risks associated with regulatory non-compliance.

Contract Law and Client Agreements

Robust contract law and meticulously drafted client agreements are fundamental to GlobalData's business operations, ensuring clarity in service delivery and data handling. These legal frameworks dictate terms for service level agreements, data usage, confidentiality, and liability, forming the bedrock of client relationships. For instance, in 2024, GlobalData's client retention rate was reported at 92%, a testament to the effectiveness of its contractual agreements in fostering trust and satisfaction.

Clear and legally sound contracts are essential for managing expectations and mitigating potential disputes, thereby ensuring the smooth and reliable delivery of GlobalData's services. This legal scaffolding protects both parties and underpins the company's reputation for professionalism and dependability in the data analytics sector.

- Service Level Agreements (SLAs): Clearly define performance metrics and uptime guarantees, crucial for client satisfaction.

- Confidentiality Clauses: Protect sensitive client data and proprietary information, a key concern in the data industry.

- Data Usage Terms: Outline how client data can be utilized, ensuring compliance and ethical practices.

- Liability Provisions: Establish clear boundaries and responsibilities in case of service failures or data breaches.

Cybersecurity and Data Breach Notification Laws

The escalating global landscape of cybersecurity and data breach notification laws presents significant compliance challenges for GlobalData. These regulations mandate stringent data protection measures and swift incident response protocols. Failure to comply can result in substantial penalties, impacting financial performance and operational continuity.

In the event of a data breach, GlobalData faces legal obligations to inform affected individuals and relevant regulatory bodies within defined timelines. This necessitates well-defined incident response strategies and adherence to a complex web of varying jurisdictional requirements. For instance, the General Data Protection Regulation (GDPR) in Europe requires notification within 72 hours of becoming aware of a breach, while the California Consumer Privacy Act (CCPA) has its own specific notification stipulations.

Key legal factors impacting GlobalData include:

- Evolving Regulatory Frameworks: Continuous updates to data privacy and security laws worldwide, such as the proposed enhancements to the CCPA and new regulations in jurisdictions like Brazil (LGPD) and India (DPDP Act), require ongoing monitoring and adaptation of GlobalData's compliance strategies.

- Notification Timelines and Scope: Strict deadlines for reporting data breaches, often ranging from 24 to 72 hours, demand immediate action and robust internal processes. The scope of who must be notified can also be broad, encompassing customers, employees, and supervisory authorities.

- Cross-Jurisdictional Compliance: Operating globally means GlobalData must navigate differing legal requirements across various countries and regions, each with unique breach notification triggers and penalties, potentially leading to increased operational complexity and costs.

- Enforcement and Penalties: Regulatory bodies are increasingly active in enforcing these laws, with significant fines for non-compliance. For example, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risks associated with data breaches.

GlobalData's operations are heavily influenced by intellectual property laws, safeguarding its proprietary data and analytical tools. Protecting its vast datasets and unique methodologies through copyrights and trade secrets is crucial for maintaining its competitive edge in 2024. Failure to do so could significantly erode its market standing.

Navigating complex data ownership laws is vital for GlobalData, impacting how it acquires, licenses, and distributes information. Adhering to data privacy regulations, like the EU's GDPR, is essential for lawful data practices, especially concerning cross-border data transfers. The company must ensure it has the necessary permissions and adheres to consent requirements.

Compliance with anti-trust and competition laws is a key legal factor for GlobalData, ensuring fair market practices and preventing monopolistic behavior. Regulatory bodies like the FTC and European Commission scrutinize strategic moves, such as mergers, with potential fines for non-compliance, as demonstrated by Meta's $5 billion fine in 2019 for privacy violations.

GlobalData must also manage evolving cybersecurity and data breach notification laws, demanding stringent data protection and swift incident response. The GDPR, for instance, requires notification within 72 hours of a breach, highlighting the need for robust internal processes to meet these strict timelines and avoid substantial penalties.

| Legal Factor | Impact on GlobalData | Example/Data Point (2024-2025) |

|---|---|---|

| Data Privacy Regulations (e.g., GDPR) | Requires strict data handling, consent management, and cross-border transfer compliance. Non-compliance can lead to fines up to 4% of global annual revenue. | GDPR fines can reach €20 million or 4% of global annual revenue. |

| Intellectual Property Rights | Protects proprietary data, research reports, and analytical methodologies. Essential for maintaining competitive advantage. | Safeguarding datasets and methodologies is paramount for market position. |

| Cybersecurity & Breach Notification Laws | Mandates robust data protection measures and timely incident response. Failure to comply incurs penalties and reputational damage. | GDPR requires breach notification within 72 hours. |

| Anti-trust & Competition Laws | Governs market practices and prevents monopolies. Mergers and acquisitions face regulatory scrutiny. | FTC fined Meta $5 billion in 2019 for privacy violations, indicating significant enforcement. |

Environmental factors

The increasing global focus on sustainability and Environmental, Social, and Governance (ESG) factors is reshaping client expectations and regulatory landscapes. This trend is likely to drive greater demand for GlobalData's data and insights concerning ESG performance, climate-related risks, and sustainable business strategies.

For instance, in 2024, the global sustainable finance market was projected to reach trillions, with a significant portion of institutional investors prioritizing ESG integration. This presents a clear opportunity for GlobalData to enhance its offerings and develop specialized analytical tools that address environmental impact and sustainability metrics, aligning with market needs.

