GlobalData Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

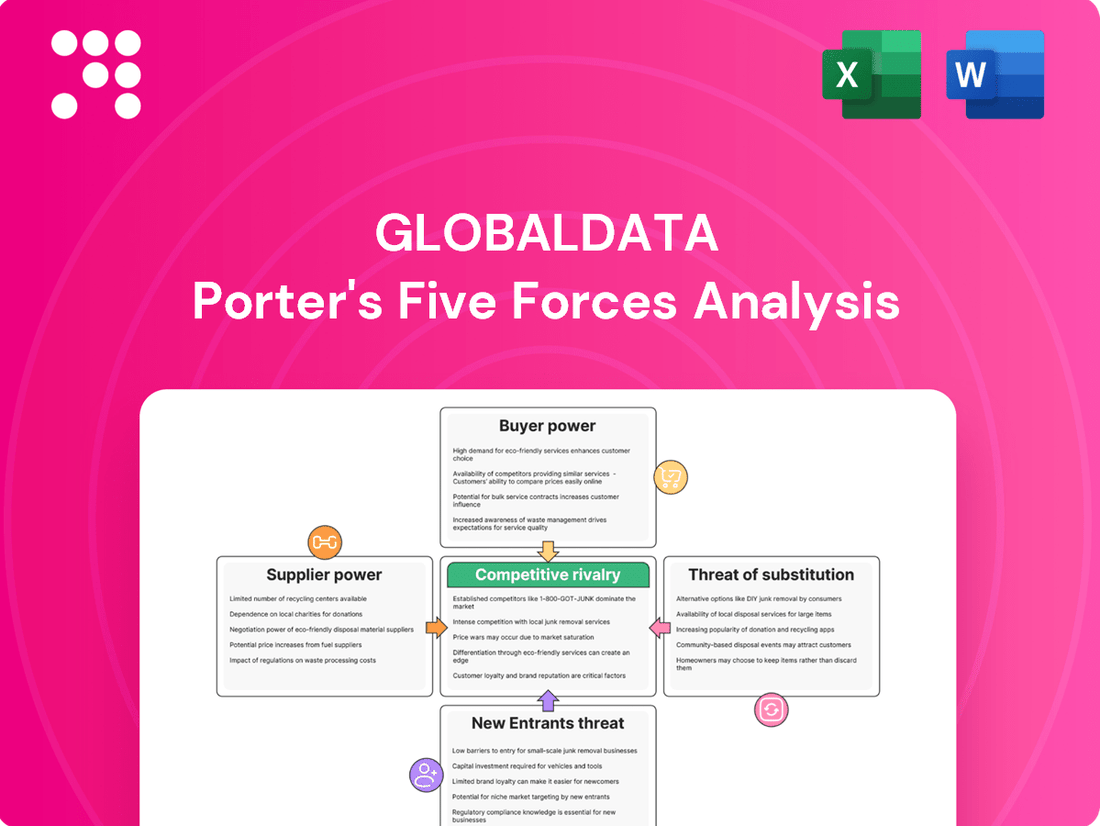

GlobalData's Porter's Five Forces Analysis provides a crucial lens through which to view the competitive landscape. It meticulously dissects the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

This comprehensive framework is essential for understanding the underlying forces that shape profitability and strategic direction. Ready to gain a competitive edge? Unlock the full Porter's Five Forces Analysis to explore GlobalData’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

GlobalData's exclusive platforms and distinct data gathering methods significantly curb the influence of external raw data providers. This strategic advantage means the company is not beholden to readily available, generic data streams, thereby strengthening its negotiating position.

The company's in-house expertise in synthesizing and analyzing data lessens its reliance on external, standardized data feeds. This internal capability grants GlobalData more command over the quality and nature of its foundational inputs, a key factor in its operational efficiency.

The market for highly skilled professionals like data scientists, industry analysts, and consulting experts is intensely competitive. These individuals, acting as suppliers of specialized knowledge and experience, possess moderate to high bargaining power. GlobalData must therefore offer competitive compensation packages and a stimulating work environment to successfully attract and retain this crucial talent.

Technology and software vendors hold significant bargaining power, especially those providing specialized cloud infrastructure, AI/ML tools, and robust database management systems. GlobalData, for instance, relies on such advanced solutions to drive its analytics. While the market offers choices, dependence on unique or large-scale platforms can allow these suppliers to influence pricing and contract terms, impacting operational costs.

