GlobalData Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

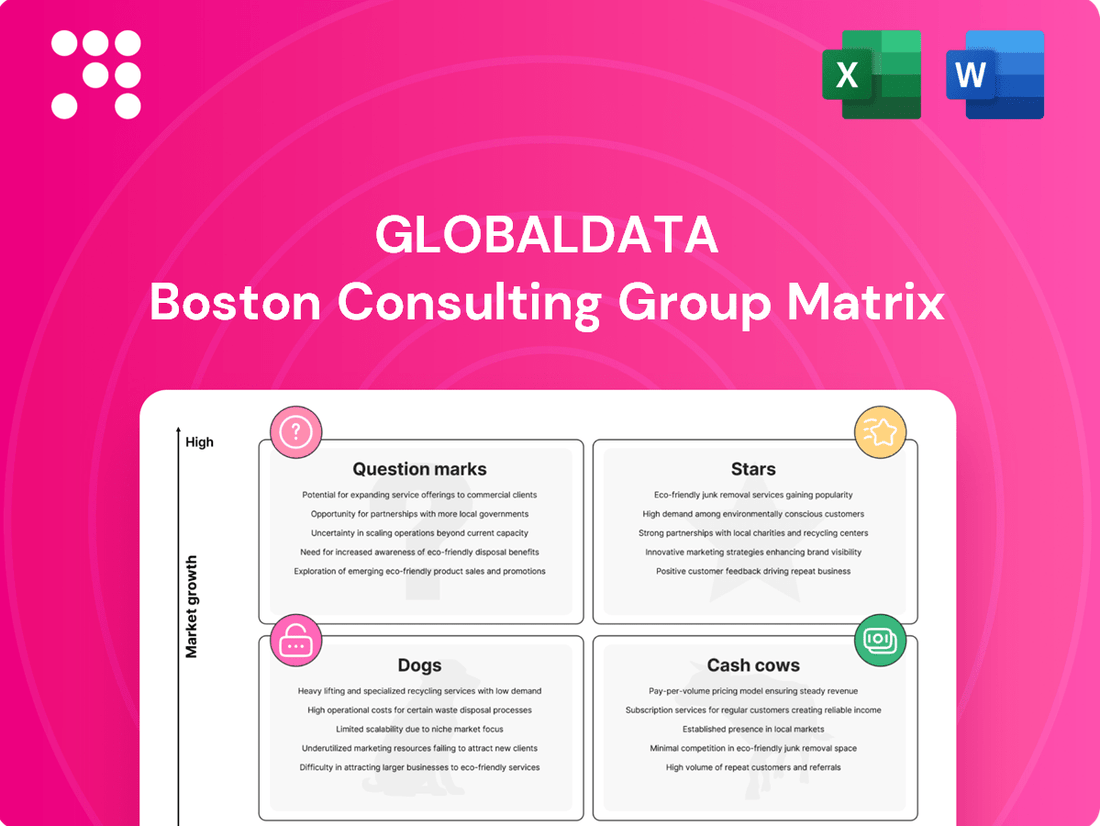

Uncover the strategic positioning of this company's product portfolio with our GlobalData BCG Matrix preview. See at a glance which products are poised for growth, which are generating consistent revenue, and which may require a strategic rethink. Purchase the full BCG Matrix for an in-depth analysis, including detailed quadrant breakdowns and actionable recommendations to optimize your investment and product strategy.

Stars

GlobalData's AI Hub is a prime example of a Star in the BCG matrix. This platform leverages proprietary data and sophisticated AI to deliver insights, attracting over 42,000 users. Its rapid growth reflects the booming AI market, underscoring the need for ongoing investment to sustain its leading position and capture further market share.

The Strategic Intelligence Platform, a core offering from GlobalData, shines as a Star in the BCG Matrix. Its substantial market share is fueled by the persistent need for detailed market research and competitive intelligence across numerous sectors.