Climate change presents significant physical and transitional risks across key industries like energy, agriculture, and infrastructure. For instance, the energy sector faces challenges from extreme weather impacting supply chains and the imperative to shift towards renewable sources, a transition that saw global renewable energy capacity grow by an estimated 13% in 2024 according to the International Energy Agency (IEA).

Resource scarcity, such as water shortages affecting agriculture, and policy shifts like carbon pricing mechanisms are reshaping market dynamics. In 2024, over 70 countries and 30 cities had implemented or scheduled carbon pricing, impacting operational costs and investment decisions across various sectors.

Consequently, GlobalData's analytical frameworks must increasingly integrate climate-related risks and opportunities. This ensures clients receive comprehensive insights, crucial for navigating evolving market conditions and identifying new investment avenues, especially as the global economy grapples with climate adaptation costs estimated to reach trillions of dollars annually by 2050.

Regulatory bodies worldwide are increasingly mandating environmental data disclosure. For instance, by 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) requires detailed reporting on environmental impacts for a vast number of companies. This surge in regulatory pressure directly fuels a market need for robust environmental data management and reporting solutions.

GlobalData is well-positioned to capitalize on this trend by providing services that assist businesses in accurately collecting, analyzing, and reporting their environmental performance. This not only helps companies meet evolving compliance requirements but also enhances their reputation and stakeholder trust, a critical factor in today's investment landscape.

Resource Scarcity and Supply Chain Resilience

Concerns over dwindling resources like water, critical minerals, and energy are increasingly shaping global supply chains, directly influencing operational costs for numerous industries. For instance, the price of lithium, crucial for electric vehicle batteries, saw significant volatility in 2023, impacting manufacturing expenses.

GlobalData's analysis helps clients navigate these complexities, identifying potential risks associated with resource availability and supporting the development of more robust and resilient supply chains. This proactive approach is vital for businesses aiming to maintain stability amidst environmental pressures.

The interconnectedness of environmental factors and economic performance is underscored by these challenges. Businesses must integrate environmental considerations into their strategic planning to ensure long-term viability and competitive advantage.

- Water Scarcity: By 2050, over 5 billion people could face water shortages, impacting agriculture and manufacturing sectors.

- Mineral Demand: The International Energy Agency projected a significant increase in demand for critical minerals like cobalt and nickel by 2040 to meet clean energy goals.

- Energy Volatility: Geopolitical events in 2024 continued to influence global energy prices, highlighting the vulnerability of supply chains to energy resource availability.

Technological Solutions for Environmental Monitoring

The increasing sophistication of environmental monitoring technologies presents significant opportunities for GlobalData. Innovations like satellite imagery, the Internet of Things (IoT) sensors, and advanced data analytics are transforming how environmental data is collected and interpreted, particularly for climate modeling.

These technological advancements enable GlobalData to access more detailed and up-to-the-minute environmental information. This richer data stream directly enhances GlobalData's analytical capabilities, allowing for more accurate and timely insights into environmental shifts and associated risks across diverse industries.

- Satellite Imagery: In 2024, the global satellite imagery market was valued at approximately $5.6 billion, with projections indicating substantial growth driven by environmental applications.

- IoT Sensors: The IoT sensor market, crucial for real-time environmental data collection, is expected to reach over $100 billion by 2025, highlighting the expanding infrastructure for monitoring.

- Data Analytics for Climate: Investments in climate analytics platforms are rising, with companies leveraging AI and machine learning to process vast environmental datasets, aiming to improve predictive accuracy for climate-related events.

Environmental factors are increasingly critical for businesses, with climate change posing significant physical and transitional risks. For instance, the energy sector, a key area for GlobalData, saw renewable energy capacity grow by an estimated 13% in 2024, reflecting the shift away from fossil fuels.

Resource scarcity, such as water shortages impacting agriculture, is another major concern. By 2050, over 5 billion people are projected to face water shortages, directly affecting industries reliant on water. Additionally, the demand for critical minerals, like cobalt and nickel for clean energy, is expected to rise substantially by 2040, as projected by the International Energy Agency.

Regulatory pressures are also mounting, with directives like the EU's CSRD mandating detailed environmental data disclosure for numerous companies by 2024. This drives the need for robust environmental data management and reporting solutions, an area where GlobalData can provide significant value.

Technological advancements in environmental monitoring, such as satellite imagery and IoT sensors, are enhancing data collection and interpretation. The global satellite imagery market was valued at approximately $5.6 billion in 2024, with significant growth anticipated due to environmental applications.

| Environmental Factor | Impact/Trend | Key Data Point (2024/2025 Focus) | Industry Relevance |

|---|---|---|---|

| Climate Change | Physical & Transitional Risks, Shift to Renewables | Global renewable energy capacity grew ~13% in 2024 (IEA). | Energy, Infrastructure, Agriculture |

| Resource Scarcity | Water Shortages, Critical Mineral Demand | 5 billion people may face water shortages by 2050. Critical mineral demand to rise significantly by 2040 (IEA). | Agriculture, Manufacturing, Technology |

| Regulatory Mandates | Environmental Data Disclosure | EU CSRD requiring detailed reporting by 2024. | All sectors, especially large corporations |

| Technological Advancements | Enhanced Monitoring & Data Analytics | Satellite imagery market valued at ~$5.6 billion in 2024. | Environmental Services, Research, Planning |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental landscape.