Content and Information Partnerships

GlobalData's reliance on content and information partnerships can significantly influence supplier bargaining power. If GlobalData needs unique industry news, specialized reports, or exclusive niche data sets to enhance its product suite, the suppliers of this content hold considerable sway. This power is amplified when the information is difficult to source elsewhere or when the supplier has a strong market position for that specific data.

The bargaining power of these content suppliers is directly tied to the uniqueness and exclusivity of the information they offer. For instance, a partnership with a leading analyst firm that provides proprietary market forecasts for a rapidly growing sector like AI chip manufacturing in 2024 would give that firm substantial leverage. Conversely, if similar data is readily available from multiple sources, the supplier's power diminishes.

- Supplier Uniqueness: The more specialized and non-substitutable the content, the higher the supplier's bargaining power.

- Exclusivity Agreements: Exclusive deals for critical data sets can lock GlobalData into specific supplier relationships, increasing supplier leverage.

- Availability of Alternatives: If GlobalData can easily find comparable data from other providers, supplier power is reduced.

- Supplier Market Position: A supplier dominating a particular data niche or industry report will naturally command greater bargaining power.

Acquisition Strategy Impact

GlobalData’s proactive acquisition strategy, notably the late 2024 and early 2025 integrations of Deallus and AI Palette, directly impacts supplier bargaining power. By bringing specialized capabilities and proprietary data sources in-house, GlobalData can reduce its dependence on external providers for critical functions.

This vertical integration strengthens GlobalData's control over its value chain, thereby diminishing the leverage individual suppliers might otherwise hold. For instance, acquiring AI Palette for its advanced AI-driven market intelligence capabilities means GlobalData relies less on third-party data providers for competitive insights.

- Reduced Reliance: Acquisitions like AI Palette aim to internalize advanced AI capabilities, lessening dependence on external data and technology suppliers.

- Enhanced Control: Integrating specialized firms allows GlobalData to gain greater control over key inputs and operational expertise, directly weakening supplier leverage.

- Strategic Integration: The Deallus acquisition in late 2024, focused on competitive intelligence, further consolidates market data sourcing within GlobalData, reducing reliance on external research vendors.

GlobalData's bargaining power with suppliers is influenced by its internal data synthesis capabilities and the competitive market for specialized talent. While technology vendors offering critical AI and cloud solutions possess significant leverage, GlobalData's strategic acquisitions, like AI Palette in 2024, are aimed at reducing external dependencies and consolidating data sourcing. This vertical integration strategy aims to strengthen GlobalData's control over its value chain, thereby mitigating supplier influence.

What is included in the product

This analysis dissects the competitive forces shaping GlobalData's industry, revealing threats from new entrants, the power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Gain a comprehensive understanding of competitive pressures with a clear, actionable framework, making complex market dynamics easily digestible for strategic planning.

Customers Bargaining Power

GlobalData’s diverse and global client base, which includes Fortune 500 companies across many industries, generally moderates the bargaining power of individual customers. However, large, key clients who represent a substantial portion of revenue can still wield considerable influence.

For clients who have deeply embedded GlobalData's proprietary platforms and data into their core decision-making workflows, the costs associated with switching to a competitor are significant. This integration means that migrating systems, retraining personnel, and adapting established processes to a new provider represents a substantial undertaking, effectively locking in many customers.

For instance, a financial services firm relying on GlobalData's real-time market intelligence for its trading algorithms would face considerable disruption and expense if it were to switch. The sheer volume of data integration and the need to revalidate algorithmic performance could take months, potentially impacting operational efficiency and revenue generation during the transition period.

Customers in the data analytics and consulting sectors are increasingly vocal about needing to see a direct, quantifiable return on their investment. This means they want to know exactly how the services will benefit their bottom line.

Beyond just results, clients are pushing for solutions tailored precisely to their unique business needs. This demand for customization means they're less likely to accept off-the-shelf packages and more inclined to seek providers who can adapt, giving them more power in negotiations.

As a result, buyers are actively negotiating for better pricing, unique insights, and even contracts tied to performance metrics. For instance, a significant portion of data analytics contracts now include clauses that link payment to achieving specific, agreed-upon KPIs, a trend that was notably growing in 2024.

Availability of Alternative Providers

The availability of alternative providers significantly amplifies customer bargaining power. In the market research sector, for instance, clients can select from a wide array of options, including global giants like Ipsos and Nielsen, boutique specialized firms, and even leverage internal data science teams. This competitive landscape means customers can easily switch or pit providers against each other to secure better terms and pricing.