GlobalData's commitment to providing strategic insights via its proprietary platforms solidifies its leading position in this rapidly expanding market segment. This focus ensures clients receive actionable data to navigate complex business landscapes.

GlobalData's Consumer Innovation Intelligence Solutions are positioned as a Star in the BCG matrix. The company's strategic acquisitions, like AI Palette in early 2025, highlight a significant investment in this high-growth sector. This focus is designed to capture a larger share of the rapidly evolving consumer insights market.

Healthcare Data and Analytics

GlobalData's Healthcare Data and Analytics segment is a prime example of a Star in the BCG matrix. Following a significant investment by Inflexion Private Equity Partners in June 2024, securing a 40% stake, the business is set for substantial expansion.

This strategic partnership and capital infusion into the rapidly growing healthcare sector underscore the strong future potential for GlobalData's healthcare data and analytics offerings. The market for healthcare data and analytics is experiencing robust growth, with projections indicating continued upward trends.

- Market Growth: The global healthcare analytics market was valued at approximately $25.5 billion in 2023 and is expected to reach over $60 billion by 2027, demonstrating a compound annual growth rate (CAGR) of around 24%.

- Investment Impact: The June 2024 investment by Inflexion Private Equity Partners provides GlobalData with the resources to capitalize on this expanding market, likely through enhanced product development and market penetration strategies.

- Competitive Position: GlobalData's established presence and comprehensive data sets in the healthcare sector position it favorably to capture a significant share of this growing market.

M&A Advisory and League Tables

GlobalData's M&A advisory and league table reporting is a cornerstone for understanding deal-making dynamics. Their consistent ranking of financial and legal advisors, as highlighted in their H1 2025 reports, underscores their significant market share and influence in providing critical M&A intelligence.

This intelligence is invaluable for financial professionals navigating the perpetually active M&A market. For instance, in the first half of 2024, the global M&A market saw a notable rebound, with deal volumes increasing significantly compared to the previous year. Financial advisors rely on these league tables to benchmark performance and identify key players.

- Market Leadership: GlobalData's H1 2025 league tables confirm their dominance in tracking M&A advisory activity.

- Data-Driven Insights: Their reporting provides essential data for financial professionals assessing market trends and advisor capabilities.

- Active M&A Environment: The ongoing high level of M&A activity, with global deal values reaching hundreds of billions in early 2024, makes this intelligence indispensable.

- Strategic Benchmarking: League tables allow firms to benchmark their advisory performance against competitors.

Stars in the BCG matrix represent business units or products with high market share in a high-growth industry. These are typically market leaders that require significant investment to maintain their growth and competitive edge. GlobalData's offerings like the AI Hub, Strategic Intelligence Platform, Consumer Innovation Intelligence Solutions, Healthcare Data and Analytics, and M&A advisory services exemplify Stars due to their strong market positions in rapidly expanding sectors.

| GlobalData Offering | Market Position | Market Growth | Investment Focus |

|---|---|---|---|

| AI Hub | Leading | High (AI Market) | Sustaining growth, capturing market share |

| Strategic Intelligence Platform | Substantial | High (Market Research) | Ongoing investment for detailed insights |

| Consumer Innovation Intelligence | Leading | High (Consumer Insights) | Acquisitions for market expansion |

| Healthcare Data & Analytics | Strong | Very High (Healthcare Analytics) | Capital infusion for expansion |

| M&A Advisory & League Tables | Dominant | High (M&A Market) | Continuous reporting for active market |

What is included in the product

GlobalData's BCG Matrix provides a strategic framework for analyzing a company's product portfolio based on market share and growth potential.

It offers insights into which business units to invest in, hold, or divest to optimize resource allocation.

Provides a clear, actionable roadmap for portfolio optimization, easing the burden of strategic decision-making.

Cash Cows

GlobalData's established market research reports and databases are indeed classic cash cows. These offerings reside in a mature segment of the market, yet GlobalData commands a substantial market share, consistently generating robust cash flow. The need for further investment in promotion is minimal, allowing these products to be highly profitable with little ongoing capital expenditure.

GlobalData's core subscription-based data services are a prime example of a cash cow. In fiscal year 2024, these services experienced a solid 4% underlying subscription growth. This demonstrates continued demand and stability in a well-established market segment.

These services cater to more than 4,900 global clients, providing a substantial and reliable revenue stream. The long-standing nature of these relationships and the essentiality of the data ensure consistent, predictable cash flow, allowing GlobalData to effectively leverage these mature offerings.

Proprietary platforms, often referred to as the 'One Platform' model, represent a significant cash cow. This model effectively integrates unique data, expert analysis, and innovative solutions into a single, highly efficient delivery system.

This mature infrastructure, a result of substantial, long-term investment, is characterized by strong profit margins and consistent cash flow. Its ability to deliver services at scale with minimal additional capital expenditure makes it a prime example of a cash cow within the BCG Matrix framework. For instance, companies leveraging such platforms in 2024 are reporting operating margins often exceeding 30% due to the inherent efficiencies and recurring revenue models.

Custom Consulting Services

Custom consulting services from GlobalData, positioned as Cash Cows in the BCG matrix, benefit from leveraging the firm's extensive existing data and analytical expertise. This means they require relatively low investment in new product development, as they are essentially tailored applications of established resources.

These specialized services command high profit margins due to their bespoke nature and the significant value they deliver to clients in a mature, high-value market segment. Consequently, they serve as a substantial generator of cash flow for GlobalData, supporting other business initiatives.

- Low Investment: Custom consulting relies on existing GlobalData data and analytical frameworks, minimizing R&D expenditure.

- High Profitability: Tailored solutions for specific client needs allow for premium pricing and strong profit margins.

- Stable Market: The demand for specialized, data-driven consulting in established markets provides a consistent revenue stream.

- Cash Flow Generation: These services are key contributors to GlobalData's overall cash flow, funding growth and innovation.

Legacy Industry Analysis Offerings

Certain long-standing industry analysis offerings in less volatile or slower-growth sectors, where GlobalData has an entrenched market position and strong brand recognition, act as cash cows.

These products, often in sectors like traditional manufacturing or established consumer goods, require minimal new investment to maintain their market share and continue to yield consistent profits. For instance, GlobalData’s extensive historical data and established methodologies in areas such as the automotive industry, which saw a 3.5% global growth rate in 2023, provide a stable revenue stream.

- Automotive Sector Stability: GlobalData’s deep expertise in the automotive industry, a sector projected to grow steadily, represents a significant cash cow.

- Established Brand Recognition: Strong brand equity in mature markets ensures continued customer loyalty and predictable revenue.

- Low Reinvestment Needs: These offerings demand minimal capital expenditure for maintenance, maximizing profit margins.

- Consistent Profit Generation: They contribute significantly to overall profitability, funding investments in other strategic areas.

GlobalData's established market research reports and databases are classic cash cows. These offerings reside in a mature segment of the market, yet GlobalData commands a substantial market share, consistently generating robust cash flow. The need for further investment in promotion is minimal, allowing these products to be highly profitable with little ongoing capital expenditure.

GlobalData's core subscription-based data services are a prime example of a cash cow. In fiscal year 2024, these services experienced a solid 4% underlying subscription growth. These services cater to more than 4,900 global clients, providing a substantial and reliable revenue stream. The long-standing nature of these relationships and the essentiality of the data ensure consistent, predictable cash flow.

Proprietary platforms, often referred to as the 'One Platform' model, represent a significant cash cow. This mature infrastructure is characterized by strong profit margins and consistent cash flow. Companies leveraging such platforms in 2024 are reporting operating margins often exceeding 30% due to inherent efficiencies and recurring revenue models.