This abundance of choice allows customers to negotiate more aggressively, demanding lower prices, higher quality services, or customized solutions. For example, a large consumer goods company seeking market insights might solicit bids from several research firms, knowing that the presence of many capable competitors gives them leverage. In 2024, many clients reported successfully negotiating discounts of up to 15% on standard research packages due to the competitive environment.

- High Competition: Numerous market research and consulting firms exist, offering diverse services.

- Customer Choice: Clients can easily find alternative providers to meet their needs.

- Negotiation Leverage: The availability of multiple options empowers customers to negotiate favorable terms.

- Price Sensitivity: Increased competition often leads to downward pressure on prices for research and consulting services.

Growth of In-house Capabilities and AI Tools

Many large organizations are increasingly building their own in-house data analytics capabilities. This allows them to conduct routine analysis internally, lessening their reliance on external service providers. For instance, by 2024, a significant portion of Fortune 500 companies had established dedicated AI and data science teams, aiming to streamline operations and gain deeper insights.

The proliferation of advanced AI tools further amplifies this trend. These tools empower customers with greater control over their data and analysis processes. This enhanced internal capacity naturally translates into increased negotiation leverage when engaging with external vendors for specialized or supplementary services.

- Increased Internal Expertise: Organizations are investing in training and hiring data scientists and analysts, building core competencies.

- AI Tool Adoption: Companies are integrating AI-powered analytics platforms to automate tasks and derive insights more efficiently.

- Reduced External Dependency: In-house capabilities diminish the need for outsourcing standard analytical functions, strengthening customer bargaining power.

- Cost Efficiency: Developing internal solutions can often prove more cost-effective in the long run compared to continuous external service fees.

Customers' bargaining power is significantly influenced by the availability of substitutes and their ability to develop in-house capabilities. In 2024, the market saw a notable increase in clients building internal data science teams, with many Fortune 500 companies investing heavily in AI and analytics talent. This trend, coupled with the widespread adoption of advanced AI tools, allows clients to perform more analysis internally, reducing their reliance on external providers and thereby strengthening their negotiation position.

The competitive landscape for data analytics and market research is robust, with numerous providers vying for clients' business. This high degree of competition empowers customers to negotiate more aggressively, often securing discounts. For example, in 2024, clients successfully negotiated average discounts of up to 15% on standard service packages by leveraging the availability of alternative providers.

Clients are increasingly demanding tailored solutions and performance-based contracts, linking payments to measurable outcomes. This shift towards customization and ROI-driven agreements, prevalent in 2024, gives buyers more leverage in pricing and service delivery negotiations.

| Factor | Impact on Bargaining Power | 2024 Trend Example |

|---|---|---|

| Availability of Alternatives | High | Clients secured up to 15% discounts by comparing multiple providers. |

| In-house Capabilities | Increasing | Fortune 500 companies expanded internal data science teams. |

| Demand for Customization | High | Contracts increasingly tied to specific, agreed-upon KPIs. |

| Switching Costs | Moderate to High | Deep integration of proprietary platforms creates customer lock-in. |

Full Version Awaits

GlobalData Porter's Five Forces Analysis

This preview showcases the complete GlobalData Porter's Five Forces Analysis you will receive upon purchase, offering an in-depth examination of competitive forces within an industry. The document displayed is precisely the same professionally formatted report that will be available for immediate download, ensuring no discrepancies or missing sections. You're looking at the actual, ready-to-use analysis that will empower your strategic decision-making the moment your transaction is complete.

Rivalry Among Competitors

The global data analytics and consulting market is a dynamic landscape, projected to expand significantly, with estimates suggesting continued growth through 2029 and beyond. This robust expansion fuels intense competition as numerous companies, from established giants to agile niche players, vie for dominance.

This influx of participants contributes to a fragmented market structure, where a multitude of firms, both large and small, are actively competing for market share. For instance, in 2023, the data analytics market alone was valued at approximately $100 billion, showcasing the immense opportunity and the sheer number of entities seeking to capitalize on it.

GlobalData operates in a highly competitive environment, facing pressure from a wide array of players. This includes established market research giants like Kantar and Nielsen, as well as major consulting firms such as Gartner and RELX, all of whom offer overlapping data and analytics services.

Further intensifying this rivalry are specialized data analytics providers, each vying for market share with unique technological capabilities or niche data sets. For instance, in 2024, the market research industry continued to see significant investment, with companies like Ipsos reporting robust revenue growth, underscoring the dynamic nature of competition.

The broad spectrum of competitors means GlobalData must constantly innovate and differentiate its offerings across various service segments. This diverse landscape ensures that competitive pressures remain high, impacting pricing strategies and the need for continuous investment in data quality and analytical tools.

GlobalData stands out by offering unique, integrated solutions powered by its vast proprietary data and sophisticated AI capabilities. Their AI Hub, for instance, showcases a commitment to leveraging advanced technologies, giving them a distinct advantage in a market where innovation is paramount.

In 2024, the demand for AI-driven insights in market intelligence is soaring. Companies like GlobalData, which invest heavily in proprietary data sets and AI development, are better positioned to meet this demand. This differentiation is crucial for capturing market share against competitors who may rely on more conventional data sources.

Aggressive M&A and Strategic Partnerships

GlobalData's competitive strategy heavily relies on aggressive mergers and acquisitions (M&A) and strategic partnerships to bolster its market position and service offerings. This proactive approach is a hallmark of intense industry rivalry, aiming to consolidate capabilities and expand market share swiftly.

The company's recent acquisitions, such as Deallus and AI Palette in late 2024 and early 2025, exemplify this strategy. These moves are designed to integrate new technologies and data sets, thereby enhancing GlobalData's competitive edge and providing a more comprehensive suite of services to its clients in the fast-evolving market intelligence sector.

- Aggressive M&A Activity: GlobalData's recent acquisitions, including Deallus and AI Palette, demonstrate a clear strategy to integrate complementary businesses and technologies.

- Market Share Consolidation: Such M&A and partnership activities are common tactics to gain a larger share of the market and consolidate fragmented offerings within the industry.

- Capability Expansion: The company leverages these strategic moves to broaden its service portfolio and enhance its data analytics and market intelligence capabilities.

Emphasis on Specialization and Niche Expertise

The consulting industry, particularly in data analytics, is experiencing a significant shift. Clients are increasingly prioritizing deep, specialized knowledge rather than broad, generalist advice.

This demand for niche expertise intensifies competition as firms strive to differentiate themselves by honing their offerings within specific industry sectors or functional domains. Consequently, rivalry among specialized players is escalating.

- Specialization Drives Competition: Clients in 2024 are actively seeking consultants with proven track records in areas like AI ethics, quantum computing analytics, or sustainability reporting, rather than firms offering a wide but shallow range of services.

- Niche Market Dominance: Firms that successfully carve out and dominate specific niches, such as cybersecurity consulting for financial institutions or supply chain optimization for the automotive sector, face less direct competition from generalists but intense rivalry from other specialists.

- Talent Wars in Niches: The scarcity of highly specialized talent fuels competition. For instance, the demand for data scientists with expertise in generative AI outstripped supply significantly in 2024, leading to aggressive recruitment and higher salary demands, further intensifying rivalry.

The competitive rivalry within the global data analytics and consulting market is fierce, characterized by a crowded field of players ranging from established giants to specialized niche providers. This intensity is driven by the market's significant growth, with the data analytics sector alone valued at approximately $100 billion in 2023, attracting numerous entities. Companies like GlobalData face direct competition from major research firms and consultancies, alongside a growing number of specialized analytics firms, all vying for market share through innovation and strategic acquisitions, as seen with GlobalData's acquisitions of Deallus and AI Palette in late 2024/early 2025.

| Competitor Type | Key Players | Competitive Tactics |

| Market Research Giants | Kantar, Nielsen | Broad data offerings, established client relationships |

| Major Consulting Firms | Gartner, RELX | Integrated advisory and data services, industry expertise |

| Specialized Analytics Providers | Various niche firms | Unique AI capabilities, proprietary data sets, sector-specific solutions |

| Emerging AI-Focused Companies | Startups in generative AI, AI ethics | Cutting-edge technology, agility, talent acquisition |

SSubstitutes Threaten

Large enterprises are increasingly building out their internal analytics departments and data science teams. This trend means they can handle more of their strategic support and routine data analysis in-house, acting as a substitute for external providers.

For instance, in 2024, a significant number of Fortune 500 companies have expanded their data science headcount by over 20% compared to 2023, demonstrating a clear shift towards internalizing these capabilities.

This growing internal expertise directly reduces the need for external consulting services, thereby posing a threat of substitution to companies like GlobalData that offer similar analytical support.

The rise of accessible open-source analytics tools and cloud platforms significantly lowers the barrier to entry for market research and data analysis. Companies can now conduct sophisticated analyses internally, reducing reliance on expensive external consultants.

For instance, in 2024, the global big data and business analytics market was projected to reach over $340 billion, a testament to the increasing adoption of these tools. This widespread availability empowers businesses of all sizes to gain valuable insights independently.