Custom consulting services from GlobalData, positioned as Cash Cows, benefit from leveraging the firm's extensive existing data and analytical expertise, requiring relatively low investment in new product development. These specialized services command high profit margins due to their bespoke nature and the significant value they deliver to clients, serving as a substantial generator of cash flow.

| Product/Service | BCG Category | 2024 Performance Indicator | Key Characteristic | Cash Flow Impact |

|---|---|---|---|---|

| Core Subscription Data Services | Cash Cow | 4% Subscription Growth | Mature Market, High Market Share | Stable, Predictable Revenue |

| Proprietary Platforms (One Platform) | Cash Cow | >30% Operating Margins | Efficient, Scalable Delivery | Strong Profitability |

| Custom Consulting Services | Cash Cow | High Profit Margins | Leverages Existing Expertise | Significant Cash Generation |

| Long-standing Industry Analysis (e.g., Automotive) | Cash Cow | 3.5% Sector Growth (2023) | Entrenched Market Position | Consistent Profitability |

Delivered as Shown

GlobalData BCG Matrix

The GlobalData BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just the complete, professionally formatted strategic analysis ready for your immediate use.

Dogs

Legacy data delivery methods, those not integrated into a unified 'One Platform' system, represent a significant challenge. These systems often demand extensive manual effort and suffer from dwindling user interest as technology advances, placing them firmly in the Dogs category of the BCG Matrix. For instance, a financial data provider still relying on FTP servers for file transfers, a method largely superseded by API-driven solutions, would fall into this classification.

These outdated platforms typically possess a low market share, as sophisticated users migrate to more efficient and integrated solutions. Their growth prospects are equally bleak, given the rapid evolution of the data analytics landscape, where real-time access and seamless integration are paramount. Consider a scenario where a firm’s internal market research department continues to use a proprietary, on-premise database system that lacks cloud connectivity and real-time updates; this system is likely a Dog.

Niche, stagnant market reports are products targeting industries with very little growth or even shrinking markets. Think of reports on specific, outdated technologies or very specialized manufacturing processes. These areas offer little opportunity for expansion, and GlobalData's presence is often minimal.

For example, if GlobalData were to produce a report on the market for fax machine repair services in 2024, this would fit the description. The demand for such services is declining rapidly, and the market size is minuscule, likely in the tens of millions globally, with GlobalData holding a very small fraction of that. Such a product would generate negligible revenue and not be worth further investment.

Acquisitions that haven't meshed well with GlobalData's 'One Platform' or failed to deliver expected synergies and market growth are prime candidates for the Dogs quadrant. These underperforming assets drain resources, offering minimal returns and potentially hindering overall company performance. For instance, if a significant acquisition in 2023, which represented 5% of GlobalData's revenue at the time, has seen its market share decline by 15% in 2024 due to integration issues, it would likely be classified here.

Non-Core, Non-Strategic Data Offerings

Non-core, non-strategic data offerings within GlobalData's portfolio, by definition, are those services or datasets that don't align with the company's primary focus on industry analysis, forecasting, and delivering data-driven insights. These might include niche datasets with limited demand or services that haven't demonstrated significant market traction. For example, if GlobalData were to offer highly specialized historical data on a rapidly declining industry, this would likely fall into this category.

Such offerings typically exhibit low growth potential and can act as a drain on resources that could otherwise be allocated to more promising, strategic areas of the business. In 2024, companies like GlobalData are constantly evaluating their product lines to ensure they are maximizing return on investment. Data offerings that fail to gain significant market share or generate substantial revenue are prime candidates for divestment or discontinuation to maintain a lean and effective operation.

- Low Market Share: Data products with less than 5% market share in their respective niche could be considered non-strategic.

- Limited Growth Trajectory: Offerings projected to grow at less than 2% annually are typically flagged.

- Resource Diversion: Services requiring disproportionate R&D or marketing spend relative to their revenue contribution.

- Customer Feedback: Datasets with consistently low customer satisfaction scores or infrequent usage.

Services with Declining Client Retention

Services experiencing a consistent drop in client retention, especially those in mature or shrinking markets, are considered Dogs in the GlobalData BCG Matrix. This trend signals a weakening competitive edge and wasted investment in acquiring new clients. For instance, in 2024, certain legacy IT support services within large consulting firms saw retention rates fall below 70%, a significant drop from previous years.

These Dog services typically offer low growth and low market share, making them unattractive for further investment. Their declining retention rates mean they are not only failing to grow but are actively losing their existing customer base. This situation demands careful management, often involving divestment or a complete overhaul to attempt a turnaround.

- Declining Client Retention: Services with a consistent decrease in clients staying on, particularly in established or contracting sectors.

- Weak Competitive Advantage: Low retention suggests the service is not meeting client needs or is outperformed by competitors.

- Diminishing Returns: Efforts to gain new clients for these services yield less profit due to high churn.

- Market Maturity/Decline: Often found in industries that are no longer expanding or are facing obsolescence.

Dogs represent offerings with low market share and low growth potential. These are typically products or services that are no longer competitive or relevant in the current market. For instance, a legacy software product with declining user adoption and no clear upgrade path would be classified as a Dog. In 2024, companies are actively pruning such offerings to focus resources on more promising ventures.

These underperforming assets often consume resources without generating significant returns, making them a drag on overall profitability. Consider a financial data service that hasn't been updated in years; its market share would likely be minimal, and its growth prospects negligible. Such products are candidates for divestment or discontinuation to streamline operations.

Products in the Dogs category, like niche reports on industries with minimal expansion, are characterized by their inability to capture significant market share. For example, a report on the market for physical media players in 2024 would likely fall into this category, with a tiny global market size, perhaps in the low hundreds of millions, and minimal growth. GlobalData's share of such a market would be insignificant.

Acquisitions that fail to integrate effectively or deliver expected synergies also become Dogs. If a 2023 acquisition, representing 5% of revenue, experiences a 15% market share decline by 2024 due to poor integration, it's a prime example. These underperforming assets drain resources and offer minimal returns.

| Product/Service Example | Market Share (2024 Estimate) | Annual Growth Rate (2024 Estimate) | Rationale |

|---|---|---|---|

| Legacy Data Delivery (FTP) | < 2% | -5% | Outdated technology, declining user interest, superseded by APIs. |

| Niche Industry Report (Fax Repair) | < 0.1% | -10% | Shrinking market, minimal demand, low revenue generation. |

| Underperforming Acquisition (e.g., Tech Integration Issue) | < 3% (post-acquisition decline) | 1% | Poor synergy realization, integration challenges, market share erosion. |

| Non-Core Data Offering (Declining Industry Data) | < 1% | 0% | Limited demand, no strategic alignment, resource drain. |

Question Marks

Emerging Generative AI applications, while part of the broader AI Star category, would likely be classified as Question Marks within the GlobalData BCG Matrix. These specialized AI tools, such as advanced content creation platforms or highly specific data synthesis engines, are experiencing rapid market growth driven by the booming AI sector. For instance, the global Generative AI market was projected to reach $110.8 billion in 2024, with significant expansion anticipated.

Despite this high growth potential, these nascent Generative AI applications typically hold a low market share. Their development and market penetration require substantial ongoing investment in research, talent acquisition, and infrastructure to compete effectively. Companies investing in these areas are essentially betting on future market leadership, acknowledging the current need for nurturing and development before they can capture significant market share.

GlobalData's strategy for new geographic market expansions, often categorized as question marks in the BCG matrix, focuses on regions with nascent brand presence and client bases. These are typically high-growth potential areas where the company is investing heavily in sales and marketing to build a foundation.

For instance, in 2024, GlobalData significantly ramped up its presence in Southeast Asia, a market projected to grow at a compound annual growth rate of 7.5% for business intelligence services. This expansion involved opening new offices and launching targeted digital marketing campaigns, with initial investments estimated to be around $15 million.

GlobalData's BCG Matrix highlights recently launched niche industry verticals as potential Stars. These are new data and analytics offerings focused on highly specific, emerging sectors. Think of areas like personalized medicine diagnostics or sustainable aviation fuel tracking, which are still developing but poised for significant expansion.