The increasing sophistication of AI-powered insight platforms presents a significant threat of substitution for traditional market research and analytics firms. These platforms, leveraging advanced AI and generative AI, can automate complex data processing, generate detailed reports, and offer predictive market trend analysis, effectively replicating services previously requiring human expertise.

By 2024, the market for AI in analytics was projected to reach substantial figures, with some estimates suggesting it could surpass $20 billion globally, indicating a growing adoption of these automated solutions. This technological advancement allows businesses to access insights faster and often at a lower cost, directly challenging the value proposition of established consulting and data providers.

Freelance Consultants and Expert Networks

The rise of freelance consultants and expert networks presents a significant threat of substitutes for traditional consulting firms. These platforms provide businesses with agile, cost-effective access to specialized expertise, often on a project-by-project basis. This flexibility allows companies to tap into niche skills without the overhead and long-term commitments associated with hiring full-time employees or engaging large consulting houses.

For instance, the global freelance platform market, which includes consulting services, saw substantial growth leading up to 2024. Platforms like Upwork and Fiverr reported increased user activity, indicating a growing preference for on-demand talent. Expert networks, such as GLG and AlphaSights, also experienced heightened demand as companies sought quick, targeted insights for strategic decision-making.

- Cost-Effectiveness: Freelancers and expert networks often charge less than traditional consulting firms, offering a more budget-friendly alternative for specific tasks.

- Agility and Speed: Businesses can quickly engage specialized talent for short-term projects, accelerating problem-solving and innovation.

- Access to Niche Expertise: These platforms provide access to a broad pool of consultants with highly specialized skills that might be difficult to find internally or through conventional channels.

- Reduced Commitment: Companies can avoid long-term contracts and employee benefits, making it easier to scale their consulting needs up or down as required.

General Business Information Providers

Companies can readily access general market information, news, and basic industry statistics from numerous free or low-cost online sources, news outlets, and industry associations. While these alternatives may not offer the depth or customization of GlobalData's specialized services, they can effectively address less critical information requirements.

For instance, many businesses utilize platforms like Statista, which provided access to over 1.5 million statistics and data points across various industries in 2024, often through tiered subscription models that are significantly less expensive than comprehensive market intelligence platforms. Similarly, financial news aggregators and industry-specific publications offer timely updates and foundational data that can reduce the perceived need for premium intelligence services for certain decision-making processes.

- Accessibility of Free Resources: A vast array of online platforms offer market trends, news, and basic industry data at no or minimal cost, serving as viable alternatives for routine information gathering.

- Cost-Effectiveness: For less critical or foundational data needs, free or low-cost sources can significantly reduce the expenditure typically associated with specialized market intelligence.

- Partial Substitution: While not offering the same level of detail or customization, these substitute sources can fulfill a portion of a company's information requirements, thereby exerting pressure on premium providers.

The threat of substitutes is amplified by the increasing availability of sophisticated AI-powered analytics platforms. These tools can automate complex data processing and predictive analysis, effectively replicating services previously requiring human expertise. By 2024, the AI in analytics market was projected to exceed $20 billion, highlighting the growing adoption of these automated solutions.

Furthermore, the rise of accessible open-source analytics tools and cloud platforms significantly lowers the barrier to entry for market research. In 2024, the global big data and business analytics market was projected to reach over $340 billion, demonstrating the widespread empowerment of businesses to gain insights independently.

The growing trend of large enterprises building internal analytics departments and expanding data science teams also poses a threat. For instance, in 2024, many Fortune 500 companies increased their data science headcount by over 20%, reducing their reliance on external providers.

Freelance consultants and expert networks offer agile, cost-effective access to specialized expertise, presenting another substitute. The global freelance platform market has seen substantial growth, with platforms reporting increased user activity leading up to 2024.

| Substitute Type | Key Characteristics | Impact on Traditional Providers | 2024 Market Data/Projections |

| Internal Analytics Teams | Cost savings, data security, tailored insights | Reduced demand for external consulting | Fortune 500 data science headcount up >20% |

| AI-Powered Platforms | Automation, speed, predictive capabilities | Disruption of traditional research methods | AI in analytics market projected >$20 billion |

| Open-Source & Cloud Tools | Accessibility, lower cost, self-service analytics | Empowerment of in-house capabilities | Big data & business analytics market >$340 billion |

| Freelance Consultants & Expert Networks | Agility, niche expertise, cost-effectiveness | Competition for project-based work | Growth in global freelance platform market |

Entrants Threaten

Launching a data analytics and consulting firm like GlobalData demands a substantial financial commitment. This includes investing heavily in developing sophisticated technology, amassing vast datasets, and securing access to specialized information streams. For instance, building a robust data infrastructure can easily run into millions of dollars, creating a significant hurdle for emerging competitors.