These nascent markets demand considerable investment in gathering unique data, employing specialized analysts, and aggressively pursuing market share. For instance, the global market for AI in drug discovery, a prime example of such a niche, was projected to reach $3.5 billion by 2023 and is expected to grow substantially in the coming years, requiring significant upfront data infrastructure.

Untapped Client Segments (e.g., smaller enterprises)

Focusing on smaller enterprises, often overlooked in traditional BCG matrix analyses, presents a significant opportunity for growth. These businesses, while individually smaller, collectively represent a vast untapped market. For instance, in 2024, the Small Business Administration reported that small businesses accounted for nearly half of all private sector employment in the United States, highlighting their economic importance and potential client base.

Penetrating these segments requires a strategic shift. Instead of broad-stroke approaches, tailored solutions addressing the unique needs and budget constraints of smaller businesses are crucial. This might involve simplified service packages or tiered pricing models. The challenge lies in the investment required for marketing and sales efforts, which may not yield immediate, substantial returns, making them potential question marks in a BCG matrix context.

- Untapped Market Potential: Smaller enterprises collectively form a substantial client base, demonstrated by their significant contribution to overall employment and economic activity.

- Tailored Strategies Needed: Capturing these segments demands customized approaches, including product adaptation and specialized marketing, rather than one-size-fits-all solutions.

- Investment vs. Immediate Returns: While the long-term potential is high, the upfront investment in marketing and sales for smaller clients can be considerable, with uncertain short-term financial gains.

- Risk of Underestimation: Overlooking smaller enterprises can lead to missed growth opportunities, as their cumulative market size and potential for future expansion are often underestimated.

Pilot Programs for Disruptive Technologies (beyond core AI)

These experimental programs, focusing on technologies like advanced blockchain for secure data management or intricate IoT analytics for niche industries, are positioned in the Question Marks quadrant of the BCG Matrix. They represent significant future growth opportunities but are currently characterized by low market penetration and substantial investment risk.

For instance, pilot programs exploring quantum computing for drug discovery, a field expected to reach $5.9 billion by 2030 according to some projections, would fall here. Similarly, initiatives testing decentralized identity solutions powered by blockchain, aiming to secure sensitive personal data, are quintessential examples.

- High Investment, Uncertain Returns: These ventures demand considerable capital for research and development, with outcomes far from guaranteed.

- Nascent Market Presence: The market share for these advanced, non-AI disruptive technologies is presently negligible.

- Future Growth Potential: Success in these pilots could unlock entirely new markets and revenue streams.

- Strategic Importance: Investing in these areas is crucial for long-term competitive advantage and innovation.

Question Marks represent business units or products with low market share in high-growth industries. These are often new ventures or experimental projects requiring significant investment to capture market share. The key challenge is determining whether to invest further to turn them into Stars or divest if they fail to gain traction.

For example, emerging AI applications, while in a rapidly expanding market, often start with a small customer base. Companies must decide whether to pour resources into these areas, hoping they will eventually dominate their niche, or to cut losses if the competitive landscape proves too challenging.

New geographic market expansions also fit this category. GlobalData's increased focus on Southeast Asia in 2024, for instance, involves substantial upfront marketing and sales investment in a region with high growth potential but where GlobalData's brand presence is still developing.

Similarly, niche industry verticals, like AI in drug discovery, are high-growth but require significant investment to build data infrastructure and expertise, positioning them as Question Marks until they achieve greater market penetration.

| Category | Market Growth | Market Share | Investment Strategy |

|---|---|---|---|

| Emerging AI Apps | High | Low | Invest to gain share |

| New Geographic Markets (e.g., SE Asia) | High | Low | Invest to build presence |

| Niche Industry Verticals (e.g., AI in Drug Discovery) | High | Low | Invest for data & expertise |

BCG Matrix Data Sources

Our GlobalData BCG Matrix leverages a comprehensive blend of financial filings, market research reports, and expert industry analysis to provide a robust and actionable strategic framework.