The strategic intelligence sector demands significant investment in building brand reputation and client trust, a process that typically spans years of consistent, high-quality service delivery. New entrants often struggle to overcome this initial hurdle, as potential clients are hesitant to entrust sensitive data and critical insights to unproven entities.

GlobalData's competitive edge is built on its unique, proprietary data and an extensive network of industry experts. This combination is a significant hurdle for potential new entrants looking to establish a similar market presence.

Developing comparable data sets and cultivating a global network of specialized analysts requires substantial investment and time, making it difficult for newcomers to match GlobalData's existing capabilities and market penetration.

Talent Acquisition and Retention Challenges

The data analytics and consulting sector is incredibly dependent on specialized expertise, such as data scientists, AI professionals, and seasoned consultants. New companies entering this field grapple with the considerable hurdle of attracting and keeping this limited and costly workforce, especially in a highly competitive job market.

For instance, in 2024, the demand for AI and machine learning specialists remained exceptionally high, with salary ranges for experienced professionals often exceeding $180,000 annually in major tech hubs. This intense competition for talent significantly raises the cost of entry for new players.

- High Demand for Specialized Skills: The industry requires niche expertise in areas like advanced analytics, machine learning, and cloud computing.

- Talent Scarcity: A global shortage of qualified data scientists and AI engineers means companies must compete fiercely for a limited pool of candidates.

- Rising Compensation Costs: To attract top talent, firms often need to offer competitive salaries, bonuses, and extensive benefits packages, increasing operational expenses.

- Retention Difficulties: Even when acquired, retaining skilled employees is challenging due to frequent poaching by competitors offering better opportunities or compensation.

Regulatory and Compliance Complexities

The intricate web of data privacy regulations, such as GDPR and CCPA, alongside sector-specific compliance mandates, presents a significant hurdle for potential new entrants. These complex requirements demand substantial investment in legal, technical, and operational infrastructure. For instance, in 2024, companies faced increasing scrutiny over data handling practices, with fines for non-compliance reaching millions of dollars for major breaches.

Established companies like GlobalData have already invested heavily in developing robust compliance frameworks and cultivating the necessary expertise. This existing infrastructure and accumulated knowledge create a considerable barrier to entry, as newcomers must replicate these efforts from scratch. The ongoing evolution of these regulations means that continuous adaptation and investment are essential, further increasing the cost and complexity for new businesses aiming to enter the market.

Key compliance areas that pose challenges include:

- Data Protection: Adhering to strict rules on collecting, processing, and storing personal data.

- Industry-Specific Standards: Meeting requirements unique to financial services, healthcare, or other regulated sectors.

- Cross-Border Data Transfer: Navigating differing regulations for international data movement.

- Cybersecurity Measures: Implementing advanced security protocols to safeguard sensitive information.

The threat of new entrants in the data analytics and consulting sector is moderate, primarily due to the substantial capital required for technology, data acquisition, and talent. For example, building a robust data infrastructure can cost millions. Furthermore, establishing brand reputation and client trust takes years of consistent service, making it difficult for unproven entities to gain traction.

GlobalData's proprietary data and expert network present a significant barrier, as replicating these assets demands considerable investment and time. The intense competition for specialized talent, with AI specialists in 2024 earning over $180,000 annually in major hubs, further elevates entry costs. Navigating complex data privacy regulations like GDPR also necessitates significant legal and technical infrastructure, a hurdle for newcomers.

| Factor | Impact on New Entrants | Example (2024 Data) |

| Capital Requirements | High | Data infrastructure investment can reach millions. |

| Brand & Trust | High Barrier | Years of consistent service needed. |

| Proprietary Data & Network | Significant Hurdle | Difficult to replicate GlobalData's assets. |

| Talent Acquisition | Challenging & Costly | AI specialists' salaries exceeding $180,000. |

| Regulatory Compliance | Complex & Expensive | GDPR fines can be substantial for breaches. |

Porter's Five Forces Analysis Data Sources

Our GlobalData Porter's Five Forces analysis is built upon a robust foundation of data, leveraging company annual reports, industry-specific trade publications, and regulatory filings to comprehensively assess competitive dynamics.